The local currency strengthened by 7 paise to close at 83.47 against the U.S dollar.

It closed at 83.54 on Thursday.

Source: Bloomberg

The local currency strengthened by 7 paise to close at 83.47 against the U.S dollar.

It closed at 83.54 on Thursday.

Source: Bloomberg

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

Key global equity indices were under pressure this week due to escalation in geopolitical events, said Shrikant Chouhan, head equity research, Kotak Securities. In the near term, market participants will keep a tab of the geopolitical developments and the impact of that on equity markets and commodities including oil and gold.

"The BSE Midcap and the BSE Smallcap indices also ended in the negative this week but outperformed their large-cap peers. Most of the sectoral indices also ended the week in the red, with the BSE Oil & Gas index being an exception," he said.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

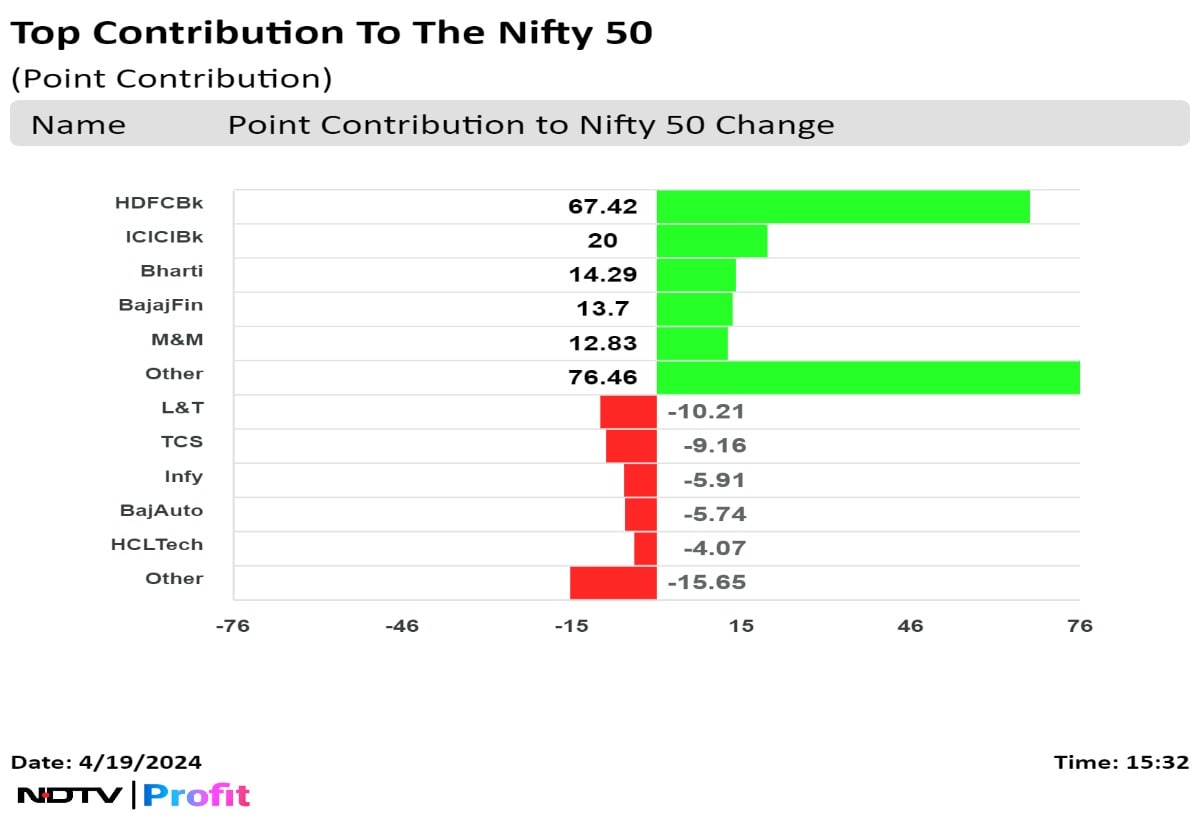

Key global equity indices were under pressure this week due to escalation in geopolitical events, said Shrikant Chouhan, head equity research, Kotak Securities. In the near term, market participants will keep a tab of the geopolitical developments and the impact of that on equity markets and commodities including oil and gold.

"The BSE Midcap and the BSE Smallcap indices also ended in the negative this week but outperformed their large-cap peers. Most of the sectoral indices also ended the week in the red, with the BSE Oil & Gas index being an exception," he said.

The benchmark recorded worst weekly declines as ongoing conflict between Israel and Iran weighed on risk appetite of investors, prompting them to flock into safe haven assets.

The NSE Nifty 50 and the S&P BSE Sensex declined 1.65% and 1.56%, respectively in the week ended on April 19. This is the worst decline since March 15.

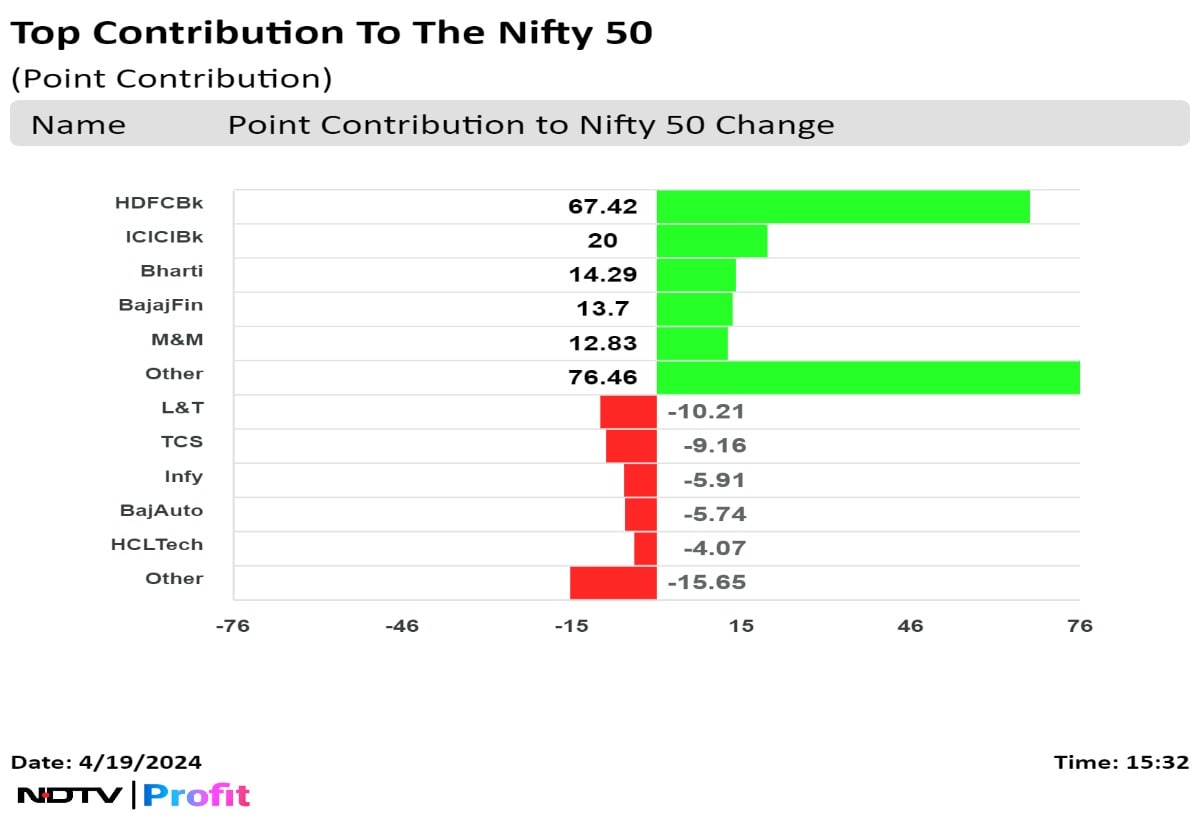

HDFC Bank Ltd., ICICI Bank Ltd., Bharti Airtel Ltd., Bajaj Finance Ltd., and Mahindra & Mahindra Ltd. added positively to the index.

Larsen & Toubro Ltd., Tata Consultancy Services Ltd., Infosys Ltd., Bajaj Auto Ltd., and HCL Technologies Ltd. limited gains in the index.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

Key global equity indices were under pressure this week due to escalation in geopolitical events, said Shrikant Chouhan, head equity research, Kotak Securities. In the near term, market participants will keep a tab of the geopolitical developments and the impact of that on equity markets and commodities including oil and gold.

"The BSE Midcap and the BSE Smallcap indices also ended in the negative this week but outperformed their large-cap peers. Most of the sectoral indices also ended the week in the red, with the BSE Oil & Gas index being an exception," he said.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

Key global equity indices were under pressure this week due to escalation in geopolitical events, said Shrikant Chouhan, head equity research, Kotak Securities. In the near term, market participants will keep a tab of the geopolitical developments and the impact of that on equity markets and commodities including oil and gold.

"The BSE Midcap and the BSE Smallcap indices also ended in the negative this week but outperformed their large-cap peers. Most of the sectoral indices also ended the week in the red, with the BSE Oil & Gas index being an exception," he said.

The benchmark recorded worst weekly declines as ongoing conflict between Israel and Iran weighed on risk appetite of investors, prompting them to flock into safe haven assets.

The NSE Nifty 50 and the S&P BSE Sensex declined 1.65% and 1.56%, respectively in the week ended on April 19. This is the worst decline since March 15.

HDFC Bank Ltd., ICICI Bank Ltd., Bharti Airtel Ltd., Bajaj Finance Ltd., and Mahindra & Mahindra Ltd. added positively to the index.

Larsen & Toubro Ltd., Tata Consultancy Services Ltd., Infosys Ltd., Bajaj Auto Ltd., and HCL Technologies Ltd. limited gains in the index.

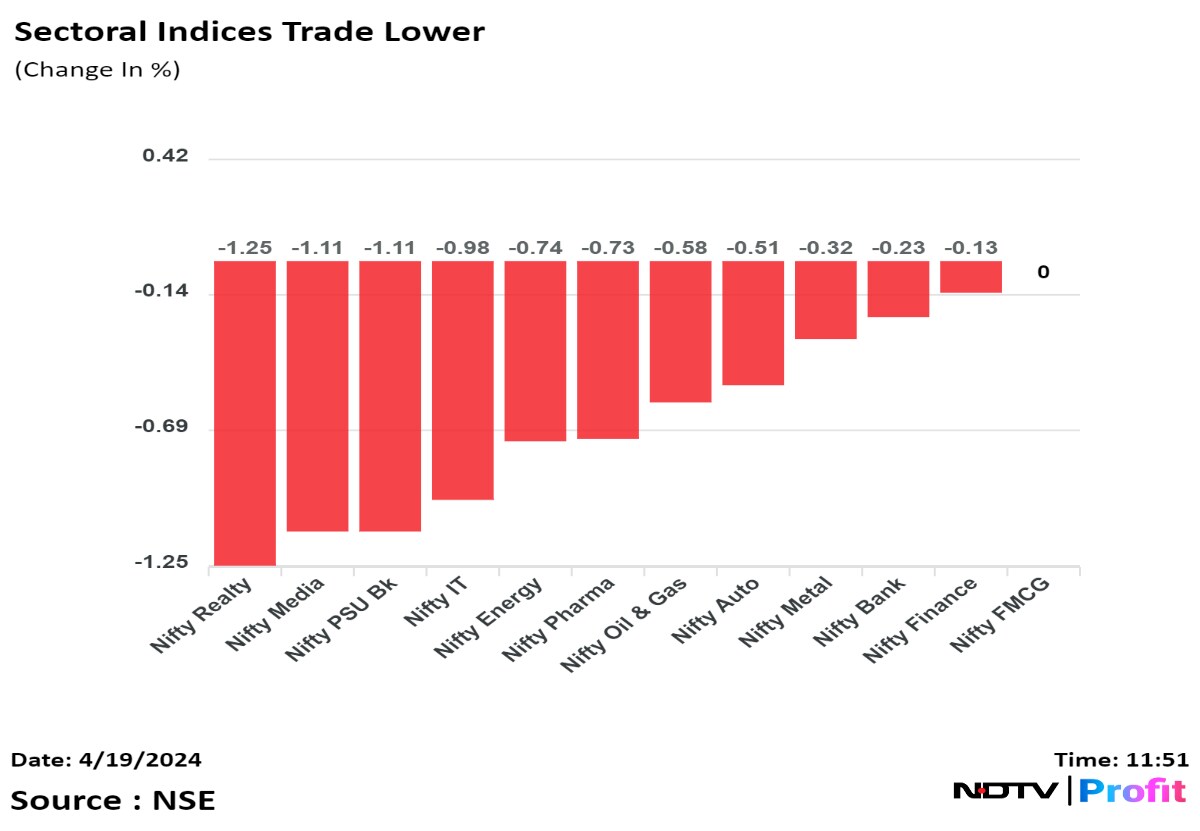

All 12 sectors ended lower this week on NSE, with the NSE Nifty IT emerging as the top loser.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

Key global equity indices were under pressure this week due to escalation in geopolitical events, said Shrikant Chouhan, head equity research, Kotak Securities. In the near term, market participants will keep a tab of the geopolitical developments and the impact of that on equity markets and commodities including oil and gold.

"The BSE Midcap and the BSE Smallcap indices also ended in the negative this week but outperformed their large-cap peers. Most of the sectoral indices also ended the week in the red, with the BSE Oil & Gas index being an exception," he said.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

Key global equity indices were under pressure this week due to escalation in geopolitical events, said Shrikant Chouhan, head equity research, Kotak Securities. In the near term, market participants will keep a tab of the geopolitical developments and the impact of that on equity markets and commodities including oil and gold.

"The BSE Midcap and the BSE Smallcap indices also ended in the negative this week but outperformed their large-cap peers. Most of the sectoral indices also ended the week in the red, with the BSE Oil & Gas index being an exception," he said.

The benchmark recorded worst weekly declines as ongoing conflict between Israel and Iran weighed on risk appetite of investors, prompting them to flock into safe haven assets.

The NSE Nifty 50 and the S&P BSE Sensex declined 1.65% and 1.56%, respectively in the week ended on April 19. This is the worst decline since March 15.

HDFC Bank Ltd., ICICI Bank Ltd., Bharti Airtel Ltd., Bajaj Finance Ltd., and Mahindra & Mahindra Ltd. added positively to the index.

Larsen & Toubro Ltd., Tata Consultancy Services Ltd., Infosys Ltd., Bajaj Auto Ltd., and HCL Technologies Ltd. limited gains in the index.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

Key global equity indices were under pressure this week due to escalation in geopolitical events, said Shrikant Chouhan, head equity research, Kotak Securities. In the near term, market participants will keep a tab of the geopolitical developments and the impact of that on equity markets and commodities including oil and gold.

"The BSE Midcap and the BSE Smallcap indices also ended in the negative this week but outperformed their large-cap peers. Most of the sectoral indices also ended the week in the red, with the BSE Oil & Gas index being an exception," he said.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

India's benchmark indices reversed a four-day losing streak to end Friday higher as heavy-weight HDFC Bank Ltd., Bajaj Finance Ltd. rose. However, the benchmark posted worst weekly fall in over a month as worries over ongoing conflict between Israel and Iran dented investors' sentiment.

The NSE Nifty 50 settled 151.15 points or 0.69% higher at 22,147.00, and the S&P BSE Sensex ended 599.34 points or 0.83% up at 73,088.33.

Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war after reports said Israel likely have launched an attack on Iran.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

Key global equity indices were under pressure this week due to escalation in geopolitical events, said Shrikant Chouhan, head equity research, Kotak Securities. In the near term, market participants will keep a tab of the geopolitical developments and the impact of that on equity markets and commodities including oil and gold.

"The BSE Midcap and the BSE Smallcap indices also ended in the negative this week but outperformed their large-cap peers. Most of the sectoral indices also ended the week in the red, with the BSE Oil & Gas index being an exception," he said.

The benchmark recorded worst weekly declines as ongoing conflict between Israel and Iran weighed on risk appetite of investors, prompting them to flock into safe haven assets.

The NSE Nifty 50 and the S&P BSE Sensex declined 1.65% and 1.56%, respectively in the week ended on April 19. This is the worst decline since March 15.

HDFC Bank Ltd., ICICI Bank Ltd., Bharti Airtel Ltd., Bajaj Finance Ltd., and Mahindra & Mahindra Ltd. added positively to the index.

Larsen & Toubro Ltd., Tata Consultancy Services Ltd., Infosys Ltd., Bajaj Auto Ltd., and HCL Technologies Ltd. limited gains in the index.

All 12 sectors ended lower this week on NSE, with the NSE Nifty IT emerging as the top loser.

Benchmark indices outperformed the broader markets. The S&P BSE Midcap ended 0.39% lower, and the S&P BSE Smallcap settled 0.04% lower.

On BSE, 11 sectors declined and nine advanced out 20. The S&P BSE Realy index was the worst performing sector, and the S&P BSE Bankex emerged as the top performing sector.

Market breadth was skewed in favour of the sellers. Around 2,063 stocks declined, 1,725 stocks advanced, and 115 remained unchanged on BSE.

Softbank-Backed Oyo is looking to sell bond sales worth $450 million for refinancing.

Source: Bloomberg

Hindustan Construction Co. Ltd. raised Rs 350 crore via rights issue.

The rights issue was subscribed 2.5 times.

Source: Exchange filing

Shares of Bharti Airtel Ltd. rose 2.43% to Rs 1,296.50, the highest level since its listing on Feb 15, 2002. It was trading 1.30% higher at Rs 898.50 as of 2:52 p.m., as compared to 0.71% advance in the NSE Nifty index.

Shares of Bharti Airtel Ltd. rose 2.43% to Rs 1,296.50, the highest level since its listing on Feb 15, 2002. It was trading 1.30% higher at Rs 898.50 as of 2:52 p.m., as compared to 0.71% advance in the NSE Nifty index.

Premier Explosives approved stock split in the ratio of 1:5.

The company approved raising up to Rs 400 crore via multiple instruments.

Source: Exchange filing

Revenue down 11% to Rs 7,549 crore from Rs 8,509 crore

Ebitda down 14% at Rs 3,649 crore from Rs 4,255 crore

Margin down 170 bps at 48.3% from 50%

Net profit down 21% at Rs 2,038 crore from Rs 2,583 crore

Source: Exchange filing

Saleable silver production is projected to be between 750-775 metric ton.

Mined metal is expected to be between 1,100-1,125 kilo ton.

Mefined metal is expected to be in the range of 1,075-1,100 kilo ton.

Zinc cost of production is expected to be between US$ 1,050-1,100 per metric ton.

Source: Exchange filing

The Rail Vikas Nigam Ltd. has emerged as the lowest bidder for a construction project for the South Central Railway.

The construction project is to double the track of Ankai Station.

Source: Exchange filing

Revenue up 33% to Rs 564.6 crore from Rs 424.5 crore

Ebitda up 46.01% at Rs 135.5 crore from Rs 92.8 crore

Margin up 213 bps at 23.99% from 21.86%

Net profit up 52.57% at Rs 103.6 crore from Rs 67.9 crore

Elecon Engineering Co. Ltd. recommended dividend share at Rs 2 per share.

The company proposed stock split at Rs 1 per share from Rs 2 per share.

Source: Exchange filing

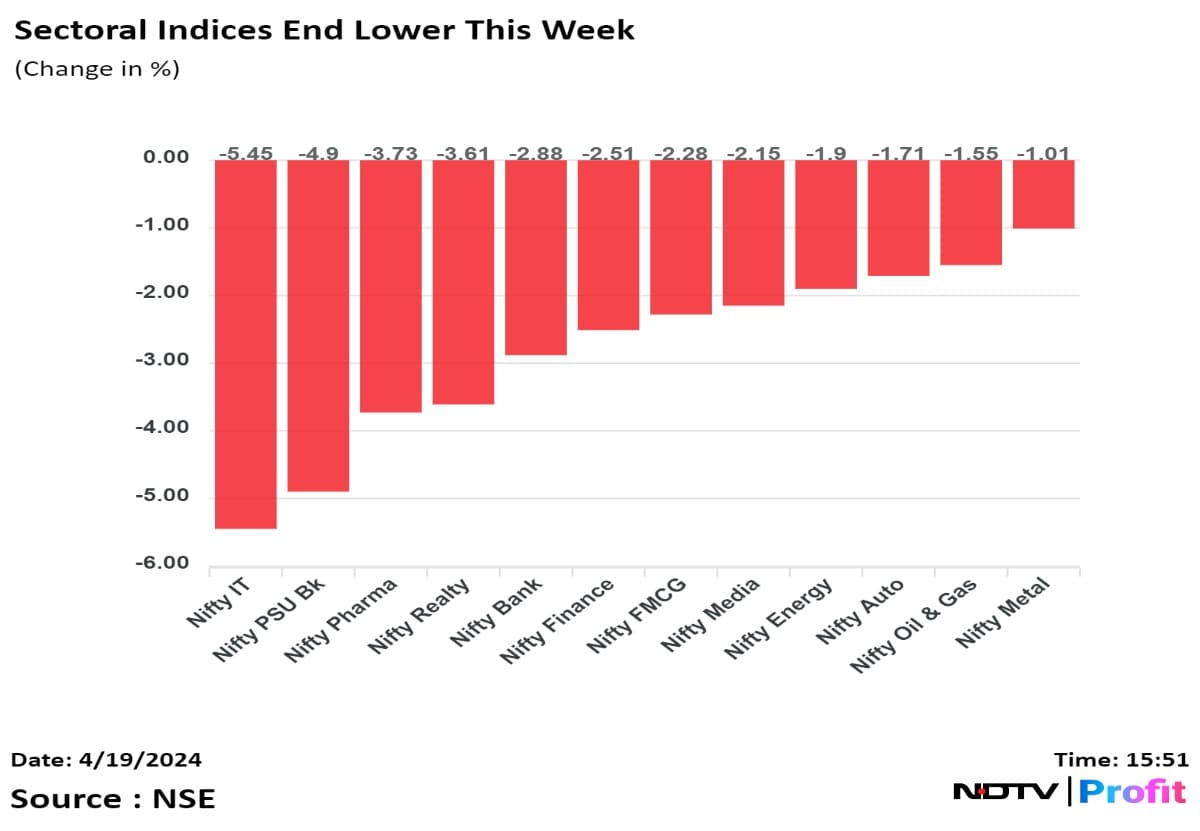

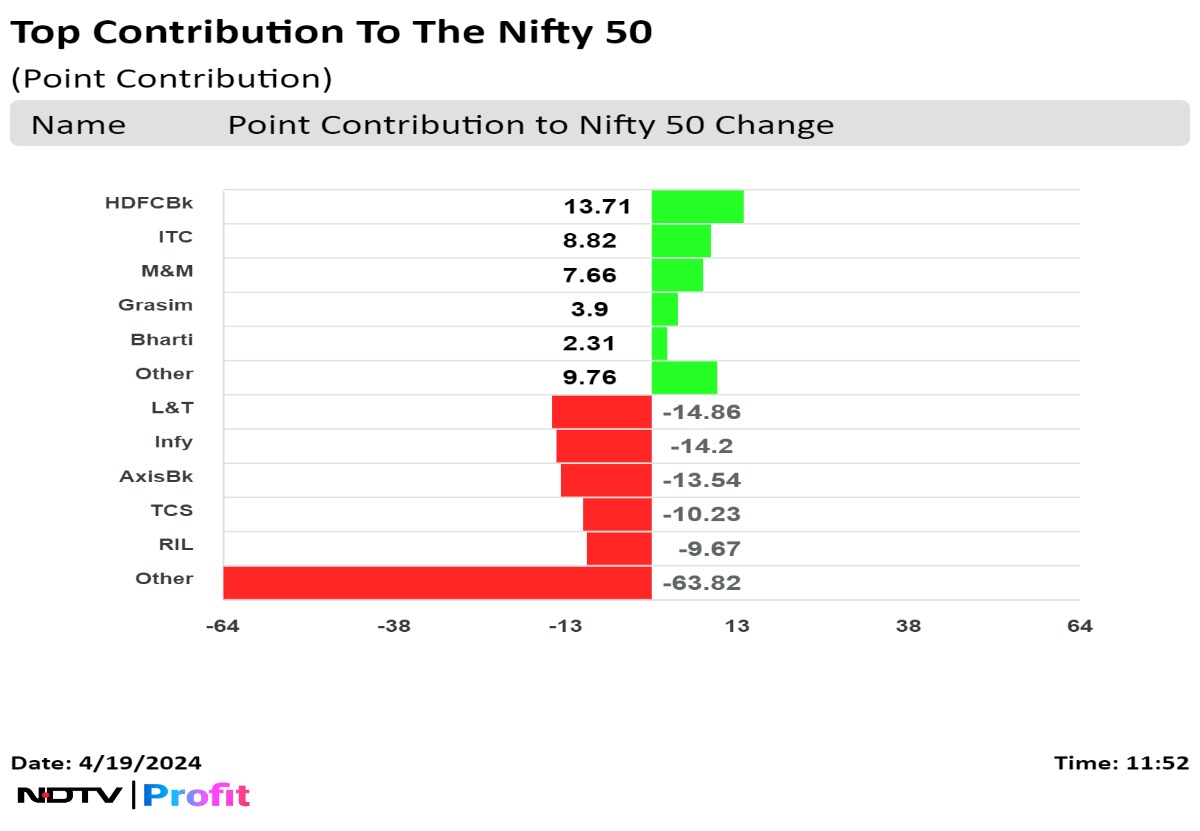

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

Larsen & Toubro Ltd., Infosys Ltd., Axis Bank Ltd., Tata Consultancy Services Ltd. and Reliance Industries Ltd. weighed on the Nifty.

HDFC Bank Ltd., ITC Ltd., Mahindra & Mahindra Ltd., Grasim Industries Ltd. and Bharti Airtel Ltd., limited losses in the index.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

Larsen & Toubro Ltd., Infosys Ltd., Axis Bank Ltd., Tata Consultancy Services Ltd. and Reliance Industries Ltd. weighed on the Nifty.

HDFC Bank Ltd., ITC Ltd., Mahindra & Mahindra Ltd., Grasim Industries Ltd. and Bharti Airtel Ltd., limited losses in the index.

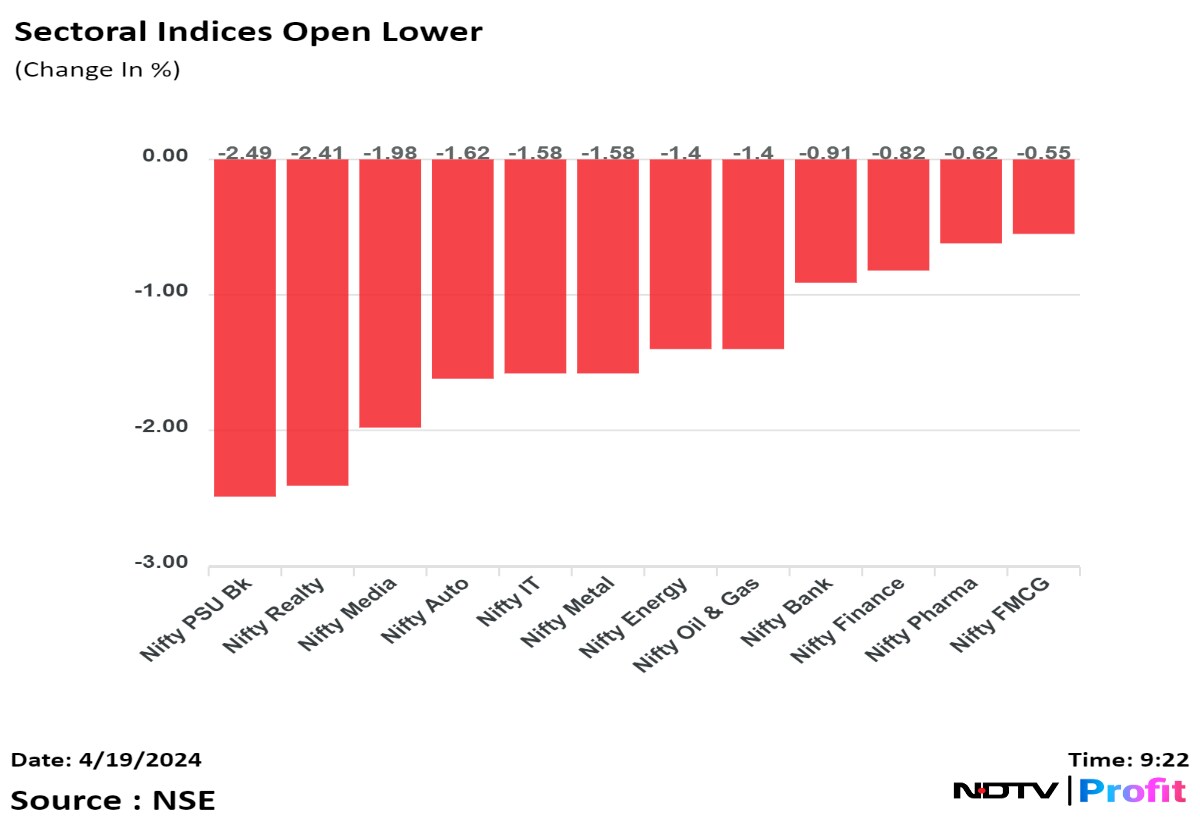

All the 12 sectors on the NSE were trading in the red, with the Nifty Realty falling the most.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

Larsen & Toubro Ltd., Infosys Ltd., Axis Bank Ltd., Tata Consultancy Services Ltd. and Reliance Industries Ltd. weighed on the Nifty.

HDFC Bank Ltd., ITC Ltd., Mahindra & Mahindra Ltd., Grasim Industries Ltd. and Bharti Airtel Ltd., limited losses in the index.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

The benchmark equity indices continued to trade lower on Friday as reports of tension in West Asia impacted investor sentiments. Larsen & Toubro Ltd., Infosys Ltd. and Axis Bank Ltd. weighed the most amid weak global cues. Intraday, the benchmarks declined nearly 1% amid investor concerns that the West Asia turmoil might escalate to war. As of 12:08 p.m., the NSE Nifty 50 was trading 76.15 points or 0.35% lower at 21,919.70 and the S&P BSE Sensex was trading 253.11 points or 0.35% down at 72,235.88.

During the day, the Nifty slumped as much as 0.99% to 21,777.65, while the Sensex fell 0.93% to 71,816.46.

"Safe-haven currencies, gold and crude oil jumped after reports of a sharp escalation in Middle East conflicts," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said.

The Indian market looks set to extend recent losses on Friday as upbeat US economic data and hawkish comments from more Fed officials poured cold water on rate-cut hopes, Bagkar said.

Larsen & Toubro Ltd., Infosys Ltd., Axis Bank Ltd., Tata Consultancy Services Ltd. and Reliance Industries Ltd. weighed on the Nifty.

HDFC Bank Ltd., ITC Ltd., Mahindra & Mahindra Ltd., Grasim Industries Ltd. and Bharti Airtel Ltd., limited losses in the index.

All the 12 sectors on the NSE were trading in the red, with the Nifty Realty falling the most.

The broader markets underperformed the benchmark indices. The BSE MidCap fell 0.97% and the BSE SmallCap declined 0.65%.

All the sectors on the BSE were trading in negative, with Realty emerging as the top loser.

The market breadth was skewed in favour of the sellers as 2,380 stocks declined, 1,195 rose and 130 remained unchanged on the BSE.

Benchmark indices pared losses after falling almost 1% each on weak global cues. Sensex was trading 0.3% higher at 72,705.76, while the Nifty 50 was up 0.2% at 22,038.80 as of 1:05 p.m.

Benchmark indices pared losses after falling almost 1% each on weak global cues. Sensex was trading 0.3% higher at 72,705.76, while the Nifty 50 was up 0.2% at 22,038.80 as of 1:05 p.m.

Benchmark indices pared losses after falling almost 1% each on weak global cues. Sensex was trading 0.3% higher at 72,705.76, while the Nifty 50 was up 0.2% at 22,038.80 as of 1:05 p.m.

Benchmark indices pared losses after falling almost 1% each on weak global cues. Sensex was trading 0.3% higher at 72,705.76, while the Nifty 50 was up 0.2% at 22,038.80 as of 1:05 p.m.

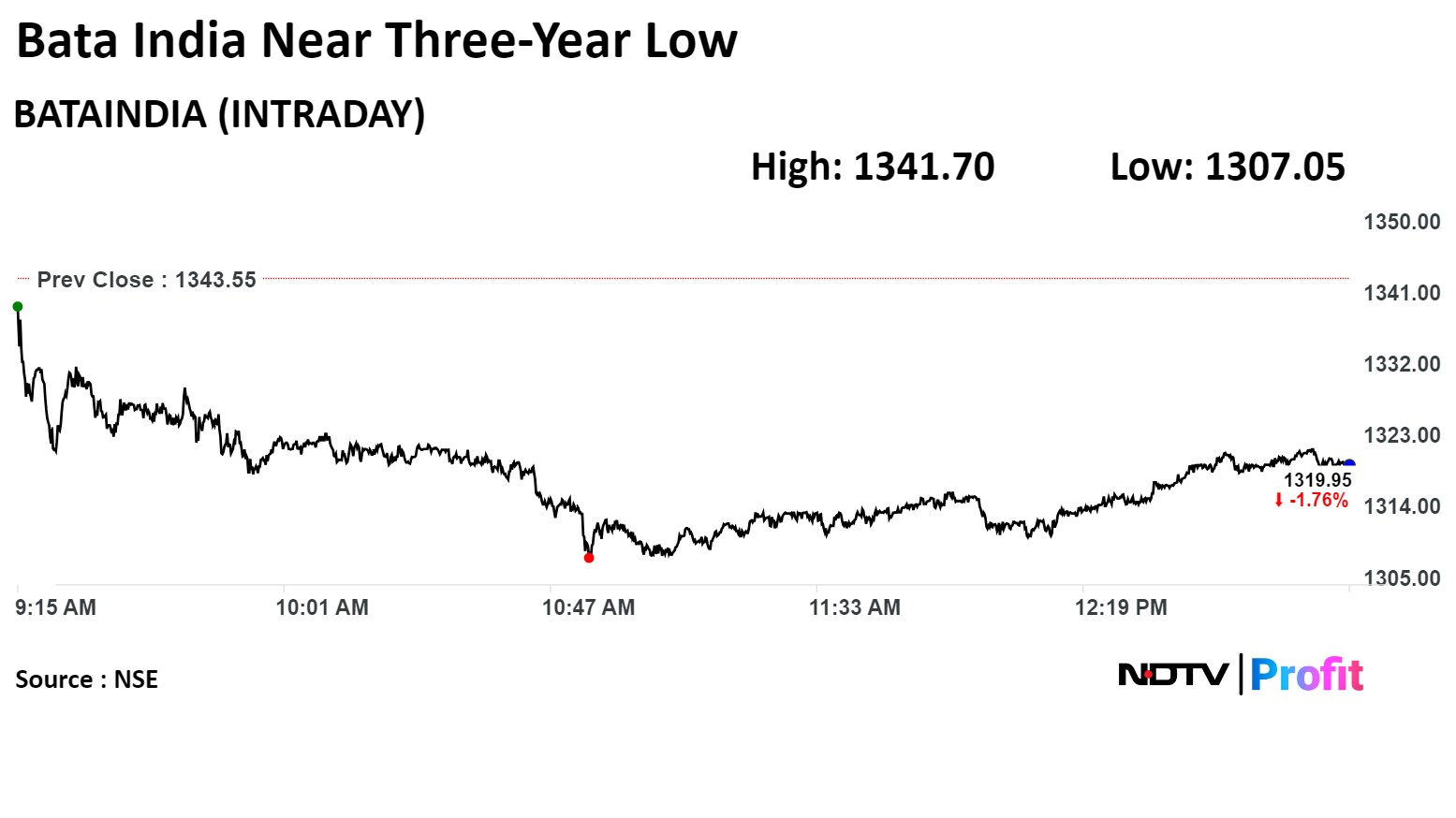

Shares of Bata India Ltd. declined 2.72% to Rs 1,307, the lowest level since April 26, 2021. It was trading 1.73% down at Rs 1,320.25 as of 1:03 p.m., as compared to 0.18% advance in the NSE Nifty index.

Shares of Bata India Ltd. declined 2.72% to Rs 1,307, the lowest level since April 26, 2021. It was trading 1.73% down at Rs 1,320.25 as of 1:03 p.m., as compared to 0.18% advance in the NSE Nifty index.

Deepak Fertilisers And Petrochemicals Corp Ltd.'s unit Mahadhan Agritech has signed a pact with Israel's Haifa Group for agricultural innovation.

Source: Exchange filing

Manappuram Finance Ltd. has approved raising up to $500 million via dollar bonds.

Source: Exchange filing

Canara Bank Ltd. set May 15 as record date for stock split.

Source: Exchange filing

Motilal Oswal Financial Services Ltd.'s Board will meet on April 26 to consider issuance of bonus shares.

Source: Bloomberg

Dixon Technologies (India) Ltd.'s subsidiary Padget Electronics in pact with Longcheer Mobile.

The pact is for manufacturing and sale of smart phones for global brands.

Source: Exchange filing

There's no damage to Iran's I nuclear sites, the International Atomic Energy Agency said in a post on X. The director general reiterated its view that nuclear facilities should never be a target in military fights, and called to exercise 'extreme restraint' from everybody.

Early in the morning, news reports said Israel likely have launched an retaliatory attack on Iran after an explosion was heard on Iran's central city Isfahan. The city has several military base and nuclear facilities.

IAEA can confirm that there is no damage to #Iran’s nuclear sites. DG @rafaelmgrossi continues to call for extreme restraint from everybody and reiterates that nuclear facilities should never be a target in military conflicts. IAEA is monitoring the situation very closely. pic.twitter.com/4F7pAlNjWM

— IAEA - International Atomic Energy Agency ⚛️ (@iaeaorg) April 19, 2024

Ind-Swift Laboratories Ltd. is to open its subsidiary in Dubai.

The wholly-owned subsidiary will be named Ind-Swift (Dubai) Ltd.

Source: Exchange filing

Most brokerages have cut the earnings estimates of HDFC Life Insurance Co. and trimmed their target price due to a weaker value of new business for the company. The VNB margin missed forecasts and product mix and guidance for the current financial year was healthy, yet relatively conservative compared to past years, Morgan Stanley said in a note on April 18.

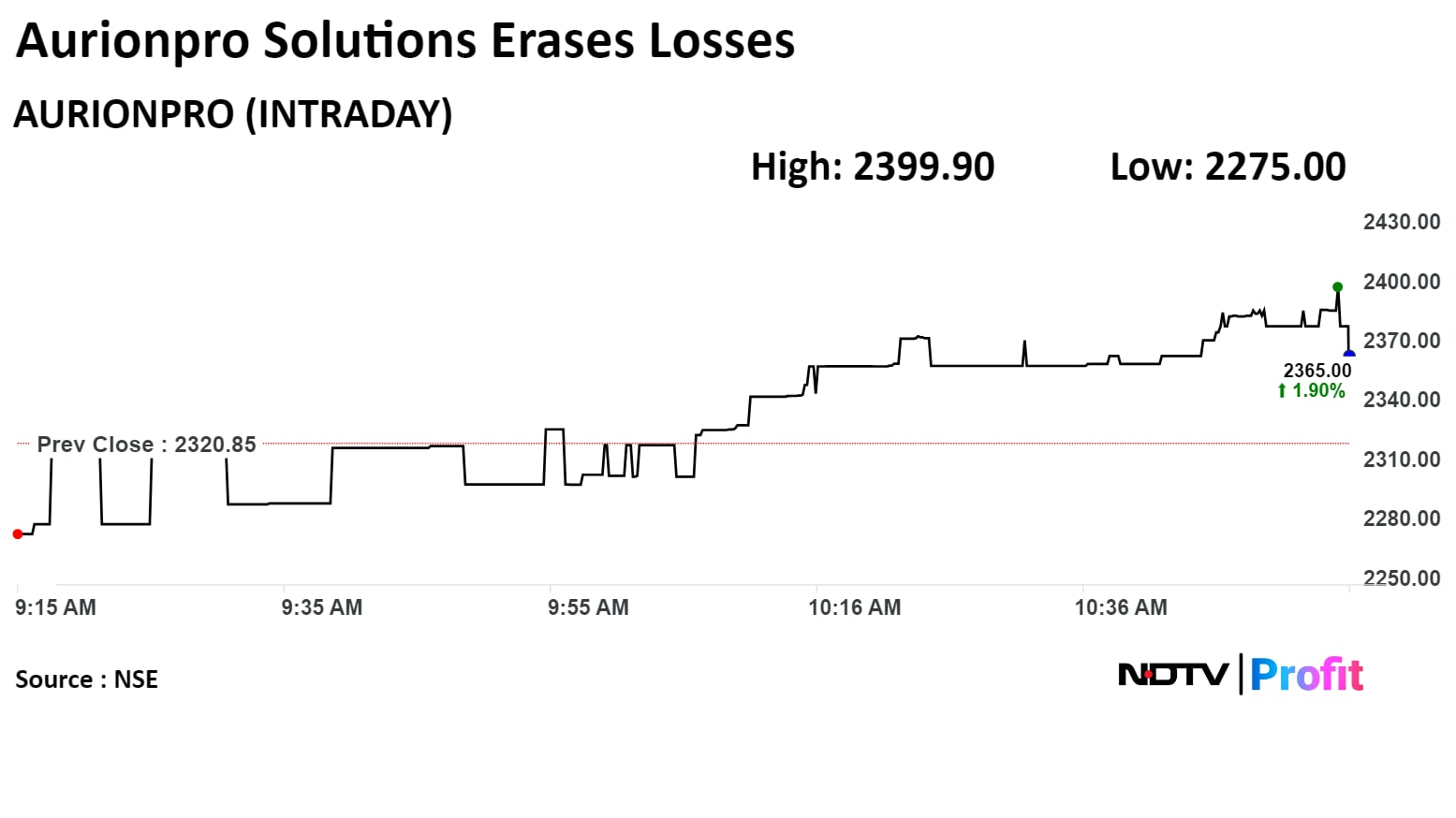

Aurionpro Solutions Ltd. acquired up to 67% stake in Arya.ai operated via legal entity Lithasa Technologies.

Source: Exchange Filing

Aurionpro Solutions Ltd. acquired up to 67% stake in Arya.ai operated via legal entity Lithasa Technologies.

Source: Exchange Filing

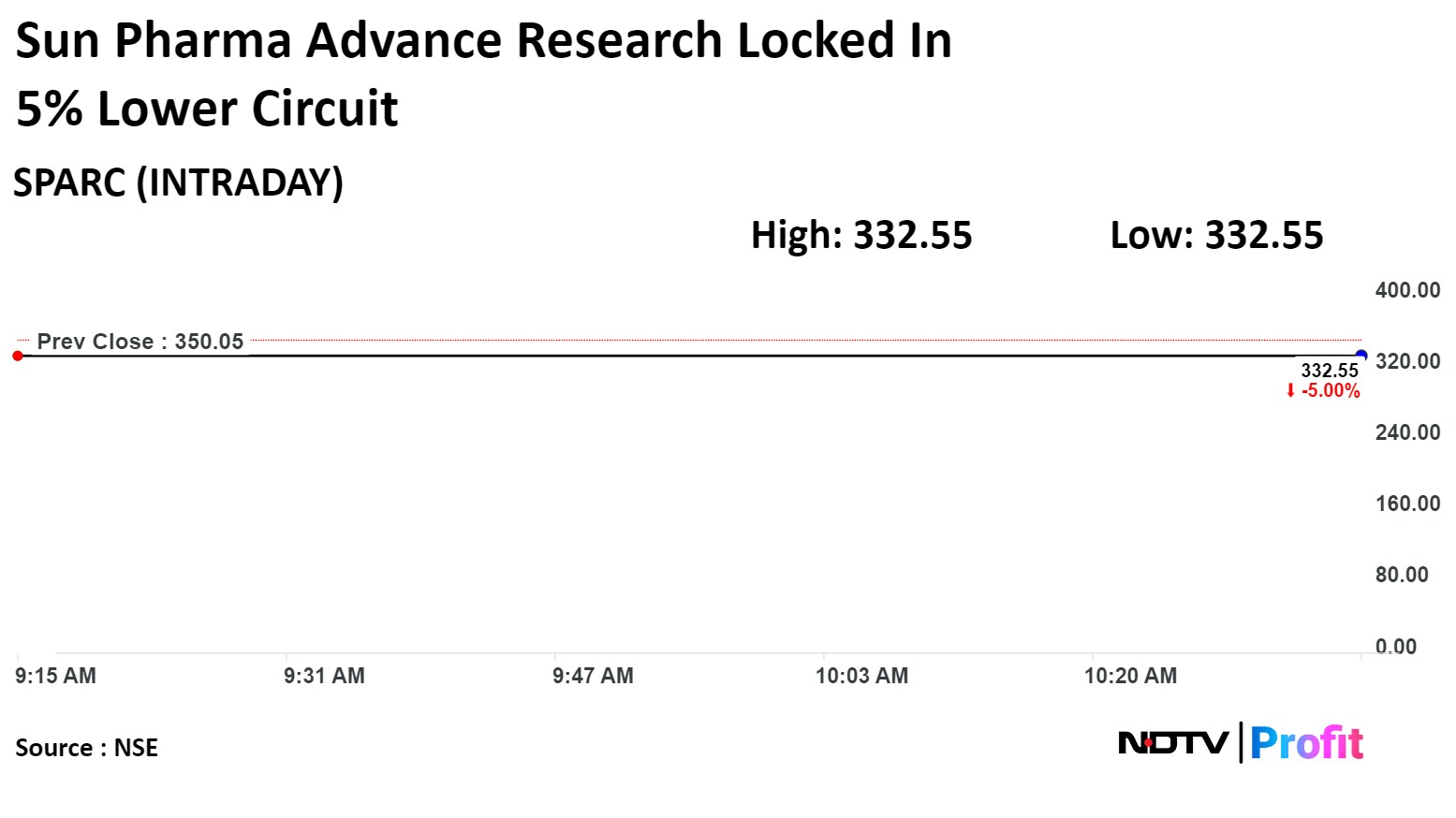

Shares of Sun Pharma Advance Research company declined as much as 5.00% to Rs 332.55, the lowest level since Feb 13. It remained locked in the lower circuit as of 10:39 a.m., compared to 0.61% decline the NSE Nifty 50 index.

The scrip has hit 5% lower circuit on April 10, and struggling to come out it for six sessions.

Shares of Sun Pharma Advance Research company declined as much as 5.00% to Rs 332.55, the lowest level since Feb 13. It remained locked in the lower circuit as of 10:39 a.m., compared to 0.61% decline the NSE Nifty 50 index.

The scrip has hit 5% lower circuit on April 10, and struggling to come out it for six sessions.

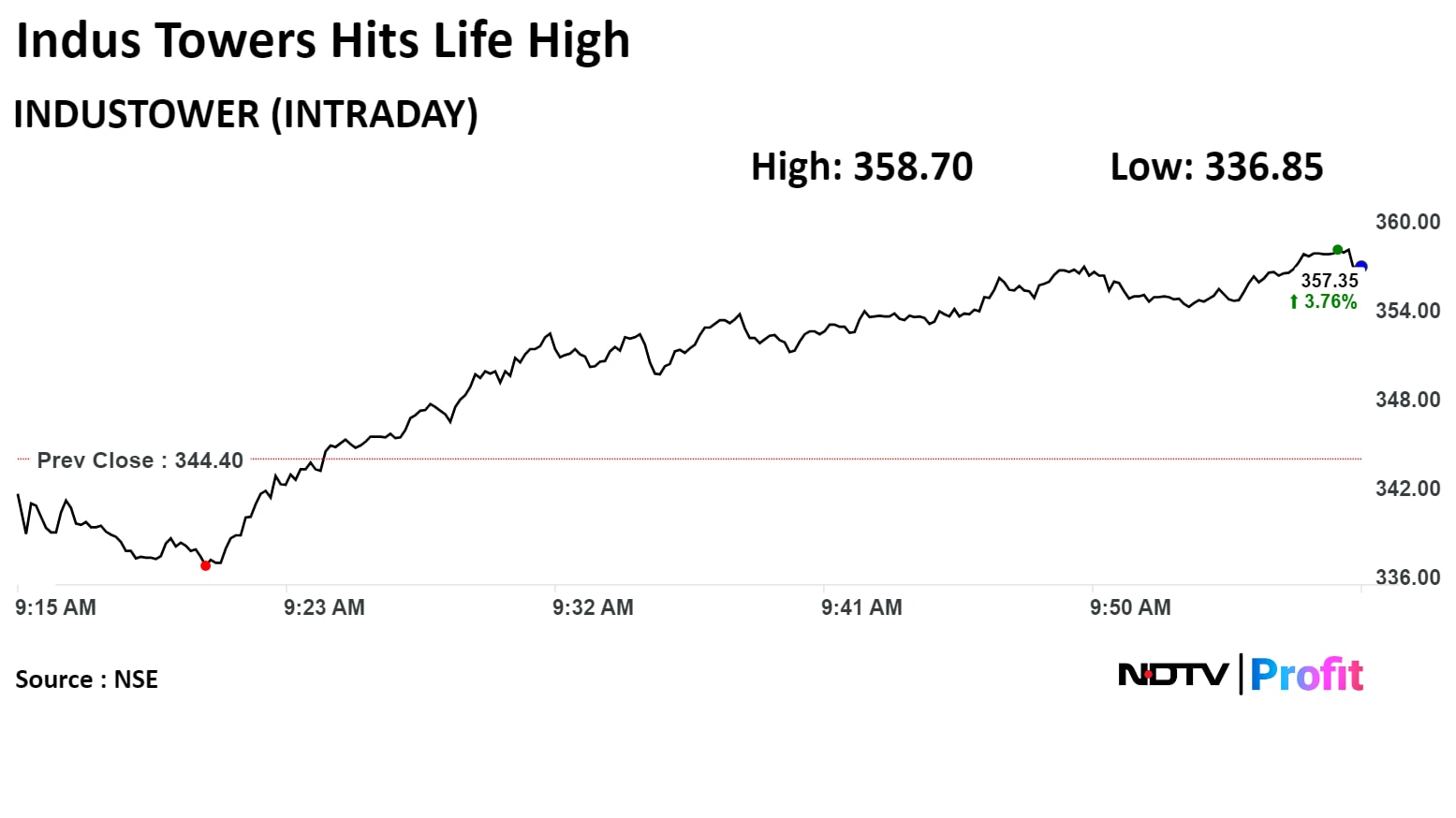

Indus Towers rose to their highest level since listing as the company signed a memorandum of understanding with the NTPC Green Energy to develop renewable power projects.

The company, a joint venture with the NTPC Green energy, develop the grid connected renewable energy based power projects including solar, wind, Energy storage, according to an exchange filing.

Shares of Indus Towers Ltd. rose 4.15% to Rs 358.70, the highest level since its listing on Dec 28, 2012. It was trading 4.02% higher at Rs 358.25 as of 10:02 a.m., as compared to 0.45% decline in the NSE Nifty 50 index.

The scrip has gained 161.97% in 12 month, and on year-to-date basis it has risen 80.38%. Total traded volume so far in the day stood at 0.64 times its 30-day average. The relative strength index was at 80.91, which implied the stock is overbought

Out of 22 analysts tracking the company, 11 maintain a 'buy' rating, six recommend a 'hold,' and six suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 29.3%

Indus Towers rose to their highest level since listing as the company signed a memorandum of understanding with the NTPC Green Energy to develop renewable power projects.

The company, a joint venture with the NTPC Green energy, develop the grid connected renewable energy based power projects including solar, wind, Energy storage, according to an exchange filing.

Shares of Indus Towers Ltd. rose 4.15% to Rs 358.70, the highest level since its listing on Dec 28, 2012. It was trading 4.02% higher at Rs 358.25 as of 10:02 a.m., as compared to 0.45% decline in the NSE Nifty 50 index.

The scrip has gained 161.97% in 12 month, and on year-to-date basis it has risen 80.38%. Total traded volume so far in the day stood at 0.64 times its 30-day average. The relative strength index was at 80.91, which implied the stock is overbought

Out of 22 analysts tracking the company, 11 maintain a 'buy' rating, six recommend a 'hold,' and six suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 29.3%

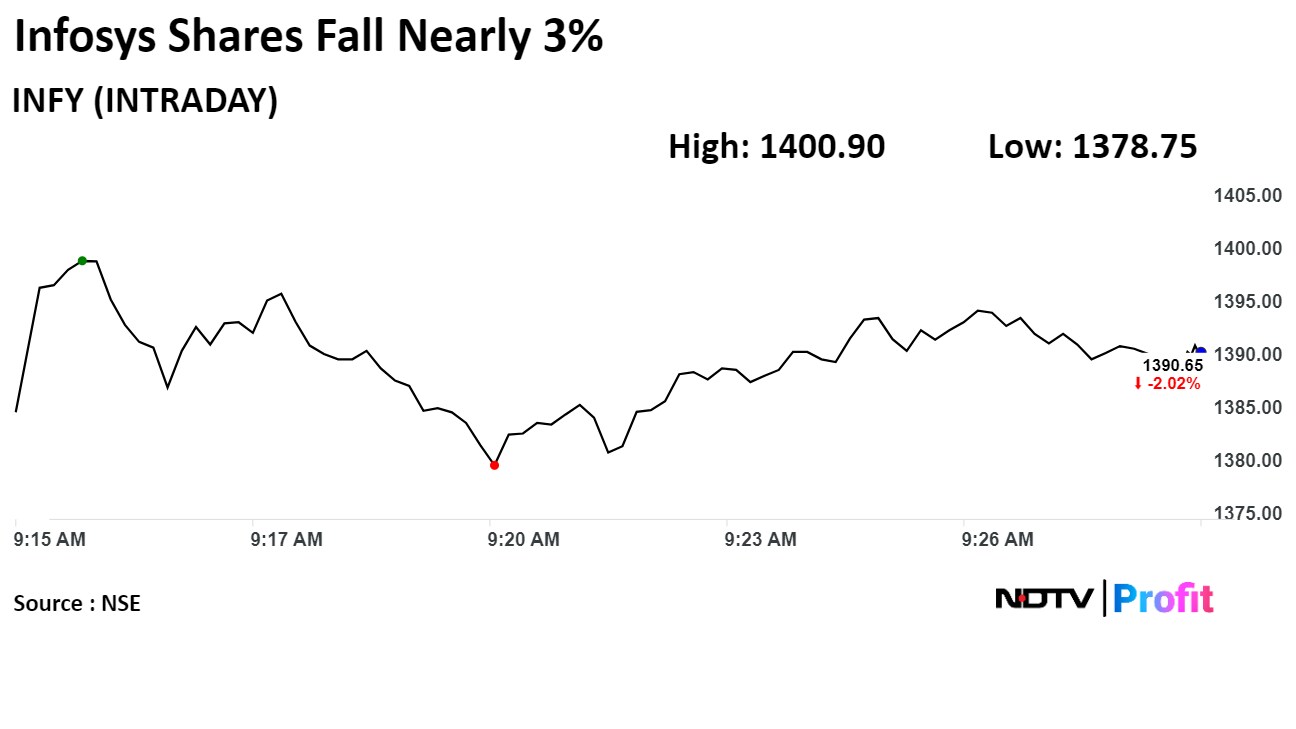

Shares of Infosys Ltd. declined nearly 3% Friday after the tech giant's revenue declined in the fourth quarter and guided for a modest revenue increase in FY25.

India's second-largest IT giant's revenue declined 2.3% on sequential basis to Rs 37,923 crore, compared to Rs 38,576 crore estimate by a Bloomberg survey.

The scrip fell as much as 2.85% to Rs 1,378.75 apiece and pared losses to trade 2.69% lower at Rs 1,381.1 apiece, as of 9:20 a.m. This compares to a 0.66% decline in the NSE Nifty 50 Index.

Infosys has risen 12.08% in 12 months. The relative strength index was at 22.

Out of 46 analysts tracking the company, 32 maintain a 'buy' rating, seven recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 16.0%.

Shares of Infosys Ltd. declined nearly 3% Friday after the tech giant's revenue declined in the fourth quarter and guided for a modest revenue increase in FY25.

India's second-largest IT giant's revenue declined 2.3% on sequential basis to Rs 37,923 crore, compared to Rs 38,576 crore estimate by a Bloomberg survey.

The scrip fell as much as 2.85% to Rs 1,378.75 apiece and pared losses to trade 2.69% lower at Rs 1,381.1 apiece, as of 9:20 a.m. This compares to a 0.66% decline in the NSE Nifty 50 Index.

Infosys has risen 12.08% in 12 months. The relative strength index was at 22.

Out of 46 analysts tracking the company, 32 maintain a 'buy' rating, seven recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 16.0%.

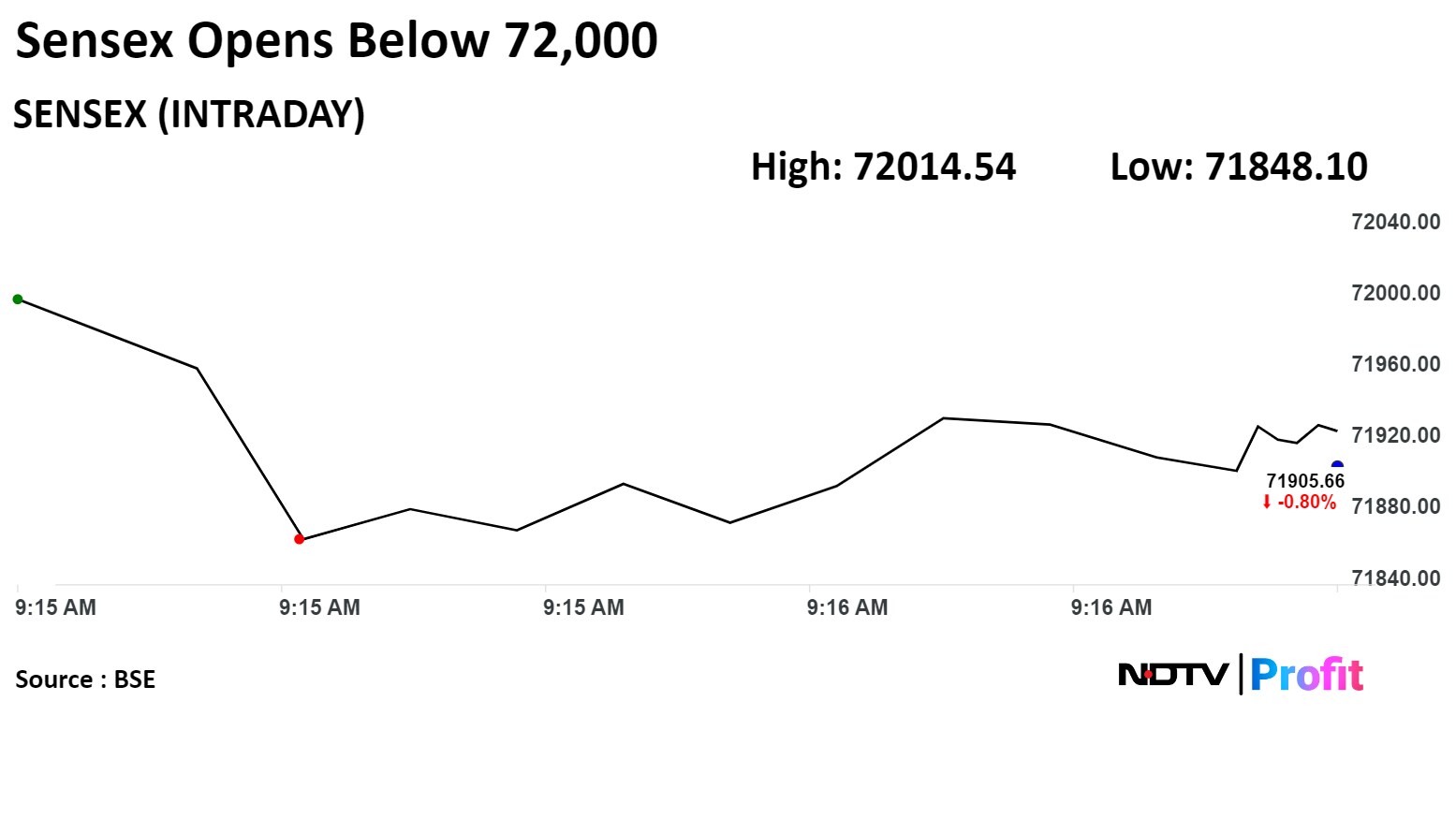

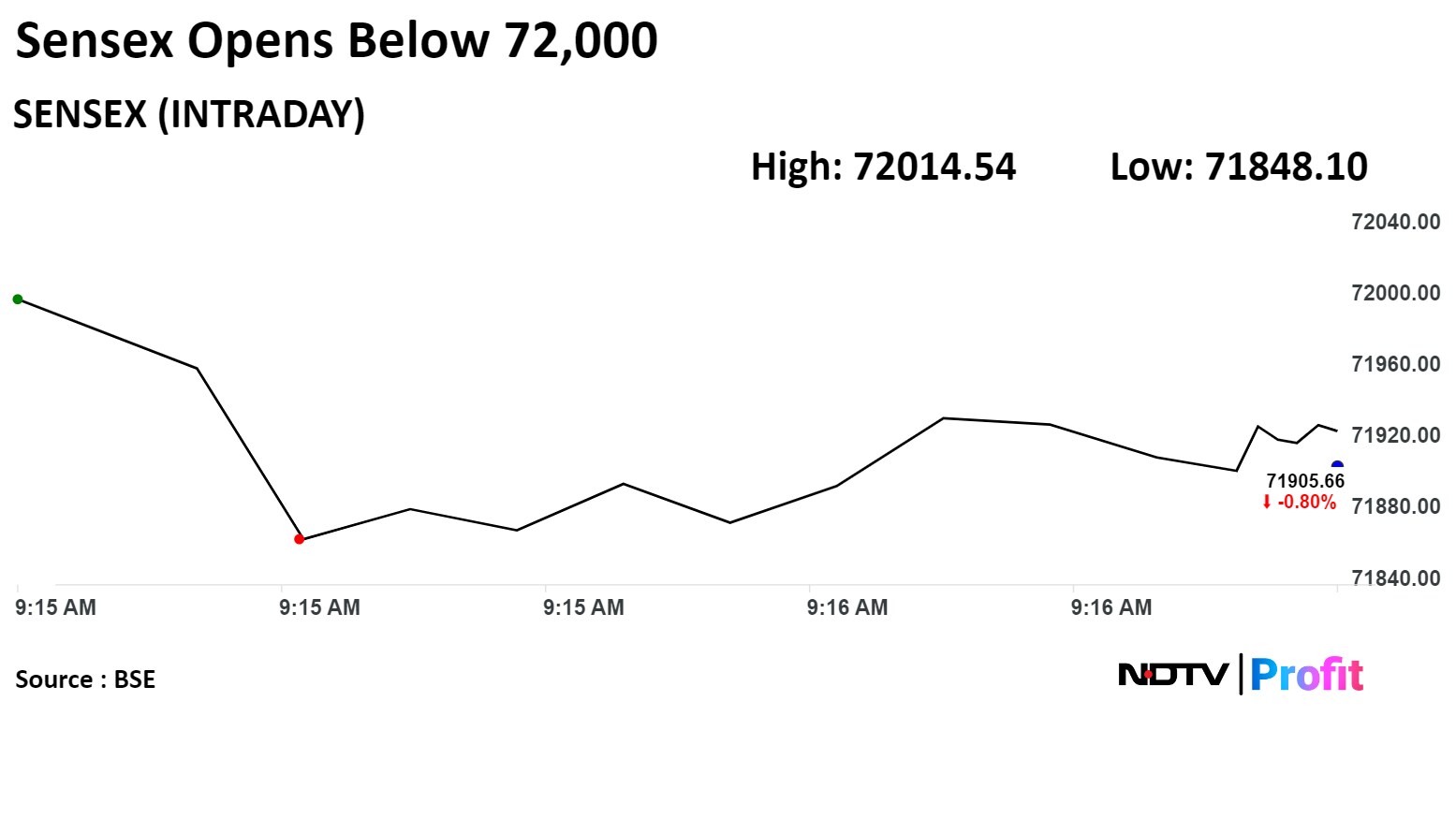

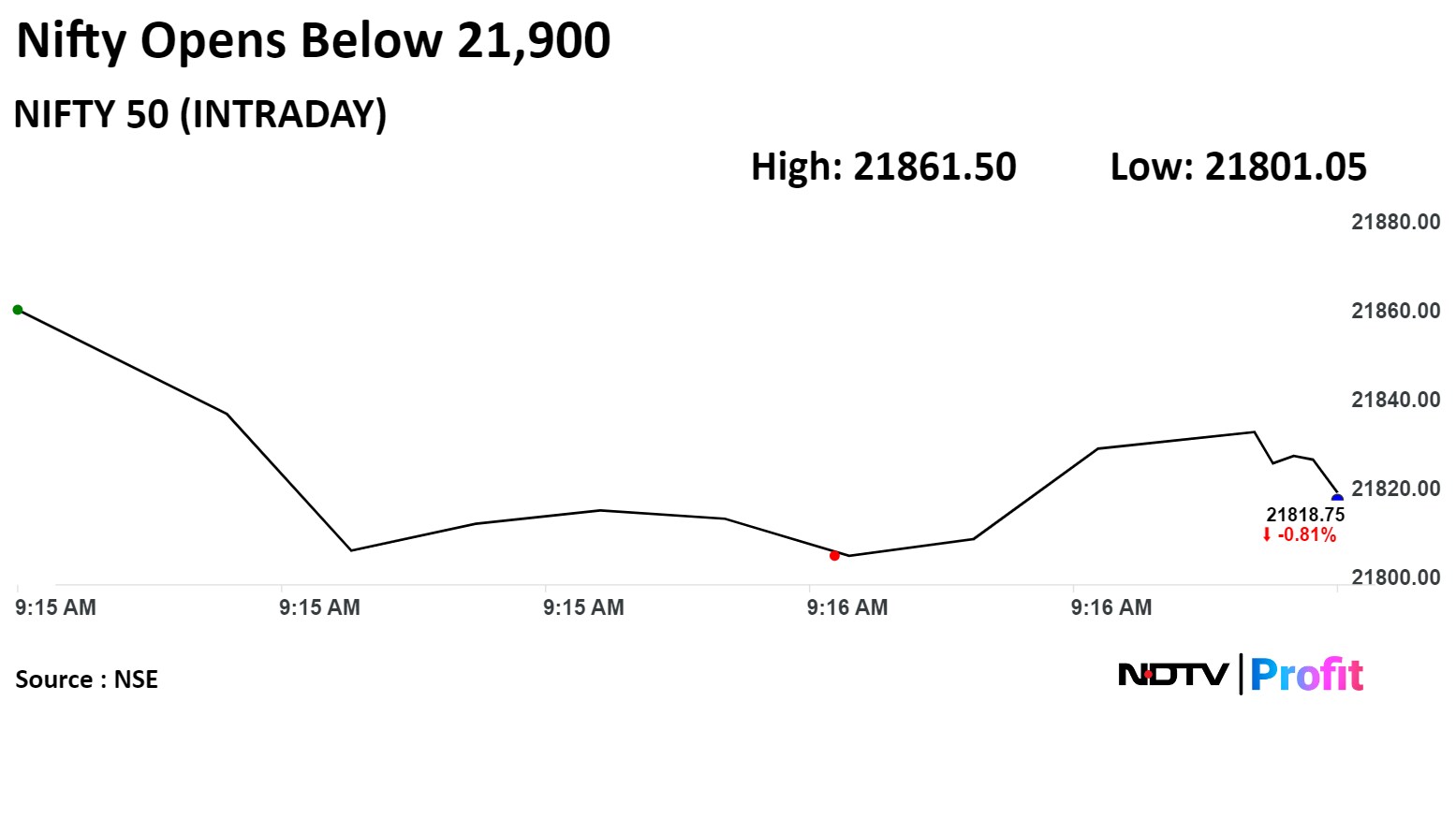

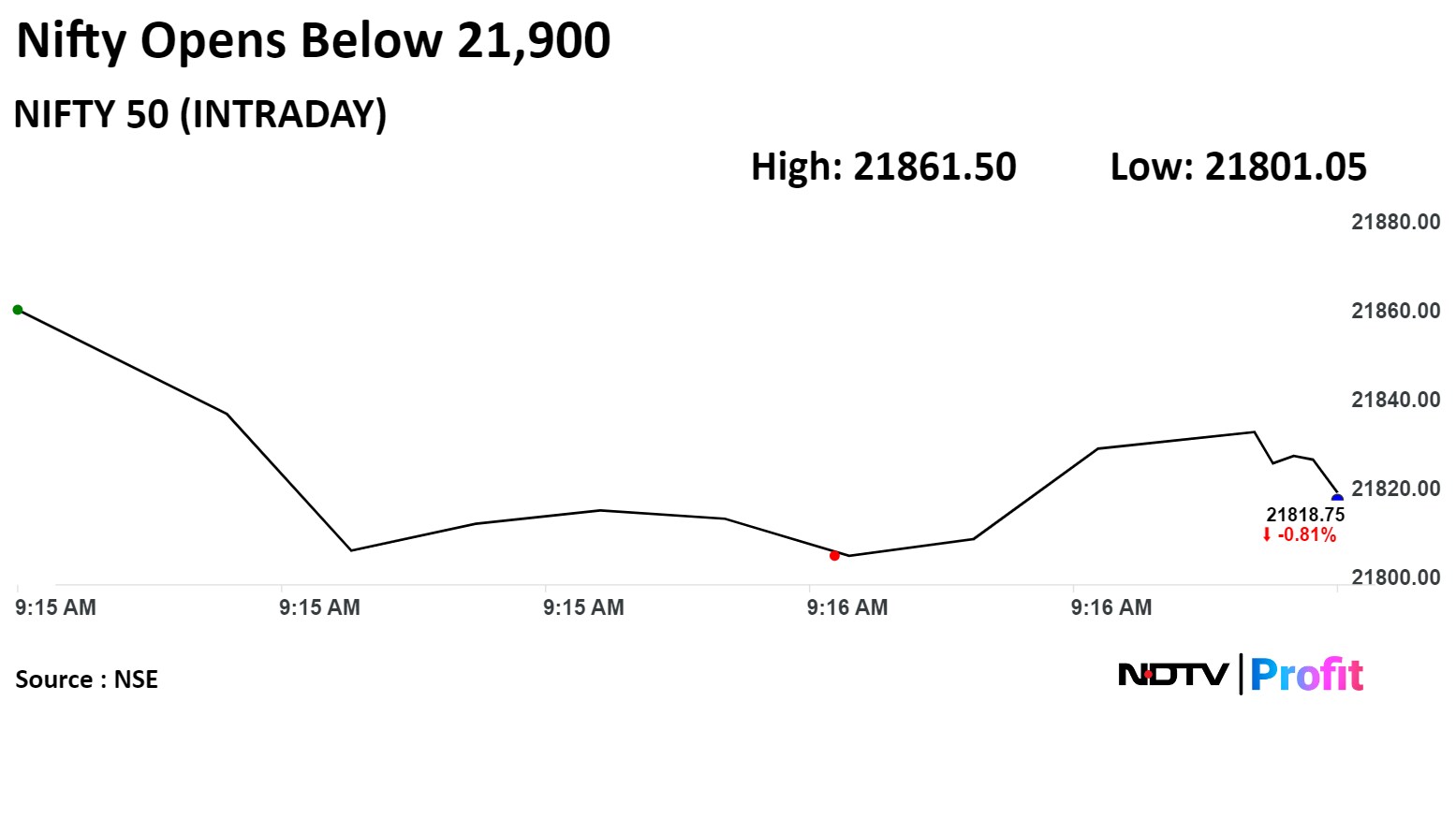

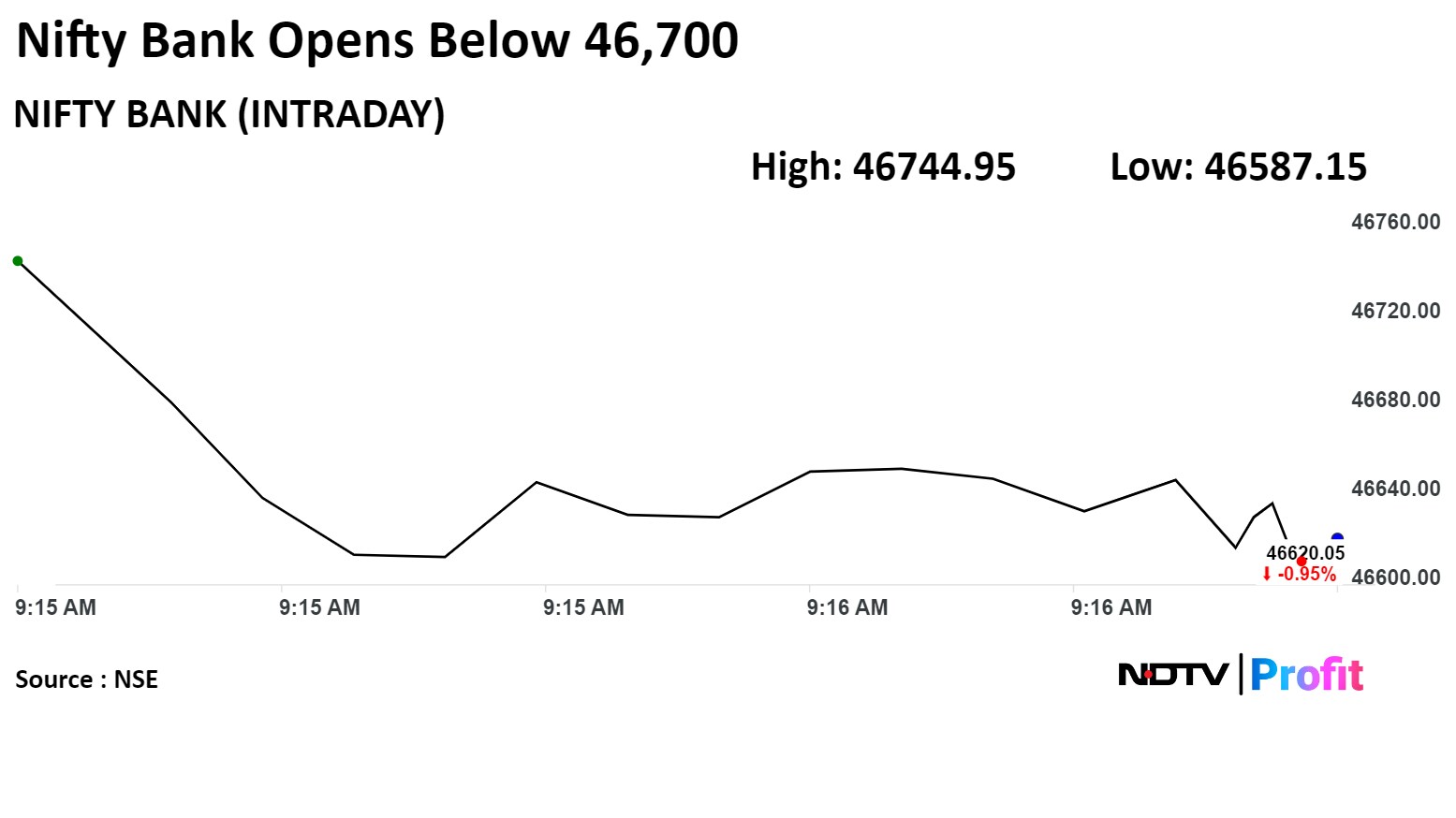

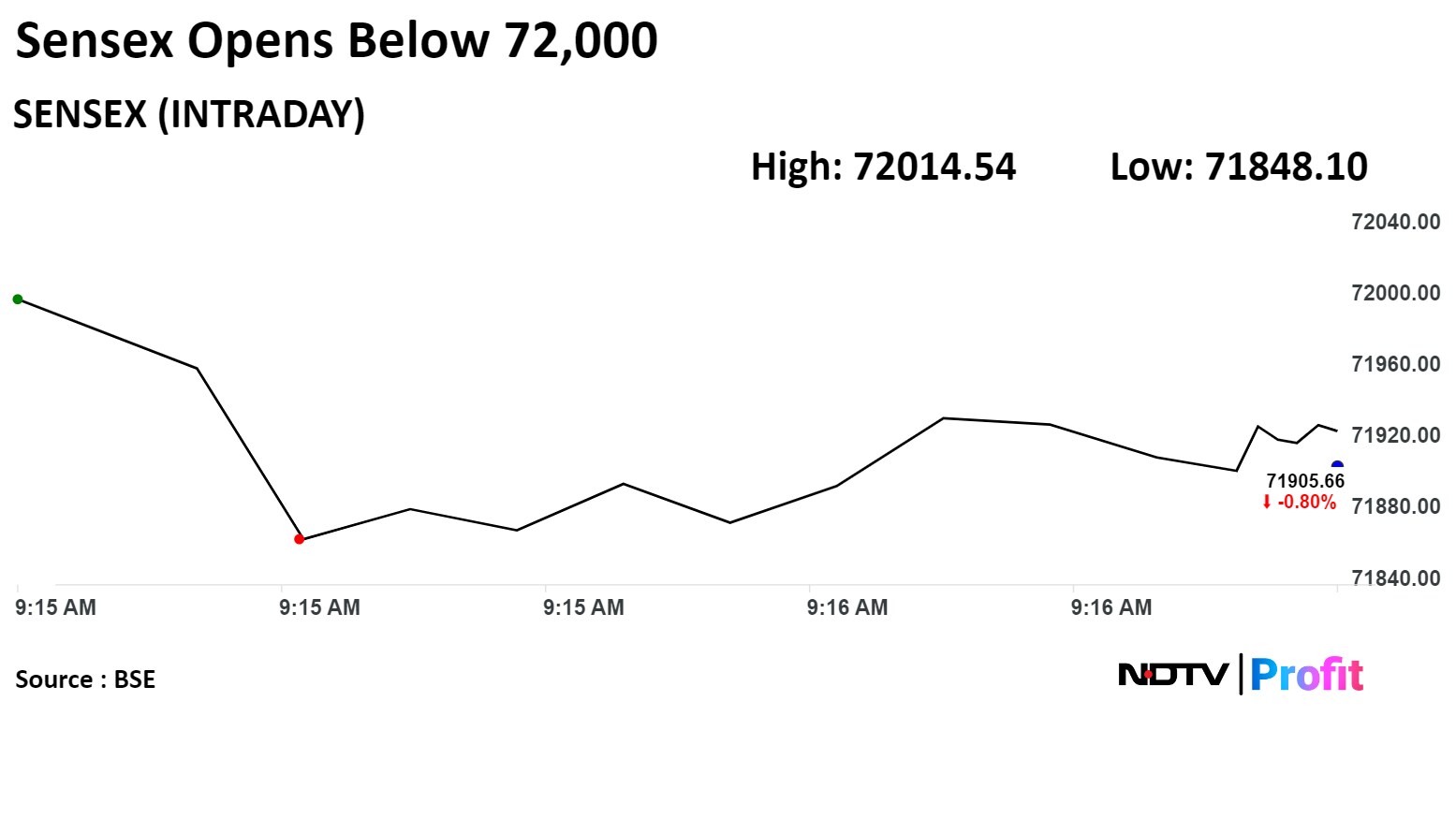

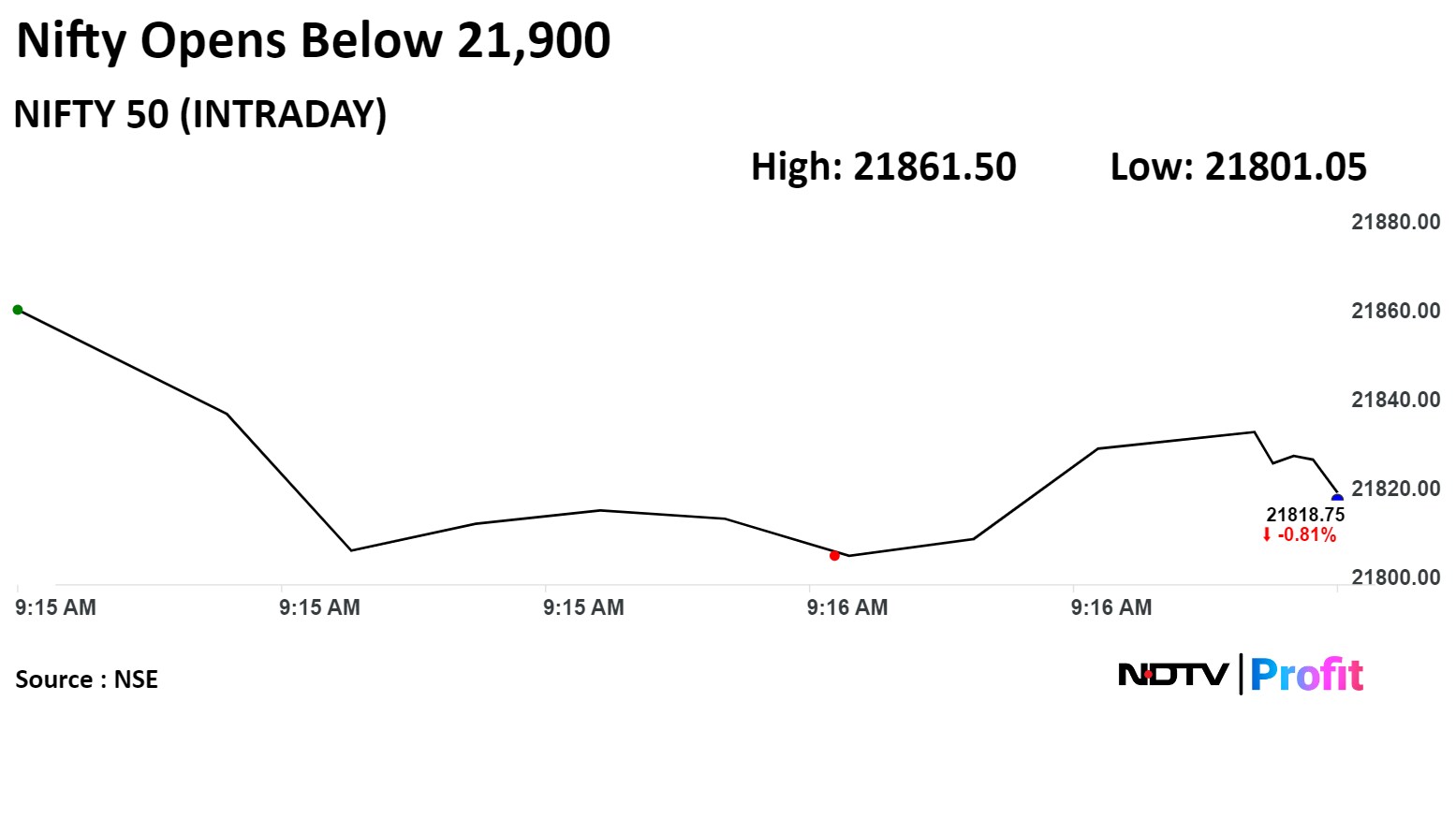

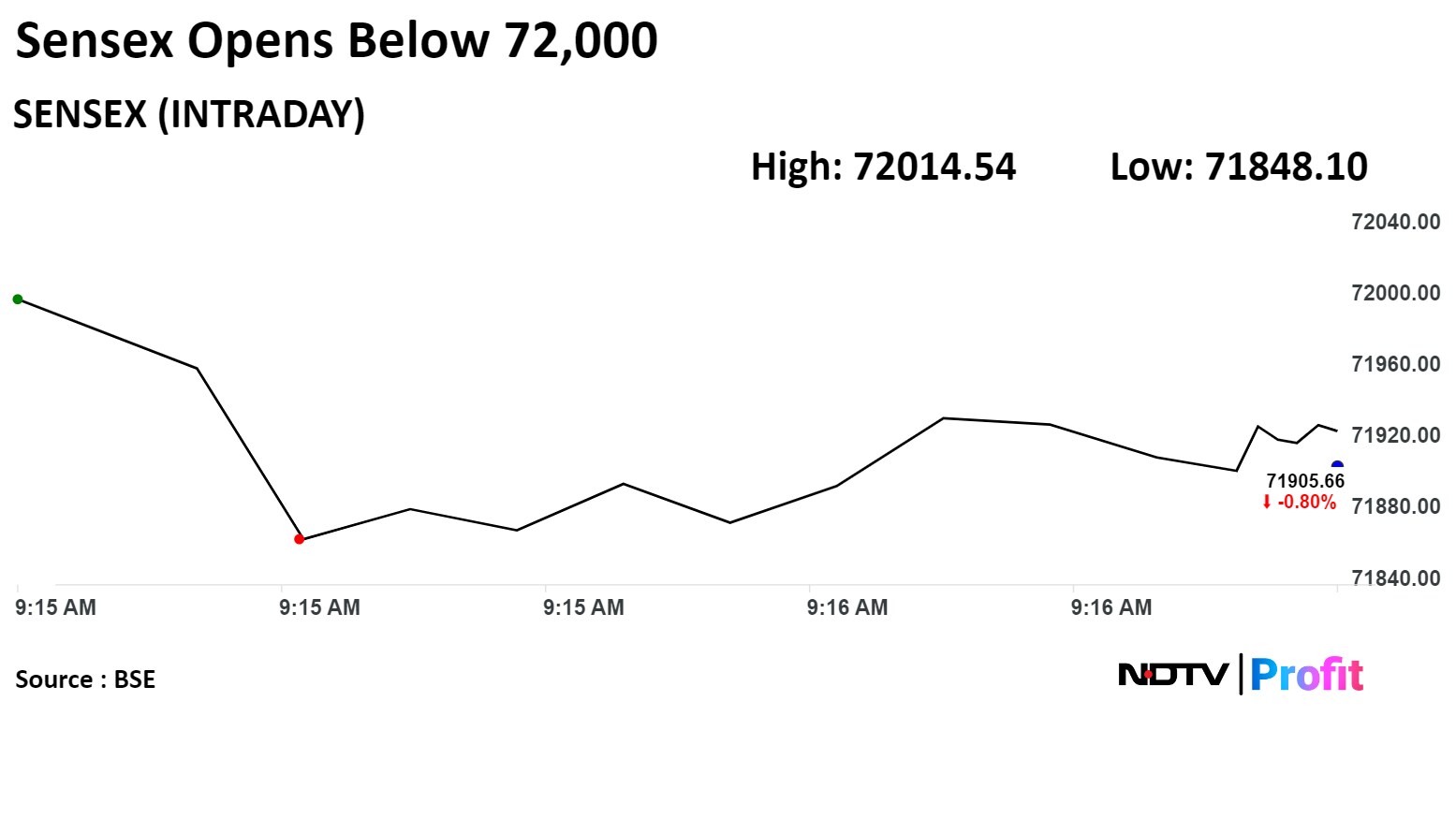

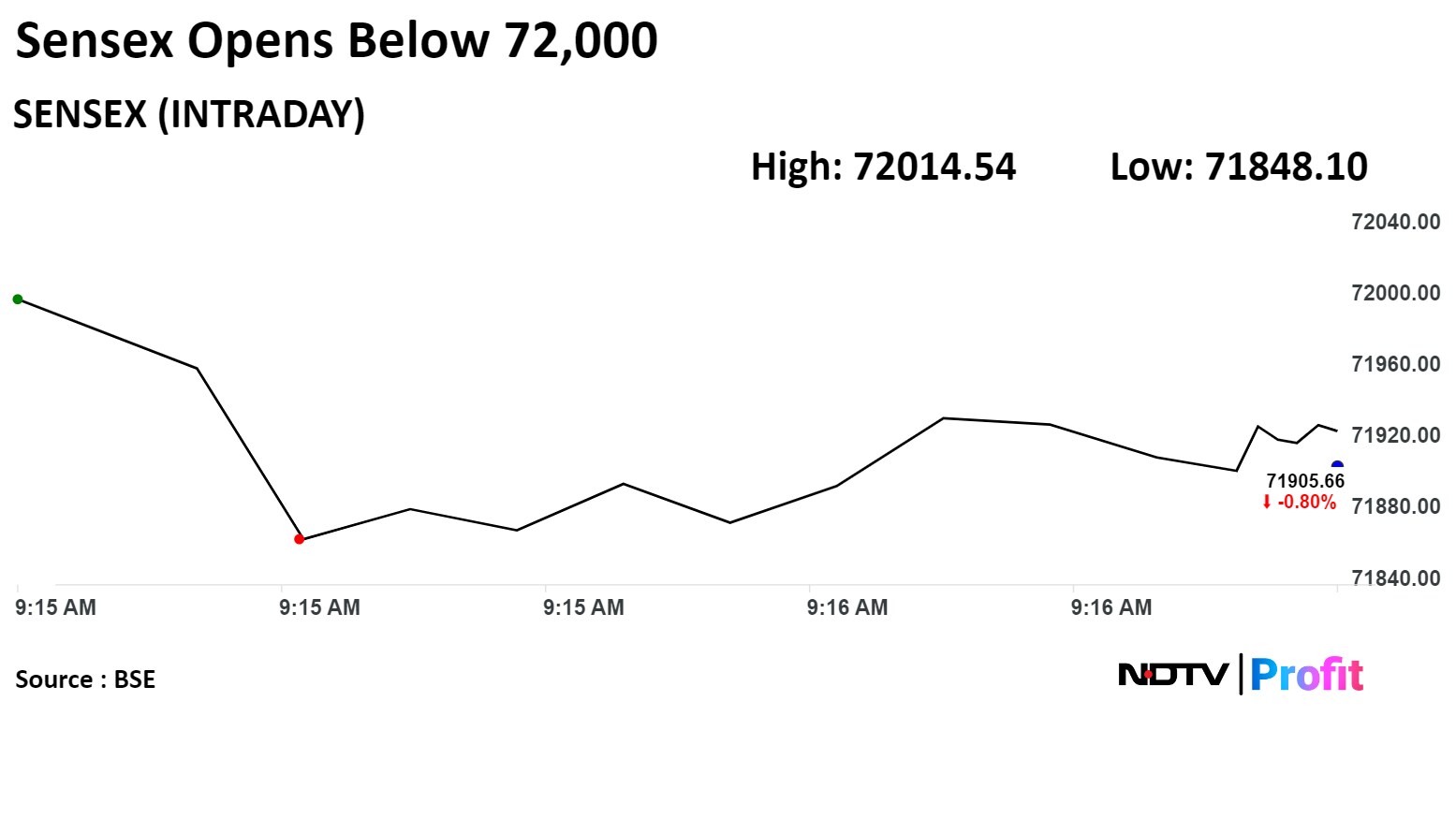

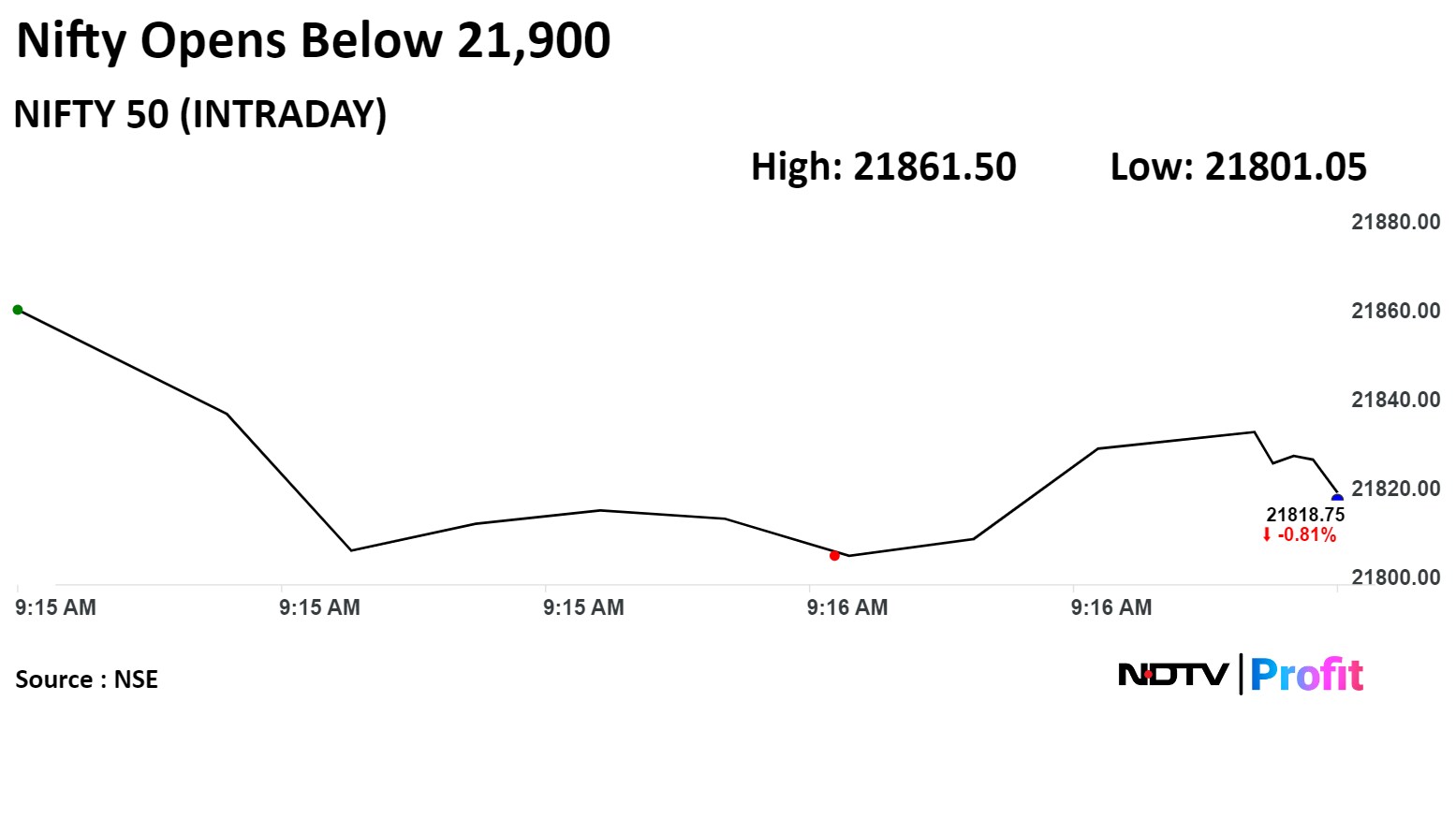

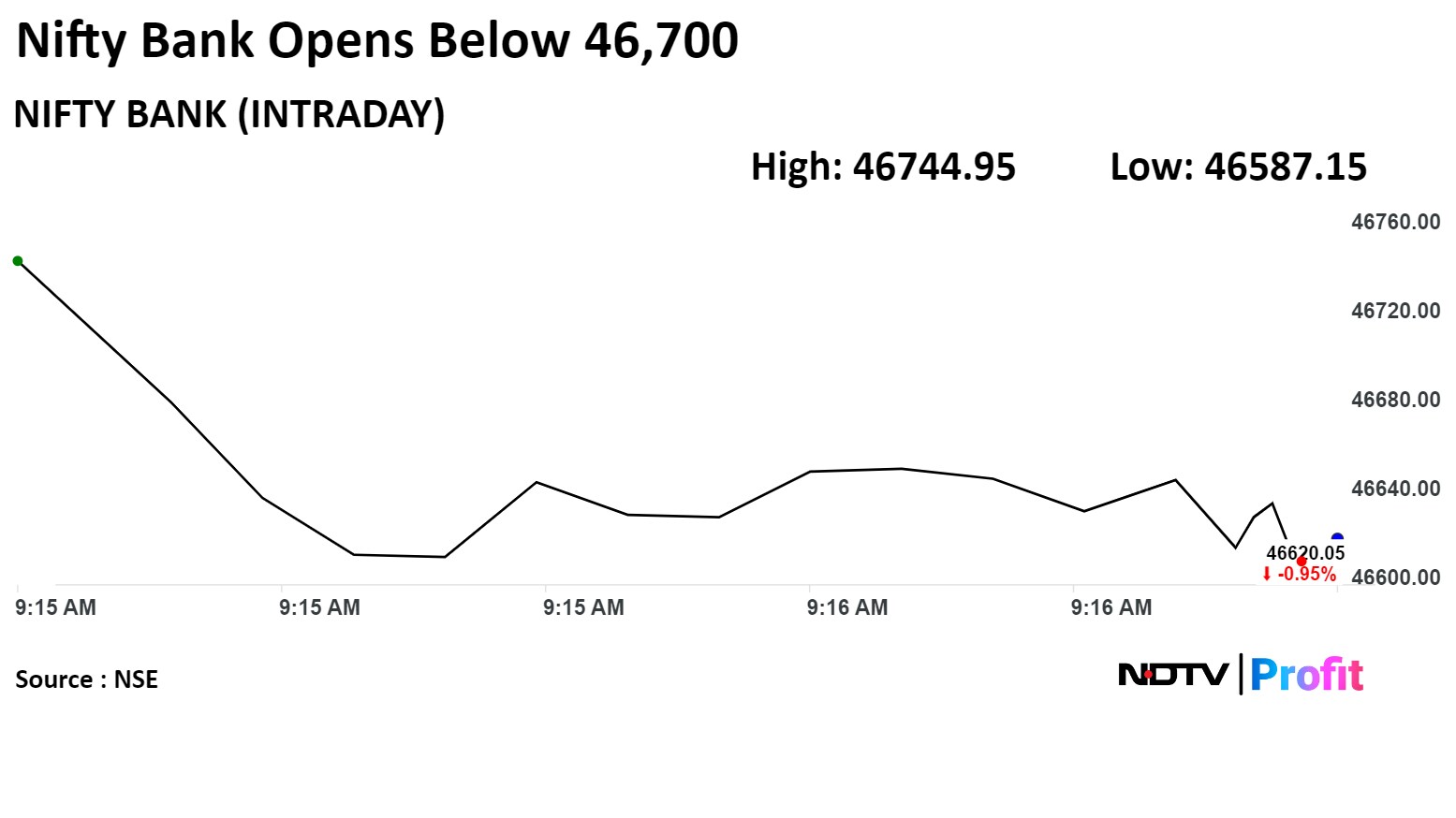

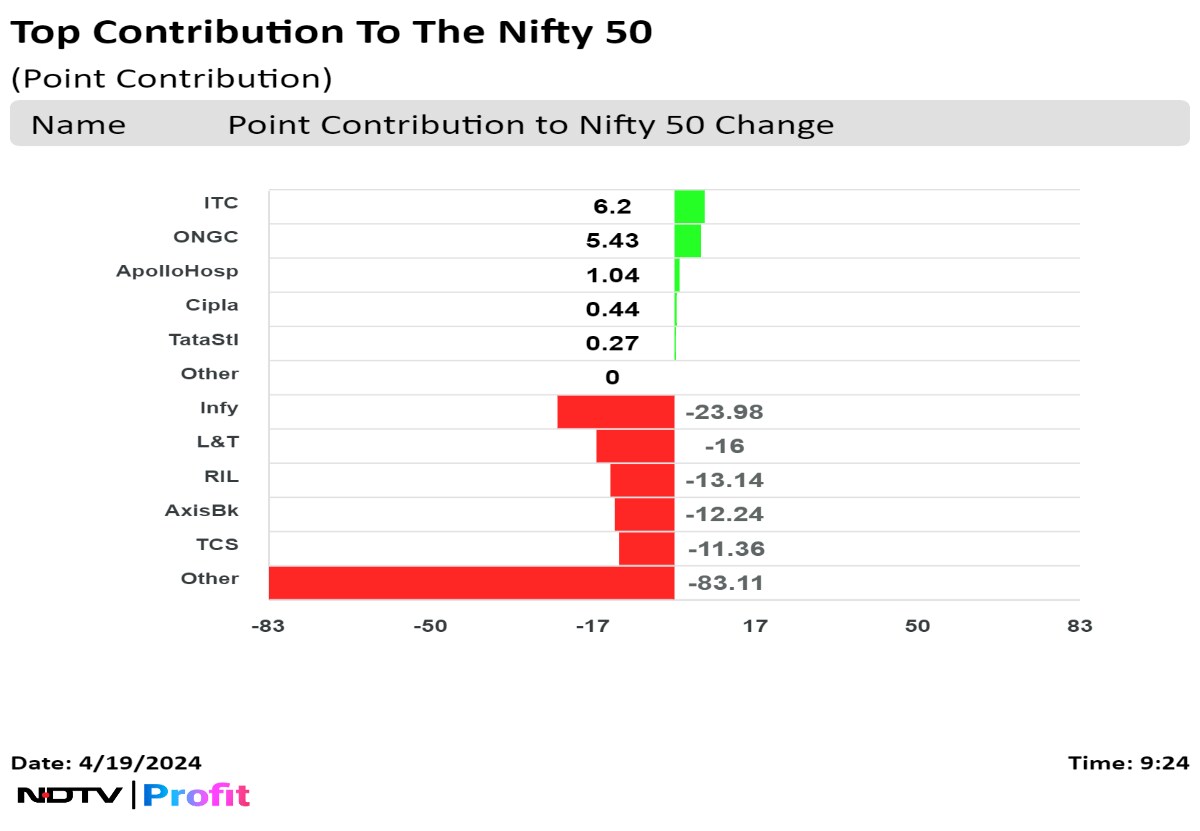

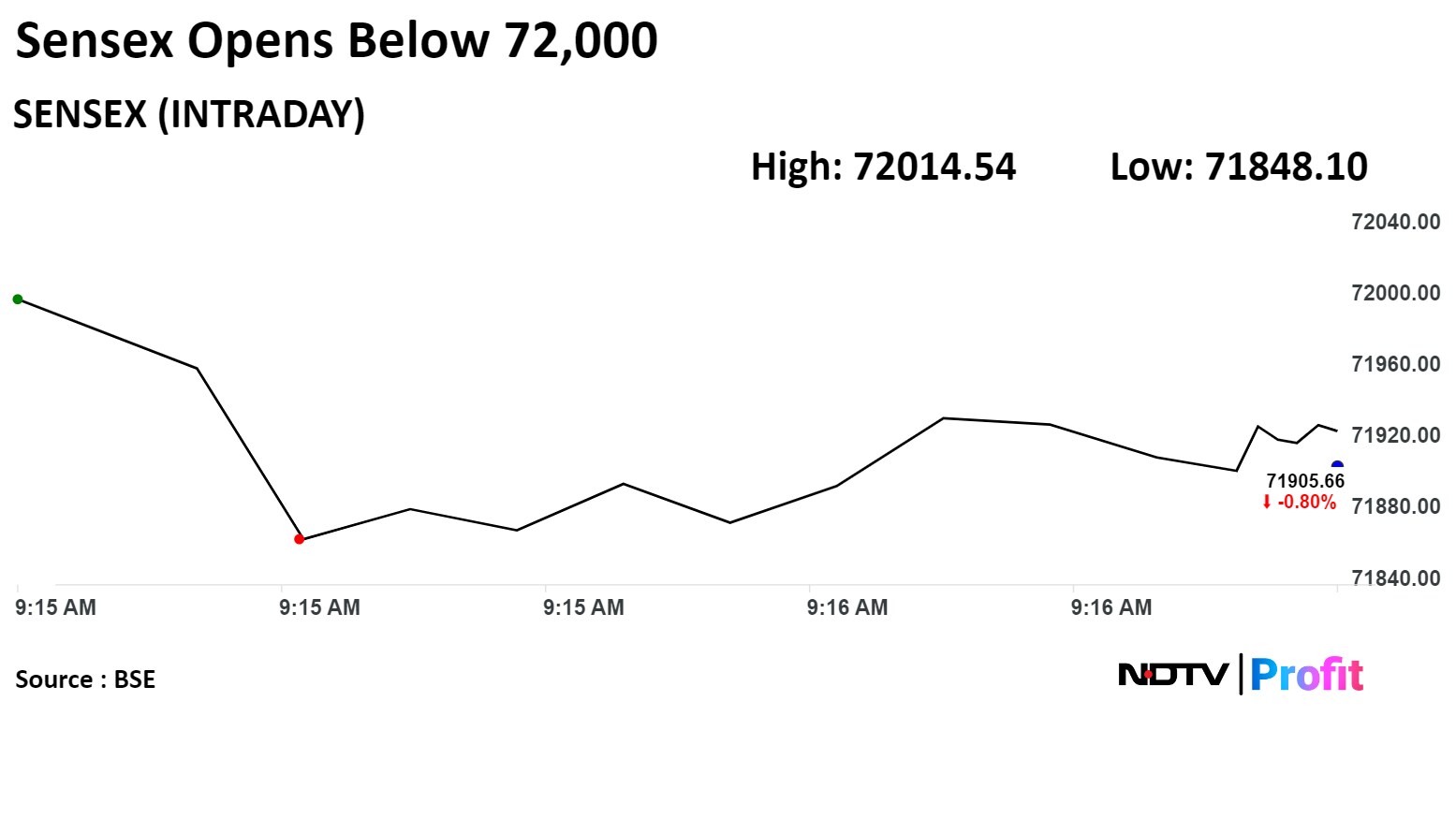

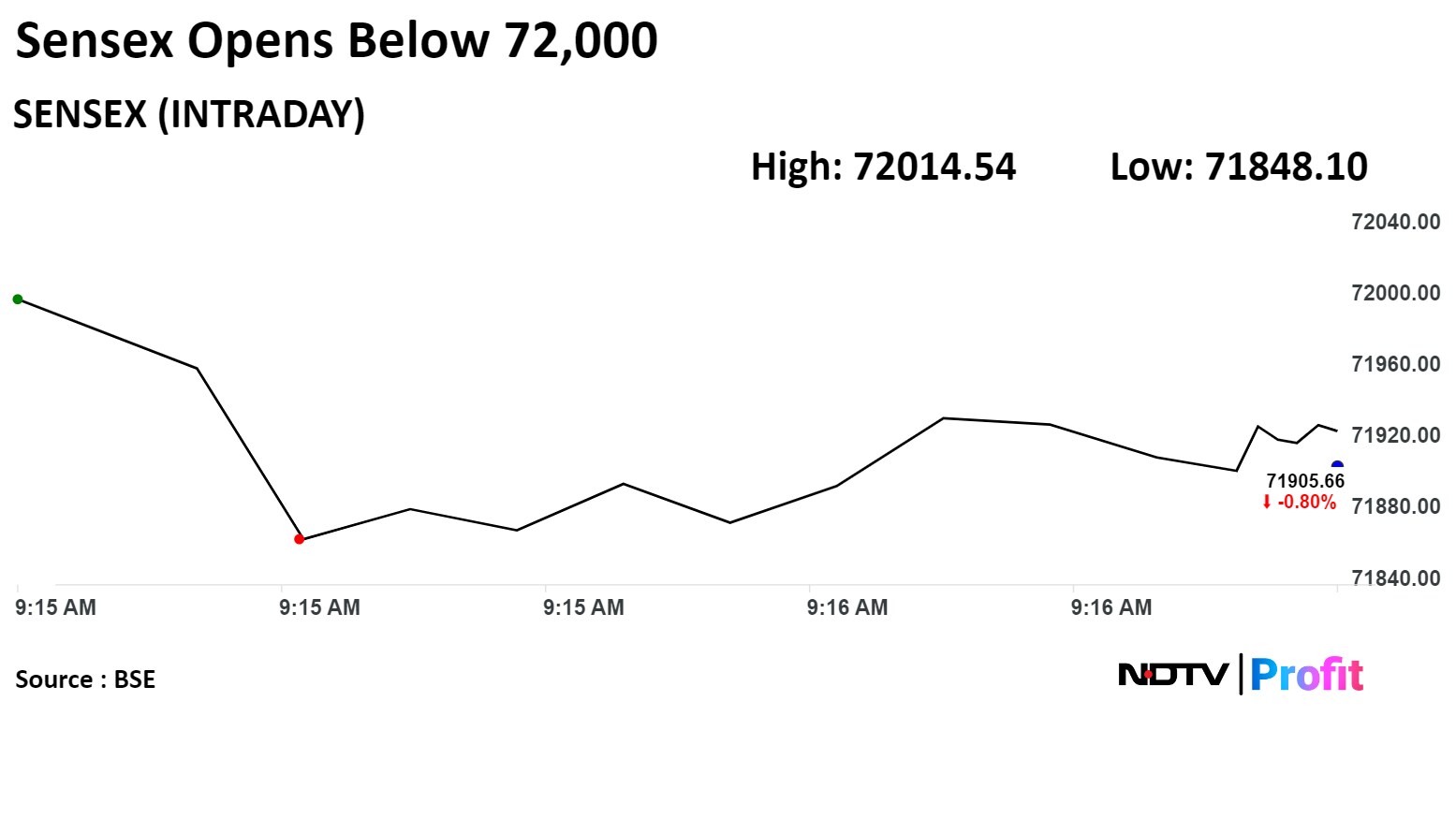

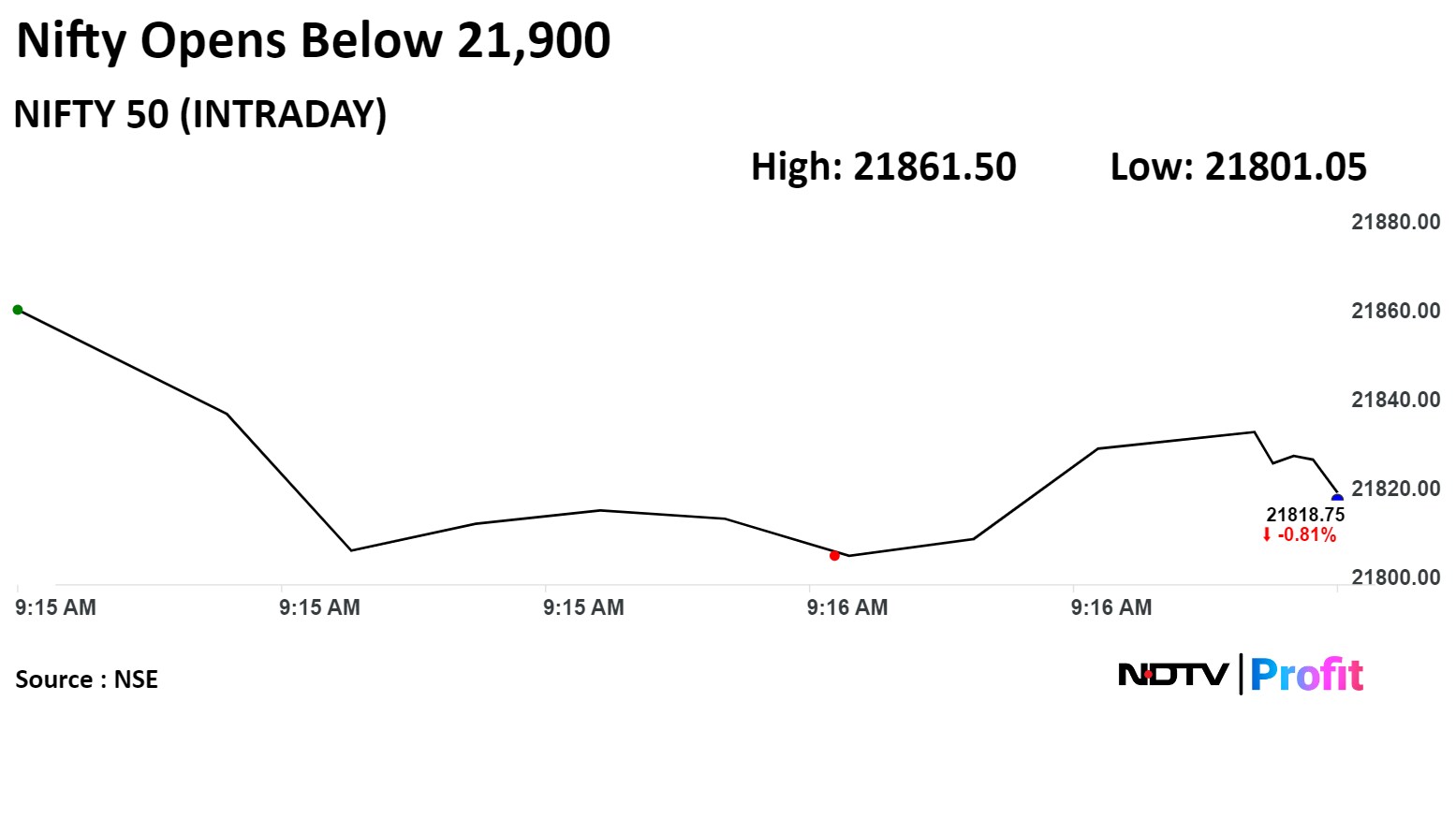

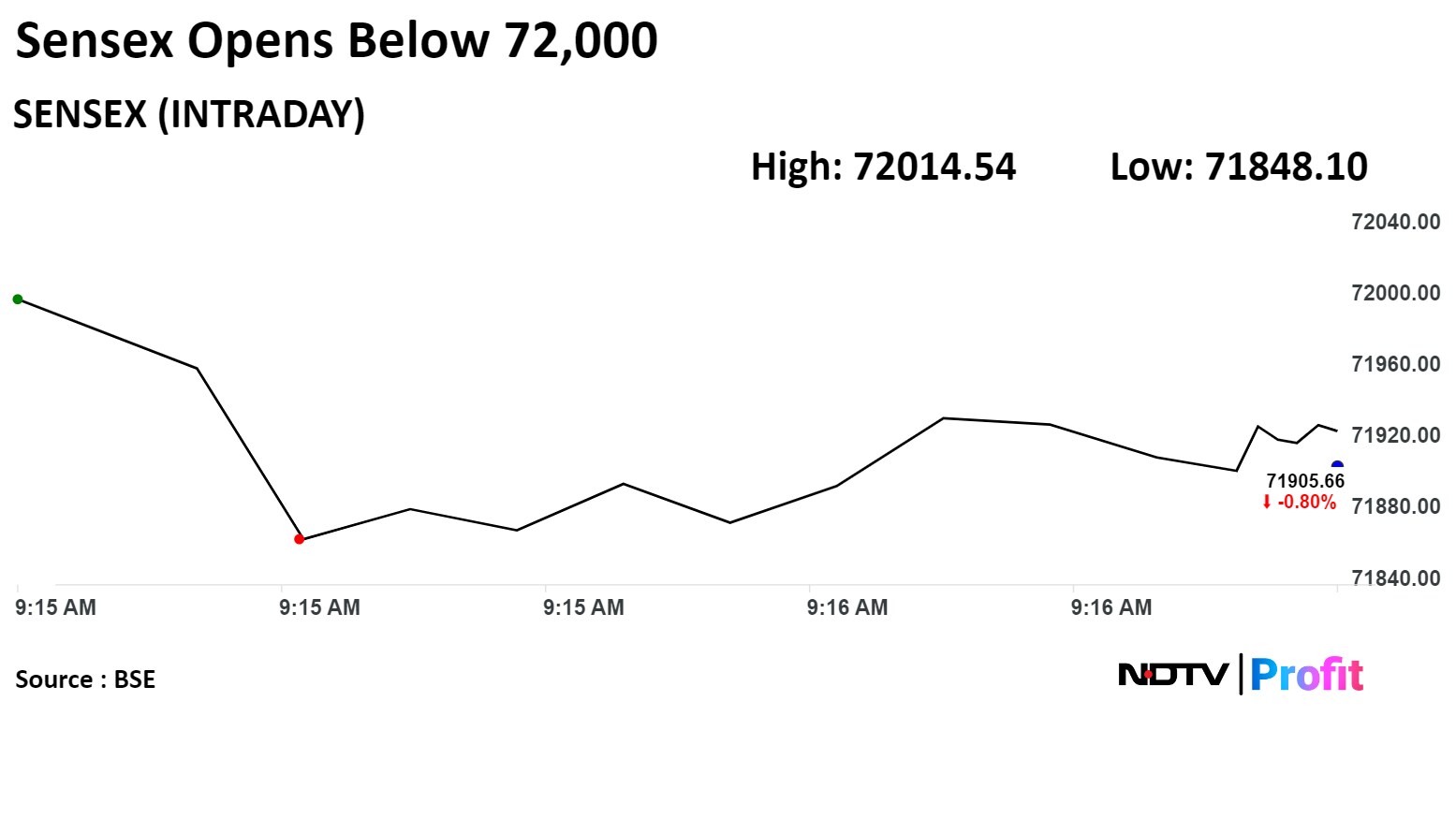

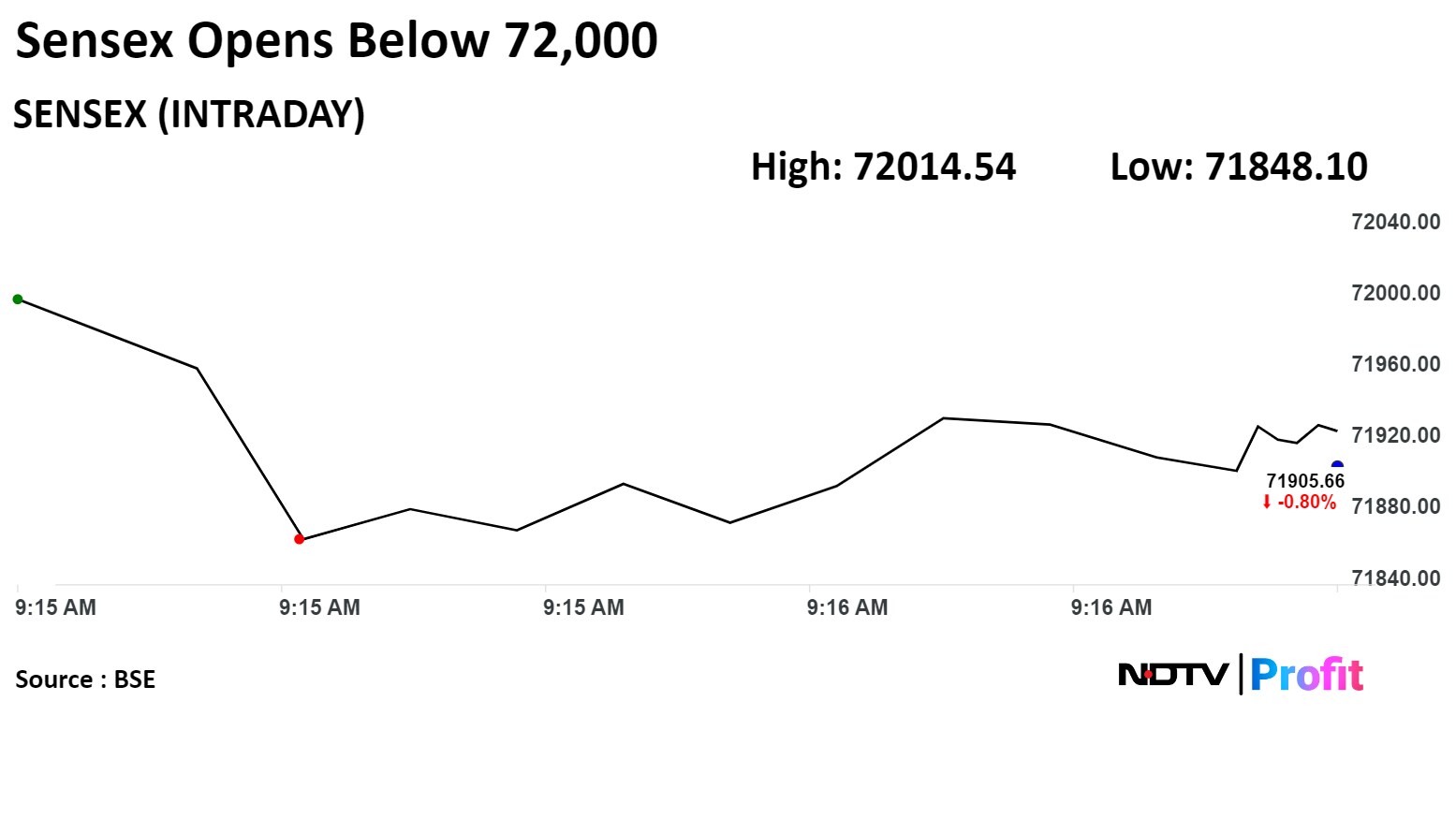

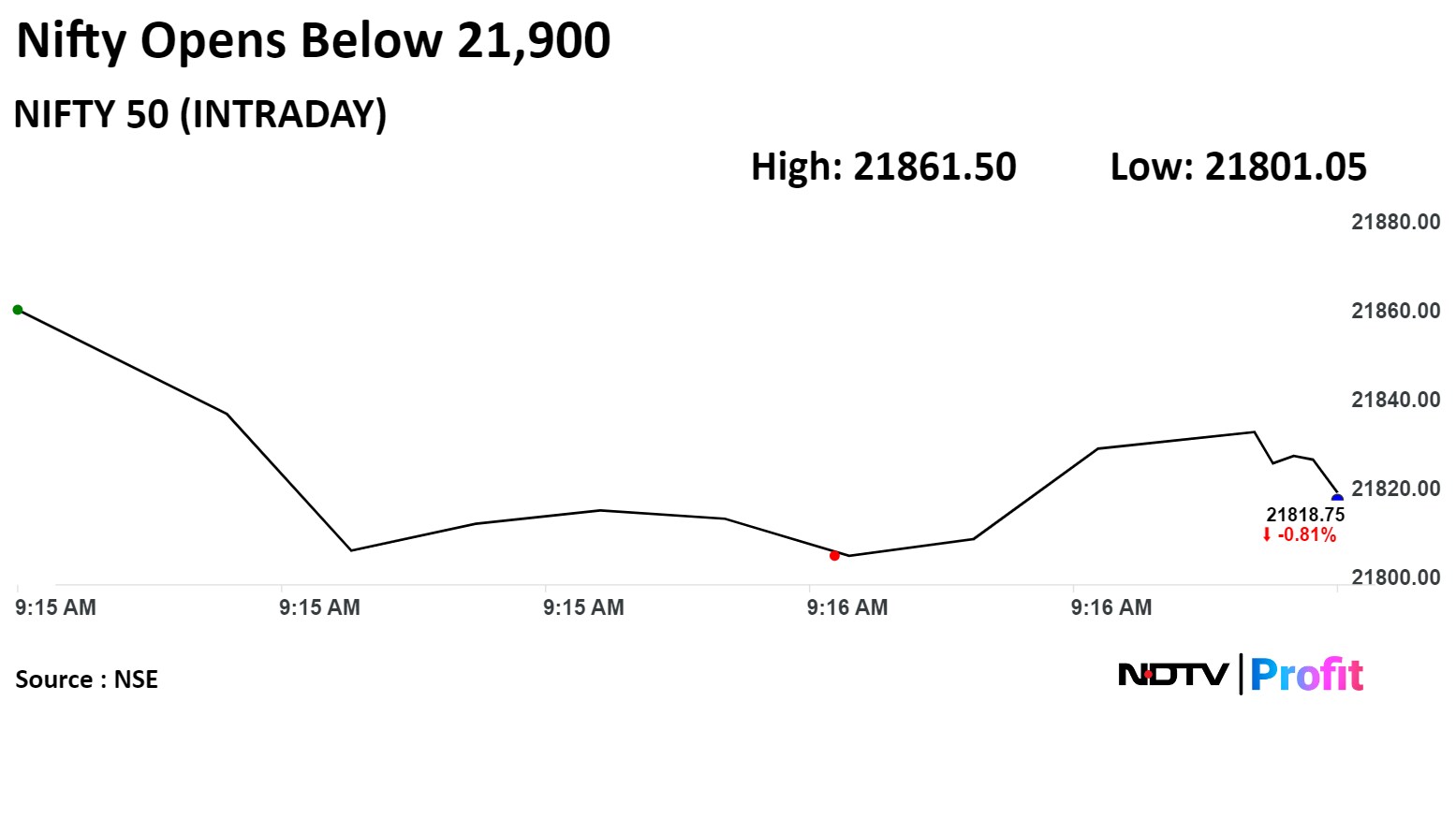

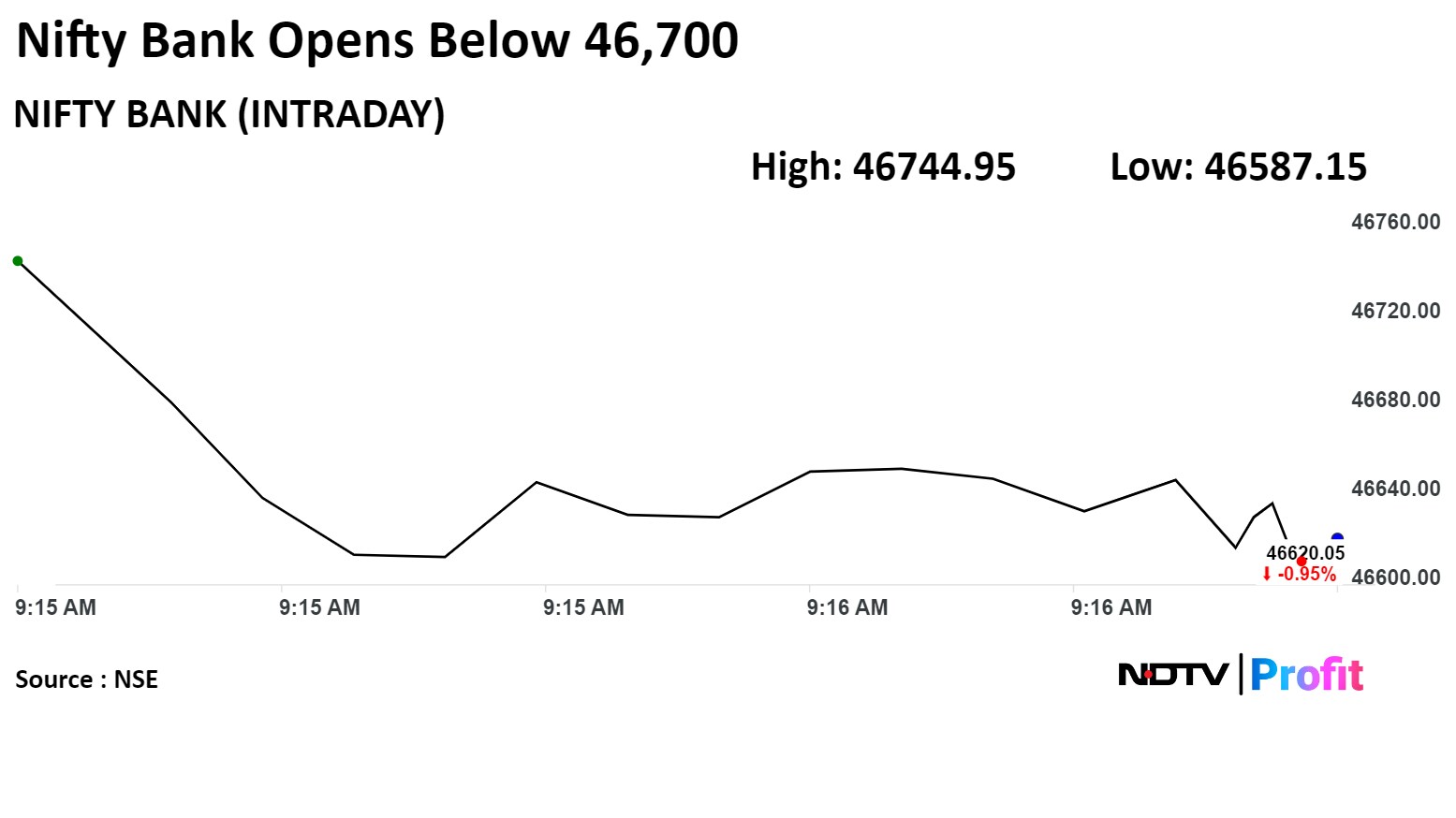

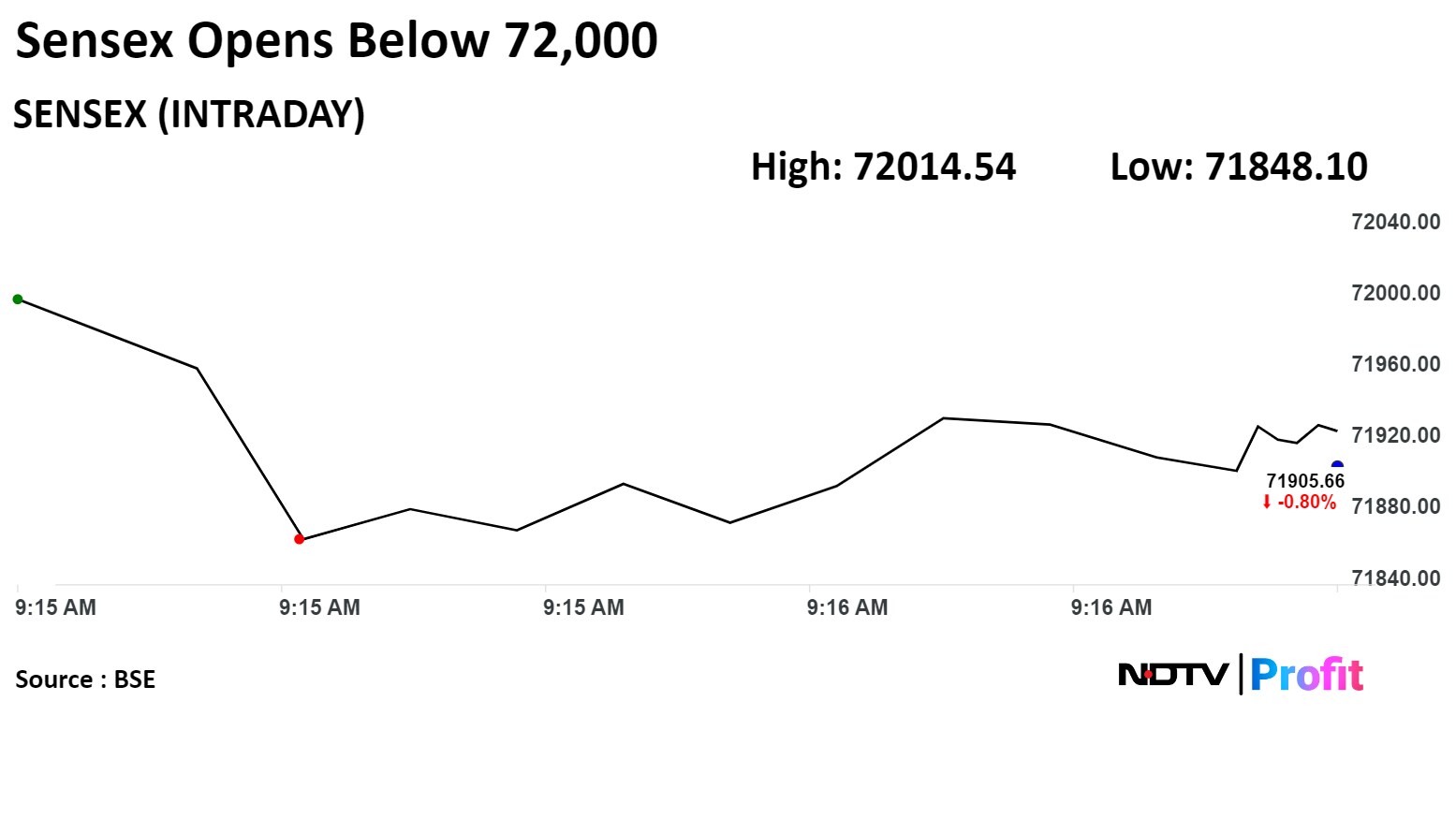

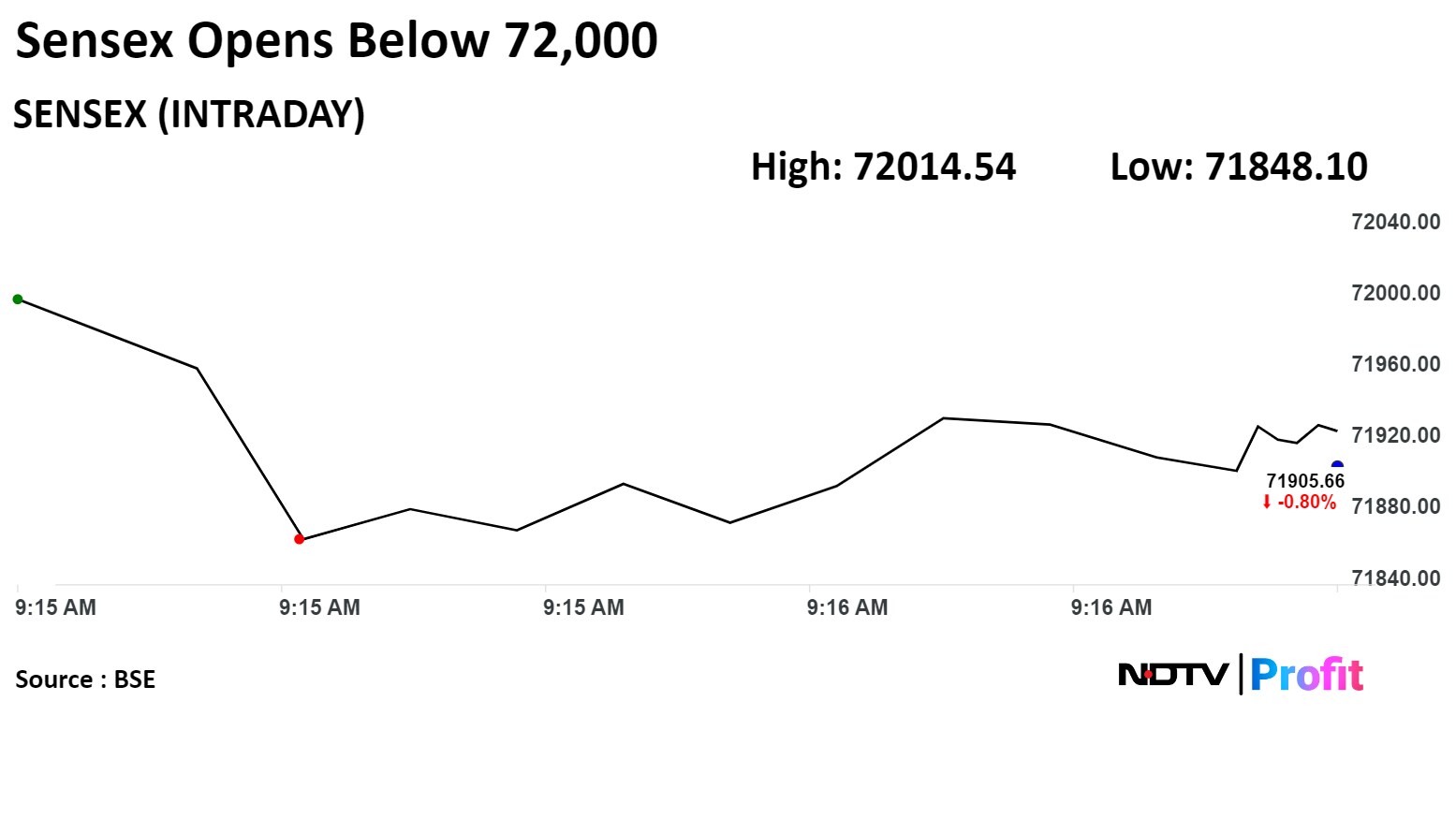

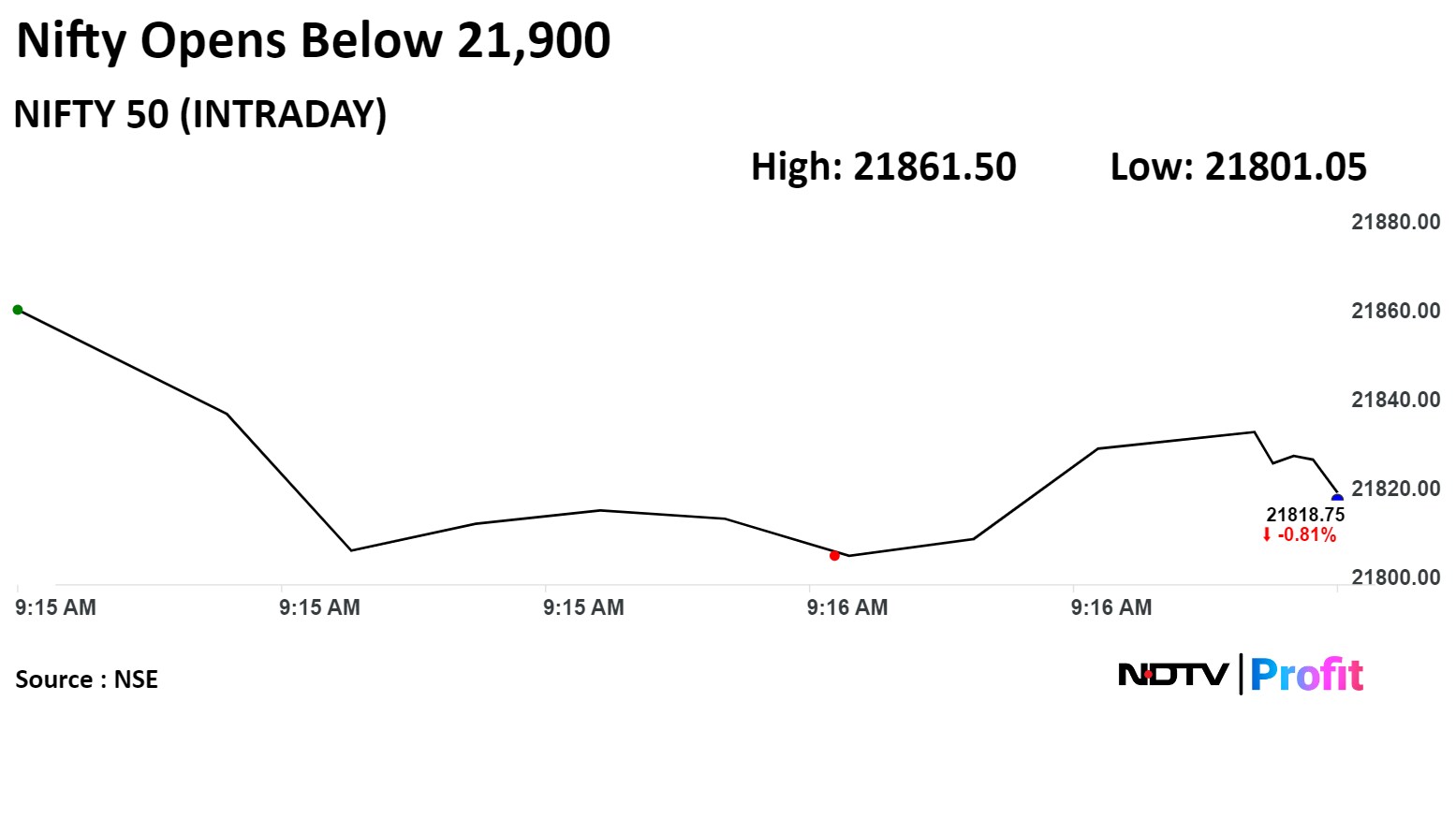

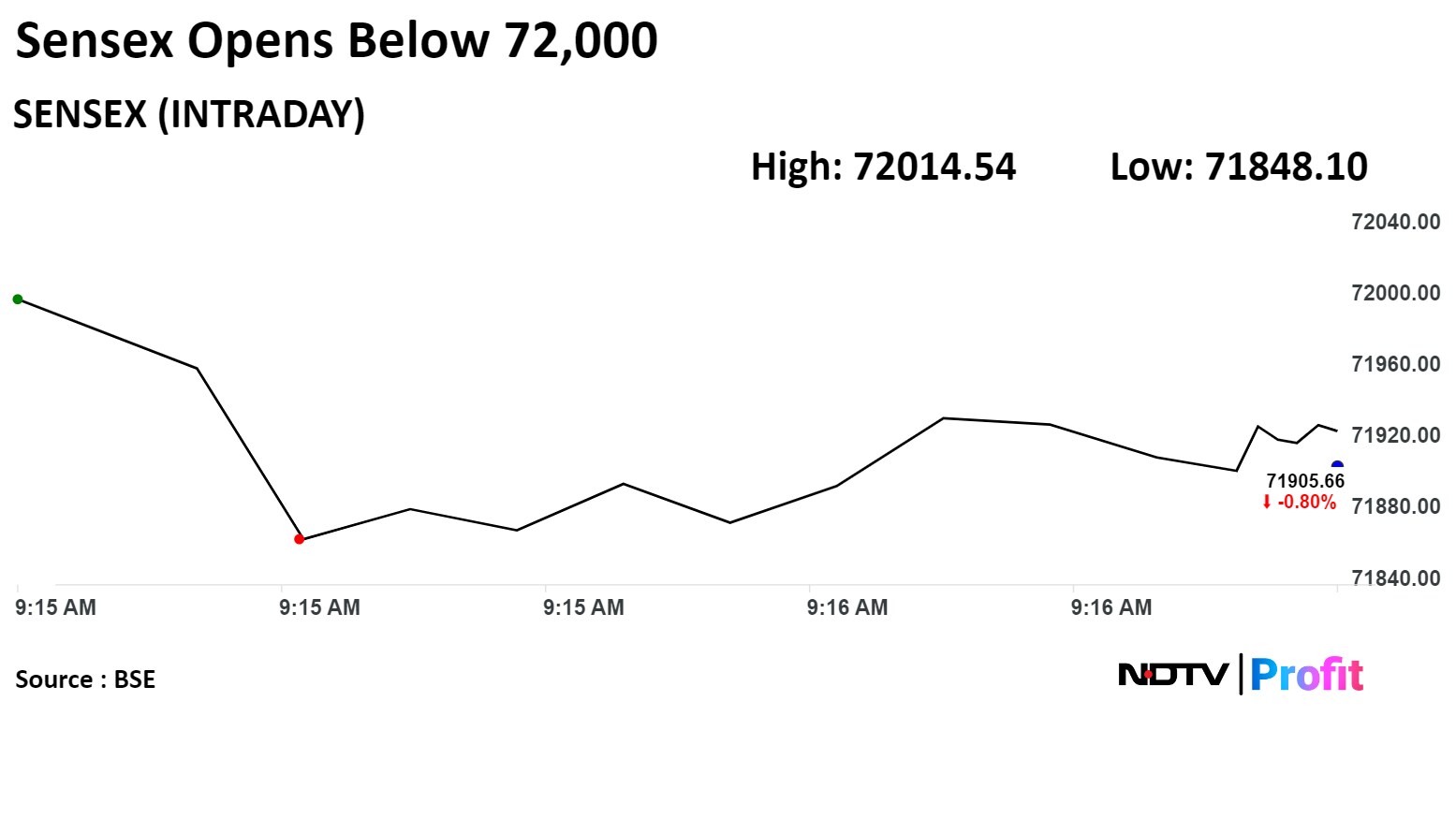

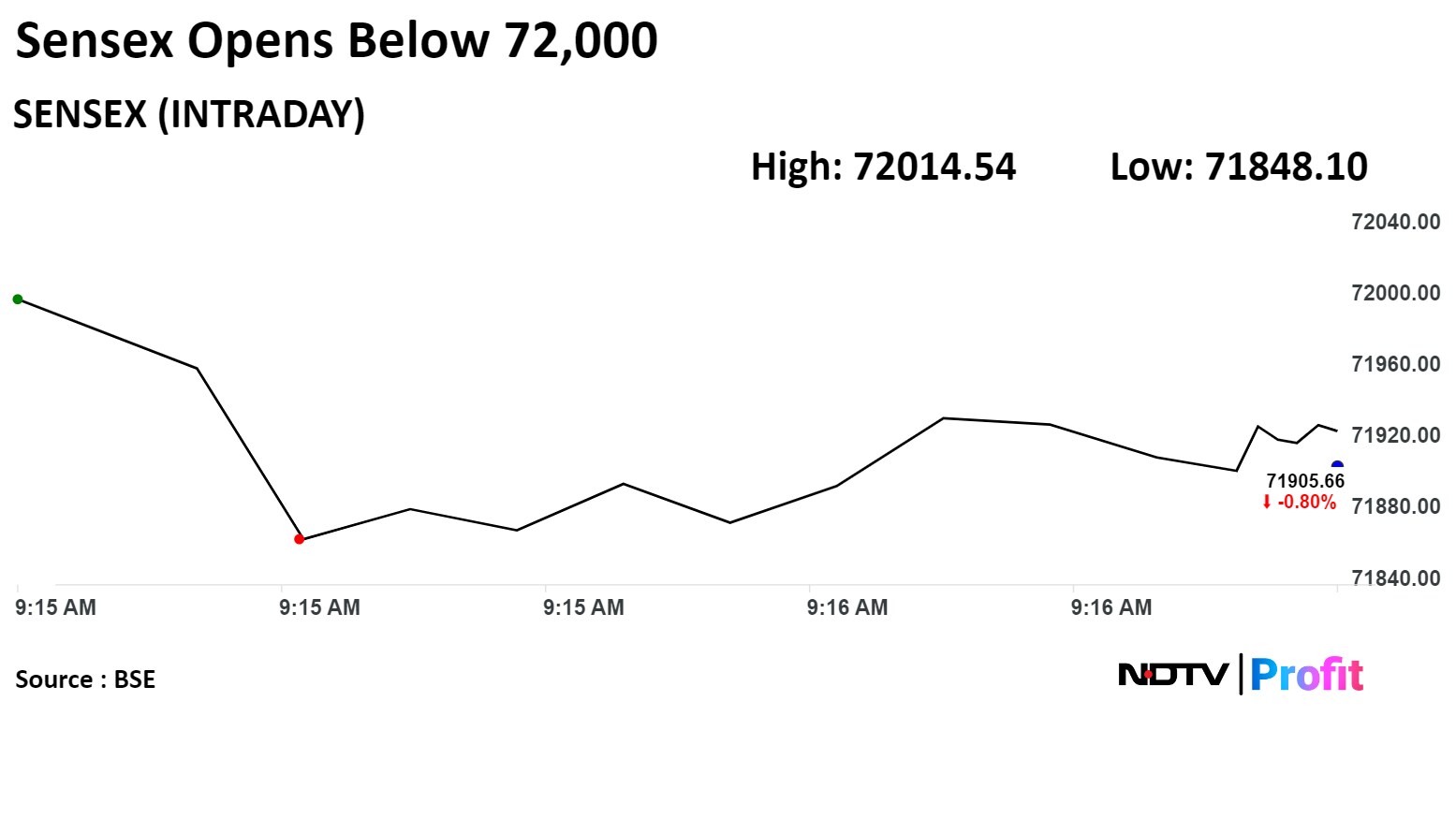

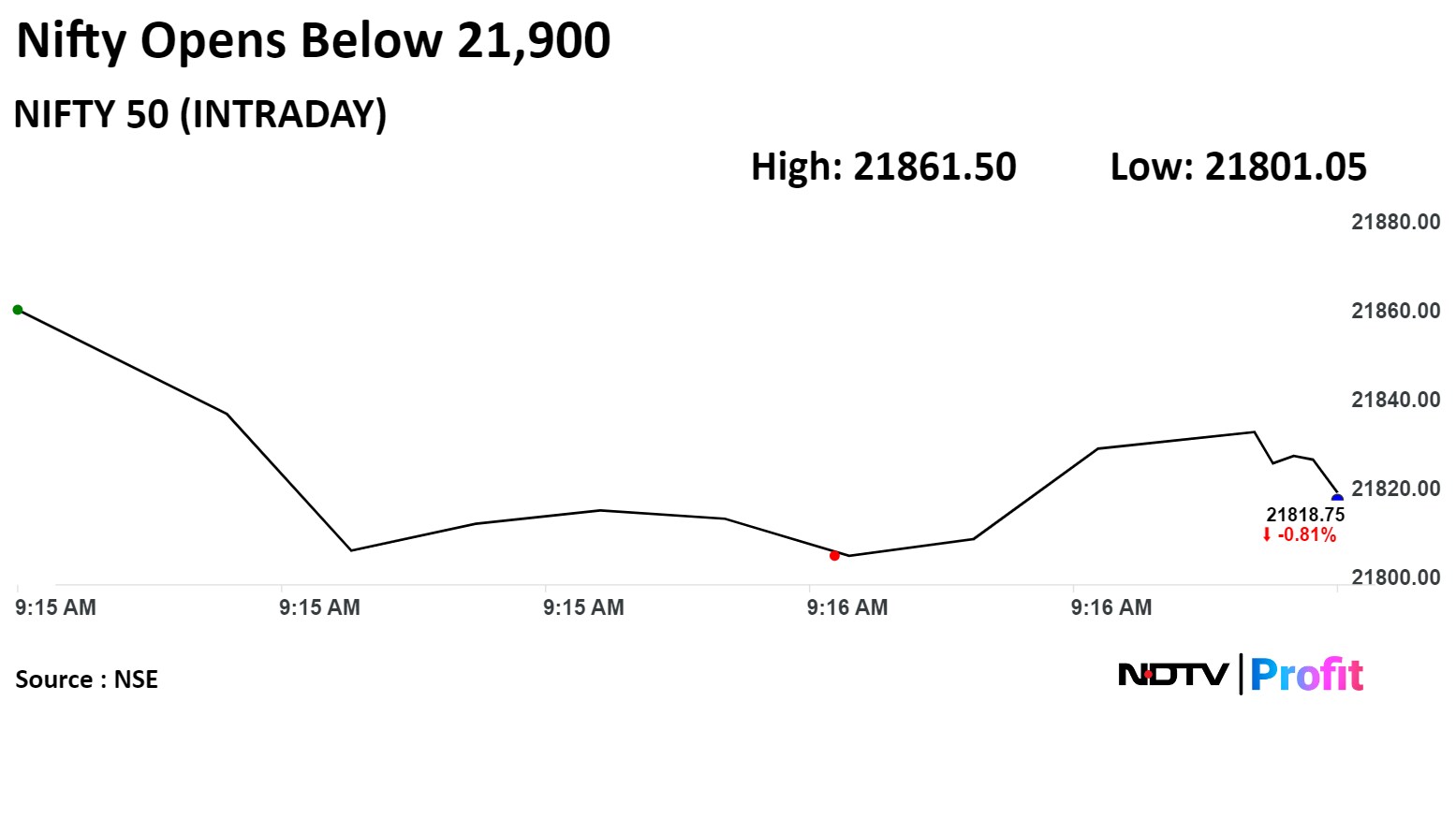

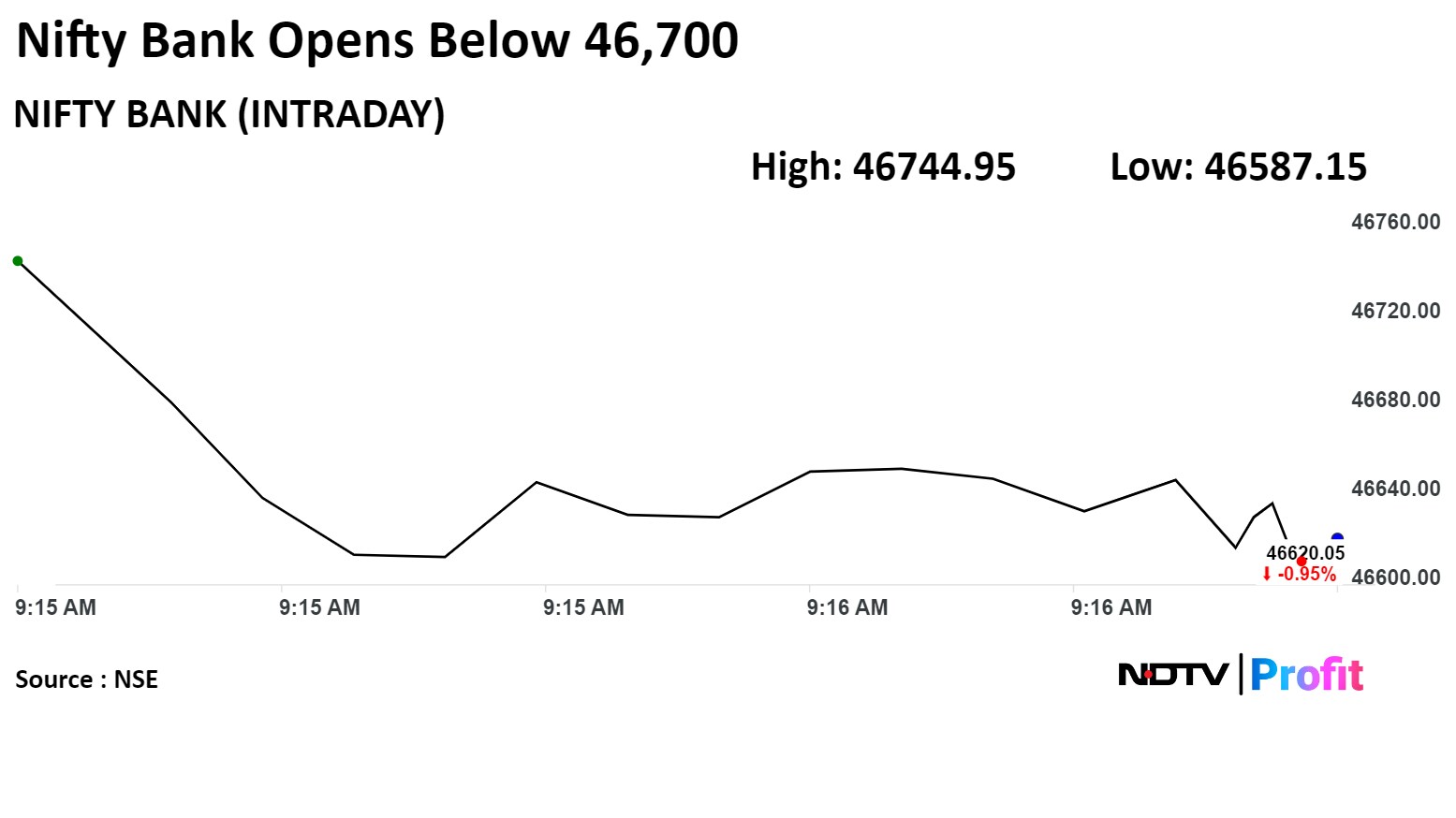

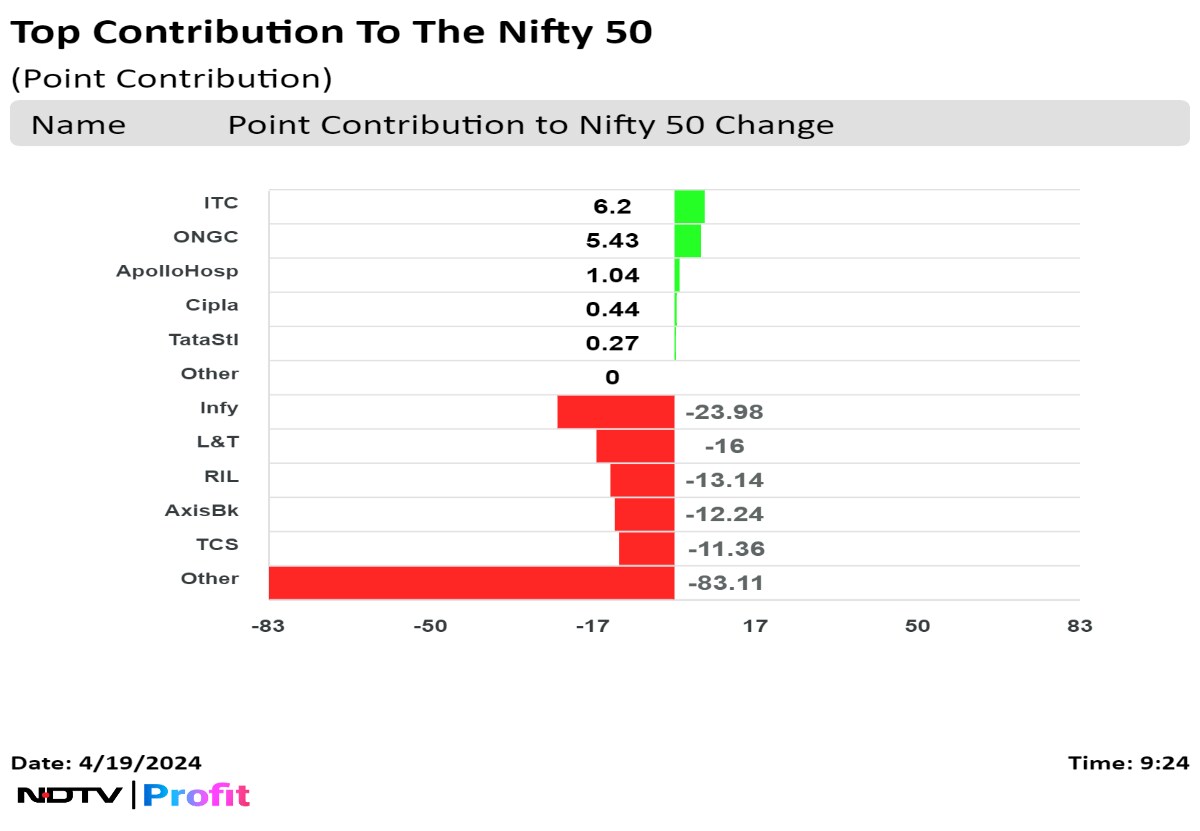

India's benchmark indices opened lower Friday as risk off sentiment heightened among investors after Israel allegedly launched retailatory attack against Iran.

Losses in shares of Infosys Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. pressured the indices further.

As of 09:22 a.m., the NSE Nifty was trading 172.95 points or 0.79% lower at 21,822.90, and the S&P BSE Sensex was trading 546.00 points or 0.75% down at 71,942.99.

Friday, early morning, an explosion was heard in Iran's Isfahan city, which is one of the launch site for the missile and drone attack on Israel on Iran, Fars News agency reported.

The Nifty 50 index has failed to cross 22,300 levels and witnessed sharp profit booking across sectors and stocks to close at three-weeks low, Vikas Jain, senior research analyst at Reliance Securities. RSI and other technical indicators are oversold on hourly charts after a strong volatility with respect to the weekly expiry. Highest call OI has moved lower to 22,300 strike while on the downside the highest put OI is at 22,000 for the monthly expiry

India's benchmark indices opened lower Friday as risk off sentiment heightened among investors after Israel allegedly launched retailatory attack against Iran.

Losses in shares of Infosys Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. pressured the indices further.

As of 09:22 a.m., the NSE Nifty was trading 172.95 points or 0.79% lower at 21,822.90, and the S&P BSE Sensex was trading 546.00 points or 0.75% down at 71,942.99.

Friday, early morning, an explosion was heard in Iran's Isfahan city, which is one of the launch site for the missile and drone attack on Israel on Iran, Fars News agency reported.

The Nifty 50 index has failed to cross 22,300 levels and witnessed sharp profit booking across sectors and stocks to close at three-weeks low, Vikas Jain, senior research analyst at Reliance Securities. RSI and other technical indicators are oversold on hourly charts after a strong volatility with respect to the weekly expiry. Highest call OI has moved lower to 22,300 strike while on the downside the highest put OI is at 22,000 for the monthly expiry

India's benchmark indices opened lower Friday as risk off sentiment heightened among investors after Israel allegedly launched retailatory attack against Iran.

Losses in shares of Infosys Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. pressured the indices further.

As of 09:22 a.m., the NSE Nifty was trading 172.95 points or 0.79% lower at 21,822.90, and the S&P BSE Sensex was trading 546.00 points or 0.75% down at 71,942.99.

Friday, early morning, an explosion was heard in Iran's Isfahan city, which is one of the launch site for the missile and drone attack on Israel on Iran, Fars News agency reported.

The Nifty 50 index has failed to cross 22,300 levels and witnessed sharp profit booking across sectors and stocks to close at three-weeks low, Vikas Jain, senior research analyst at Reliance Securities. RSI and other technical indicators are oversold on hourly charts after a strong volatility with respect to the weekly expiry. Highest call OI has moved lower to 22,300 strike while on the downside the highest put OI is at 22,000 for the monthly expiry

India's benchmark indices opened lower Friday as risk off sentiment heightened among investors after Israel allegedly launched retailatory attack against Iran.

Losses in shares of Infosys Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. pressured the indices further.

As of 09:22 a.m., the NSE Nifty was trading 172.95 points or 0.79% lower at 21,822.90, and the S&P BSE Sensex was trading 546.00 points or 0.75% down at 71,942.99.

Friday, early morning, an explosion was heard in Iran's Isfahan city, which is one of the launch site for the missile and drone attack on Israel on Iran, Fars News agency reported.