Good morning!

The GIFT Nifty is trading marginally lower near 26,156, indicating a negative open for the benchmark Nifty 50.

US and European index futures are trading higher during Asian trading hours.

S&P 500 futures trade up 0.18%

Euro Stoxx 50 futures up 0.56%

Markets On The Home Turf

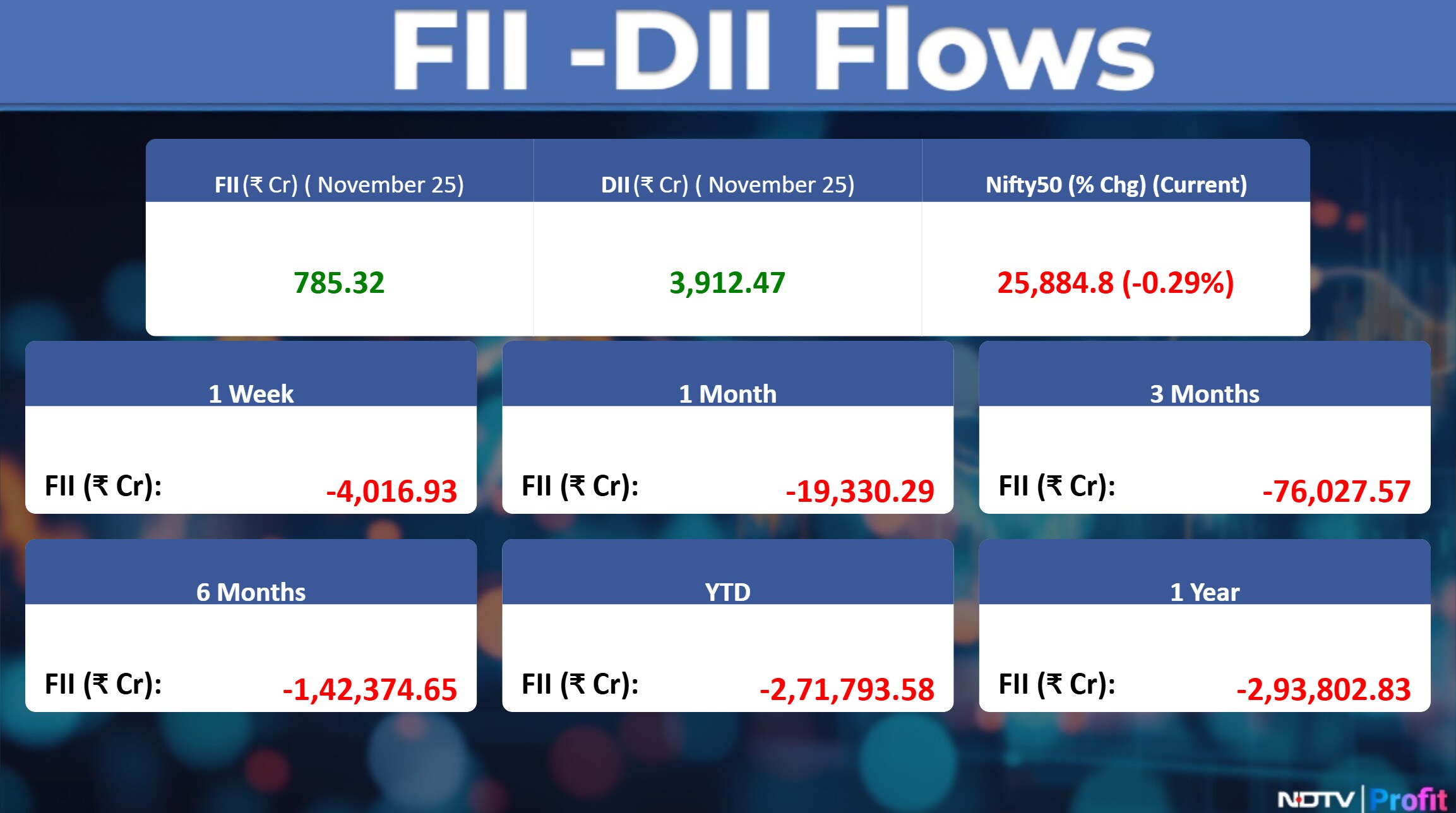

The NSE Nifty 50 closed 74.7 points or 0.29% lower at 25,884.8, while the BSE Sensex ended 313.7 points or 0.37% down at 84,587.01 on Tuesday.

The midcap index eased by 0.3% and the smallcap index fell by 0.9%. Nifty IT was the lone outperformer. In contrast, Defence and Realty indices were the biggest sectoral losers, shedding over 2%.

US Market Wrap

US equities regained traction as consumer confidence posted its sharpest decline since April in November, while retail sales in September rose only modestly — signs that consumer spending is losing steam after months of robust demand. The delayed US economic data reinforced market expectations of a December Fed cut, despite Chair Jerome Powell cautioning last month that such a move is not guaranteed.

Asian Market Wrap

Asian stocks extended their rally for a third straight session, mirroring gains on Wall Street after weak US consumer data strengthened expectations of a Federal Reserve rate cut next month.

Markets in Japan, South Korea and Australia opened higher, following a 0.9% rise in the S&P 500 and a 0.6% advance in the Nasdaq 100. Chinese shares will be closely watched after Alibaba Group Holding Ltd. slipped in US trading post-earnings.

Commodity Check

Meanwhile, renewed diplomatic efforts to end the war in Ukraine are shifting attention to the fate of global commodity flows disrupted by the nearly four-year conflict.

Russia's invasion triggered a major reshaping of oil, gas and agricultural trade routes. Any further upheaval in commodities markets in the coming months will depend on whether the conflict comes to an end, how quickly sanctions on Moscow might be lifted, and in what sequence — along with Russia's willingness to abide by any negotiated agreement.

Stocks In News

Inox Green: The company allots 12.3 lakh shares at Rs 145 each to a non-promoter warrant holder.

Bliss GVS Pharma: The company's arm incorporated a 100% owned step-down subsidiary, Theralife Pharma Ltd, in Nairobi, Kenya, on Nov. 24, 2025.

SIS: The company announced the resignation of Ravindra Kishore Sinha as Chairman and Executive Director due to health reasons, and appointed Rita Kishore Sinha as Chairman and Non-Executive Director.

Jyoti: The company received a Letter of Intent worth Rs 40.8 crore for the supply of 11 kV VCB panels.

Indian Overseas Bank: The company received an income-tax refund order of Rs 835 crore for AY 2022–23.

Zydus Life: The company received final approval from the US FDA for Verapamil Hydrochloride tablets, which are used to reduce the risk of strokes and heart attacks.

Rashtriya Chemicals: The government entrusted Nazhat J. Shaikh with additional charge of the CMD post for six months, effective Jan. 1, 2026.

Jindal Stainless: Arti Luniya ceased to be an Independent Director upon completion of her tenure.

Bayer CropScience: The company highlighted its crop outlook, citing strong cotton exports with demand recovery by FY26–27, steady acreage growth and firm prices in corn, and supportive pricing in pulses and oilseeds driven by government push and import curbs.

Exide Industries: The company invested Rs 75 crore in its arm, Exide Energy Solutions, on a rights basis.

Nelco: The company received additional government authorisation to sell VSAT services of other UL-GMPCS licensees.

Nitco: The company recorded Rs 58 crore from real estate in H1 FY26; already has LOIs from Prestige and Lodha for Rs 280 crore orders.

Jayant Infratech: The company received a Rs 162 crore order from Konkan Railway Corporation.

Shoppers Stop: The company completed its total investment of Rs 50 crore in its arm, Global SS Beauty Brands, including Rs 10 crore invested in the fourth tranche via rights issue.

United Breweries: The company launched its premium beer, Heineken Silver, in New Delhi, priced in the range of Rs 155–305.

NCC: The company received a Rs 2,063 crore order for the expansion of Gauhati Medical College and Hospital.

Aditya Birla Capital: The company allotted 200 NCDs worth Rs 200 crore on a private placement basis.

Bank of Maharashtra: The government appointed Prabhat Kiran as Executive Director for a three-year term.

Igl: The company enters a JV with CEID Consultants & Engineering to develop a Compressed Biogas plant.

Surya Roshni: The company will install solar power plants at two facilities; together, the two projects will have a combined capacity of over 3 MWp, supported by a total investment of around Rs 10.15 crore.

Mahindra: The company is set to set up 250 EV charging stations with 1,000 charging points by 2027.

Bharti Airtel: The Mittal family is set to sell 34.3 million shares (0.56% stake) at Rs 2,097, a 3% discount to CMP; the offer size is Rs 7,193 crore.

Waaree Energies: The I-T Dept. completed searches at company offices and facilities; says all plants and offices operated without disruption during the investigation.

Ask Automotive: Promoter Kuldip Singh Rathee offloaded a 4% stake; promoter holding drops to 74.95% from 78.95% post sale.

Zen Tech: The company bagged a Rs 108 crore Defence Ministry order to supply Tank Crew Gunnery Training Simulators.

Concord Control Systems: The company approved a Rs 50.01 crore fundraise via preferential share issue.

TV Today: The company approved entering an MoU with Abhijit Realtors and Infraventures Private Limited to sell its FM Radio Broadcasting Operations (three stations under 104.8 FM) for Rs 10 crore, allowing it to focus on its core business.

Panorama Studios: The company acquired rights to produce the Hindi remake of Malayalam film, Drishyam 3.

Unimech Aerospace: The company approved additional investment of up to Rs 5.53 crore to acquire 2,625 preference shares in Dheya Engineering Tech.

LMW: The company signed an MoU with the Tamil Nadu government through its nodal agency ‘Guidance'.

Refex Industries: The MCA approves incorporation of Venwind Refex Projects as a wholly owned arm of Venwind Refex Power, making it a step-down subsidiary of the company.

Ugro Capital: The company approved the allotment of 17.8 lakh shares to holders of compulsory convertible debentures.

MedPlus Health Services: The company's arm received one suspension order for a drug licence for a store in Telangana.

Rama Steel Tubes: The company approved an investment of AED 36 million in its arm, RST International Trading FZE.

A-1: The company secured a Rs 150.5 crore order to supply 25,000 MT of industrial urea to manufacturing locations across India.

Patel Engineering: The company's board will meet on Nov. 28 to consider a rights issue for an amount not exceeding Rs 500 crore.

Cholamandalam Investment and Finance: The company raised Rs 1,000 crore via the allotment of 50,000 unsecured non-convertible securities, including a green shoe option of Rs 500 crore.

IPO Offering

Sudeep Pharma: The public issue was subscribed to 93.72x on day 3. The bids were led by Qualified institutional investors (0.13x), non-institutional investors (12x), retail investors (4.97x)

IPO listing

Excelsoft Technologies: The company will debut on the exchanges on Wednesday. The public issue was subscribed to 43.19x on day 3. The bids were led by Qualified institutional investors (213.08 x), non-institutional investors (116.72x), retail investors (15.65x)

Bulk And Block Deals

ASK Automotive: Kuldip Singh Rathee sold 78.86 lakh shares at Rs 473 each for about Rs 372.99 crore, while SBI Mutual Fund bought a total of 78.62 lakh shares at the same price for roughly Rs 371.86 crore.

AWL Agri Business: AustralianSuper bought 94.86 lakh shares at Rs 274.95 each, amounting to a transaction value of about Rs 260.82 crore.

Narayana Hrudayalaya: Shakuntala Shetty sold 11.77 lakh shares at Rs 1,960.07 each, amounting to a total transaction value of about Rs 230.70 crore.

Reliance Infrastructure: Elimath Advisors Private Limited bought 51.69 lakh shares at Rs 157 each, while Florintree Insurtech LLP sold 51.69 lakh shares at the same price, with the total transaction value at about Rs 81.17 crore.

Elgi Equipments: SBI Mutual Fund bought 20.62 lakh shares at Rs 483 each, amounting to about Rs 99.59 crore.

Trading Tweaks

Price Band change from 5% to 20%: Tata Motors Cv , Allcargo Logistics

Ex -Dividend : Power Finance Corporation( Rs 3.65/share)

Bonus issue: HDFC Asset Management Company (1:1)

List of securities shortlisted in Short Term ASM Framework : Jet Freight Logistics Limited

List of securities shortlisted in Long Term ASM Framework: Enfuse Solutions

F&O Cues

Nifty Nov futures down by 0.44% to 25,886.80 at a premium of 2 points.

Nifty Nov futures open interest down by 28.73%

Nifty Options 18 Nov Expiry: Maximum Call open interest at 25,900 and Maximum Put open interest at 25,850.

Currency/Bond Market

The rupee pared initial gains and settled 4 paise lower at 89.20 against the greenback on Tuesday, weighed down by negative cues from domestic equity markets. Yield on the 10-year bond ended two points lower at 6.52.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.