The benchmark equity indices ended the volatile week higher on Friday, snapping a one-day fall.

Intraday, both Nifty and Sensex had risen over 2%.

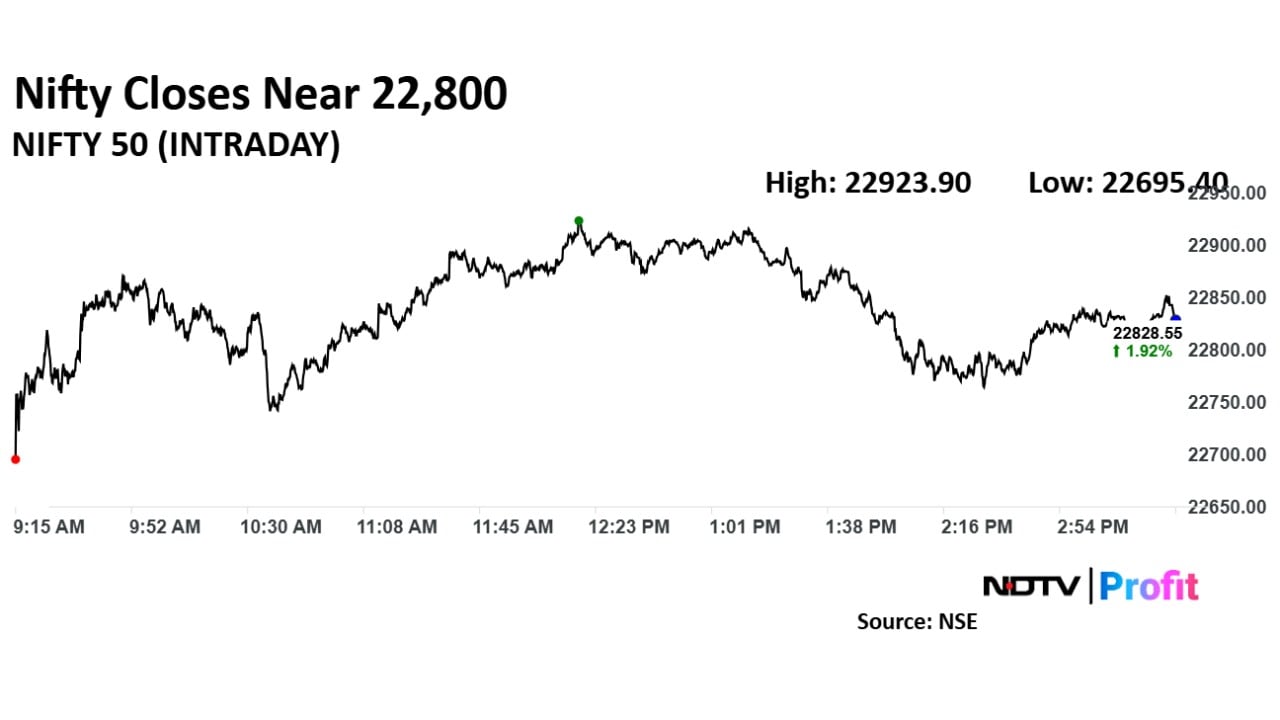

Nifty ends 429.40 points or 1.92% higher at 22,828.55.

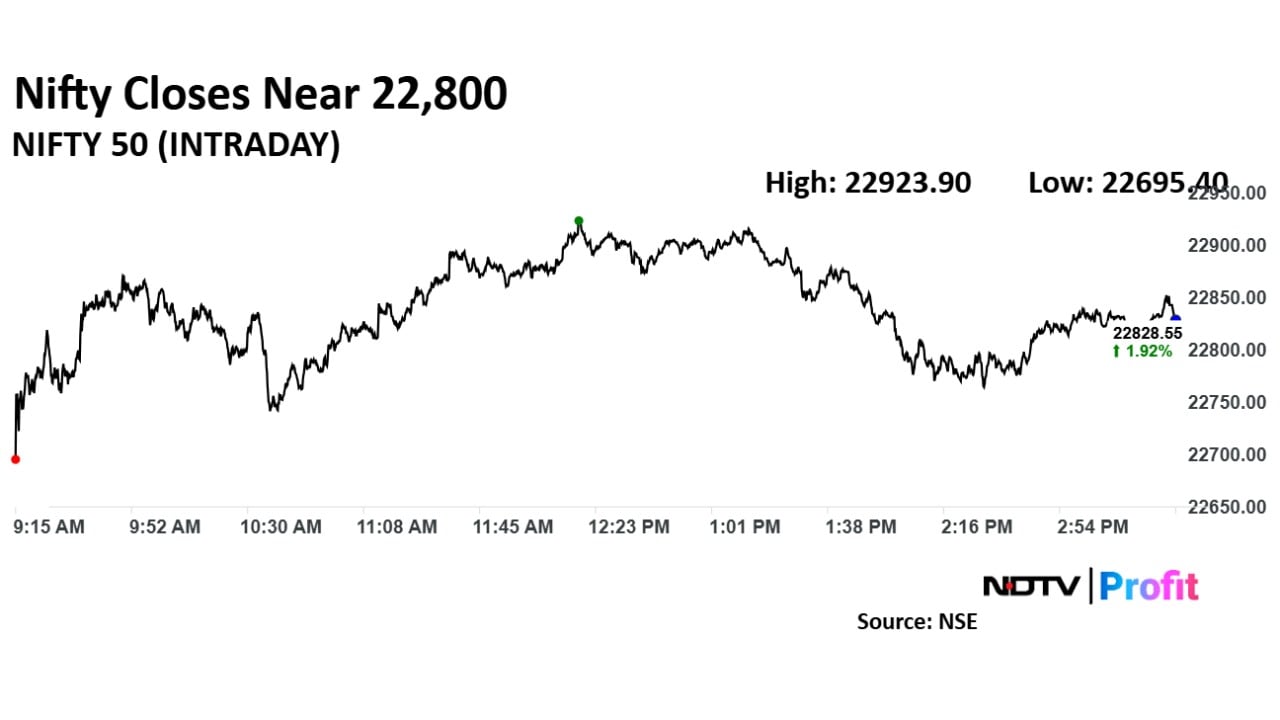

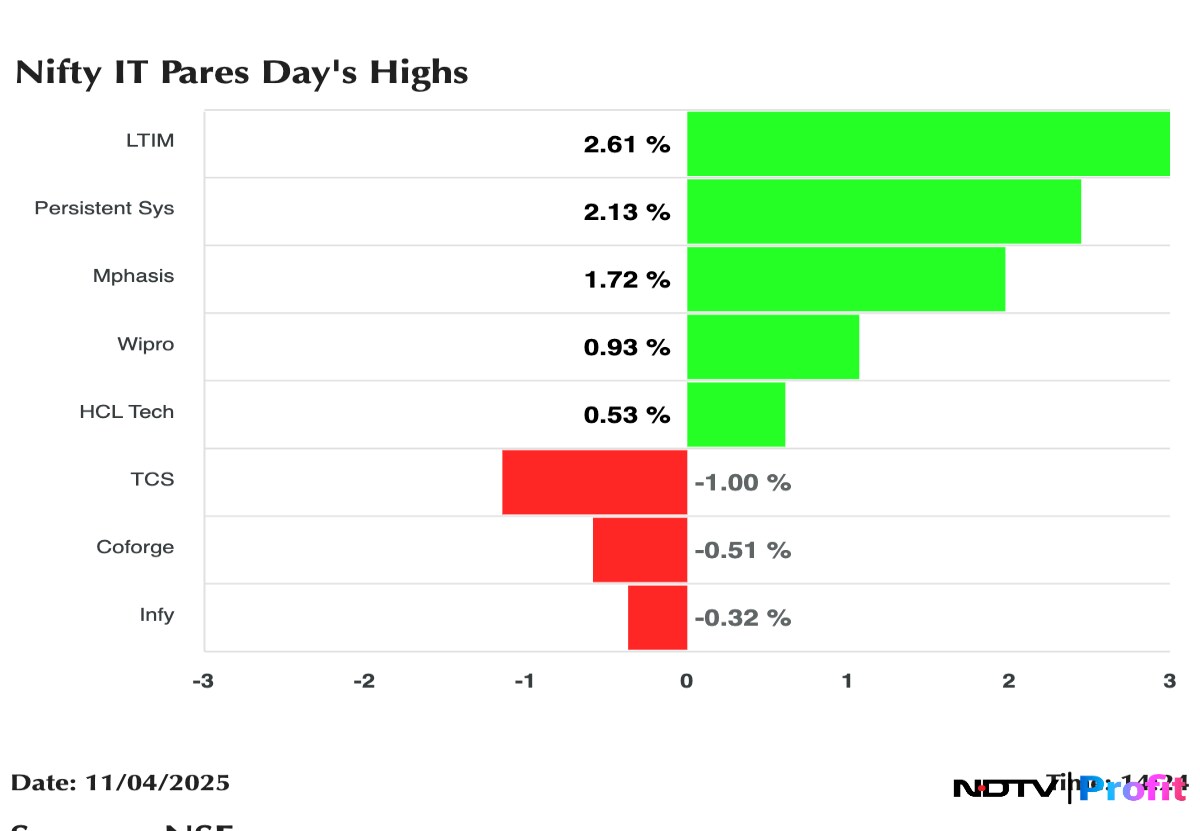

Sensex ends 1,310.11 points or 1.77% down at 75,157.26.

Broader indices also closed higher. Nifty Midcap 100 ended 1.85% higher; and the Nifty Smallcap 100 outperformed at a 2.88% advance.

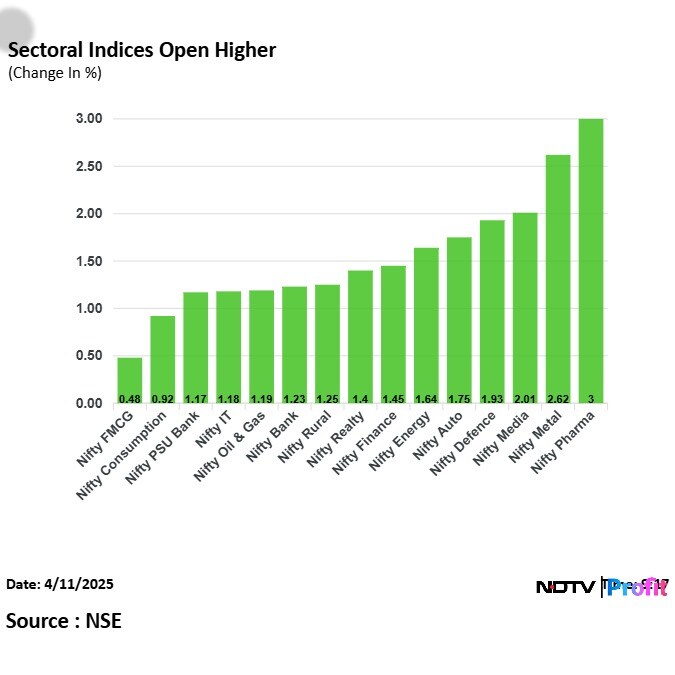

All sectoral indices rose with Nifty Metal and Energy leading the pack.

The market breadth was skewed in the favour of buyers, as 1,284 stocks advanced, 267 declined and nine remained unchanged on the NSE.

HDFC Bank, Reliance Industries, Bharti Airtel emerged as the top gainers for the day.

On the other hand, Tata Consultancy Services, Asian Paints and Apollo Hospitals were the worst performers of the Nifty 50 index.

The benchmark equity indices ended the volatile week higher on Friday, snapping a one-day fall.

Intraday, both Nifty and Sensex had risen over 2%.

Nifty ends 429.40 points or 1.92% higher at 22,828.55.

Sensex ends 1,310.11 points or 1.77% down at 75,157.26.

Broader indices also closed higher. Nifty Midcap 100 ended 1.85% higher; and the Nifty Smallcap 100 outperformed at a 2.88% advance.

All sectoral indices rose with Nifty Metal and Energy leading the pack.

The market breadth was skewed in the favour of buyers, as 1,284 stocks advanced, 267 declined and nine remained unchanged on the NSE.

HDFC Bank, Reliance Industries, Bharti Airtel emerged as the top gainers for the day.

On the other hand, Tata Consultancy Services, Asian Paints and Apollo Hospitals were the worst performers of the Nifty 50 index.

The benchmark equity indices ended the volatile week higher on Friday, snapping a one-day fall.

Intraday, both Nifty and Sensex had risen over 2%.

Nifty ends 429.40 points or 1.92% higher at 22,828.55.

Sensex ends 1,310.11 points or 1.77% down at 75,157.26.

Broader indices also closed higher. Nifty Midcap 100 ended 1.85% higher; and the Nifty Smallcap 100 outperformed at a 2.88% advance.

All sectoral indices rose with Nifty Metal and Energy leading the pack.

The market breadth was skewed in the favour of buyers, as 1,284 stocks advanced, 267 declined and nine remained unchanged on the NSE.

HDFC Bank, Reliance Industries, Bharti Airtel emerged as the top gainers for the day.

On the other hand, Tata Consultancy Services, Asian Paints and Apollo Hospitals were the worst performers of the Nifty 50 index.

The benchmark equity indices ended the volatile week higher on Friday, snapping a one-day fall.

Intraday, both Nifty and Sensex had risen over 2%.

Nifty ends 429.40 points or 1.92% higher at 22,828.55.

Sensex ends 1,310.11 points or 1.77% down at 75,157.26.

Broader indices also closed higher. Nifty Midcap 100 ended 1.85% higher; and the Nifty Smallcap 100 outperformed at a 2.88% advance.

All sectoral indices rose with Nifty Metal and Energy leading the pack.

The market breadth was skewed in the favour of buyers, as 1,284 stocks advanced, 267 declined and nine remained unchanged on the NSE.

HDFC Bank, Reliance Industries, Bharti Airtel emerged as the top gainers for the day.

On the other hand, Tata Consultancy Services, Asian Paints and Apollo Hospitals were the worst performers of the Nifty 50 index.

Nifty falls second week in a row, smallcaps outperform

Nifty Realty worst performing sector for the week, falls third week in a row

Nifty Realty, Metal, Pharma, Auto fall third week in a row

Nifty IT falls second week in a row

Nifty PSU Bank snaps three-week gaining streak

Nifty Bank, Finserv fall second week in a row

Nifty FMCG top performing sector this week

Nifty FMCG gains fourth week in a row, longest gaining streak since July 2024

Nifty Bank closes near 200-DMA

Nifty Smallcap 250 closes near 20-DMA

Nifty Smallcap 250 closes near 50-DMA

Nifty PSE closes near 100-DMA

Nifty Pvt Bank closes above 200-DMA

Rupee strengthened 65 paise to close at 86.05 against US dollar

It ended at 86.70 a dollar on Wednesday

The dollar index hit the lowest level since April 5, 2023

Source: Bloomberg

Rupee strengthened 65 paise to close at 86.05 against US dollar

It ended at 86.70 a dollar on Wednesday

The dollar index hit the lowest level since April 5, 2023

Source: Bloomberg

The Maharashtra Cyber Department has issued a whitepaper to ticketing platforms (BookMyShow etc), outlining measures to curb exorbitant pricing and black marketing of concerts and live shows. Failure to comply may result in legal action

Source: NDTV

FY25 total volume grew to 5.09 million versus 4.72 million twenty-foot equivalent unit

January-March total volume at 1.35 million versus 1.24 million TEU

Source: Exchange Filing

The company sold 560 residential units for Rs 1,153 crore at Greater Noida

Source: Exchange Filing

The IT major partners with Google to introduce agentic AI solutions

Source: Exchange Filing

Over 1.02 million shares of Swiggy were traded via a block deal on Friday. The share price of Swiggy fell as much as 2.47% to Rs 331.35 apiece.

Apollo Hospitals Enterprise is looking for acquisitions to capitalise on the growing demand for high-end medical care in India.

The company plans to add 3,500 beds over three to four years, focusing on India's northern region, and is building a $29 million cancer center.

Source: Bloomberg

USFDA concludes inspection conducted from March 24 to April 10 at arm's Raleigh plant and issues form 483 with 11 observations

Source: Exchange Filing

The bank appointed Amit Mittal as Group CFO

Source: Exchange Filing

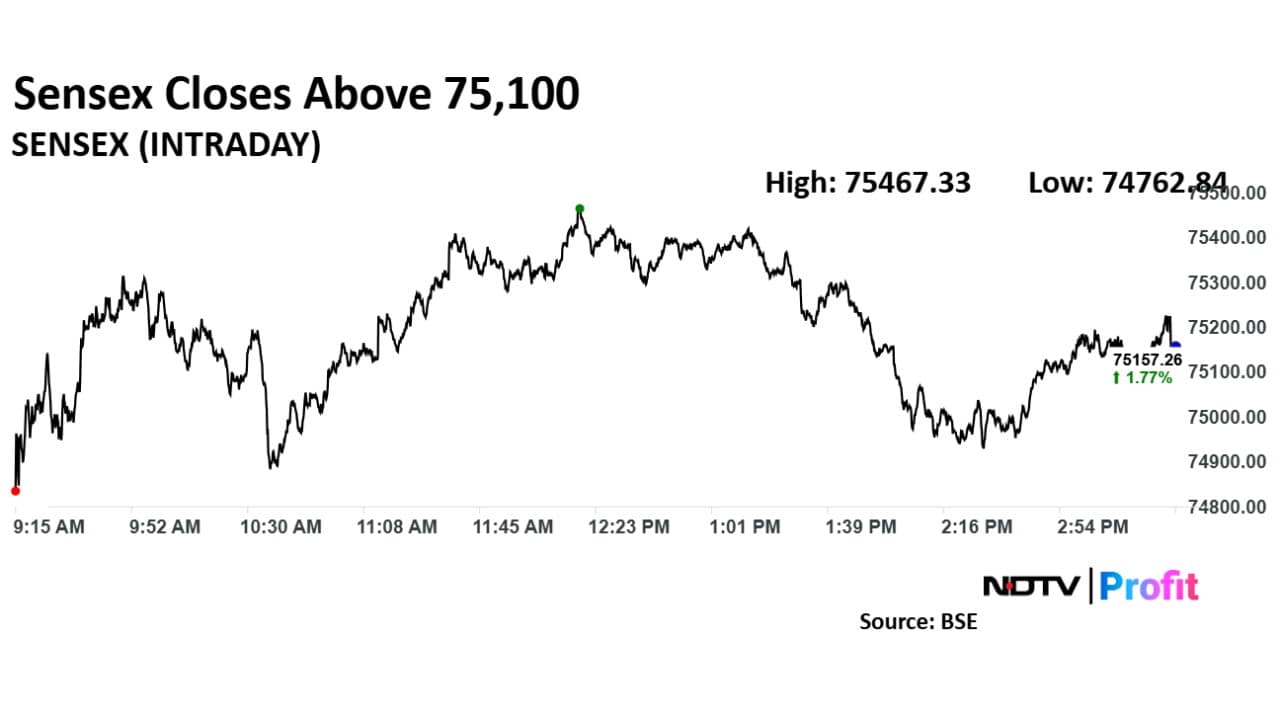

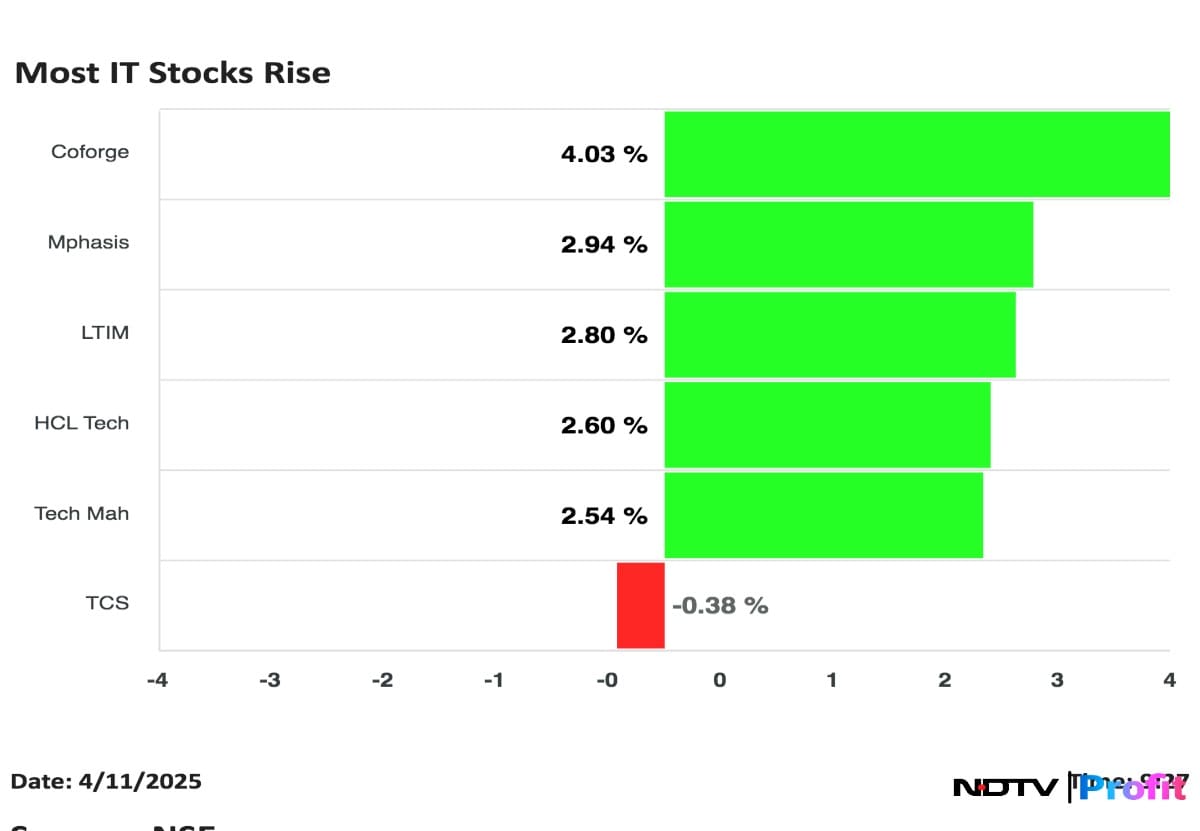

Nifty IT gives up 2% gains from day's high, with decline led by laggards TCS, Coforge, and Infosys.

Nifty IT gives up 2% gains from day's high, with decline led by laggards TCS, Coforge, and Infosys.

The National Stock Exchange of India marked another milestone in April 2025, with the total number of investor accounts surpassing 22 crore.

Source: Press Release

Minimal material impact on business from reciprocal tariffs

See minimal risk to customer retention & demand

Direct exposure to tariffs remains manageable

Source: Exchange Filing

China is set to increase the levies imposed on the US to 125%.

Source: Xinhuanet

Gets EPC orders in the range of Rs 400 crore & above for transmission lines & AIS substation

Source: Exchange Filing

Subsidiary Choice Consultancy Services gets 45 MW solar plant project in Maharashtra

Source: Exchange Filing

The company is set to release its financial information for the final quarter of fiscal 2025 on April 24, 2025.

Source: Exchange Filing

The second tranche of Stahlschmidt Cable Systems acquisition delayed

Expected to be completed in line with Asset Purchase Agreement executed

Source: Exchange Filing

Rolls out first Roadster X motorcycle from future factory in Krishnagiri, Tamil Nadu

Deliveries for Roadster X series to begin April

Source: Exchange Filing

The company emerged as the lowest bidder for order worth Rs 143 crore from Southern Railways.

Source: Exchange Filing

Indian equities were trading higher at noon, with the Nifty up nearly 2.24% at 22,901.25 and Sensex up 1,533 points at 75,380.67 as of 12:33 p.m.

Intraday, both Nifty and Sensex rose over 2%.

Nifty rose 2.34% to 22,923.90, and Sensex was up as much as 2.19% to 75,467.33.

Broader indices were trading in line with the benchmarks. Nifty Midcap 150 was up 2.03%; Nifty Smallcap 250 was trading 2.80% higher.

All sectoral indices advanced, led by Nifty Metal and Nifty Defence.

HDFC Bank, Reliance Industries, ICICI Bank, Bharti Airtel, and Kotak Mahindra Bank were top Nifty gainers.

Asian Paints and Apollo Hospitals were the only Nifty losers.

Over 1.12 million shares of IRB Infra were traded via a block deal on Friday. The share price of IRB Infra rose as much as 2% to Rs 45.01 apiece.

Carpet area sales rose 64% to 1.9 lakh square feet

Collection down 8% to Rs 182 crore

Sales value down 13% to Rs 250 crore

Source: Exchange Filing

Over 1.03 million shares of Samvardhana Motherson were traded via a block deal on Friday. The share price of Motherson rose as much as 6.19% to Rs 120 apiece.

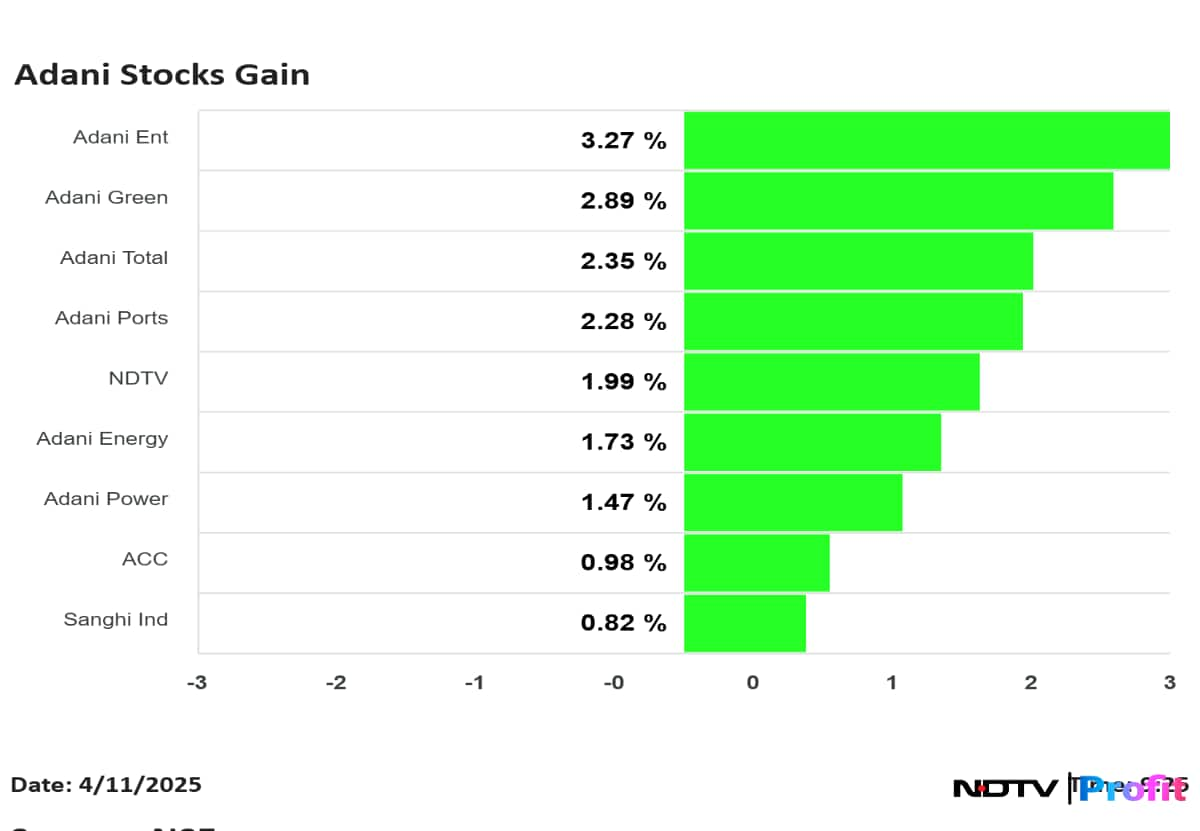

The Adani group stocks led the rally in Friday's trading session as the stock market opened on a positive note. Leading the charge among the top gainers in the group was Adani Green Energy, which soared nearly 5% to reach Rs 903.4, and Adani Enterprises, which followed closely with a 4.77% increase to Rs 2,343.5.

The Adani group stocks led the rally in Friday's trading session as the stock market opened on a positive note. Leading the charge among the top gainers in the group was Adani Green Energy, which soared nearly 5% to reach Rs 903.4, and Adani Enterprises, which followed closely with a 4.77% increase to Rs 2,343.5.

Read the whole story here.

Over 1.1 million shares of Cello World were traded via a block deal on Friday. The share price of Cello World rose as much as 3.51% to Rs 537.65 apiece.

Maintain Overweight with target price of Rs 2,421

Announcement addresses a key investor question on the quantum, capacity and timelines around fully integrated downstream strategy

Per unit capex appears largely in line with similar greenfield investments seen recently

Estimate that net debt/equity will rise to 0.4 times by F27

Timely execution on announced projects will underpin multiples

Initiate Buy, with a target price of Rs 5,100, indicating a 27% potential upside

Believe near-term catalysts will emerge when aircraft deliveries commence

See 29% upside in revenue, 33% in Ebitda and 29% in profit after tax CAGR over FY25-27

Strong order book and recent inflows underpin revenue visibility

Order book of Rs 1.8 lakh croe to provide three-year visibility

Sales Volume in Q4 grew 12.8% (QoQ)

Sales Volume for the fiscal grew 19% (YoY)

Source: Exchange Filing

As per analysts, Government to cut APM gas allocation yet again

Allocation to come down to 40% from 50%

This will be replaced by gas from New Wells which is expensive than APM

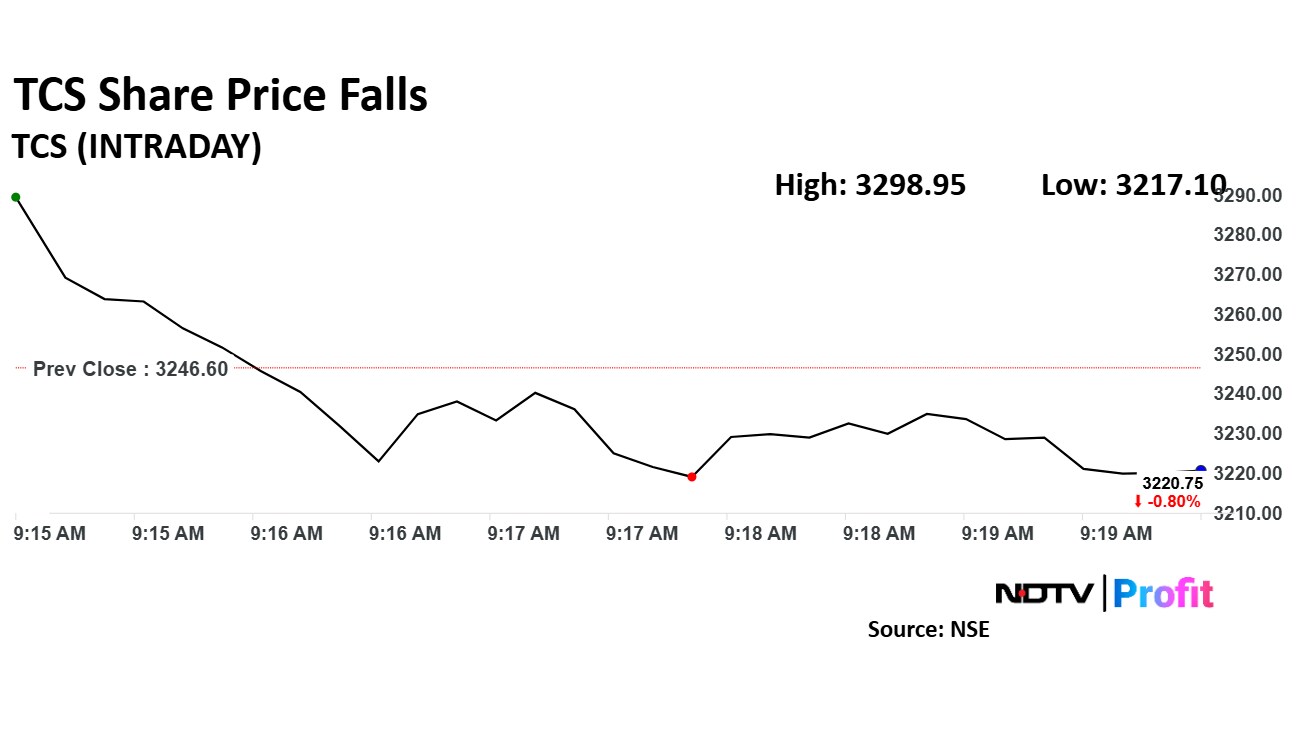

Tata Consultancy Services's share price declined as the IT major reported a declined in its net profit for the January–March quarter of fiscal 2025, against expectation of an increase. The company's net profit fell 1.26% to Rs 12,224 crore compared to Rs 12,766 crore estimated by Bloomberg.

Tata Consultancy Services's share price declined as the IT major reported a declined in its net profit for the January–March quarter of fiscal 2025, against expectation of an increase. The company's net profit fell 1.26% to Rs 12,224 crore compared to Rs 12,766 crore estimated by Bloomberg.

Read the whole story here.

Over 1.03 million shares of GMR Airports were traded via a block deal on Friday. The share price of GMR Airports rose as much as 1.50% to Rs 87.14 apiece.

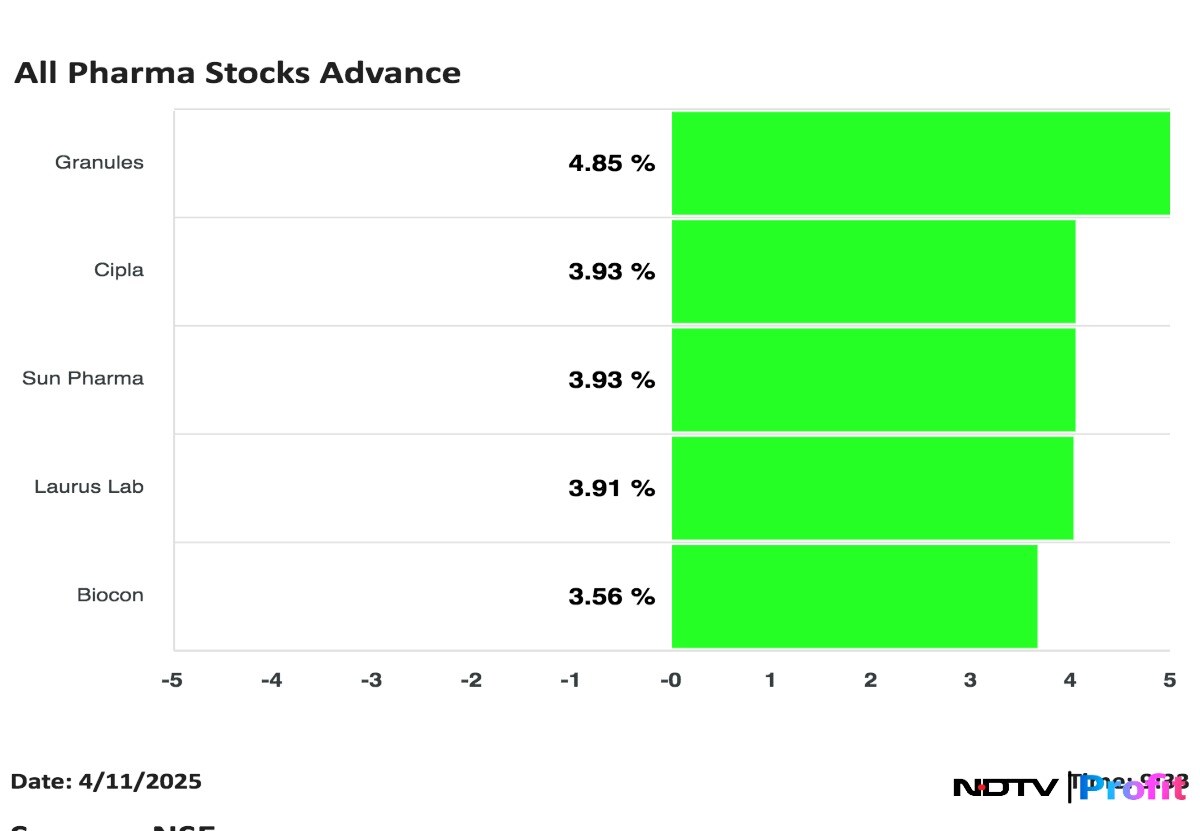

All pharmaceutical stocks were trading in the green, with the Nifty Pharma index trading 2.89% higher.

All pharmaceutical stocks were trading in the green, with the Nifty Pharma index trading 2.89% higher.

Pentagon to end IT contracts from Accenture, Deloitte in $5.1 billion spending cut.

Source: Reuters

IT stocks, which had closed lower in four of the last five sessions, opened broadly in the green today, lead by midcaps Coforge and Mphasis.

IT stocks, which had closed lower in four of the last five sessions, opened broadly in the green today, lead by midcaps Coforge and Mphasis.

All the sectors were trading higher at market open, with gains led by Nifty Pharma and Nifty Metal.

All the sectors were trading higher at market open, with gains led by Nifty Pharma and Nifty Metal.

The NSE Nifty 50 and BSE Sensex opened higher on Friday. The Nifty 50 opened 1.32% higher at 22695.40 after it ended in red in the previous session and Sensex opened 1.34% up at 74,835.49.

Over 1.08 million shares of HDFC Bank were traded via a block deal on Friday. The share price of HDFC Bank rose as much as 2.05% to Rs 1,801.10 apiece.

At pre-open, the NSE Nifty 50 was trading 296 points or 1.32% higher at 22,695.40. The BSE Sensex was 988 points higher at 74,835.49.

The company aims to add 1,000 medical representatives in the next three years.

Source: Exchange Filing

The yield on the 10-year bond opened flat at 6.45%.

Source: Bloomberg

Rupee strengthened 45 paise to open at 86.25 against US dollar.

It ended at 86.70 a dollar on Wednesday.

Source: Bloomberg

The company approved the acquisition of Fintra Software Private for Rs 23 crore.

Source: Exchange Filing

Godrej Consumer Products – Upgrade to overweight from equal-weight; Hike target price to Rs 1,431 from Rs 1,231

Hindustan Unilever – Upgrade to equal-weight from underweight; Hike target price to Rs 2,338 from Rs 2,073

Dabur – Downgrade to underweight from equal-weight; Cut target price to Rs 396 from Rs 475

ITC – Maintain overweight; Cut target price to Rs 500 from Rs 578

Tata Consumer Products – Maintain overweight; Hike target price to Rs 1,255 from Rs 1235

Varun Beverages – Maintain overweight; Hike target price to Rs 615 from Rs 608

Britannia – Maintain equal-weight; Hike target price to Rs 5,511 from Rs 5,157

Nestle – Maintain underweight; Hike target price to Rs 2,081 from Rs 2,033

Marico – Maintain equal-weight; Hike target price to Rs 674 from Rs 625

Reposition staples preferences that are insulated from any reset

Current global backdrop creates domestic uncertainty, giving defensives an opportunity to shine

Believe opportunities should be selective and not broad-based

Competitive intensity may have waned but incumbents unlikely to revive historical growth algo

Any sharp rise in commodity prices could have a negative impact on earnings growth assumptions

Preferred picks: Godrej Consumer Products and Tata Consumer Products

22,300 may act as an immediate and crucial support, and an immediate resistance may be placed at 22,550, says Hardik Matalia, derivative analyst, Choice Broking. A sustained move above this level could attract some buying interest, pushing the index toward the 22,700–22,850 zone according to the analyst.

The drugmaker gets USFDA final approval for Paclitaxel protein-bound particles application for injectable suspension. The product is expected to be launched in H1FY26 in the US.

Note: Protein-bound Paclitaxel is used for treatment of metastatic breast cancer.

Exchange Filing

Pause in US tariffs is a big positive

Pivot market view, brokerage now expects a strong India equities rally

Rally to come amid earnings bottoming out, lower global uncertainty and moderate valuations

Brokerage expects some volatility, but suggests to buy into any consequent corrections

Retains Nifty target at 26,000 for March 2026

Turns positive on technology and materials

Retain overweight on discretionary and healthcare

Cut staples exposure to zero, retain underweight on financials

Nifty April Futures down by 0.56% to 22,479 at a premium of 80 points.

Nifty April futures open interest down by 2%.

Nifty Options April 17 Expiry: Maximum Call open interest at 25,400 and Maximum Put open interest at 20,400.

Put-Call ratio at 1.05, with highest change in Put open interest at 22,400.

Securities in ban period: Birla soft, Hindustan Copper, Manappuram Finance, National aluminium.

The US Dollar index is down 0.69% at 100.17.

Euro was up 1.05% at 1.1319.

Pound was up 0.37% at 1.3018.

Yen was down 0.52% at 143.70.

TCS: The IT company reported a consolidated net profit of Rs 12,224 crore for the March quarter, down 1.3% year-on-year but in line with Bloomberg estimates. Revenue rose marginally to Rs 64,479 crore. The company declared a final dividend of Rs 30 per share.

Tata Steel: Tata Steel Nederland has announced a major transformation programme to enhance its competitiveness. The reorganisation is expected to lead to a loss of 1,600 management and support function roles.

NBCC: The company successfully sold 1,185 residential units at Uttar Pradesh through an e-auction. The total sale value was approximately Rs 1,504.69 crore.

Take a look at other potential market movers for Friday.

Asian markets slumped on Friday, triggered by Washington's confirmation of a steep 145% levy on all Chinese goods entering the country. Japan's Nikkei 225 was down 4.50%, while South Korea's KOSPI declined 1.66%.

On Wall Street, a steep intraday plunge in the S&P 500 took the index dangerously close to triggering circuit breakers. Although equities pared back some of the losses later in the session, the S&P 500 still closed well below its intraday high at 3.46% down. The Dow Jones and the Nasdaq composite also closed 2.50% and 4.31% lower respectively.

The GIFT Nifty was trading above 22,900 early Friday. The futures contract based on the benchmark Nifty 50 fell 0.39% at 22,953.50 as of 7:11 a.m. indicating a negative start for the Indian markets.

The benchmark equity indices ended Wednesday's session lower, snapping their single-day advance. The Nifty 50 ended 136.70 points or 0.61% lower at 22,399.15, while the Sensex closed 379.93 points or 0.51% down at 73,847.15.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.