Good afternoon readers. The NSE Nifty 50 and BSE Sensex opened higher on Wednesday after it closed near 25,200 in the previous session. The Nifty 50 opened 0.33% higher at 25,258.85 and Sensex opened 0.04% up at 81,892.36. However, minutes after open the markets rose further with Nifty trading above 25,300 levels and Sensex was also trading over 400 points higher.

That's all for today folks. But before you leave some interesting and important stories to read:

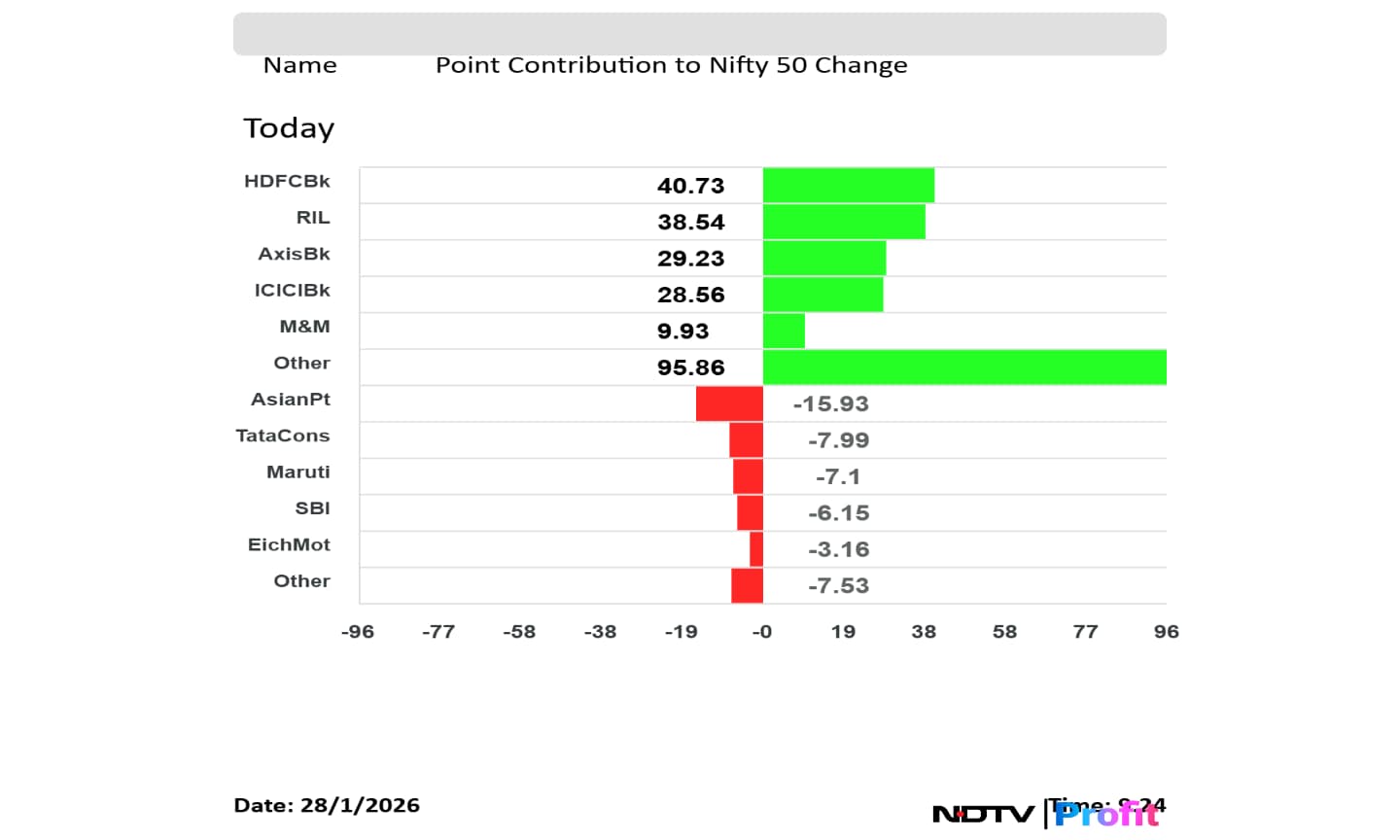

BEL, RIL, Eternal, HDFC Bank, ONGC emerged as the top gainers for the day.

On the other hand, Asian Paints, Maruti Suzuki, Bharti Airtel, Tata Consumers and Sun Pharma were the worst performers of the Nifty 50 index.

Broader indices also ended in positive. Nifty Midcap 150 ended 1.62% higher and Nifty Smallcap 250 closed 1.92% higher.

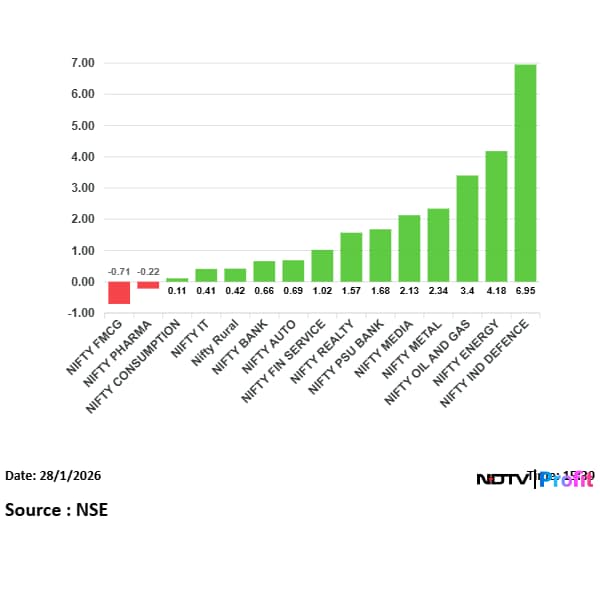

Most sectoral indices rose with Nifty Defence and Nifty Energy leading the advance, while Nifty FMCG and Nifty Pharma as the only sectors in red.

The market breadth was skewed in the favour of sellers, as 1,291 stocks declined, 2,945 advanced and 144 remained unchanged on the BSE.

IndiGo's focus is to double in size by the end of this decade

"By 2030 we aim to have over 4000 daily departures and 200 million plus passengers (yearly)," said Pieter Elbers, CEO, IndiGo.

He also added that the Indian government has a strong vision for Aviation infrastructure.

Said DK Sunil, HAL, CMD

Profit up 3.7% at Rs 3,794 crore versus Rs 3,659 crore

Revenue up 28.7% at Rs 49,892 crore versus Rs 38,752 crore

Ebitda up 10% at Rs 5,572 crore versus Rs 5,065 crore

Margin at 11.2% versus 13.1%

One-Time impact of Rs 594 crore due to new Labour Codes.

Profit up 20.8% at Rs 1,590 crore versus Rs 1,316 crore.

Revenue up 23.7% at Rs 7,122 crore versus Rs 5,756 crore.

EBITDA up 28.1% at Rs 2,118 crore versus Rs 1,653 crore.

Margin at 29.7% versus 28.7%.

Over 1.02 million shares of ONGC were traded via block deal on Wednesday. The share of ONGC fell as much as 8.69% to Rs 269.50 apiece.

Over 1.73 million shares of Sun Pharma were traded via block deal on Wednesday. The share of Sun Pharma fell as much as 2.37% to Rs 1,600 apiece.

Nifty and Sensex fall from day's low. Nifty index was down nearly 150 points from day's high.

The shares of TVS Motor rose over 3.81% to Rs 3,703.90 apiece on Wednesday, highest level since Jan. 20. It pared gains to trade 2.72% higher at Rs 3,666 apiece, as of 1:37 p.m. This compares to a 0.22% advance in the NSE Nifty 50 Index.

It has risen 56.35% in the last 12 months and fallen 1.87% year-to-date. Total traded volume so far in the day stood at 1.97 times its 30-day average and 6 times its 20-day average. The relative strength index was at 22.64.

Out of 43 analysts tracking the company, 26 maintain a 'buy' rating, 10 recommend a 'hold,' and seven suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target stands at Rs 3,866.57 indicating an upside of 5.8%.

With the budget as close as the weekend, let's understand a few terminologies. The first being 'Capital Expenditure'

Capex remains the backbone. Tax revenue assumptions stay under watch. The fiscal glide path holds steady. These three numbers will define the Budget story this year.

#UnionBudget2026 | @_nirajshah decodes 'The Budget Math.'

— NDTV Profit (@NDTVProfitIndia) January 28, 2026

Capex remains the backbone. Tax revenue assumptions stay under watch.

The fiscal glide path holds steady. These three numbers will define the Budget story this year. pic.twitter.com/fuhUQG2MFZ

Robert Kiyosaki, the author of bestselling book 'Rich Dad Poor Dad', has addressed rumours that he offloaded all his silver holdings to buy Bitcoin, calling it false.

“There is a rumour I sold all my silver to buy more Bitcoin. This is not true,” he said.

In a candid post, Kiyosaki revealed he sold portions of his Bitcoin and gold holdings, and not silver, to fund the purchase of his new home.

“I sold some Bitcoin and later some gold to buy my new home. I have not sold any of my silver. I wish I had not sold some gold and some Bitcoin. Selling some gold and Bitcoin was my mistake….a big mistake. Thank God I did not sell my silver,” Kiyosaki wrote.

The shares of Landmark Shares rose over 10.64% to Rs 424.15 apiece on Wednesday, extending gains for the second day. It pared gains to trade 4.60% higher at Rs 401 apiece, as of 12:57 p.m. This compares to a 0.35% advance in the NSE Nifty 50 Index.

It has fallen 23.21% in the last 12 months and 15.06% year-to-date. Total traded volume so far in the day stood at 5.3 times its 30-day average and 6 times its 20-day average. The relative strength index was at 67.18.

Over 1.29 million shares of SAIL were traded via block deal on Wednesday. The share of SAIL rose as much as 1.21% to Rs 157.45 apiece.

IGI MD & CEO Tehmasp Printer on policy support, lab-grown diamonds, and what the sector is hoping to see next this Budget.

Know Your Company | Budget watch for the diamond industry.

— NDTV Profit (@NDTVProfitIndia) January 28, 2026

IGI MD & CEO Tehmasp Printer on policy support, lab-grown diamonds, and what the sector is hoping to see next this #Budget2026. @Sharad9Dubey

Watch👇 pic.twitter.com/qxHuXsJpUA

CarTrade Tech Q3 Highlights (Consolidated, YoY)

Over 1.33 million shares of Eternal were traded via block deal on Wednesday. The share of Eternal rose as much as 2.70% to Rs 260.70 apiece.

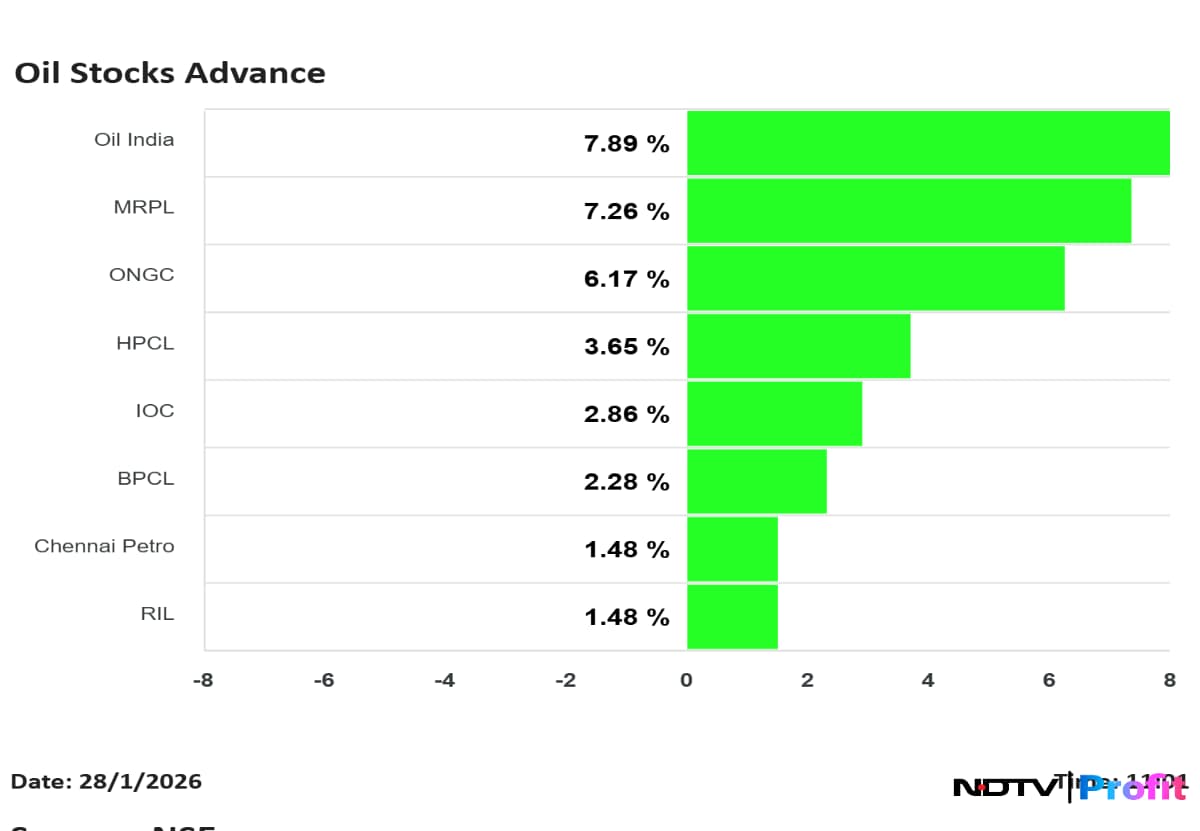

All oil companies were trading higher on Wednesday as oil prices surged. This comes as oil prices are rebounding from having declined to multi-year lows in December. Crude oil prices have moved to a four-month high, with Brent Crude trading close to the $68 per barrel mark.

Oil India led the decline followed by MRPL.

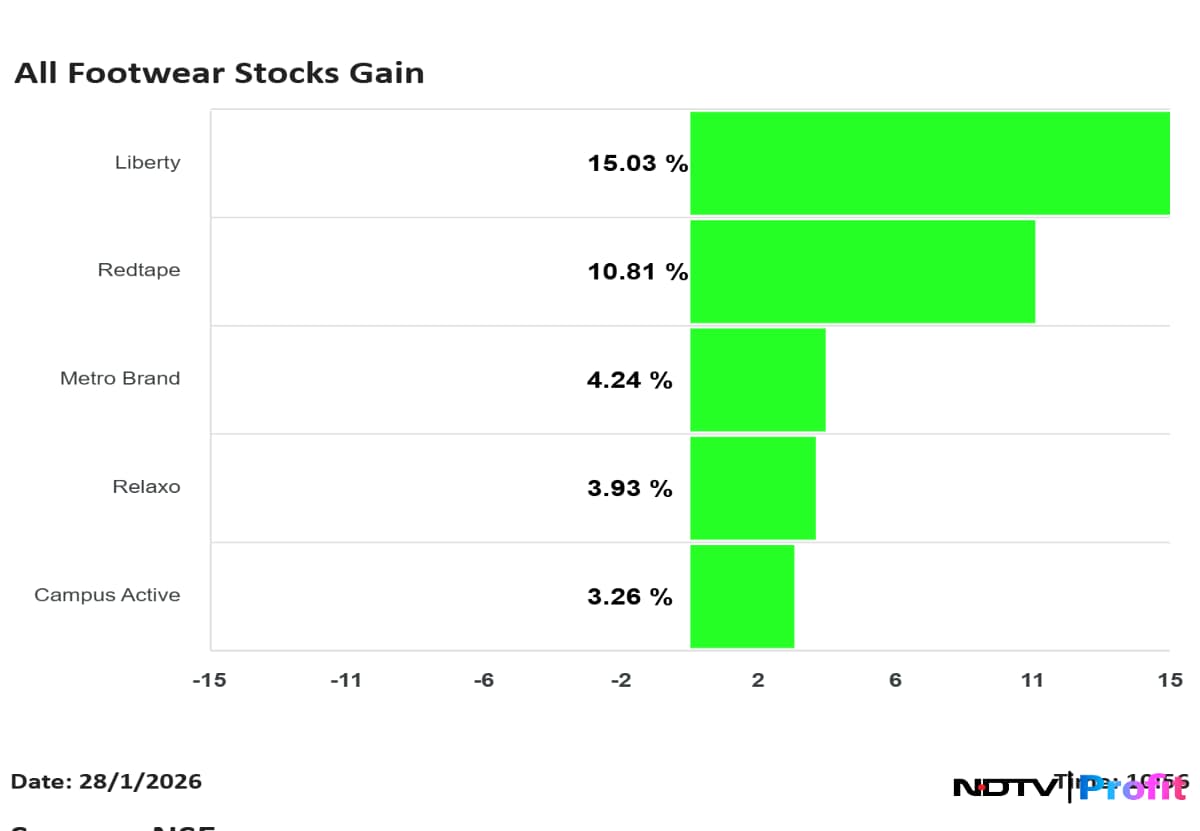

All footwear stocks gain on Wednesday with Liberty leading the gains with 16.66% rise, followed by Redtap that rose as much as 12.77%.

The shares of Spandana Sphoorty rose over 14.27% to Rs 271 apiece on Wednesday, highest level since Jan. 5. It pared gains to trade 10.50% higher at Rs 262.05 apiece, as of 10:47 a.m. This compares to a 0.41% advance in the NSE Nifty 50 Index.

It has fallen 2.91% in the last 12 months and 15.76% year-to-date. Total traded volume so far in the day stood at 8.39 times its 30-day average. The relative strength index was at 54.04.

The shares of Mahindra Logistic rose over 15% to hit a two-month high of Rs 339.45 per share. The scrip rose as much as 14.91% to Rs 339.45 apiece on Wednesday, highest level since Nov. 18. It pared gains to trade 13.47% higher at Rs 336.65 apiece, as of 10:39 a.m. This compares to a 0.49% advance in the NSE Nifty 50 Index.

It has risen 6.13% in the last 12 months and fallen 5.08% year-to-date. Total traded volume so far in the day stood at 0.07 times its 30-day average. The relative strength index was at 49.63.

Over 2.02 million shares of Kotak Mahindra Bank were traded via block deal on Wednesday. The share of Kotak Mahindra Bank rose as much as 0.69% to Rs 411.50 apiece.

Shares of Shadowfax Technologies fell 6.8% during its debut on stock market.

During the three-day bidding period, the IPO received bids for 24,23,88,360 shares against 8,90,88,807 shares on offer. The Qualified Institutional Buyers led the demand, subscribing 3.81 times their allotted quota. Retail investors booked their segment 2.31 times, while the Non-Institutional Investors' (NIIs) category was subscribed 0.84 times.

Maharashtra Deputy Chief Minister Ajit Pawar passes away in a plane crash at Baramati on Wednesday, DGCA sources told NDTV Profit.

Track all the live updates on the plane accident here.

Over 1.11 million shares of Tata Power were traded via block deal on Wednesday. The share of Tata Power rose as much as 1.93% to Rs 354.45 apiece.

Over 1.03 million shares of JSW Energy were traded via block deal on Wednesday. The share of JSW Energy rose as much as 1.08% to Rs 444.80 apiece.

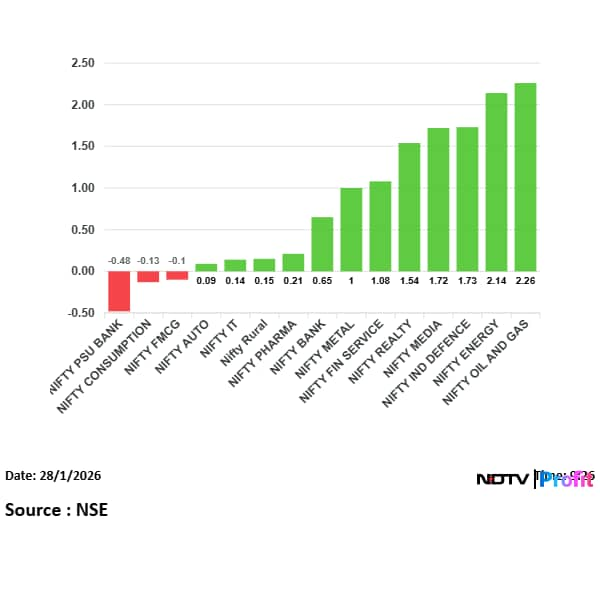

On NSE, 13 of the 15 sectors were in the green. Nifty Oil and Gas and Nifty Energy lead the gains, while Nifty PSU Bank fell the most.

Broader markets were trading higher, with the NSE Midcap 150 trading 0.80% higher and NSE Smallcap was trading 1.04% higher.

Asian Paints, Tata Consumers, Maruti Suzuki, SBI and Eicher Motors weighed on the Nifty 50 index.

HDFC Bank, RIL, Axis Bank, ICICI Bank and M&M added to the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex opened higher on Wednesday after it closed near 25,200 in the previous session. The Nifty 50 opened 0.33% higher at 25,258.85 and Sensex opened 0.04% up at 81,892.36. However, minutes after open the markets rose further with Nifty trading above 25,300 levels and Sensex was also trading nearly 600 points higher.

Over 1.19 million shares of HDFC Bank were traded in pre-market trading on Wednesday.

At pre-open, the NSE Nifty 50 was trading 83.45 points or 0.33% higher at 25,258.85. The BSE Sensex was up 32.54 points at 81,890.02.

Gold and silver prices dazzled on Wednesday with both precious metals vaulting to uncharted highs, driven by strong investor demand and a global rally amid rising geopolitical and trade tensions. Silver prices continued its remarkable performance, outperforming gold for yet another session in the bullion markets.

Gold and silver prices are expected to stay firm this week as traders brace for the US Supreme Court's hearing on trade tariffs and the Federal Reserve's upcoming interest rate decision, analysts told news agency PTI.

The gold rate in India on Wednesday is Rs 1,58,460 while the silver rate is Rs 3,56,790, according Bullions website.

Shares of Tata Motors Commercial Vehicle Ltd. will be in focus heading into trade on Wednesday after the stock received initiation from UBS. The brokerage firm has initiated coverage with a 'buy' call on the counter, citing a strong India business and an impending 'resurgence'.

UBS believes Tata Motors CV is unfettered and accelerating, backed by a strong domestic business that has shown promising signs. Keeping that in mind, the firm has issued a 'buy' call with a price target of Rs 550, which implies an upside of roughly 24% from Tuesday's closing price of Rs 444.

The demerged Tata Motors CV could benefit from improving trucking volumes in Europe, which in turn could support margin expansion and bolster the company's cash flow.

UBS adds that the commercial vehicle space is a more favourable space than the passenger vehicle or the two-wheeler space. Tata Motors, to that end, has emerged as a strong buy for the brokerage firm.

Dollar Index falls for 5th day near 96 levels, near its four-year low.

Lower numbers are positive for Emerging Markets

Trump’s commentary-stating not concerned with Dollar’s decline

Yen already putting pressure

Economies trying the dollar debasement trade

India-EU Trade deal completion

Rupee strengthened against dollar in last session

RBI interventions continue

Source: Bloomberg

Asian currencies strengthened as the US dollar fell to its weakest level in four years, with investors growing increasingly cautious toward the world's reserve currency amid unpredictable policy signals from Washington. Equity markets in Asia were mixed, with South Korea posting gains while Japan moved lower. Meanwhile, US stock-index futures continued to climb following a Wall Street Journal report that SoftBank is in discussions to inject as much as $30 billion in additional funding into OpenAI, reports Bloomberg.

Good morning readers.

The GIFT Nifty was trading near 25,400 early on Wednesday. The futures contract based on the benchmark Nifty 50 rose 0.16% at 25,458 as of 6:49 a.m. indicating a positive start for the Indian markets.

In the previous session on Tuesday, the benchmark ended in green. The Nifty ended 126.75 points or 0.51% higher at 25,175.40 and Sensex ended 319.78 points or 0.39% higher at 81,857.48.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.