Equities and U.S. contracts rose on Monday as investors assessed the outlook for growth in some of the world's largest economies.

Equities clocked modest gains in Japan, Australia and South Korea, while Nasdaq 100 and S&P 500 futures added 1% each. The S&P 500 dropped for a seventh straight week--a stretch of weakness not seen since 2001. The Singapore-traded SGX Nifty, an early barometer of India's benchmark Nifty 50, fell more than 0.5% to 16,171.50 points as of 6:30 am.

In China, traders will watch if stocks can maintain gains after the Chinese banks cut a key interest rate for long-term loans by a record amount as a property slump and Covid-19 lockdowns weigh on the economy.

Nymex crude rose 0.2% to $110.53 a barrel. Bitcoin recovered to $30,200.

Earnings Post Market Hours

Paytm Q4 FY22 (YoY)

Paytm's operator One 97 Communications Ltd. reported a net loss of Rs 760 crore for the March quarter, versus a loss of Rs 780 crore a quarter earlier. Revenues rose to Rs 1,540 crore from Rs 1,460 crore.

Shree Cement Q4 FY22 (YoY)

Revenues up 3.6% at Rs 4,098.8 crore

Net profit down 15.9% at Rs 645.2 crore

EBITDA down 22.9% at Rs 910.6 crore

EBITDA margin at 22.2% vs 29.9%

NTPC Q4 FY22 (Standalone, YoY)

Revenue up 23.86% at Rs 32,905.02 crore

EBITDA up 55.51% at Rs 10,120.56 crore

EBITDA margin 30.76% vs 24.5%

Net profit up 25.51% at Rs 5,621.89 crore

Recommended final dividend of Rs 3 per share

Thermax Q4 FY22 (Consolidated, YoY)

Revenue up 26.51% at Rs 1,991.92 crore

EBITDA fell 3.87% at Rs 135.22 crore

EBITDA margin 6.79% Vs 8.93%

Net profit fell 4.48% at Rs 102.54 crore

Recommended dividend of Rs 9 per share

Sobha Q4 FY22 (Consolidated, YoY)

Revenue up 32.15% at Rs 731.3 crore

EBITDA up 36.47% at Rs 204.30 crore

EBITDA margin 27.94% vs 27.05%

Net profit up 39.6% at Rs 25 crore

Recommended dividend of Rs 3 per share

Pfizer Q4 FY22 (Consolidated, YoY)

Revenue down 18.68% at Rs 549.66 crore

EBITDA down 15.23% at Rs 165.45 crore

EBITDA margin 30.1% vs 28.88%

Net profit down 12.6% at Rs 125.79 crore

Recommended a dividend of Rs 35 per share

Nuvoco Vistas Corporation Q4 FY22 (Consolidated, YoY)

Revenue up 11.35% at Rs 2,930.18 crore

EBITDA down 18.91% at Rs 424.93 crore

EBITDA margin at 14.5% vs 19.91%

Net profit 22.37% at Rs 29.11 crore

ZF Commercial Vehicle Control Systems Q4 FY22 (Consolidated, YoY)

Revenue up 9.78% at Rs 781.98 crore

EBIT up 6.7% at Rs 89.03 crore

EBIT margin at 11.4% Vs 11.71%

Net profit up 14.07% at Rs 76.71 crore

Metro Brands Q4 FY22 (Consolidated, QoQ)

Revenue up 26.26% at Rs 403.16 crore

EBITDA up 52.86% at Rs 129.84 crore

EBITDA margin at 32.21% vs 26.6%

Net profit up 59.68% at Rs 68.79 crore

Dividend of Rs 0.75/share declared

CE Infosystems Q4 FY22 (Consolidated, QoQ)

Revenue up 31.51% at Rs 57.04 crore

EBIT up 65.19% at Rs 22.45 crore

EBIT margin at 39.36% vs 31.34%

Net profit 53.81% at Rs 33.50 crore

Amara Raja Batteries Q4 FY22 (Consolidated, YoY)

Revenue up 3.73% at Rs 2,180.96 crore

EBITDA fell 30.41% at Rs 220.18 crore

EBITDA margin at 10.1% vs 15.05%

Net profit down 47.8% at Rs 98.85 crore

Recommended dividend of Rs 0.5 per share

Indiabulls Housing Finance Q4 FY22 (Consolidated, YoY)

Revenue down 7.69% at Rs 2,189.31 crore

EBIT up 4.38% at Rs 372.47 crore

EBIT margin at 87.41 vs 80.14 crore

Net profit up 4.38% at Rs 372.47 crore

Hindustan Foods Q4 FY22 (Consolidated, YoY)

Revenue up 18.45% at Rs 581.43 crore

EBITDA up 5.53% at Rs 30.89 crore

EBITDA margin at 5.31% vs 5.96%

Net profit down 5.33% at Rs 12.25 crore

Stocks To Watch

Infosys: The Bengaluru-based IT services firm has reappointed Salil Parekh as CEO and MD for a period of five years.

UPL: The company completed buyback of 1.33 crore equity shares at Rs 813.92 apiece aggregating to Rs 1,093.73 crore, representing 99.43% of maximum buyback size.

Jet Airways: The company has been re-issued air operator certificate by Directorate General of Civil Aviation for commercial flights.

Zydus Lifesciences: The company's promoters may participate in the buyback of 1.15 crore shares representing 1.13% of total equity shares at price of Rs 650.

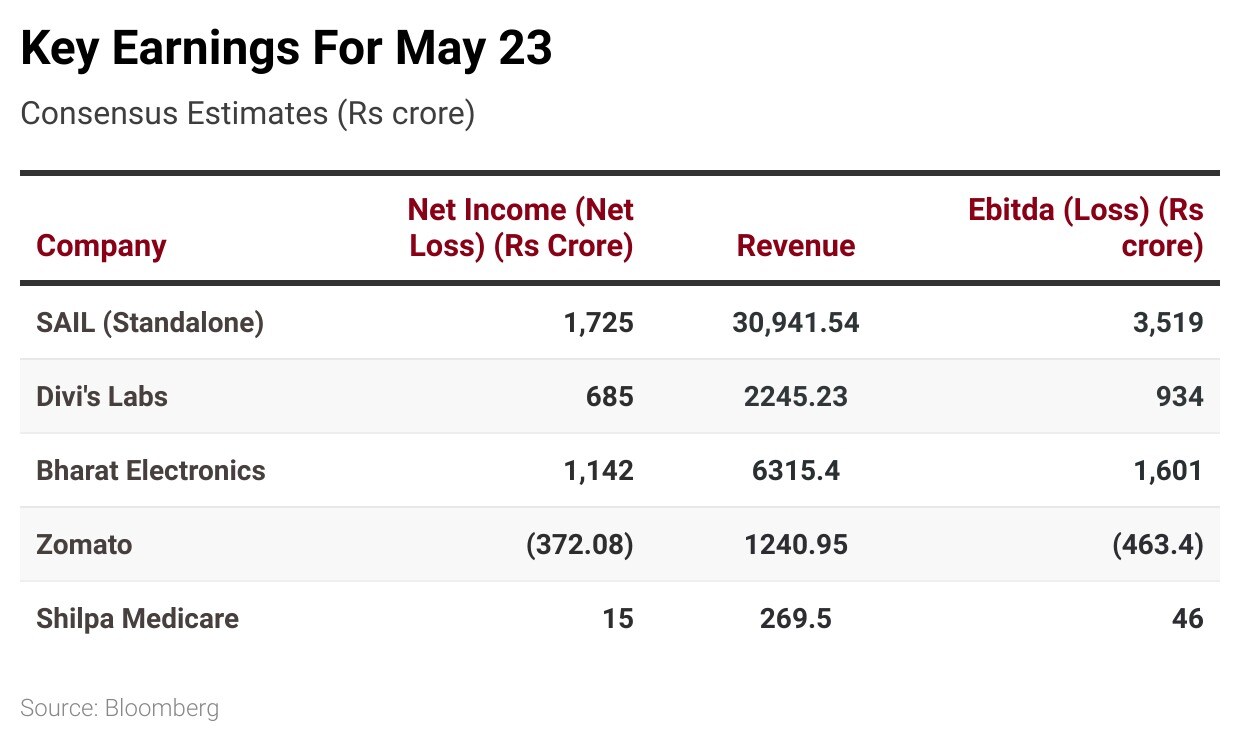

Earnings Today: Steel Authority of India, Zomato, Bharat Electronics, Divi's Laboratories, HLE Glascoat, Ramco Cements, The New India Assurance Co., Graphite India, BirlaSoft, Kaveri Seeds, National Highways Infra Trust, Shilpa Medicare, Sansera Engineering, HG Infra Engineering, Rolex Rings, Rupa & Co., Dollar Industries, Thomas Cook India, Action Construction Equipment

Insider Trades

Usha Martin: Promoter Stuti Raghav Agarwalla bought 12,000 shares on May 18. Promoter Peterhouse Investments sold 1 lakh shares on May 17.

Geojit Financial Services: Promoter BNP Paribas SA sold 9.5 lakh shares between May 17 and May 19.

Block Deals

Godrej Agrovet: Godrej Industries bought 40 lakh (2.08%) shares at Rs 492.6 apiece. V-Sciences Investments Pte sold 40 lakh (2.08%) shares at Rs 492.6 apiece.

Greenlam Industries: Hydra Trading bought 20 lakh (1.65%) shares at Rs 300 apiece. Ashish Dhawan sold 20 lakh (1.65%) shares at Rs 300 apiece.

Raymond: J.K. Investors (Bombay) bought 2.36 lakh (0.35%) shares at Rs 872 apiece. J.K. Sports Foundation sold 2.36 lakh (0.35%) shares at Rs 872 apiece.

Who's Meeting Whom

Fortis Healthcare: To meet analysts and investors on May 26.

Minda Industries: To meet analysts and investors on May 24.

Ashoka Buildcon: To meet analysts and investors on May 26.

PSP Projects: To meet analysts and investors on May 27.

Aditya Birla Fashion: To meet analysts and investors on May 24.

Goldiam International: To meet analysts and investors on May 23.

Data Patterns: To meet analysts and investors on May 24.

DFM Foods: To meet analysts and investors on May 27.

Pitti Engineering: To meet analysts and investors on May 25.

Music Broadcast: To meet analysts and investors on May 25.

Valiant Organics: To hold a rescheduled earnings call on May 26.

Max Ventures: To meet analysts and investors on May 25.

Max India: To meet analysts and investors on May 26.

Bigbloc Construction: To meet analysts and investors on May 23.

Bank of India: To meet analysts and investors on May 24.

Vijaya Diagnostic Centre: To meet analysts and investors on May 27.

IRFC: To meet analysts and investors on May 24.

Balrampur Chini Mills: To meet analysts and investors on May 25.

Dhanuka Agritech: To meet analysts and investors on May 25.

UltraTech Cement: To meet Axis Mutual Fund on May 23.

Shiva Texyarn: To meet analysts and investors on May 25.

JK Tyres: To meet analysts and investors on May 21.

Thermax: To meet analysts and investors on May 23.

NIIT: To meet analysts and investors on May 24.

IPCA: To meet analysts and investors on May 25.

Latent View Analytics: To meet analysts and investors on May 24.

Vaibhav Global: To meet analysts and investors on May 24.

Transport Corp. of India: To meet analysts and investors on May 30.

Jubilant Pharmova: To meet analysts and investors on May 27.

The Ramco Cements: To meet analysts and investors on May 23.

Ganesha Ecosphere: To meet analysts and investors on May 24.

KNR Constructions: To meet analysts and investors on May 31.

Torrent Pharma: To meet analysts and investors on May 25.

Trading Tweaks

Record Date Dividend: Trent

Record Date Interim Dividend: Kewal Kiran Clothing

Ex-Date Interim Dividend: Dolat Algotech, Coforge

Ex-Date Annual General Meeting/Dividend: Cyient

Ex-Date Final Dividend: Angel One

Move Into Short-Term ASM Framework: Elgi Equipments, Triveni Engineering & Industries, Nava Bharat Ventures

Move Out Of Short-Term ASM Framework: Shree Renuka Sugars, Genus Power Infrastructures

Money Market Update

The rupee ended at Rs 77.54 against the U.S. Dollar on Friday as compared to Thursday's closing of 77.72.

F&O Cues

Nifty May futures ended at 16,274.90, a premium of 8.75 points.

Nifty May futures shed 13.23% and 23,020 shares in Open Interest.

Nifty Bank May futures ended at 34,305, a premium of 28.60 points.

Nifty Bank May futures shed 2.88% and 2,685 shares in Open Interest.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.