That wraps up Thursday's live market coverage. Thanks for staying with us!

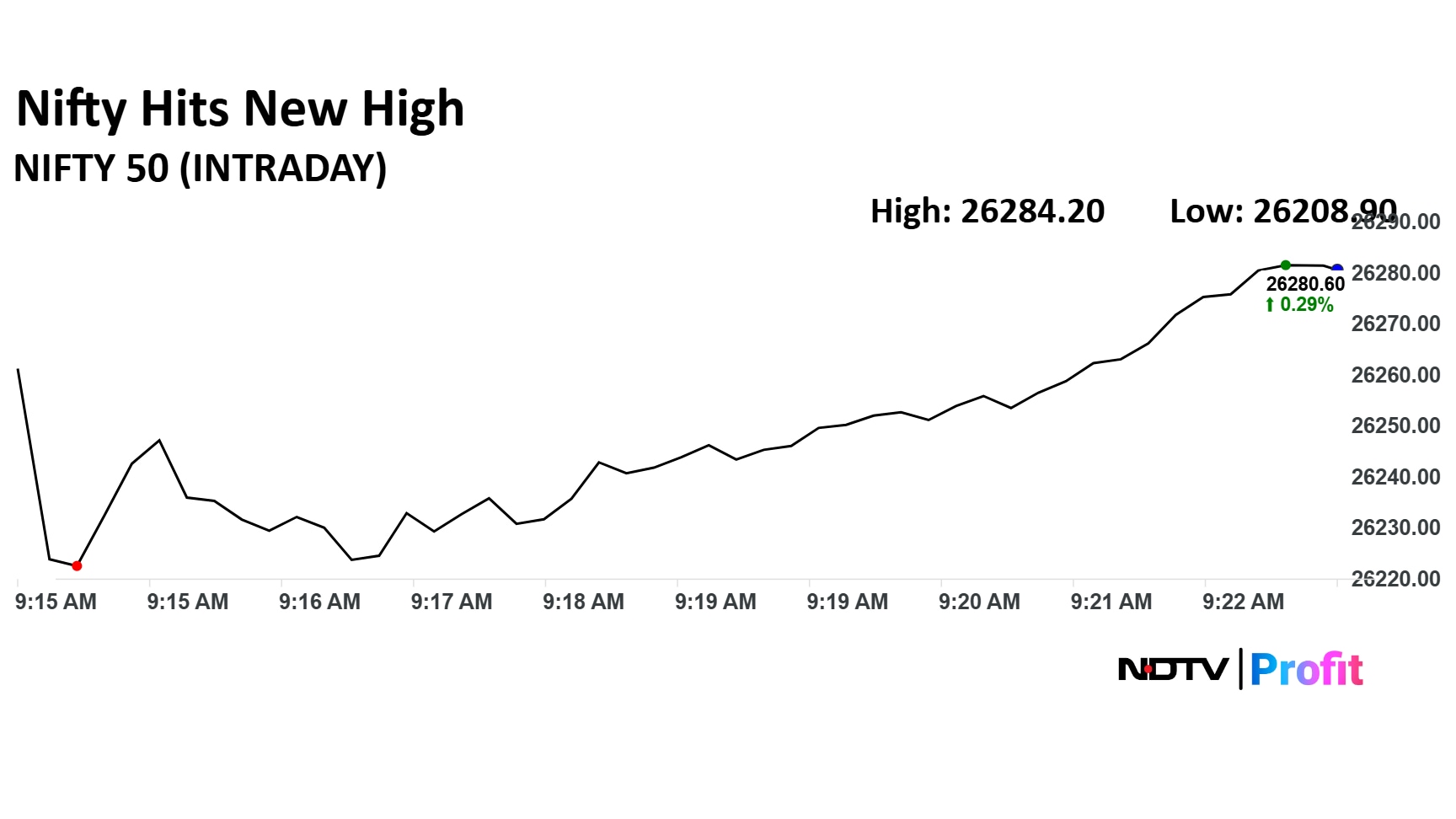

Nifty hit an all time high and close lower for the day

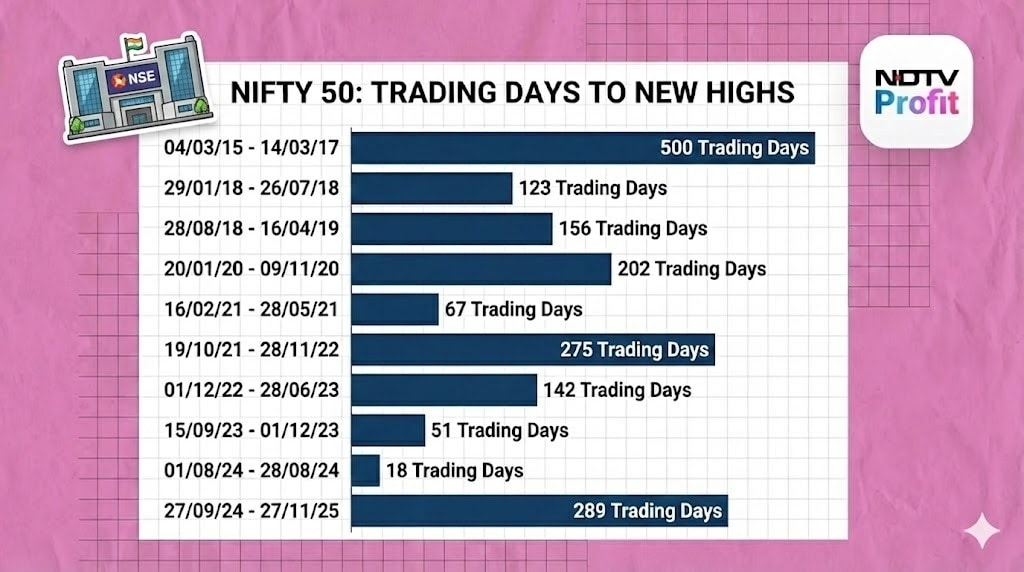

Nifty hit an all-time high after 289 trading sessions

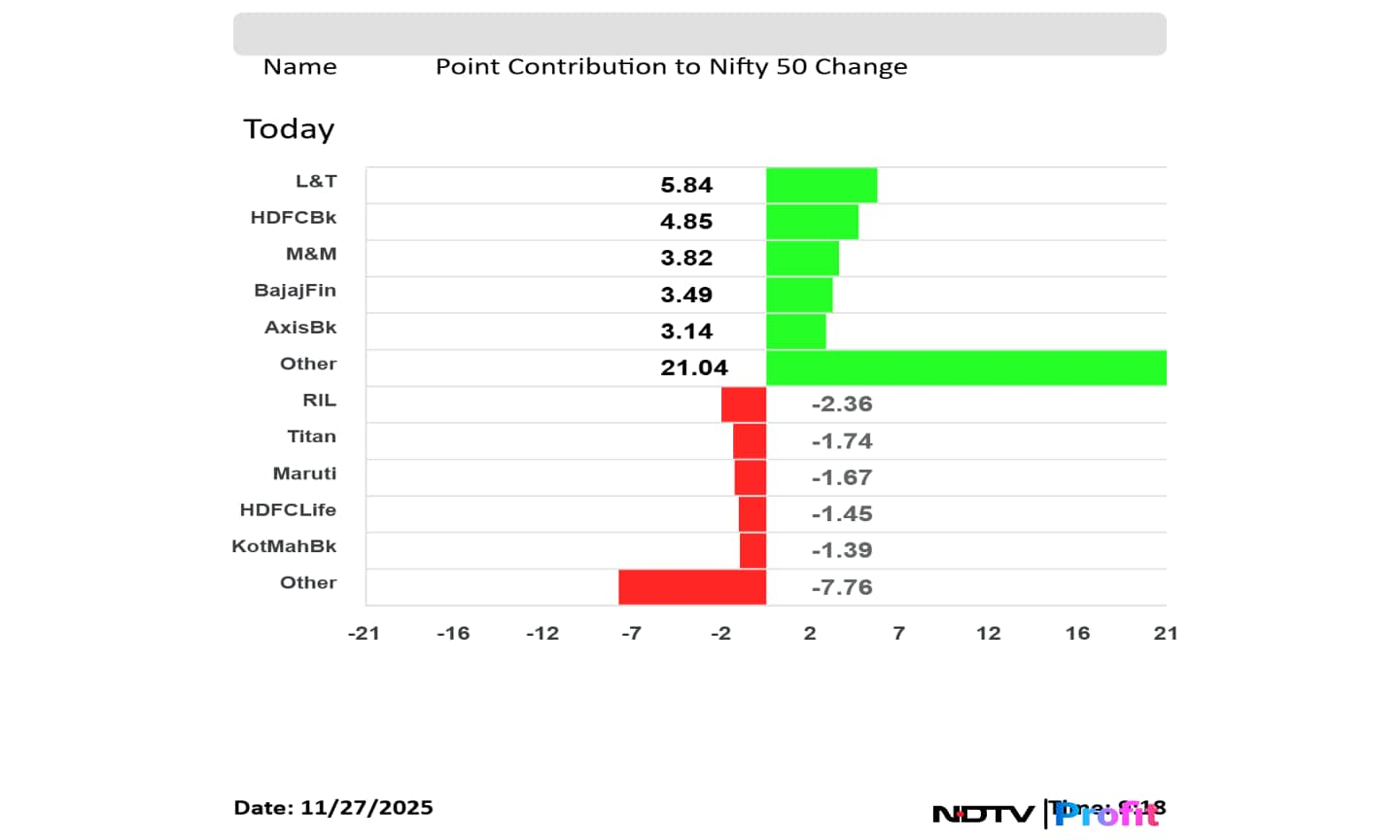

Bharti Airtel, ICICI Bank and RIL contributed the most to Nifty Rally

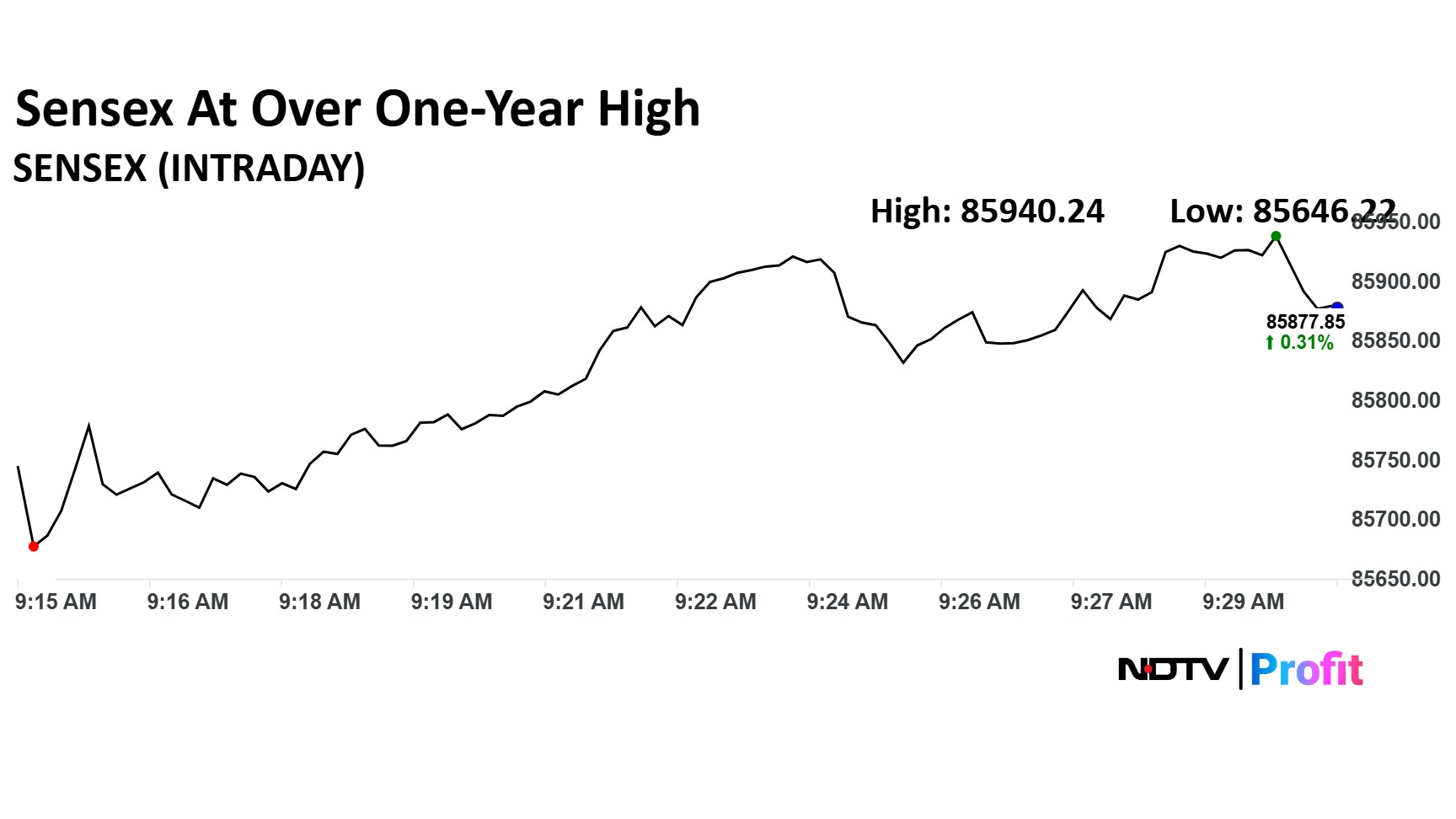

Sensex, Nifty PSU Bank, Nifty Bank, Auto all hit an all time high

Nifty fell over 100 points from the day’s high; close above 26,200 mark

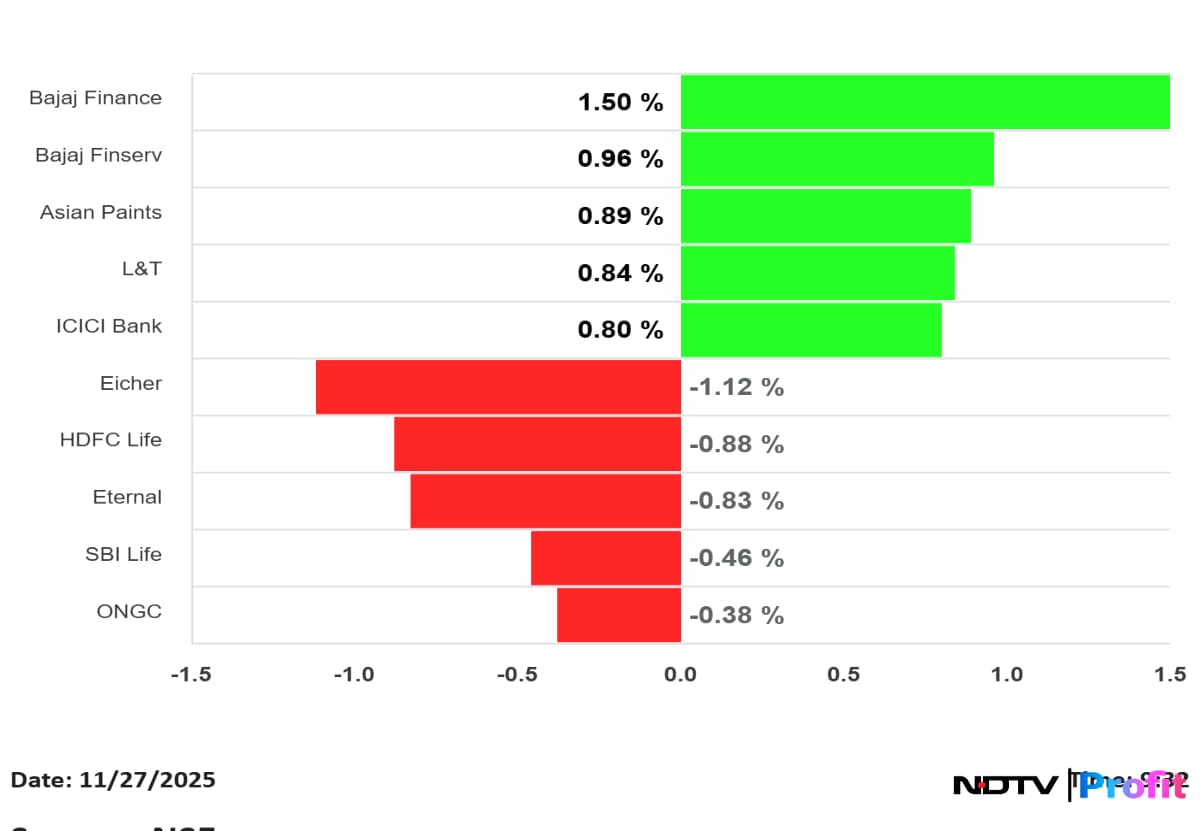

Eicher Motors fell the most in Nifty

Eicher Motors fell over 3% from the day’s high

Benchmarks outperforms broader Market Indices

Nifty Media emerge as the top gaining sector for the day

TV18 Broadcast and Saregama gain the most in Nifty Media

Nifty hit an all time high and close lower for the day

Nifty hit an all-time high after 289 trading sessions

Bharti Airtel, ICICI Bank and RIL contributed the most to Nifty Rally

Sensex, Nifty PSU Bank, Nifty Bank, Auto all hit an all time high

Nifty fell over 100 points from the day’s high; close above 26,200 mark

Eicher Motors fell the most in Nifty

Eicher Motors fell over 3% from the day’s high

Benchmarks outperforms broader Market Indices

Nifty Media emerge as the top gaining sector for the day

TV18 Broadcast and Saregama gain the most in Nifty Media

Rupee closed 4 paise weaker at 89.31 against US Dollar

It closed at 89.27 a dollar on Wednesday

Source: Bloomberg

There is no excitement despite the NSE Nifty 50 index hit a new high on Thursday as investors' portfolios did not perform well, said Quant Mutual Fund Founder Sandeep Tandon. However, he said that in the current situation, investors should participate rather than sitting on the sidelines.

India’s Real Estate Investment Trust market, which recently crossed the Rs 1 lakh crore market capitalisation milestone, is set for an additional Rs 10.8 lakh Crore expansion across office and retail sectors over the next four years, according to JLL.

Patel Engineering’s share price surged over 16% on Thursday after the company announced receiving two Letters of Intent from Saidax Engineers and Infrastructure.

Shares of Ashok Leyland Ltd. surged 6.39% on Thursday after B&K Securities’ channel checks signalled a strong commercial vehicle upcycle gaining momentum. Wholesale volumes for November are expected at 12,000–13,000 units, with vendors and dealers indicating robust schedules through March 2026.

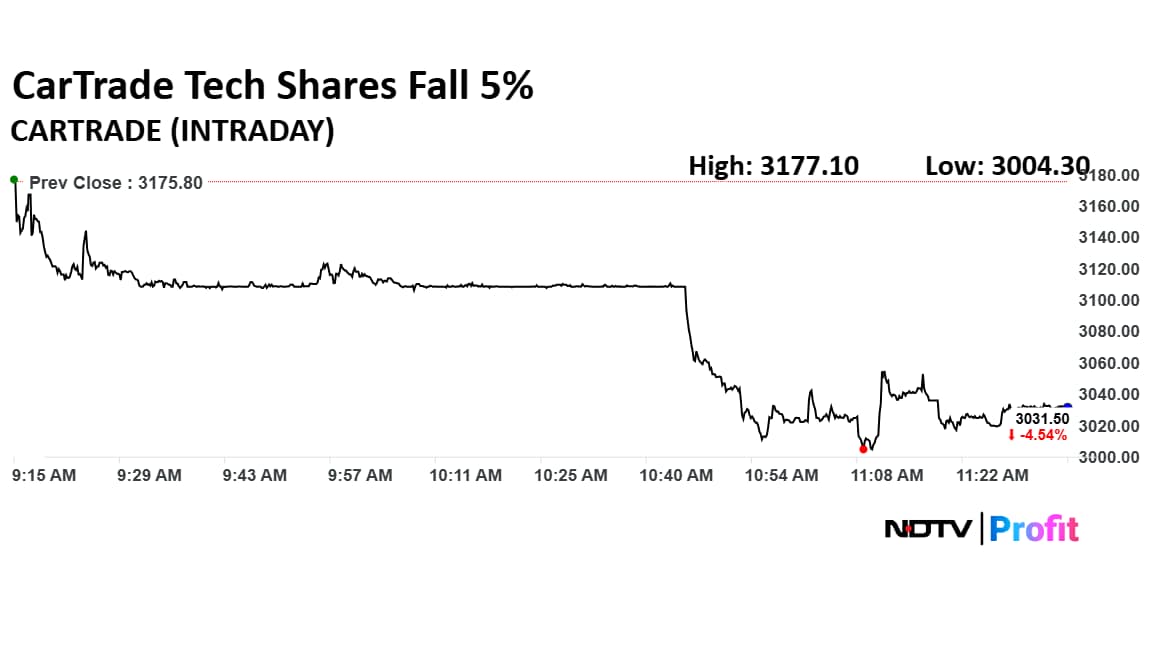

CarTrade Tech Ltd. shares fell over 5% on Thursday after it called off its proposed deal with Girnar Software, the parent company of CarDekho and BikeDekho. The deal was for potential consolidation in their automotive classifieds businesses in India.

CarTrade Tech Ltd. shares fell over 5% on Thursday after it called off its proposed deal with Girnar Software, the parent company of CarDekho and BikeDekho. The deal was for potential consolidation in their automotive classifieds businesses in India.

Helios Capital CEO Dinshaw Irani is fairly overweight on BFSI, consumers, platform companies and hospitality.

Irani believes its the fundamental trigger playing vs tariff trigger expected earlier.

Last September was a weak quarter, so a good base is also working in favour.

He expects a mid-teens growth in December.

Juniper Hotels's board approved to in insolvency proceeding of Gstaad Hotels. Target asset under Gstaad Hotels' insolvency proceeding is a property in Bengaluru.

The Committee of Creditors has determined claims worth Rs 1,175 crore for Gstaad Hotels Insolvency, the company said in the exchange filing.

Granules India incorporated a wholly-owned arm, Granules Pharmaceuticals, Canada, the company said in the exchange filing.

The Nifty's all-time high of 26,295.55 on Thursday has triggered a wave of cautious optimism across Dalal Street, with top market voices urging investors to celebrate the milestone but keep expectations measured.

Ajay Srivastava, the managing director of Dimensions Consulting, summed up the mood bluntly: "I feel relieved. That's the only word that comes to mind because this has been a very, very bad year for all of us. It's not because India has performed poorly, but because everyone else has performed so well."

Indian Hume Pipe signed a pact to sell 18,312 quare yards of freehold land in Hyderabad for Rs 174 crore. The company also signed a pact with Ashoka Builders India to sell freehold land in Hyderabad.

Indian equity benchmarks scaled fresh all-time highs as Nifty surged after 289 trading sessions to set a new record, while Sensex followed suit. The rally was powered by heavyweights like Bharti Airtel Ltd., ICICI Bank, and Reliance Industries Ltd., alongside standout performers such as Eicher Motors Ltd. and Bharat Electronics Ltd., which posted sharp gains from previous peaks.

JPMorgan has turned more optimistic on India’s market trajectory, raising its Nifty 50 base case target to 30,000 by the end of 2026.

The outlook is shaped by several events investors should monitor: developments in bilateral trade agreements with the US and EU, the festive season trajectory, the upcoming RBI and US Federal Reserve meetings, India’s FY26–27 Union Budget, a revamped methodology for economic indicators, and key state elections in 2026.

Rategain Travel Technologies Ltd extended long-standing partnership with Singapore Airlines for four more years, the company said in the exchange filing.

India’s quick commerce players are recalibrating their strategies, and JPMorgan believes the competitive landscape is quietly undergoing another shift. After months of intense discounting, the battleground is moving away from subsidies and towards performance-led marketing, with Blinkit and Swiggy Instamart taking the lead while Zepto pulls back.

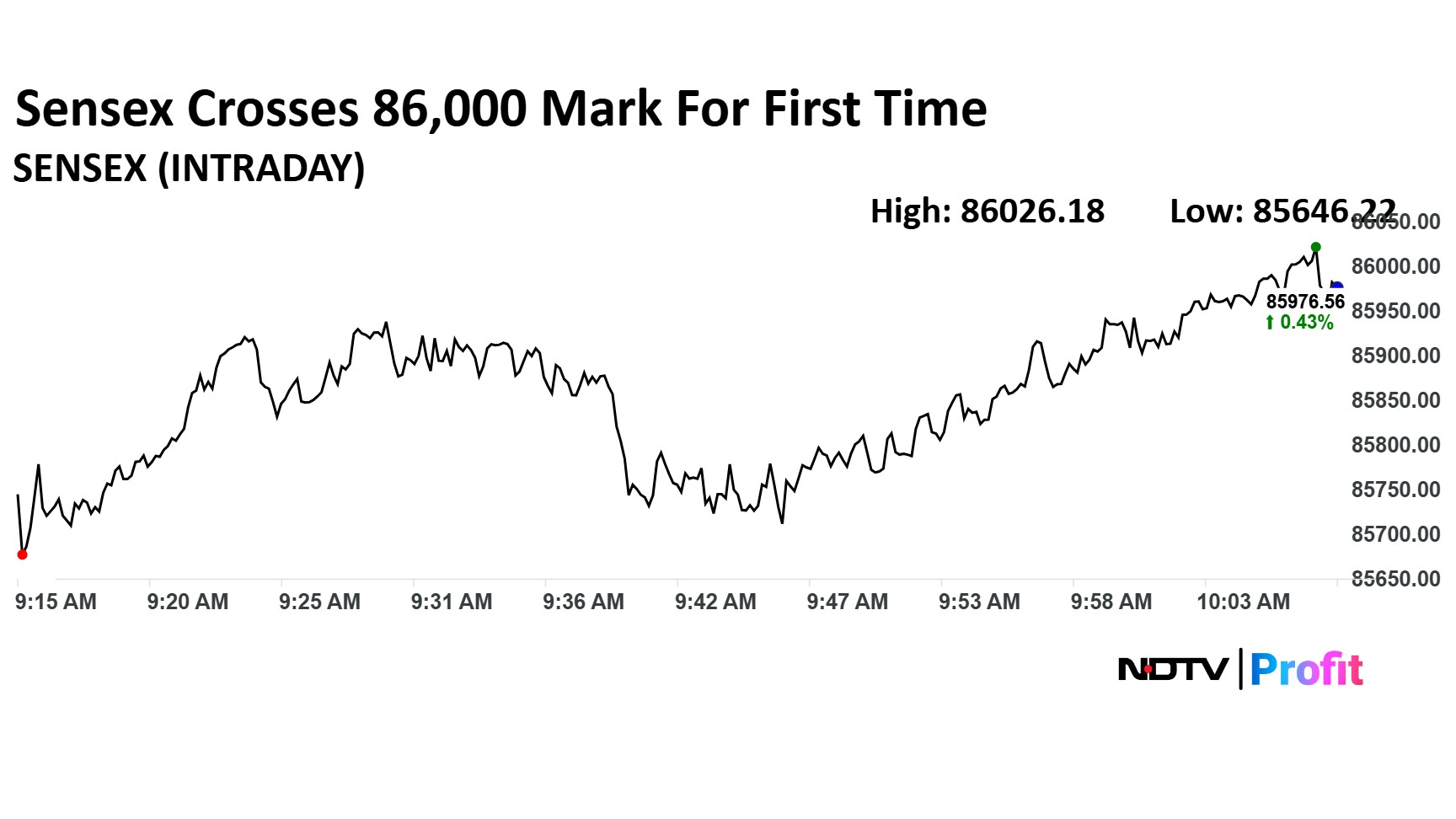

Nifty 50 and BSE Sensex hit an all-time high after 14 months on Thursday with Bharti Airtel Ltd., ICICI Bank Ltd. and Reliance Industries Ltd. leading the gains. BSE Sensex crossed 86,000 mark for first time. The surge was buoyed by positive global cues and surge in Nifty Bank.

The Nifty 50 surged 0.39% to hit 26,306.95, while the Sensex climbed 0.46% to 86,006.88 as of 10:13 a.m. This comes after the indices rose over 1.2% each in the previous session.

India’s benchmark indices climbed to new peaks on Thursday, with both Nifty and Sensex marking their highest levels on record after recovering from a steep correction earlier this year.

The Nifty index touched 26,295.55 in trade, surpassing its previous record of 26,277 set in September 2024. The Sensex also hit an all-time high. The move follows a rebound in the market after both indices dropped more than 15% from their earlier peak recorded on April 7, 2025. They have since rallied about 18% to reach today’s highs. It took Nifty roughly 289 trading sessions to reclaim a new high from its September 2024 peak, the second-longest such recovery period in the past decade.

Glenmark Pharma received 'Voluntary Action Indicated' from the US Food and Drug Administration for formulations manufacturing unit in Monroe Commercial Manufacturing. The facility at the Monroe site will now restart

The US FDA inspected Monroe facility from June 9-17. The Monroe site was earlier under warning letter since June 2023

The benchmark Nifty 50 index hit a fresh record high on Thursday's trading session, finally topping its previous peak set nearly 14 months ago.

The index touched the 26,295.55 mark in trade, surpassing the previous all-time high of 26,277 set in Sept. 2024, after which followed a period of slowdown.

The BSE Sensex rose to a new high and crossed 86,000 mark for first time. The index was trading 0.46% higher at 86,6006.88 as of 10:13 a.m.

The BSE Sensex rose to a new high and crossed 86,000 mark for first time. The index was trading 0.46% higher at 86,6006.88 as of 10:13 a.m.

CarTrade Tech Ltd. on Thursday said that its proposed deal with Girnar Software, the parent company of CarDekho and BikeDekho, regarding a potential consolidation in their automotive classifieds businesses in India has been called off.

Share price of appliance maker Whirlpool of India Ltd. took a hit in early trade on Thursday after the execution of a block deal worth Rs 1,000 crore, as per Bloomberg data.

The NSE Nifty Midcap 150 was trading in a small range, while the NSE Nifty Smallcap 250 was trading flat.

Ashok Leyland, National Aluminium Co, and Coromandel International were top gainers in the NSE Nifty Midcap 150 index. Meanwhile,Whirlpool India Ltd., Jubilant Industries Ltd., and DCM Shriram Ltd. were top losers in the NSE Nifty Smallcap 250 index.

The NSE Nifty Midcap 150 was trading in a small range, while the NSE Nifty Smallcap 250 was trading flat.

Ashok Leyland, National Aluminium Co, and Coromandel International were top gainers in the NSE Nifty Midcap 150 index. Meanwhile,Whirlpool India Ltd., Jubilant Industries Ltd., and DCM Shriram Ltd. were top losers in the NSE Nifty Smallcap 250 index.

The BSE Sensex rose 0.39% to a 52-week high of 85,939.28.

The BSE Sensex rose 0.39% to a 52-week high of 85,939.28.

The NSE Nifty rose 0.34% to a new high of 26,284.20 as HDFC Bank Ltd. and Larsen & Toubro Ltd. shares led. The index took 289 trading days to hit a new high.

The NSE Nifty rose 0.34% to a new high of 26,284.20 as HDFC Bank Ltd. and Larsen & Toubro Ltd. shares led. The index took 289 trading days to hit a new high.

The yield on the 10-year bond opened flat at 6.44%

Source: Bloomberg

Rupee opened 6 paise stronger at 89.21 against US Dollar

It closed at 89.27 a dollar on Wednesday

Source: Bloomberg

US Food and Drug Administration classified Biocon Biologics’ Drug substance facility in Bengaluru as 'Voluntary Action Indicated'. The US FDA inspected Bengaluru facility from Aug 26-Sept 3, Biocon said in an exchange filing.

Kotak Institutional Equities has initiated coverage on full-stack home-services platform Urban Company Ltd., on a bearish note. The brokerage has ascribed a 'sell' rating on the firm, with a target price of Rs 120 apiece.

The brokerage sees steady growth ahead in both India and overseas markets and expects the core India consumer services business to deliver strong improvement in profitability over the next few years. However, it notes that the newly launched Insta Help vertical will need meaningful investment.

ICICI Securities has initiated coverage on Travel Food Services Ltd. with a ‘Buy’ rating and a target price of Rs 1,600, citing a strong structural growth story in the travel food and lounge segment.

Macquarie has turned positive on Indian equities for the calendar year 2026 as it sees three tailwinds assisting the markets. Its top core choices are HDFC Bank Ltd., Reliance Industries Ltd., Mahindra & Mahindra Ltd., Divi's Laboratories Ltd., JSW Steel Ltd.

Tata Consumer Products Ltd., MakeMy Trip Ltd., Lemon Tree Hotels Ltd., L&T Technology Services Ltd., Delhivery Ltd., and Aditya Birla Capital Ltd. are six rising stars, according to Macquarie.

Gold prices continued to rise for second session as market participants anticipate a rate cut in the US next month. Lower interest rates make the precious metal affordable for countries that use other currencies than US dollar.

In India, bullion prices rose 0.6% to Rs 1,26,570 per 10 gram. Meanwhile, in global markets, gold prices consolidated early morning after rising over 1% in the previous session.

Paytm parent One 97 Communications Ltd., Whirlpool of India Ltd., Asian Paints Ltd., Oberoi Realty Ltd. and J&K Bank Ltd. are some of the key stock that will draw market attention today after their corporate announcements.

Learn about more stocks which will likely be in focus on Thursday here.

The GIFT Nifty was trading 0.05% or 13.50 points higher at 26,422 as of 6:51 a.m., which implied a positive open for the benchmark index, NSE Nifty 50.

Traders will keep an eye for Bayer Cropscience Ltd., Zydus Lifesciences Ltd., NCC Ltd., Indian Overseas Bank Ltd., United Breweries Ltd., and Aditya Birla Capital Ltd. shares.

The NSE Nifty 50 closed 74.7 points or 0.29% lower at 25,884.8, while the BSE Sensex ended 313.7 points or 0.37% down at 84,587.01 on Tuesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.