Good afternoon readers. The NSE Nifty 50 and BSE Sensex opened higher on Friday extending gains for the second day. However, as the day progressed the indices pared the gains to trade lower. Nifty fell 0.40% to 25,187.60 as of 12 p.m., while Sensex was down 0.44% at 81,949.04. Eternal, RIL, L&T, HDFC Bank and Axis Bank were top Nifty losers.

That's all for today folks. But before you head for your long weekend, here are few stories that will interest you.

Why Senior Living Is Entering The Retirement Conversation In A Nuclear India

Sunil Mehta To Step Down As IndusInd Bank's Part-Time Chairman, Arijit Basu Named Successor

Govt Building Portal To Track India's Green Hydrogen From Production To Use

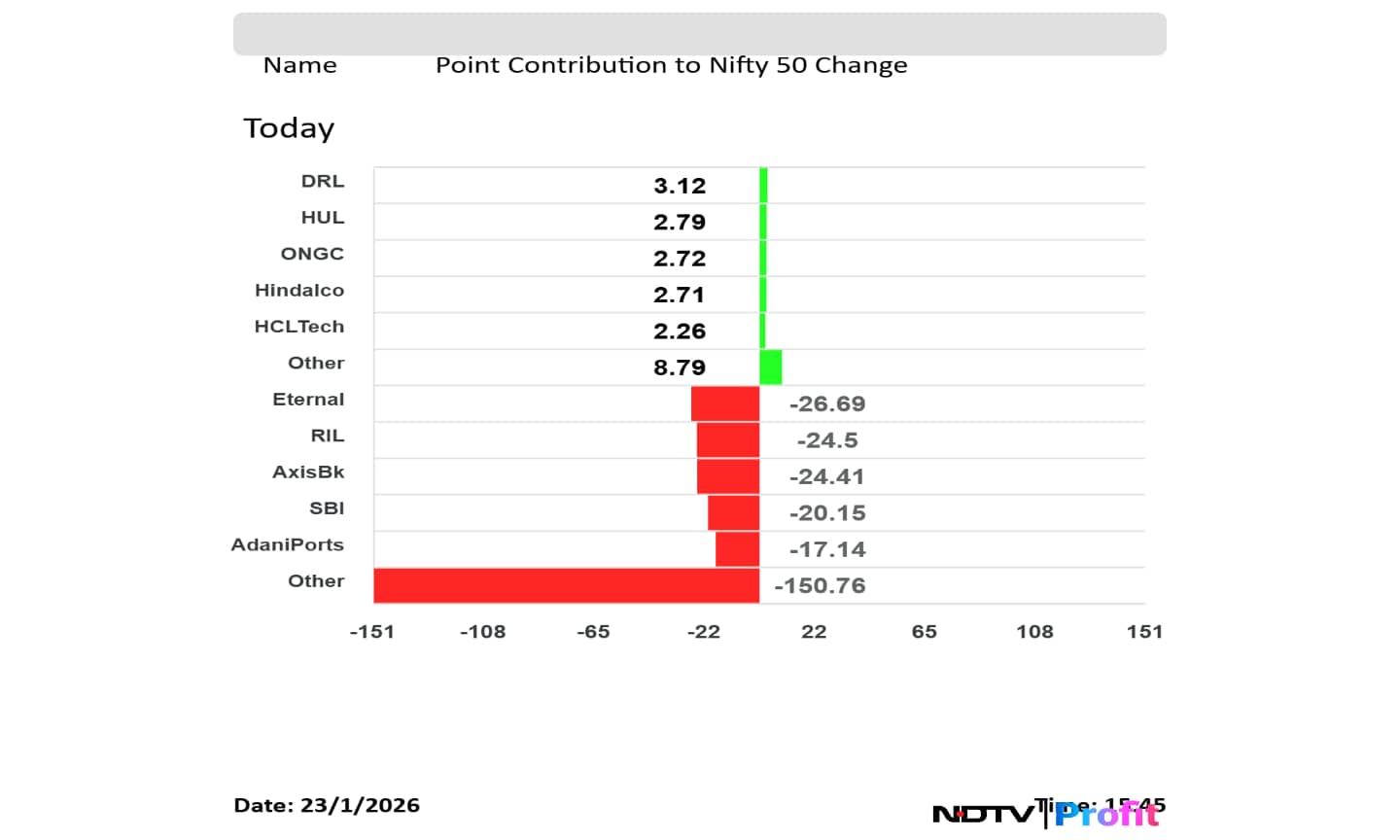

Dr. Reddy's, HUL, ONGC, Hindalco and HCLTech emerged as the top gainers for the day.

On the other hand, Eternal, RIL, Axis Bank, SBI and Adani Ports were the worst performers of the Nifty 50 index.

Broader indices on the other hand ended in the negative. Nifty Midcap 150 ended 1.72% lower and Nifty Smallcap 250 closed 1.95% lower.

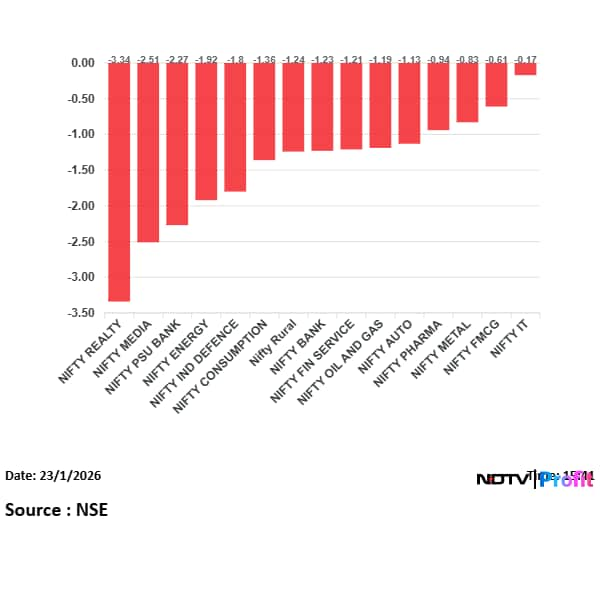

All sectoral indices fell with Nifty Realty and Nifty Media leading the decline.

The market breadth was skewed in the favour of sellers, as 2,880 stocks declined, 1,332 advanced and 153 remained unchanged on the BSE.

Indian equities end volatile session in red. Nifty had fallen below the 25,100 levels and closed near 25,000.

Intraday, both Nifty and Sensex fell over 1%.

Nifty ends 25,048.65 points or 0.95% lower at 25,048.65.

Sensex ends 769.67 points or 0.94% lower at 81,537.70.

Hiring sentiment in India's white-collar job market remains firmly optimistic heading into the first half of 2026, with recruiters signalling strong intent to add new roles rather than merely replace existing ones, according to the latest Hiring Outlook H1 2026 released by Naukri.

The bi-annual survey, based on responses from over 1,250 recruiters, shows that 95% expect to hire in H1 2026. More importantly, 76% anticipate new job creation, up from 72% in H2 2025-signalling expansion across sectors despite global uncertainty.

Recruiters appear increasingly confident that demand conditions will support fresh hiring rather than just replacement-led recruitment.

Nifty as of 2:03 p.m. fell as much as 1%, while Sensex was down over 700 points.HDFC Bank, Eternal lead decline.

Rupee on Friday hit a record low of 91.78 per dollar.

Cipla Q3 Highlights (Consolidated, YoY)

READ MORE: Cipla Q3 Results: Profit Falls 57% Due To Labour Codes Impact; Misses Analyst Estimates

Nifty FMCG and Nifty Pharma are the two defensive sector and are trading in green.

Nifty 50 is at day's low of 25,120.80 and the Nifty is taking support near its 200-DMA, which is at 25,143.

Silver's white-hot rally has pushed Indian ETFs into overdrive, reigniting the debate on whether investors should chase momentum or step back and reassess risk.

The precious metal has surged close to the psychological $100 mark, a level that market participants say could either open the door for a sharp extension towards $110–$120 or trigger violent profit booking if momentum falters. Reflecting the frenzy, Tata Silver ETF jumped 17%, while Nippon India Silver ETF, DSP Silver ETF and ICICI Prudential Silver ETF rallied around 10–11% each.

Over 1.19 million shares of AU Small Finance were traded via block deal on Friday. The share of Kotak Mahindra Bank fell as much as 0.2.17% to Rs 978.85 apiece.

Paytm parent One 97 Communication Ltd.'s shares slid nearly 10% to hit a more-than-three-month low in trade, reversing recent gains that followed Investec's initiation of coverage with a ‘Buy' rating and a target price of Rs 1,550. The sharp correction came as investors turned cautious over regulatory uncertainty surrounding the Payment Infrastructure Development Fund (PIDF) scheme, despite brokerages flagging potential mitigation levers.

The stock had climbed 3.48% earlier, but selling pressure emerged as the market began pricing in the risk that the Reserve Bank of India may not renew the PIDF scheme beyond December 2025.

As equity markets turn volatile, many retail investors are tempted to pause or stop their systematic investment plans (SIPs). But a recent post on Reddit is serving as a timely reminder of why patience often matters more than timing. The user shared how disciplined investing over 15 years helped turn a total investment of just Rs 51,420 into a corpus of Rs 2.10 crore —delivering an annualised return of about 17.1%.

Read more: Thinking Of Stopping Your SIP? This Reddit Story Shows What Patience Can Build

Yes Bank To NDTV Profit

A sharp surge in US gas and Asian LNG prices could weigh on near-term earnings for India's major gas companies, according to a latest note by Citigroup. While the impact may be time-bound, Citi cautioned that higher input costs and volatility could pressure margins across gas transmission, trading and city gas distribution businesses.

Citi noted that February 2026 Henry Hub gas futures jumped sharply over the past week, rising from about $3.1 to nearly $5.5 per mmbtu. Although March 2026 futures suggest prices could normalise closer to $3.7, the spike could still weigh on fourth-quarter FY26 earnings for companies such as GAIL, Indraprastha Gas and Mahanagar Gas.

For GAIL, Citi said the impact would depend on how much of its US LNG sourcing is not tied to Henry Hub pass-through pricing and how higher feedstock costs affect petrochemical profitability. The brokerage estimates that a $2 per mmbtu increase in Henry Hub prices for one month could reduce GAIL's Q4FY26 EBITDA by about Rs 2 billion.

The shares of Paytm fell on Friday after it pared morning gains. The stock had risen 3.48% after Investec initiated 'Buy' coverage with a target price of Rs 1,550. But as of 11:50 the stock was trading lower and was down nearly 4%.

Here's what the brokerage had to say:

The shares of Ashoka Buildcon rose as much as 4% on Friday after it won an order worth Rs 307 crore. The scrip rose as much as 4.5% to Rs 151 apiece on Friday, highest level since Jan. 16, 2022. It pared gains to trade 1.81% higher at Rs 147.11 apiece, as of 11:29 a.m. This compares to a 0.06% decline in the NSE Nifty 50 Index.

It has fallen 45.80% in the last 12 months and 12.93% year-to-date. Total traded volume so far in the day stood at 1.12 times its 30-day average. The relative strength index was at 44.10.

After witnessing a major drawdown on Thursday, shares of IIFL Finance Ltd. have gained sharply on Friday as investor sentiment improved following the management's clarification on the Income Tax Department's special tax audit on the company.

The stock is trading at Rs 561.5, accounting for gains of more than 4% compared to Thursday's closing price of Rs 528.25. It must be remembered that the stock fell more than 15% on Thursday, with the special tax audit dampening investor mood even as the company reported relatively strong third-quarter results.

Watch the full clarification on NDTV Profit

IIFL Finance clarifies special audit

— NDTV Profit (@NDTVProfitIndia) January 23, 2026

No new proceedings, no undisclosed information, says founder, Nirmal Jain. The audit, he adds, is part of a standard assessment process.

Watch the full clarification on NDTV Profit👇@Heeraal @JainNirmal pic.twitter.com/Rm4CnwjxIu

Shares of Bandhan Bank Ltd. rose over 5% in early trade during Friday's session, despite the company reporting a 52% decline in net profit for the quarter ended December.

The Kolkata-based bank had a net profit of Rs 426.29 crore in the third quarter of the preceding fiscal. Its total income declined to Rs 6,122 crore during the third quarter of FY26 from Rs 6,591 crore a year ago.The total expenditure increased to Rs 4,677 crore during the quarter under review against Rs 4,569 crore in the year-ago period.

Gross non-performing assets improved to 3.33% of gross advances, from 4.68% in the third quarter of FY25.

Bandhan Bank's management struck a cautiously optimistic tone on the outlook, guiding for lower credit costs in Q4FY26 and providing FY27 credit cost guidance of 1.6–1.7%, while pegging credit costs for the Emerging Entrepreneurs Business (EEB) at around 2.5%.

Over 1.13 million shares of Kotak Mahindra Bank were traded via block deal on Friday. The share of Kotak Mahindra Bank fell as much as 0.42% to Rs 425.30 apiece.

The shares of Hindustan Zinc were in focus on Friday after the company's board approved raising Rs 1,400 crore Via NCDs. In addition to that silver was near record high, further boosting the rally.

Over 1 million shares of Dabur were traded via block deal on Friday. The share of Eternal rose as much as 1.52% to Rs 533 apiece

Over 1.59 million shares of Eternal were traded via block deal on Friday. The share of Eternal fell as much as 3.94% to Rs 265.60 apiece.

The shares of IndiGo fell as much as 4% on Friday after it announced its third quarter result. This is the lowest since Jan. 16. The shares pared losses and was trading 1.89% lower at Rs 4,837 per share.

It has risen 17.30% in the last 12 months and fallen 5.02% year-to-date. Total traded volume so far in the day stood at 2.1 times its 30-day average. The relative strength index was at 41.26.

Over 3.44 million shares of FSN E-commerce were traded via block deal on Friday. The share of FSN E-commerce fell as much as 1.21% to Rs 237.20 apiece.

Over 1.04 million shares of DLF were traded via block deal on Friday. The share of DLF fell as much as 0.98% to Rs 1,235.60 apiece.

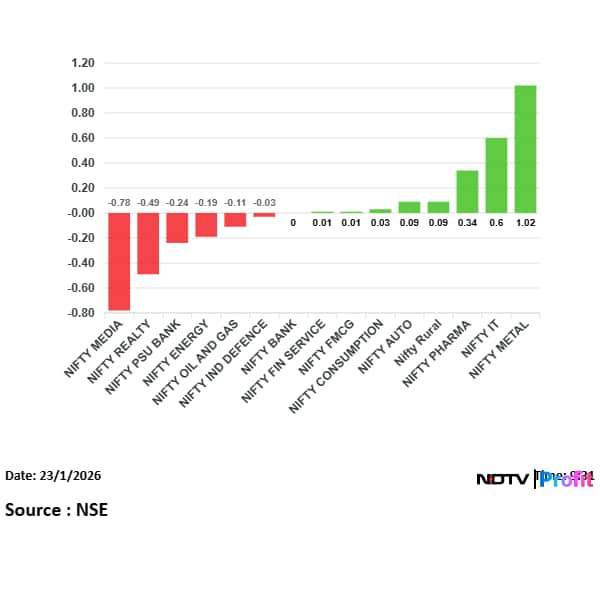

On NSE, eight of the 15 sectors were in the green. Nifty Metal and Nifty IT lead the advance.

Broader markets were trading higher, with the NSE Midcap 150 trading 020% higher and NSE Smallcap was trading 0.01% higher.

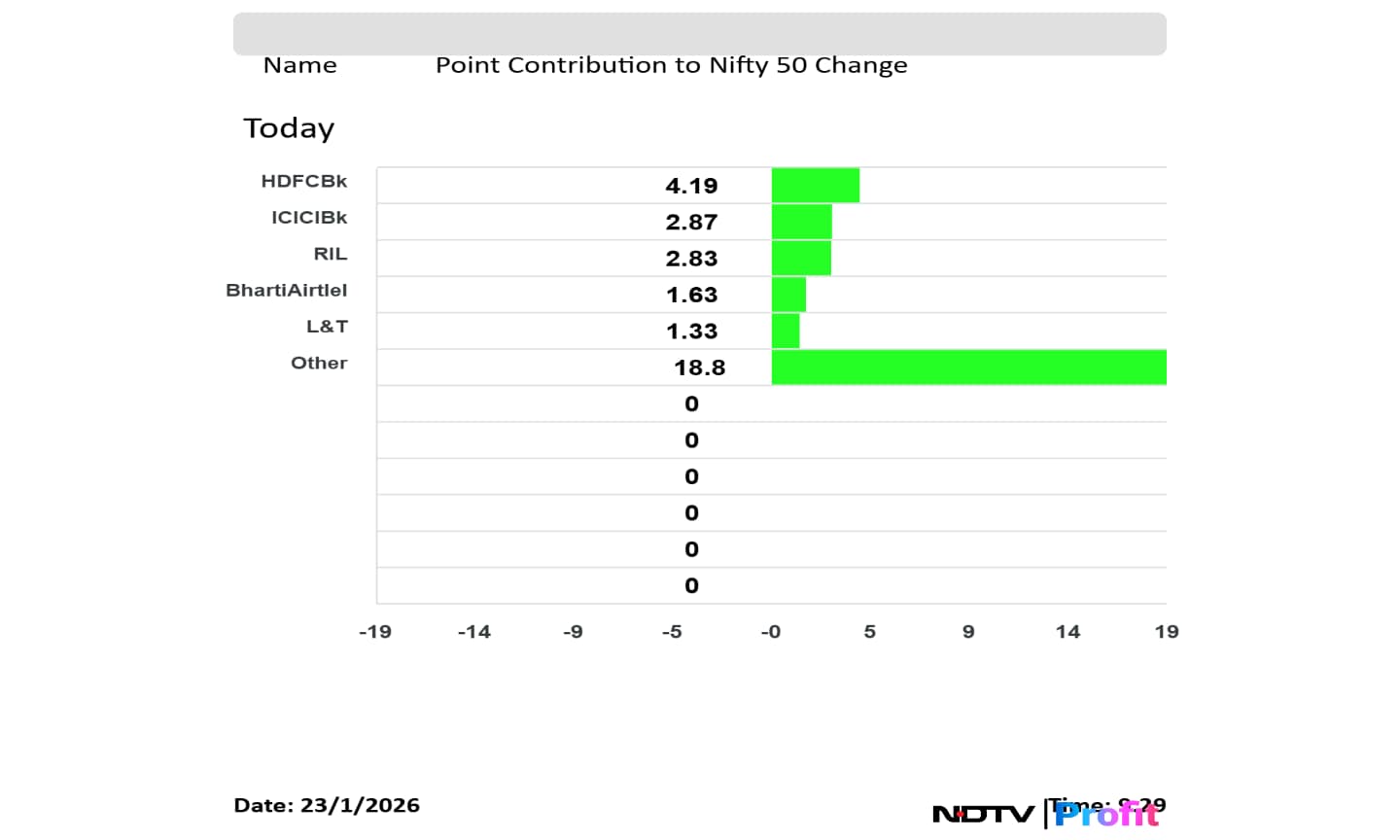

HDFC Bank, ICICI Bank, RIL, Bharti Airtel and L&T added to the Nifty 50 index. There were no losers during the early minutes.

The NSE Nifty 50 and BSE Sensex opened higher on Friday extending gains for the second day. The Nifty 50 opened 0.21% higher at 25,344.15 and Sensex opened 0.03% up at 82,335.94. However, minutes after open the markets fell the Nifty was trading 0.09% lower and Sensex was also trading nearly 100 points lower.

At pre-open, the NSE Nifty 50 was trading 54.70 points or 0.22% higher at 25,344.60. The BSE Sensex was up 28.69 points at 82,336.06.

Morgan Stanley on Go Digit

Maintain Equal-weight with TP of Rs 335

Q3 beat on adjusted profits

Combined ratio higher YoY due to a higher two-wheeler mix

IFRS combined ratio improved YoY

Loss ratio improved

Valuation remains full

Jefferies on Go Digit

Maintain Buy; Hike TP to Rs 430 from Rs 420

Q3 beat driven by reinsurance gains and operating leverage

Combined ratio improved ~30 bps YoY to 110.5%

Lower commission expense aided by retention strategy

Motor OD loss ratio worsened due to competition and mix

Morgan Stanley on IndiGo

Maintain Overweight; Hike TP to Rs 6498 from Rs 6359

Q3 PBT beat estimates by 18%

Company lowered Q4 capacity guidance and raised CASK outlook

Valuation attractive at FY27 EV/EBITDA of 8.5x vs 10-yr median of 9x

Franchise strength is materially better now

Citi on IndiGo

Maintain Buy; Cut TP to Rs 5700 from Rs 5800

Q3 strong despite multiple operational disruptions

Operations normalised post-disruptions

Yield estimates cut; higher costs factored in

Investec on IndiGo

Maintain Sell with TP of Rs 4050

Weak Q3 print; weaker visibility

Q4 capacity growth guidance cut to ~10% YoY

Rising regulatory risk from strict FDTL norms

Cost pressures expected to intensify

FY26 EPS cut by 35%; FY27–28 unchanged

Jefferies on Waaree Energies

Maintain Underperform; Cut TP to Rs 2185 from Rs 2295

Volume-led beat

Management expects to exceed >100% FY26 EBITDA growth guidance

Exports declined sharply post-US tariffs

Order book increasingly skewed towards the US amid AD/CVD risk

FY26/27E EBITDA raised by 16%/8%

Beneficiary of PM Kusum and subsidy schemes due to strong retail presence and DCR production

Morgan Stanley on HPCL

Maintain Overweight with TP of Rs 610

Chairman constructive on the startup of ~$12 bn of work-in-progress investments every quarter in 2026

Confidence on cost controls and deleveraging surprised positively

HPCL among few global refiners with 1.5x capacity rise

Well placed to leverage the “Golden Age” in fuel markets

Jefferies on HPCL

Maintain Underperform; Cut TP to Rs 385 from Rs 405

Dec-25 quarter missed estimates; valuation appears full

EBITDA 11% below estimates due to weaker refining

Low crude outlook is supportive for marketing margins

LPG compensation to boost earnings in Q4FY26–FY27

Rajasthan refinery commissioning by early FY27 to be a drag

FY26E PAT cut by 3%

Gold and silver prices traded higher across major Indian cities on Friday, Jan. 23, 2026, as the precious metals felt the pressure of geopolitical risk and threats to the Federal Reserve's independence added support to a rally fueled by a retreat from currencies and bonds.

Today, gold is trading at Rs 157,270 while silver is at Rs 327,280, according to the India Bullions' website.

Silver rallied even more than gold levels with an Indian average at Rs 327,280. The white metal was trading at Rs 326,690 in Mumbai, according to Bullion's website.

Coforge Ltd. has reported its third-quarter earnings for the financial year ending March 2026, registering a 5% sequential revenue growth, while profit saw a 33% sequential downtick, largely driven by Rs 118 crore one-time expenses related to Labour Codes. The company has also announced an interim dividend for the third quarter.

The IT services firm's revenue for the December quarter stood at Rs 4,188 crore, compared to the topline of Rs 3,986 crore in the previous quarter. Net profit, meanwhile, fell 33% to Rs 250 crore compared to the previous quarter's bottom line of Rs 375.8 crore. The profits were largely impacted by the IT Labour Codes' impact of Rs 118 crore.

Coforge's margin for the third quarter took a slight hit of 70 basis points to 13.4%.

Read more: Coforge Q3 Results: Profit Falls 33%; Board Announces Dividend

Shares of Wipro Ltd., Persistent Systems Ltd., United Spirits Ltd., Ksolves India Ltd. and SRF Ltd. will be of interest on Friday, as the day marks the last session for investors to buy shares to qualify for receiving the dividend before the stock goes ex/record-date.

The record date determines the eligible shareholders who will receive the dividend payment. The ex-dividend date, which mostly coincides with the record date, marks when the share price adjusts to reflect the upcoming payout.

Given India's T 1 settlement cycle, shares purchased on the record date (Jan. 27 in this case) will not be eligible for the dividend payment. Therefore, investors who own shares by Jan. 23 will be the beneficiaries.

Nifty Options 27th Jan Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 25000.

Securities in ban period: Bandhan Bank, Sammaan Capital

Asian equities followed Wall Street higher on Friday after upbeat US economic data and easing geopolitical tensions buoyed investor sentiment. MSCI's regional stocks gauge rose 0.2% after the US benchmarks advanced for a second consecutive day. Japan's Topix rose 0.2, reports Bloomberg.

Good morning readers.

The GIFT Nifty was trading near 25,400 early on Friday. The futures contract based on the benchmark Nifty 50 rose 0.11% at 25,387 as of 6:45 a.m. indicating a positive start for the Indian markets. This comes after the Wall Street rally on Thursday.

In the previous session on Thursday, the benchmark ended in green snapping its three-day decline. The NSE Nifty 50 ended 132.40 points or 0.53% higher at 25,289.90, while the BSE Sensex closed 397.74 points or 0.49% higher at 82,307.37.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.