Good afternoon readers. The NSE Nifty 50 and BSE Sensex opened higher but minutes after open the markets fell with Nifty trading 0.32% lower and Sensex was also trading nearly 300 points lower. However, the markets gave up early losses and was trading in the green. Nifty was above 25,100 and Sensex rose over 100 points.

That's All For Today Folks. But before we go, few interesting events and articles for you to read:

The shares of Asian Paints fell as much as 5.86% to Rs 2,546 apiece on Tuesday, lowest level since Nov. 4. It pared losses to trade 2.5% lower at Rs 2,632.10 apiece, as of 2:41 p.m. This compares to a 0.18% advance in the NSE Nifty 50 Index.

It has fallen 17.05% in the last 12 months and 4.94% year-to-date. Total traded volume so far in the day stood at 2.49 times its 30-day average. The relative strength index was at 50.48.

Out of 38 analysts tracking the company, 16 maintain a 'buy' rating, six recommend a 'hold,' and 16 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target stands at Rs 2,839.05 indicating an upside of 9%.

Read more: Asian Paints Q3 Results: Profit Falls On Back Of Exceptional Loss; Shares Hit Nearly Three-Month Low

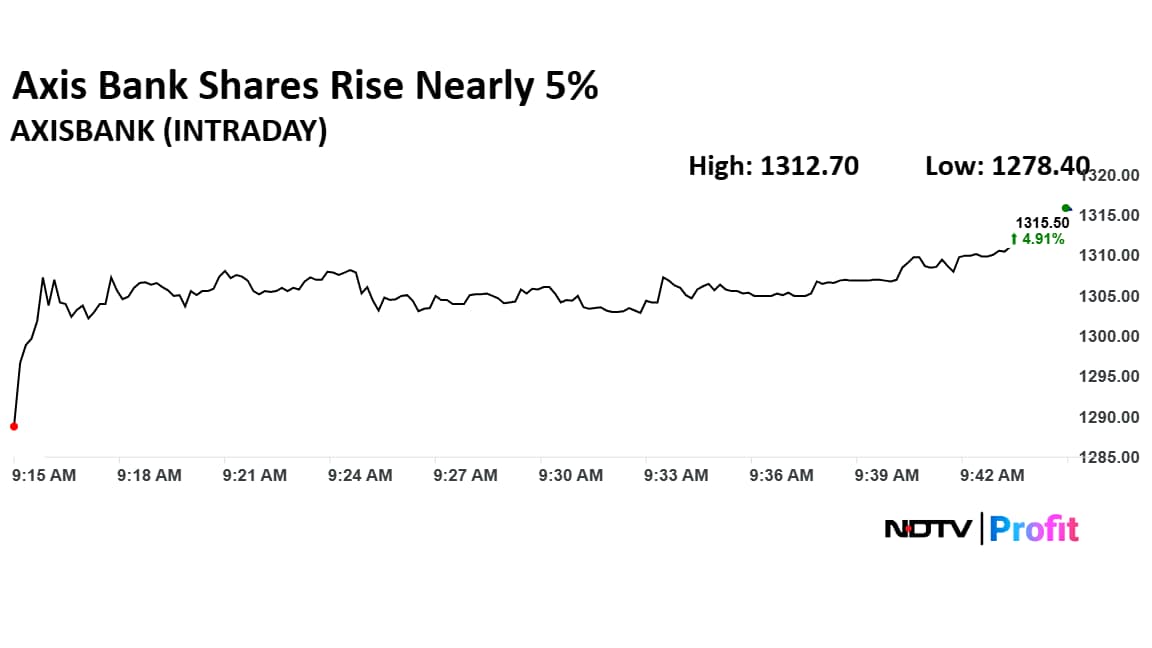

Over 5.13 million shares of Axis Bank were traded via block deal on Tuesday. The share of Axis Bank rose as much as 6.32% to Rs 1,333.20 apiece.

Asian Paints Q3 Highlights (Consolidated, YoY)

India Vix cross 15 for the first time in the last six months. It is up more than 25% in last five sessions. It is the highest since June 13, 2025.

Tata Consumer Products Q3 Highlights (Consolidated, YoY)

Net Profit up 38% at Rs 385 crore versus Rs 279 crore

Revenue up 15% at Rs 5,112 crore versus Rs 4,444 crore

EBITDA up 27.6% at Rs 721 crore versus Rs 565 crore

EBITDA Margin at 14.1% versus 12.7%

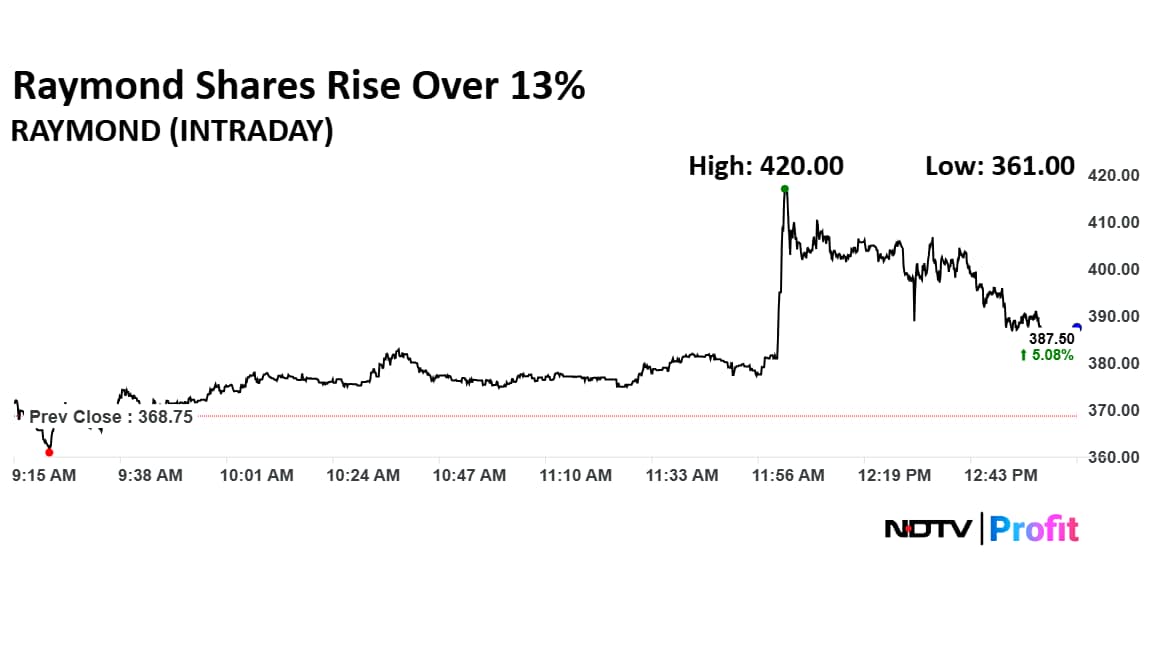

Raymond Ltd.'s shares rose over 13% on Tuesday after it announced its third quarter results.

Raymond Q3 Highlights (Consolidated, YoY)

Net Profit down 90.2% at Rs 7.1 crore versus Rs 72.3 crore

Revenue up 19.5% at Rs 557 crore versus Rs 466 crore

EBITDA up 32% at Rs 59.9 crore versus Rs 45.4 crore

EBITDA Margin at 10.8% versus 9.7%

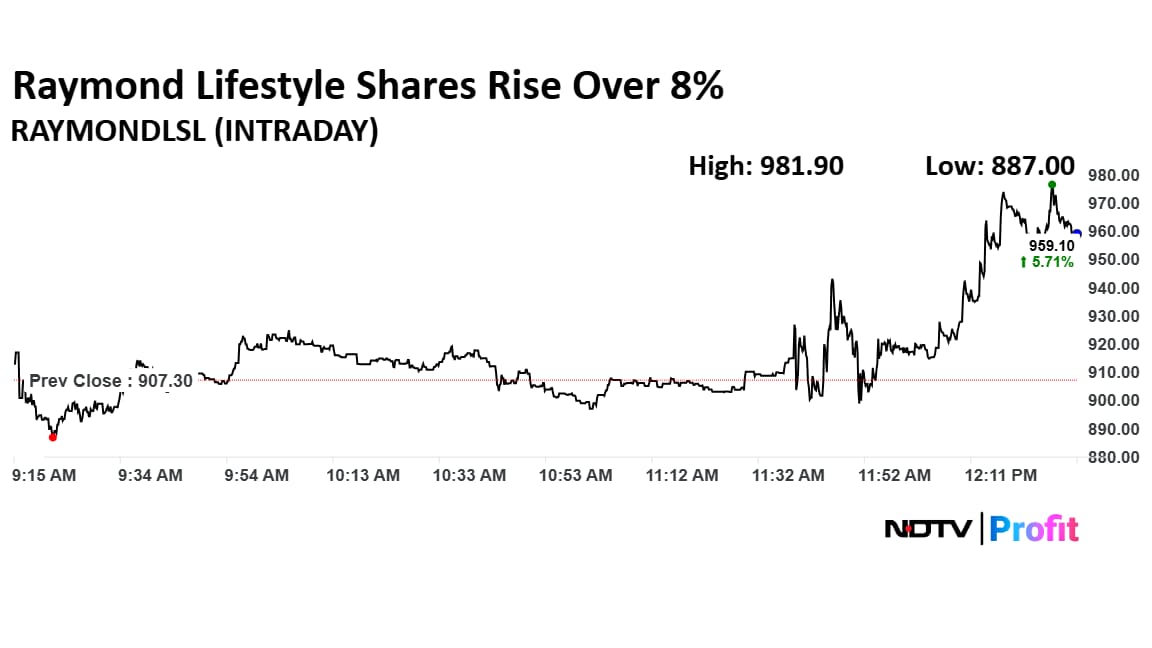

Raymond Lifestyle's shares rose 8.22% after it announced its results. The shares pared gains to trade 6.10% higher at Rs 962.60 per share.

Raymond Lifestyle Q3 Highlights (Consolidated, YoY)

Net Profit down 33% at Rs 42.9 crore versus loss of Rs 64.2 crore

Revenue up 5.4% at Rs 1,849 crore versus Rs 1,754 crore

EBITDA up 32% at Rs 237 crore versus Rs 180 crore

EBITDA Margin at 12.8% versus 10.2%Save

South Korea's Kospi index rose 2.7% to close at 5,084.85.

Over 1.32 million shares of ITC were traded via block deal on Tuesday. The share of ITC fell as much as 0.60% to Rs 321.05 apiece.

Silver prices surged to fresh record highs on the domestic futures market on Tuesday, tracking gains in global markets as a weaker US dollar, geopolitical tensions and expectations of US rate cuts boosted demand for safe-haven assets. On the Multi Commodity Exchange (MCX), March silver futures saw a sharper rally, jumping 6.9% to a lifetime high of Rs 3,57,000 per kg. February gold futures also climbed 1.48% to Rs 1,58,343 per 10 grams, after hitting an intraday peak of Rs 1,59,820.

The rally came despite some profit-booking at higher levels, underscoring the strength of underlying sentiment for precious metals.

WeWork India Q3 Highlights (Consolidated, YoY)

Net Profit of Rs 16.7 crore versus loss of Rs 83.3 crore

Revenue up 29% at Rs 634 crore versus Rs 492 crore

EBITDA up 31% at Rs 408 crore versus Rs 311 crore

EBITDA Margin at 64.3% versus 63.3%

As Nifty and Sensex continue to be volatile, the markets are now back in red. Nifty as of 11:10 a.m. is trading near the 25,000 level, while Sensex was down nearly 200 points.

Shares of IndusInd Bank fell over 5% in early trade on Tuesday, reacting to the lender's weak third-quarter earnings.

The private sector bank on January 23 reported an 89% year-on-year decline in standalone net profit for the December quarter to Rs 161 crore, compared with Rs 1,401 crore in the same period last year.

However, on a sequential basis, the bank returned to profit, aided by a drop in provisions, after having posted a loss of Rs 445 crore in the second quarter of FY26.

Net interest income (NII) — the difference between interest earned and interest paid — rose 3% quarter-on-quarter, but declined 13% year-on-year to Rs 4,562 crore, reflecting pressure on core profitability.

Prime Minister Narendra Modi on Tuesday said India and the European Union have announced an agreement, describing it as the “mother of all deals”, during remarks at the India-EU summit.

Addressing the nation, Modi said the agreement announced between India and the European Union would create new opportunities for people in both regions and reflected a partnership between two major global economies. He said the arrangement covered nearly 25% of global GDP and about one-third of global trade, underlining its scale and reach.

"This is a perfect example of a partnership between two major economies of the world...," Modi said.

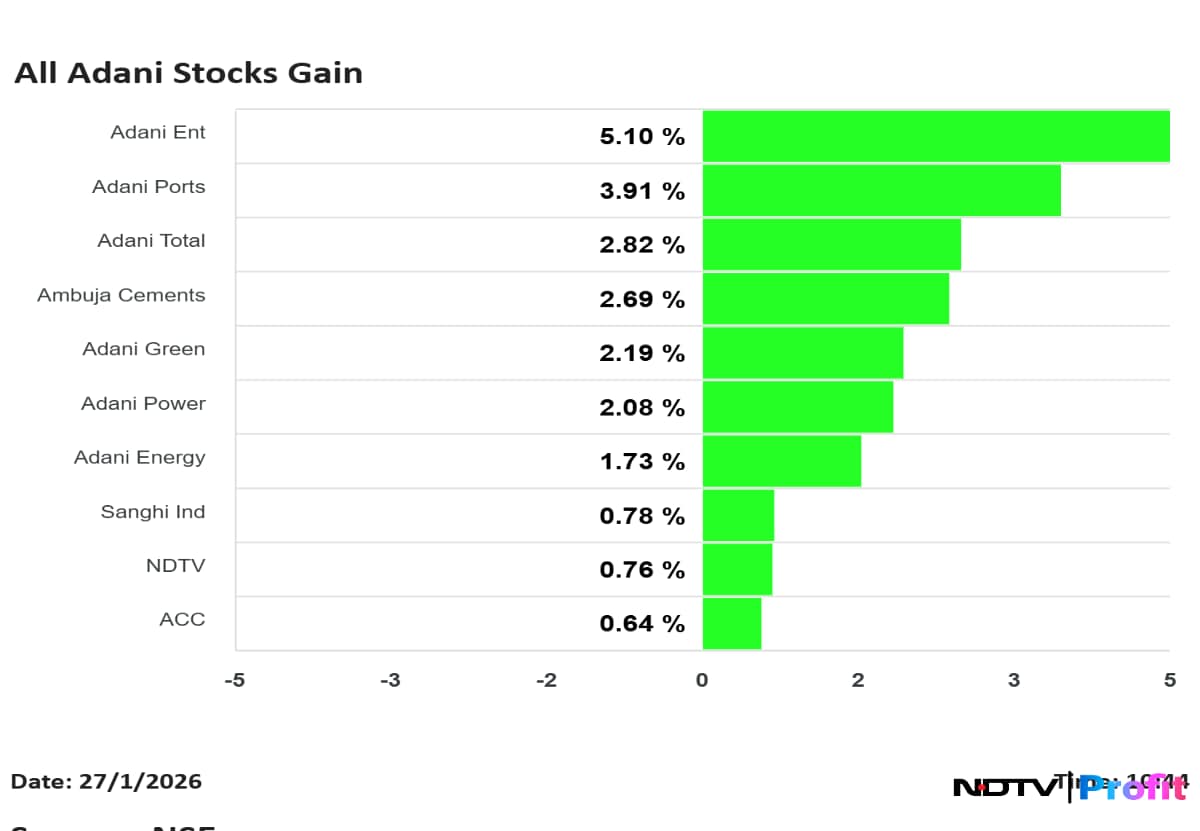

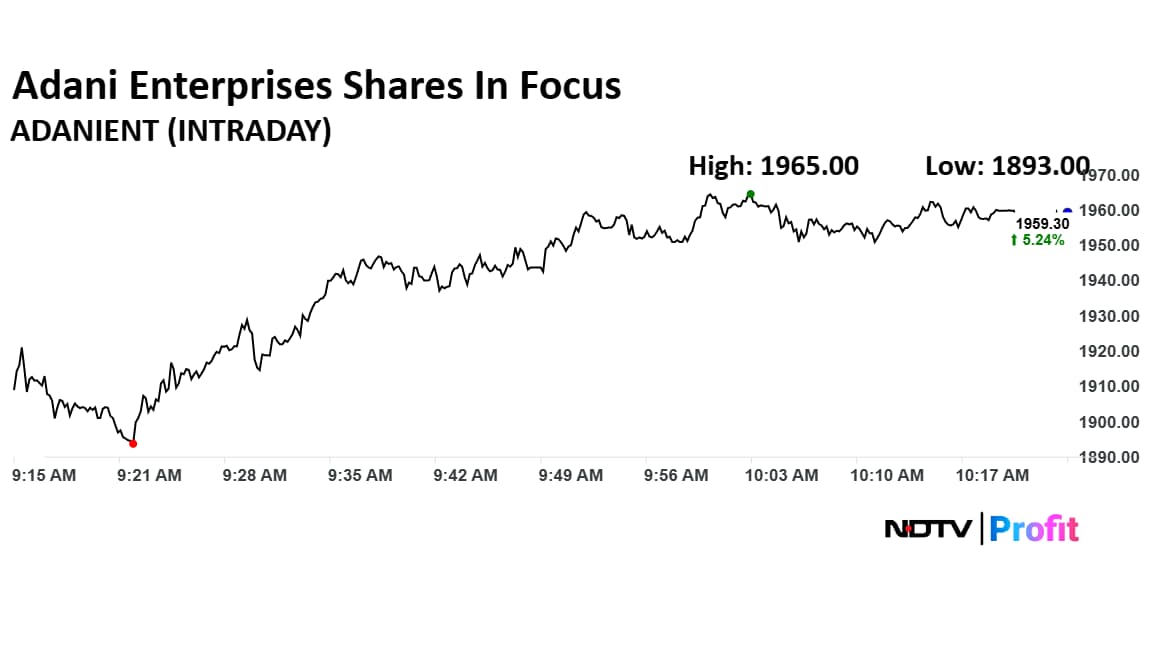

The shares of Adani Enterprises Ltd. rose over 5% on Thursday dragging the Adani Group stocks in green. Adani Enterprises stocks rose as much as 5.54% to Rs 1,965 apiece on Tuesday, highest level since Jan. 23. Adani Green Ltd. was among the second gainer in the group with the stock rising over 5% on Thursday. Adani Ports and Special Economic Zone Ltd. shares were also in the green as it rose as much as 4%. Ambuja Cements Ltd. and Adani Total Gas Ltd. gained over 3% on Tuesday. NDTV Ltd., Adani Power Ltd., Adani Energy Ltd. and Sanghi Industries were up nearly 2%. ACC Ltd, was also up 1.2%.

The shares of Adani Enterprises rose as much as 5.54% to Rs 1,965 apiece on Tuesday, highest level since Jan. 23. It pared gains to trade 5.08% higher at Rs 1,956.10 apiece, as of 10:21 a.m. This compares to a 0.49% advance in the NSE Nifty 50 Index.

It has risen 13.44% in the last 12 months and 12.66% year-to-date. Total traded volume so far in the day stood at 2.08 times its 30-day average. The relative strength index was at 30.70.

Shares of JSW Energy are facing immense pressure in trade on Tuesday after the company reported its third-quarter earnings for the financial year ending March 2026. The stock is currently trading at Rs 434, which accounts for a correction of almost 10% compared to Friday's closing price of Rs 482.

The pressure comes even after the company reported a 65% year-on-year surge in net generation. This growth was primarily driven by higher asset availability and a significantly expanded capacity base. Notably, JSW Energy has added 5.2 GW of capacity in the last 12 months, with 125 MW commissioned in Q3 FY26 alone.

MCX Silver March Futures rose 6.9% to hit a fresh record high of Rs 3.57 Lk/Kg.

Nifty on Tuesday opened in green before falling below 25,000. However it parred the earlier losses to trade in green again. Nifty as of 10:00 a.m. was trading 0.34% higher at 25,129.35. Similarly, Sensex continued its see-saw movement but was trading over 200 points higher at 81,752.79.

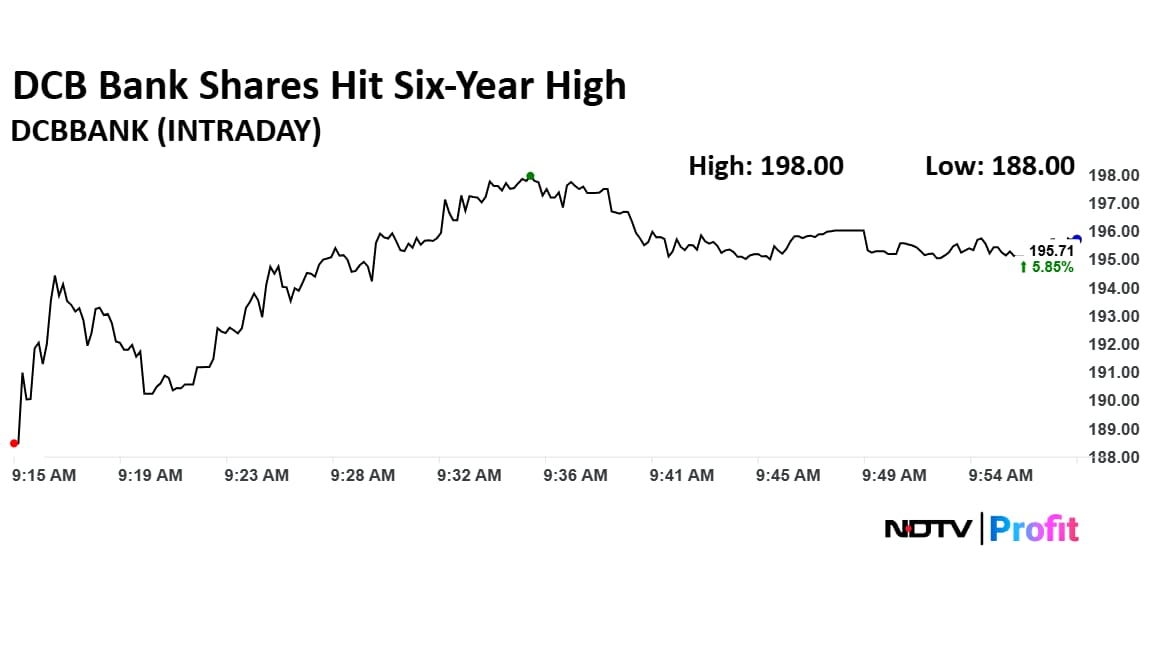

The shares of DCB Bank hit six-year high after it rose as much as 7.09% to Rs 198 apiece on Tuesday, highest level since Jan. 20, 2020. It pared gains to trade 5.62% higher at Rs 195.15 apiece, as of 9:55 a.m. This compares to a 0.32% advance in the NSE Nifty 50 Index.

It has risen 65.80% in the last 12 months and 13.50% year-to-date. Total traded volume so far in the day stood at 2.87 times its 30-day average. The relative strength index was at 57.94.

The shares of Axis Bank rose as much as 4.95% to Rs 1,316 apiece on Tuesday, highest level since Jan. 20. It pared gains to trade 4.47% higher at Rs 1,310.90 apiece, as of 9:48 a.m. This compares to a 0.17% advance in the NSE Nifty 50 Index.

It has risen 38.16% in the last 12 months and 3.17% year-to-date. Total traded volume so far in the day stood at 1.21 times its 30-day average. The relative strength index was at 53.90.

Shares of Indian auto companies, including the likes of Mahindra & Mahindra, Tata Motors, Maruti Suzuki and Hyundai Motor India, are all falling in trade on Monday, amid reports of India slashing auto import tariffs for European carmakers, as part of the Free Trade Agreement with the European Union (EU).

The sharp fall in these auto stocks is led by M&M, which is trading with cuts of more than 4%. Tata Motors, Hyundai and Maruti Suzuki have all corrected more than 1% in trade, as investors fear reduction of import tariffs could potentially impact the luxury car market in India.

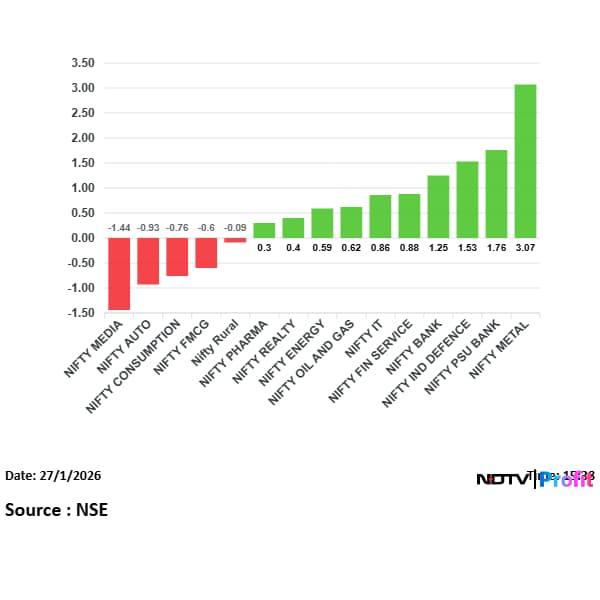

On NSE, 10 of the 15 sectors were in the red. Nifty Metal and Nifty Auto lead the decline.

Broader markets were trading lower, with the NSE Midcap 150 trading 0.28% lower and NSE Smallcap was trading 0.56% higher.

Photo Credit: NDTV Profit

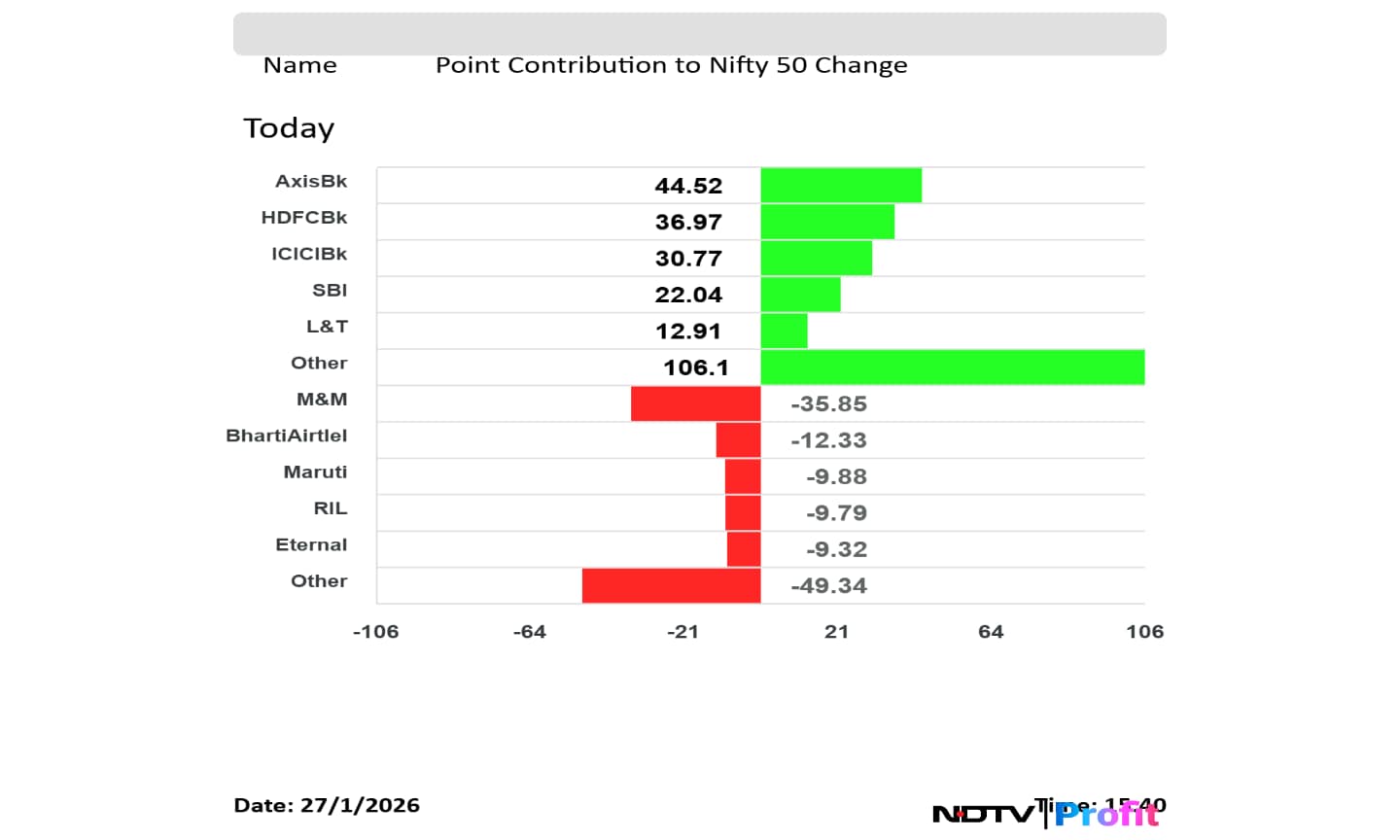

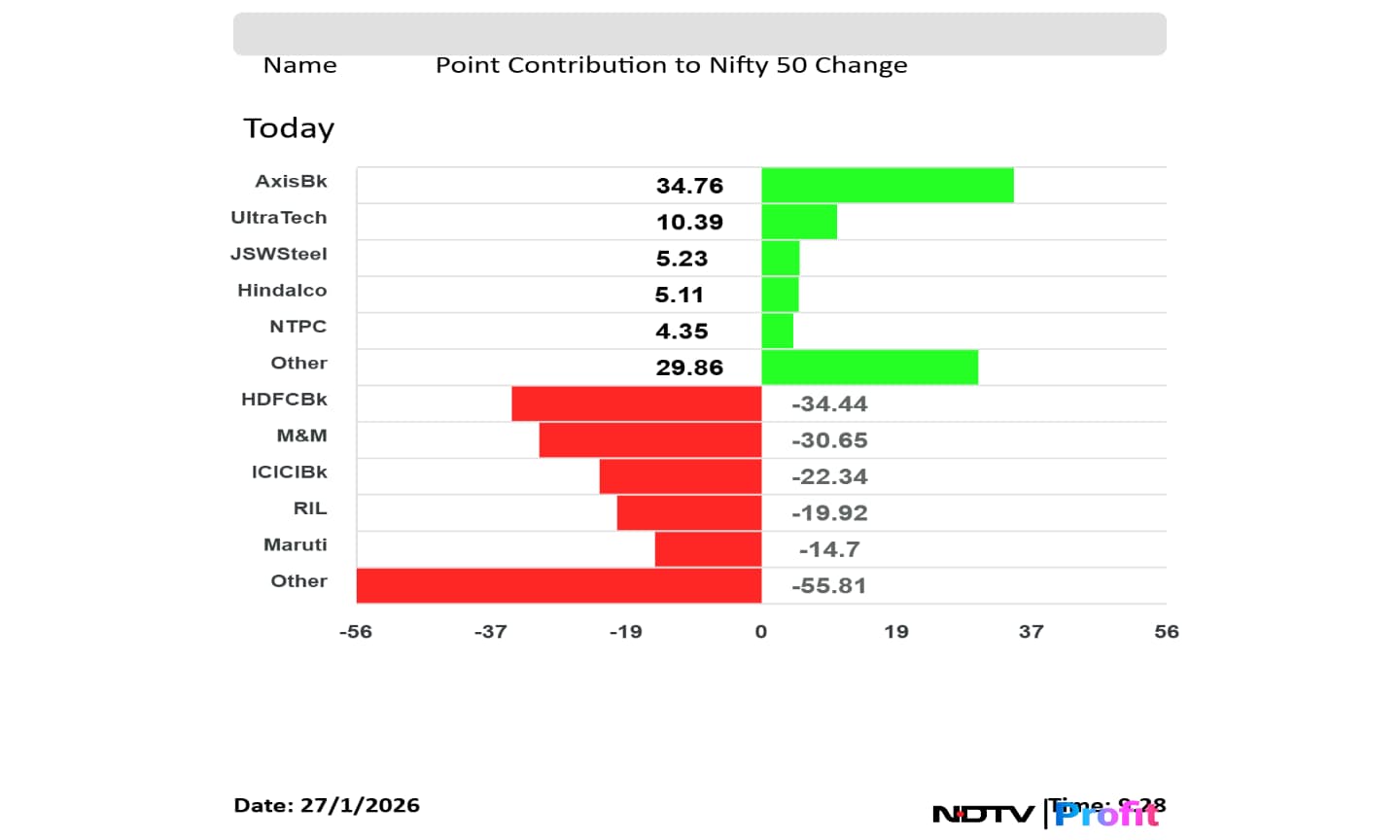

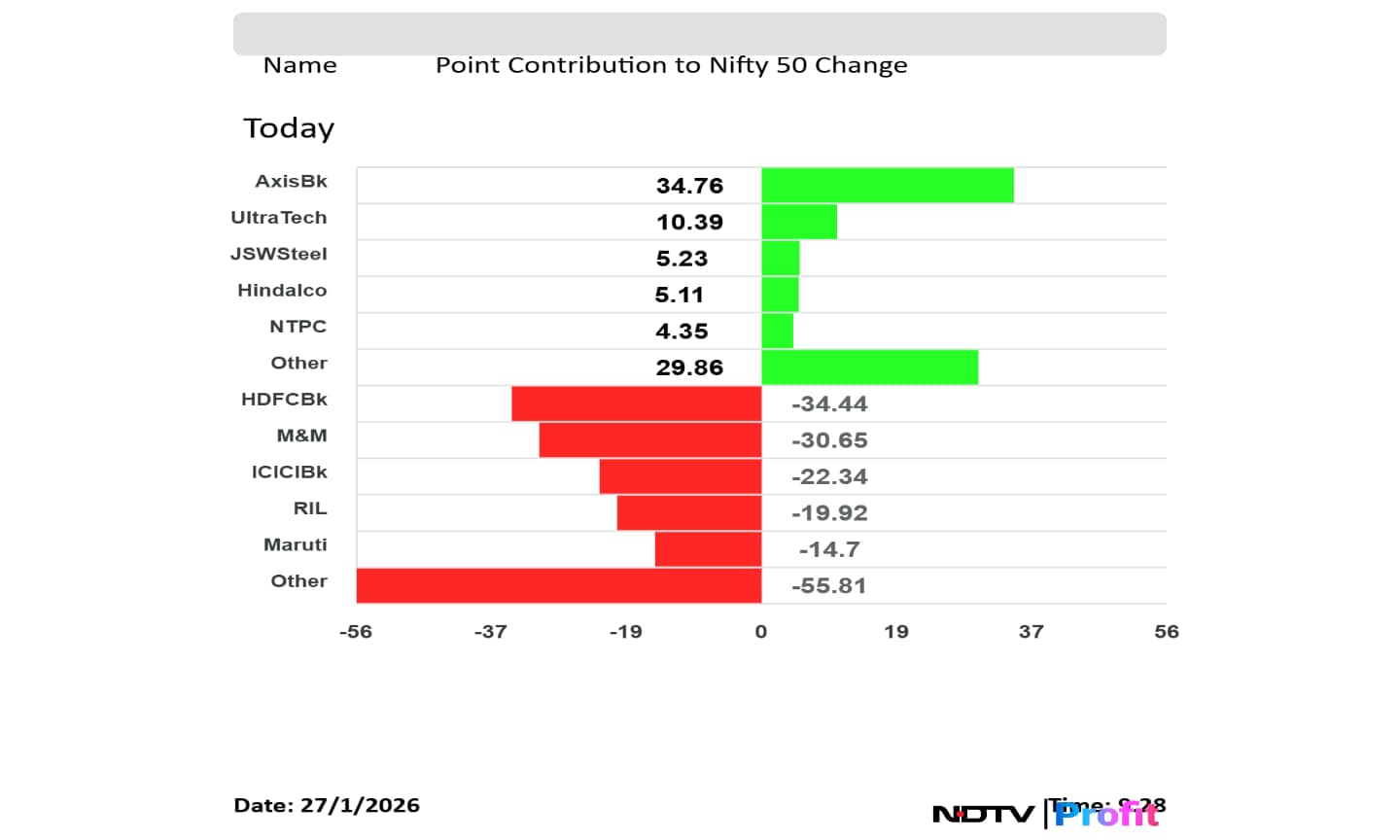

HDFC Bank, M&M, ICICI Bank, RIL and Maruti Suzuki weighed on the Nifty 50 index.

Axis Bank, UltraTech Cement, JSW Steel, Hindalco and NTPC added to the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex opened higher on Monday after it closed near 25,000 in the previous session. The Nifty 50 opened 0.06% higher at 25,063.35 and Sensex opened 0.12% up at 81,436.79. However, minutes after open the markets fell with Nifty trading 0.32% lower and Sensex was also trading nearly 300 points lower.

Over 1.93 million shares of HDFC were traded in pre-market trading on Tuesday.

At pre-open, the NSE Nifty 50 was trading 14.70 points or 0.06% higher at 25,063.35. The BSE Sensex was down 34.50 points at 81,503.20.

Shares of KEI Industries Ltd., KPI Green Energy Ltd., Wendt (India) Ltd. and K. P. Energy Ltd. will be of interest on Tuesday, as the day marks the last session for investors to buy shares to qualify for receiving the dividend before the stock goes ex/record-date.

The record date determines the eligible shareholders who will receive the dividend payment. The ex-dividend date, which mostly coincides with the record date, marks when the share price adjusts to reflect the upcoming payout.

Macquarie on Coforge

CLSA on Coforge

Goldman Sachs on Cipla

HSBC on Cipla

Bofa on Cipla

Macquarie on Cipla

Jefferies on Paytm

Goldman Sachs on Urban Company

Morgan Stanley on Urban Company

Shares of auto companies will be in focus heading into trade on Monday as India and the European Union look to finalise the Free Trade Agreement framework before the Union Budget 2026. A key part of the talks between the EU and India revolves around the Indian government potentially cutting car import tariffs for EU carmakers.

Over the weekend, Reuters reported that India is planning a major cut in import tariffs, marking the biggest ever easing in the country's tightly-protected automobile market. The import tariffs for EU carmakers could be slashed from 110% to 40%, thus offering greater market access for European companies to one of the fastest-growing automobile markets in the world.

Given that the EU is already home to some of the biggest car brands in the world, including the likes of Ferrari, BMW, Mercedes, Audi, Volkswagen and Lamborghini, among others, the move could have serious implications for India's premium automobile market.

Read full story: Tata Motors, Hyundai And Other Auto Stocks In Focus As India Mulls Tariff Cut For EU Carmakers

Asian stocks slipped as renewed tariff worries emerged after President Donald Trump signaled he may increase duties on South Korean products. The yen maintained its recent strength. South Korea's Kospi Index — among the strongest global performers this year — declined 0.9%, and the won retreated after four consecutive sessions of gains. Japanese equities also fell for a second straight day, pressured by the firmer yen, reports Bloomberg.

US stock and bond markets posted modest gains, but those moves were eclipsed by sharp swings in energy, commodity, and currency markets as the week began. The US dollar slipped to its lowest level since 2022, gold surged past $5,000, and natural gas prices spiked nearly 30% as severe cold weather spread across much of the United States.

Good morning readers.

The GIFT Nifty was trading near 25,200 early on Tuesday. The futures contract based on the benchmark Nifty 50 rose 0.32% at 25,169.5 as of 6:42 a.m. indicating a positive start for the Indian markets.

In the previous session on Friday, the benchmark ended in red. The Nifty ended 25,048.65 points or 0.95% lower at 25,048.65 and Sensex ended 769.67 points or 0.94% lower at 81,537.70.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.