Nifty declined 0.4% for the week, drag by Nifty FMCG.

ITC and Godrej Consumer Products fall the most in Nifty FMCG.

UltraTech Cement and Grasim Industries fall the most in Nifty.

Broader Market Indices outperformed Benchmark Indices this week.

Nifty Midcap 150 jumps more than 1% for the week, led by Suzlon energy and BSE.

Nifty smallcap 250 jumps 1.7% for the week, led by MMTC and ITI.

Nifty FMCG, Oil and Gas, Auto, IT fall for the 2nd week in a row.

Nifty Realty gains for the 3rd week in a row.

Nifty Metal snaps two week gaining streak.

Nifty PSU Banks, Nifty Bank gains for the 3rd week in a row.

Nifty fall for the 2nd consecutive week.

Nifty declined 0.4% for the week, drag by Nifty FMCG.

ITC and Godrej Consumer Products fall the most in Nifty FMCG.

UltraTech Cement and Grasim Industries fall the most in Nifty.

Broader Market Indices outperformed Benchmark Indices this week.

Nifty Midcap 150 jumps more than 1% for the week, led by Suzlon energy and BSE.

Nifty smallcap 250 jumps 1.7% for the week, led by MMTC and ITI.

Nifty FMCG, Oil and Gas, Auto, IT fall for the 2nd week in a row.

Nifty Realty gains for the 3rd week in a row.

Nifty Metal snaps two week gaining streak.

Nifty PSU Banks, Nifty Bank gains for the 3rd week in a row.

Nifty fall for the 2nd consecutive week.

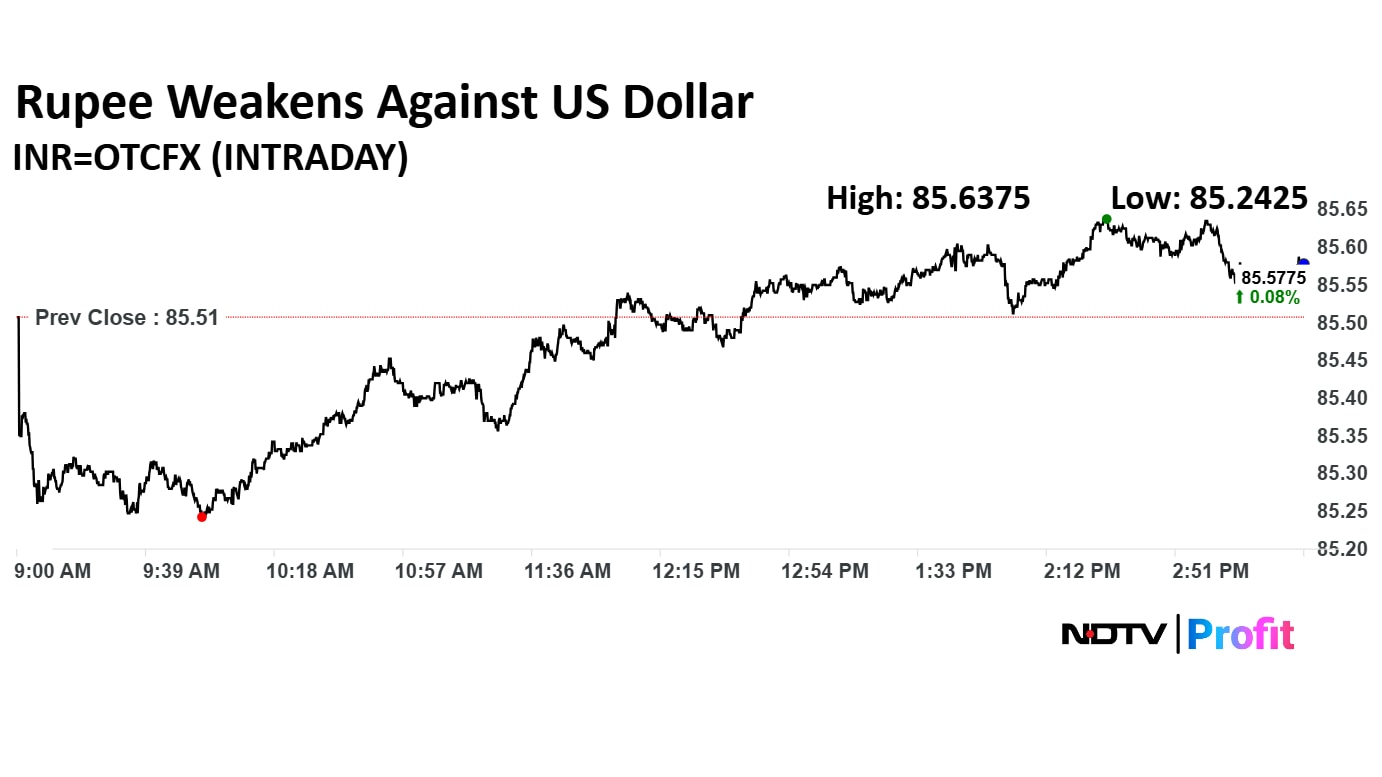

Rupee closed 5 paise weaker at 85.58 against US Dollar

It closed at 85.53 a dollar on Thursday

Source: Bloomberg

Rupee closed 5 paise weaker at 85.58 against US Dollar

It closed at 85.53 a dollar on Thursday

Source: Bloomberg

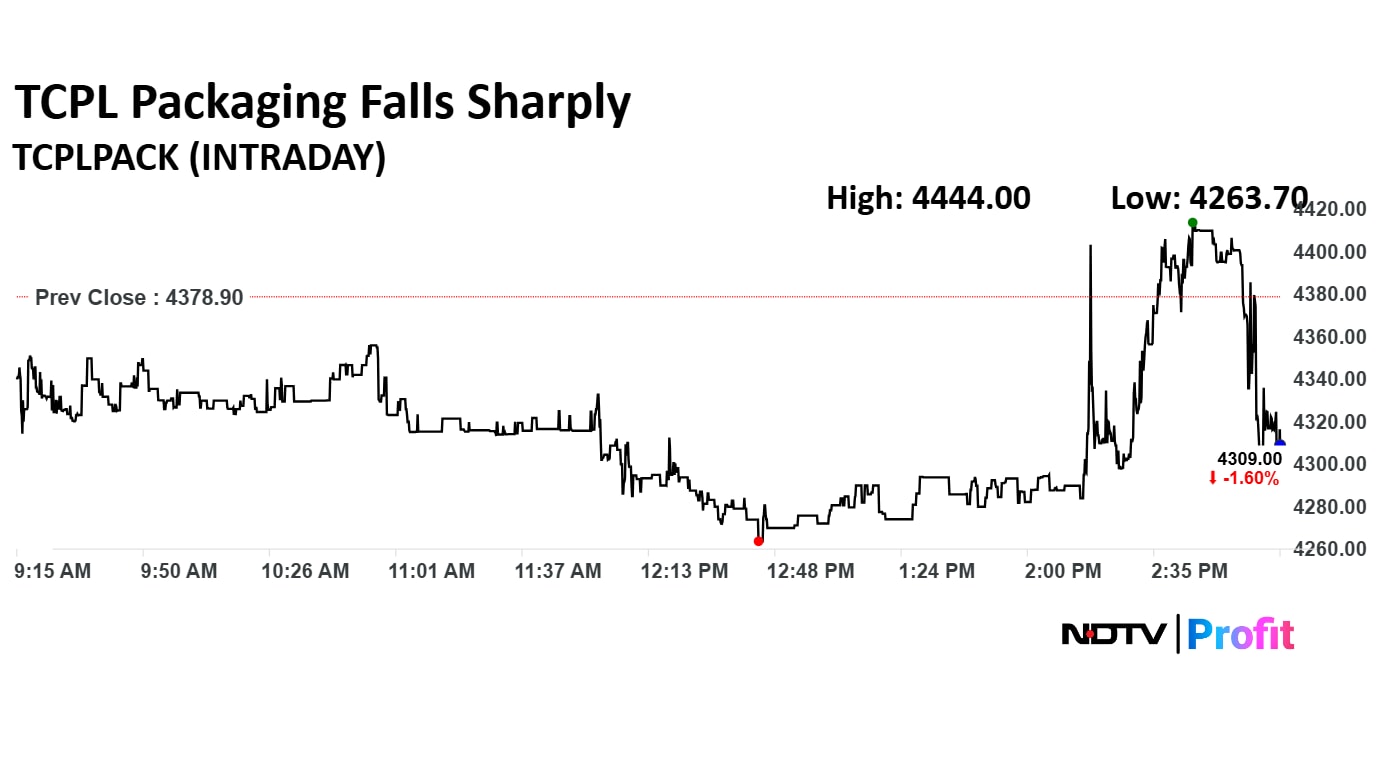

TCPL Packaging Q4 Highlights (Consolidated, YoY)

Revenue up 5.5% to Rs 422 crore versus Rs 401 crore.

Ebitda up 2.4% to Rs 72.1 crore versus Rs 70.4 crore.

Margin at 17.1% versus 17.6%.

Net Profit up 32.8% to Rs 38 crore versus Rs 28.6 crore.

TCPL Packaging Q4 Highlights (Consolidated, YoY)

Revenue up 5.5% to Rs 422 crore versus Rs 401 crore.

Ebitda up 2.4% to Rs 72.1 crore versus Rs 70.4 crore.

Margin at 17.1% versus 17.6%.

Net Profit up 32.8% to Rs 38 crore versus Rs 28.6 crore.

LTIMindtree Ltd. appointed Venugopal Lambu as managing director and chief executive officer with effect from May 31, the company said in an exchange filing.

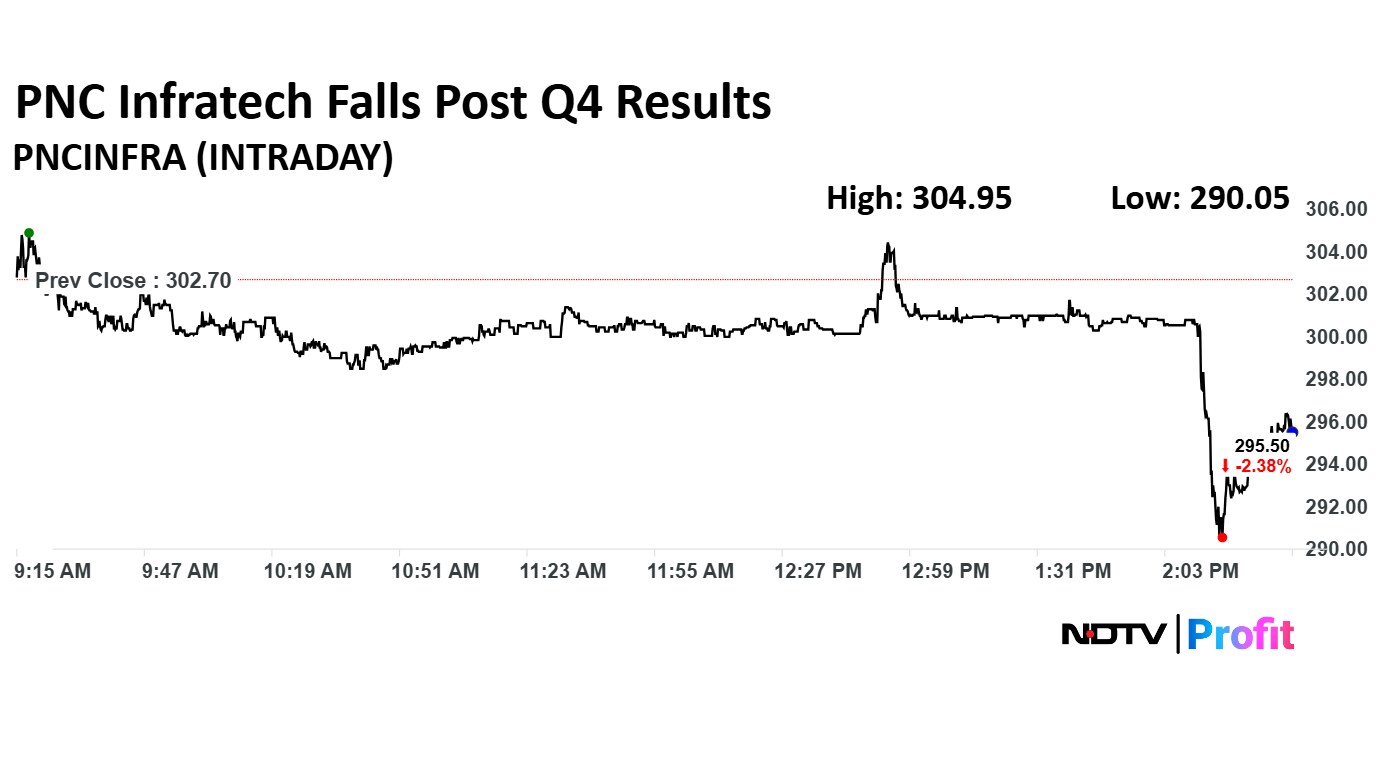

PNC Infratech Q4 Highlights (Consolidated, YoY)

Revenue down 34.47% at Rs 1704.11 crore vs Rs 2600.15 crore

Ebitda down 50.79% at Rs 362.33 crore vs Rs 736.2 crore

Margin at 21.26% vs 28.31% down 705 bps

Net profit down 80.94% at Rs 75.43 crore vs Rs 395.89 crore

For faster update on fourth-quarter earnings click here.

PNC Infratech Q4 Highlights (Consolidated, YoY)

Revenue down 34.47% at Rs 1704.11 crore vs Rs 2600.15 crore

Ebitda down 50.79% at Rs 362.33 crore vs Rs 736.2 crore

Margin at 21.26% vs 28.31% down 705 bps

Net profit down 80.94% at Rs 75.43 crore vs Rs 395.89 crore

For faster update on fourth-quarter earnings click here.

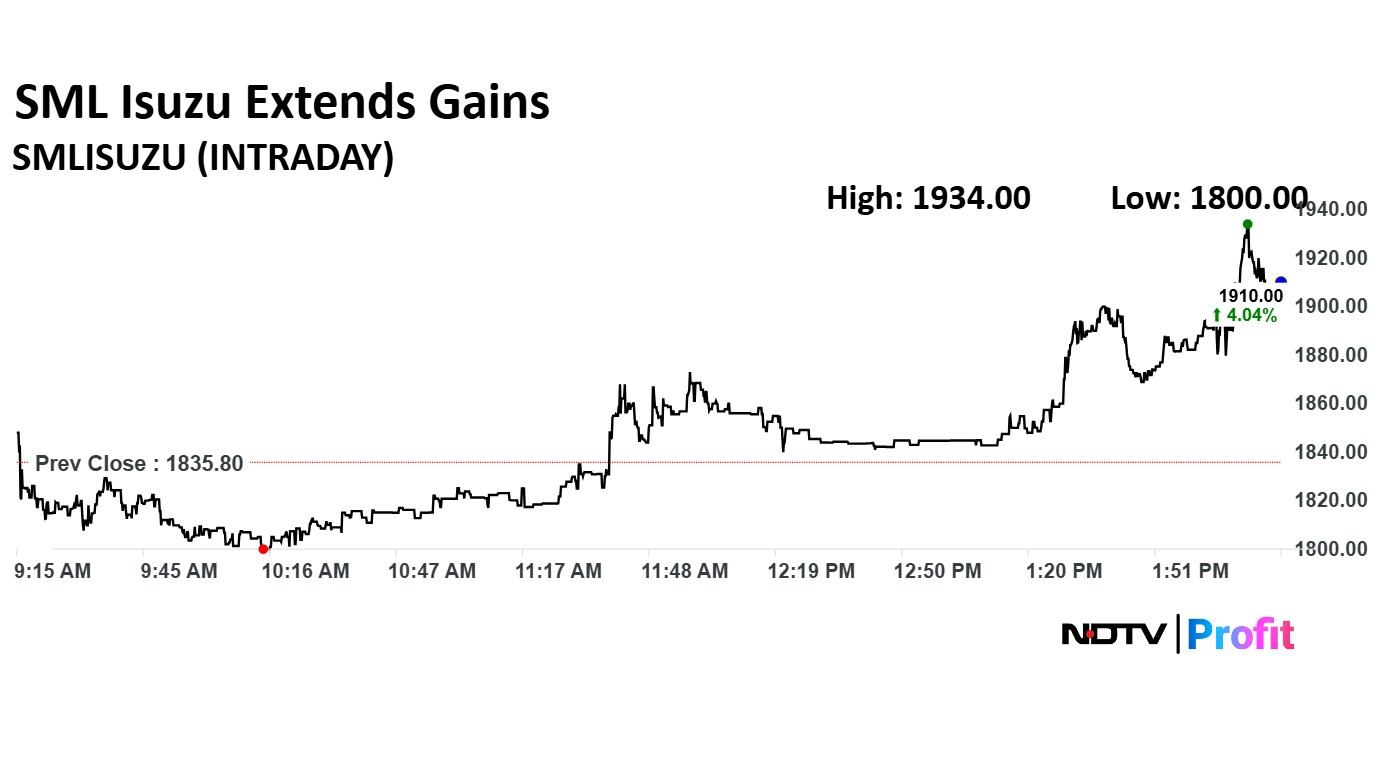

SML Isuzu Ltd. share price extended gains after the company reported that its consolidated net profit rose 1.2% on the year to Rs 52.9 crore during January–March.

SML Isuzu Ltd. share price extended gains after the company reported that its consolidated net profit rose 1.2% on the year to Rs 52.9 crore during January–March.

Equitas Small Finance Bank Ltd. raised Rs 1,250 crore via qualified institutional placement, other means in one or more tranches, the company said in an exchange filing.

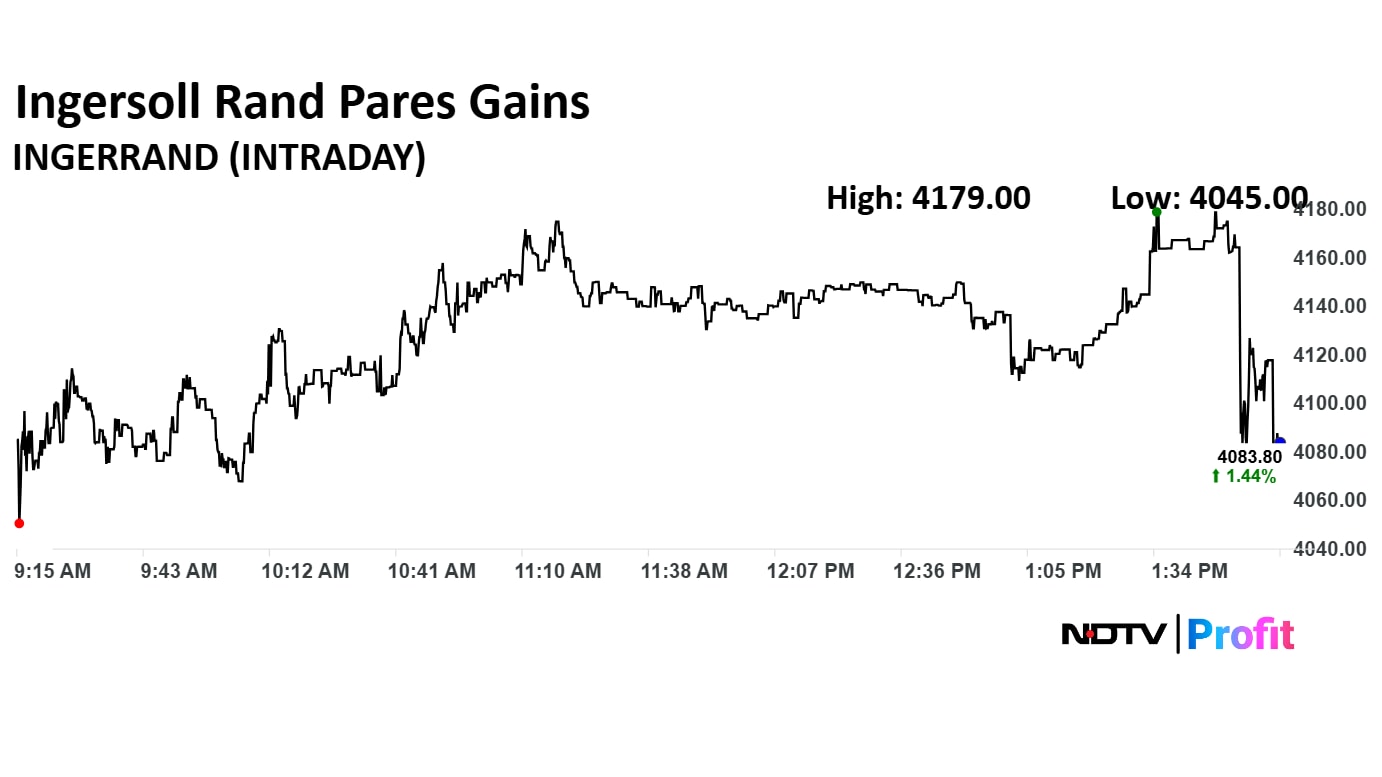

Ingersoll-Rand Q4 Highlights (Consolidated, YoY)

Revenue rises 8% to Rs 322 crore versus Rs 299 crore.

Ebitda rises 13.4% to Rs 83.4 crore versus Rs 73.5 crore.

Margin at 25.9% versus 24.6%.

Net Profit rises 6% to Rs 67.7 crore versus Rs 63.9 crore.

To pay final dividend of Rs 25 per share.

Ingersoll-Rand Q4 Highlights (Consolidated, YoY)

Revenue rises 8% to Rs 322 crore versus Rs 299 crore.

Ebitda rises 13.4% to Rs 83.4 crore versus Rs 73.5 crore.

Margin at 25.9% versus 24.6%.

Net Profit rises 6% to Rs 67.7 crore versus Rs 63.9 crore.

To pay final dividend of Rs 25 per share.

Spandana Sphoorty Financial Ltd. do not have any information of forensic audit to assess cash position, the company said in an exchange filing.

Vodafone Idea Ltd., Nykaa parent FSN E-Commerce Ventures Ltd. and TCI Express Ltd. are among the companies that are set to announce their fourth-quarter results on Friday, as the earnings season draws to a close.

Track live updates here.

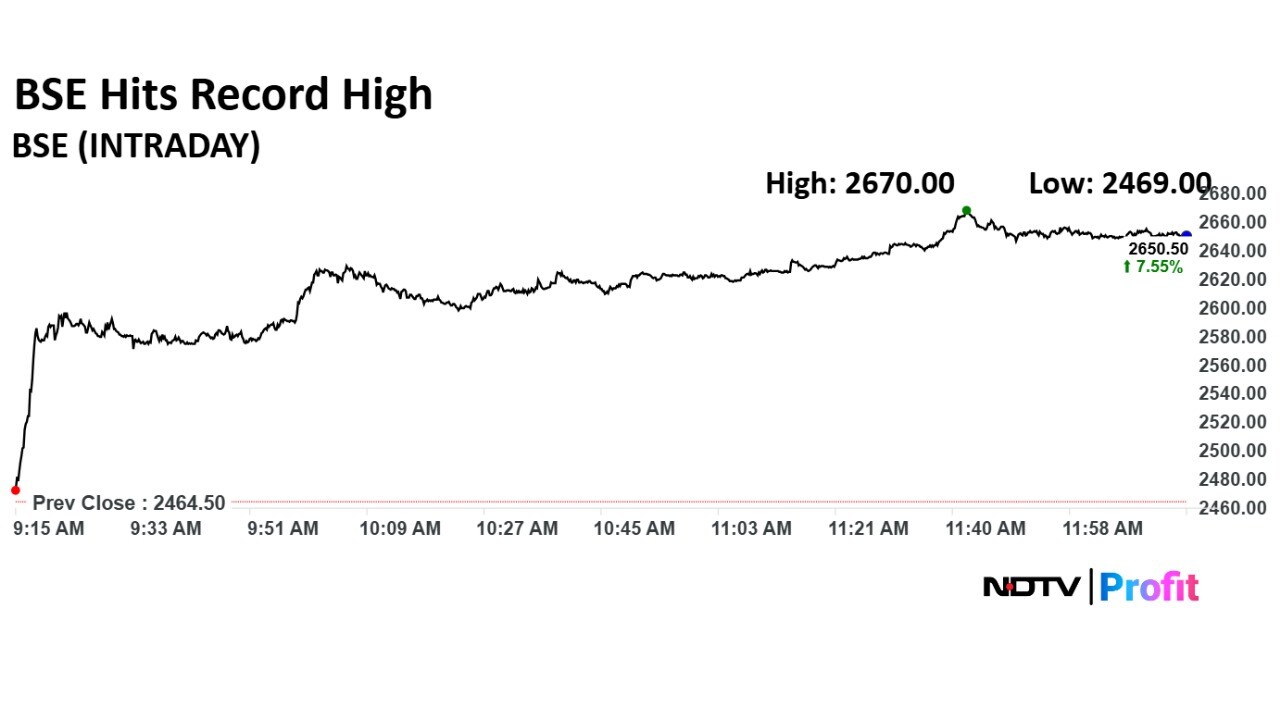

The shares of BSE Ltd. hit life high on Friday after a block deal on the National Stcok Exchange. The shares rose over 8% extending its gains for the third day.

Over 1.49 lakh equity shares changed hands in a block deal worth Rs 38.75 crore on Friday.

The shares of BSE rose as much as 8.34% to Rs 2,670 apiece touching a fresh life high. It pared gains to trade 7.67% higher at Rs 2,652.50 apiece, as of 12:28 p.m. This compares to a 0.32% decline in the NSE Nifty 50 Index.

The shares of BSE Ltd. hit life high on Friday after a block deal on the National Stcok Exchange. The shares rose over 8% extending its gains for the third day.

Over 1.49 lakh equity shares changed hands in a block deal worth Rs 38.75 crore on Friday.

The shares of BSE rose as much as 8.34% to Rs 2,670 apiece touching a fresh life high. It pared gains to trade 7.67% higher at Rs 2,652.50 apiece, as of 12:28 p.m. This compares to a 0.32% decline in the NSE Nifty 50 Index.

Adani Ports & Special Economic Zone Ltd. raised Rs 5,000 crore through non-convertible debentures from Life Insurance Corp. The company tapped the largest ever domestic-bond worth Rs 5,000 crore, the company said in an exchange filing.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Waaree Energies' unit signed a supply order with a US firm. The order is for 586 modules, which will be made at Texas plant. The estimated value of the order is $176 million, according to Bloomberg.

India Glycols Ltd. approved to split stock into two, the company said in an exchange filing.

Tejas Networks' managing director and chief executive officer Anand Athreya resigned. Chief Operating Officer Arnob Roy took additional responsibility of CEO, the company said in an exchange filing.

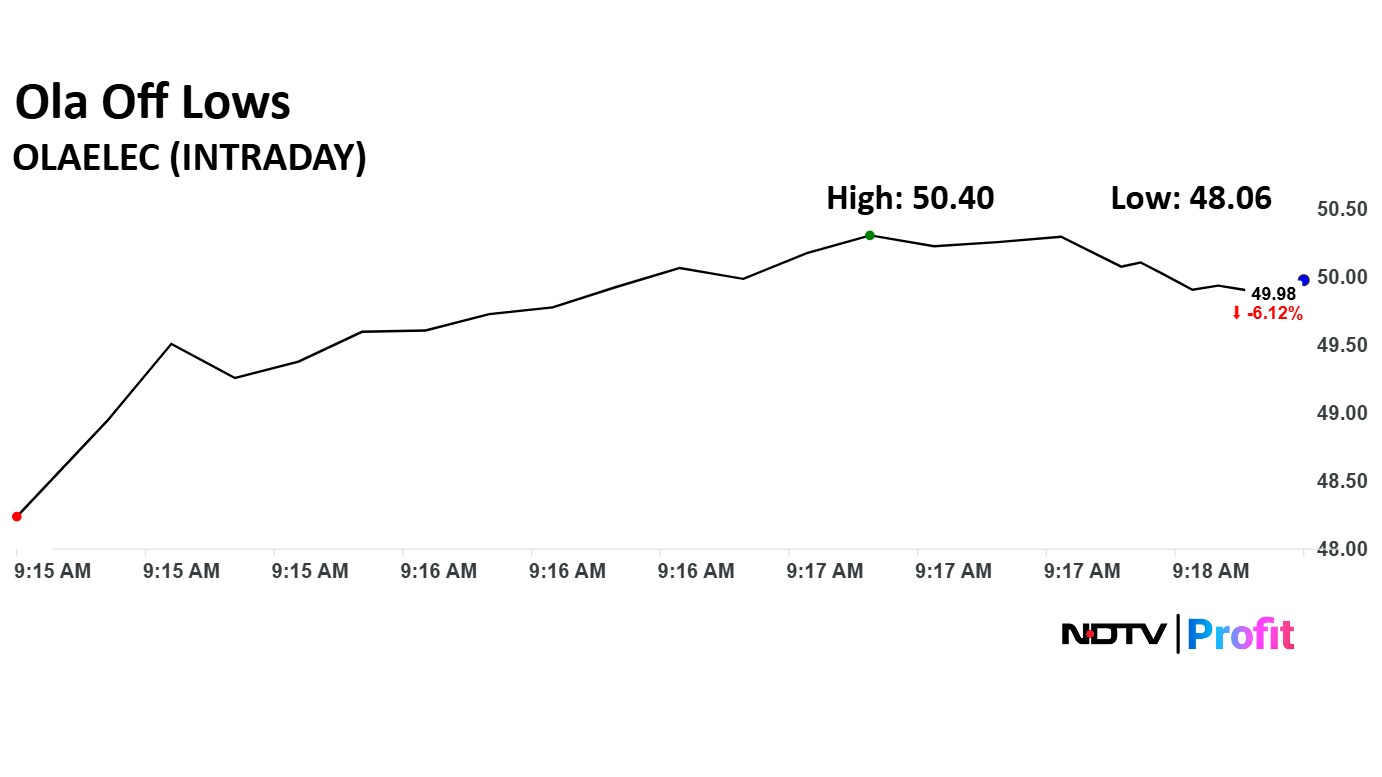

Kotak Securities downgraded Ola Electric Mobility Ltd. shares to 'Sell'.

The brokerage also cut the target price to Rs 30 from Rs 50.

The current target price implied 43.7% downside from Thursday's close price.

Kotak Securities' negative view came after Ola Electric Mobility reported disappointing earning in fourth quarter.

In the world of investing, where market volatility can be a constant source of uncertainty, high-dividend-yield stocks stand out as a beacon of stability and tangible returns. Their primary allure lies in the promise of a regular income stream, rewarding shareholders with a consistent share of the company's profits, regardless of day-to-day stock price fluctuations.

Read the full article here.

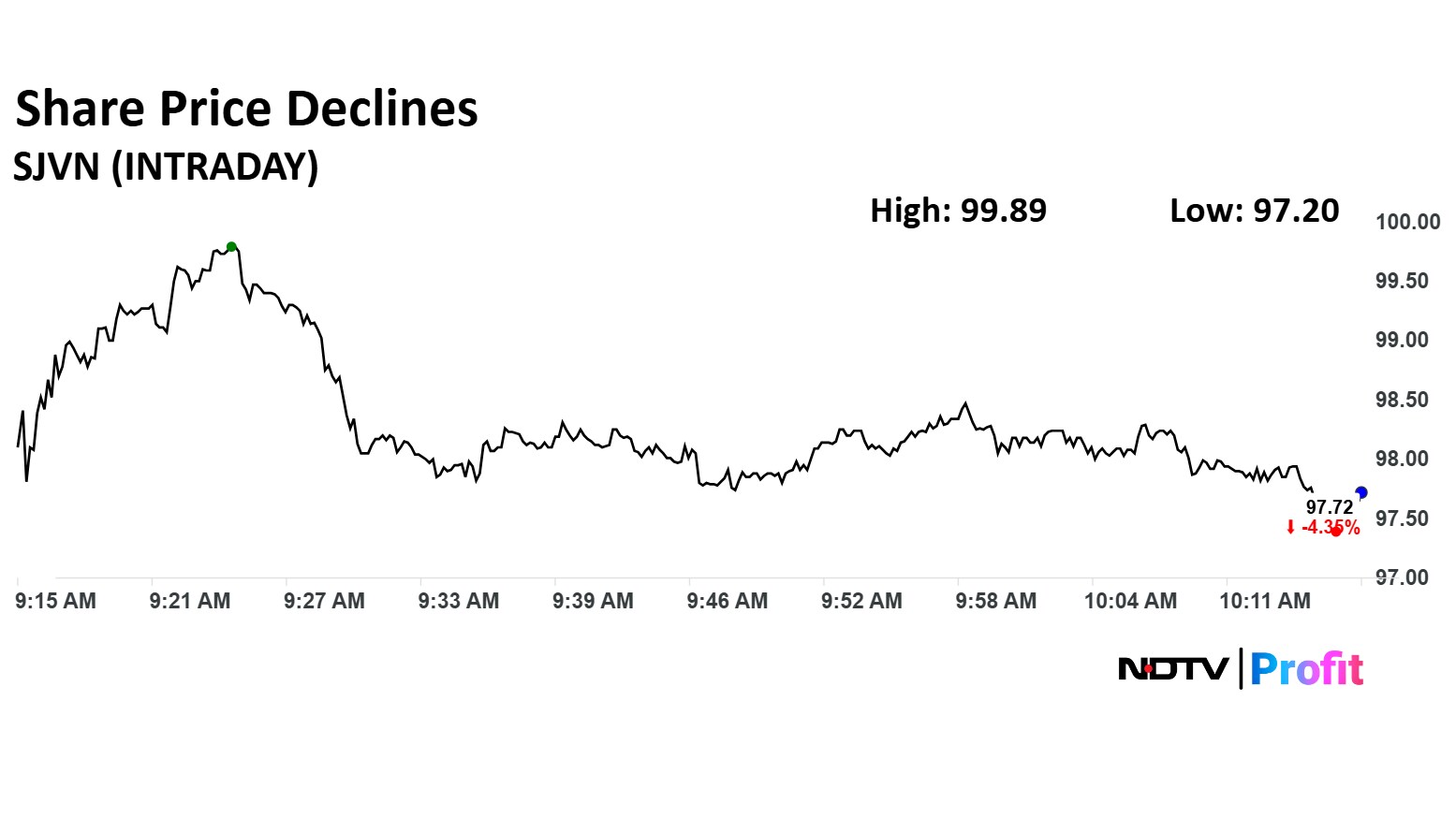

SJVN Ltd.'s share price fell by 4.37% following the announcement of its Q4 FY25 results, which revealed a net loss of Rs 127 crore.

SJVN Ltd.'s share price fell by 4.37% following the announcement of its Q4 FY25 results, which revealed a net loss of Rs 127 crore.

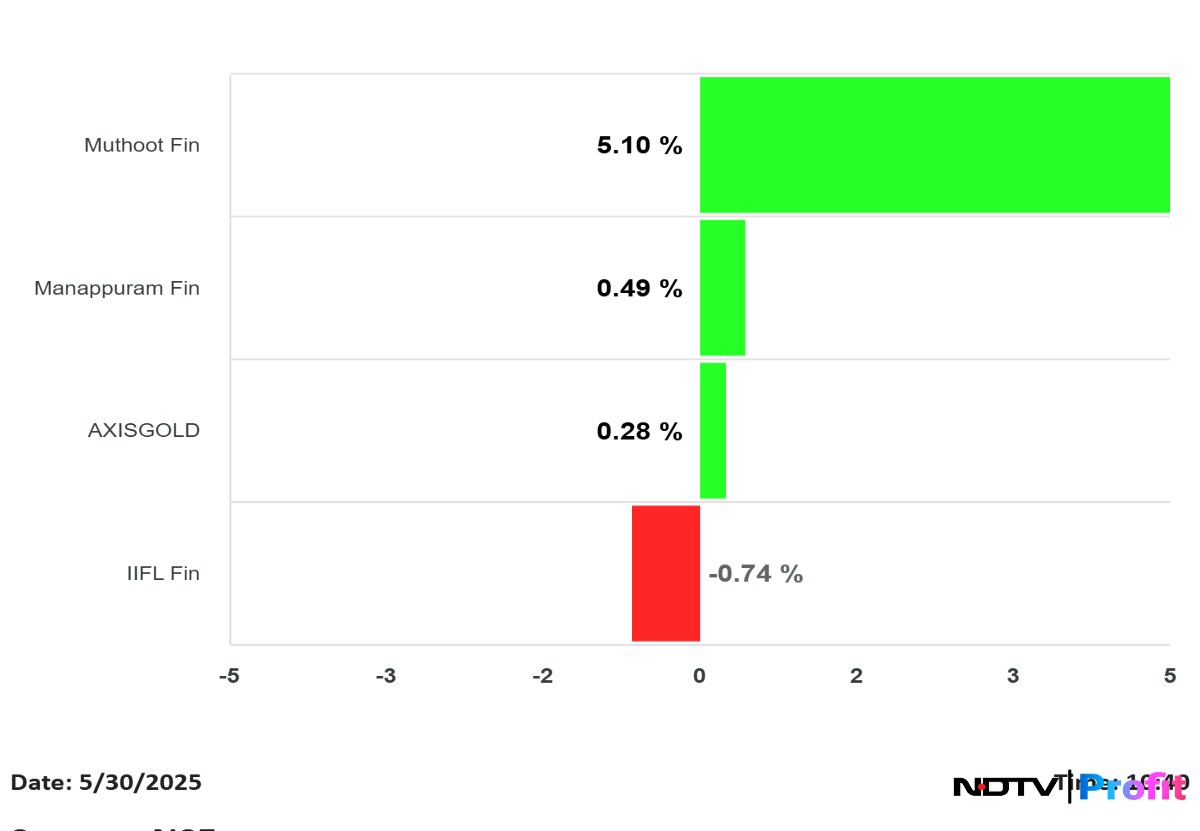

Most gold loan providers' stock advanced on National Stock Exchange. Muthoot Finance Ltd. share price rose 5.70% to Rs 2,183 apiece to lead the gains among its peers.

Gold loan providers stock rose amid the Department of Financial Services suggesting the Reserve Bank of India to implement draft gold lending norms. DFS also suggested to give exemption to borrowers availing loans below Rs 2 lakh.

Muthoot Finance will likely be the key beneficiary in case suggestions get implemented as the lender has 63% of its loan book below Rs 3 lakh.

Most gold loan providers' stock advanced on National Stock Exchange. Muthoot Finance Ltd. share price rose 5.70% to Rs 2,183 apiece to lead the gains among its peers.

Gold loan providers stock rose amid the Department of Financial Services suggesting the Reserve Bank of India to implement draft gold lending norms. DFS also suggested to give exemption to borrowers availing loans below Rs 2 lakh.

Muthoot Finance will likely be the key beneficiary in case suggestions get implemented as the lender has 63% of its loan book below Rs 3 lakh.

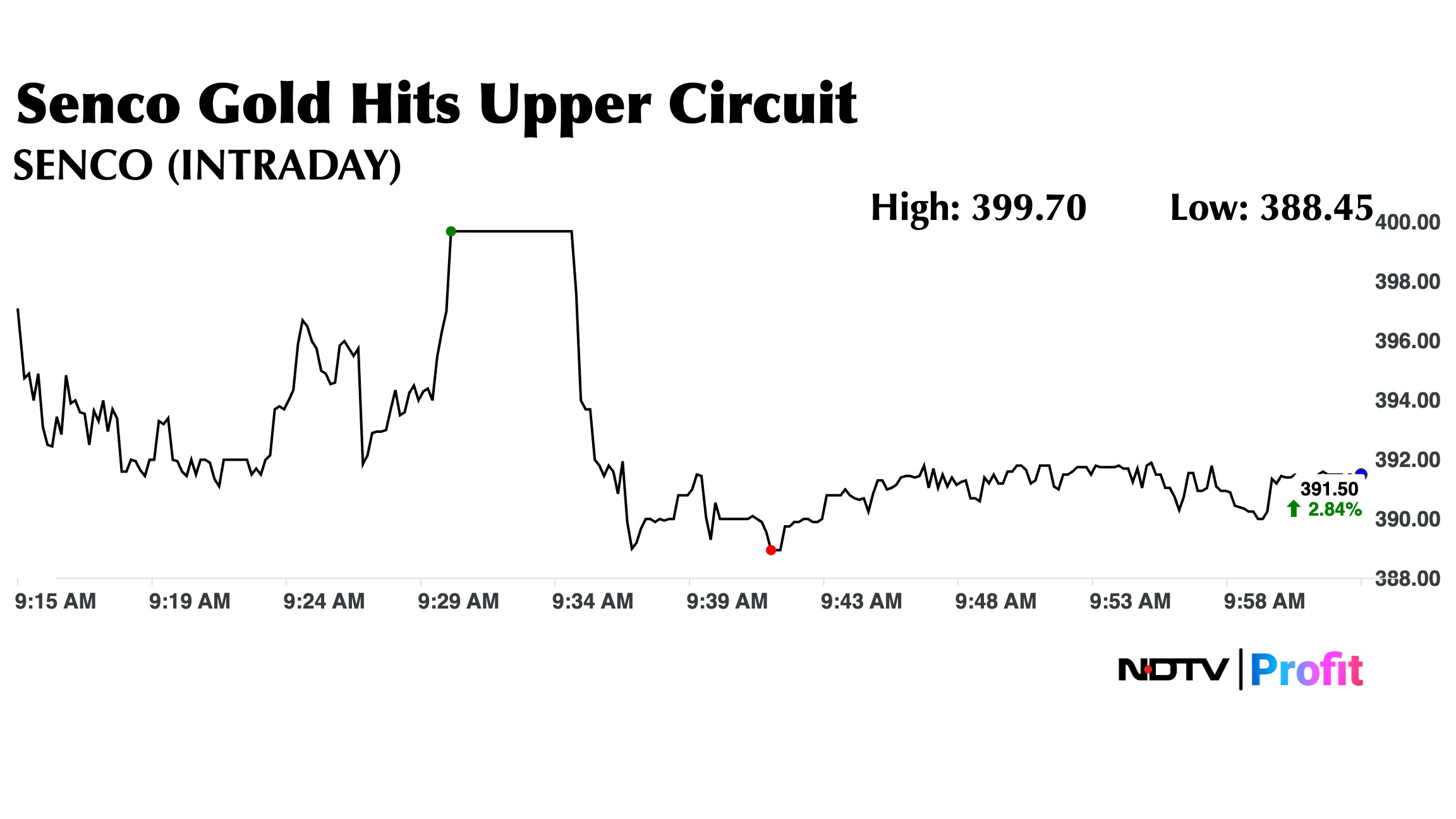

Share price of Senco Gold Ltd. shot up in Friday's trade after the company reported robust financials for the quarter ended March, with net profit nearly doubling as compared to the year-ago period.

Share price of Senco Gold Ltd. shot up in Friday's trade after the company reported robust financials for the quarter ended March, with net profit nearly doubling as compared to the year-ago period.

Kiri Industries Ltd. entered into a share purchase agreement with Zhejiang Longsheng Group to sell 37.57% stake in Singapore-Based DyStar Global Holdings to the latter. The company will acquire stakes at an overall consideration of nearly Rs 6,000 crore, the company said in an exchange filing.

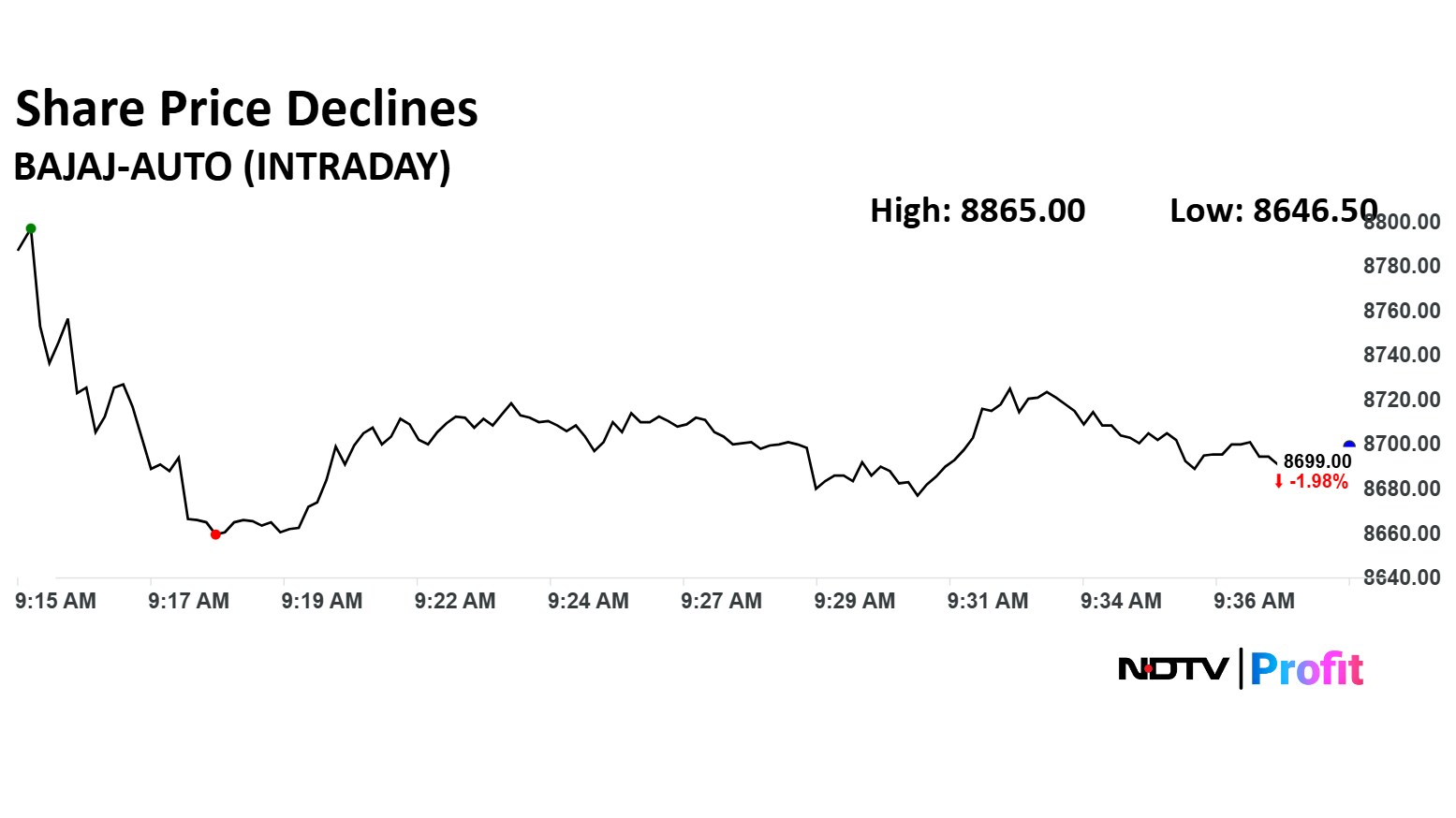

Bajaj Auto Ltd.'s share price declined 2.57% on Friday, even as the firm reported growth in the fourth quarter of fiscal 2025. The scrip fell as much as 2.57% to Rs 8,646 apiece.

Bajaj Auto Ltd.'s share price declined 2.57% on Friday, even as the firm reported growth in the fourth quarter of fiscal 2025. The scrip fell as much as 2.57% to Rs 8,646 apiece.

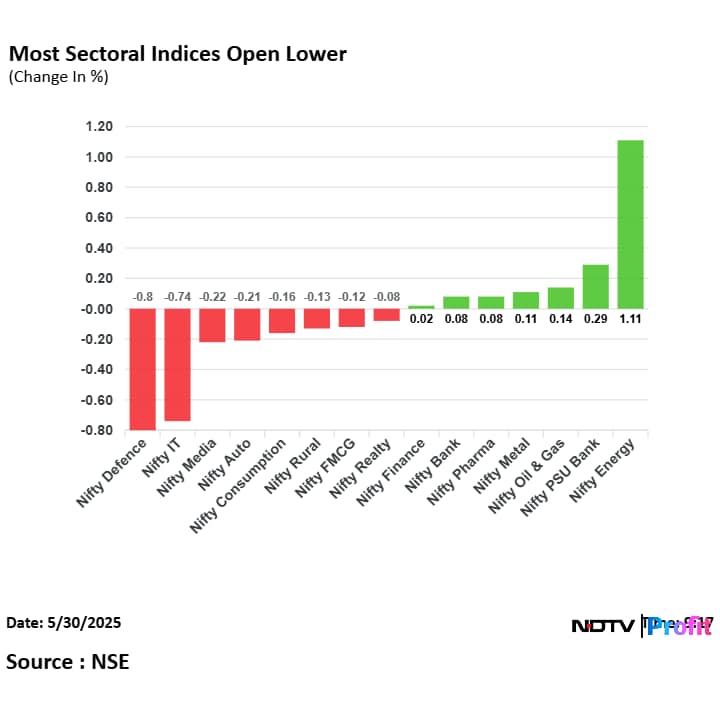

On NSE, eight sectoral indices declined, six advanced, and one remained flat out of 15. The NSE Nifty Defence declined the most, and the NSE Nifty Energy rose the most.

On NSE, eight sectoral indices declined, six advanced, and one remained flat out of 15. The NSE Nifty Defence declined the most, and the NSE Nifty Energy rose the most.

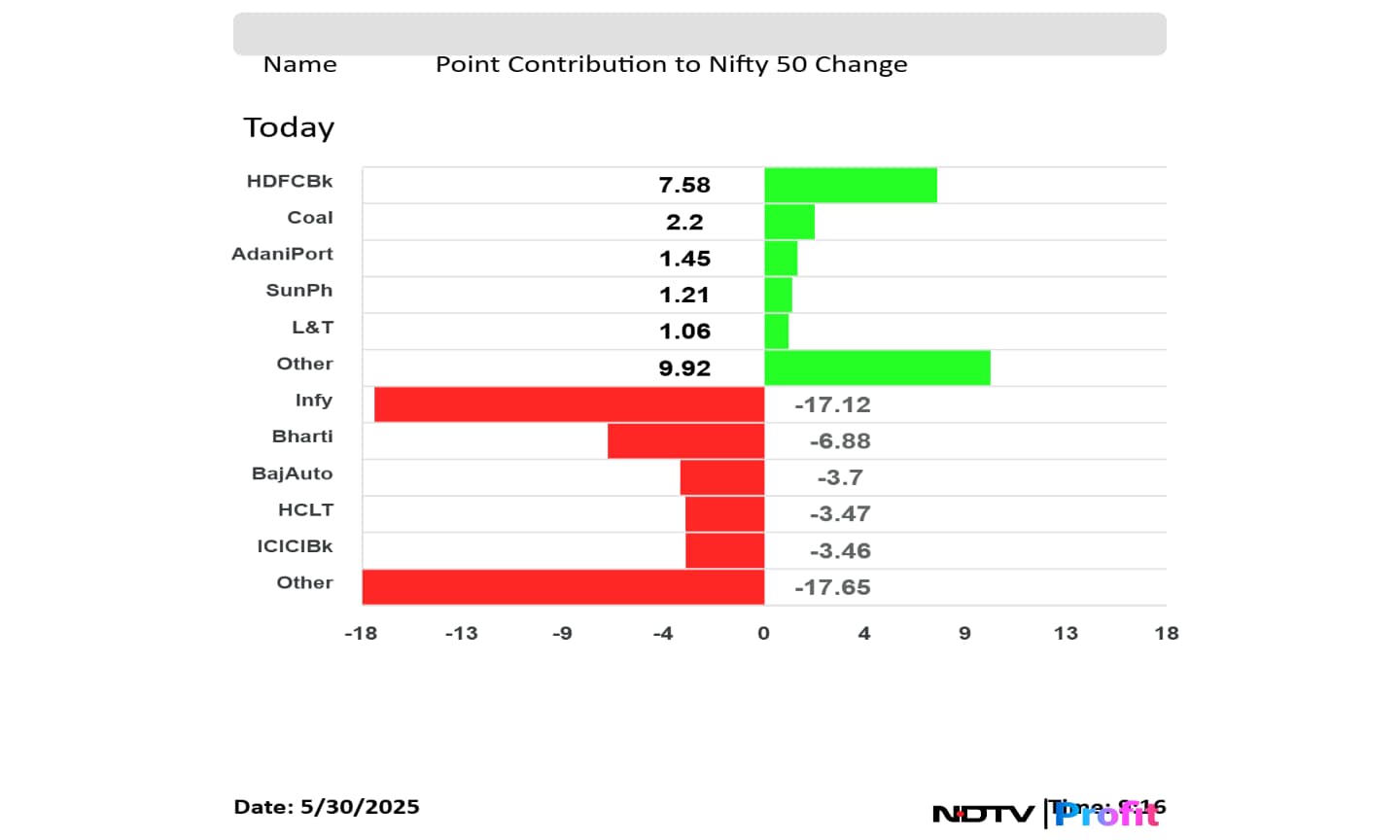

HDFC Bank Ltd., Coal India Ltd., Adani Port and Special Economic Zone Ltd., Sun Pharmaceutical Industries Ltd., and Larsen & Toubro Ltd. added to the Nifty 50 index.

Infosys Ltd., Bharti Airtel Ltd., Bajaj Auto Ltd., HCLTech Ltd., and ICICI Bank Ltd. weighed on the Nifty 50 index.

HDFC Bank Ltd., Coal India Ltd., Adani Port and Special Economic Zone Ltd., Sun Pharmaceutical Industries Ltd., and Larsen & Toubro Ltd. added to the Nifty 50 index.

Infosys Ltd., Bharti Airtel Ltd., Bajaj Auto Ltd., HCLTech Ltd., and ICICI Bank Ltd. weighed on the Nifty 50 index.

Ola Electric Mobility share price fell 9.73% to Rs 48.06 apiece, the lowest level since May 9.

Ola Electric Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue down 61.8% to Rs 611.00 crore versus Rs 1,598.00 crore.

Ebitda loss widens by 123% to Rs 695.00 crore versus Rs 312.00 crore.

Net Loss widens by 109% to Rs 870.00 crore versus Rs 416.00 crore.

Ola Electric Mobility share price fell 9.73% to Rs 48.06 apiece, the lowest level since May 9.

Ola Electric Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue down 61.8% to Rs 611.00 crore versus Rs 1,598.00 crore.

Ebitda loss widens by 123% to Rs 695.00 crore versus Rs 312.00 crore.

Net Loss widens by 109% to Rs 870.00 crore versus Rs 416.00 crore.

The NSE Nifty 50 and BSE Sensex started the day on a muted note. HDFC Bank Ltd. and Reliance Industries Ltd. contributed the most. The Nifty 50 and Sensex were trading 0.08% and 0.05% higher, respectively as of 9:29 a.m.

The NSE Nifty 50 and BSE Sensex started the day on a muted note. HDFC Bank Ltd. and Reliance Industries Ltd. contributed the most. The Nifty 50 and Sensex were trading 0.08% and 0.05% higher, respectively as of 9:29 a.m.

At pre-open, the NSE Nifty 50 was trading 0.08% or 21 points down at 24,812.60, and the BSE Sensex was trading 0.20% or 167.33 points lower at 81,465.69.

The yield on the 10-year bond opened flat 6.24%

Source: Bloomberg

Rupee opened 16 paise stronger at 85.37 against US Dollar

It closed at 85.53 a dollar on Thursday.

Source: Bloomberg

Downgrade to Sell with a revised FV of Rs 30 from Rs 50 earlier

High warrant costs drags EBITDA lower below expectations

Company reported Free Cash Flow outflow of Rs35 bn in FY2025

Expect Ebitda losses to continue amid weakening brand equity and increased competitive intensity.

Ola Electric’s future hinges on scaling up volumes and successful motorcycle foray

Motorcycle foray faces executive and credibility challenges

Cut FY2026-27E volume assumptions by 32-34%

Company needs to scale up its volume to avoid a looming cash crunch

SEBI Exploring Prioritising Internal Promotions for ED appointment

Applicable service rules allow external hires only if no internal fit.

Rules provide for 11 ED posts, including 3 available on contractual/ deputation basis

SEBI board may also discuss the issue in the June 18 meeting.

Employee association has pushed to fill ED posts internally first.

One ED post vacant for 2+ years due to no suitable external candidate, source said.

Source: People In The Know

Upgrade to Outperform from Market-perform; cut target price to Rs 430 from Rs 450

Delhivery: Signs of a recovery

See potential tailwinds from industry consolidation, and resilience in traditional logistics volumes

Raise EBITDA by 1-2% over FY26-27

But temper long-term expectations given quick commerce impact and mixed execution track record

Call is momentum-led, not a full reversion to the earlier growth narrative

Valuation reflects some optimism, but near-term catalysts should help

Share indices across Asia-Pacific were trading lower with the Nikkei 225 and Hang Seng falling over 1% as risk-off sentiment soared on worries over US economy.

Apart from ongoing uncertainty over US President Donald Trump's tariff from the judicial front, weak economic data, rising jobless claims fuelled worries about the fate of US economy.

Moreover, Tokyo inflation rose the most in two years, as reported by Bloomberg, which may prompt the Bank of Japan to hike interest rates.

US share indices ended with slight gains on Thursday after appeal court reinstated tariffs of President Donald Trump administration. The Court of International Trade based in New York struck down Trump's sweeping tariff using the International Emergency Economic Power Act.

The Dow Jones Industrial Average rose 0.28% at 42,215.73. S&P 500 Futures fell 0.29% at 5,905.50. Nasdaq 100 Futures fell 0.36% at 21,333.25.

The GIFT Nifty was trading 0.01% or 3.50 points higher at 24,942.50 as of 6:48 a.m., which implied a higher open for the NSE Nifty 50.

Investors may monitor Bajaj Auto Ltd., Mazagon Dock Shipbuilders Ltd., SJVN Ltd., and Landmark Cars Ltd. shares because they released their fourth-quarter earnings. Apart from these stocks, Castrol India Ltd., Cipla Ltd., and NLC Ltd. shares will be important because of the overnight news flow.

The benchmark equity indices closed higher on Thursday, snapping a two-day slump as share prices of IndusInd Bank Ltd. and Sun Pharmaceutical Industries Ltd. gained the most. The NSE Nifty 50 closed 81.15 points, or 0.33% higher at 24,833.60 and the BSE Sensex ended 320.7 points, or 0.39% up at 81,633.02.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.