Benchmark Indices close flat for the day.

Nifty and Sensex closed higher for the second consecutive day.

Nifty Midcap 150 fall for the 2nd consecutive day.

Nifty small cap 250 snaps 2-day gaining streak.

Benchmark Indices outperformed Broder Market Indices

Hindustan Unilever and Tata Consumer Products are the top gainers in Nifty.

Nifty FMCG gains 1.6%, becomes the top gaining sector for the day.

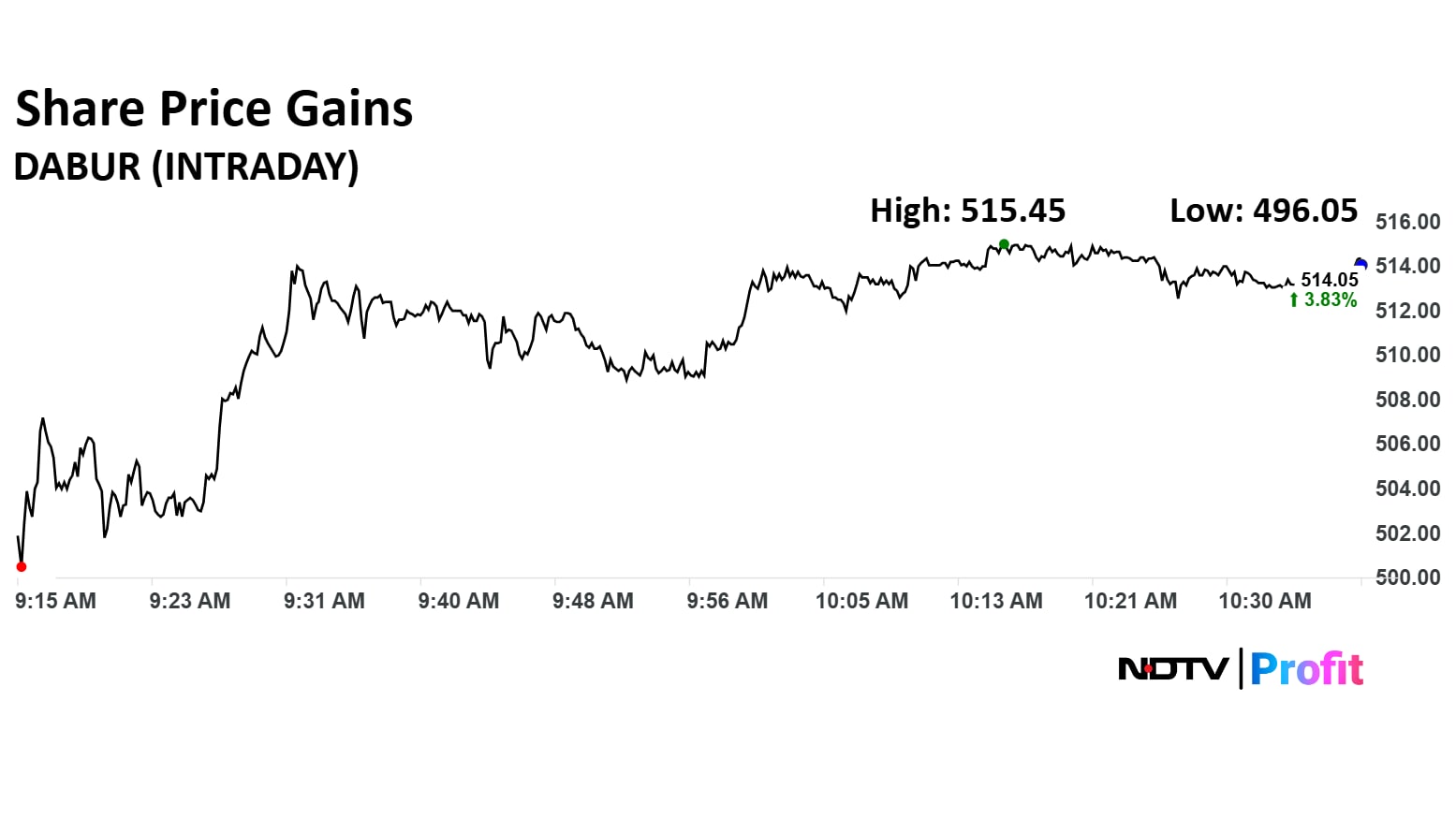

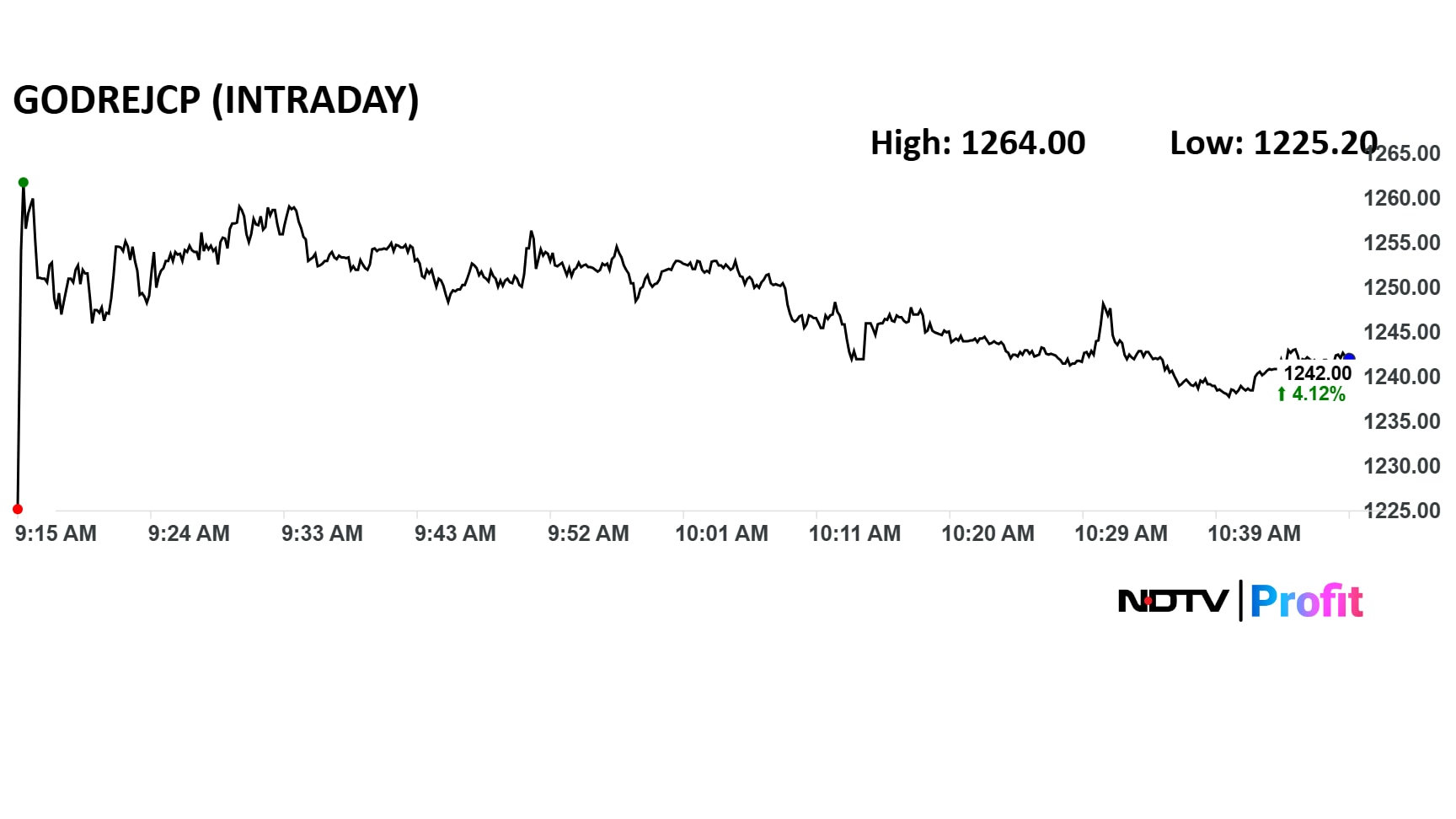

Godrej Consumer and Dabur India are the top gainers in Nifty FMCG.

Nifty Media becomes Top losing sector for the day, drag by Nazara Technologies and Sun TV Network.

Nifty FMCG, Oil and Gas gains for the third day in a row.

Nifty Pharma snaps 11-day gaining streak.

Nifty Auto fell for the 2nd consecutive day.

Nifty Metal fell for the 3rd consecutive day.

Nifty Media snaps 2-day gaining streak.

Benchmark Indices close flat for the day.

Nifty and Sensex closed higher for the second consecutive day.

Nifty Midcap 150 fall for the 2nd consecutive day.

Nifty small cap 250 snaps 2-day gaining streak.

Benchmark Indices outperformed Broder Market Indices

Hindustan Unilever and Tata Consumer Products are the top gainers in Nifty.

Nifty FMCG gains 1.6%, becomes the top gaining sector for the day.

Godrej Consumer and Dabur India are the top gainers in Nifty FMCG.

Nifty Media becomes Top losing sector for the day, drag by Nazara Technologies and Sun TV Network.

Nifty FMCG, Oil and Gas gains for the third day in a row.

Nifty Pharma snaps 11-day gaining streak.

Nifty Auto fell for the 2nd consecutive day.

Nifty Metal fell for the 3rd consecutive day.

Nifty Media snaps 2-day gaining streak.

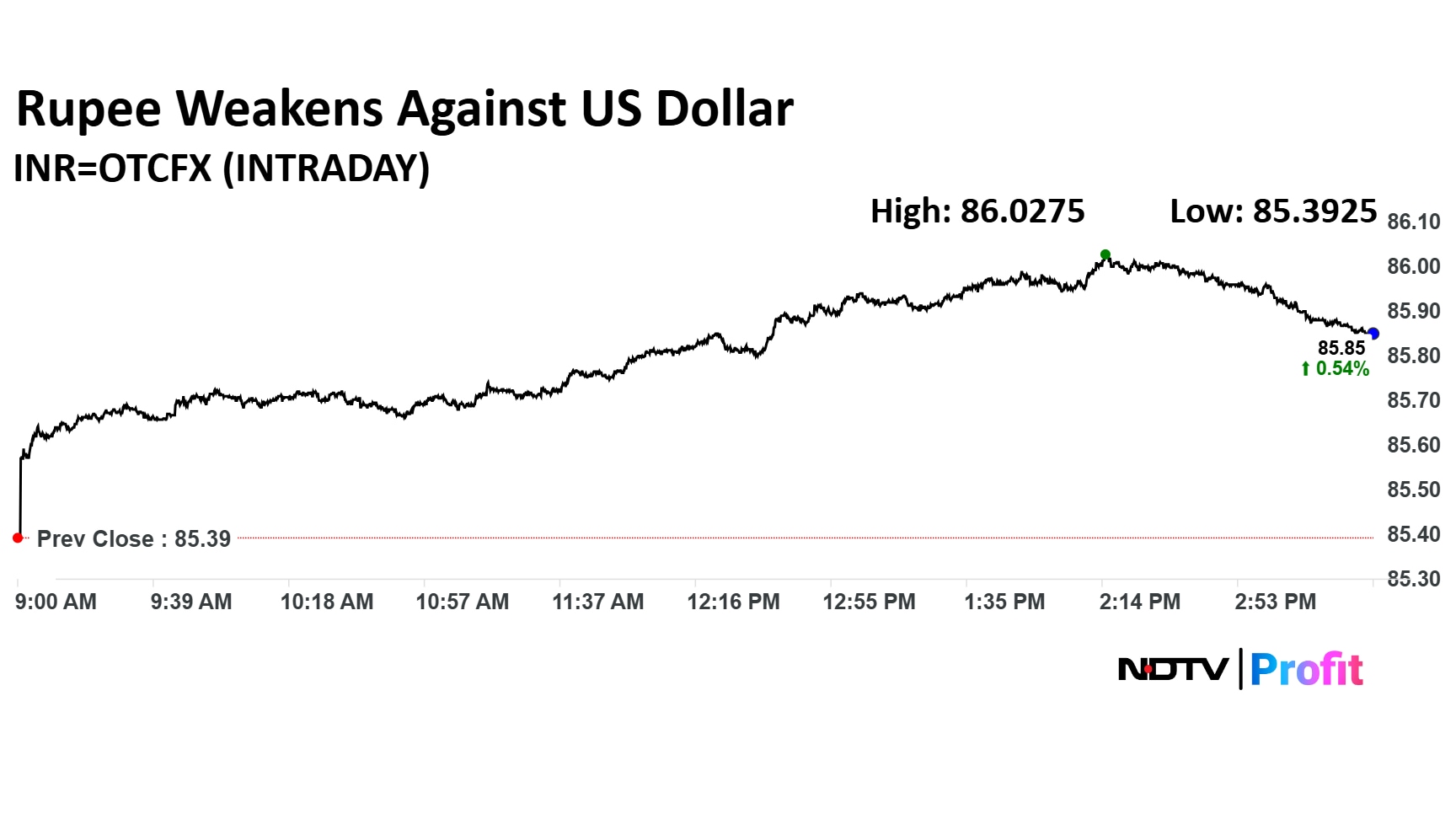

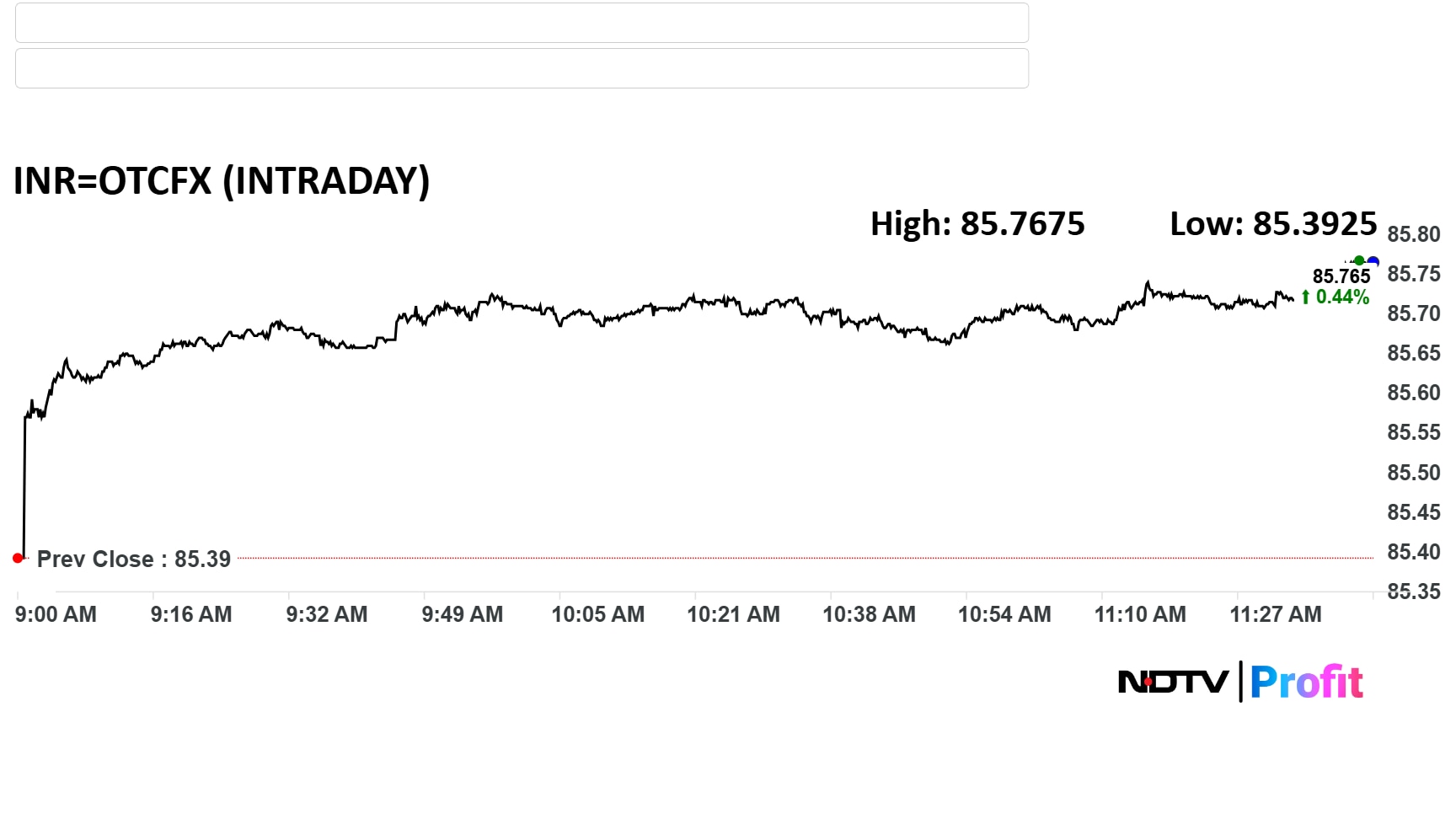

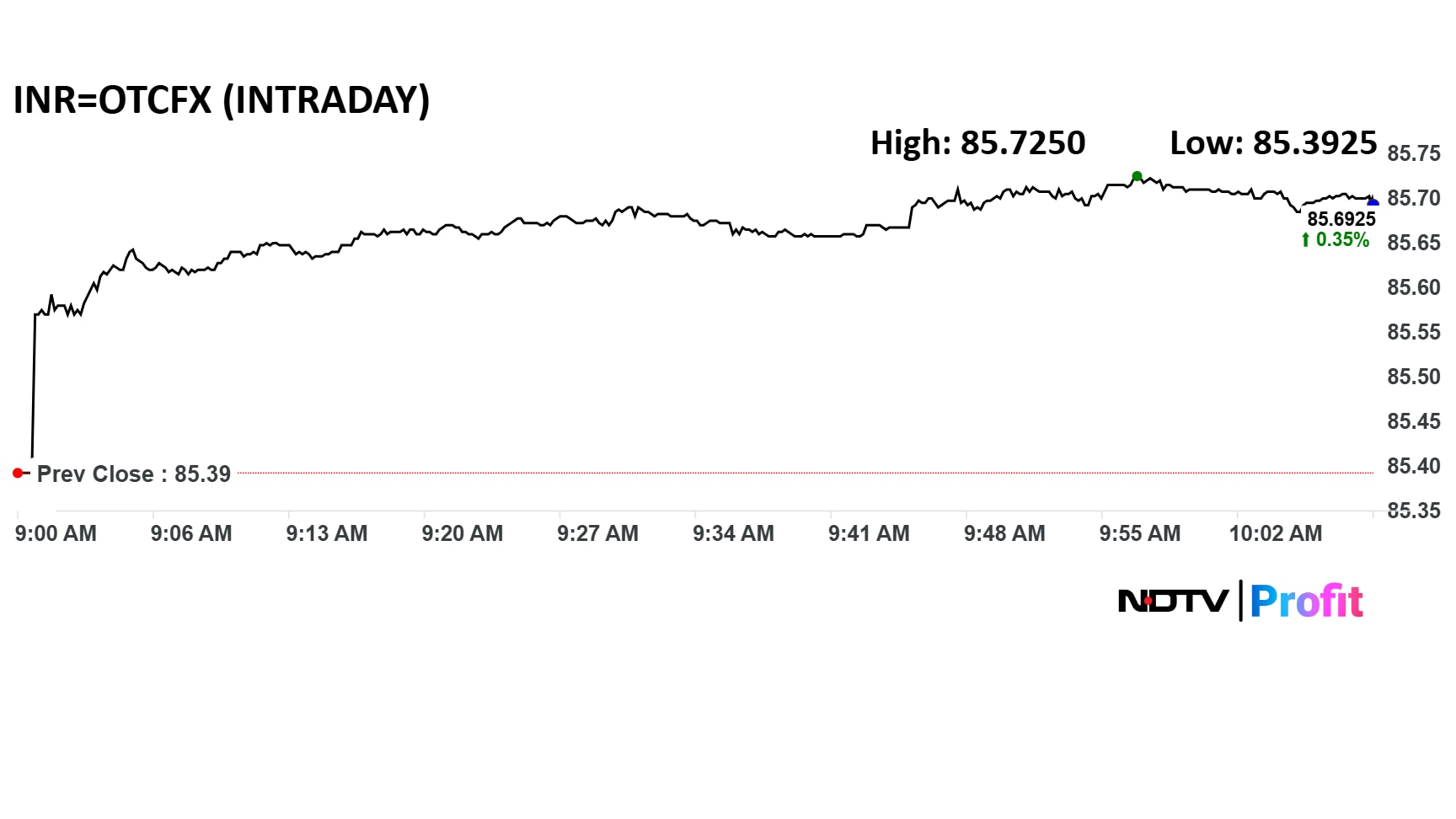

Rupee closed 46 paise weaker against US Dollar at 85.86

It's lowest close level since June 25

It closed at 85.40 a dollar on Friday.

Source: Bloomberg

Rupee closed 46 paise weaker against US Dollar at 85.86

It's lowest close level since June 25

It closed at 85.40 a dollar on Friday.

Source: Bloomberg

JK Lakshmi Cement receives LoI from Assam Mineral Development Corporation to operate as a mine developer and supply limestone. This partnership aims to enhance limestone supply for cement production.

Shakti Pumps successfully closes QIP issue, raising Rs 293 crore from institutional investors. Funds to support growth initiatives.

Platinum Industries reports a fire incident at its unit's Palghar factory. Operations are temporarily shut; no casualties reported. Damage assessment is ongoing, the company said in the exchange filing.

Castrol India has appointed Mrinalini Srinivasan as CFO, effective July 28, as per an exchange filing.

Tega Industries Ltd. appointed Sourav Sen as chief executive officer of arm, the company said in the exchange filing.

Alembic Pharma announced that RK Baheti has relinquished his position as CFO but will continue to serve as Executive Director.

Total Business rose 9.5% to Rs 2.5 lakh crore

Total Deposits rose 12% to Rs 1.5 lakh crore

CASA Deposits rose 2.9% to Rs 67,901 crore

Gross Advances rose 5.5% to Rs 1.04 crore

Gross Investment rose 27.6% to 43,311 crore

Source: Exchange Filing

Trump's BRICS tariff threats will hit Yuan and Rupee and reflects his intent to weaken attempts to de-dollarise, says Societe Generale. Such tariffs will weigh on EM currencies.

INR and Indonesian Rupiah are most susceptible to volatility generated by Trump's BRICS tariff, according to Convera Singapore.

Source: Bloomberg

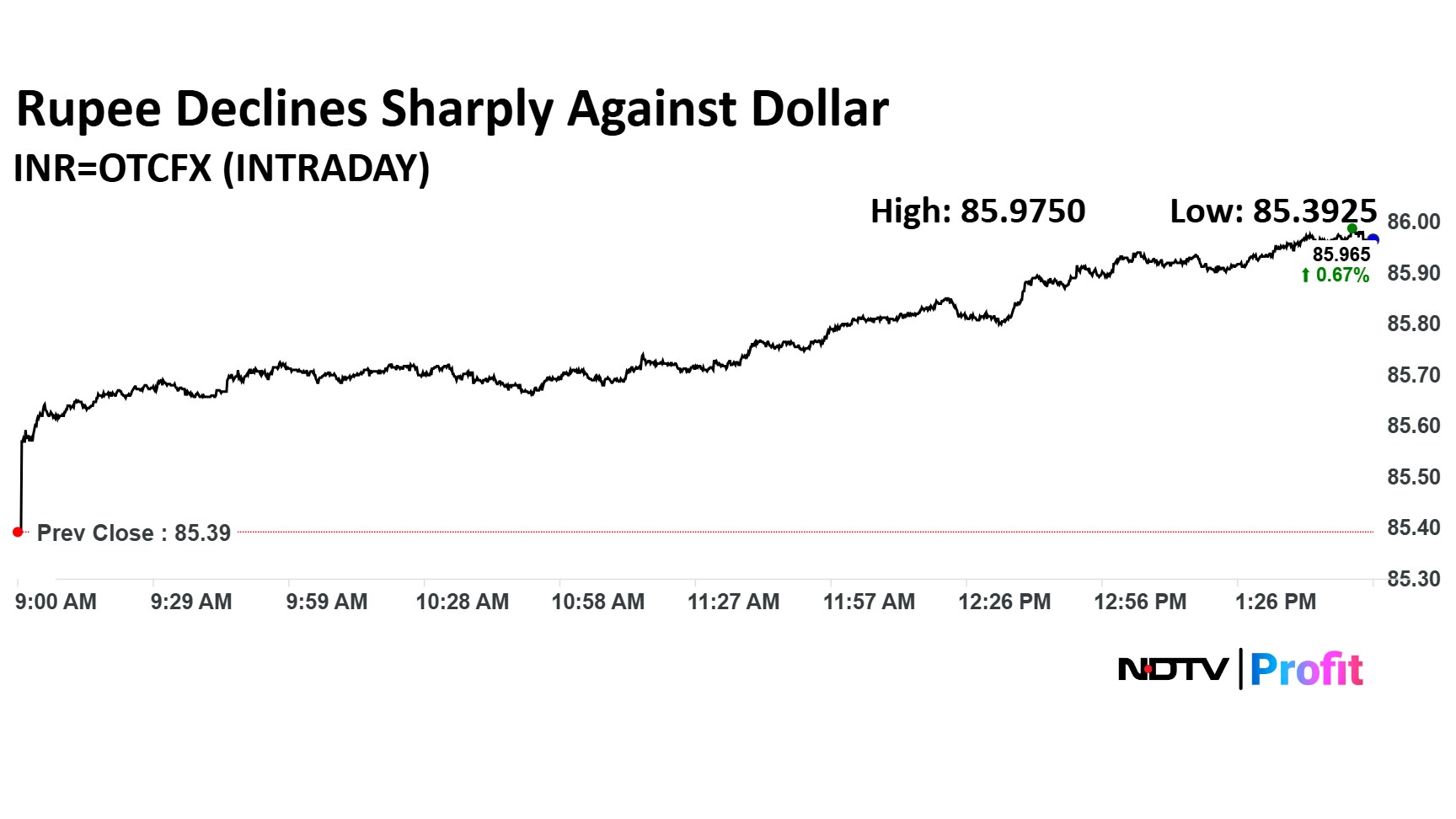

The Indian rupee dropped as much as 58 paise to 85.98 against the dollar. The local currency has seen its sharpest decline since June 13.

Rupee is the second-worst performer in Asia, roiled by Trump's tariff policies.

The Indian rupee dropped as much as 58 paise to 85.98 against the dollar. The local currency has seen its sharpest decline since June 13.

Rupee is the second-worst performer in Asia, roiled by Trump's tariff policies.

Jaiprakash Power Ventures, BSE, Dixon Tech, Godrej Consumer Products, PC Jeweller, HDFC Bank, Trent, Bharat Electronics, Reliance Industries and Hindustan Unilever are the most traded stocks in terms of value as of 1:30 pm.

Source: NSE

Sigachi Industries has officially approved the appointment of Lijo Stephen Chacko as the Deputy Group CEO.

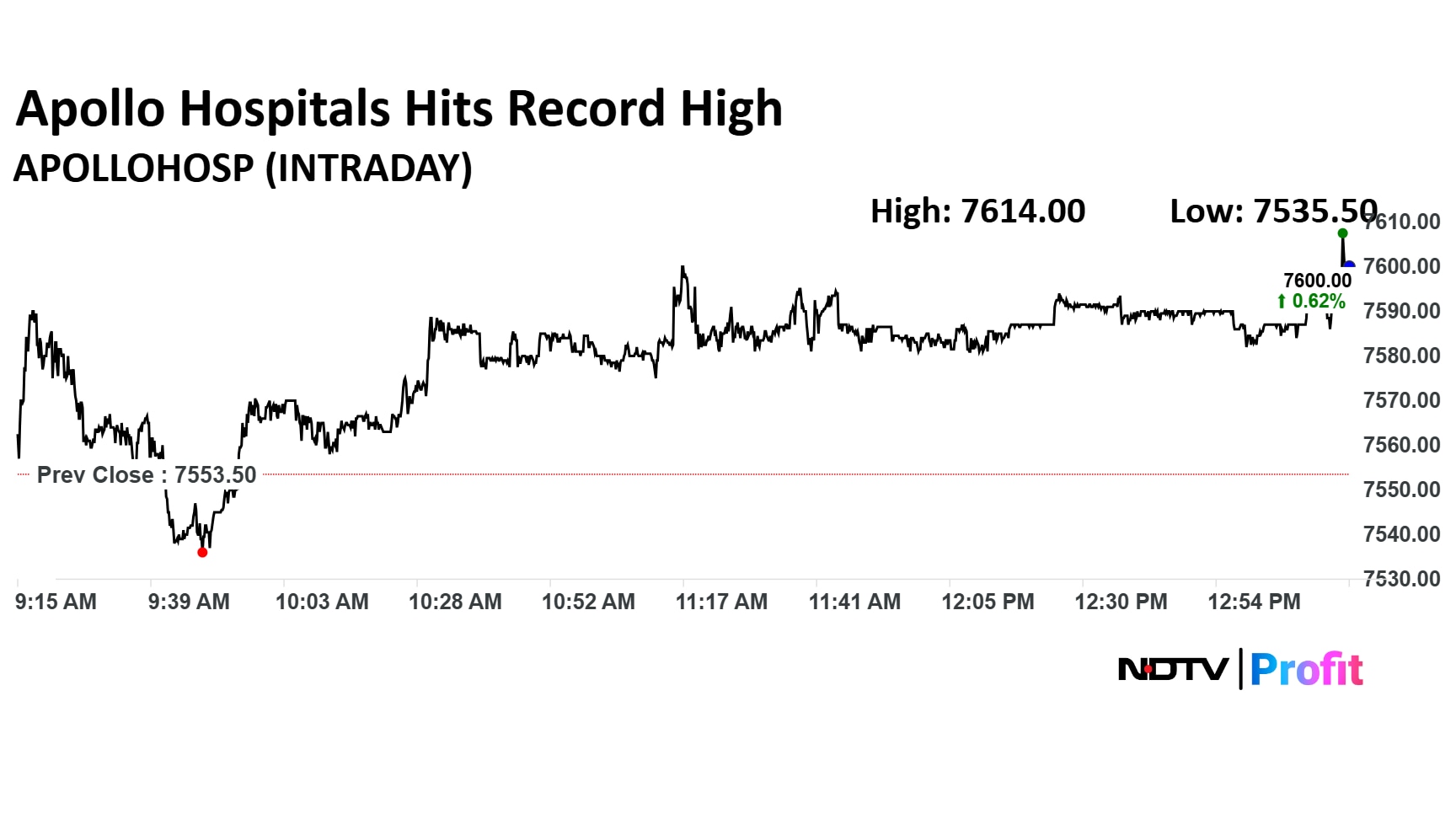

Apollo Hospitals Enterprise share price rose 0.80% to a record high of Rs 7,614 apiece. The share price was trading 0.74% higher at Rs 7,609.5 as of 1:21 p.m., as compared to 0.01% decline in the NSE Nifty 50 index.

Apollo Hospitals Enterprise share price rose 0.80% to a record high of Rs 7,614 apiece. The share price was trading 0.74% higher at Rs 7,609.5 as of 1:21 p.m., as compared to 0.01% decline in the NSE Nifty 50 index.

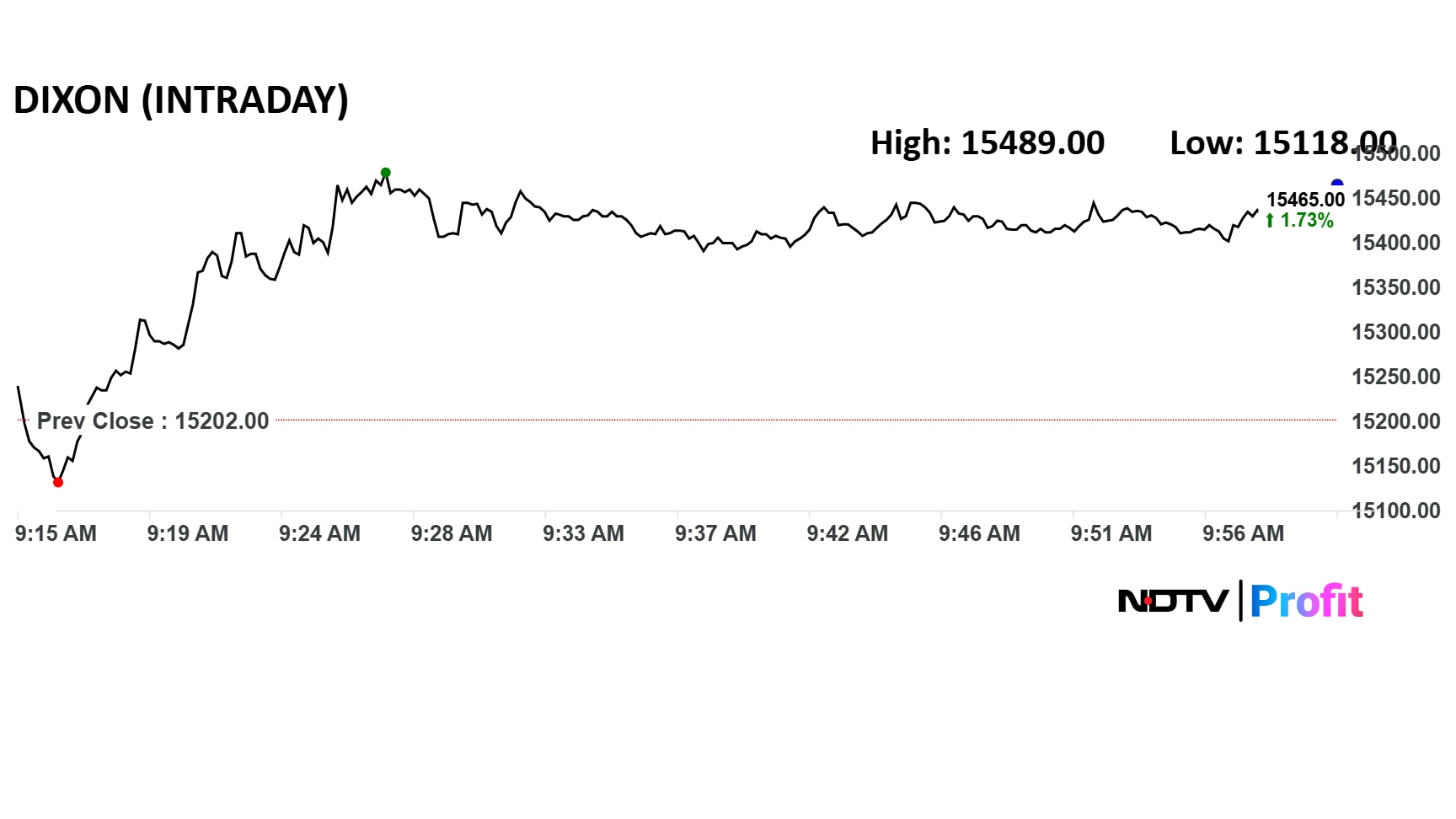

Eureka Forbes has entered into a pact with Dixon Technologies for the manufacturing of robotic vacuum cleaners. This collaboration aims to enhance production capabilities and expand market reach.

Andhra Paper's Rajahmundry plant operations are disrupted due to a worker strike demanding higher wage revisions. The company is in talks with trade unions to resolve the issue. The expected loss of production per day of the strike is approximately 520 metric tonne.

India Inc anxiously awaits the announcement of the India-US trade deal after months of negotiations between two of the world's top economies. The question on every investor's mind is how should the market partipants play this? Considering the present scenario, market veteran, Saurabh Mukherjea, Chief Investment Officer (CIO) and founder of Marcellus Investment Managers, has warned that investors must diversity away from Indian markets.

Speaking about the trade deal, also known as the India-US free trade agreement (FTA), in an exclusive interview with NDTV Profit, the market expert expressed confidence that the FTA will materialise and that the market has baked in the trade deal factor.

Read the full article here.

Revenue rose 57% to Rs 1,879 crore versus Rs 1,197 crore

Net Profit rose 36.3% to Rs 246 crore versus Rs 180 crore

Ebitda rose 32.8% to Rs 358 crore versus Rs 270 crore

Margin at 19.05% versus 22.5%

Kunal Rambhia, fund manager and trading strategist at The Streets, has recommended buying shares of 360 One Wam, Hindustan Unilever Ltd., and GMR Airports Infrastructure Ltd.

Rambhia suggests buying 360 One Wam Ltd. with a stop loss at Rs 1,220 and a target price of Rs 1,300.

Read the full article here.

Rupee's decline sharpest since June 19

Asian currencies slide, Rupee second worst performer

Trump's BRICS tariff threat roils Asian currencies

Source: Bloomberg

Rupee's decline sharpest since June 19

Asian currencies slide, Rupee second worst performer

Trump's BRICS tariff threat roils Asian currencies

Source: Bloomberg

United Drilling Tools has secured an order worth Rs 17.6 crore from Oil India for the supply of pipes.

Acme Solar Holdings has placed an order for a Battery Energy Storage System (BESS) with a total capacity of over 3.1 GWh from Zhejiang Narada and Trina Energy. The project is set to be commissioned over the next 12-18 months across various locations in India

SEBI will soon launch a theme-based investor awareness campaign.

Surveillance on markets continues at both SEBI and exchange levels.

Surveillance measures will be upgraded to better monitor market activity.

On reducing weekly expiries:

SEBI is keeping a close watch and will take action based on data analysis.

A white paper may be released today with 3-month data and detailed analysis.

The paper will show losses in weekly vs monthly expiries and also break down data age-wise.

Source: Tuhin Kanta Pandey, SEBI Chairperson

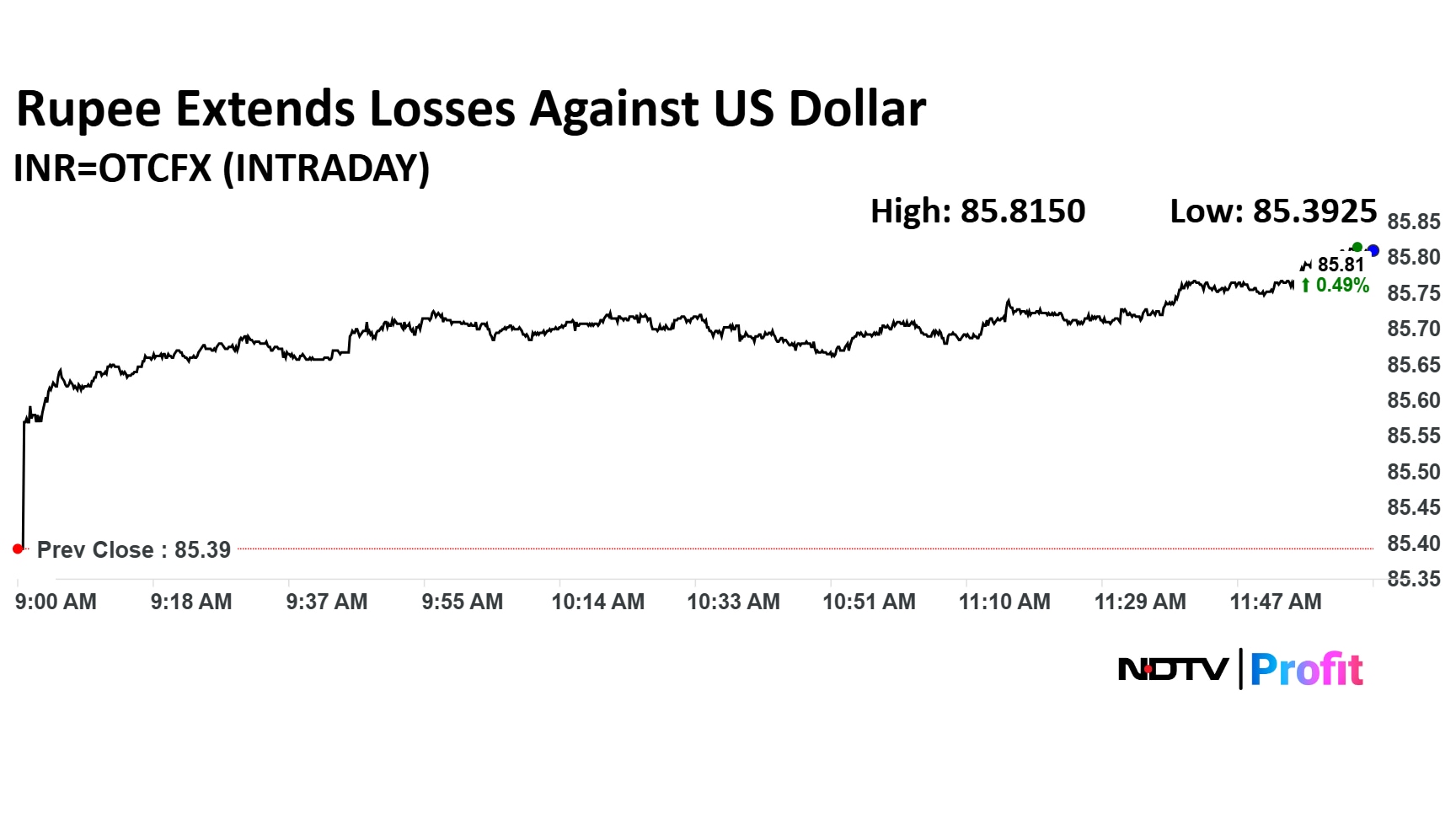

The rupee contiued to weaken against the dollar around noon on Monday. The local currency is under pressure after Trump threatened to impose 10% additional tariffs.

The rupee contiued to weaken against the dollar around noon on Monday. The local currency is under pressure after Trump threatened to impose 10% additional tariffs.

SEBI's recent ban on Jane Street for market manipulation has sent ripples through the financial markets, with brokerages offering varied perspectives on the impact. Still, Jefferies and Goldman Sachs foresee limited effects on BSE. Goldman Sachs, however, has reduced target price to Rs 2,300 from Rs 2,430 for the stock.

BSE will see limited impact from the SEBI order, according to Jefferies. "Earnings hit for BSE may be low as FPIs form 3-4% of turnover."

Saurabh Mukherjea, founder and CIO of Marcellus Investment Manager said investors will diversify away from Indian markets if India-US trade deal kicks in.

"Indian markets performed extremely well in last 5 years, but economy is slowing down and the market is expensive. For portfolio strategy, diversify away from Indian markets if India-US trade deal kicks in," he told NDTV Profit.

Dabur's share price jumped over 4% on Monday after the company reported a sequential recovery in demand during the first quarter of the current fiscal.

Dabur noted an uptick in volume growth, particularly in urban markets. The home and personal care division is expected to perform strongly, driven by significant growth in the oral, home, and skincare categories.

Dabur's share price jumped over 4% on Monday after the company reported a sequential recovery in demand during the first quarter of the current fiscal.

Dabur noted an uptick in volume growth, particularly in urban markets. The home and personal care division is expected to perform strongly, driven by significant growth in the oral, home, and skincare categories.

Vaishali Parekh of Prabhudas Lilladher has provided his recommendations for three stocks - Salasar Techno Engineering Ltd, Welspun Living, and Infosys for Monday, July 7, 2025.

Read full story here.

Godrej Consumer shares rose on Monday after its first quarter business update showed healthy top-line growth, particularly in the Home Care segment.

Morgan Stanley emphasises the strong beat and future growth prospects. While Macquarie, remains cautious on margin expansion and maintains a neutral stance.

Godrej Consumer shares rose on Monday after its first quarter business update showed healthy top-line growth, particularly in the Home Care segment.

Morgan Stanley emphasises the strong beat and future growth prospects. While Macquarie, remains cautious on margin expansion and maintains a neutral stance.

CK Narayan placed a stoploss at 25,000 for the Nifty. This can be raised once the Nifty futures rises and holds above 25700 in the week ahead, he writes for NDTV Profit.

The initial public offering of Travel Food Services Ltd. opened today. The price band for the IPO is set at Rs 1,045 to Rs 1,100 per share.

Travel Food Services IPO is entirely an offer for sale worth up to Rs 2,000 crore, with no fresh issue component. The face value of each share is Rs 1. Investors can bid for a minimum of 13 shares, and then in multiples thereof. The promoters off-loading their stake is Kapur Family Trust.

BSE Ltd., Dixon Technologies Ltd., Hindustan Unilever Ltd., Dabur India Ltd. and IndusInd Bank Ltd. were among the top companies on brokerages' radar on Monday.

Analysts have reviewed the first-quarter business performance of some of these companies.

Dixon Tech got a new brokerage initiation with a target price of Rs 18,946. B&K Securities said the company is uniquely positioned to benefit from the accelerating shift towards electronic outsourcing.

NDTV Profit tracks what analysts are saying about various stocks and sectors. Here are the analyst calls to keep an eye out for today.

The Indian rupee fell 31 paise to 85.7 to the dollar after Trump threatened to tariff BRICS more.

Rupee was the second worst performer in Asia.

The Indian rupee fell 31 paise to 85.7 to the dollar after Trump threatened to tariff BRICS more.

Rupee was the second worst performer in Asia.

Dixon Technologies Ltd., has received a 'buy' rating from B&K Securities as the brokerage initiated coverage on the stock, with a target price of Rs 18,946. The target implies a price-to-earnings ratio of approximately 62 times on FY27E earnings.

"We believe high growth, larger TAM, favourable policy support and high return ratio will help sustain valuation for the stock," the brokerage said.

Read full story here.

Dixon Technologies Ltd., has received a 'buy' rating from B&K Securities as the brokerage initiated coverage on the stock, with a target price of Rs 18,946. The target implies a price-to-earnings ratio of approximately 62 times on FY27E earnings.

"We believe high growth, larger TAM, favourable policy support and high return ratio will help sustain valuation for the stock," the brokerage said.

Read full story here.

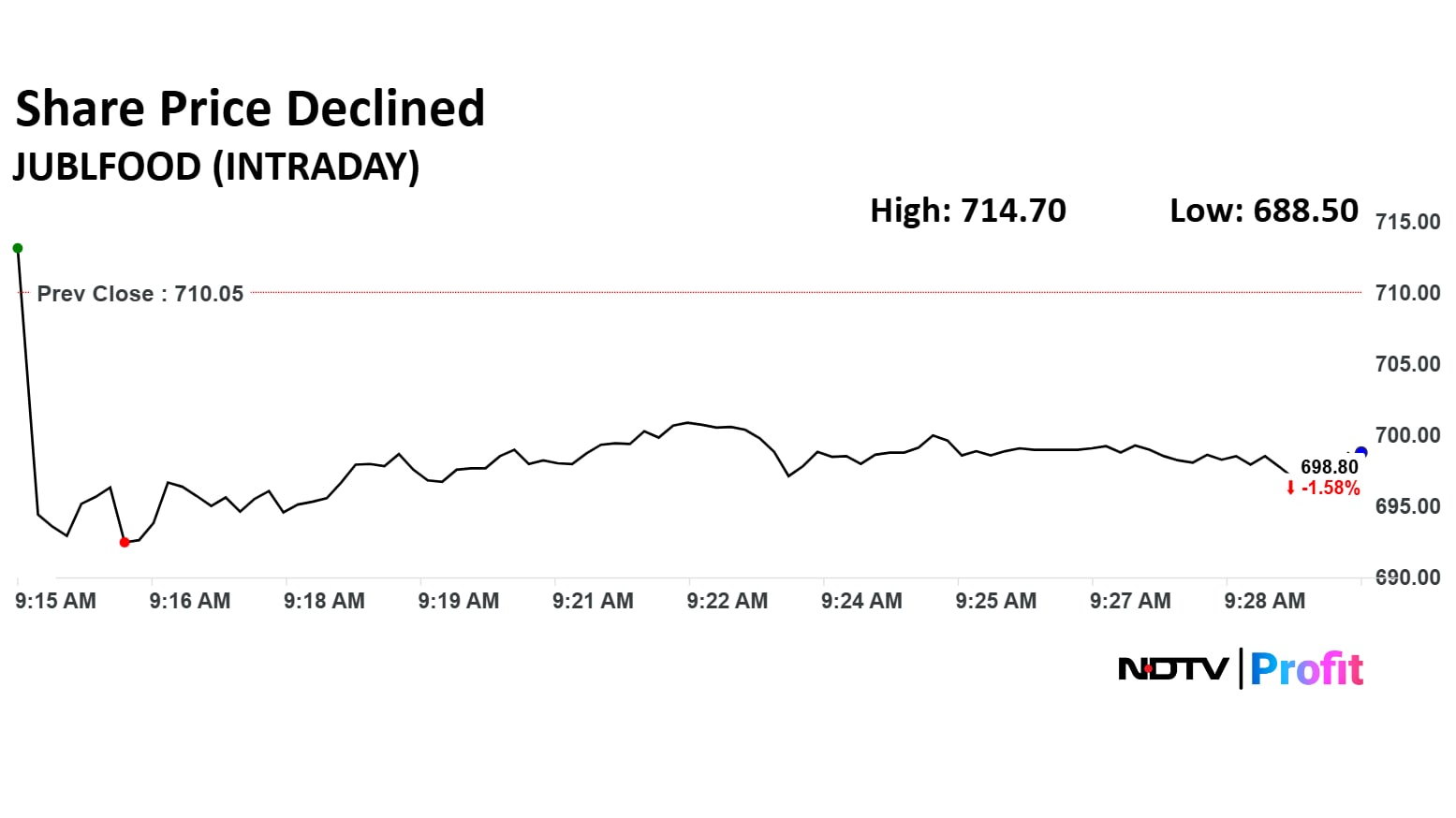

Jubilant FoodWorks Ltd.'s share price fell by 3.05% on Monday despite the release of a robust first quarter business update.

The operator of Domino's Pizza reported a consolidated revenue from operations of Rs 2,261 crore for the first quarter, marking a 17% year-on-year increase. Standalone revenue saw a rise of 18.2%, reaching Rs 1,702 crore. The company also expanded its footprint by adding 73 new stores, bringing the total store count to 3,389.

Read story here.

Jubilant FoodWorks Ltd.'s share price fell by 3.05% on Monday despite the release of a robust first quarter business update.

The operator of Domino's Pizza reported a consolidated revenue from operations of Rs 2,261 crore for the first quarter, marking a 17% year-on-year increase. Standalone revenue saw a rise of 18.2%, reaching Rs 1,702 crore. The company also expanded its footprint by adding 73 new stores, bringing the total store count to 3,389.

Read story here.

Shares of Titan Co., JSW Steel Ltd., Solar Industries Ltd. and JK Cement Ltd. will be of interest on Monday as it marks the last session for investors to buy shares to qualify for receiving the dividend before the stock goes ex/record-date.

Under India's T+1 settlement cycle, shares purchased on the record date itself will not qualify for the dividend payment. Hence, if the record date of a dividend stock is July 8, then shares must be purchased by July 7.

Read story here.

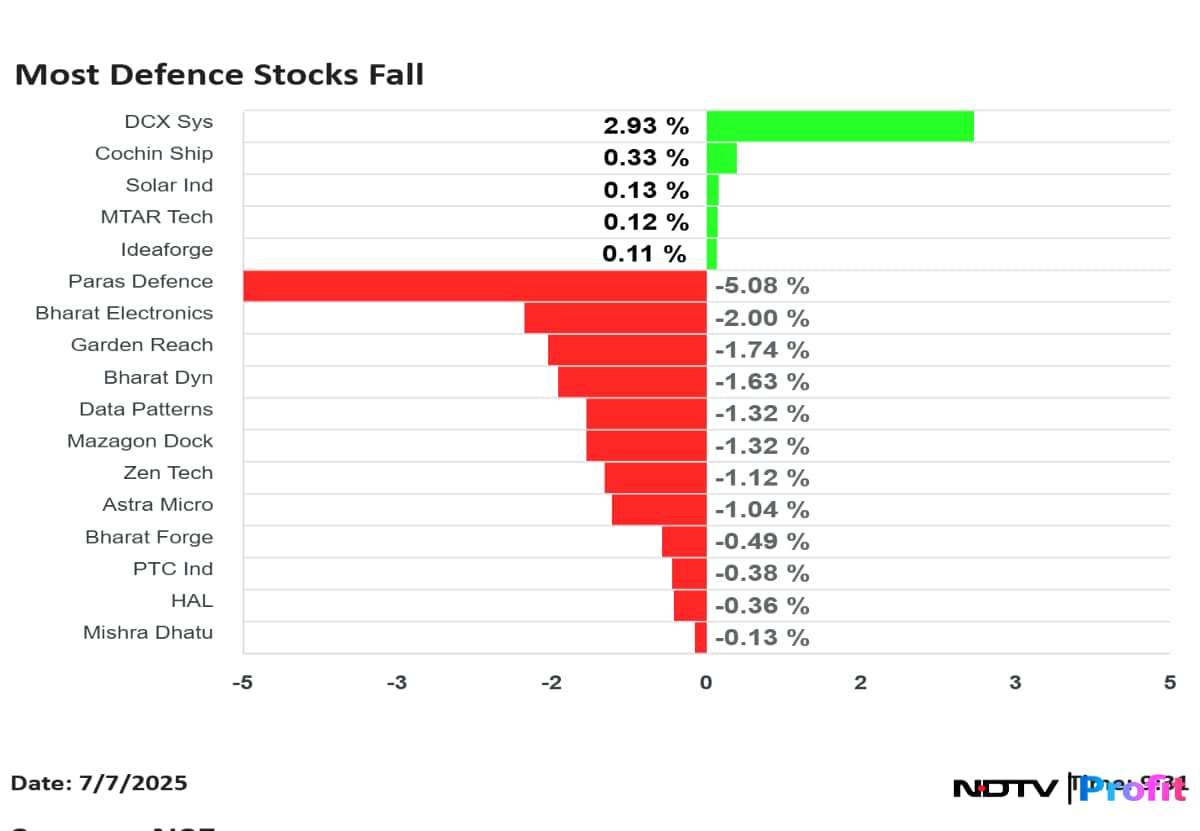

The Nifty Defence index down is 1%. Top loser in the counter is Paras Defence, folowed by Bharat Electronics and GRSE.

The Nifty Defence index down is 1%. Top loser in the counter is Paras Defence, folowed by Bharat Electronics and GRSE.

The broader markets are flat. The Nifty Midcap 150 and Nifty Smallcap 250 initially fell after market open but recovered from losses to trade unchanged.

The broader markets are flat. The Nifty Midcap 150 and Nifty Smallcap 250 initially fell after market open but recovered from losses to trade unchanged.

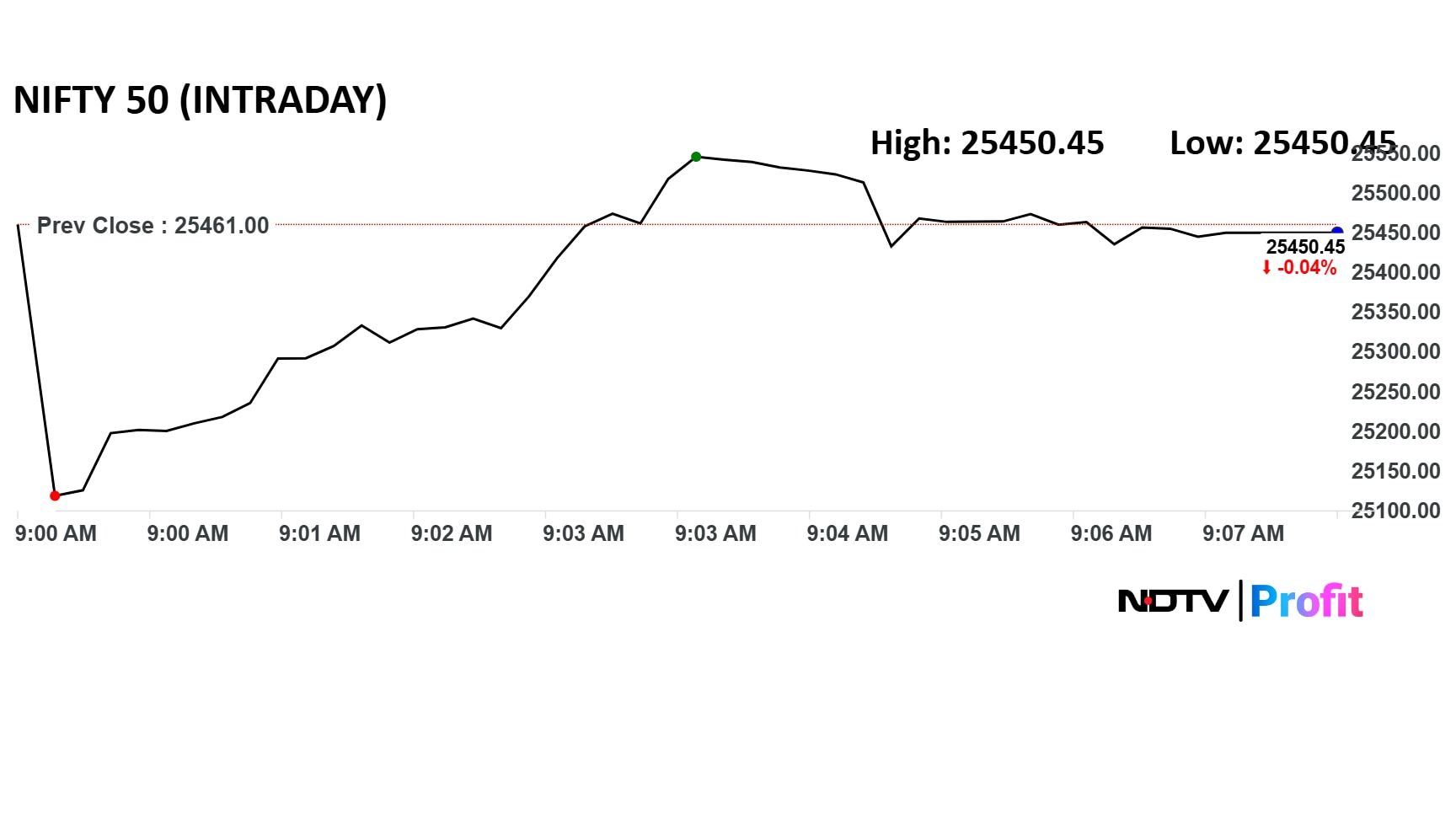

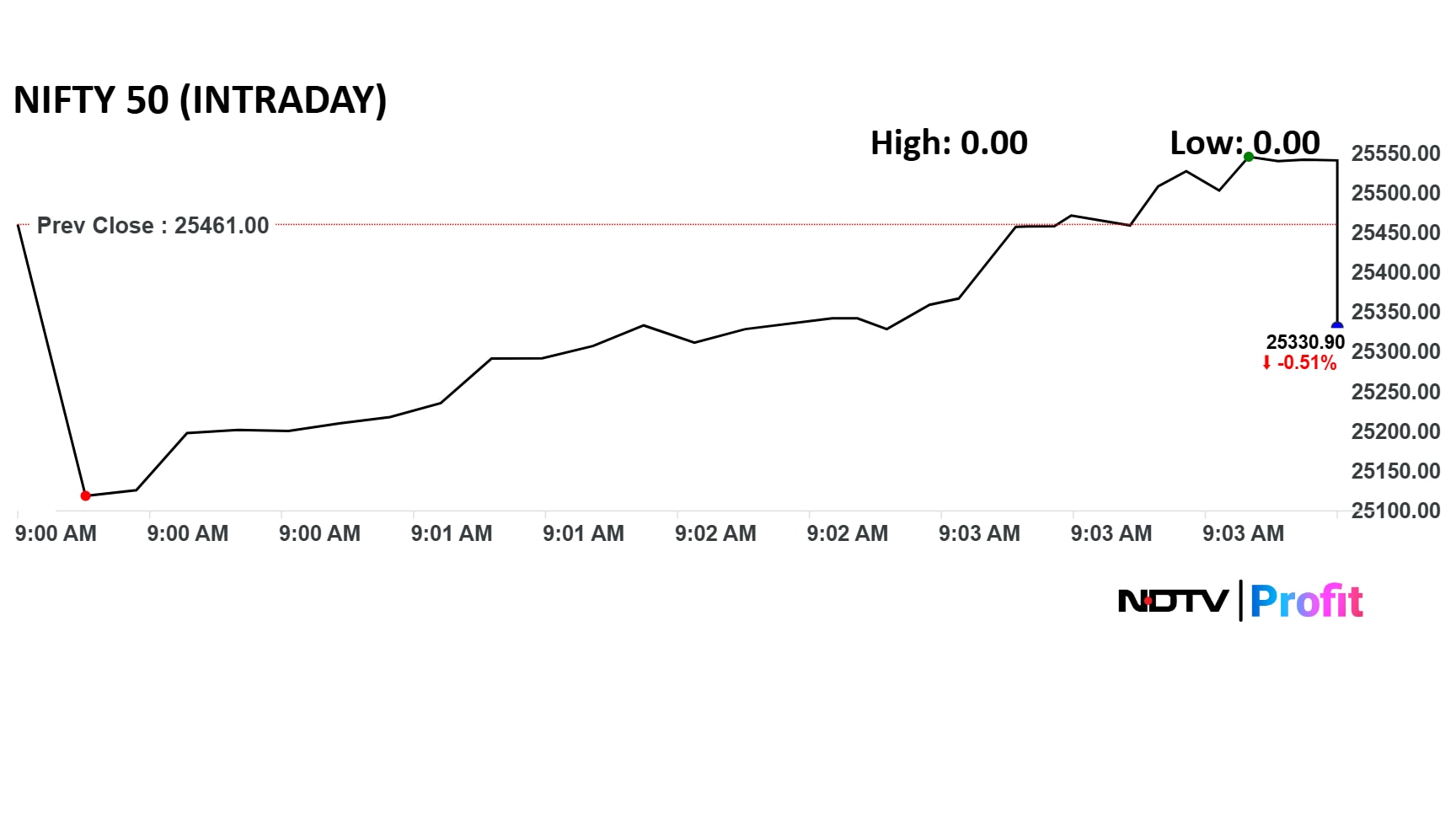

India's benchmark Nifty and Sensex opened lower on Monday as trade uncertainities remained high ahead of the July 9 US tariff deadline. Donald Trump threatened BRICS countries with an additional 10% tariff.

The Nifty opened at 25,450 and Sensex at 83,400.

India's benchmark Nifty and Sensex opened lower on Monday as trade uncertainities remained high ahead of the July 9 US tariff deadline. Donald Trump threatened BRICS countries with an additional 10% tariff.

The Nifty opened at 25,450 and Sensex at 83,400.

The Nifty has been volatile in the pre-open session. It dropped below 25,200 and soon recovered to trade higher, before again slipping marginally.

The Nifty has been volatile in the pre-open session. It dropped below 25,200 and soon recovered to trade higher, before again slipping marginally.

The rupee opened 18 paise lower at 85.57 against US Dollar on Monday. It closed at 85.39 on Friday.

Source: Bloomberg

The Nifty dropped below 25,200 minutes into the pre-open session. An hour back, Donald Trump threatened a 10% additional tariff on BRICS countries.

The Nifty dropped below 25,200 minutes into the pre-open session. An hour back, Donald Trump threatened a 10% additional tariff on BRICS countries.

Nifty July futures up by 0.17% to 25,552 at a premium of 91 points.

Nifty January futures open interest down by 1.73%

Nifty Options July 10 Expiry: Maximum call open interest at 26,500 and maximum put open interest at 25,000

Securities in ban period: RBL Bank

Markets remained closed on Friday in observance of Independence Day.

US stocks advanced in Thursday’s trading session, with the Dow Jones, Nasdaq, and S&P 500 all posting gains following the release of strong US jobs data by the Labor Department.

Asian shares posted modest moves at the open as investors awaited progress on trade deals with the US ahead of the July 9 deadline imposed by President Donald Trump.

Indexes in Japan, Australia and South Korea posted small declines after Trump administration officials signaled Aug. 1 as the date for higher levies to kick in and said some countries may get more time to negotiate deals.

The GIFT Nifty was trading near 25,529 early Monday. The futures contract based on the benchmark Nifty 50 rose 0.01% as of 6:39 a.m. indicating a positive start for the Indian markets.

Benchmark indices broke a two-day losing streak to settle higher on Friday but on a weekly basis the Nifty 50 and Sensex declined over 0.75%. The NSE Nifty 50 ended 55.70 points or 0.22% higher at 25,461, while the BSE Sensex closed 193.42 points or 0.23% up at 83,432.89.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.