Nifty close above 24,700 mark, snapping two day losing streak.

Benchmark Indices underperformed broader market Indices for the day.

Nifty Midcap 150 gains over 1% for the day, led by Aditya Biral Capital and Delhivery.

Aditya Biral Capital gain over 10% after posting its Q1 results.

Nifty smallcap 250 gains nearly 1% for the day, led by Eclerx Services and Capri Global Services.

Nifty Metal gains over 2% for the day, emerges as the top gaining sector for the day.

Sail and Tata Steel gain the most in Nifty Metal.

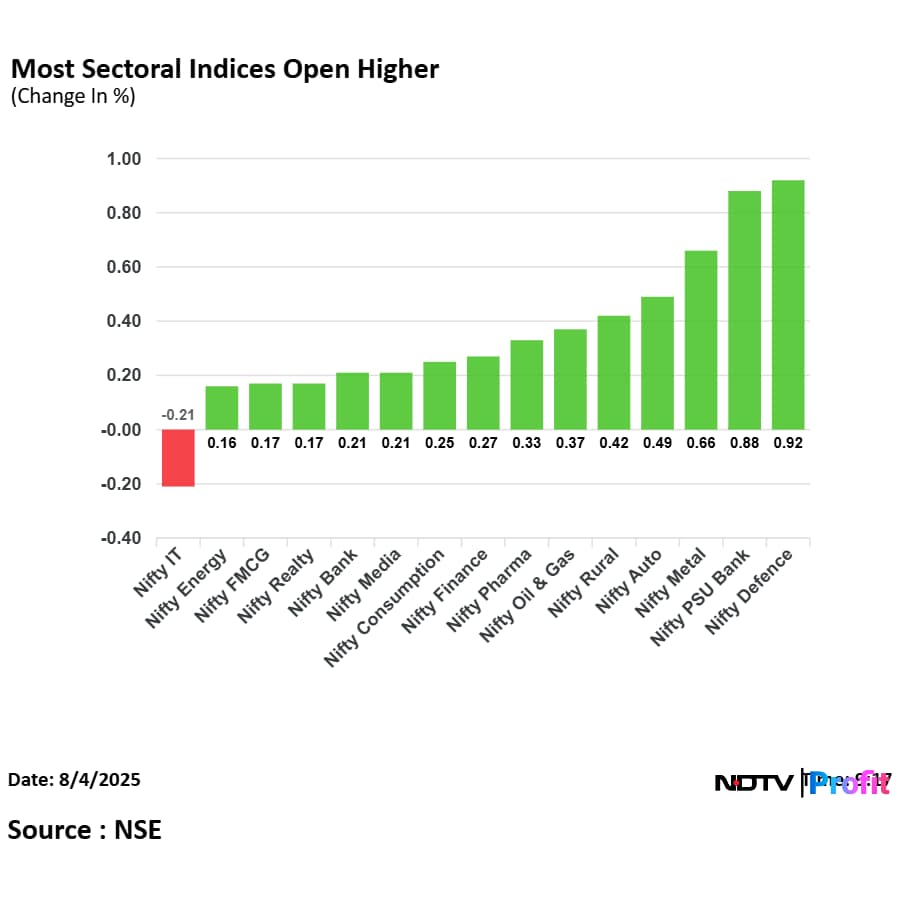

Most sectoral indices gains in trade.

Nifty FMCG and Financial Services end on a flat note.

Nifty PSU Bank, IT, Auto, Realty and Metal gains over 1% for the day.

Nifty Metal, Realty, Auto, Oil and Gas, Nifty Bank and PSU Bank snaps 3-day losing streak.

Nifty IT, Pharma snaps 2-day losing streak.

Nifty FMCG snaps 5-day gaining streak.

Nifty IT recovered the most from the day’s low.

Tech Mahindra, Mphasis, Coforge and Persistent Systems gains over 3% for the lows.

Nifty close above 24,700 mark, snapping two day losing streak.

Benchmark Indices underperformed broader market Indices for the day.

Nifty Midcap 150 gains over 1% for the day, led by Aditya Biral Capital and Delhivery.

Aditya Biral Capital gain over 10% after posting its Q1 results.

Nifty smallcap 250 gains nearly 1% for the day, led by Eclerx Services and Capri Global Services.

Nifty Metal gains over 2% for the day, emerges as the top gaining sector for the day.

Sail and Tata Steel gain the most in Nifty Metal.

Most sectoral indices gains in trade.

Nifty FMCG and Financial Services end on a flat note.

Nifty PSU Bank, IT, Auto, Realty and Metal gains over 1% for the day.

Nifty Metal, Realty, Auto, Oil and Gas, Nifty Bank and PSU Bank snaps 3-day losing streak.

Nifty IT, Pharma snaps 2-day losing streak.

Nifty FMCG snaps 5-day gaining streak.

Nifty IT recovered the most from the day’s low.

Tech Mahindra, Mphasis, Coforge and Persistent Systems gains over 3% for the lows.

Rupee closed 12 paise weaker at 87.66 against US Dollar

It closed at 87.54 a dollar on Friday.

Source: Cogencis

Steel Strips Wheels Ltd. received project worth Rs 300 Crore from European original equipment manufacturers for vehicle programs to be produced in Europe and South America.

Kirloskar Ferrous Q1 Highlights (Cons, QoQ)

Revenue down 2.2% to Rs 1,698 crore versus Rs 1,737 crore.

Ebitda up 7.8% to Rs 217 crore versus Rs 201 crore.

Margin up to 12.8% versus 11.6%.

Net profit up 3% to Rs 95.1 crore versus Rs 92.3 crore.

Bharti Airtel Ltd.'s digital arm Xtelify introduced Telco-Grade cloud platform 'Airtel Cloud', the company said in the exchange filing.

Bondada Engineering appointed Sreenivas Ratnam as chief executive officer, the company said in the exchange filing.

Marico Q1 Highlights (Consolidated, YoY)

Revenue up 23.3% at Rs 3,259 crore versus Rs 2,643 crore. (Bloomberg estimates: Rs 3,198 crore)

Ebitda up 4.6% at Rs 655 crore versus Rs 626 crore.

Margin at 20% versus 23.7%.

Net Profit up 8.6% at Rs 504 crore versus Rs 464 crore. (Bloomberg estimate: Rs 488 crore)

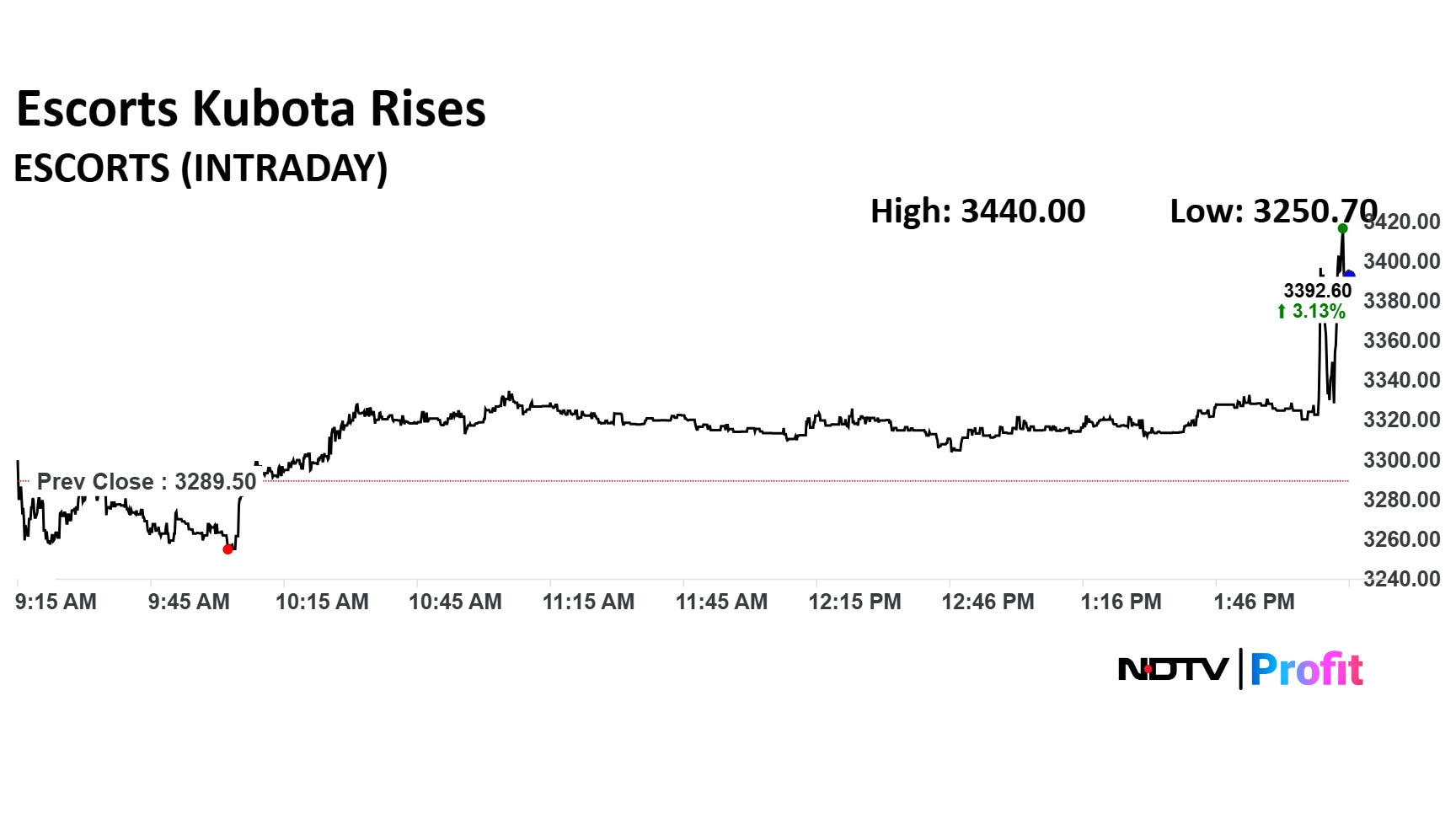

Escorts Kubota Q1 Highlights (Cons, YoY)

Revenue down 2.8% to Rs 2,483 crore versus Rs 2,556 crore.

Ebitda up 2.6% to Rs 325 crore versus Rs 317 crore.

Margin at 13% versus 12.4%.

Net Profit rises to Rs 1,400 crore versus Rs 304 crore.

Escorts Kubota Q1 Highlights (Cons, YoY)

Revenue down 2.8% to Rs 2,483 crore versus Rs 2,556 crore.

Ebitda up 2.6% to Rs 325 crore versus Rs 317 crore.

Margin at 13% versus 12.4%.

Net Profit rises to Rs 1,400 crore versus Rs 304 crore.

Stock Market Today: The NSE Nifty 50 and BSE Sensex have rebounded from two-day slump in Monday's session. The benchmark Nifty 50 rose 0.64% to 24,722.25, and the Sensex has risen 0.54% to 81,044.98 so far today. Market participants deemed Monday's move as a technical recovery as the indices has been on a declining trajectory because of uncertainty over US reciprocal tariffs.

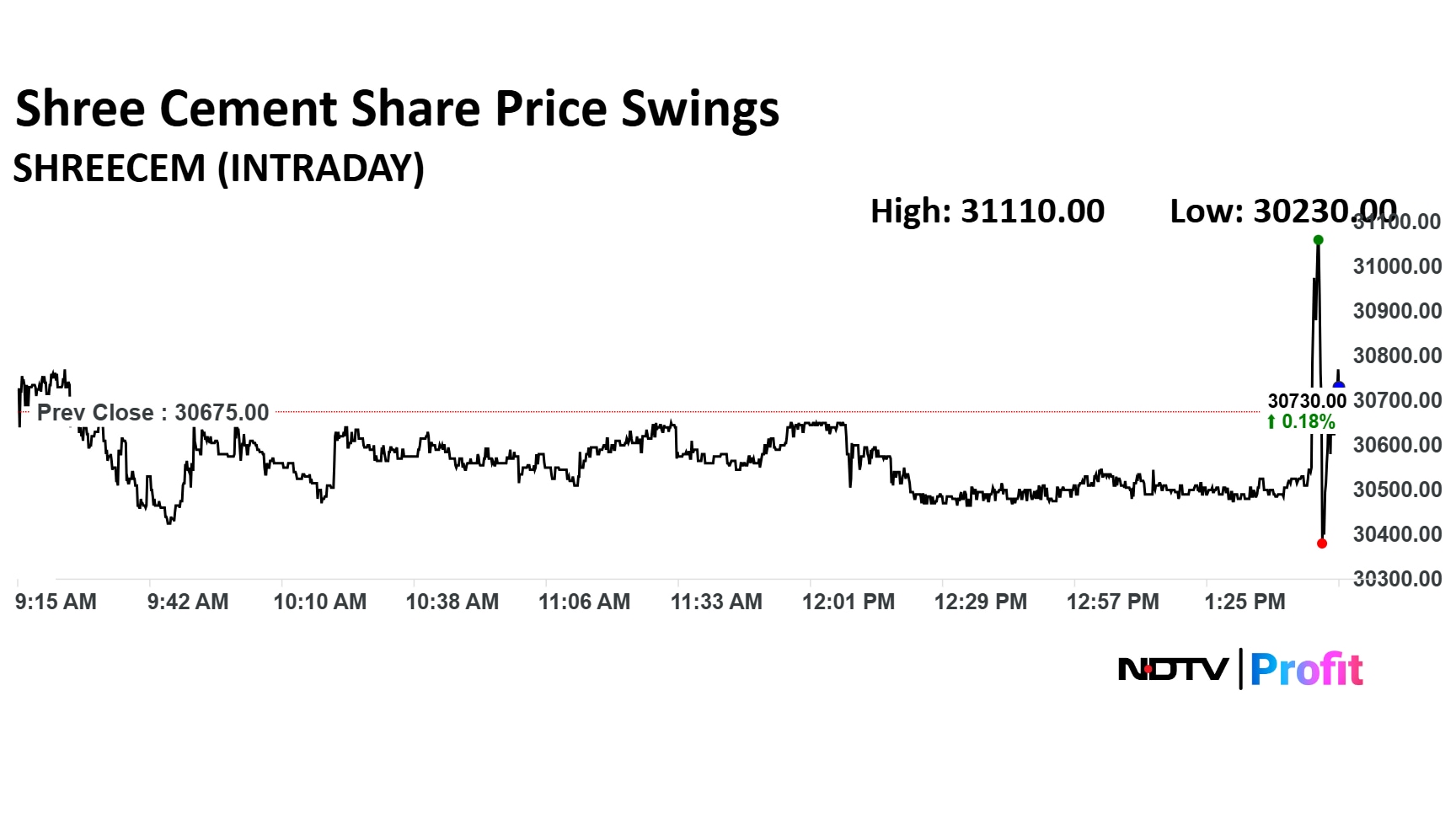

Shree Cement Q1 Earnings Key Highlights (Consolidated, YoY)

Net Profit rose 130% Rs 643 crore versus Rs 279 crore

Revenue rose 3% to Rs 5,281 crore versus Rs 5,124 crore

Ebitda rose 43.7% to Rs 1,333 crore versus Rs 927 crore

Margin at 25.2% versus 18%

Shree Cement Q1 Earnings Key Highlights (Consolidated, YoY)

Net Profit rose 130% Rs 643 crore versus Rs 279 crore

Revenue rose 3% to Rs 5,281 crore versus Rs 5,124 crore

Ebitda rose 43.7% to Rs 1,333 crore versus Rs 927 crore

Margin at 25.2% versus 18%

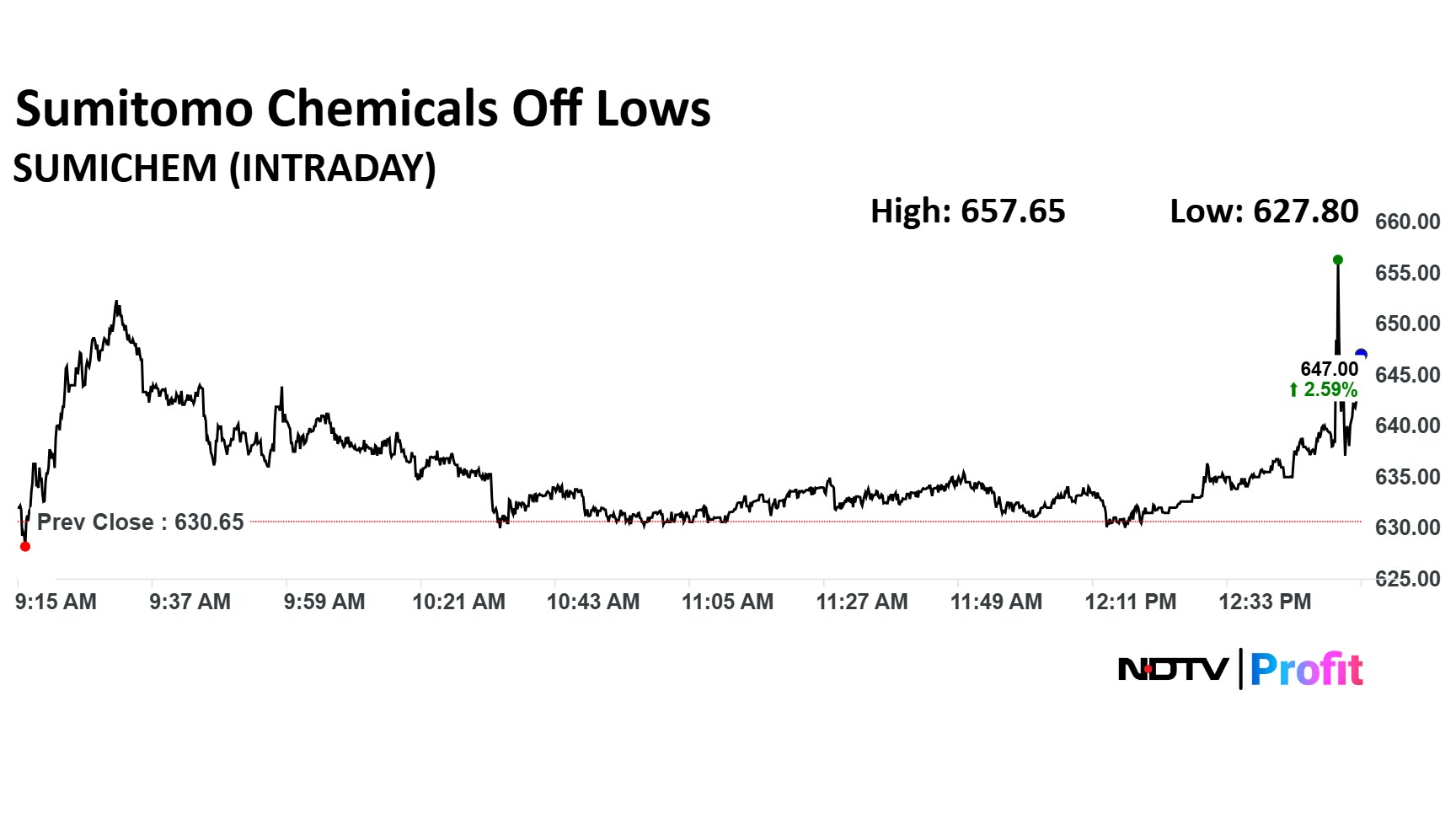

Sumitomo Chemical Q1 Highlights (Consolidated, YoY)

Revenue up 26% at Rs 1,057 crore versus Rs 834 crore.

Ebitda up 36% at Rs 219 crore versus Rs 161 crore.

Margin at 20.7% versus 19.2%.

Net Profit up 40.8% at Rs 178 crore versus Rs 127 crore.

Track live updates on first-quarter earnings here.

Sumitomo Chemical Q1 Highlights (Consolidated, YoY)

Revenue up 26% at Rs 1,057 crore versus Rs 834 crore.

Ebitda up 36% at Rs 219 crore versus Rs 161 crore.

Margin at 20.7% versus 19.2%.

Net Profit up 40.8% at Rs 178 crore versus Rs 127 crore.

Track live updates on first-quarter earnings here.

VST Tillers Tractors launched FENTM Tractor Series, the company said in the exchange filing.

AU Small Finance Bank Ltd. signed a corporate agency partnership with SBI Life Insurance Co to distribute latter's insurance portfolio, the company said in the exchange filing.

Pressure Sensitive received order worth Rs 150 crore from RFBL Flexi Pack, the company said in the exchange filing.

Tata Investment board approved splitting of stock into 10, the company said in the exchange filing.

Adani Group is not exploring any form of collaboration with BYD for battery manufacturing in India. The group is also not in any discussion with Beijing Welion New Energy Technology for partnership

The group has put out a clarification on Bloomberg report.

GlaxoSmithKline Pharma has not received any letter from the US Government to reduce prices. It is also not aware of any information or announcements on this regard, the company said in the exchange filing.

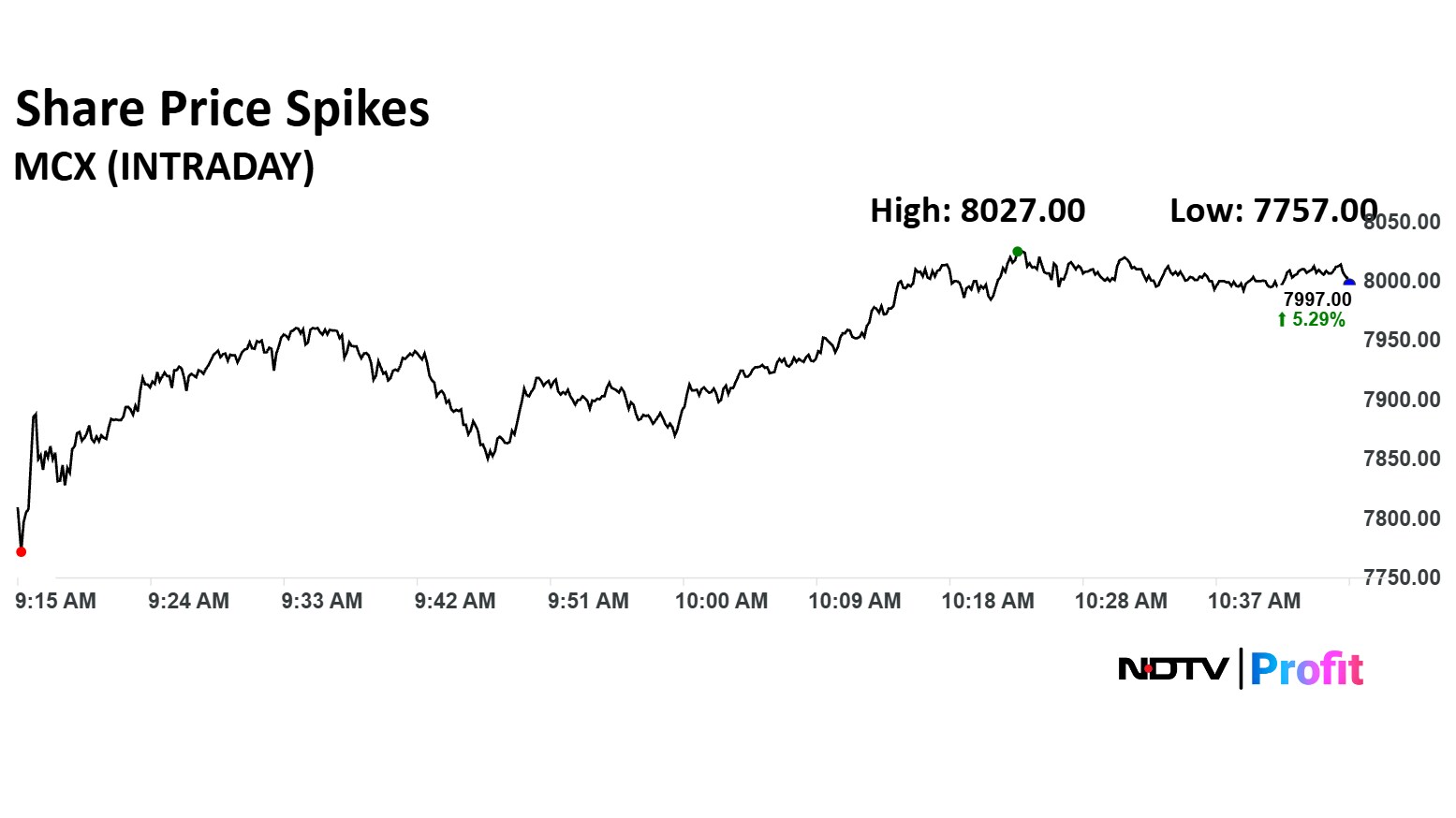

Multi Commodity Exchange of India Ltd.'s share price spiked 5.65% on Monday after the company posted first-quarter results for the financial year 2026.

The company's revenue was up 28% at Rs 373.21 crore. Morgan Stanley noted that the results were largely in line with expectations.

Multi Commodity Exchange of India Ltd.'s share price spiked 5.65% on Monday after the company posted first-quarter results for the financial year 2026.

The company's revenue was up 28% at Rs 373.21 crore. Morgan Stanley noted that the results were largely in line with expectations.

Premier Explosives to manufacture and supply defence explosives in two years for Rs 190 crore, the exchange filing said.

JSW Steel Ltd. is in pact with JFE Steel Corp to expand electrical steel capacity to 3.5 lakh third-party access in India. The company and JFE Steel Corp to jointly invest nearly Rs 5,845 crore for this expansion.

NIBE Ltd. received order from Elbit Systems for 70 mm guided advanced tactical rocket, the company said in the exchange filing.

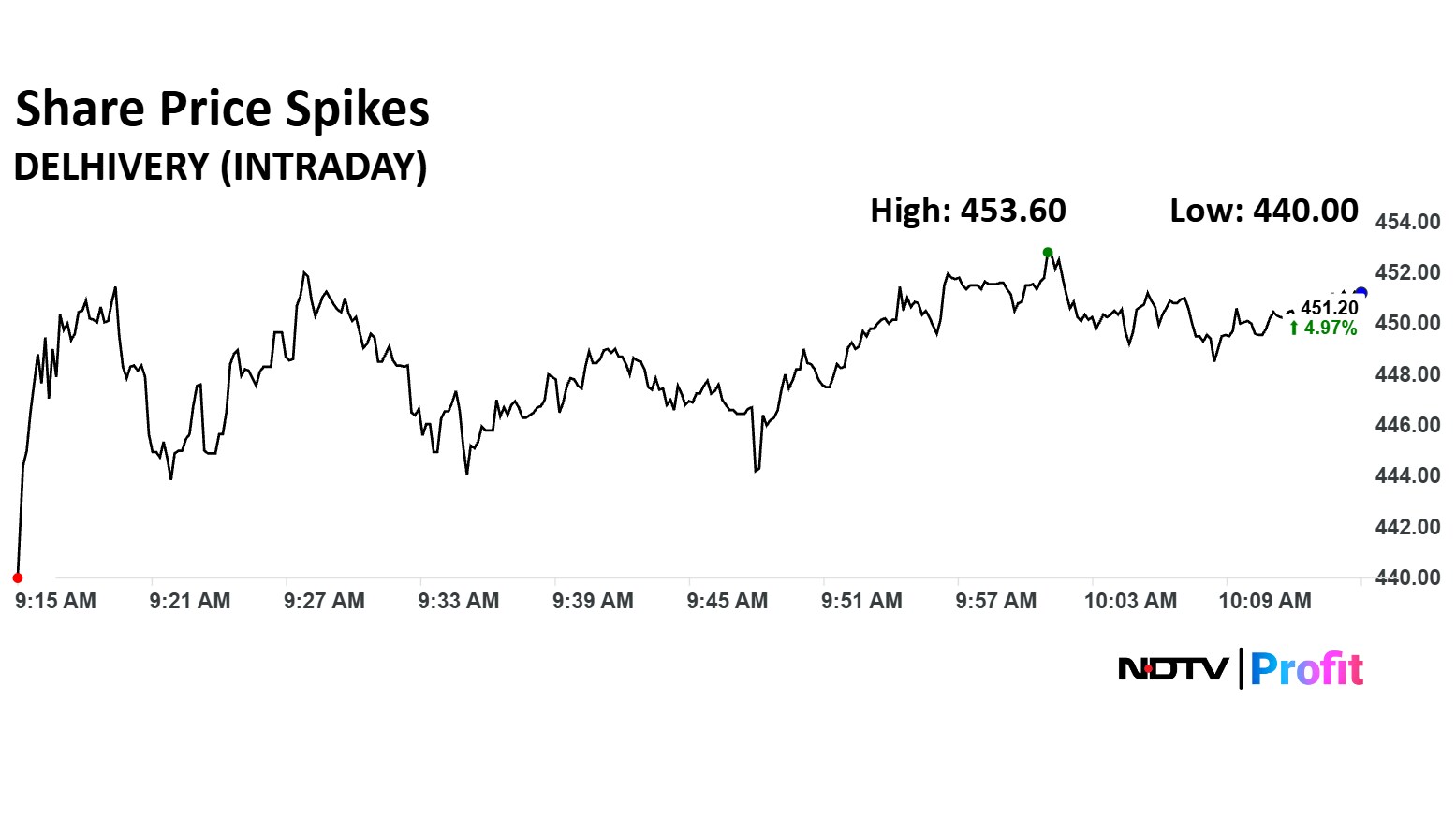

Delhivery share price spiked 5.53% on Monday hitting an all-time high after the company posted a 70% spike in its net profit in first quarter results of financial year 2026. The company's revenue came at Rs 2,294 crore, up 5.6% on an annual basis.

The scrip rose to Rs 458 apiece, the highest level since May 18.

Delhivery share price spiked 5.53% on Monday hitting an all-time high after the company posted a 70% spike in its net profit in first quarter results of financial year 2026. The company's revenue came at Rs 2,294 crore, up 5.6% on an annual basis.

The scrip rose to Rs 458 apiece, the highest level since May 18.

Higher US tariff of 25% against other countries is a disadvantage for India

Curtailed access to US diminishes India's manufacturing sector

Favourable outlook for India's services sector remains intact

See India's domestic demand staying resilient to external pressures

L&T Renewables received an order in the range of Rs 1,000-2,500 crore, Larsen & Toubro Ltd. said in the exchange filing. L&T Renewables received an order to develop BESS-integrated solar plant in Bihar,

Shares of Multi Commodity Exchange Ltd., Federal Bank Ltd., Tata Power Co., ITC Ltd., ABB India Ltd., among others, reacted to their first quarter results on Monday. The earnings report of these companies came in post-market hours of Friday and through the weekend.

Among the notable gainers in the pack were Delhivery Ltd., MCX, LIC Housing Finance Ltd. and GR Infraprojects Ltd.

Lloyds Engineering Ltd.'s arm received an order for escalators from Mumbai Railway Vikas Corp, the company said in an exchange filing. The order is worth Rs 19.6 crore and the nature of its annual maintenance contract.

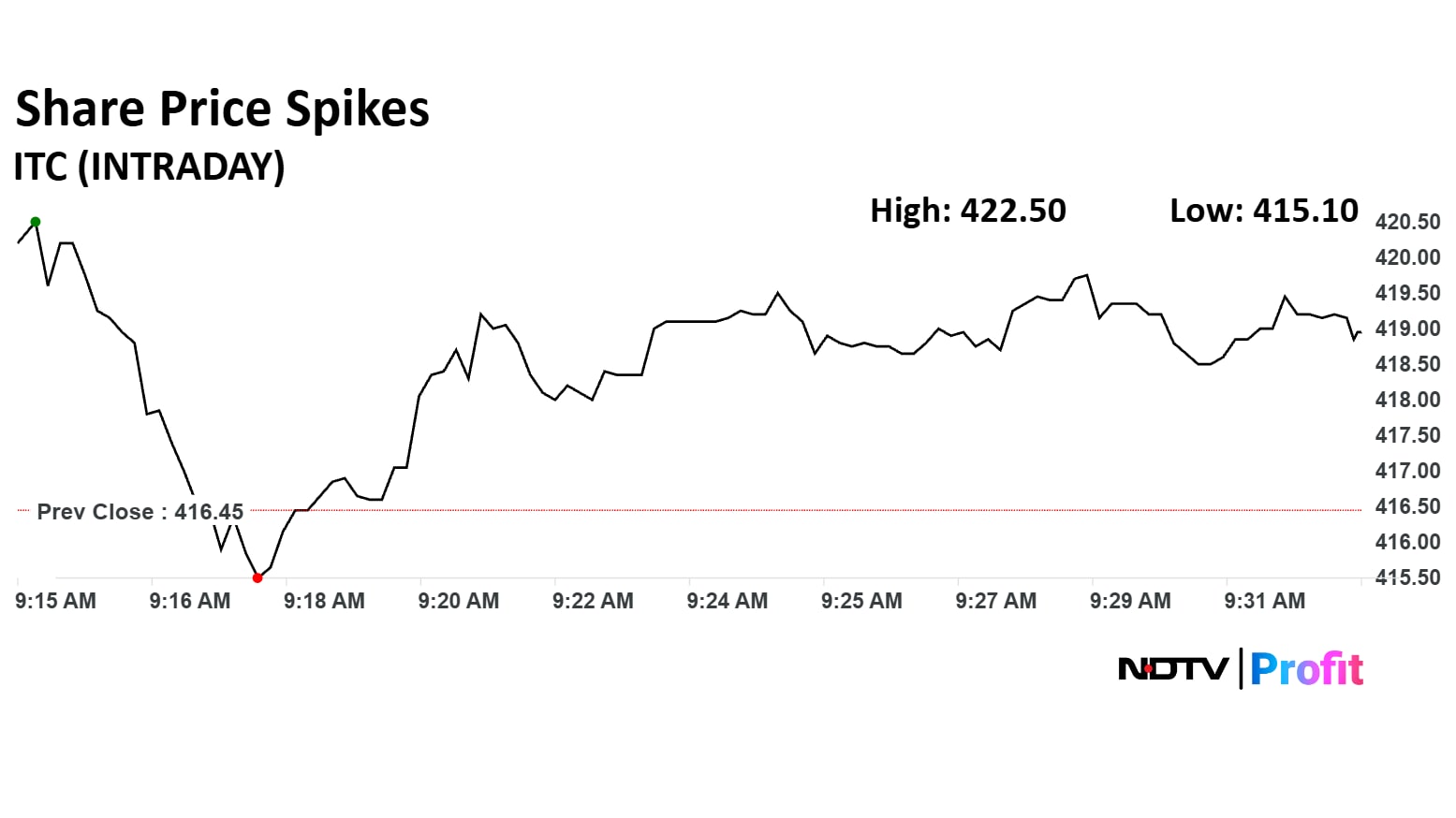

ITC share price spikes 1.45% after the company posted first-quarter results. The company reported a flat net profit, but its revenue saw a 21% rise.

The cigarette maker posted a profit of Rs 4,912.36 crore, as against Rs 4,917.45 crore in the year-ago period. The company's revenue came at Rs 19,749.91 crore as against Rs 16,374.02 crore in the same quarter last year.

ITC share price spikes 1.45% after the company posted first-quarter results. The company reported a flat net profit, but its revenue saw a 21% rise.

The cigarette maker posted a profit of Rs 4,912.36 crore, as against Rs 4,917.45 crore in the year-ago period. The company's revenue came at Rs 19,749.91 crore as against Rs 16,374.02 crore in the same quarter last year.

On National Stock Exchange, 14 sectoral indices advanced, and one declined out of 15 sectoral indices. The NSE Nifty Defence advanced the most, and the NSE Nifty IT emerged to be the worst performing index.

On National Stock Exchange, 14 sectoral indices advanced, and one declined out of 15 sectoral indices. The NSE Nifty Defence advanced the most, and the NSE Nifty IT emerged to be the worst performing index.

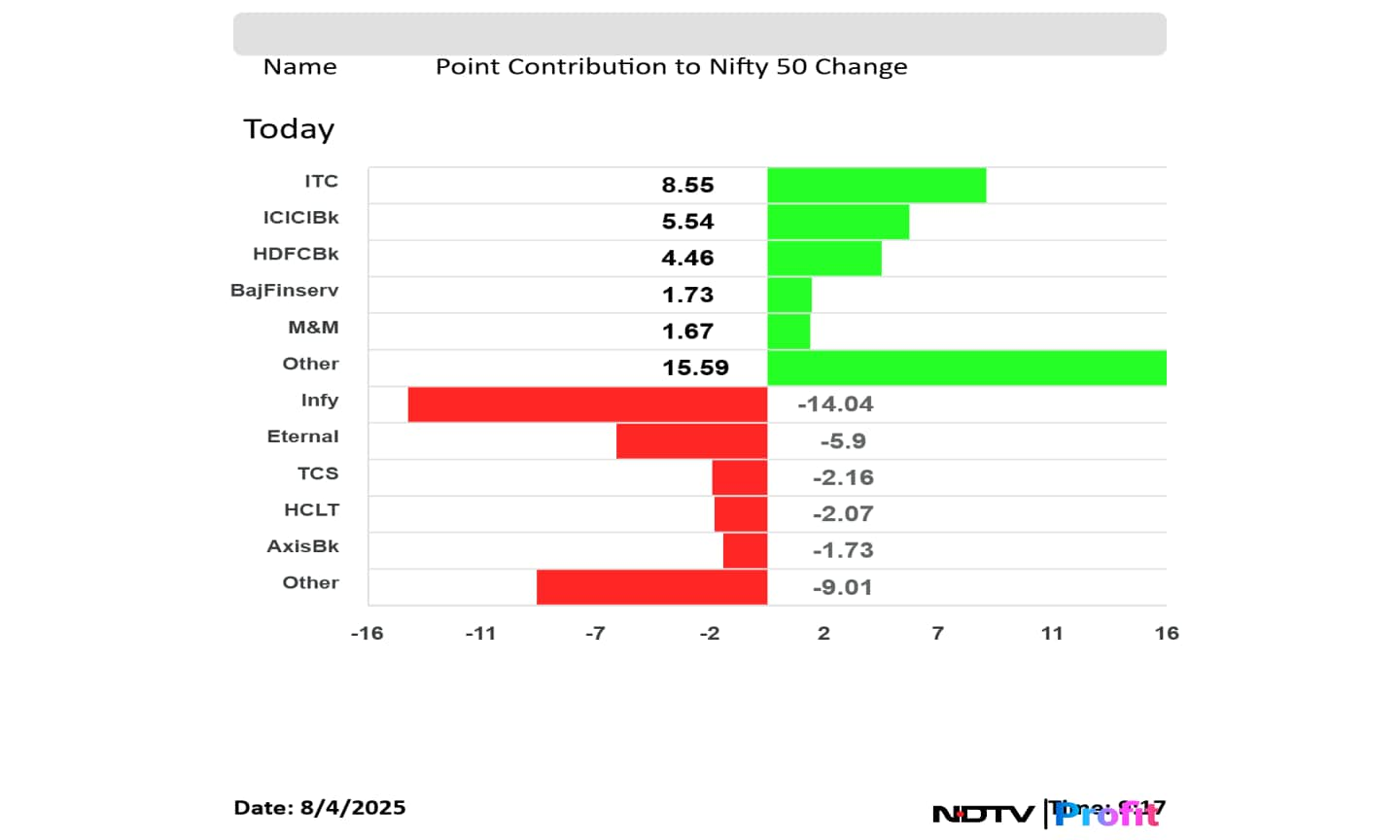

ITC Ltd., ICICI Bank Ltd., HDFC Bank Ltd., Bajaj Finserve Ltd., and Mahindra & Mahindra Ltd. added to the NSE Nifty 50 index.

Infosys Ltd., Eternal Ltd., Tata Consultancy Services Ltd., HCLTech Ltd., and Axis Bank Ltd. weighed on the NSE Nifty 50 index.

ITC Ltd., ICICI Bank Ltd., HDFC Bank Ltd., Bajaj Finserve Ltd., and Mahindra & Mahindra Ltd. added to the NSE Nifty 50 index.

Infosys Ltd., Eternal Ltd., Tata Consultancy Services Ltd., HCLTech Ltd., and Axis Bank Ltd. weighed on the NSE Nifty 50 index.

The NSE Nifty 50 and BSE Sensex opened higher on Monday as ITC Ltd. and ICICI Bank Ltd. shares advanced. The indices were trading 0.25% and 0.20% higher, respectively as of 9:22 a.m.

Kotak Securities believe that the short-term market outlook is weakening; however, a fresh selloff is possible only if the 24,500/80400 level is broken below. If that happens, the market could slip to around 24,350/80200. Further downside may continue, potentially dragging the index down to 24,200–24,150/79,700-79,500, said Shrikant Chouhan, head, equity research, Kotak Securities.

The NSE Nifty 50 and BSE Sensex opened higher on Monday as ITC Ltd. and ICICI Bank Ltd. shares advanced. The indices were trading 0.25% and 0.20% higher, respectively as of 9:22 a.m.

Kotak Securities believe that the short-term market outlook is weakening; however, a fresh selloff is possible only if the 24,500/80400 level is broken below. If that happens, the market could slip to around 24,350/80200. Further downside may continue, potentially dragging the index down to 24,200–24,150/79,700-79,500, said Shrikant Chouhan, head, equity research, Kotak Securities.

At pre-open, the NSE Nifty 50 was trading 0.12% higher at 24,596.05, and the BSE Sensex was trading 0.21% higher at 80,765.83.

The initial public offering of Mumbai-based real estate firm Sri Lotus Developers and Realty Ltd. closed with a strong demand on Aug. 1. The mainboard IPO was overall booked 69.14 times on the last day of subscription.

The public offer received applications for more than 274.18 crore shares against 3.7 crore shares available for bidding.

The 10-year bond yield opened 3 basis points lower at 6.34%

It closed at 6.37% on Friday

Source: Cogencis

Rupee opened 32 paise stronger at 87.22 against US Dollar

It closed at 87.54 a dollar on Friday.

Source: Cogencis

Morgan Stanley has initiated a positive outlook on Suzlon Energy, maintaining an 'Overweight' rating, primarily in response to the Ministry of New and Renewable Energy guidelines for the localisation of wind manufacturing. The broking's stance is bullish, with a target price of Rs 77 based on the potential for domestic original equipment manufacturers, or OEMs, with Suzlon being a key player.

Axiscades Technologies received Rs 224-crore order from Indian Army for supply of 212 tank transporter trailers, the company said in the exchange filing.

Blue Cloud deployed AI-powered video analytics platform AccessGenie at Telangana Anti-Narcotics Bureau, the company said in the exchange filing.

Gold prices consolidated in Asia session Monday after four-day gaining streak. Soft US economic data increased bets for rate cuts by the Federal Reserve.

The Bloomberg spot Gold was trading 0.31% down at $3,353.14 an ounce as of 8:10 a.m.

Deccan Gold Mines' potential Ni-Cu-PGE discovery on Bhalukona Nickel project In Chhattisgarh. The PGE stands for platinum group elements, the company said in the exchange filing.

JSW Cement India set the initial public offer price band at Rs 139–147 apiece, the company said in a statement.

All Time Plastics set the price band at Rs 260–270 apiece.

Oil futures prices decline as higher supply is expected to rise compared to demand after Organization of Petroleum Exporting Countries and Allies raised the output from September.

The October future contract of Brent was trading 0.34% down at $69.43 a barrel as of 7:44 a.m.

Markets across Asia–Pacific region were trading on a mixed note as traders assessed the impact of Organisation of Petroleum Exporting Countries and Allies' latest output hike, and weak jobs data from the US.

The Nikkei 225 was trading 1.87% down as of 7:41 a.m. The CSI 300 was trading 0.02% higher, while the KOSPI was 0.54% higher as of 7:42 a.m.

After a slump in US equities on Friday on concern of slow job growth in US and Federal Reserve policy outlook, futures rebounded in Asia session. The S&P 500 and Nasdaq 100 futures were trading 0.26% and 0.31%, higher respectively as of 7:38 a.m.

The GIFT Nifty was trading 0.09% or 22 points higher at 24,691.00 as of 6:54 a.m., which implied a positive start for the NSE Nifty 50 index.

ITC Ltd., Shriram Pistons Ltd., ABB India Ltd., LIC Housing Finance Ltd., and Tata Motors Ltd. shares will likely be in focus because of the first-quarter results.

Indian stock markets logged their fifth consecutive week of losses on Friday amid trade uncertainties with the US and persistent foreign institutional outflows.

The NSE Nifty 50 settled 203 points or 0.82% lower at 24,565.35 and the Sensex lost 585.67 points or 0.72% to close at 80,599.91.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.