Good morning!

The GIFT Nifty is trading flat at 25,085 as of 6:30 a.m., indicating a muted start for the benchmark Nifty 50.

US index futures fell during Asian trade after minutes of the Federal Open Market Committee's July 29-30 meeting showed most officials highlighted inflation risks as outweighing concerns over the labor market at their meeting last month.

S&P 500 futures down 0.2%

Euro Stoxx 50 futures down 0.2%

Key Events/Data To Watch

HSBC will release preliminary August surveys for manufacturing and services PMI.

The monsoon session of Parliament will to come to an end.

The Ministry of Coal will launch the 13th round of commercial coal mine auctions.

Markets On Home Turf

The benchmark equity indices closed in the green for the fifth straight session on Wednesday.

The NSE Nifty 50 ended 69.9 points or 0.28% higher at 25,050.55 and the BSE Sensex closed 213.45 points or 0.26% up at 81,857.8. The Nifty recorded the longest winning streak since June 11, while the Sensex posted the best winning streak since April 23.

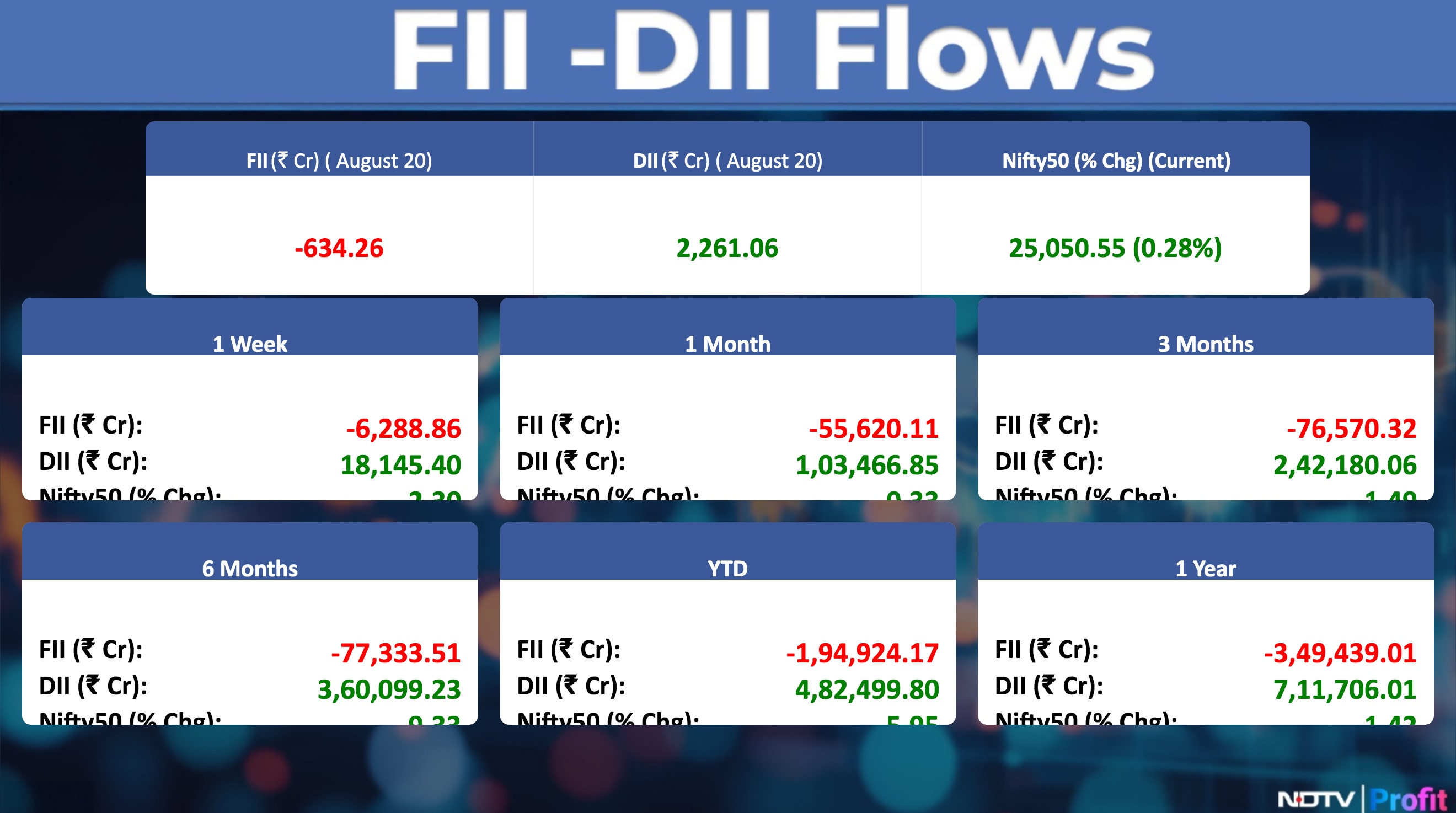

The FPIs sold stocks worth approximately Rs 1,100 crore, according to provisional data from the National Stock Exchange. The DIIs, who have been buyers for the 32th straight session, mopped up stocks worth Rs 1,806 crore.

Wall Street Recap

US stocks fell for a fourth day on Wednesday as traders rotated out of technology high-flyers into less risky sectors after the minutes of the last Federal Reserve meeting showed officials saw inflation risks outweighing concern over the labor market.

The S&P 500 closed 0.2% lower, with the tech and consumer discretionary sectors leading declines. The tech-heavy Nasdaq 100 Index declined 0.6%.

Asia Market Update

Asian technology stocks edged up in early trade on Thursday after dip buyers helped lift US stocks from their lowest levels of the day.

Nikkei down 0.6%

Kospi up 1%

S&P/ASX 200 up 0.6%

Hang Seng futures rose 0.8%

Commodities Check

Oil prices held gains after US crude stockpiles declined the most since mid-June, keeping inventories well below the seasonal average. West Texas Intermediate traded near $63 a barrel after rising more than 1% on Wednesday. Brent closed below $67.

Gold prices held gain after President Donald Trump's call for a Fed governor to quit raised fresh concerns about the central bank's independence, bolstering haven demand. Bullion traded above $3,342 an ounce.

Stocks in News

Shree Cement: The company's income tax demand for fiscal year 2021-22 has been reduced from Rs 588.65 crore to Rs 221.72 crore following a rectification order.

UltraTech Cement: The company's MPS Committee has approved the sale of up to 2.01 crore equity shares, representing a 6.49% stake in the India Cements Ltd, through a stock exchange mechanism. The floor price of the offer is Rs 368.

Jupiter Wagons: The company's arm Jupiter Tatravagonka Railwheel Factory has received a letter of intent for supply of total 5,376 wheelsets for Vande Bharat Train for an order value of approximately Rs 215 crore.

Poonawalla Fincorp: The board of directors approved issuance of non-convertible debentures of face value of Rs 1 lakh each for an amount aggregating up to Rs 500 crore, in dematerialized form, through private placement.

Exide Industries: The company has invested an additional Rs 100 crore in its wholly owned subsidiary, Exide Energy Solutions, through a rights issue, bringing its total investment in the subsidiary to Rs 3,802.23 crore.

IFGL Refractories: The company has received a show-cause notice from the State Pollution Control Board, Odisha regarding the revocation of its consent to operate.

Tanla Platforms: The company has completed the buyback and extinguishment of 20 lakh of its equity shares at a price of Rs 875 per share, for a total of Rs 175 crore, reducing its total equity share capital from 13.46 crore to 13.26 crore shares.

AGI Greenpac: The company has received a disputed demand notice of Rs 40.61 crore from Telangana's Southern Power Distribution for surplus power procured between 2002 and 2022.

SBFC Finance: The board of directors approved the allotment of 20,000 redeemable non-convertible debentures of face value of Rs 1 lakh each aggregating to Rs 200 crore on private placement basis.

Poly Medicure: The company has received approval from National Company Law Tribunal for a resolution plan for the corporate insolvency of Himalayan Mineral Waters. This approval allows the company to proceed with the resolution of the insolvent company.

PTC India Financial Services: The company has executed a definitive agreement with EIE Renewables for the transfer of management of Vento Power Infra for Rs 115.61 crore.

Computer Age Management Services: The company has received no objection letter from Reserve Bank of India for transferring the online payment aggregator activities to CAMS Payment Services a wholly owned subsidiary of the company.

Crisil: The company's arm Crisil Irevna UK has approved incorporation of a wholly owned subsidiary by the name of “Crisil Canada Inc” in Canada.

Railtel Corporation of India: The company has received the work order from Odisha Higher Education Department for work order amounting to Rs 15.42 crore. The company has also received the work order from Kerala State Information Technology Mission for Projects O&M of SDC amounting to Rs 34.99 crore.

Godrej Properties: The company has entered into an agreement to acquire 7% equity shares of Godrej Skyline Developers from its existing shareholders.

Thermax: The company has completed its acquisition of 23.03% stake in Thermax Bioenergy Solutions from Everenviro Resource Management making it a wholly owned subsidiary.

Glenmark Pharmaceuticals: The company has completed its acquisition of a stake in O2 Renewable Energy XXIV by investing the remaining Rs 24 lakh, bringing its total investment to Rs 1.99 crore and its total ownership stake to 32.95%.

Reliance Industries: The company's arm Reliance TerraTech has completed a voluntary winding up process and filed a ‘Certificate of Termination' with the Secretary of State of Texas.

Embassy Developments: The company issued and allotted 53.80 lakh fully paid equity shares to Bellanza Developers at a price of Rs 111.51 per share. This action was taken after the company received the balance consideration of Rs 44.99 crore, which was 75% of the total issue price.

Zota Health Care: The company has allotted 14,734 shares at a price of Rs 509 each to a non-promoter group warrant holder who exercised their warrants by paying the remaining 75% of the issue price.

Voltas: The company has executed a Business Transfer Agreement to transfer its ongoing and defects liability period projects from its overseas branches in Dubai and Abu Dhabi to its arm, Universal MEP Contracting.

Nucleus Software: The board approved the appointment of Vishnu R Dusad, Managing Director of the Company, as the Interim Chief Financial Officer.

Piramal Pharma: The company's arm Piramal Healthcare has completed the subscription of 1,903 optionally convertible redeemable preference shares of PPL Pharma, another step-down subsidiary, for a total of Rs 1,626.49 crore.

Innova Captab: The company has successfully completed the inspection of its Cephalosporin plant, Baddi, Himachal Pradesh conducted by the United Kingdom Medicines and Healthcare products Regulatory with noncritical & major observations.

Hitachi Energy: The board approved the appointment of Ismo Antero Haka as the Chairman of the Board and of the Company in place of Achim Michael Braun.

Tech Mahindra: The Company has incorporated a new wholly owned subsidiary, Tech Mahindra Regional Headquarters, in Saudi Arabia to provide strategic direction and management support to its subsidiaries in Bahrain and Egypt.

RACL Geartech: The company gets long-term supply orders for transmission gears for premium motorcycles.

Prostarm Info Systems: The company emerges as lowest bidder to set up a 150 mw/ 300 mwh standalone battery energy storage system.

Zee Entertainment: The company updates that Aditya Birla Finance moves Delhi High Court against arbitral tribunal's award.

Fedbank Financial: The board to meet on Aug. 25 to consider issuance of NCDs worth up to Rs 2,500 crore.

Ujaas Energy: The Board to meet on Aug. 26 to consider the bonus issue of shares.

Ajanta Pharma: The company informs that the income tax department conducted search operations at some of the company's offices and manufacturing units.

IPO Offering

Shreeji Shipping Global: The company operates in shipping and logistics focusing on dry-bulk cargo. The public issue was subscribed 6.6 times on day 2. The bids were led by Qualified institutional investors (2.42 times), non-institutional investors (11.22 times), retail investors (7.00 times).

Gem Aromatics: The company manufactures speciality ingredients, including essential oils, aroma chemicals. The public issue was subscribed to 2.90 times on day 2. The bids were led by Qualified institutional investors (1.54 times), non-institutional investors (3.95 times), retail investors (3.19 times).

Vikram Solar: The company manufactures solar photo-voltaic modules. The public issue was subscribed to 4.57 times on day 2. The bids were led by Qualified institutional investors (0.11 times), non-institutional investors (13.01 times), retail investors (3.47 times) & Employees (2.37 times).

Patel Retail: The company operates as a retail supermarket chain that operates primarily in tier-III cities and nearby suburban areas. The stores offer a wide range of products, including food, non-food, general merchandise, and apparel. The public issue was subscribed to 19.50 times on day 2. The bids were led by Qualified institutional investors (17.16 times), non-institutional investors (26.11 times), retail investors (16.58 times) & Employees (9.58 times)

Mangal Electrical Industrie: The Company is engaged in manufacturing the transformers that are used for the distribution and transmission of electricity in the power sector. The public issue was subscribed to 0.54 times on day 1. The bids were led by Qualified institutional investors (0.12 times), non-institutional investors (0.72 times), retail investors (0.70 times)

Bulk & Block Deals

Shaily Eng Plastics: American Funds Fundamental bought & Lighthouse India Fund III sold 5 lakh shares (1.08%) at Rs 1,925 apiece.

V-Guard Industries: Chittilappilly Thomas Kochuouseph sold and ICICI Prudential Mutual Fund bought 41.51 lakh shares (0.95%) at Rs 370 apiece.

HCG: Axis Mutual bought & Basavalinga Sadasivaiah Ajaikumar sold 13.92 lakh (0.99%) shares at Rs. 660 a piece.

Pledge Share Details

Senco Gold: Jai Hanuman Shri Siddhivinayak Trust, the promoter, acquired 5,100 shares.

Signpost India: Niren Chand Suchanti, the promoter, disposed of 11,950 shares.

Action Construction Equipment: Promoter and Director Vijay Agarwal acquired 2,200 shares and Sorab Agarwal, the promoter & director, acquired 2,200 shares.

Man Infraconstruction: Promoter Group Parag K Shah acquired 4.61 lakh shares.

Asahi India Glass: Promoter Group Krishna Chamanlal Tiku disposed of 10,000 shares.

Nirlon: Promoter Group Shital Trading & Interiors disposed of 10,000 shares.

Usha Martin: Promoter Group Peterhouse Investments India disposed of 2 lakh shares.

Trading Tweaks

List of securities shortlisted in Short - Term ASM Framework Stage – I : Brightcom Group, Signpost India.

Ex-Dividend: Thomas Cook (India), Coal India, Manorama Industries, Relaxo Footwears, Rail Vikas Nigam, Hindustan Aeronautics.

F&O Cues

Nifty Aug futures is up by 0.17% to 25,077 at a premium of 27 points.

Nifty Aug futures open interest down by 2.11%.

Nifty Options 21th Aug Expiry: Maximum Call open interest at 25,500 and Maximum Put open interest at 25,000.

Securities in ban period: Titagarh, RBL Bank, PGEL.

Currency/Bond Update

The Indian Rupee closed 5 paise weaker against the US Dollar on Wednesday at 87.1 a dollar. It closed at 86.96 a dollar on Tuesday. The yield on the benchmark 10-year bond settled lower at 6.50%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.