Nifty and Sensex jumps 0.5% for the day.

Bajaj Auto and JSW Steel are the top gainers in Nifty.

Nifty Midcap 150 jumps 0.5% for the day, led by Linde India and Timken India.

Nifty smallcap 250 jumps nearly 0.5% for the day, led by BEML and Finolex Industries,

All sectoral indices ended in gain for the day.

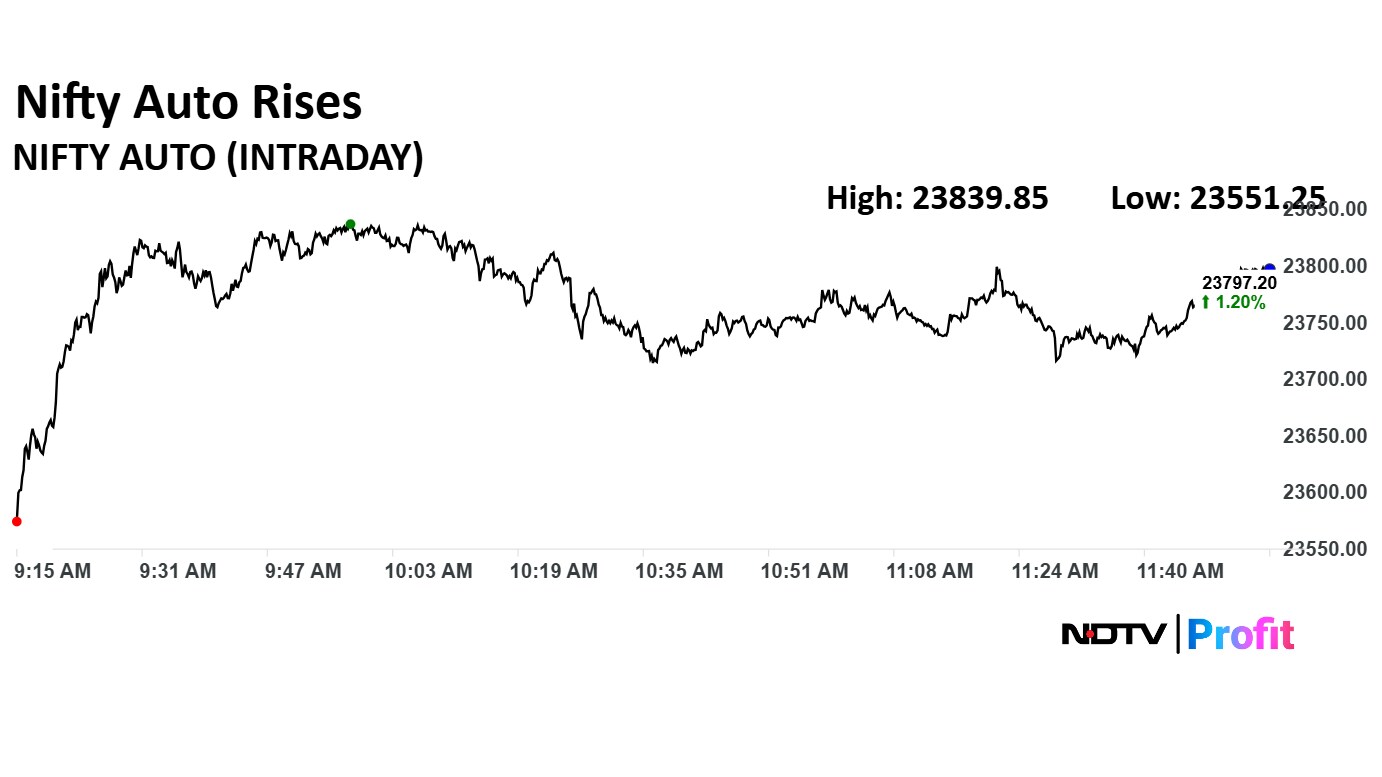

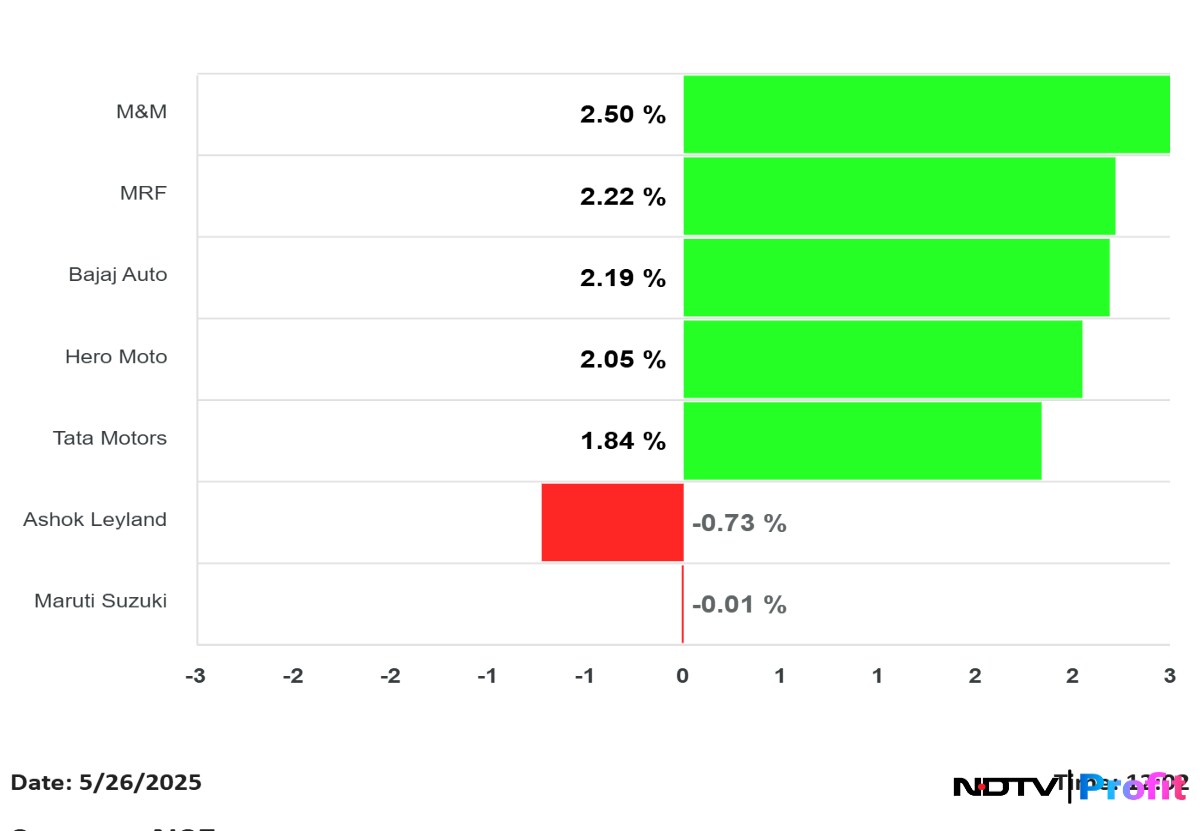

Nifty Auto emerged as top sectoral index for the day, led by Bajaj Auto and Mahindra & Mahindra.

Nifty Auto, IT, FMCG, Metal, Realty, Oil and Gas, Financial Services, Bank, PSU Bank gains higher for the second day in a row.

Nifty Media jumps higher for the 4th day in a row.

Nifty Pharma snaps two days losing streak.

Nifty and Sensex jumps 0.5% for the day.

Bajaj Auto and JSW Steel are the top gainers in Nifty.

Nifty Midcap 150 jumps 0.5% for the day, led by Linde India and Timken India.

Nifty smallcap 250 jumps nearly 0.5% for the day, led by BEML and Finolex Industries,

All sectoral indices ended in gain for the day.

Nifty Auto emerged as top sectoral index for the day, led by Bajaj Auto and Mahindra & Mahindra.

Nifty Auto, IT, FMCG, Metal, Realty, Oil and Gas, Financial Services, Bank, PSU Bank gains higher for the second day in a row.

Nifty Media jumps higher for the 4th day in a row.

Nifty Pharma snaps two days losing streak.

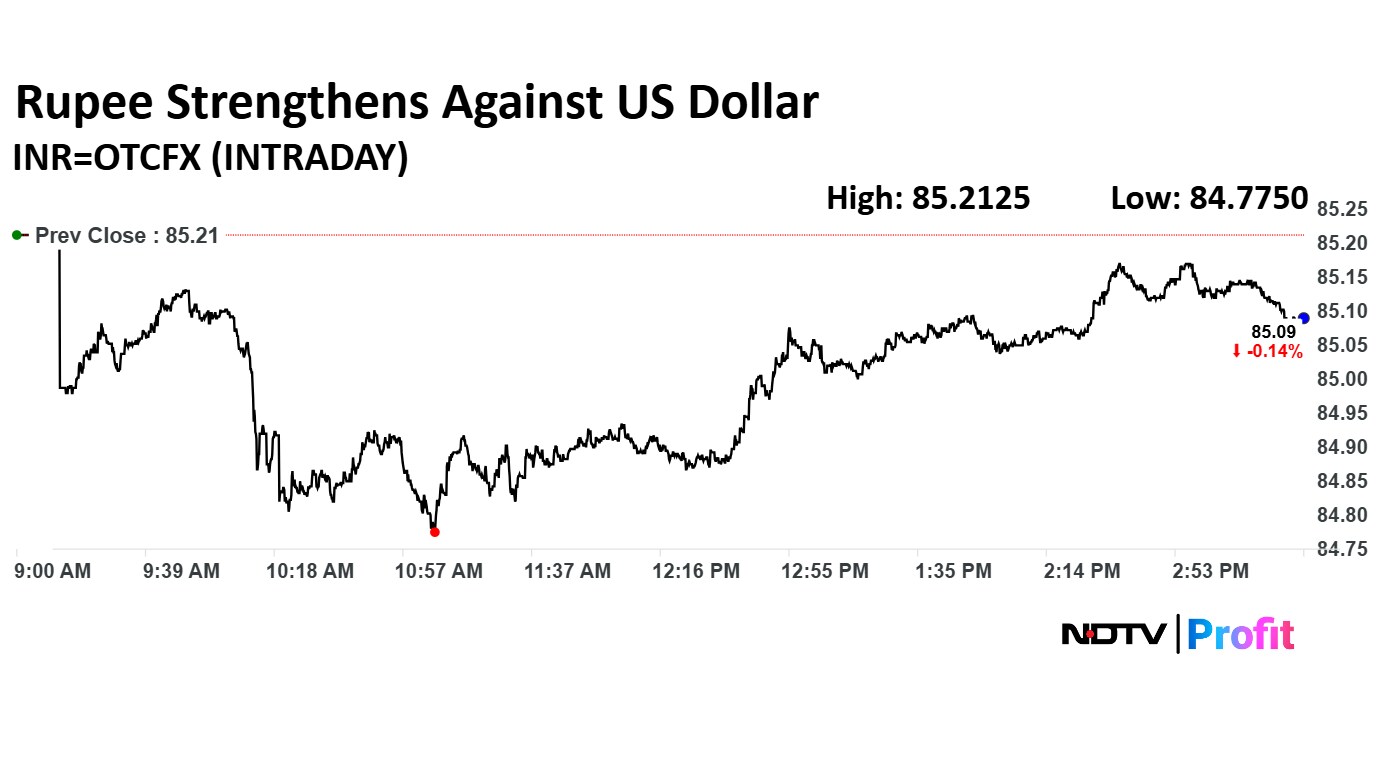

Rupee closed 12 paise stronger at 85.1 against US Dollar

It closed at 85.22 a dollar on Friday.

Source: Bloomberg

Rupee closed 12 paise stronger at 85.1 against US Dollar

It closed at 85.22 a dollar on Friday.

Source: Bloomberg

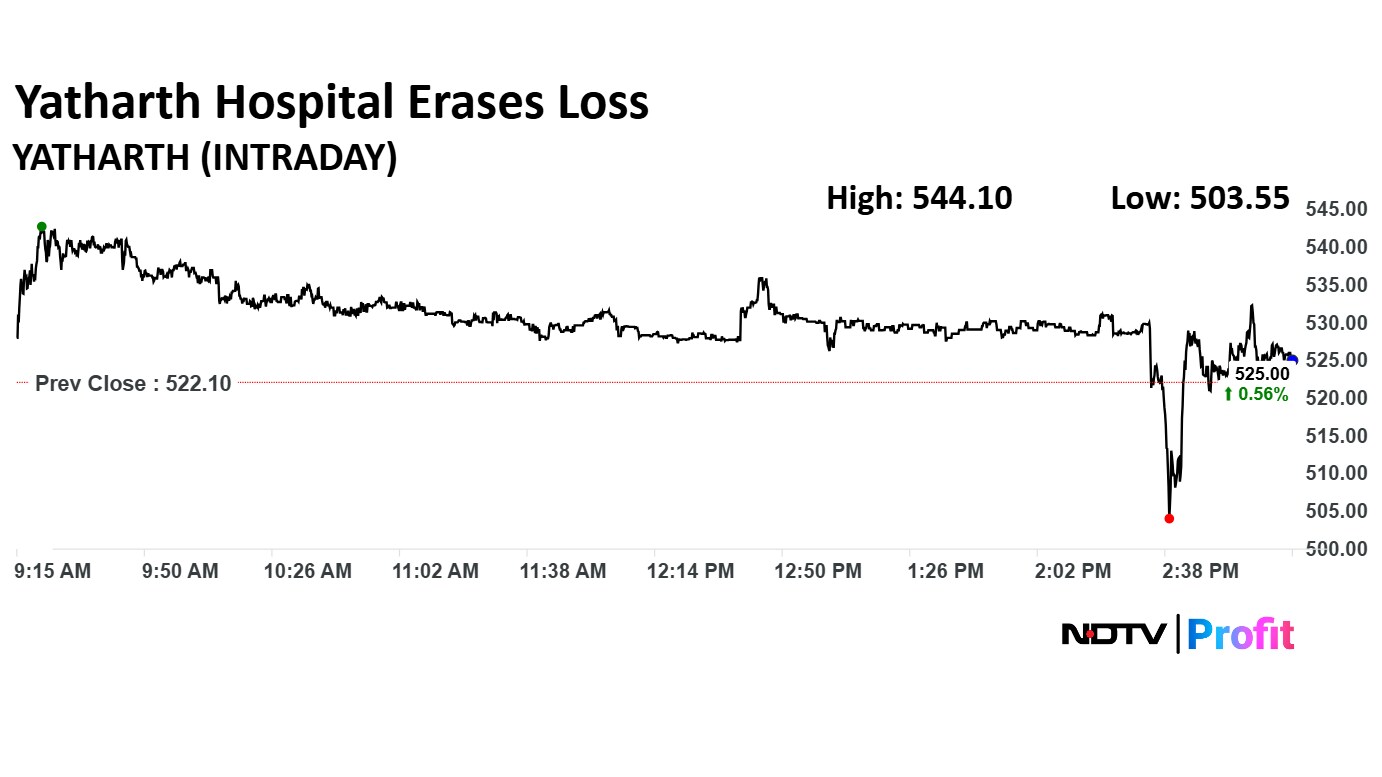

Yatharth Hospital Q4 Highlights (Consolidated, YoY)

Net Profit up 1% at Rs 38.7 crore versus Rs 38 crore.

Revenue up 30.4% at Rs 232 crore versus Rs 178 crore.

EBITDA up 22.6% at Rs 57 crore versus Rs 46.5 crore.

Margin at 24.6% versus 26.2%.

For faster updates on Q4 earnings on Monday click here.

Yatharth Hospital Q4 Highlights (Consolidated, YoY)

Net Profit up 1% at Rs 38.7 crore versus Rs 38 crore.

Revenue up 30.4% at Rs 232 crore versus Rs 178 crore.

EBITDA up 22.6% at Rs 57 crore versus Rs 46.5 crore.

Margin at 24.6% versus 26.2%.

For faster updates on Q4 earnings on Monday click here.

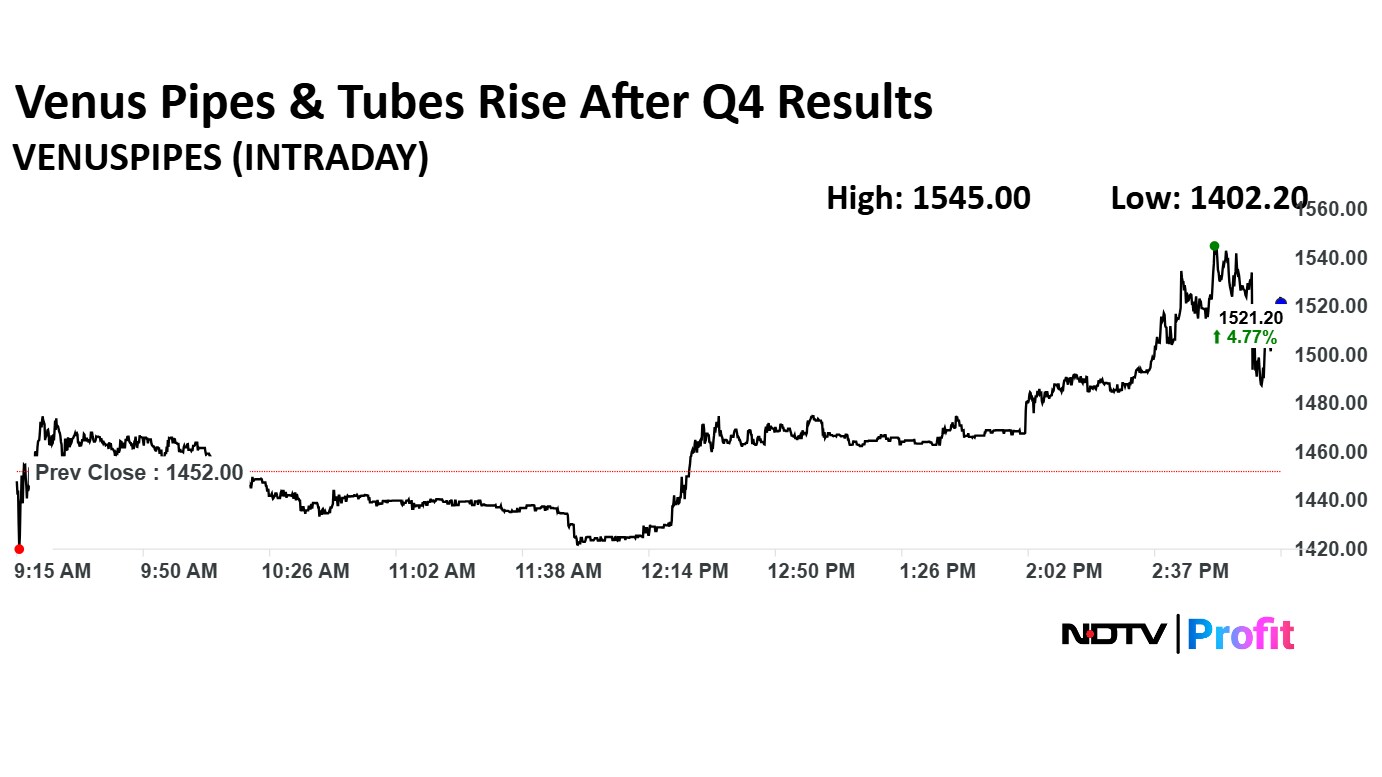

The stock price rose despite a fall in net profit during January-March quarter.

Net Profit fell 5.3% to Rs 23.7 crore versus Rs 25 crore

Revenue rose 15.2% to Rs 258 crore versus Rs 224 crore

Ebitda fell 7.6% to Rs 41.6 crore versus Rs 45 crore

Margin at 16% versus 20%

The stock price rose despite a fall in net profit during January-March quarter.

Net Profit fell 5.3% to Rs 23.7 crore versus Rs 25 crore

Revenue rose 15.2% to Rs 258 crore versus Rs 224 crore

Ebitda fell 7.6% to Rs 41.6 crore versus Rs 45 crore

Margin at 16% versus 20%

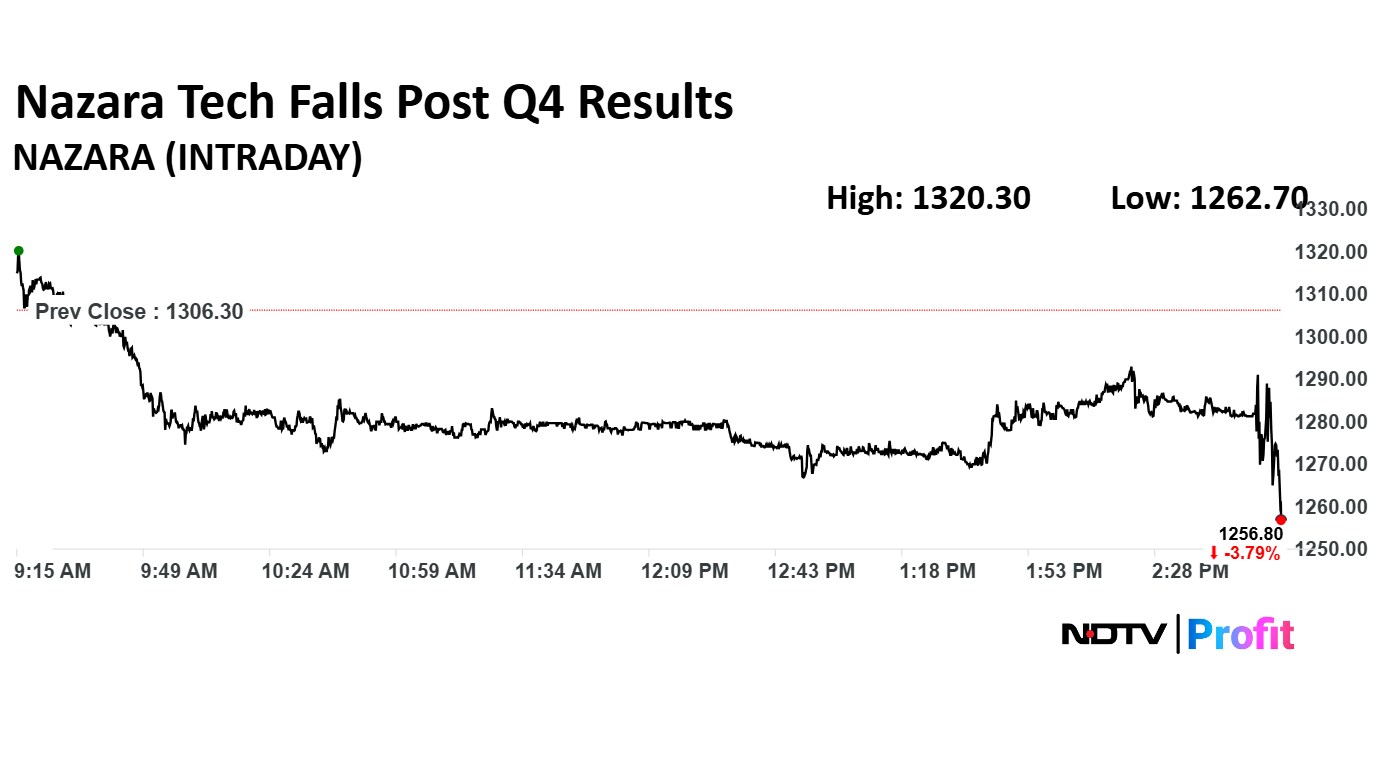

Nazara Technologies Ltd. share price declined 4.69% to Rs 1,262.79 apiece. despite posting good performance in fourth quarter.

Nazara Technologies Ltd. share price declined 4.69% to Rs 1,262.79 apiece. despite posting good performance in fourth quarter.

Life Insurance Co will likely increase its stake in Nestle India Ltd. above 5%, the company said in an exchange filing.

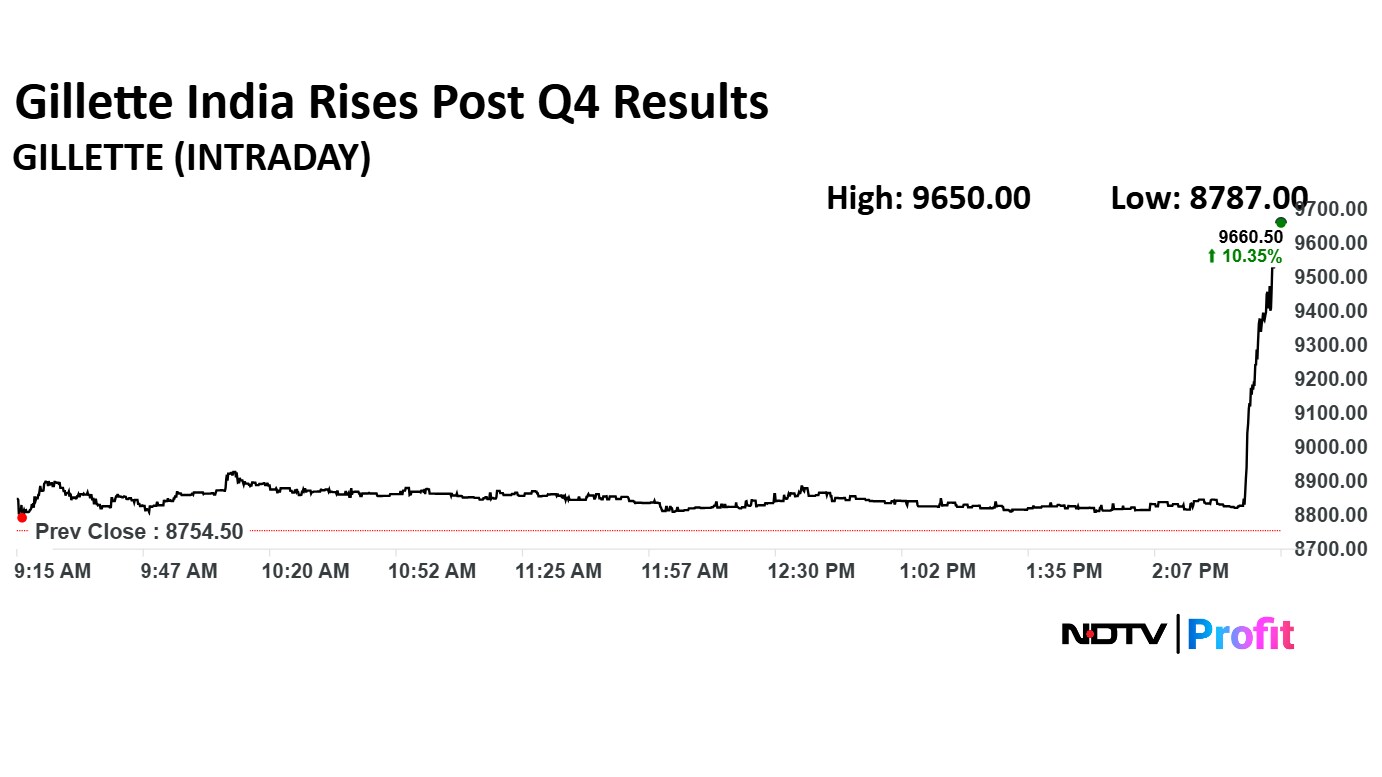

Gillette India Ltd. share prices rose 12.82% to Rs 9,650 apiece, the highest level since Jan 9 as fourth-quarter net profit increased. Gillette India's net profit rose 423.25 to Rs 519 crore in January–March from Rs 99.2 crore in the corresponding period of previous financial year.

For faster updates on Q4 earnings on Monday click here.

Gillette India Ltd. share prices rose 12.82% to Rs 9,650 apiece, the highest level since Jan 9 as fourth-quarter net profit increased. Gillette India's net profit rose 423.25 to Rs 519 crore in January–March from Rs 99.2 crore in the corresponding period of previous financial year.

For faster updates on Q4 earnings on Monday click here.

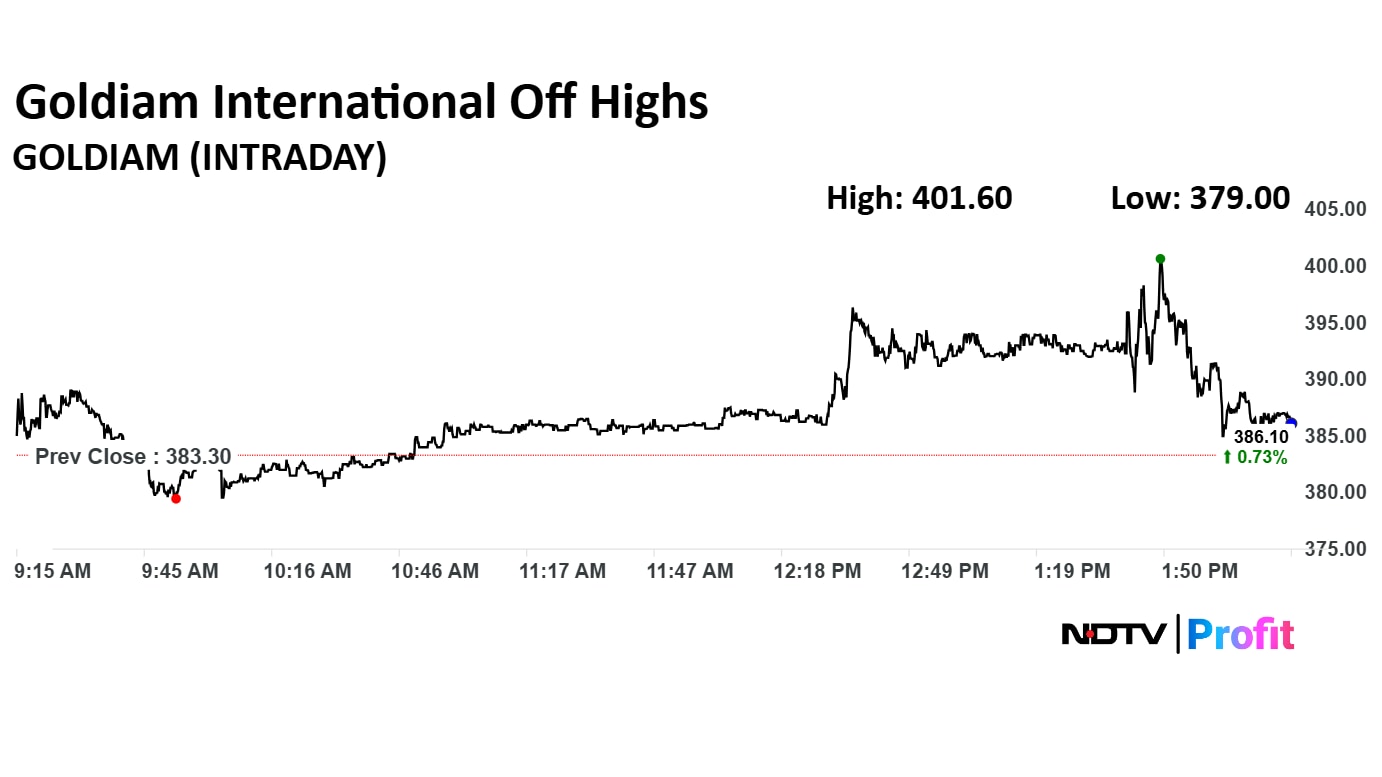

Goldiam International Q4 Highlights (Consolidated, YoY)

Net Profit up 30.5% to Rs 23.2 crore versus Rs 17.8 crore

Revenue up 34.3% to Rs 199 crore versus Rs 148 crore

Ebitda up 51.5% to 36.3 crore versus Rs 23.9 crore

Margin at 18.3% versus 16.2%

To pay final dividend of Rs 1 per share

Goldiam International Q4 Highlights (Consolidated, YoY)

Net Profit up 30.5% to Rs 23.2 crore versus Rs 17.8 crore

Revenue up 34.3% to Rs 199 crore versus Rs 148 crore

Ebitda up 51.5% to 36.3 crore versus Rs 23.9 crore

Margin at 18.3% versus 16.2%

To pay final dividend of Rs 1 per share

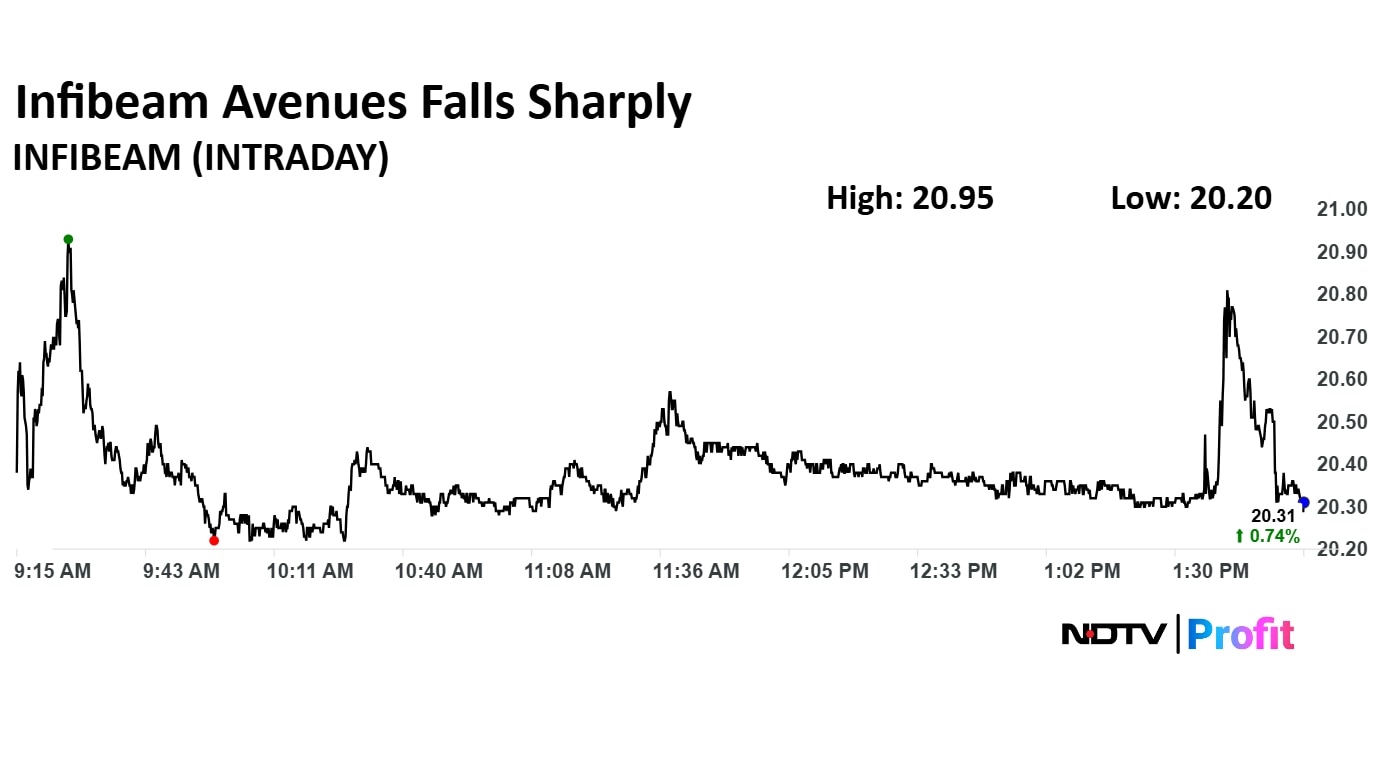

Infibeam Avenues Q4 Highlights (Consolidated, QoQ)

Net profit at Rs 96.2 crore versus Rs 6.2 crore

Revenue down 0.8% at Rs 1,160 crore versus Rs 1,170 crore

EBIT down 62.4% to Rs 60 crore versus Rs 159 crore

Margin at 5.2% versus 13.6%

Infibeam Avenues Q4 Highlights (Consolidated, QoQ)

Net profit at Rs 96.2 crore versus Rs 6.2 crore

Revenue down 0.8% at Rs 1,160 crore versus Rs 1,170 crore

EBIT down 62.4% to Rs 60 crore versus Rs 159 crore

Margin at 5.2% versus 13.6%

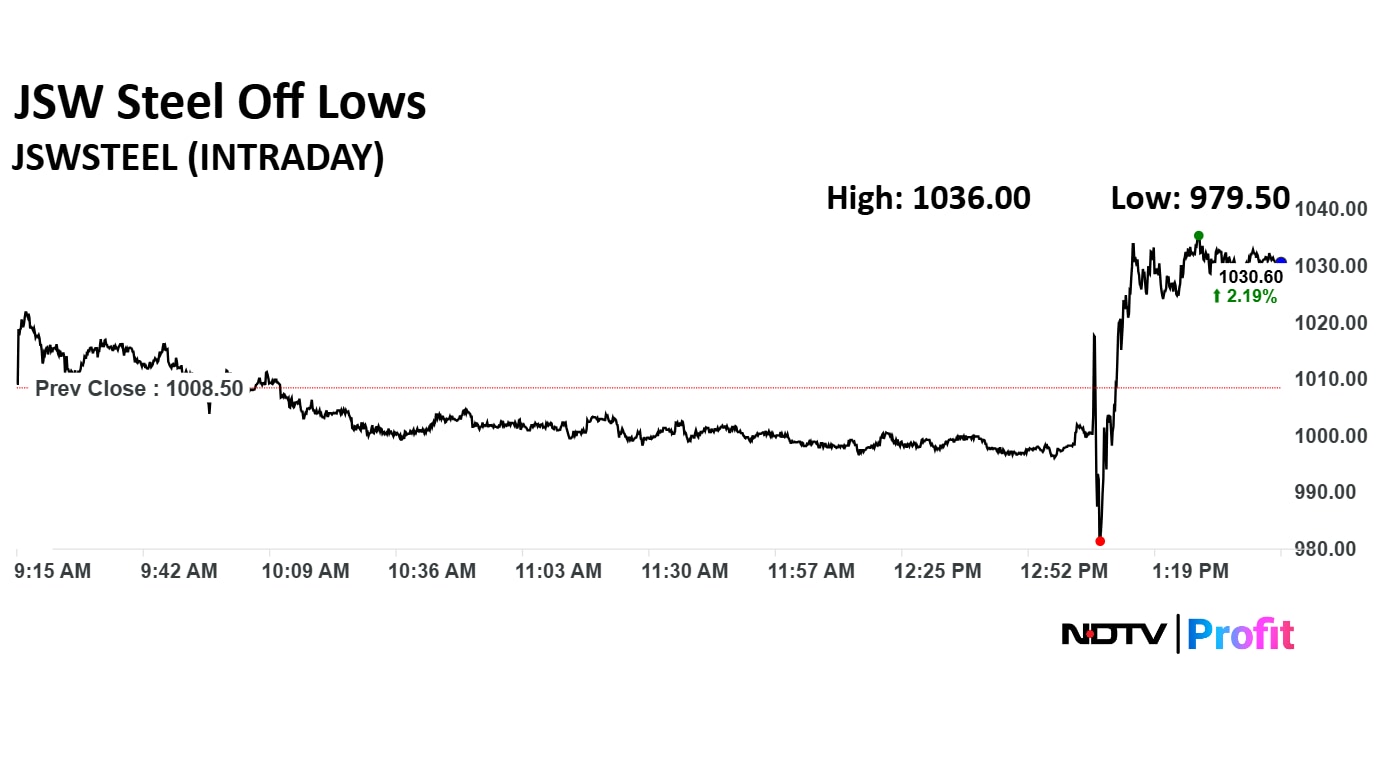

JSW Steel Ltd. share price erased losses after the Supreme Court directed a 'Status Quo' on National Company Law Appellate Tribunal's proceedings further in Bhushan Steel And Power Ltd. case. The status quo is especially to avoid irreversible steps like liquidation.

The apex court has not permitted any conclusive judgement yet. It has permitted to submit a review petition as time is not over yet.

Earlier, JSW Steel filed a petition to seek 60-day stay on liquidation process.

JSW Steel Ltd. share price erased losses after the Supreme Court directed a 'Status Quo' on National Company Law Appellate Tribunal's proceedings further in Bhushan Steel And Power Ltd. case. The status quo is especially to avoid irreversible steps like liquidation.

The apex court has not permitted any conclusive judgement yet. It has permitted to submit a review petition as time is not over yet.

Earlier, JSW Steel filed a petition to seek 60-day stay on liquidation process.

Aurobindo Pharma Ltd., KEC International Ltd., Blue Dart Express Ltd. are among the companies that are set to announce their fourth-quarter results on Monday.

The initial public offering of Aegis Vopak Terminals Ltd. has been subscribed 6% on its first day of bidding on Monday.

The grey market premium of the Aegis Vopak Terminals IPO fell to Rs 10 as of 10:54 a.m, according to InvestorGain. This implies shares of the company will likely list at Rs 245 apiece, indicating a 4.26% premium to the upper end of the price band.

Find more details about Aegis Vopak Terminals here.

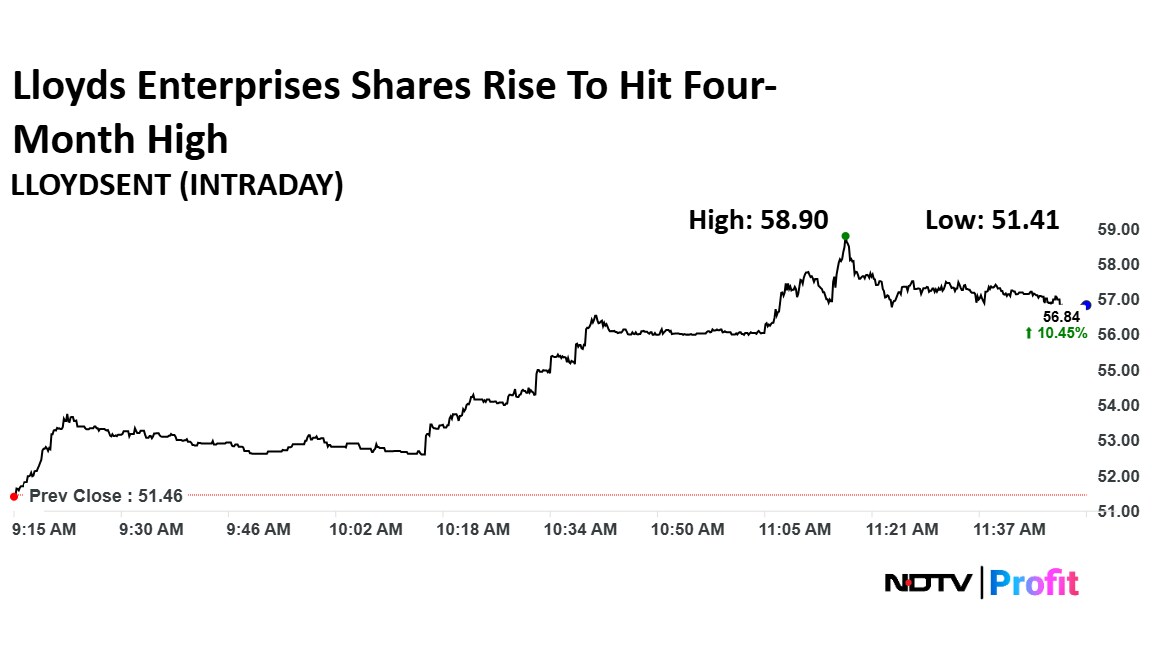

Shares of Lloyds Enterprises Ltd. rose on Monday to hit a four-month high. The shares were up over 14%, extending advances for the second straight session.

The shares on Friday closed 2.57% higher after rising 4.23% to Rs 52.29 per share.

Shares of Lloyds Enterprises Ltd. rose on Monday to hit a four-month high. The shares were up over 14%, extending advances for the second straight session.

The shares on Friday closed 2.57% higher after rising 4.23% to Rs 52.29 per share.

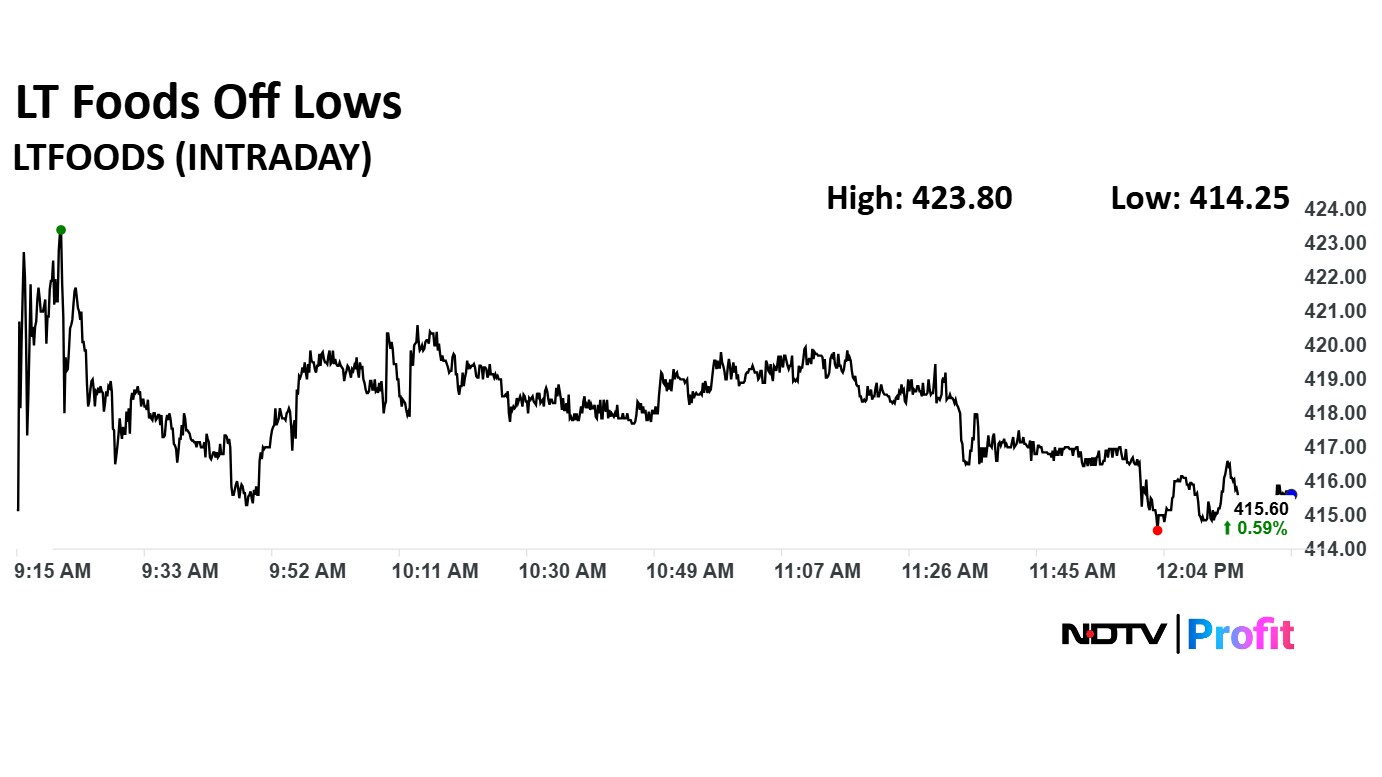

LT Foods is in joint venture with Kameda to expand portfolio & further strengthen roasted gluten-free snacks segment, the company said in an exchange filing.

LT Foods is in joint venture with Kameda to expand portfolio & further strengthen roasted gluten-free snacks segment, the company said in an exchange filing.

Patel Engineering Ltd. received a letter of acceptance for order worth Rs 958 crore from Maharashtra Krishna Valley Development Corp, the company said in an exchange filing.

The NSE Nifty Auto rose 138% to 23,839.85 as Mahindra & Mahindra Ltd. and Tata Motors Ltd. share price led.

The NSE Nifty Auto rose 138% to 23,839.85 as Mahindra & Mahindra Ltd. and Tata Motors Ltd. share price led.

Most stocks of automobile stocks advanced in Monday's session as US President Donald Trump agreed to extend deadline for 50% tariff imposition on European Union.

The NSE Nifty Auto rose 138% to 23,839.85 as Mahindra & Mahindra Ltd. and Tata Motors Ltd. share price led.

The NSE Nifty Auto rose 138% to 23,839.85 as Mahindra & Mahindra Ltd. and Tata Motors Ltd. share price led.

Most stocks of automobile stocks advanced in Monday's session as US President Donald Trump agreed to extend deadline for 50% tariff imposition on European Union.

Welspun Enterprises re-appointed Balkrishan Goenka as Chairman for 1 year from June 1. They also re-appointed Sandeep Garg as MD for 1 year effective June 1.

Govt-Owned NBFCs to sustain strong growth

Govt-Owned NBFCs to gain market share in next two years

See India Govt-Owned NBFC's loan growth at 15% YoY for 2 Years

See relatively higher growth for NaBFID, IREDA from low base

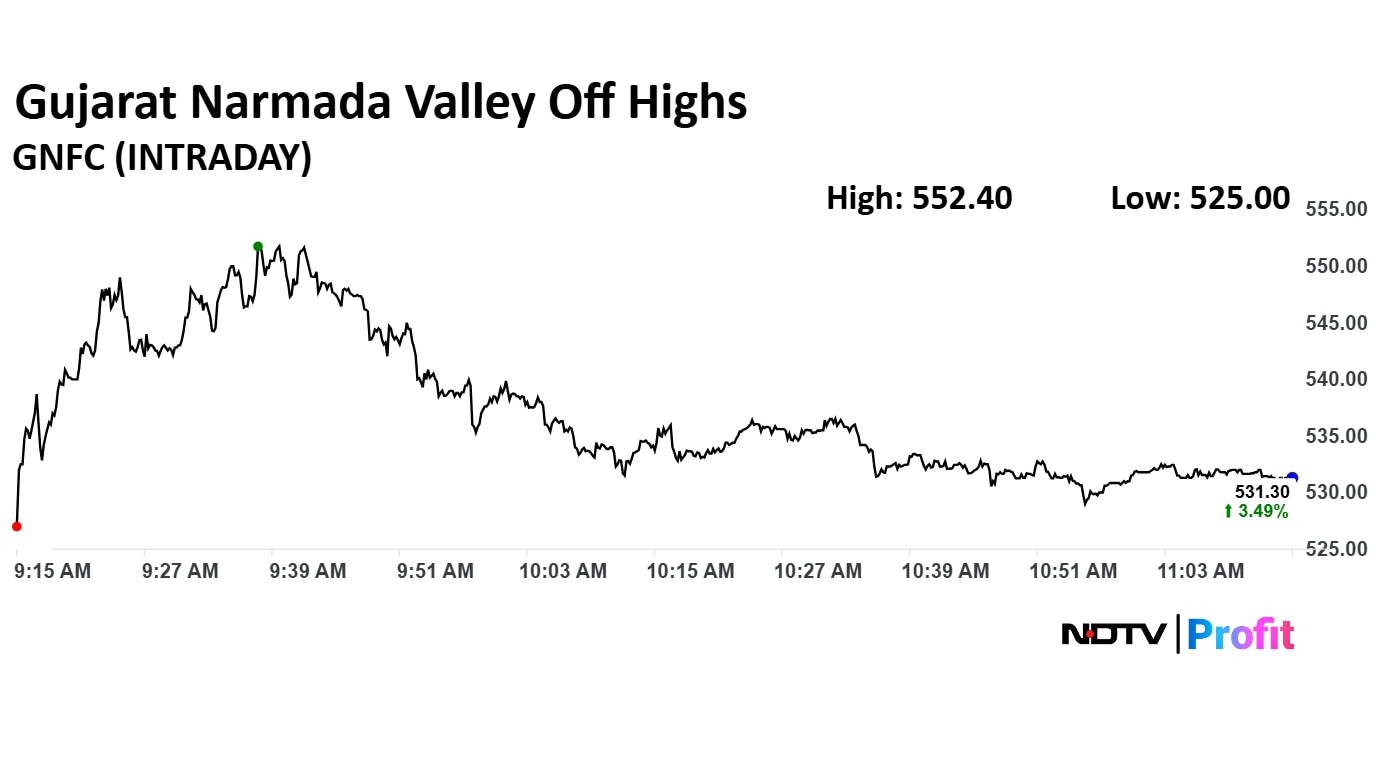

Gujarat Narmada Valley Fertilizers & Chemicals Ltd. share price jumped 7.60% to Rs 552.40 apiece, the highest level since Feb 21. It was trading 3.62% higher at Rs 532 apiece as of 11:16 a.m., as compared to 0.44% advance in the NSE Nifty 50 index.

The share price rose as the company posted a stellar result for January–March quarter.

Revenue down 2.6% at Rs 2,055 crore versus Rs 2,110 crore

EBITDA up 65.5% at Rs 240 crore versus Rs 145 crore

Margin at 11.7% versus 6.9%

Net Profit up 62.3% at Rs 211 crore versus Rs 130 crore

To pay dividend of Rs 18 per share.

Ebitda uptick due to a 14%, 9%,10% downtick in employee expenses, other expenses and the cost of materials.

Gujarat Narmada Valley Fertilizers & Chemicals Ltd. share price jumped 7.60% to Rs 552.40 apiece, the highest level since Feb 21. It was trading 3.62% higher at Rs 532 apiece as of 11:16 a.m., as compared to 0.44% advance in the NSE Nifty 50 index.

The share price rose as the company posted a stellar result for January–March quarter.

Revenue down 2.6% at Rs 2,055 crore versus Rs 2,110 crore

EBITDA up 65.5% at Rs 240 crore versus Rs 145 crore

Margin at 11.7% versus 6.9%

Net Profit up 62.3% at Rs 211 crore versus Rs 130 crore

To pay dividend of Rs 18 per share.

Ebitda uptick due to a 14%, 9%,10% downtick in employee expenses, other expenses and the cost of materials.

Narayana Hrudayalaya share price rose 8.44% to Rs 1,869.90 apiece, the highest level since April 21. The share price advanced as fourth-quarter net profit rose.

Revenue up 18.4% at Rs 1,475 crore versus Rs 1,246 crore.

Ebitda up 22.9% at Rs 357.7 crore versus Rs 291 crore.

Margin at 24.2% versus 23.4%.

Net profit up 3.4% at Rs 197.2 crore versus Rs 190.7 crore.

Final dividend of Rs 4.5/share declared.

Narayana Hrudayalaya share price rose 8.44% to Rs 1,869.90 apiece, the highest level since April 21. The share price advanced as fourth-quarter net profit rose.

Revenue up 18.4% at Rs 1,475 crore versus Rs 1,246 crore.

Ebitda up 22.9% at Rs 357.7 crore versus Rs 291 crore.

Margin at 24.2% versus 23.4%.

Net profit up 3.4% at Rs 197.2 crore versus Rs 190.7 crore.

Final dividend of Rs 4.5/share declared.

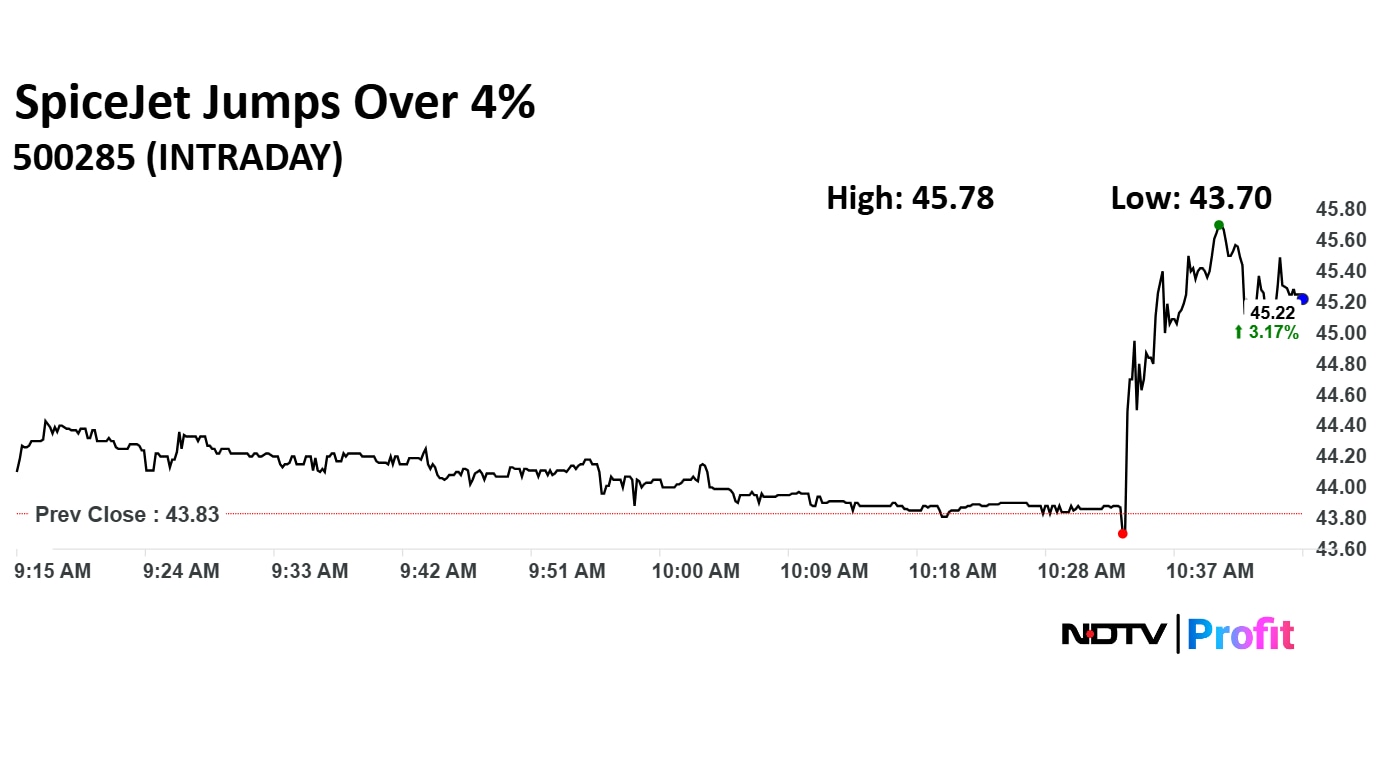

The Delhi High Court has rejected an appeal by KAL Airways and Kalanithi Maran seeking damages of over Rs 1,300 crore. This decision was disclosed in an exchange filing by SpiceJet.

Following the disclosure the stock price jumped as much as 4.45% to Rs 45.78 apiece as of 10:46 a.m.

The Delhi High Court has rejected an appeal by KAL Airways and Kalanithi Maran seeking damages of over Rs 1,300 crore. This decision was disclosed in an exchange filing by SpiceJet.

Following the disclosure the stock price jumped as much as 4.45% to Rs 45.78 apiece as of 10:46 a.m.

Lupin Ltd. is in license pact with SteinCares for commercialisation of Ranibizumab in Latin America. SteinCares to handle regulatory filings, commercialise Ranibizumab, the exchange filing said.

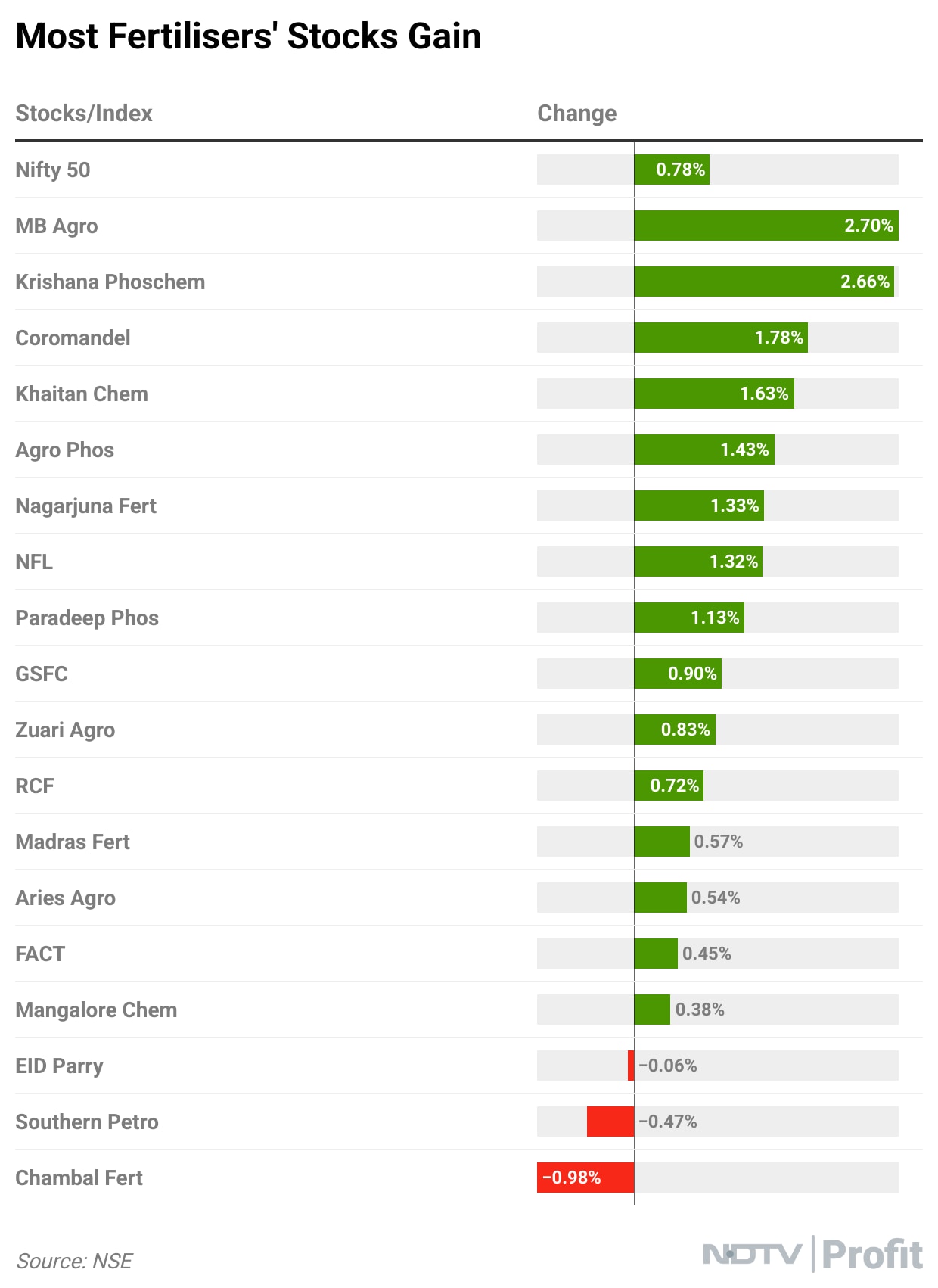

Madhya Bharat Agro Products Ltd., Krishana Phoschem Ltd., and Coromandel International Ltd. share prices were leading gains as most fertilisers' stocks advance.

"Fertiliser stocks are likely to see positive momentum following the European Parliament's decision to raise tariffs on fertilizers and select agricultural imports from Russia and Belarus,"Reliance Securities

Madhya Bharat Agro Products Ltd., Krishana Phoschem Ltd., and Coromandel International Ltd. share prices were leading gains as most fertilisers' stocks advance.

"Fertiliser stocks are likely to see positive momentum following the European Parliament's decision to raise tariffs on fertilizers and select agricultural imports from Russia and Belarus,"Reliance Securities

Stock broking platform Groww has become the latest company to pre-file the draft papers for its initial public offering confidentially, the company said on Sunday.

The draft red herring prospectus, filed with the regulator on May 24, looks to list the Bengaluru-based firm on both the National Stock Exchange and BSE, with shares having a face value of Rs 2 each.

Read the full article here.

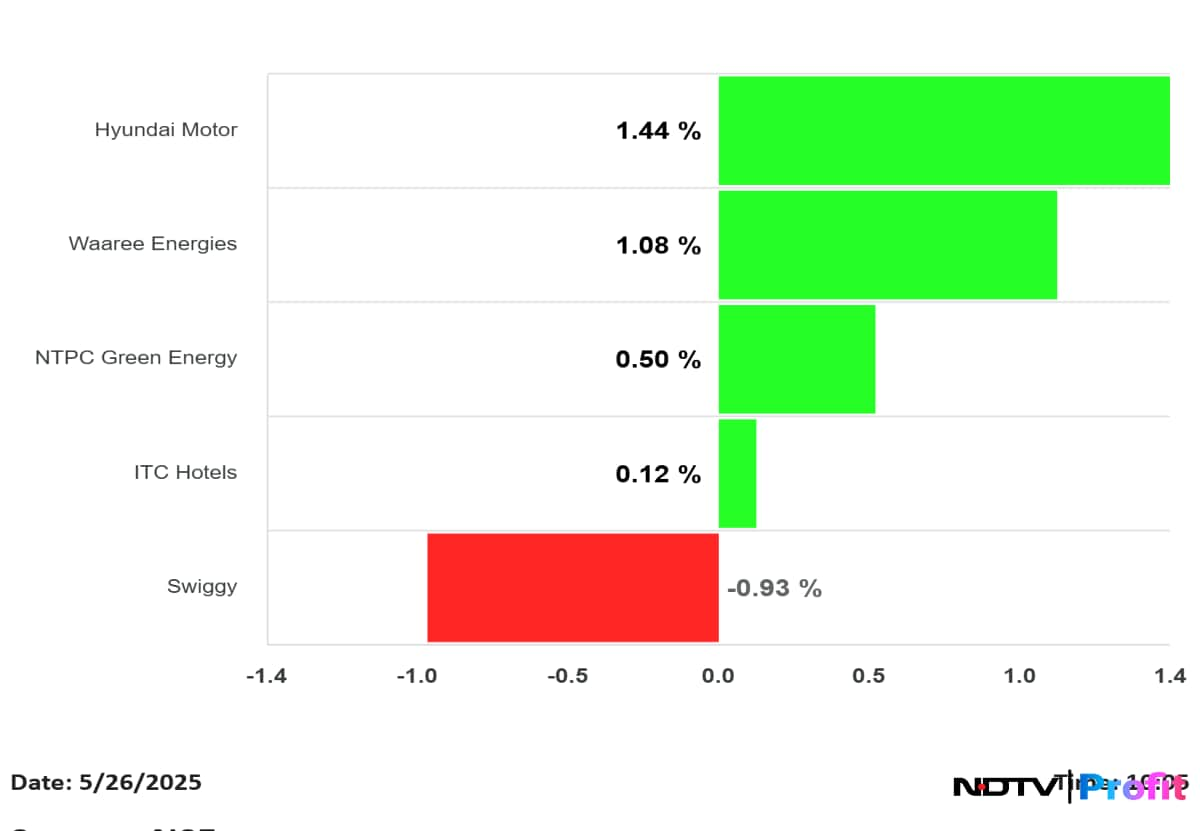

Hyundai Motor India Ltd., Waaree Energies Ltd., NTPC Green Energy share prices rose as these stocks will be added to FTSE Global Equity Index in the large-cap category.

Meanwhile, ITC Hotels Ltd. will enter the mid-cap category.

Hyundai Motor India Ltd., Waaree Energies Ltd., NTPC Green Energy share prices rose as these stocks will be added to FTSE Global Equity Index in the large-cap category.

Meanwhile, ITC Hotels Ltd. will enter the mid-cap category.

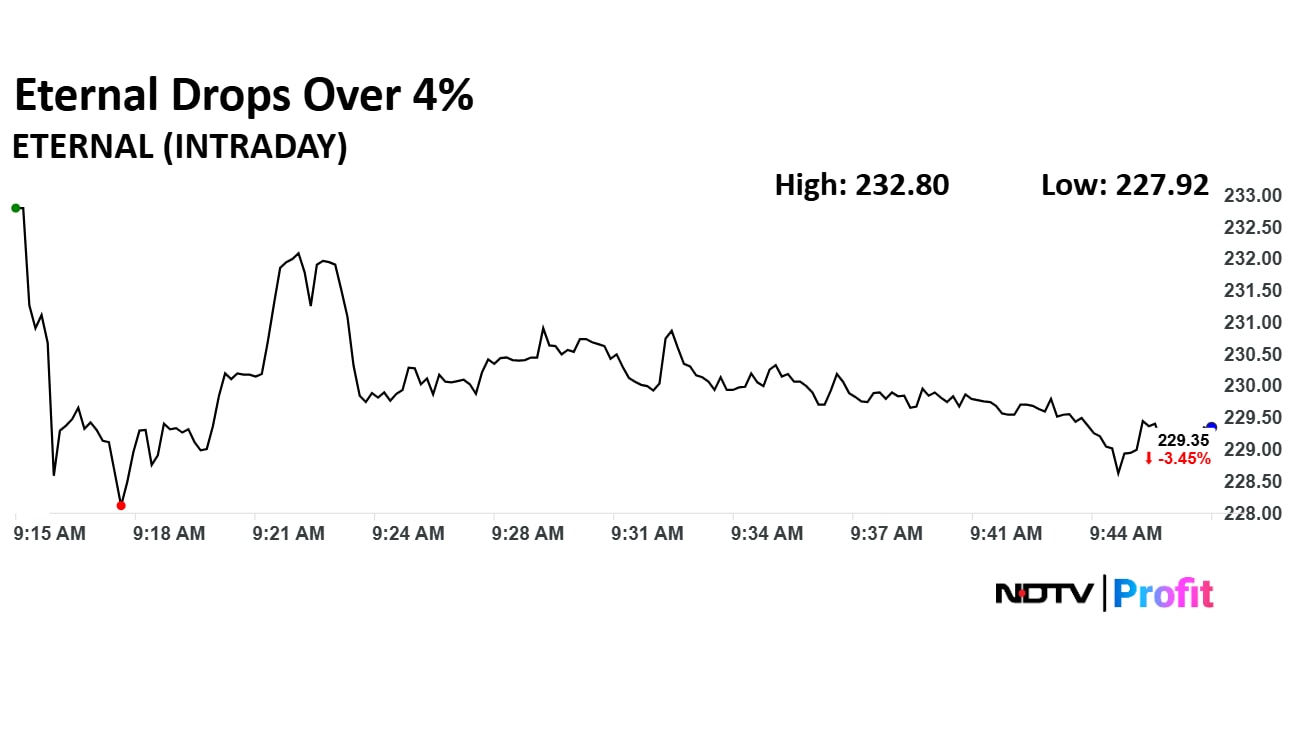

Eternal Ltd. share price declined 4.05% to Rs 227.92 apiece, the lowest level since May 21. The share price declined sharply as $840 million outflow is expected in the current week as FTSE and MSCI cut weightage of the company.

The weightage were reduced after Foreign Ownership fell from 100% to 49.5%.

Eternal Ltd. share price declined 4.05% to Rs 227.92 apiece, the lowest level since May 21. The share price declined sharply as $840 million outflow is expected in the current week as FTSE and MSCI cut weightage of the company.

The weightage were reduced after Foreign Ownership fell from 100% to 49.5%.

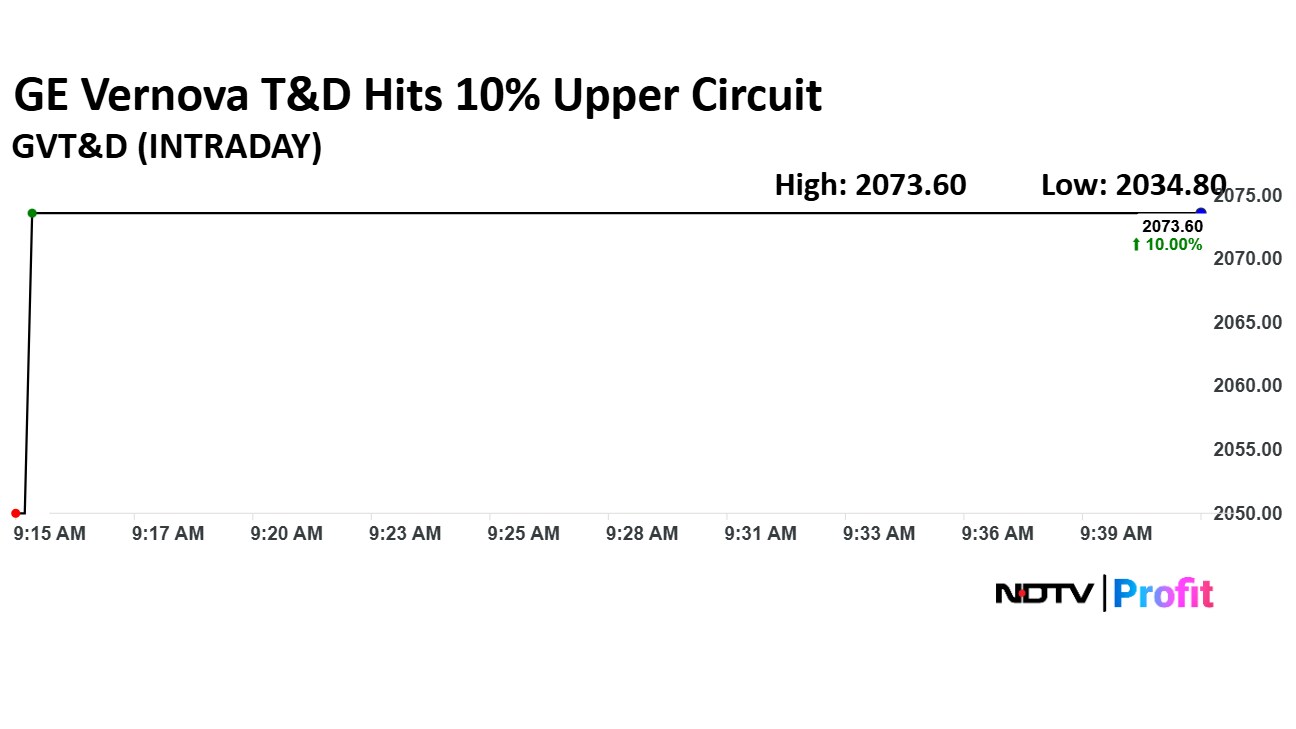

GE Vernova T&D India Ltd. share price hit 10% and rose to Rs 2,073.60 apiece, the highest level since Jan 6. The share price rose despite not so good performance during fourth-quarter.

GE Vernova T&D India Ltd. share price hit 10% and rose to Rs 2,073.60 apiece, the highest level since Jan 6. The share price rose despite not so good performance during fourth-quarter.

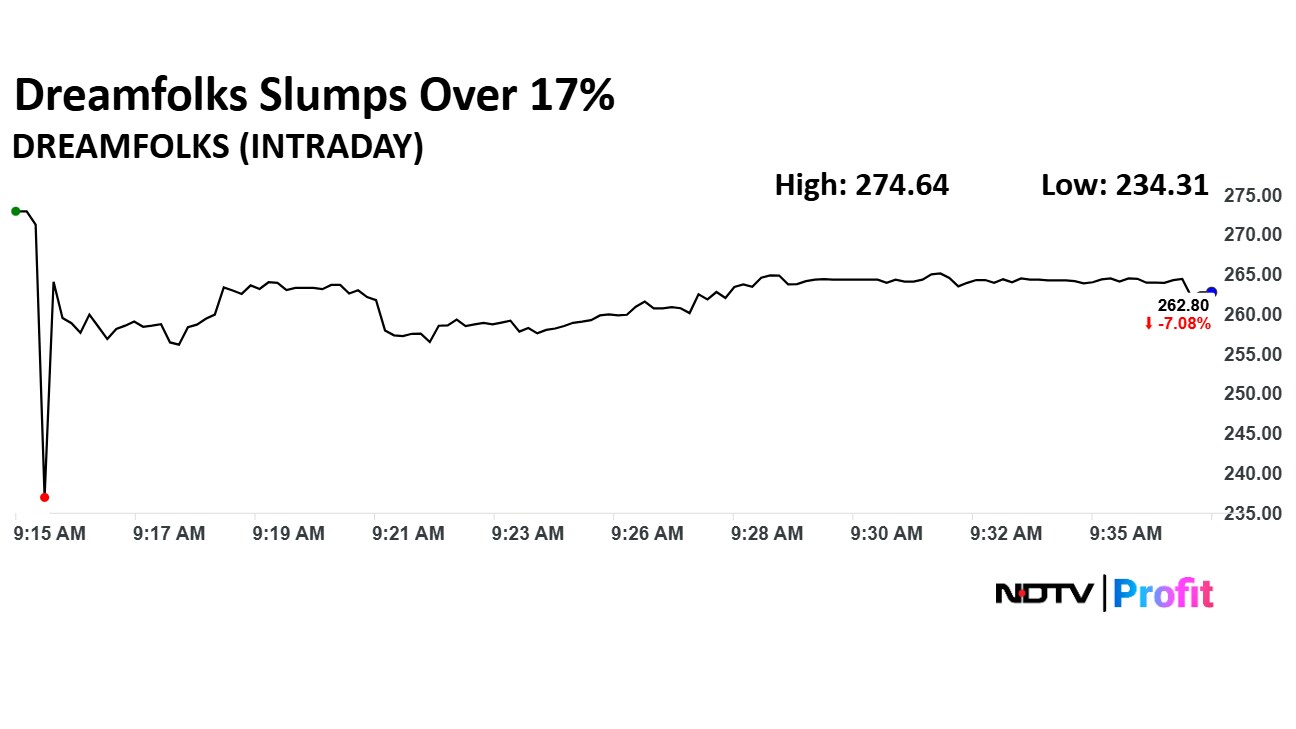

Dreamfolks Services Ltd. share price declined 17.16% to Rs 234.31 apiece, the lowest level since May 12. The share price declined as fourth-quarter earning slipped.

Revenue up 11.7% at Rs 314.1 crore versus Rs 281.1 crore

Ebitda down 19.1% at Rs 19.9 crore versus Rs 24.6 crore

Margin at 6.3% versus 8.8%

Net Profit down 17.2% at Rs 14.9 crore versus Rs 18 crore

Dreamfolks Services Ltd. share price declined 17.16% to Rs 234.31 apiece, the lowest level since May 12. The share price declined as fourth-quarter earning slipped.

Revenue up 11.7% at Rs 314.1 crore versus Rs 281.1 crore

Ebitda down 19.1% at Rs 19.9 crore versus Rs 24.6 crore

Margin at 6.3% versus 8.8%

Net Profit down 17.2% at Rs 14.9 crore versus Rs 18 crore

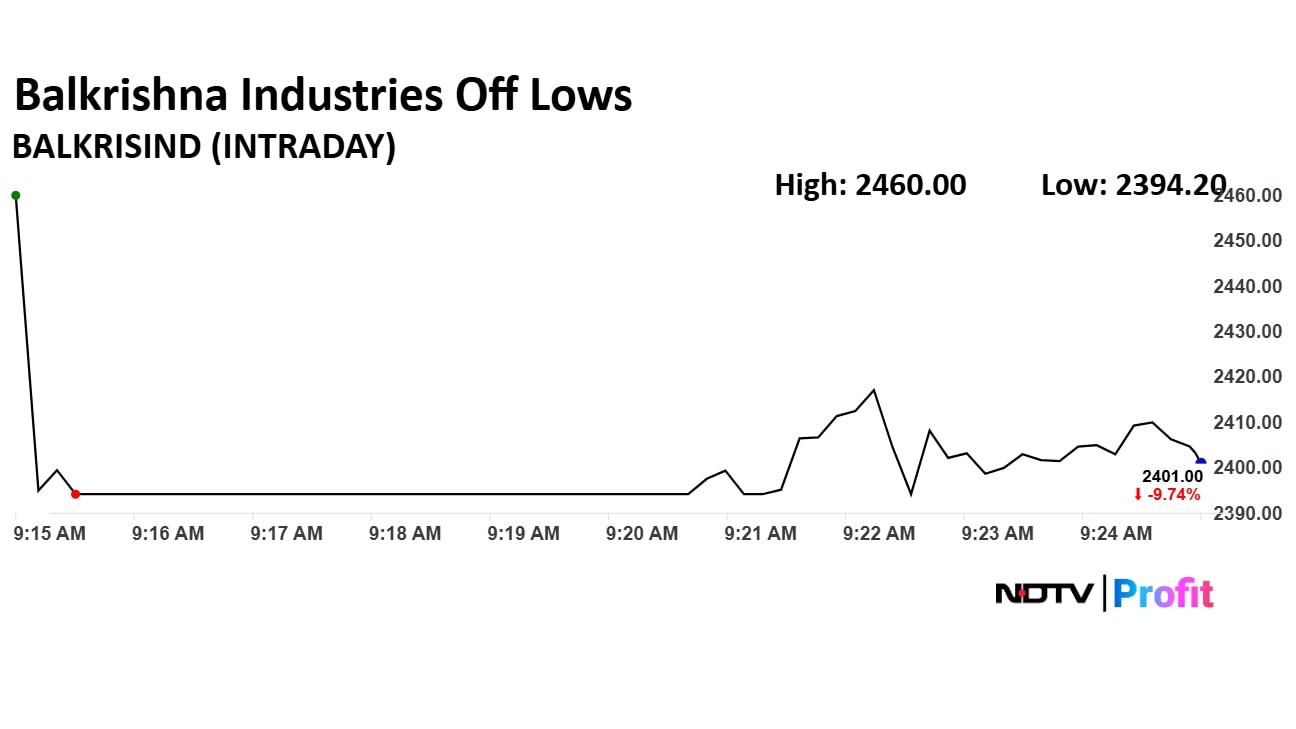

Balkrishna Industries Ltd. share price declined 10% to Rs 2,394.20 apiece, the lowest level since April 15. The share price declined as the company reported more than expected fall in its net profit for fourth quarter.

Revenue up 2.8% to Rs 2,746.6 crore versus Rs 2,673 crore (Bloomberg estimate: Rs 2716.5 crore)

Ebitda down 9.6% to Rs 602 crore versus Rs 665 crore (Bloomberg estimate: Rs 691 crore)

Margin at 21.9% versus 24.9% (Bloomberg estimate: 25.4%)

Net profit down 24.7% to Rs 362 crore versus Rs 481 crore (Bloomberg estimate: Rs 448.5 crore)

Balkrishna Industries Ltd. share price declined 10% to Rs 2,394.20 apiece, the lowest level since April 15. The share price declined as the company reported more than expected fall in its net profit for fourth quarter.

Revenue up 2.8% to Rs 2,746.6 crore versus Rs 2,673 crore (Bloomberg estimate: Rs 2716.5 crore)

Ebitda down 9.6% to Rs 602 crore versus Rs 665 crore (Bloomberg estimate: Rs 691 crore)

Margin at 21.9% versus 24.9% (Bloomberg estimate: 25.4%)

Net profit down 24.7% to Rs 362 crore versus Rs 481 crore (Bloomberg estimate: Rs 448.5 crore)

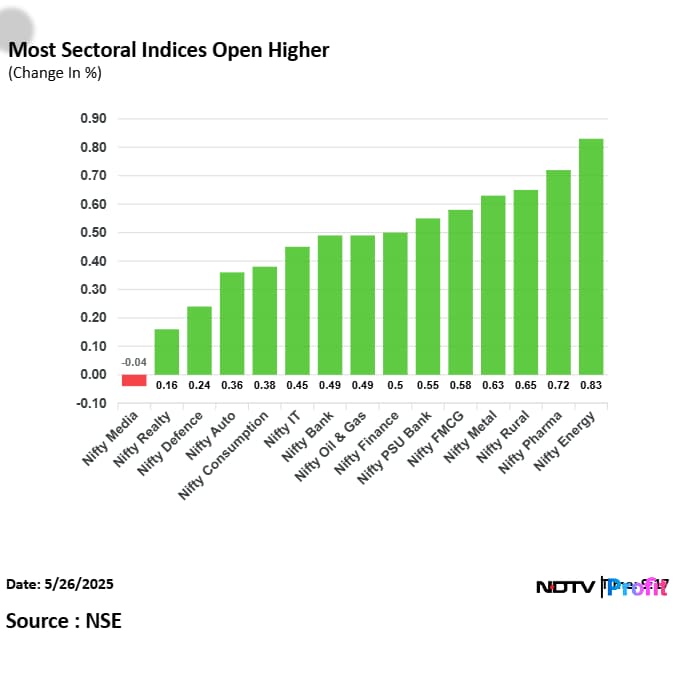

On NSE, 14 sectoral indices advanced, and one declined out of 15. The NSE Nifty Energy rose the most, and the NSE Nifty Media declined the most.

On NSE, 14 sectoral indices advanced, and one declined out of 15. The NSE Nifty Energy rose the most, and the NSE Nifty Media declined the most.

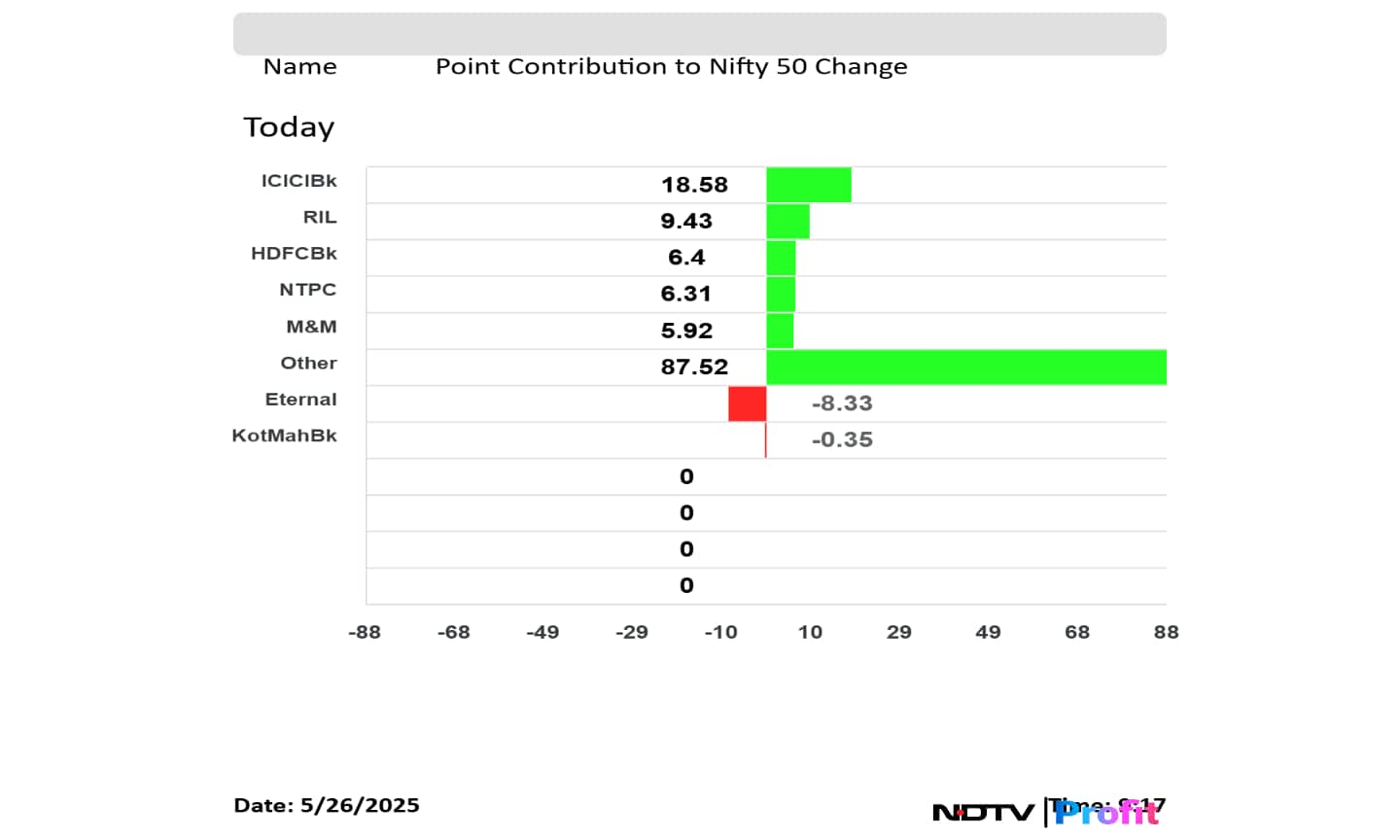

ICICI Bank Ltd., Reliance Industries Ltd., HDFC Bank Ltd., NTPC Ltd., and Mahindra & Mahindra Ltd. added to the Nifty 50 index.

Eternal Ltd., and Kotak Mahindra Bank Ltd. weighed on the Nifty 50 index.

ICICI Bank Ltd., Reliance Industries Ltd., HDFC Bank Ltd., NTPC Ltd., and Mahindra & Mahindra Ltd. added to the Nifty 50 index.

Eternal Ltd., and Kotak Mahindra Bank Ltd. weighed on the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex advanced at open as ICICI Bank Ltd. and Reliance Industries Ltd. share prices led. The Nifty 50 was trading 144.25 points or 0.58% higher at 24,997.40, and the Sensex was 596.02 points or 0.73% higher at 82,317.10.

The NSE Nifty 50 and BSE Sensex advanced at open as ICICI Bank Ltd. and Reliance Industries Ltd. share prices led. The Nifty 50 was trading 144.25 points or 0.58% higher at 24,997.40, and the Sensex was 596.02 points or 0.73% higher at 82,317.10.

At pre-open, the NSE Nifty 50 was trading 0.30% or 75.55 points higher at 24,928.70, and the BSE Sensex was trading 0.17% or 138.84 points higher at 81,859.92.

The yield on the 10-year bond opened 3 basis points higher at 6.28%

It closed at 6.25% on Friday.

Source: Bloomberg

Rupee opened 17 paise stronger at 85.05 against US Dollar

It closed at 85.22 a dollar on Friday.

Source: Bloomberg

Fourth Quarter Ahead But Earnings Downgrades Continue

Nifty 50 recovered some of the YTD underperformance despite a relatively subdued domestic growth environment

Believe consumption recovery is key to returns hereon

Economists expect urban recovery from H2FY26, have a positive outlook on rural consumption demand

Raise Consumer Discretionary to Neutral from Underweight earlier

Valuations are no longer inexpensive at 20x 1yr forward P/E.

See limited upsides from here; would be buyers of dips

Maintain Equal-weight with a target price of Rs 1,000

Q4 Results In-line; BPSL uncertainty remains

Standalone EBITDA was 5% below estimates

Overseas subsidiaries' performance was weaker

Management expects improvement in FY26, mainly on back of higher steel prices

Management believes to have implemented a resolution plan in compliance with the law, and is in discussions with legal advisors for legal remedies

The US Food Drug Administration classified inspection at Telangana active pharmaceutical ingredient unit as 'Voluntary Action Indicated'. The regulator inspected Telangana unit from March 3-7, the company said in an exchange filing.

Oil future prices rose in Asia session as US extended deadline to impose tariff on European Union erased some of the tension related to international trade.

The July future contract of Brent crude was trading 0.08% higher at $64.26 a barrel as of 8:04 a.m.

Most markets in Asia-Pacific markets were trading higher Monday morning as US President Donald Trump extended deadline on European Union. Trump is about to impose 50% tariff on the bloc from July 9.

The Nikkei 225 and KOSPI were trading 0.43% and 0.96% higher respectively as of 7:50 a.m.

Share indices on Wall Street ended lower Friday as US President Donald Trump threatened to impose higher tariff on European Union and Apple Inc. which weighed on the sentiments.

The Dow Jones Industrial Average and S&P 500 ended 0.61% and 0.67% down, respectively. The Nasdaq Composite ended 1% down.

The GIFT Nifty was trading 0.31% or 76 points higher at 24,919.50 as of 6:58 a.m., which implied positive start for the Nifty 50 index.

Investors will monitor share prices of Balkrishna Industries Dreamfolks Services Ltd., JSW Steel Ltd., Glenmark Pharma Ltd. and Bharti Airtel Ltd. because of the earnings and news flow overnight.

The benchmark equity indices closed higher on Friday after a day's respite, amid volatility in domestic markets.

The NSE Nifty 50 closed 243.45 points, or 0.99% higher at 24,853 and the BSE Sensex ended 769 points, or 0.95% up at 81,721.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.