And that's a wrap for NDTV Profit's real-time market coverage on Aug 12. Thank you for joining us today.

Benchmark outperforms broader market indicies

Sectoral indices end mixed; Pharma, Media top gainers, Finserv, Bank fall the most

Nifty pharma gains for second day in row , gains led by Alkem lab and biocon

Nifty fin services falls the most , dragged by Bajaj finance and CIFC

Benchmark outperforms broader market indicies

Sectoral indices end mixed; Pharma, Media top gainers, Finserv, Bank fall the most

Nifty pharma gains for second day in row , gains led by Alkem lab and biocon

Nifty fin services falls the most , dragged by Bajaj finance and CIFC

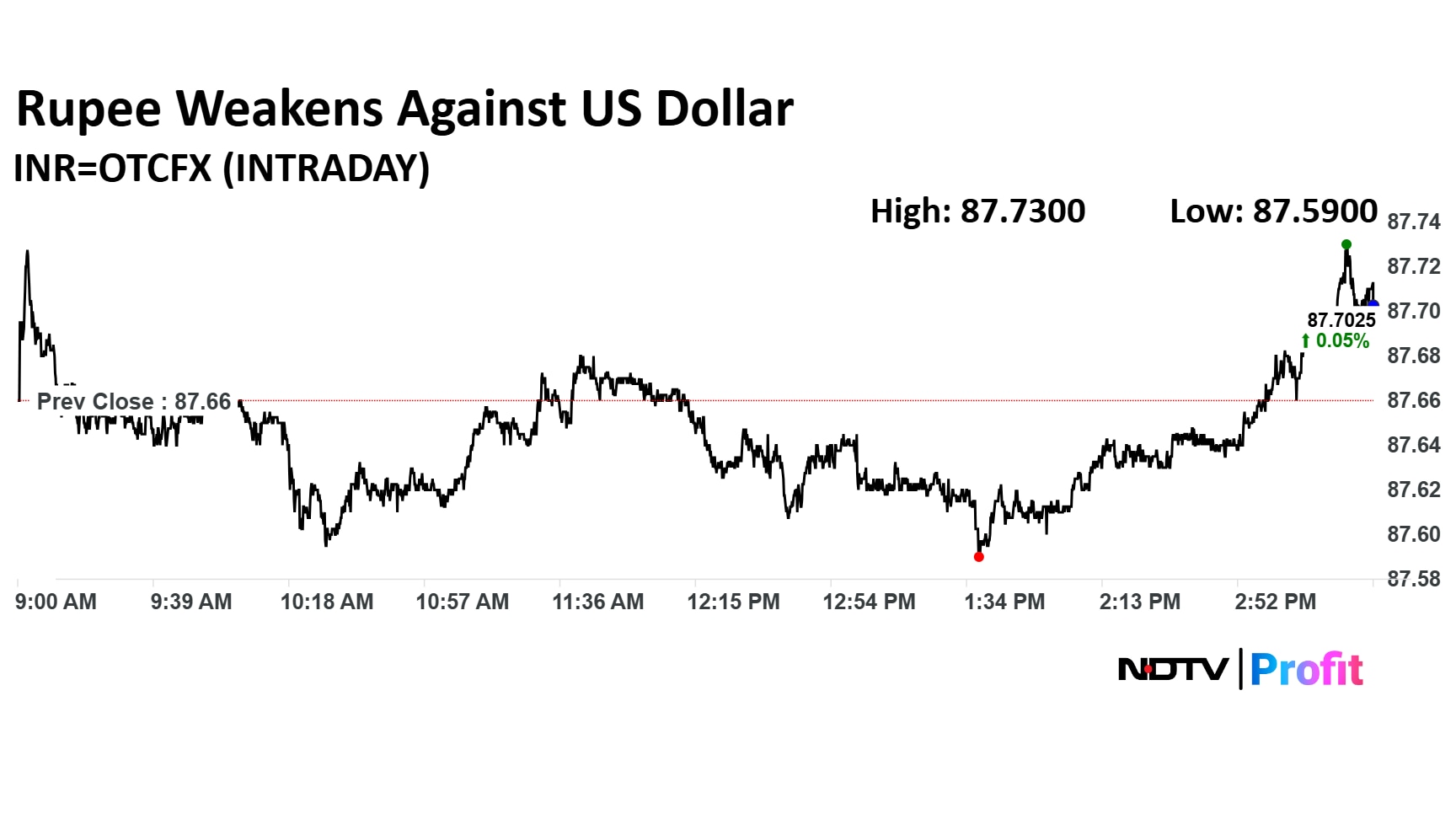

Rupee opened 5 paise weaker at 87.71 a dollar

It closed at 87.66 a dollar on Monday.

Source: Bloomberg

Rupee opened 5 paise weaker at 87.71 a dollar

It closed at 87.66 a dollar on Monday.

Source: Bloomberg

PTC Industries has announced a memorandum of understanding with Kineco Aerospace to collaborate on value-added aerospace components and structures, the exchange filing said.

India's hospitality sector has witnessed a sustained demand momentum over last three years. According to experts, the outlook for sector remains buoyant as the demand outpaces supply and discretionary spends.

In the current scenario, Indian Hotels Company Ltd's chief has said that the majority growth for the company is coming from the mid market segment.

Puneet Chhatwal, Managing Director and Chief Executive Officer, IHCL told NDTV Profit that the company expects its Ginger brand to contribute 15% to revenue going forward. "Profitability of the Ginger brand is increasing," he noted.

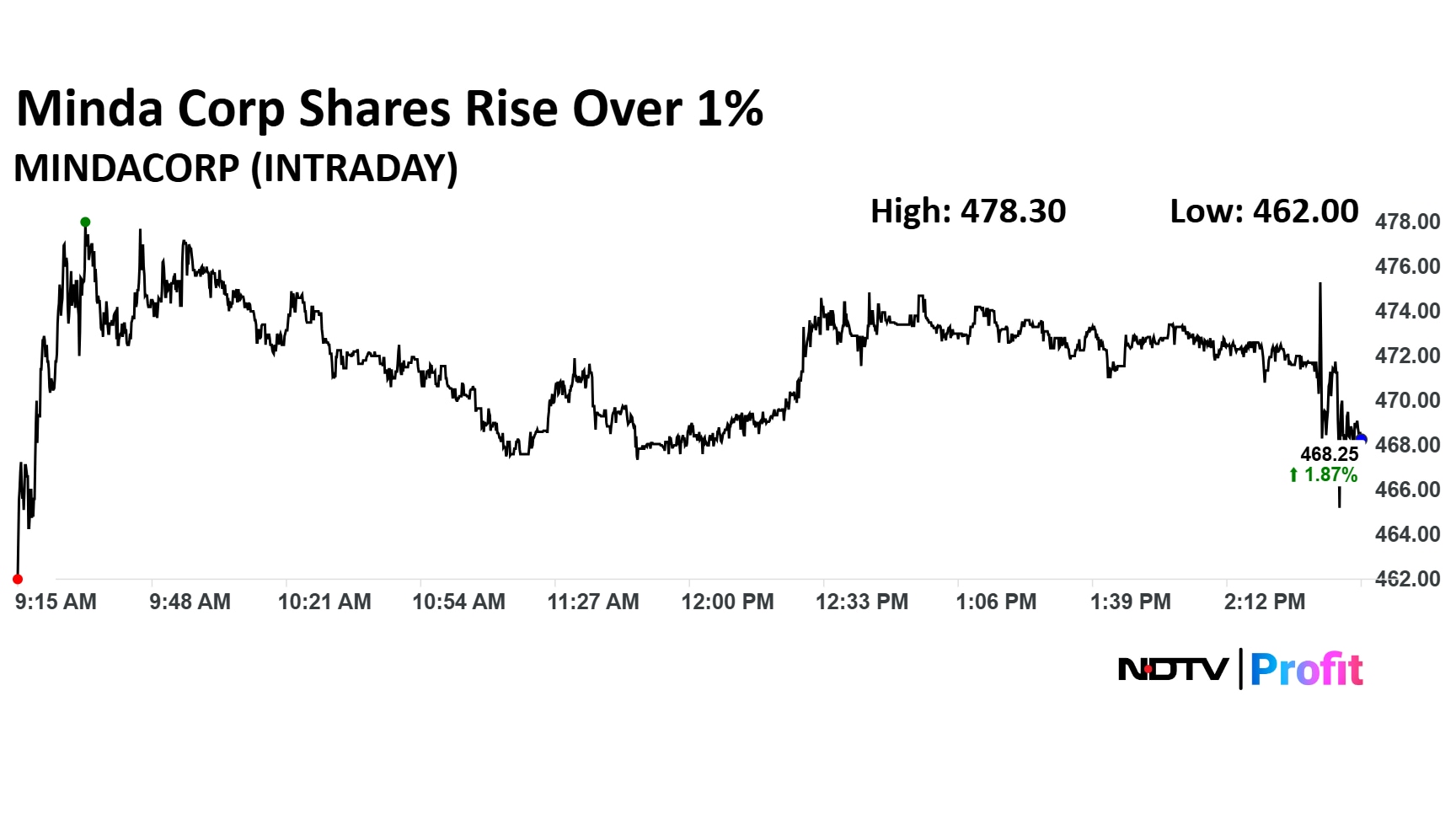

Minda Corp Q1 Highlights (Cons, YoY)

Revenue up 16.2% to Rs 1,385 crore versus Rs 1,192 crore

Ebitda up 19% to Rs 155 crore versus Rs 130.70 crore

Margin at 11.2% versus 11.0%

Net Profit up 2% to Rs 65.30 crore versus Rs 64.20 crore

Minda Corp Q1 Highlights (Cons, YoY)

Revenue up 16.2% to Rs 1,385 crore versus Rs 1,192 crore

Ebitda up 19% to Rs 155 crore versus Rs 130.70 crore

Margin at 11.2% versus 11.0%

Net Profit up 2% to Rs 65.30 crore versus Rs 64.20 crore

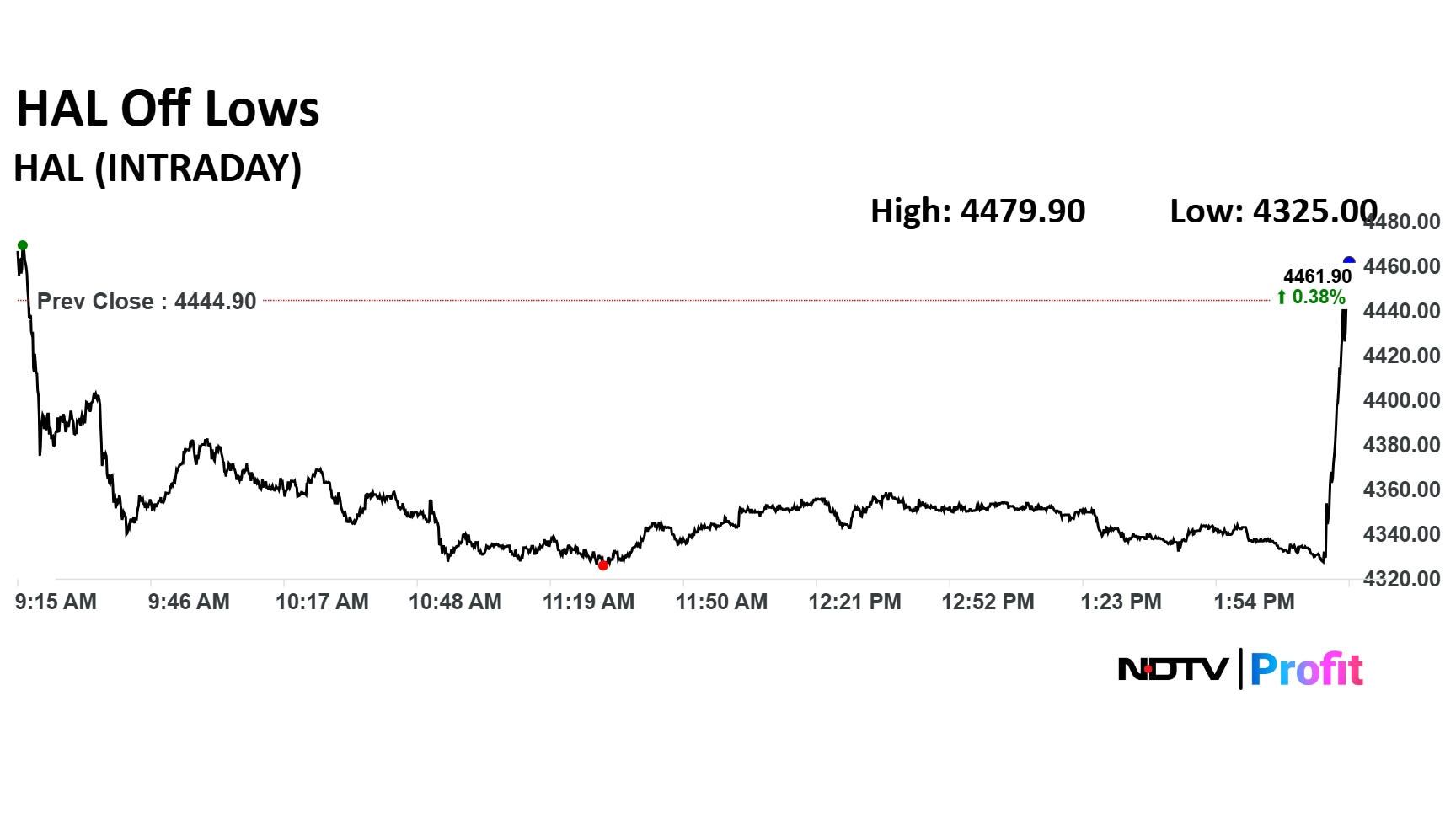

HAL Q1 Highlights (Cons, YoY)

Revenue up 10.9% to Rs 4,819 crore versus Rs 4,347 crore

Ebitda up 30% to Rs 1,282.30 crore versus Rs 990.14 crore

Margin at 26.6% versus 22.8%

Net Profit down 4% to Rs 1,383 crore versus Rs 1,437 crore

HAL Q1 Highlights (Cons, YoY)

Revenue up 10.9% to Rs 4,819 crore versus Rs 4,347 crore

Ebitda up 30% to Rs 1,282.30 crore versus Rs 990.14 crore

Margin at 26.6% versus 22.8%

Net Profit down 4% to Rs 1,383 crore versus Rs 1,437 crore

NDTV Profit India has been tracking the action in the top dealing rooms of India’s financial capital, and this edition of ‘Heard On The Street’ provides you with buzzing action on stocks like Biocon, Cipla, Himadri Speciality, Apollo Hospital, Suzlon, M&M and Kaynes Tech.

Heard On The Street provides readers with what well-informed investors, especially HNIs, FIIs, DIIs, and mutual funds, are buying and selling in the stock market. It also tracks the latest unconfirmed/unverified chatter around stocks and/or sectors.

Ingersoll Rand Q1 Highlights (YoY)

Revenue up 0.4% to Rs 315 crore versus Rs 314 crore.

Ebitda down 6.2% to Rs 74.2 crore versus Rs 79.2 crore.

Margin at 23.5% versus 25.2%

Net Profit down 4.7% to Rs 58.9 crore versus Rs 61.9 crore.

Track live updates on Q1 earnings here.

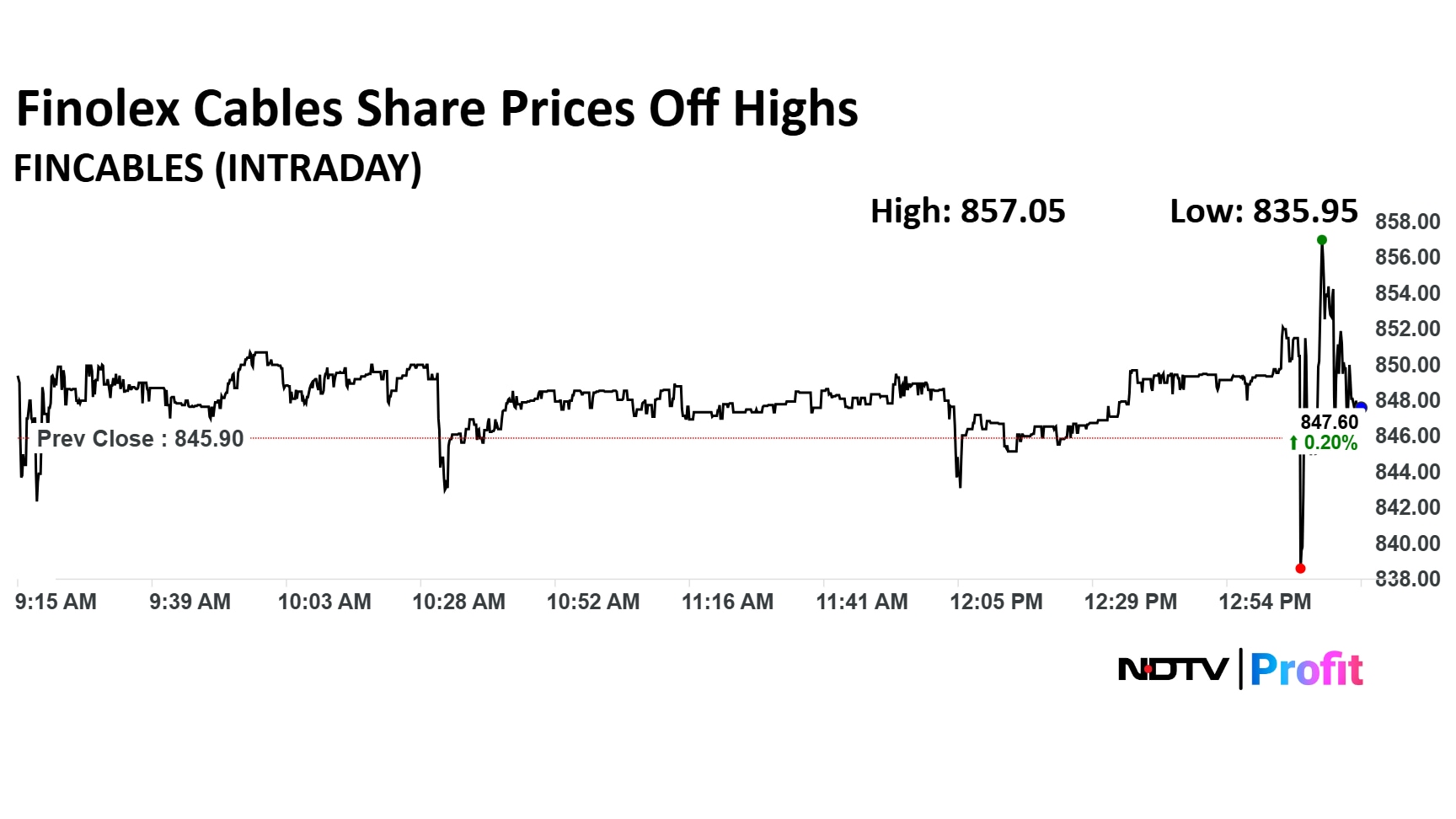

Finolex Cables Q1 Highlights (Consolidated, YoY)

Revenue up 13.4% at Rs 1,396 crore versus Rs 1,230 crore

EBITDA up 7.5% at Rs 136 crore versus Rs 127 crore

Margin at 9.8% Vs 10.3%

Net Profit down 33.3% At Rs 163 crore versus Rs 244 crore

Finolex Cables Q1 Highlights (Consolidated, YoY)

Revenue up 13.4% at Rs 1,396 crore versus Rs 1,230 crore

EBITDA up 7.5% at Rs 136 crore versus Rs 127 crore

Margin at 9.8% Vs 10.3%

Net Profit down 33.3% At Rs 163 crore versus Rs 244 crore

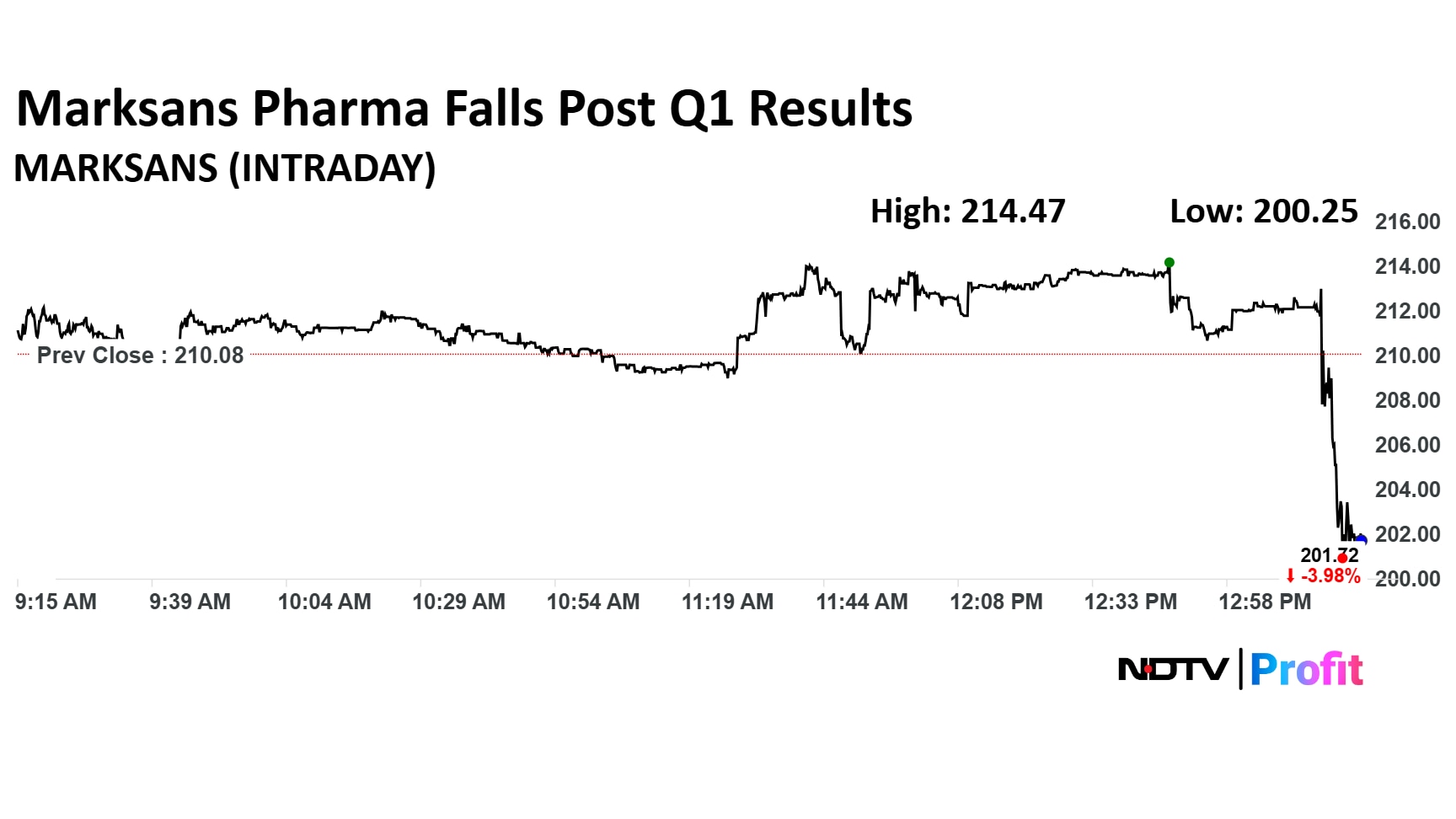

Markans Pharma Q1 Highlights (Consolidated, YoY)

Revenue up 5% at Rs 620 crore versus Rs 591 crore

EBITDA down 22.1% at Rs 100 crore versus Rs 128 crore

Margin at 16.1% versus 21.7%

Net Profit down 34.3% at Rs 58.3 crore versus Rs 88.8 crore

Markans Pharma Q1 Highlights (Consolidated, YoY)

Revenue up 5% at Rs 620 crore versus Rs 591 crore

EBITDA down 22.1% at Rs 100 crore versus Rs 128 crore

Margin at 16.1% versus 21.7%

Net Profit down 34.3% at Rs 58.3 crore versus Rs 88.8 crore

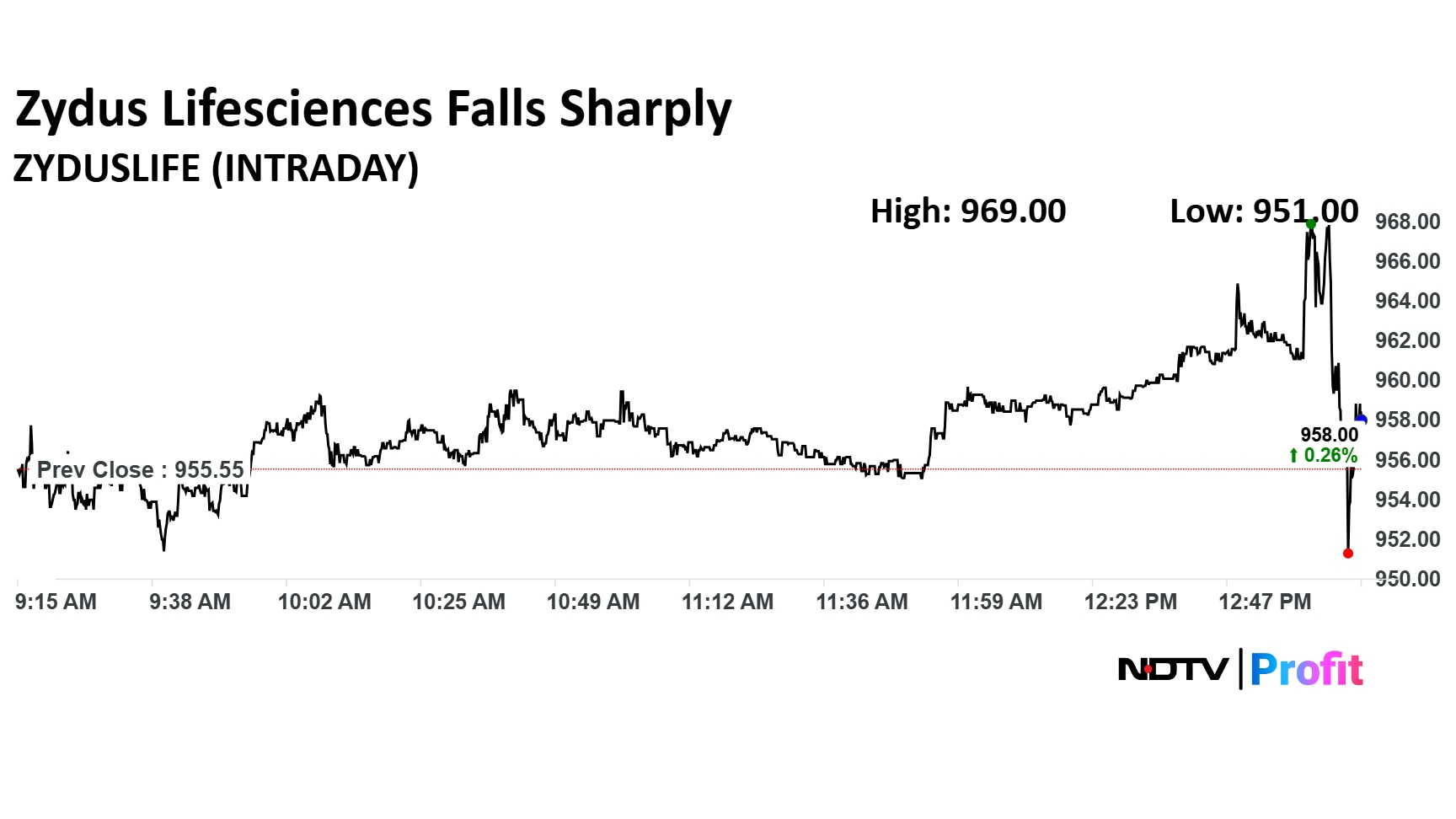

Zydus Lifesciences Q1 Earnings Key Highlights (Consolidated, YoY)

Net Profit rose 3.3% to Rs 1,467 crore versus Rs 1,420 crore

Revenue rose 5.9% to Rs 6,574 crore versus Rs 6,208 crore

Ebitda rose 0.2% to Rs 2,089 crore versus Rs 2,084 crore

Margin at 31.8% versus 33.6%

Zydus Lifesciences Q1 Earnings Key Highlights (Consolidated, YoY)

Net Profit rose 3.3% to Rs 1,467 crore versus Rs 1,420 crore

Revenue rose 5.9% to Rs 6,574 crore versus Rs 6,208 crore

Ebitda rose 0.2% to Rs 2,089 crore versus Rs 2,084 crore

Margin at 31.8% versus 33.6%

Granules India Q1 Highlights (Cons, YoY)

Revenue up 2.6% to Rs 1,210 crore versus Rs 1,180 crore

Ebitda down 4.9% to Rs 247 crore versus Rs 259 crore

Margin at 20.4% versus 22%

Net Profit down 16.3% to Rs 113 crore versus Rs 135 crore

Track live updates on Q1 earnings here.

Granules India Q1 Highlights (Cons, YoY)

Revenue up 2.6% to Rs 1,210 crore versus Rs 1,180 crore

Ebitda down 4.9% to Rs 247 crore versus Rs 259 crore

Margin at 20.4% versus 22%

Net Profit down 16.3% to Rs 113 crore versus Rs 135 crore

Track live updates on Q1 earnings here.

India’s top textile exporters face a mixed global outlook as the India–UK Free Trade Agreement (FTA) opens a duty-free route to the British market while tariff uncertainty clouds prospects in the United States, their largest export destination.

The BSE reported a 9% jump in net profit for the first quarter, reaching Rs 539.41 crore and Sundararaman Ramamurthy, the managing director and chief executive officer of BSE Ltd, described the numbers as "very good and the first of its kind in the last 150 years of BSE."

In a conversation with NDTV Profit on Monday, Ramamurthy noted that he is optimistic on the exchange's outlook, linking potential growth to India's broader economic trajectory.

Premier Explosives Ltd. share price declined after a blast at its facility in Telangana claimed the life of one worker. This is the second such blast at this unit, which has raised questions about safety measures.

Premier Explosives Ltd. share price declined after a blast at its facility in Telangana claimed the life of one worker. This is the second such blast at this unit, which has raised questions about safety measures.

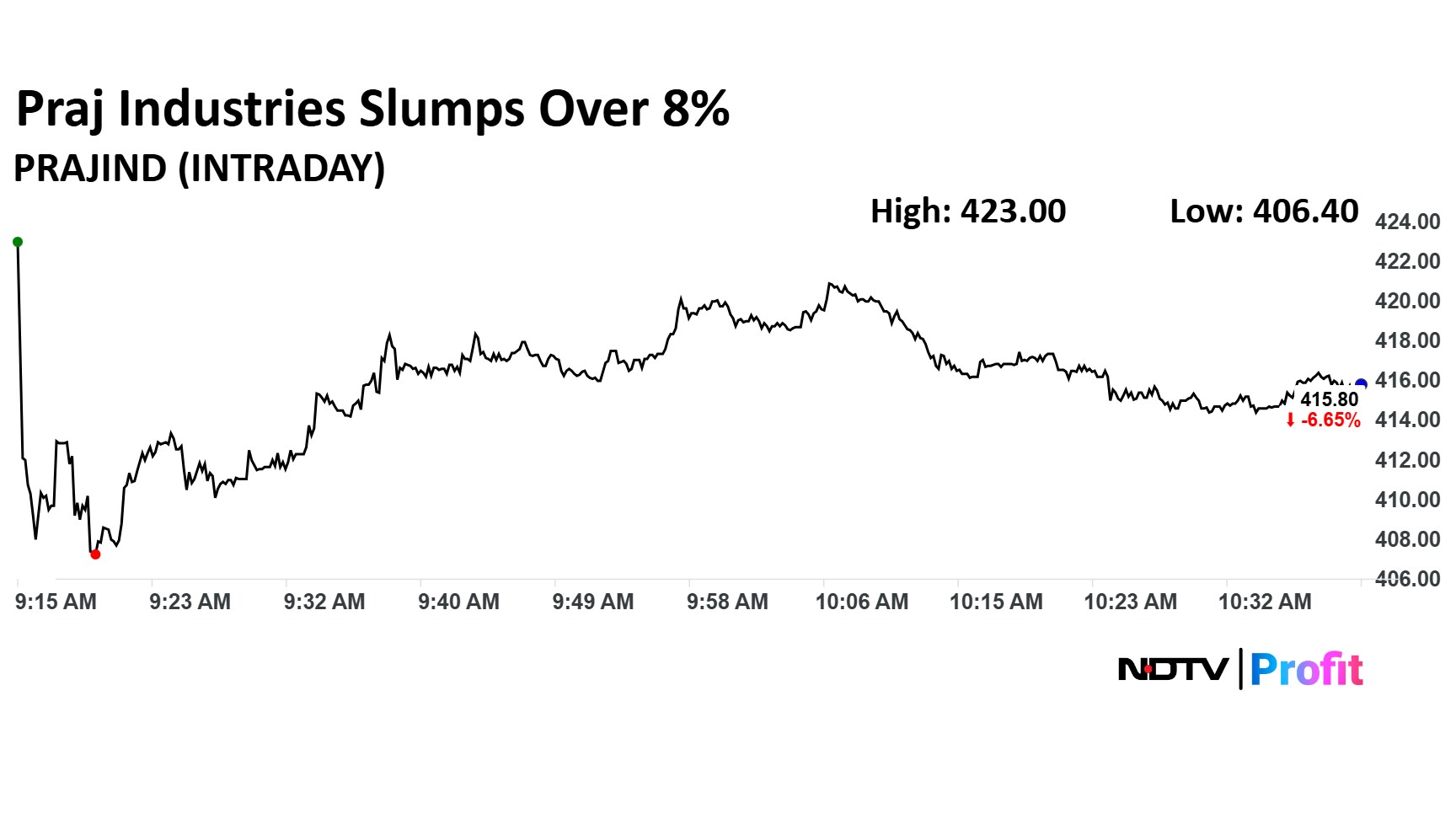

Praj Industries Ltd.'s share price slumped to the lowest level in two years as the company reported disappointing results for April–June period. Its topline, operating profit, and net profit all declined.

Praj Industries' consolidated net profit plunged 94% on the year to Rs 5.30 crore. Its revenue fell 8.4% to Rs 640 crore during April–June from Rs 699 crore. Its Ebitda declined 59% to Rs 35.30 crore during first quarter from Rs 84 crore.

Praj Industries Ltd.'s share price slumped to the lowest level in two years as the company reported disappointing results for April–June period. Its topline, operating profit, and net profit all declined.

Praj Industries' consolidated net profit plunged 94% on the year to Rs 5.30 crore. Its revenue fell 8.4% to Rs 640 crore during April–June from Rs 699 crore. Its Ebitda declined 59% to Rs 35.30 crore during first quarter from Rs 84 crore.

Tata Teleservices is in pact with McAfee to strengthen cybersecurity for medium small and micro enterprises in India.

Stallion India Fluorochemicals Ltd. share price jumped 11% in Tuesday's session. The company signed a memorandum of understanding with the Rajasthan Government to build 32 new refrigerant gas manufacturing plant.

Stallion India Fluorochemicals Ltd. share price jumped 11% in Tuesday's session. The company signed a memorandum of understanding with the Rajasthan Government to build 32 new refrigerant gas manufacturing plant.

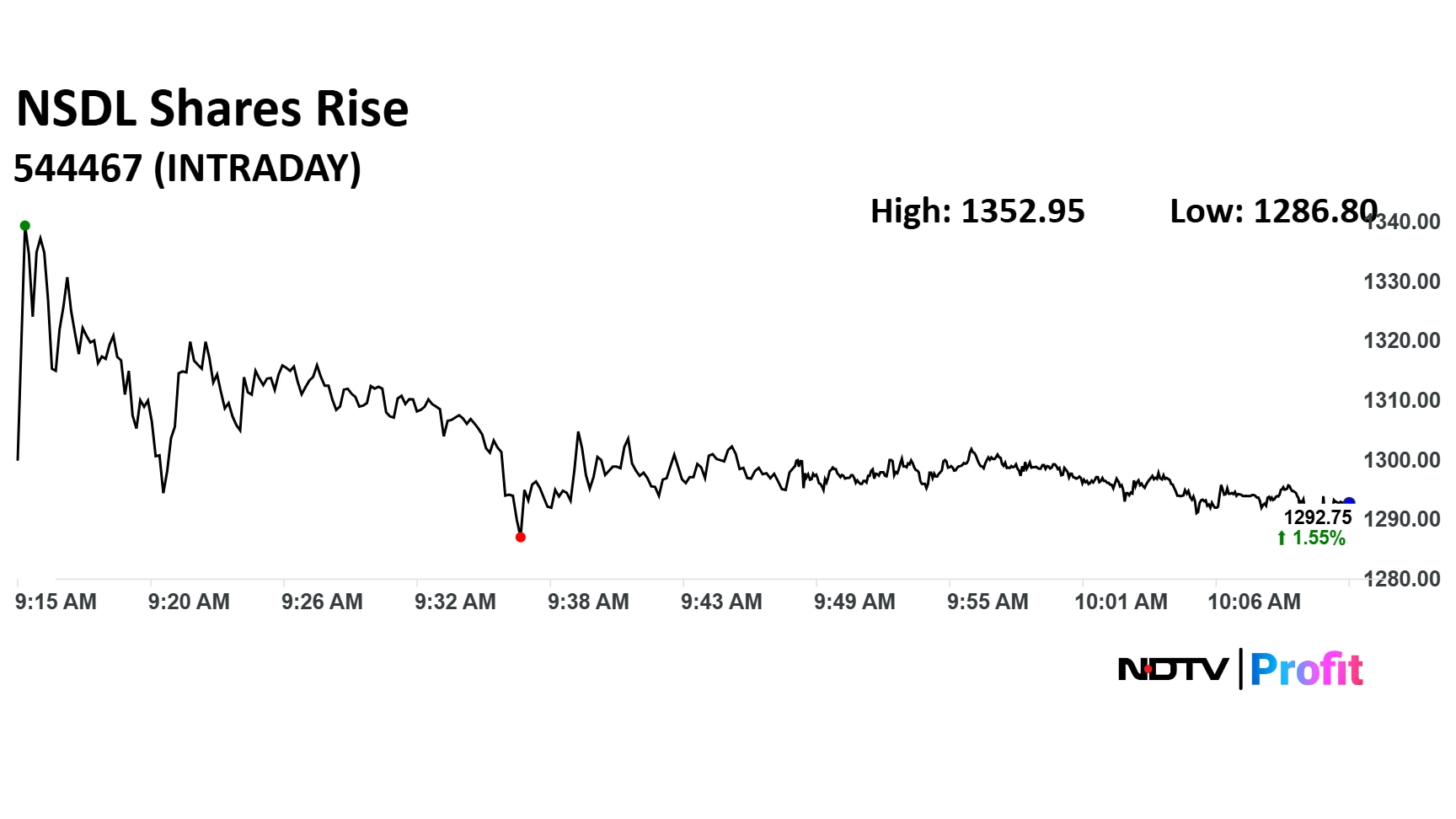

Shares of National Securities Depository Ltd. traded higher during the early Tuesday session, ahead of the first-quarter results. The scrip rose as much as 6.3% to Rs 1,352.95 apiece.

The stock has gained over 61% since listing last week.

Shares of National Securities Depository Ltd. traded higher during the early Tuesday session, ahead of the first-quarter results. The scrip rose as much as 6.3% to Rs 1,352.95 apiece.

The stock has gained over 61% since listing last week.

HBL Engineering Ltd. received order worth Rs 54 crore, the company said in the exchange filing.

Highway Infrastructure Ltd. made a stellar debut at the stock market on Tuesday, listing at a premium of 67% over the IPO price. The scrip opened trading at Rs 115 on the NSE and Rs 117 on the BSE. The IPO price was Rs 70.

The Rs 130-crore IPO was subscribed 300.61 times, with the non-institutional investors portion overbooked by 447 times, institutional investors by 420 times and the retail portion by 156 times.

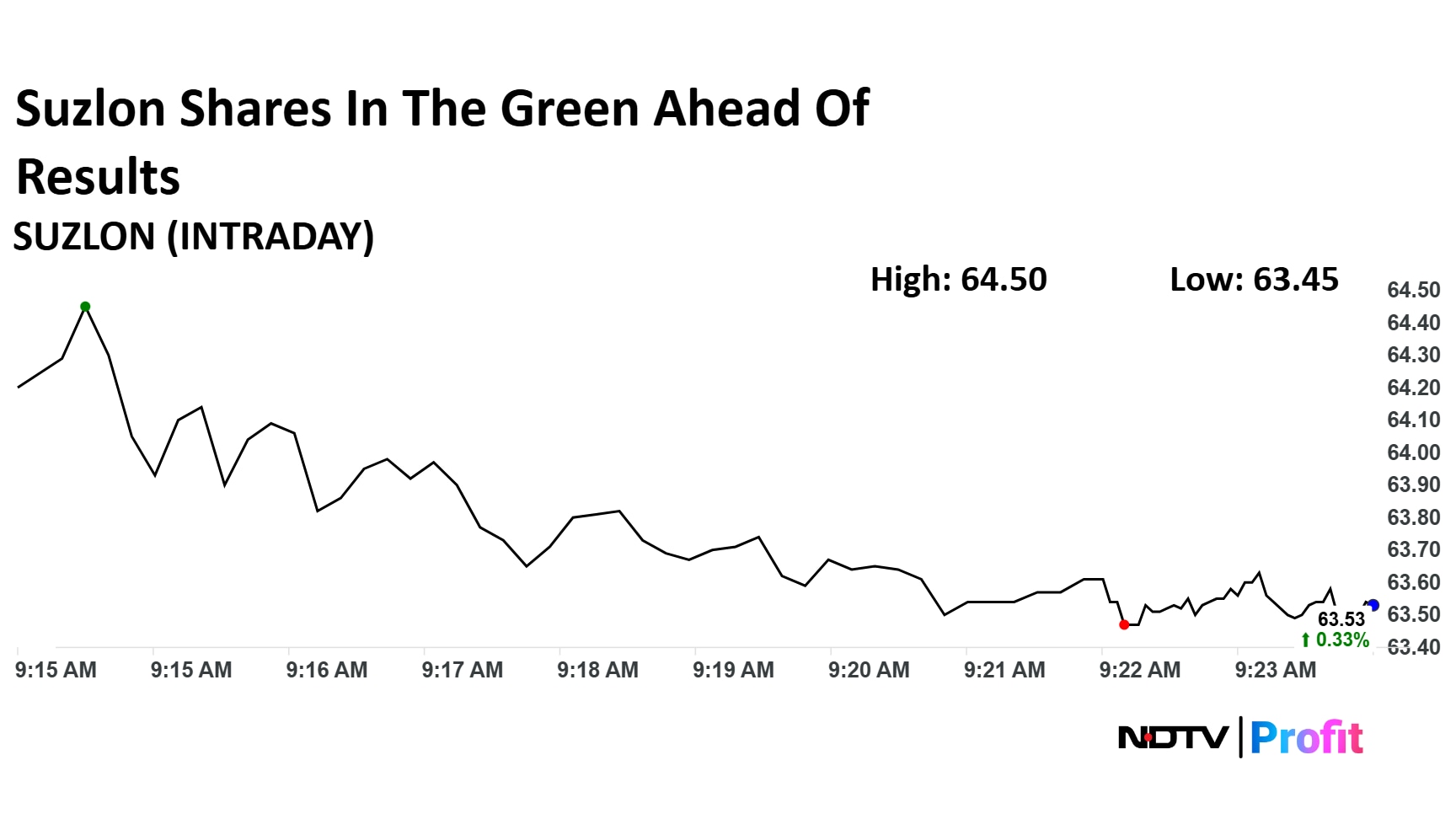

The shares of Suzlon Energy Ltd., was trading higher ahead of the company posting its first quarter results. The company in the previous quarter had reported a nearly fivefold surge in its fourth-quarter net profit, majorly due to a deferred tax credit but also driven by solid revenue and operating income growth.

The shares of Suzlon Energy Ltd., was trading higher ahead of the company posting its first quarter results. The company in the previous quarter had reported a nearly fivefold surge in its fourth-quarter net profit, majorly due to a deferred tax credit but also driven by solid revenue and operating income growth.

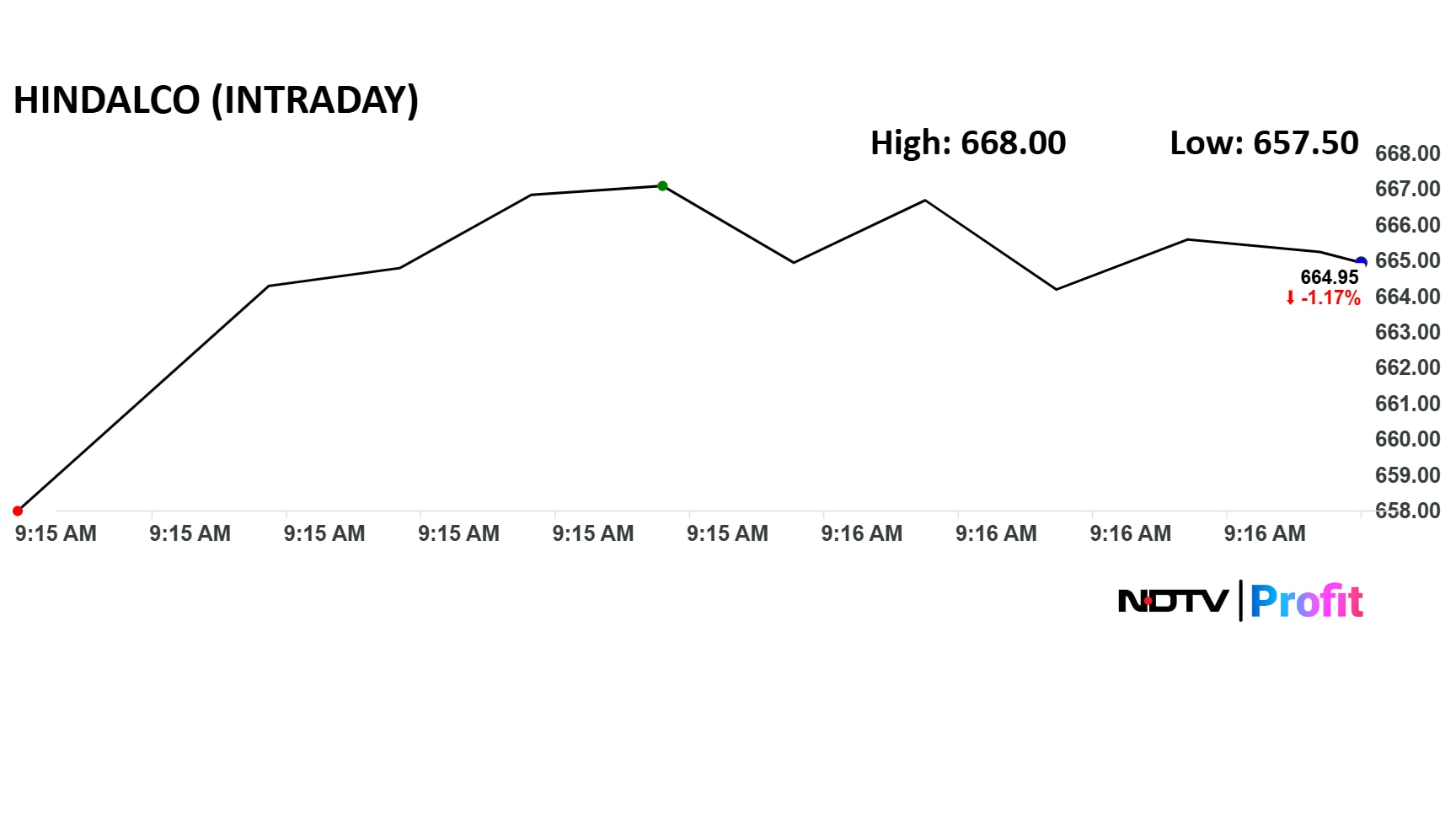

Hindalco Industries Ltd. shares fell during early trade on Tuesday after US arm Novelis Inc. reported a subdued first quarter, missing market expectations.

The company's net profit fell 67% sequentially to $96 million for the June quarter of fiscal 2026. On a year-on-year basis, it was down 36%.

Hindalco Industries Ltd. shares fell during early trade on Tuesday after US arm Novelis Inc. reported a subdued first quarter, missing market expectations.

The company's net profit fell 67% sequentially to $96 million for the June quarter of fiscal 2026. On a year-on-year basis, it was down 36%.

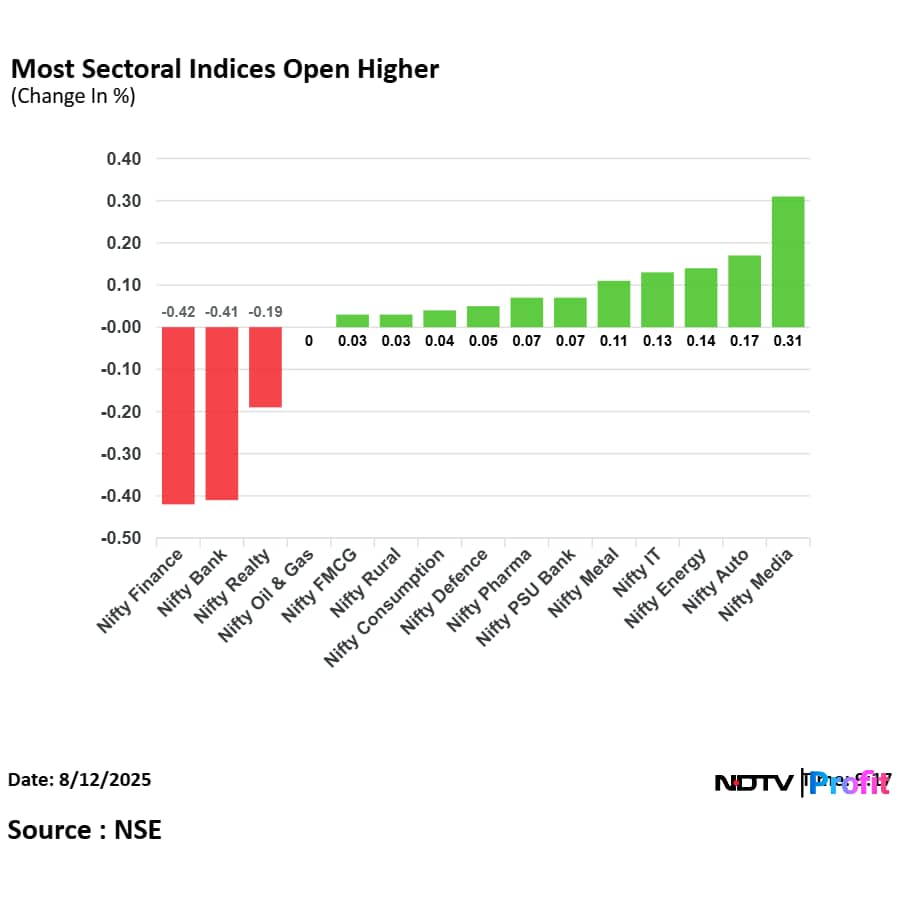

On National Stock Exchange Ltd., three sectoral indices opened lower, eight higher, and four remained flat out of 15.

On National Stock Exchange Ltd., three sectoral indices opened lower, eight higher, and four remained flat out of 15.

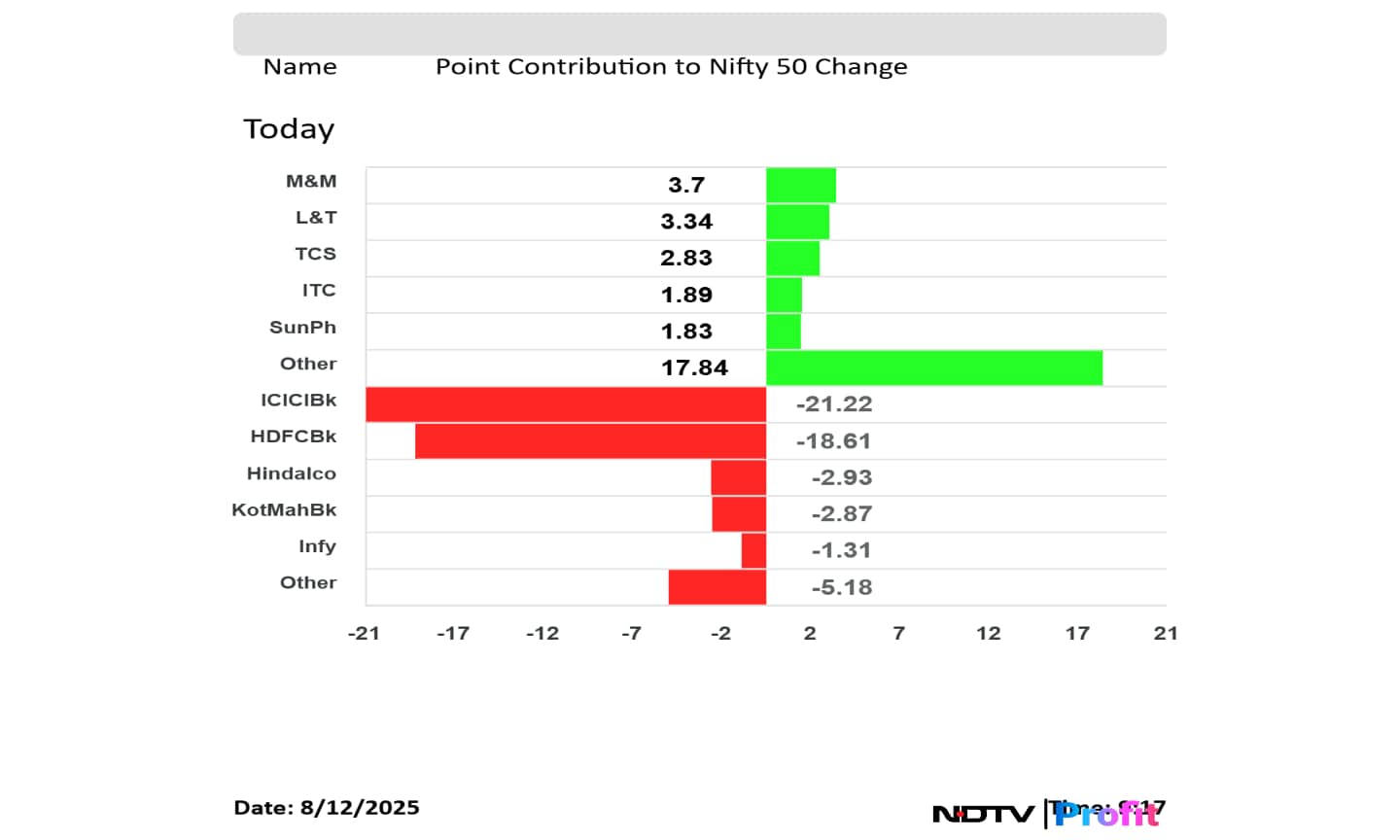

ICICI Bank Ltd., HDFC Bank Ltd., Hindalco Industries Ltd., Kotak Mahindra Bank Ltd., and Infosys Ltd. weighed in the Nifty 50 index.

Mahindra & Mahindra Ltd., Larsen & Toubro Ltd., Tata Consultancy Services Ltd., ITC Ltd., and Sun Pharmaceutical Industries limited losses in the NSE Nifty 50 index.

ICICI Bank Ltd., HDFC Bank Ltd., Hindalco Industries Ltd., Kotak Mahindra Bank Ltd., and Infosys Ltd. weighed in the Nifty 50 index.

Mahindra & Mahindra Ltd., Larsen & Toubro Ltd., Tata Consultancy Services Ltd., ITC Ltd., and Sun Pharmaceutical Industries limited losses in the NSE Nifty 50 index.

The NSE Nifty 50 and BSE Sensex reversed all gains at open as ICICI Bank Ltd. and HDFC Bank Ltd. shares weighed. The indices were trading 0.04% and 0.07% down, respectively as of 9:20 a.m.

The NSE Nifty 50 and BSE Sensex reversed all gains at open as ICICI Bank Ltd. and HDFC Bank Ltd. shares weighed. The indices were trading 0.04% and 0.07% down, respectively as of 9:20 a.m.

The yield on the 10-year bond opened flat at 6.44%

Source: Bloomberg

Rupee opened 4 paise weaker at 87.70 a dollar

It closed at 87.66 a dollar on Monday.

Source: Bloomberg

Goldman Sachs has initiated its coverage on Hyundai Motors India with a 'Buy' with a target price of Rs 2,600. The broking’s optimistic outlook is based on its belief that Hyundai is exceptionally well-positioned to capitalise on a major stress point in the auto industry. The view is driven by key factors, like the company's product cycle, capacity expansion, and favourable macroeconomic conditions.

Goldman Sachs highlights that the company is in a strong position to launch new products and gain market share as it expands its manufacturing capacity. This strategic "catch-up" is expected to be a significant growth boost.

Expect muted returns; be nimble/rotate sectors for alpha

Risks skewed to downside

Small and midcaps still overvalued but see some pockets of opportunities

Move IT sector from Underweight to Overweight and Utilities from UW to Neutral

Continue to expect negative returns from small and midcaps

See pockets of opportunities now within Building Materials, Auto Components& Travel/Tourism

Continue to prefer Large caps over Small and midcaps

Consensus earnings cuts to continue

Trade tariffs: base case is for India to attract 15% tariffs from the US; see downside risk if higher tariffs at 25-50% sustains

US Macro outlook remains uncertain

Populism step-up: subsidy spike could curtail capex (see report): a market risk

Flows: risk-reward for FIIs is still unfavorable; do not see revival of FII flows

Policy response: India may step-up legislative reforms, improve policies and offer fiscal support to boost growth/avert tariff impact

Japan's benchmark index Nikkei 225 hit a record high in Tuesday's session. Markets in China, South Korea, and Australia advanced after the US extended deadline on interim relief from tariffs on Chinese imports.

The Nikkei 225 was trading 2.53% higher at 42,887.50 as of 8:03 a.m. The S&P ASX 200 and KOSPI were trading 0.18% and 0.70% higher, respectively.

US stock futures were trading on a mixed note on Tuesday morning as market participants assessed trade relation between US and China while awaiting inflation number.

The Dow Jones Industrial Average 0.06% rose and S&P 500 futures were trading 0.01% down as of 7:54 a.m.

The GIFT Nifty was trading 0.12% or 28.50 points higher at 24,580.50, which indicated 5 points lower open for the benchmark NSE Nifty 50 index.

Ashoka Buildcon Ltd., Muthoot Microfin Ltd., Dollar Industries Ltd., Ugro Capital Ltd., and Bata India Ltd. shares will likely be in focus because of first-quarter results.

The Indian equity benchmarks closed in the green on Monday as shares of HDFC Bank Ltd., Reliance Industries Ltd. and State Bank of India led the gains.

The NSE Nifty 50 ended 221.75 points or 0.91% higher at 24,585.05 and the BSE Sensex ended 746.29 points or 0.93% up at 86,604.08.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.