While that's all for markets today folks, you can now go and check live IPL Mini Auction updates here.

Have a good rest of the day. See you tomorrow.

Rupee ends at record closing low of 91.03 against the US Dollar.

Rupee falls over 1% in the last five trading sessions.

Rupee falls over 2.6% in last one month.

Rupee continues to be the worst performing Asian currency; Falls nearly 6% in 2025 so far.

The benchmark equity indices extend loosing streak on Tuesday.

Intraday, both Nifty and Sensex had fallen nearly 0.70%.

Nifty ends 167.20 points or 0.64% lower at 15,860.10.

Sensex ends 565.24 points or 0.66% down at 84,648.12.

Broader indices also closed lower. Nifty Midcap 150 and Nifty Smallcap 250 closed 0.77% lower each.

Most sectoral indices fell with Nifty realty leading the decline. Nifty Media was the only sector to end the day in green.

The market breadth was skewed in the favour of sellers, as 2,522 stocks declined, 1,651 advanced and 174 remained unchanged on the BSE.

Bharti Airtel, Titan, M&M, ICICI Bank and Tata Consumer emerged as the top gainers for the day.

On the other hand, Axis Bank, Reliance Industries, Eternal, Bajaj Finance and L&T were the worst performers of the Nifty 50 index.

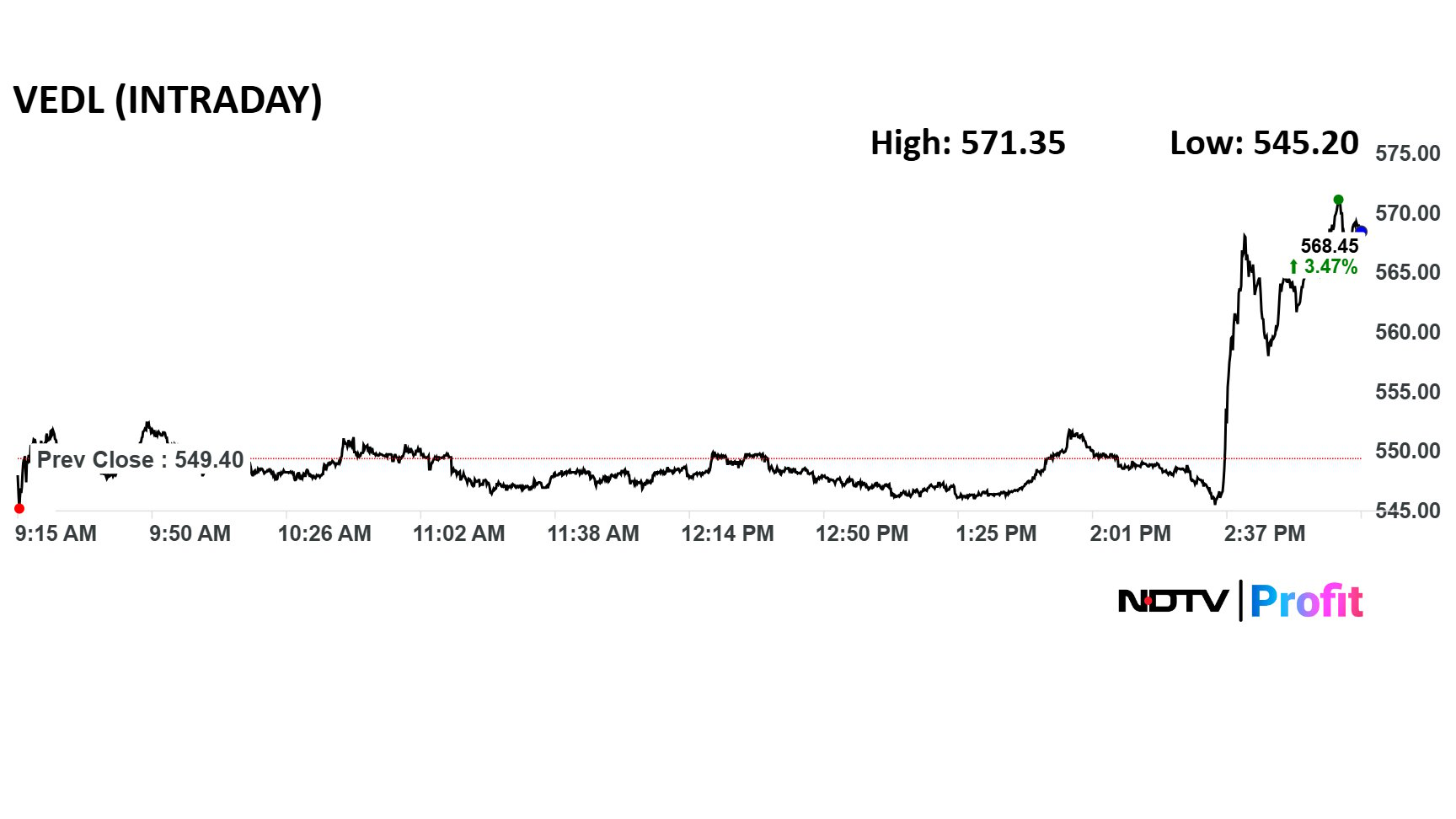

Vedanta Ltd. share price hit an all time high on Tuesday after the National Company Law Tribunal approved the demerger.

Vedanta Ltd. share price hit an all time high on Tuesday after the National Company Law Tribunal approved the demerger.

In an exclusive interaction with NDTV Profit, Neelkanth Mishra - Chief Economist, Axis Bank and Head - Global Research, Axis Capital said today that the INR's latest weakness is not a 'big concern' for the economy and also, many of the global currencies will start debasing in the next 3-5 years.

BEML shares are in focus as the company gets Rs 110 crore order from Defence Ministry for supply of engines.

NCLT on Tuesday approved the Vedanta merger. The demerger was approved by the board on Sept, 29, 2023.

After a difficult start to 2025, where Indian equities faced immense pressure and underperformed against most global peers, the worst is officially over and the stage is set for a broad-based market recovery in 2026, driven by domestic consumption, according to Herald Van Der Linde, Head of Equity Strategy, Asia Pacific at HSBC.

Speaking to NDTV Profit, Herald noted that estimates for Indian markets in 2026 are already outpacing 2025 projections, and there could be brighter days ahead for the market.

Grocery delivery firm Zepto Ltd. is preparing to file for an initial public offering of about $500 million in Mumbai as early as next week, according to people familiar with the matter, as competition hots up in India’s quick-commerce market.

Source: Bloomberg

Brent crude falls below $60 on Tuesday. Crude has fallen 18% in the last six months.

Currently silver is costlier than crude.

The release of Aditya Dhar’s spy thriller Dhurandhar has had a visible impact on several listed media and cinema-related stocks, even as share price reactions have remained mixed.

Since the movie’s release, shares of Cineline India the operator of MovieMax, Saregama and UFO Moviez have traded in the green, reflecting optimism around footfall recovery and content momentum. Saregama has gained about 3.01%, while UFO Moviez is up 7.27%. Cineline India has also rise around 6% since the release. In contrast, PVR Inox has underperformed, slipping 1.48% over the same period.

While we are tracking the market decline, you can take a look at the live updates on the IPL auction that will begin in sometime.

Get live updates on the latest bids here.

The ICICI Prudential AMC IPO was subscribed 5.52 times at 12:23 p.m. on Tuesday.

Qualified Institutional Buyers (QIBs): 7.43 times

Non-Institutional Investors (NIIS): 12.16 times

Retail Individual Investors: 1.48 times

Reservation for ICICI Bank shareholders: 6.16 times.

The finance minister Nirmala Sitharaman on Tuesday has tabled the Insurance Bill 2025 in the Lok Sabha.

Indian equities were trading lower after snapping its two day winning streak. Nifty fell nearly 0.11% at 25,980.75 and Sensex fell nearly 500 points to 84,695.01 as of 12 p.m.

Intraday, both Nifty and Sensex fell nearly 0.60%.

Nifty fell 0.58% to 25,877.25.

Sensex fell 0.60% to 84,700.36.

Broader indices were trading lower. Nifty Midcap 150 fell 0.77%; Nifty Smallcap 250 was trading 0.62% lower.

Most sectoral indices fell, led by Nifty Defence and Nifty Metal.

Nifty Bank fell 0.73%, Nifty IT was down nearly 1%.

Bharti Airtel, Titan, M&M, ITC and Tata Consumers were top Nifty gainers.

Axis Bank, Eternal, Reliance Industries, HDFC Bank and L&T were top Nifty losers.

Rupee hits record low of 91 against US Dollar.

Rupee falls over 1% against the US Dollar in last five trading sessions.

With the proposed Insurance Bill 2025 likely to put a cap on insurance commissions, HDFC Bank, ICICI Bank and Axis Bank are in focus on Tuesday. These banks earned the most from insurance commissions in the previous fiscal.

HDFC Bank earned Rs 6,308 crore – 7% of PBT

ICICI Bank earned Rs 4,474 crore – 7% of PBT

Axis Bank earned Rs 3,174 crore – 9% of PBT

Rupee hits record low of 90.91 against US Dollar in intraday trade.

Rupee falls over 1% against the US Dollar in last five trading sessions.

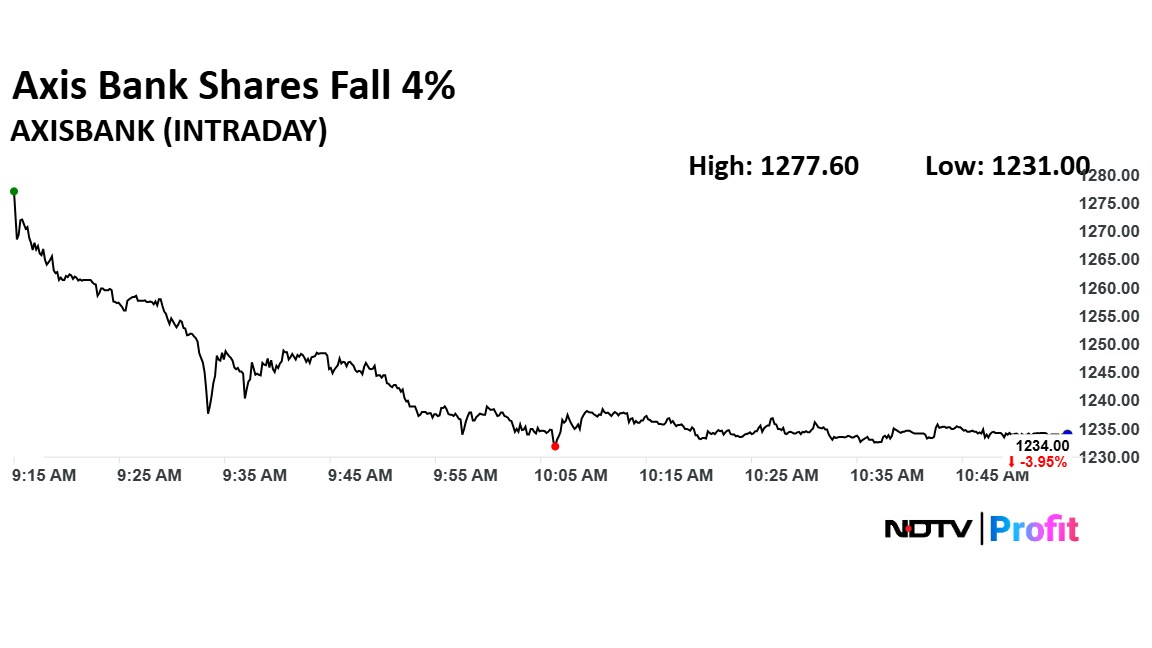

Axis Bank shares fell over 4% on Tuesday pulling down the Nifty index. The shares declined after management sees margin recovery delay.

Banks says NIMs will now bottom either in the fourth quarter or the first quarter in the previous year versus earlier guidance of third quarter.

The management now forecasts a shallow, 'C'-shaped NIM trajectory towards a targeted 3.8% over next 15-18 months, bank told Citi Research.

Axis Bank shares fell over 4% on Tuesday pulling down the Nifty index. The shares declined after management sees margin recovery delay.

Banks says NIMs will now bottom either in the fourth quarter or the first quarter in the previous year versus earlier guidance of third quarter.

The management now forecasts a shallow, 'C'-shaped NIM trajectory towards a targeted 3.8% over next 15-18 months, bank told Citi Research.

Shares of Shakti Pumps Ltd. are buzzing in trade on Tuesday's session, extending a sharp rally that has seen the stock rise up to 35% in the last few days.

The stock is currently trading at Rs 782, which accounts for gains of more than 4%. This compares to Monday's closing price of Rs 752.

The proposed Insurance Bill 2025 will empower Insurance Regulatory and Development Authority to cap agent commissions through regulations and also tightening oversight on payouts and disclosures, NDTV Profit learnt through sources.

Read more here.

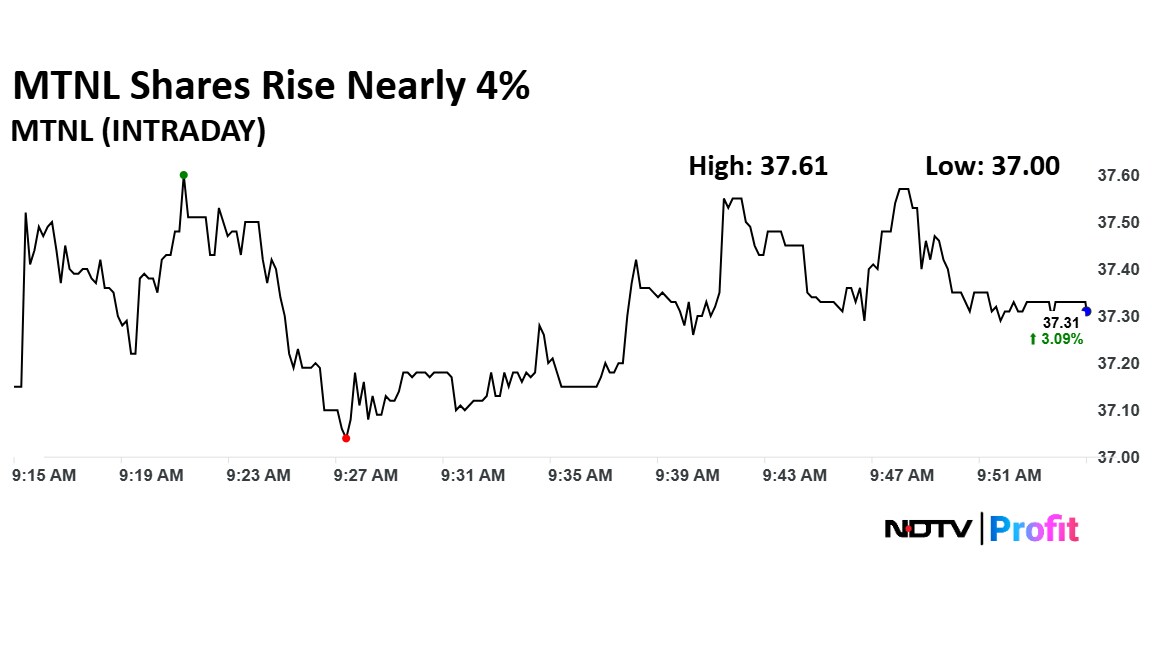

MTNL shares rose nearly 4% on Tuesday after the company sold Mumbai residential property to NABARD for Rs 350.7 crore.

MTNL shares rose nearly 4% on Tuesday after the company sold Mumbai residential property to NABARD for Rs 350.7 crore.

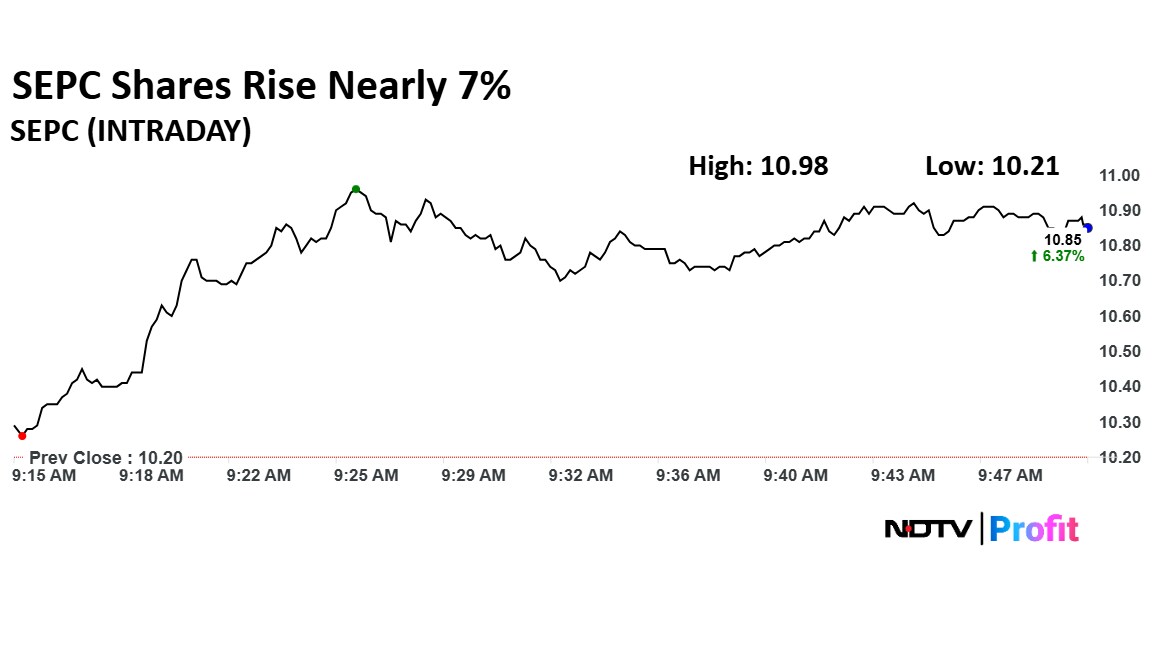

SEPC shares rise nearly 7% on Tuesday after it received Rs 270 crore purchase order from Vishnu Prakash for Railway Infra Project.

SEPC shares rise nearly 7% on Tuesday after it received Rs 270 crore purchase order from Vishnu Prakash for Railway Infra Project.

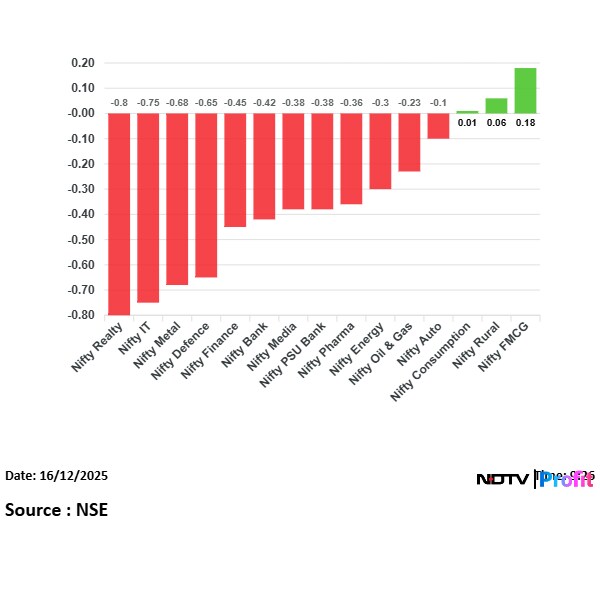

On NSE, 12 of the 15 sectors were in the red. Nifty Realty fell the most while Nifty FMCG was the best performing sector during open.

Broader markets were also in the red, with the NSE Midcap 150 trading 0.51% lower and NSE Smallcap was trading 0.62% lower.

On NSE, 12 of the 15 sectors were in the red. Nifty Realty fell the most while Nifty FMCG was the best performing sector during open.

Broader markets were also in the red, with the NSE Midcap 150 trading 0.51% lower and NSE Smallcap was trading 0.62% lower.

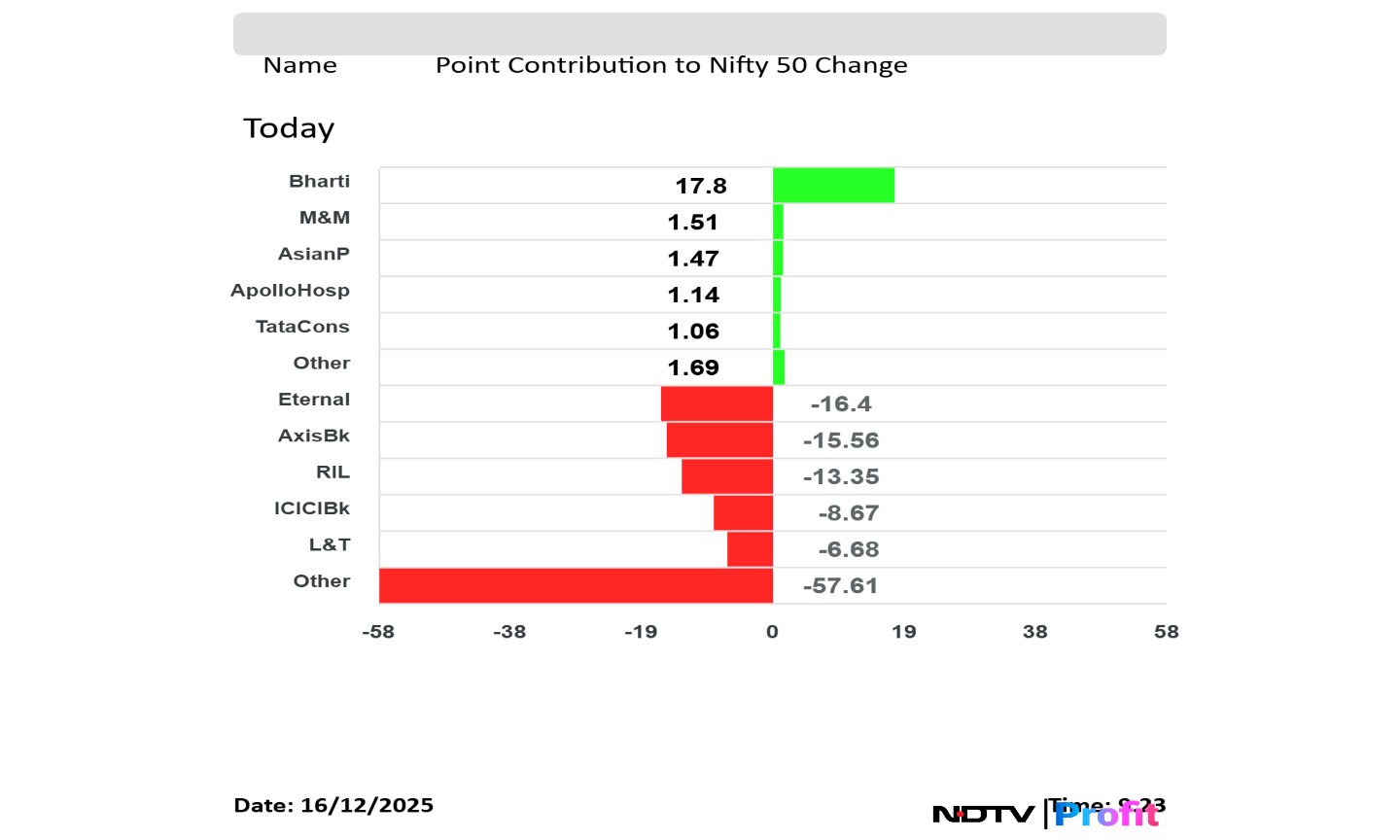

Eternal, Axis Bank, Reliance Industries, ICICI Bank and L&T weighed on the Nifty 50 index.

Bharti Airtel, M&M, Asian Paints, Apollo Hospitals and Tata Consumers added to the Nifty 50 index.

Eternal, Axis Bank, Reliance Industries, ICICI Bank and L&T weighed on the Nifty 50 index.

Bharti Airtel, M&M, Asian Paints, Apollo Hospitals and Tata Consumers added to the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex opened lower on Tuesday. The Nifty 50 opened 0.29% lower at 25,951.50 extending decline for the second day and Sensex opened 0.22% down at 85,025.61.

At pre-open, the NSE Nifty 50 was trading 75.80 points or 0.29% lower at 25,951.50. The BSE Sensex was down 0.23% or 192.33 points at 85,021.03.

Rupee opened at record low of 90.82 against US Dollar. It closed at 90.73 on Monday.

Source: Bloomberg

Silver prices have surged past oil for the first time since the early 1980s, marking a rare and historic inversion in global commodity markets. One ounce of silver now trades nearly at $64, overtaking WTI crude oil at $60 per barrel. The shift is striking compared with mid-2022, when crude was 5.5 times more expensive than silver.

ICICI Securities has upgraded PNB Housing Finance to ‘Add’ from ‘Hold’, citing valuation comfort and the appointment of a new managing director and chief executive officer as a key positive trigger. The brokerage has retained its target price of Rs 970, implying an upside of about 5% from the current market price of Rs 922.

Oil held near the lowest level since 2021 as traders weighed the outlook for a ceasefire in Ukraine, which could pave the way for fewer curbs on Russian crude flows into an already oversupplied market.

West Texas Intermediate traded near $57 a barrel after closing at the lowest in more than four years on Monday. Brent settled below $61. US President Donald Trump said a deal to end Russia’s war in Ukraine is closer than ever following talks with Ukraine’s Volodymyr Zelenskiy and European leaders.

Nifty December futures down to 26,103 at a premium of 76 points.

Nifty December futures open interest down by 2.6%.

Nifty Options on Dec 16: Maximum Call open interest at 26,200 and Maximum Put open interest at 25,900.

Investors treaded cautiously in the markets, awaiting crucial US economic data that could provide insight into the future direction of interest rates. As a result, stocks edged lower, with the MSCI Asia Pacific Index declining 0.6%. The dollar lingered near two-month lows, while the yen gained strength. Japanese shares also fell, dropping nearly 1%.

Japan’s Topix fell 0.8% while Hong Kong’s Hang Seng fell 0.3%. The Japanese yen was little changed at 155.08 per dollar while the offshore yuan was little changed at 7.0434 per dollar, reports Bloomberg.

The last full trading week of 2025 started with stocks, bonds and the dollar wavering as Wall Street geared up for key economic data that will help shape the Federal Reserve rate outlook.

On the eve of the jobs report, the S&P 500 closed mildly lower. A renewed tech slide saw Broadcom Inc. posting its worst three-day plunge since 2020. Oracle Corp. extended its multi-session selloff to about 17%. The S&P 500 closed below 6,820. The yield on 10-year Treasuries was little changed at 4.18%, reports Bloomberg.

The US Dollar index is down 0.04% at 98.91.

Euro was down 0.01% at 1.1754.

Pound was down 0.04% at 1.3368.

Yen was down 0.25% at 154.85.

Good morning readers.

The GIFT Nifty was trading above 26,000 early on Tuesday. The futures contract based on the benchmark Nifty 50 fell 0.23% at 26,030 as of 7:18 a.m. indicating a lower start for the Indian markets.

In the previous session on Friday, the benchmark equity snapped their two-day winning streak. The NSE Nifty 50 ended 19.65 points or 0.08% lower at 26,027.30, while the BSE Sensex closed 54.30 points or 0.06% higher at 85,213.36.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.