Overseas investors turned buyers on Tuesday after three days of selling.

Foreign portfolio investors bought stocks worth Rs 10.13 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors remained net buyers for the sixth day and mopped up equities worth Rs 5,024.36 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 10,021 crore worth of Indian equities so far in 2024, according to data from the National Securities Depository Ltd., updated till the previous trading day.

The local currency strengthened by 14 paise to close at 83.29 against the U.S. Dollar.

It recorded its lowest ever close at Rs 83.43 on Friday.

Source: Bloomberg

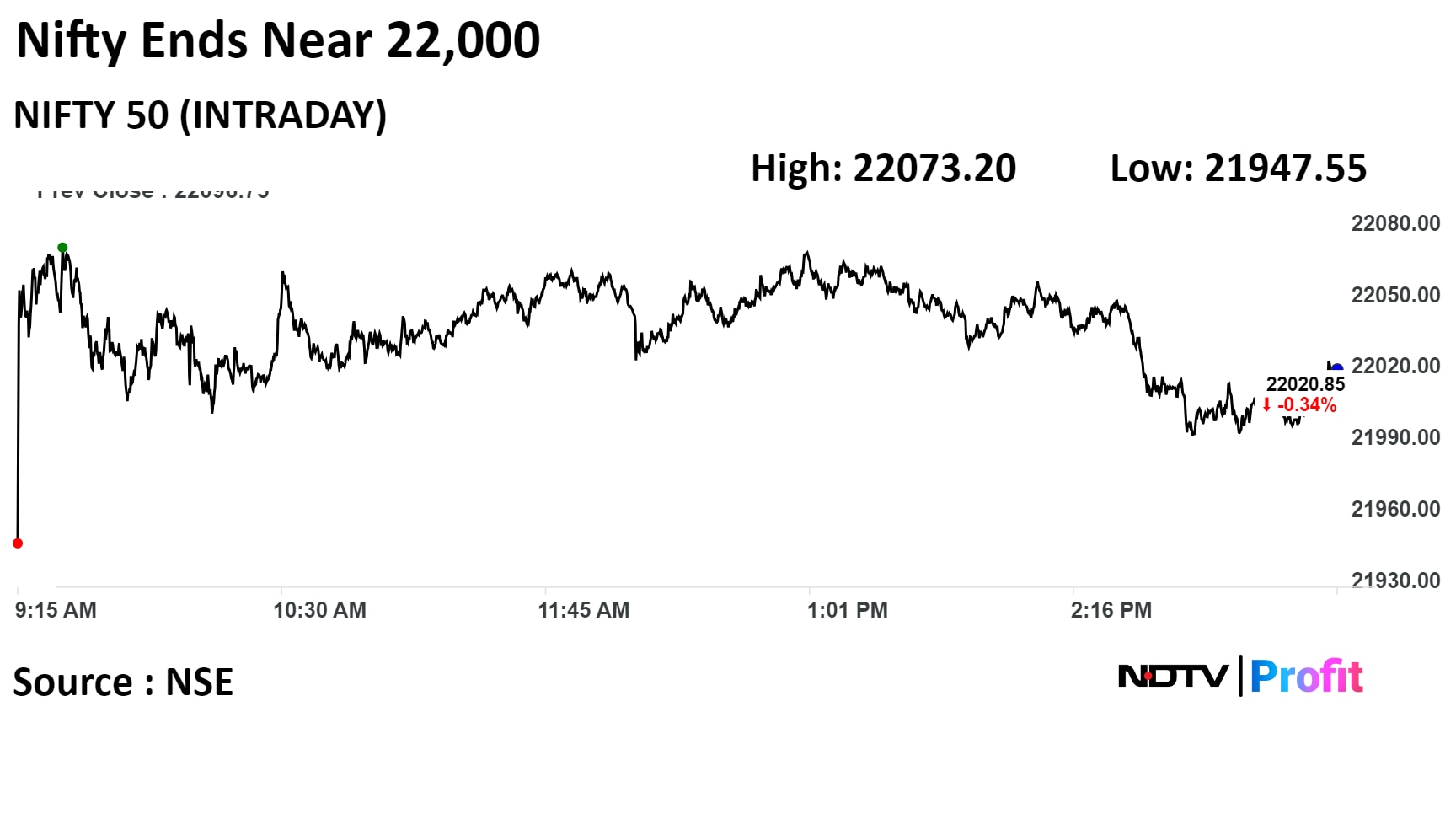

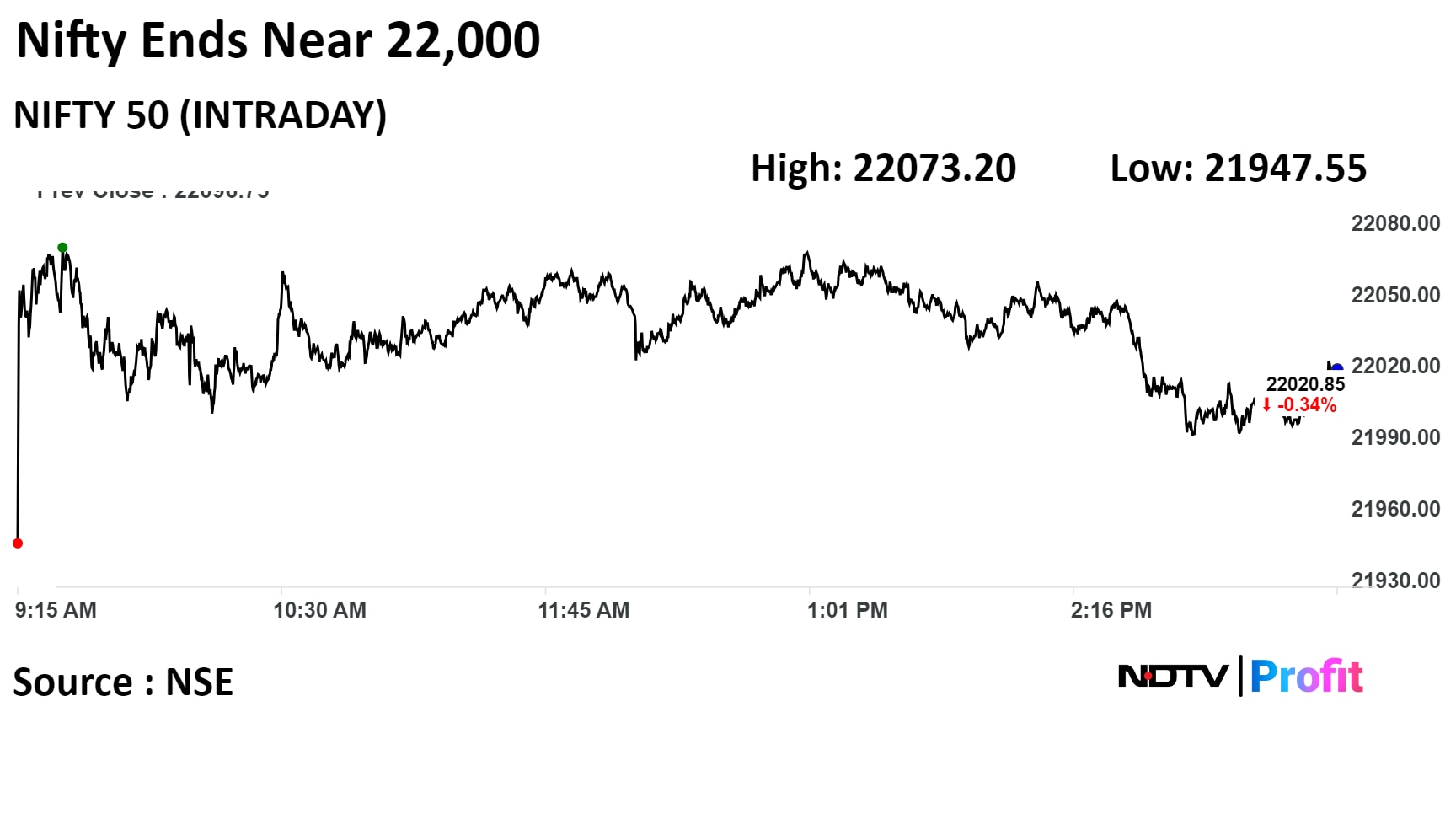

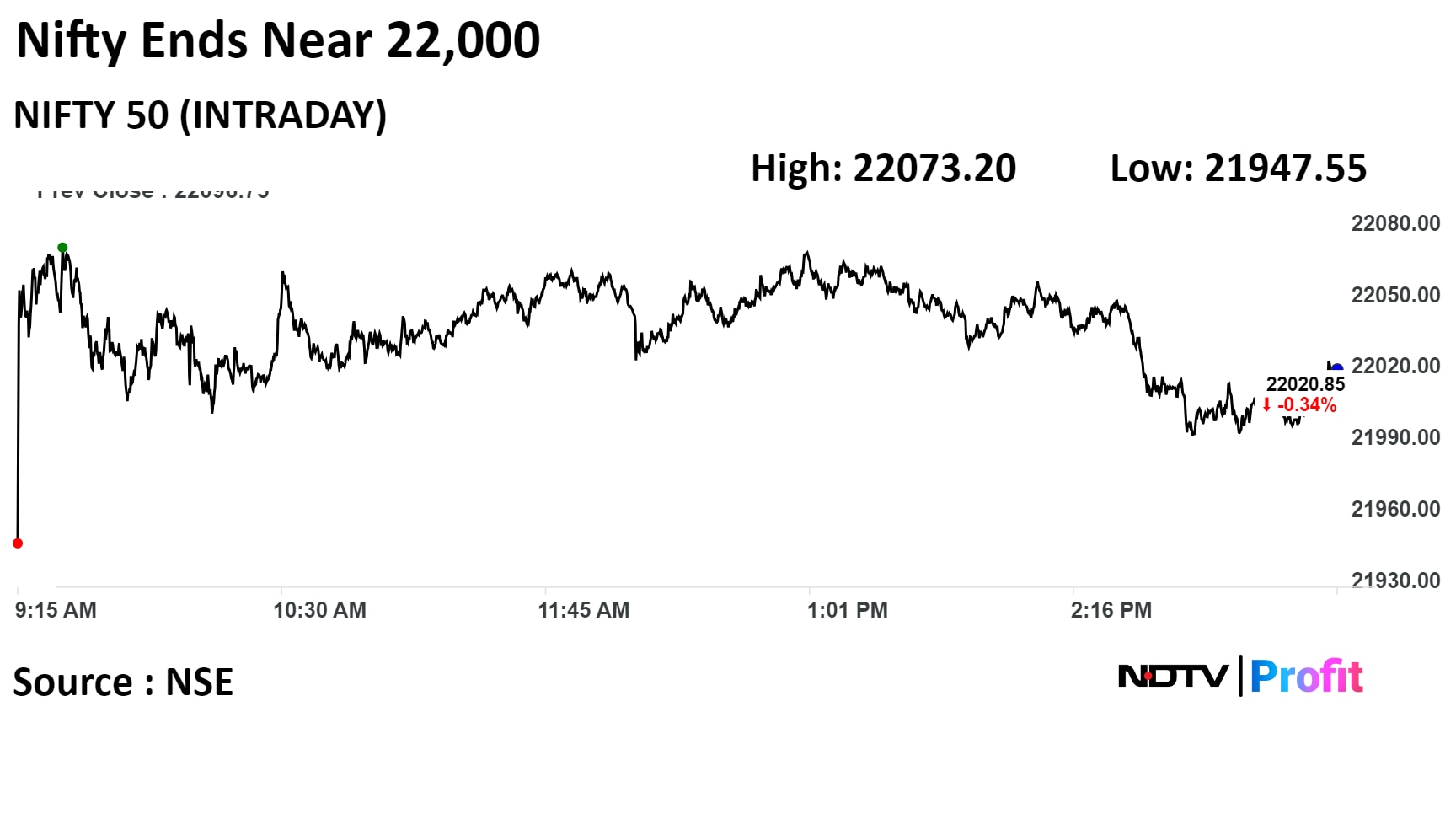

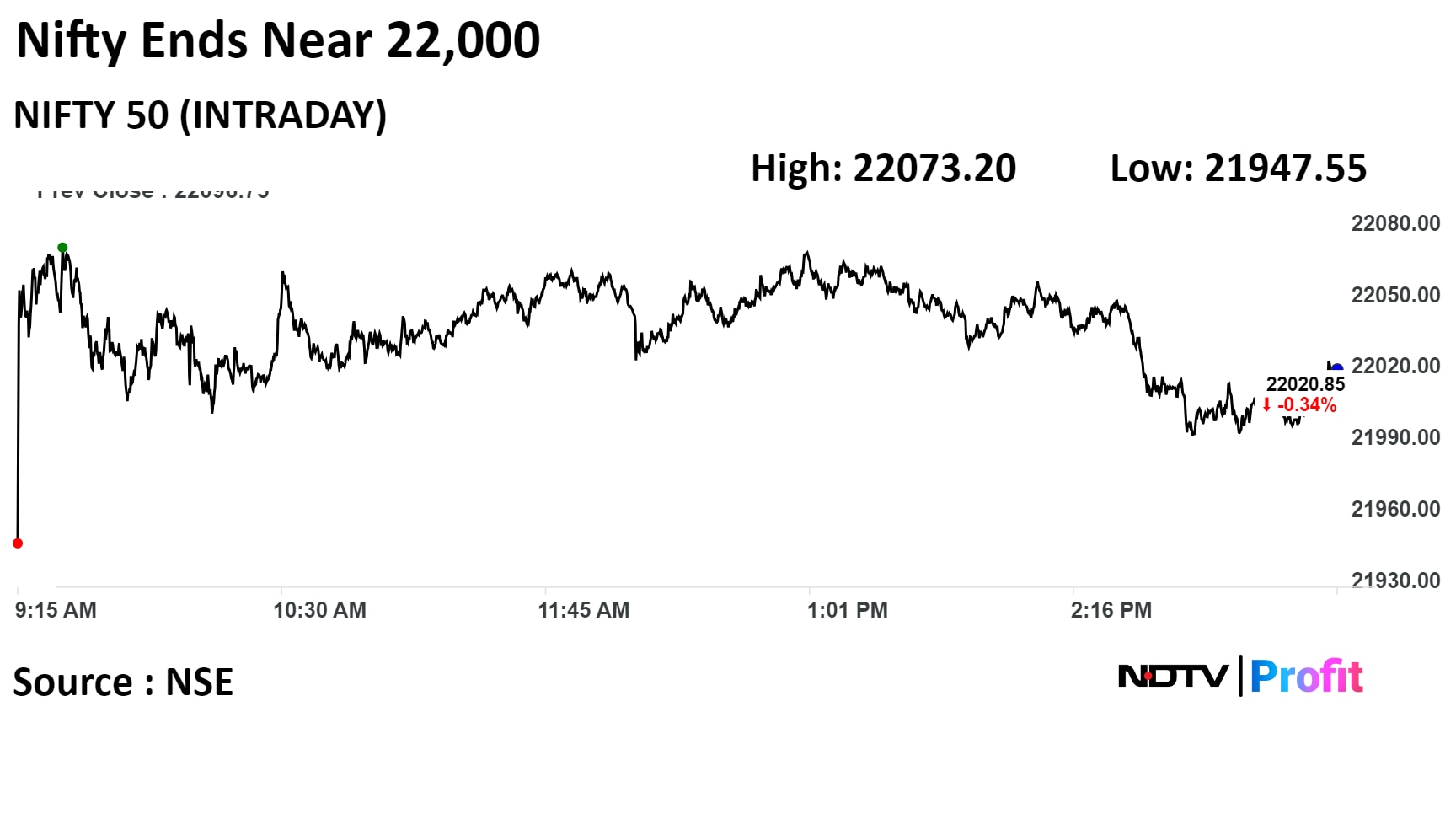

Benchmark equity indices snapped their three-day rally and ended lower today as losses in heavyweights weighed while broader indices ended higher.

The Nifty lost 75.90 points or 0.34% to close at 22,020.85 while the Sensex ended at 72,473.96 points, down 357.98 points or 0.49%.

"On the hourly chart, it appears that the Index is forming an inverted head & shoulder formation where a level of 22,200 will be considered as a breakout point (neckline), and in that case, the target is 22,640, said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices snapped their three-day rally and ended lower today as losses in heavyweights weighed while broader indices ended higher.

The Nifty lost 75.90 points or 0.34% to close at 22,020.85 while the Sensex ended at 72,473.96 points, down 357.98 points or 0.49%.

"On the hourly chart, it appears that the Index is forming an inverted head & shoulder formation where a level of 22,200 will be considered as a breakout point (neckline), and in that case, the target is 22,640, said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices snapped their three-day rally and ended lower today as losses in heavyweights weighed while broader indices ended higher.

The Nifty lost 75.90 points or 0.34% to close at 22,020.85 while the Sensex ended at 72,473.96 points, down 357.98 points or 0.49%.

"On the hourly chart, it appears that the Index is forming an inverted head & shoulder formation where a level of 22,200 will be considered as a breakout point (neckline), and in that case, the target is 22,640, said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices snapped their three-day rally and ended lower today as losses in heavyweights weighed while broader indices ended higher.

The Nifty lost 75.90 points or 0.34% to close at 22,020.85 while the Sensex ended at 72,473.96 points, down 357.98 points or 0.49%.

"On the hourly chart, it appears that the Index is forming an inverted head & shoulder formation where a level of 22,200 will be considered as a breakout point (neckline), and in that case, the target is 22,640, said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices snapped their three-day rally and ended lower today as losses in heavyweights weighed while broader indices ended higher.

The Nifty lost 75.90 points or 0.34% to close at 22,020.85 while the Sensex ended at 72,473.96 points, down 357.98 points or 0.49%.

"On the hourly chart, it appears that the Index is forming an inverted head & shoulder formation where a level of 22,200 will be considered as a breakout point (neckline), and in that case, the target is 22,640, said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices snapped their three-day rally and ended lower today as losses in heavyweights weighed while broader indices ended higher.

The Nifty lost 75.90 points or 0.34% to close at 22,020.85 while the Sensex ended at 72,473.96 points, down 357.98 points or 0.49%.

"On the hourly chart, it appears that the Index is forming an inverted head & shoulder formation where a level of 22,200 will be considered as a breakout point (neckline), and in that case, the target is 22,640, said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices snapped their three-day rally and ended lower today as losses in heavyweights weighed while broader indices ended higher.

The Nifty lost 75.90 points or 0.34% to close at 22,020.85 while the Sensex ended at 72,473.96 points, down 357.98 points or 0.49%.

"On the hourly chart, it appears that the Index is forming an inverted head & shoulder formation where a level of 22,200 will be considered as a breakout point (neckline), and in that case, the target is 22,640, said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices snapped their three-day rally and ended lower today as losses in heavyweights weighed while broader indices ended higher.

The Nifty lost 75.90 points or 0.34% to close at 22,020.85 while the Sensex ended at 72,473.96 points, down 357.98 points or 0.49%.

"On the hourly chart, it appears that the Index is forming an inverted head & shoulder formation where a level of 22,200 will be considered as a breakout point (neckline), and in that case, the target is 22,640, said Aditya Gaggar, director of Progressive Shares.

Shares of HDFC Bank Ltd., Reliance Industries Ltd., ICICI Bank Ltd., Infosys Ltd., and Bharti Airtel Ltd. dragged the indices.

Meanwhile, those of Larsen & Toubro Ltd., Bajaj Finance Ltd., NTPC Ltd., Axis Bank Ltd., and Hindalco Industries Ltd. minimised the losses.

Most sectoral indices were lower with Nifty Media losing the most. On the other hand, Nifty Realty gained over 1%.

Broader markets ended on a mixed note. The S&P BSE Midcap ended 0.71% higher, and the S&P BSE Smallcap ended 0.11% lower.

On BSE, six sectors declined, and 14 sectors advanced. The S&P BSE TECK index fell the most among sectoral indices. The S&P BSE Services was the best performing sector.

Market breadth was skewed in favour of sellers. Around 2,538 stocks declined, around 1,422 stocks advanced, and 140 remained unchanged on BSE.

Board advises MD to further simplify management structure

Identifies business verticals that require assessment

Music business to focus on optimising costs

Forms special panel to review management’s performance

Source: Exchange Filing

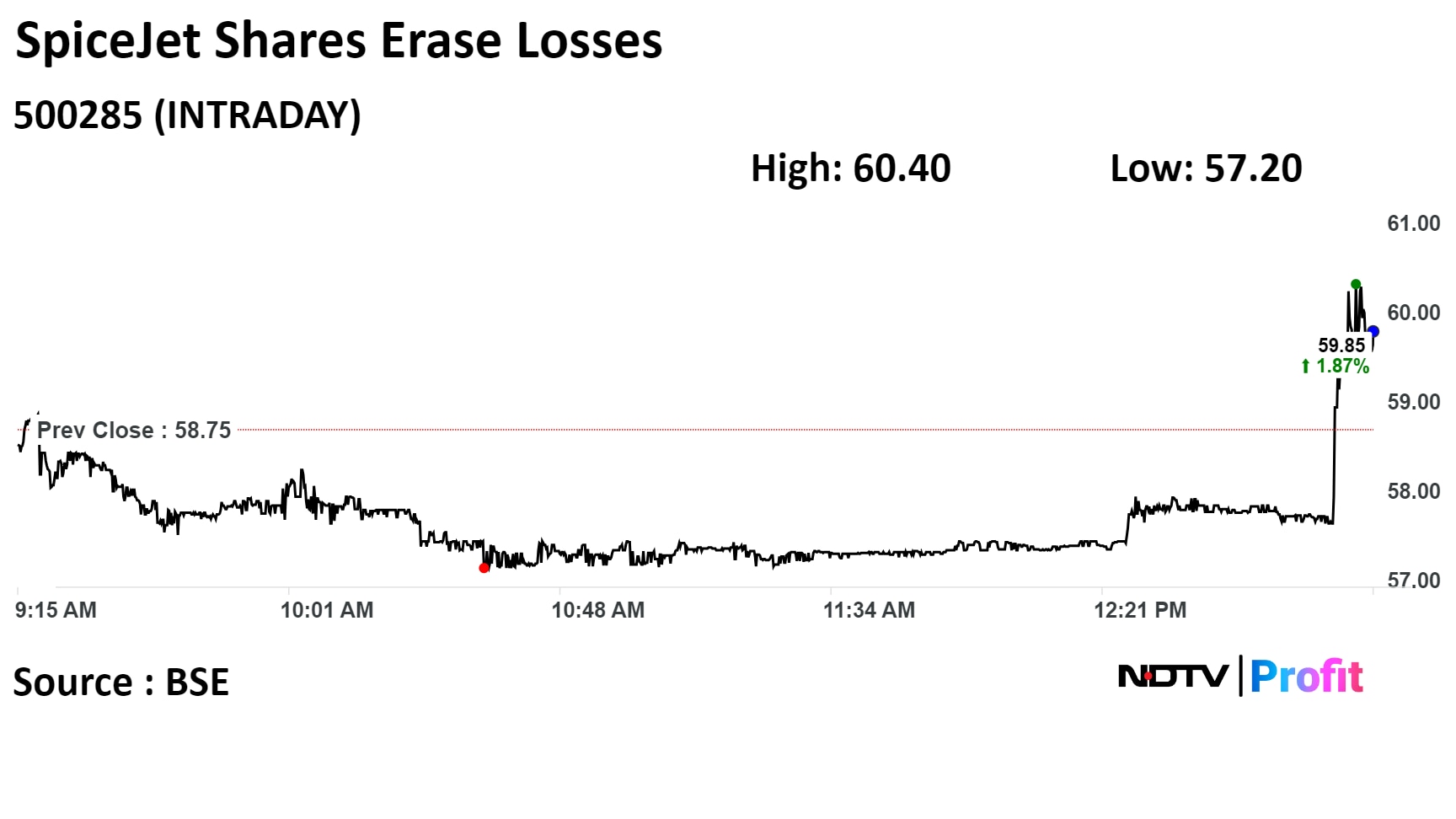

SpiceJet Ltd. rose as much as 5.53% to Rs 62.00 apiece, the highest level since March 18. It was trading 5.46% higher at Rs 61.96 apiece, as of 1:25 p.m. This compares to a 0.29% decline in the S&P BSE Sensex Index.

It has risen 95.22% in 12 months. The relative strength index was at 48.95.

Out of four analysts tracking the company, one maintains a 'buy' rating, two recommend a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 22.9%.

SpiceJet Ltd. rose as much as 5.53% to Rs 62.00 apiece, the highest level since March 18. It was trading 5.46% higher at Rs 61.96 apiece, as of 1:25 p.m. This compares to a 0.29% decline in the S&P BSE Sensex Index.

It has risen 95.22% in 12 months. The relative strength index was at 48.95.

Out of four analysts tracking the company, one maintains a 'buy' rating, two recommend a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 22.9%.

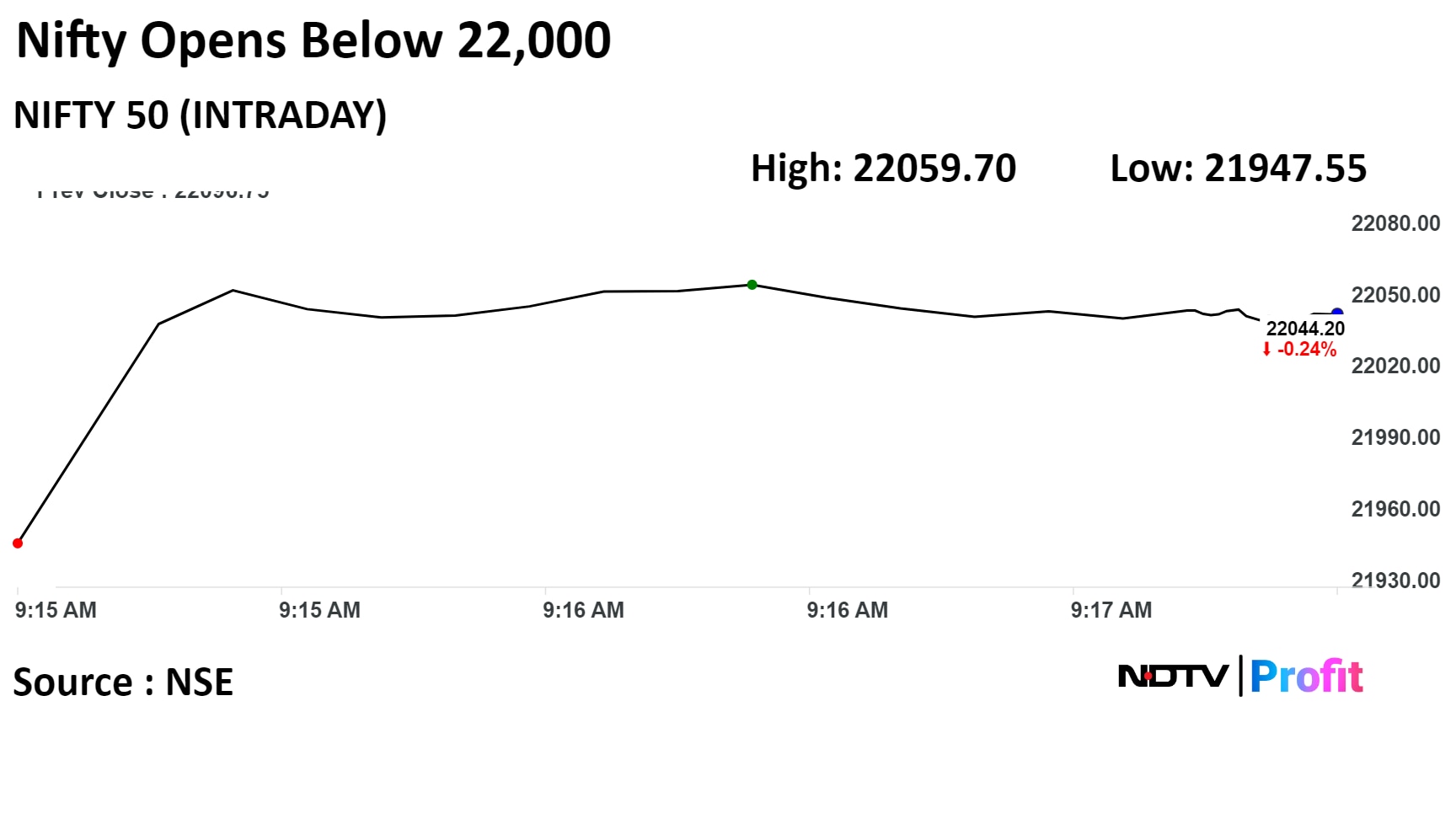

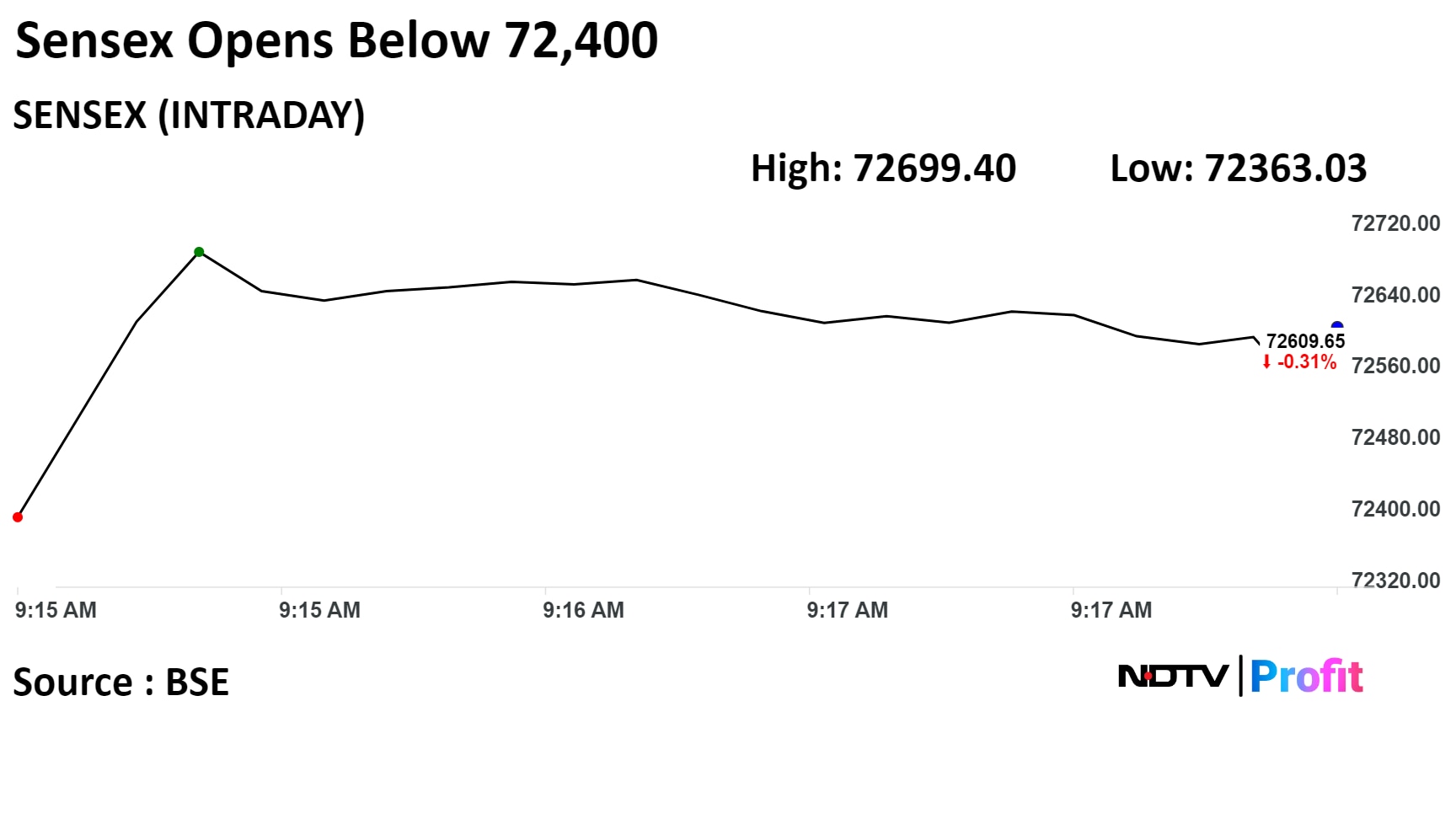

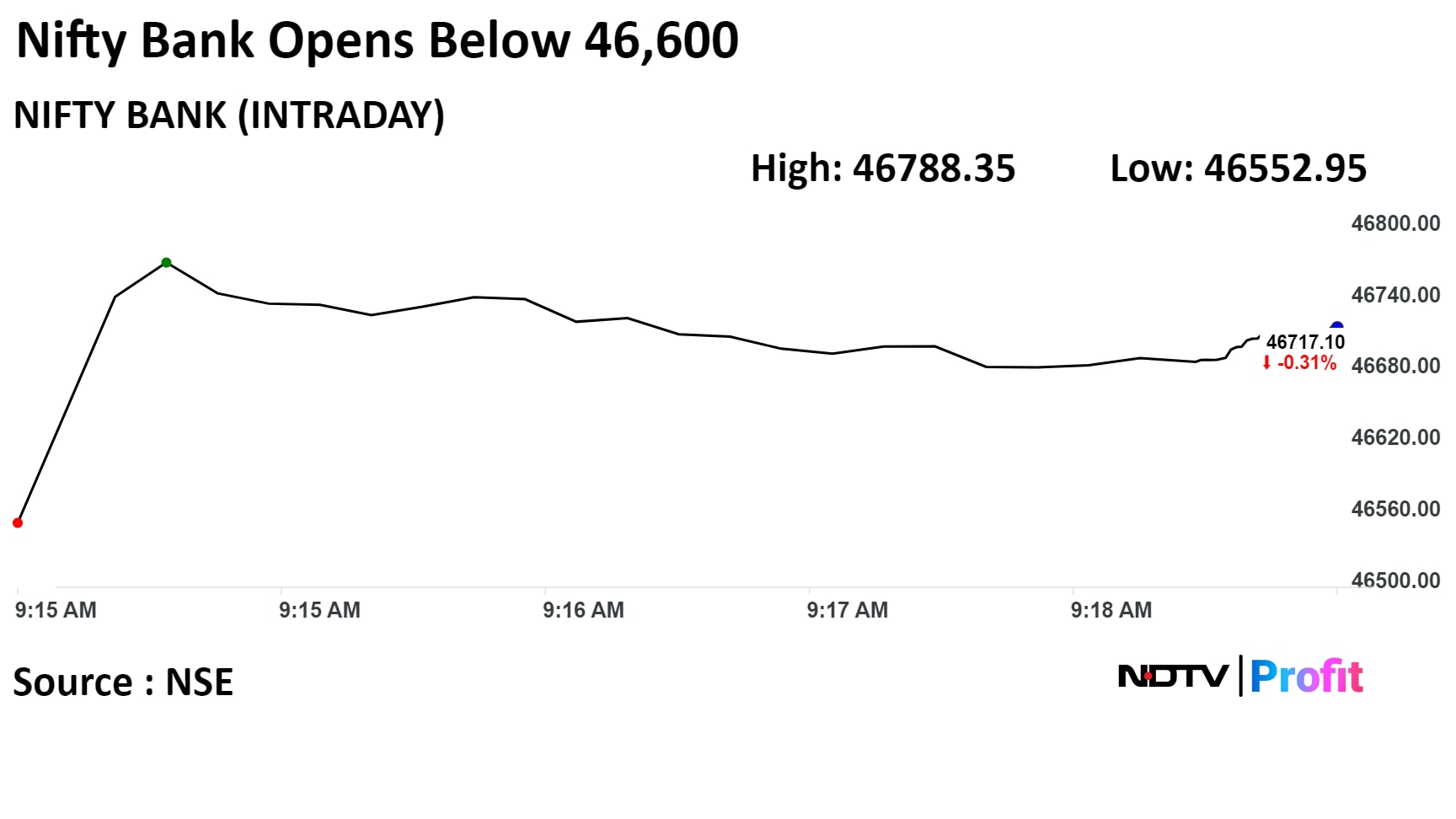

India's benchmark indices were trading lower through midday on Tuesday, weighed by index-heavy HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 68.20 points, or 0.31%, lower at 22,030, and the S&P BSE Sensex fell 301.42 points, or 0.41%, to trade at 72,530.01.

The Nifty hit an intraday low of 21,947.55 and the Sensex touched the low of 72,363.03 so far on Tuesday.

Traders are likely to adopt a cautious approach, opting to observe market movements closely, said Shrey Jain, founder and chief executive officer at SAS Online.

"It's a good opportunity to buy quality large-cap stocks during dips. With no significant catalysts in sight, it's anticipated that the market will remain range-bound throughout this holiday-shortened week," Jain said.

The Nifty 50 faces resistance at 22,250 while maintaining support at 21,950, he said.

India's benchmark indices were trading lower through midday on Tuesday, weighed by index-heavy HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 68.20 points, or 0.31%, lower at 22,030, and the S&P BSE Sensex fell 301.42 points, or 0.41%, to trade at 72,530.01.

The Nifty hit an intraday low of 21,947.55 and the Sensex touched the low of 72,363.03 so far on Tuesday.

Traders are likely to adopt a cautious approach, opting to observe market movements closely, said Shrey Jain, founder and chief executive officer at SAS Online.

"It's a good opportunity to buy quality large-cap stocks during dips. With no significant catalysts in sight, it's anticipated that the market will remain range-bound throughout this holiday-shortened week," Jain said.

The Nifty 50 faces resistance at 22,250 while maintaining support at 21,950, he said.

India's benchmark indices were trading lower through midday on Tuesday, weighed by index-heavy HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 68.20 points, or 0.31%, lower at 22,030, and the S&P BSE Sensex fell 301.42 points, or 0.41%, to trade at 72,530.01.

The Nifty hit an intraday low of 21,947.55 and the Sensex touched the low of 72,363.03 so far on Tuesday.

Traders are likely to adopt a cautious approach, opting to observe market movements closely, said Shrey Jain, founder and chief executive officer at SAS Online.

"It's a good opportunity to buy quality large-cap stocks during dips. With no significant catalysts in sight, it's anticipated that the market will remain range-bound throughout this holiday-shortened week," Jain said.

The Nifty 50 faces resistance at 22,250 while maintaining support at 21,950, he said.

India's benchmark indices were trading lower through midday on Tuesday, weighed by index-heavy HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 68.20 points, or 0.31%, lower at 22,030, and the S&P BSE Sensex fell 301.42 points, or 0.41%, to trade at 72,530.01.

The Nifty hit an intraday low of 21,947.55 and the Sensex touched the low of 72,363.03 so far on Tuesday.

Traders are likely to adopt a cautious approach, opting to observe market movements closely, said Shrey Jain, founder and chief executive officer at SAS Online.

"It's a good opportunity to buy quality large-cap stocks during dips. With no significant catalysts in sight, it's anticipated that the market will remain range-bound throughout this holiday-shortened week," Jain said.

The Nifty 50 faces resistance at 22,250 while maintaining support at 21,950, he said.

India's benchmark indices were trading lower through midday on Tuesday, weighed by index-heavy HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 68.20 points, or 0.31%, lower at 22,030, and the S&P BSE Sensex fell 301.42 points, or 0.41%, to trade at 72,530.01.

The Nifty hit an intraday low of 21,947.55 and the Sensex touched the low of 72,363.03 so far on Tuesday.

Traders are likely to adopt a cautious approach, opting to observe market movements closely, said Shrey Jain, founder and chief executive officer at SAS Online.

"It's a good opportunity to buy quality large-cap stocks during dips. With no significant catalysts in sight, it's anticipated that the market will remain range-bound throughout this holiday-shortened week," Jain said.

The Nifty 50 faces resistance at 22,250 while maintaining support at 21,950, he said.

India's benchmark indices were trading lower through midday on Tuesday, weighed by index-heavy HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 68.20 points, or 0.31%, lower at 22,030, and the S&P BSE Sensex fell 301.42 points, or 0.41%, to trade at 72,530.01.

The Nifty hit an intraday low of 21,947.55 and the Sensex touched the low of 72,363.03 so far on Tuesday.

Traders are likely to adopt a cautious approach, opting to observe market movements closely, said Shrey Jain, founder and chief executive officer at SAS Online.

"It's a good opportunity to buy quality large-cap stocks during dips. With no significant catalysts in sight, it's anticipated that the market will remain range-bound throughout this holiday-shortened week," Jain said.

The Nifty 50 faces resistance at 22,250 while maintaining support at 21,950, he said.

India's benchmark indices were trading lower through midday on Tuesday, weighed by index-heavy HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 68.20 points, or 0.31%, lower at 22,030, and the S&P BSE Sensex fell 301.42 points, or 0.41%, to trade at 72,530.01.

The Nifty hit an intraday low of 21,947.55 and the Sensex touched the low of 72,363.03 so far on Tuesday.

Traders are likely to adopt a cautious approach, opting to observe market movements closely, said Shrey Jain, founder and chief executive officer at SAS Online.

"It's a good opportunity to buy quality large-cap stocks during dips. With no significant catalysts in sight, it's anticipated that the market will remain range-bound throughout this holiday-shortened week," Jain said.

The Nifty 50 faces resistance at 22,250 while maintaining support at 21,950, he said.

India's benchmark indices were trading lower through midday on Tuesday, weighed by index-heavy HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 68.20 points, or 0.31%, lower at 22,030, and the S&P BSE Sensex fell 301.42 points, or 0.41%, to trade at 72,530.01.

The Nifty hit an intraday low of 21,947.55 and the Sensex touched the low of 72,363.03 so far on Tuesday.

Traders are likely to adopt a cautious approach, opting to observe market movements closely, said Shrey Jain, founder and chief executive officer at SAS Online.

"It's a good opportunity to buy quality large-cap stocks during dips. With no significant catalysts in sight, it's anticipated that the market will remain range-bound throughout this holiday-shortened week," Jain said.

The Nifty 50 faces resistance at 22,250 while maintaining support at 21,950, he said.

HDFC Bank Ltd., Reliance Industries Ltd., ICICI Bank Ltd., Infosys Ltd., Bharti Airtel Ltd. weighed on the Nifty 50.

Larsen & Toubro Ltd., Bajaj Finance Ltd., Tata Motors Ltd., Bajaj Finserv Ltd., and NTPC Ltd limited losses in the index.

On NSE, six sectors declined, and rest advanced out of 12 sectors. The NSE Nifty Oil & Gas was the best performing sector, and the NSE Nifty Media was the worst performing sector.

Broader markets outperformed benchmark indices, with the S&P BSE Midcap rising 0.44% and the S&P BSE Smallcap gaining 0.09% through midday on Tuesday.

On BSE, five sectors out of 20 declined, and 15 advanced. The S&P BSE TECK fell the most among peers, and the S&P BSE Capital Goods rose the most.

The market breadth was skewed in favour of the sellers. Around 2,179 stocks declined, 1,554 stocks rose, and 185 stocks remained unchanged.

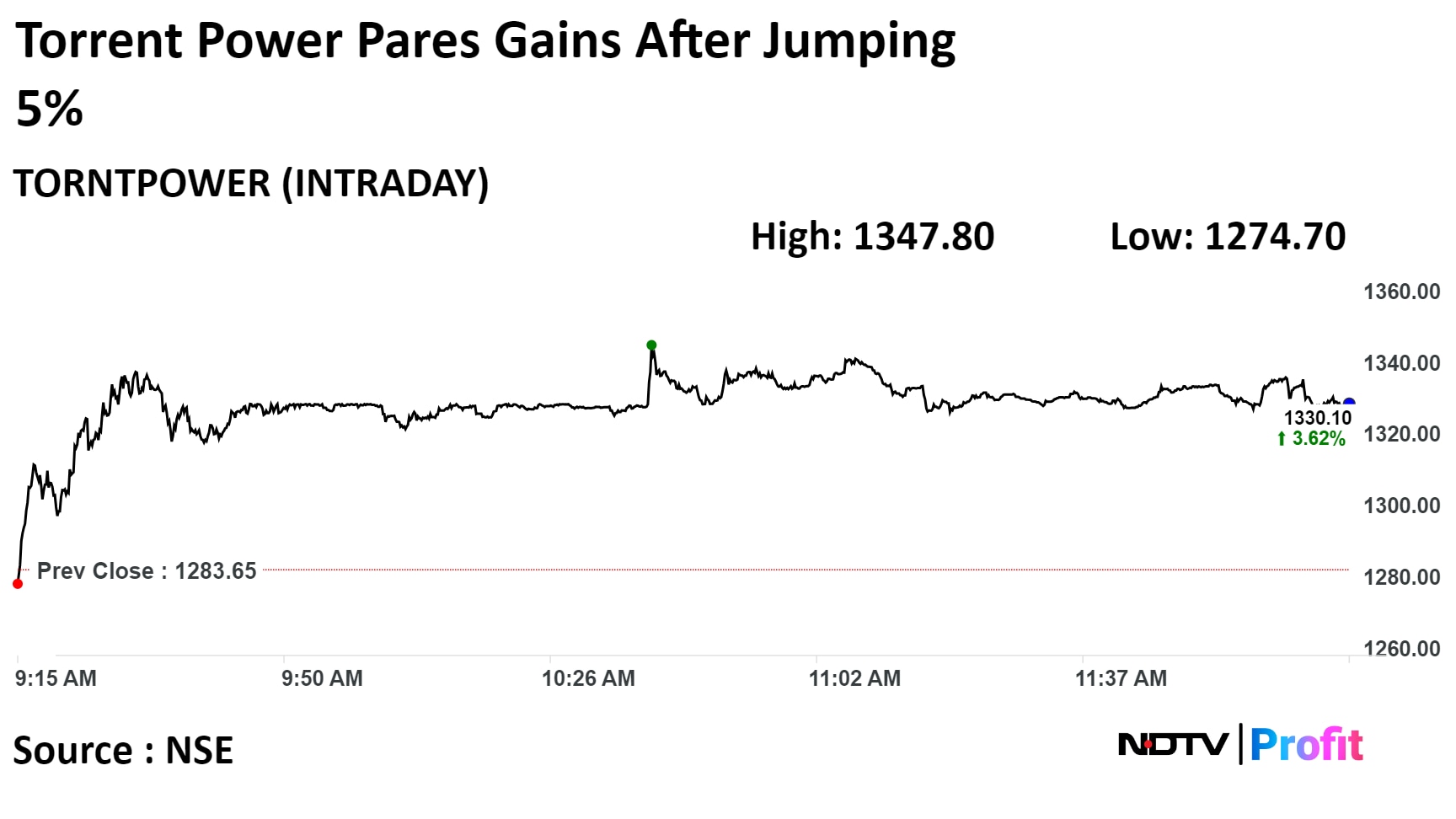

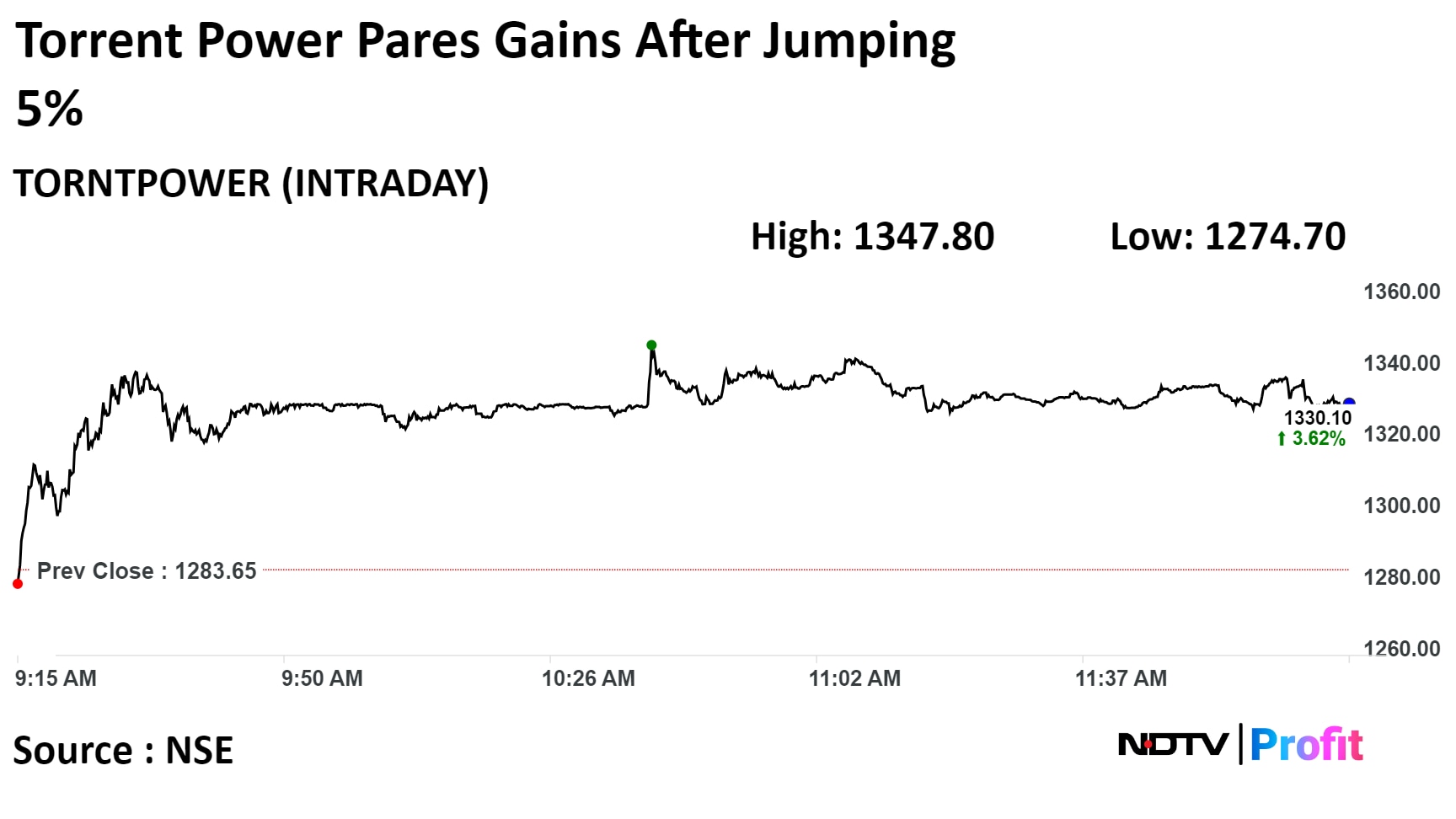

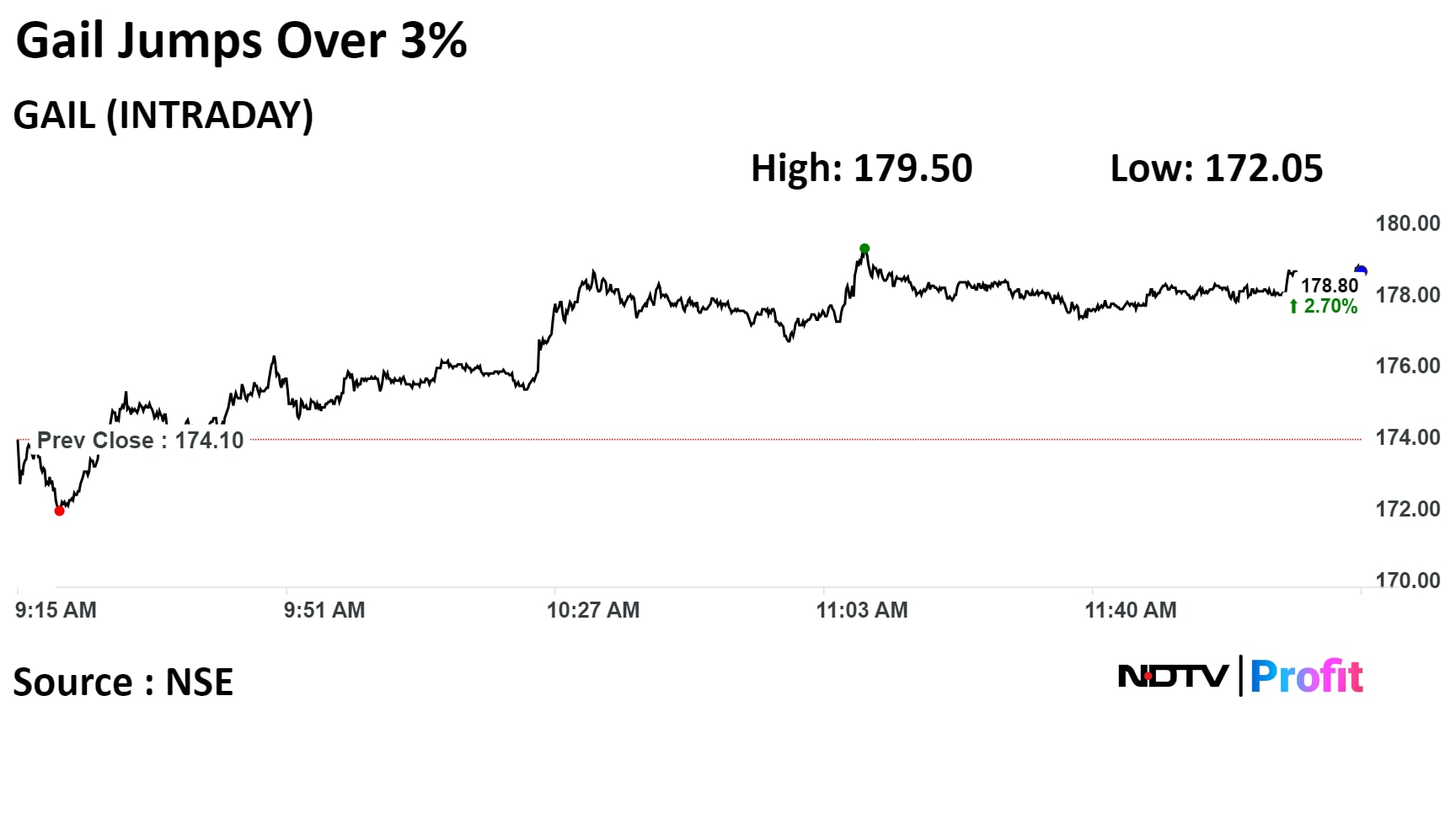

Shares of Torrent Power jumped after Liquified Natural Gas spot prices hit a a three year low. Those of Gail (India) also gained over 3%.

Shares of Torrent Power jumped after Liquified Natural Gas spot prices hit a a three year low. Those of Gail (India) also gained over 3%.

Shares of Torrent Power jumped after Liquified Natural Gas spot prices hit a a three year low. Those of Gail (India) also gained over 3%.

Shares of Torrent Power jumped after Liquified Natural Gas spot prices hit a a three year low. Those of Gail (India) also gained over 3%.

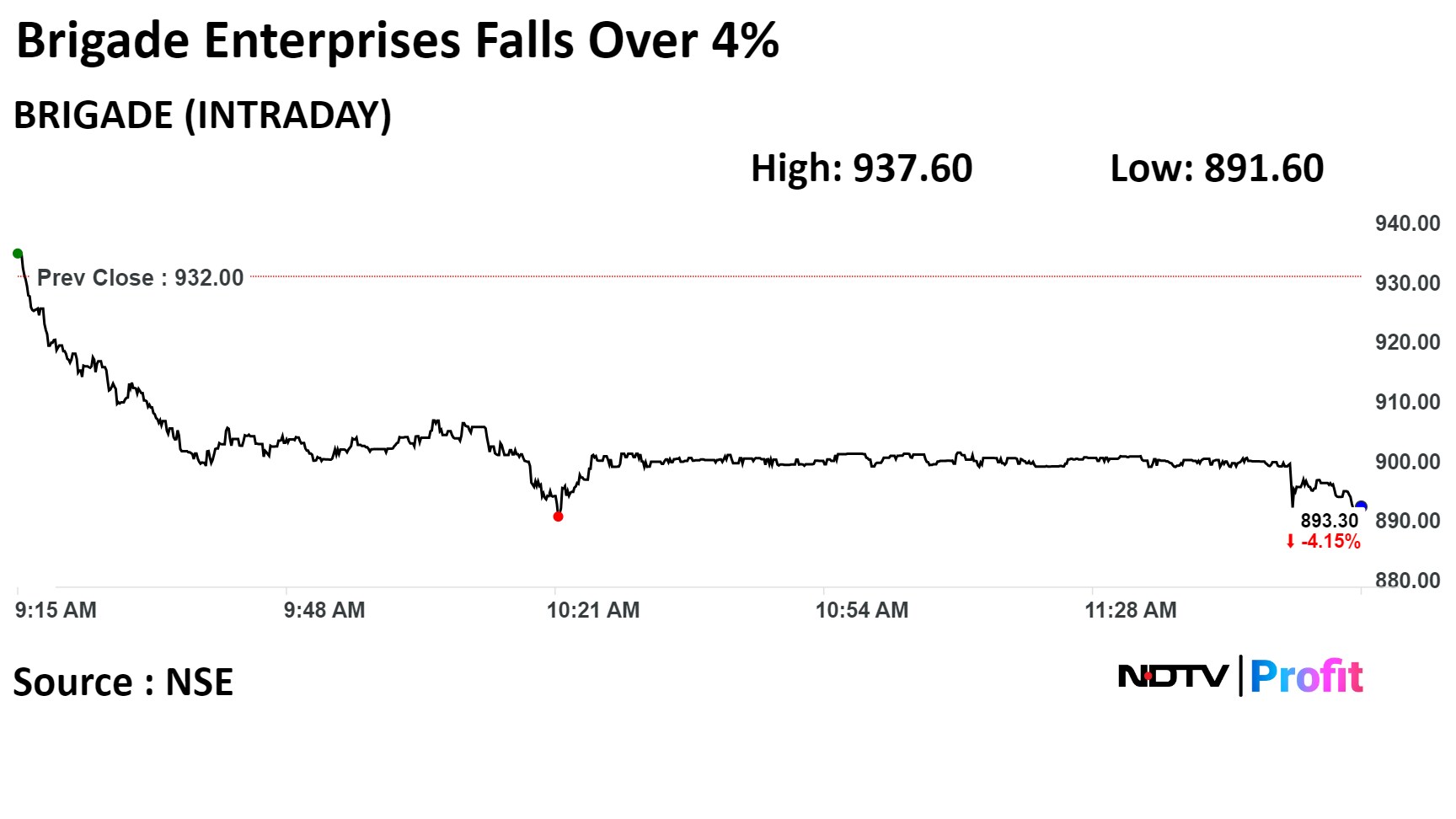

The stock had gained 9% in the four- day rally before falling as much as 4.33% today.

The stock had gained 9% in the four- day rally before falling as much as 4.33% today.

Indian banks' profitability to remain resilient despite margin pressure

NIM compression will limit earnings upside over the medium term

Banks' rising funding cost is likely to remain an important factor driving NIMs

Expect earnings to be resilient despite the sector's dependence on NII

Expect NIMs to narrow 10 -20 bps over next 2 years from current cyclical peak of 3.6% in 9MFY24

Expectation is driven by rising funding costs due to greater competition for deposits

NIM expectation fuelled by normalising liquidity conditions and elevated loan growth

Source: Fitch Ratings

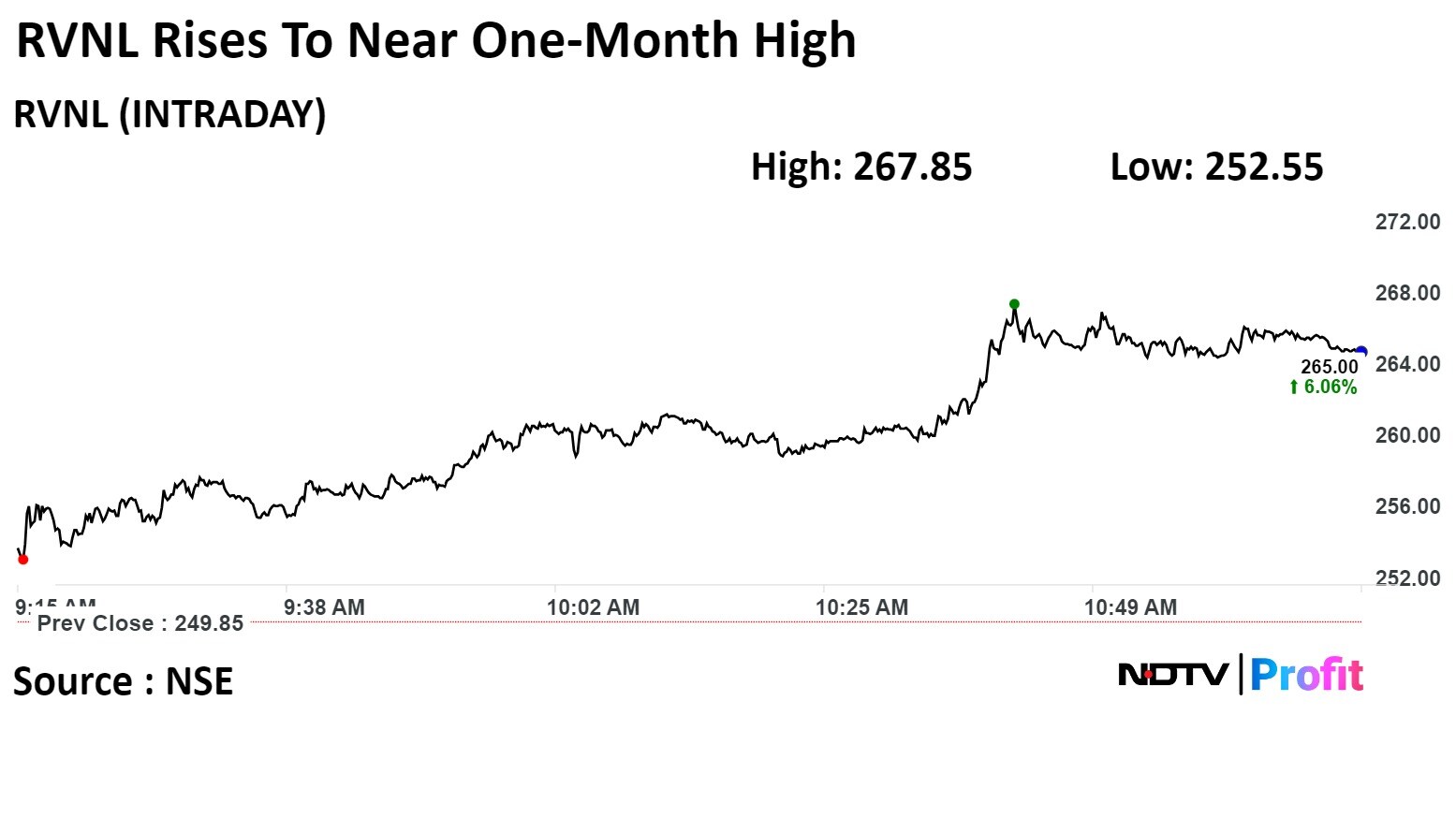

Rail Vikas Nigam Ltd. rose to near one-month high on Tuesday as the company signed a contract with the Airports Authority of India to build an underpass.

The scrip rose as much as 7.20% to Rs 267.85 apiece, the highest level since Feb 28. It was trading 6.36% higher at Rs 265.75 apiece, as of 11:09 a.m. This compares to a 0.27% decline in the NSE Nifty 50 Index.

It has risen 299.62% in 12 months. Total traded volume so far in the day stood at 2.5 times its 30-day average. The relative strength index was at 58.88.

Out of three analysts tracking the company, one maintains a 'buy' rating, two recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an downside of 9.4%.

Rail Vikas Nigam Ltd. rose to near one-month high on Tuesday as the company signed a contract with the Airports Authority of India to build an underpass.

The scrip rose as much as 7.20% to Rs 267.85 apiece, the highest level since Feb 28. It was trading 6.36% higher at Rs 265.75 apiece, as of 11:09 a.m. This compares to a 0.27% decline in the NSE Nifty 50 Index.

It has risen 299.62% in 12 months. Total traded volume so far in the day stood at 2.5 times its 30-day average. The relative strength index was at 58.88.

Out of three analysts tracking the company, one maintains a 'buy' rating, two recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an downside of 9.4%.

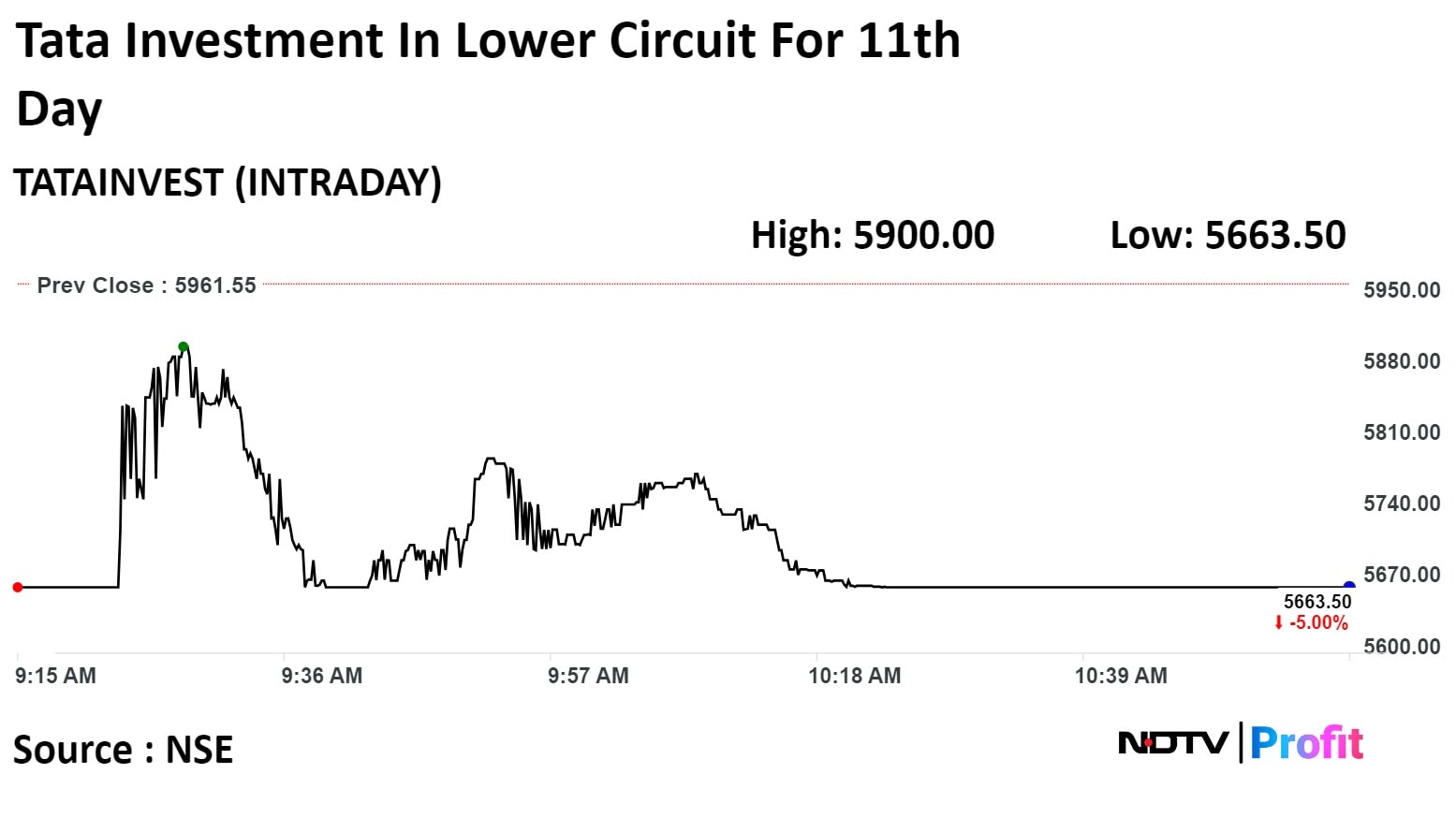

Tata Investment Corp. Ltd. has declined 42% in 11 sessions as it remained locked in 5% lower circuit. It. As of 11:03 a.m., the scrip remained locked in lower circuit, which compares to a 0.3% decline in the NSE Nifty 50 Index.

It has risen 202.76% in 12 months. Total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 33.80.

Tata Investment Corp. Ltd. has declined 42% in 11 sessions as it remained locked in 5% lower circuit. It. As of 11:03 a.m., the scrip remained locked in lower circuit, which compares to a 0.3% decline in the NSE Nifty 50 Index.

It has risen 202.76% in 12 months. Total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 33.80.

Signs pact to provide staffing services

Source: Exchange Filing

Most stocks of the insurance companies were trading higher on NSE as the Insurance Regulation and Development Authority of India retained its 'Surrender Value Regulation', which will have less impact on earnings.

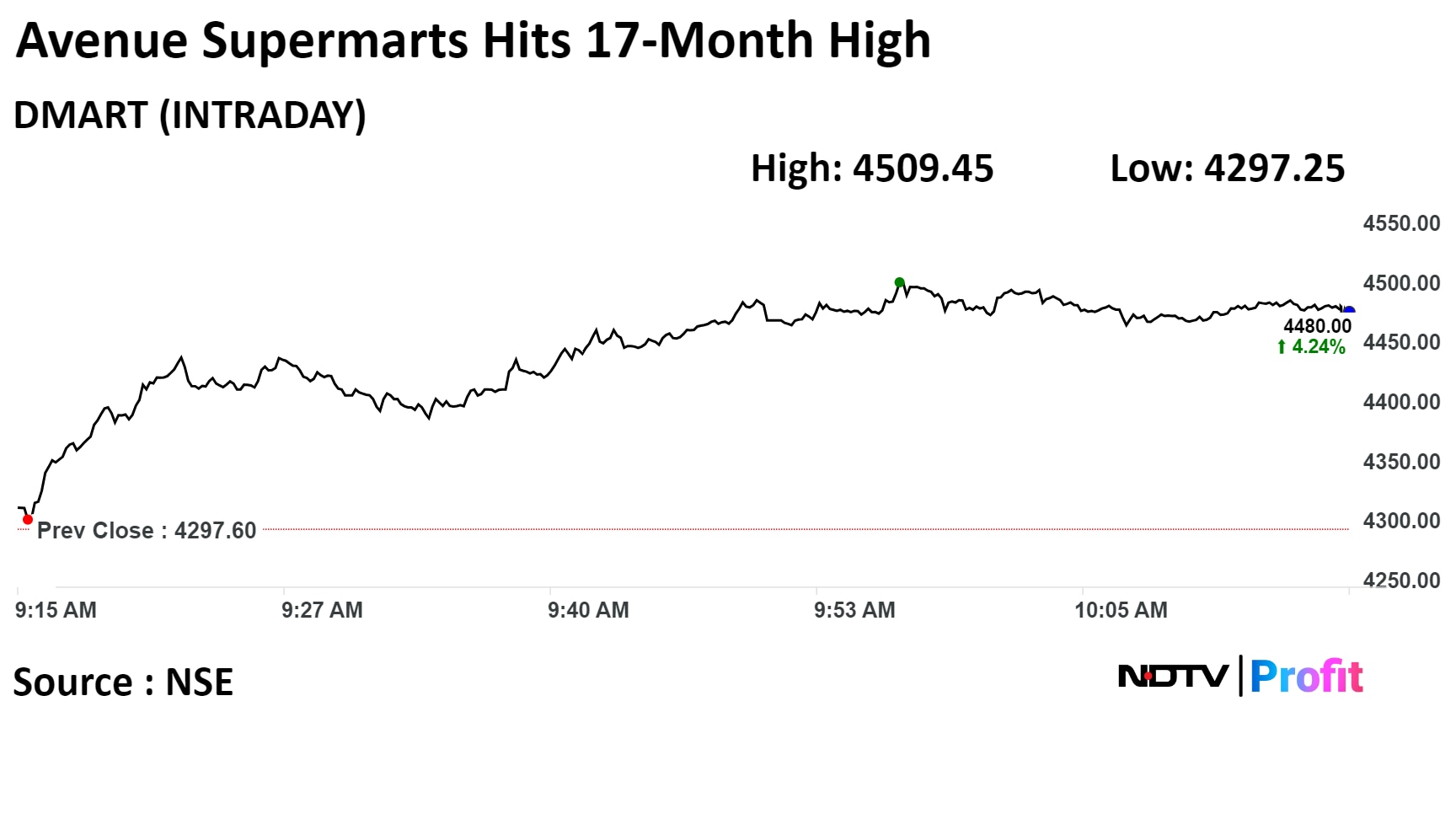

The stock has gained 10.9% in the three-day rally.

The stock has gained 10.9% in the three-day rally.

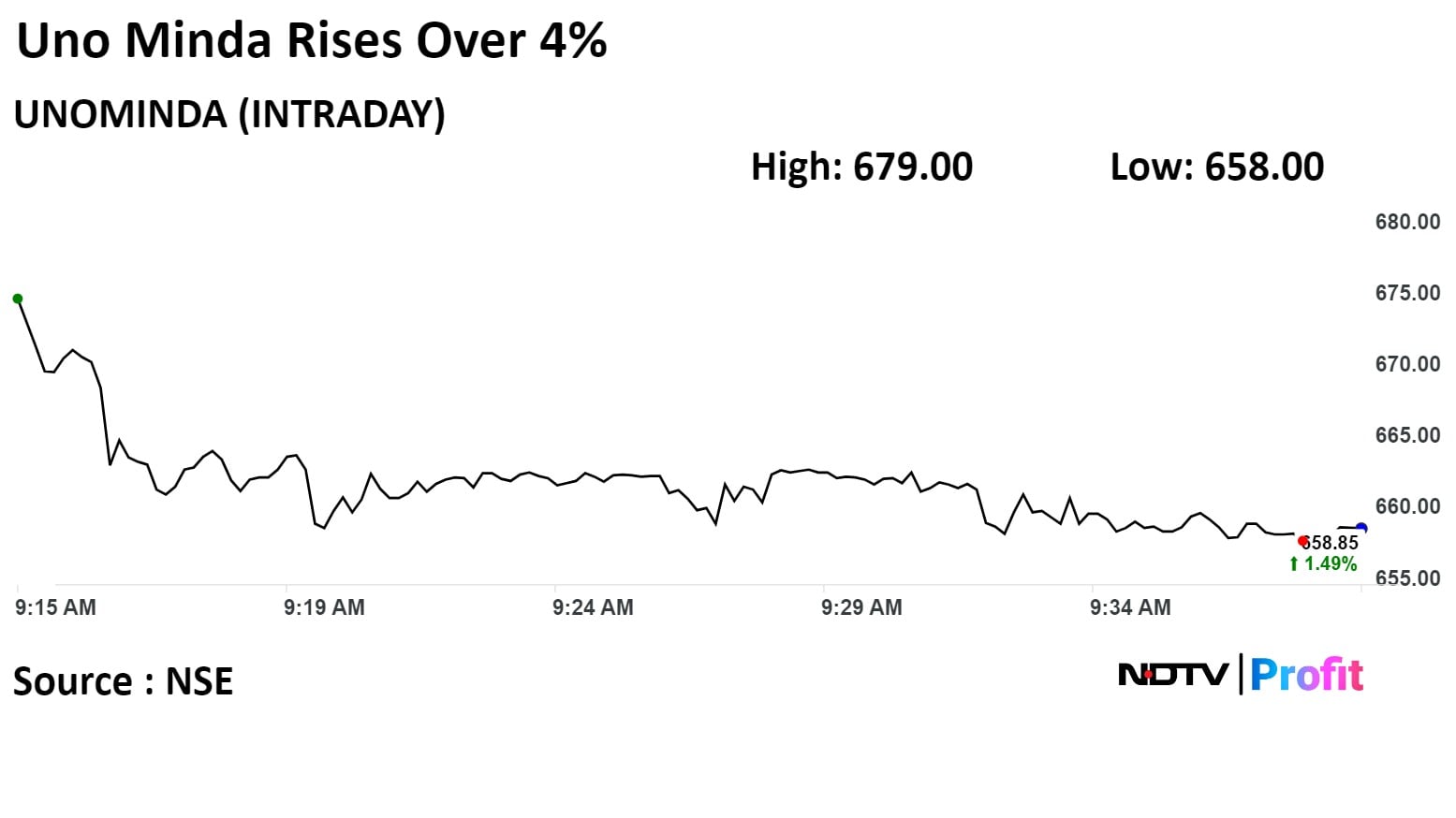

Shares of Uno Minda Ltd. rose over 4% as the company signed a contract with the Starcharge Energy Pte. to sell electric vehicle equipment in India.

Shares of Uno Minda Ltd. rose over 4% as the company signed a contract with the Starcharge Energy Pte. to sell electric vehicle equipment in India.

Uno Minda Ltd. rose as much as 4.59% to Rs 679.00 apiece, the highest level since Feb 9. It was trading 1.97% higher at Rs 662.00 apiece, as of 09:34 a.m. This compares to a 0.29% decline in the NSE Nifty 50 Index.

It has risen 45.46% in 12 months. Total traded volume so far in the day stood at 8.9 times its 30-day average. The relative strength index was at 55.64.

Out of 17 analysts tracking the company, 13 maintain a 'buy' rating, three recommend a 'hold,' and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 13.3%.

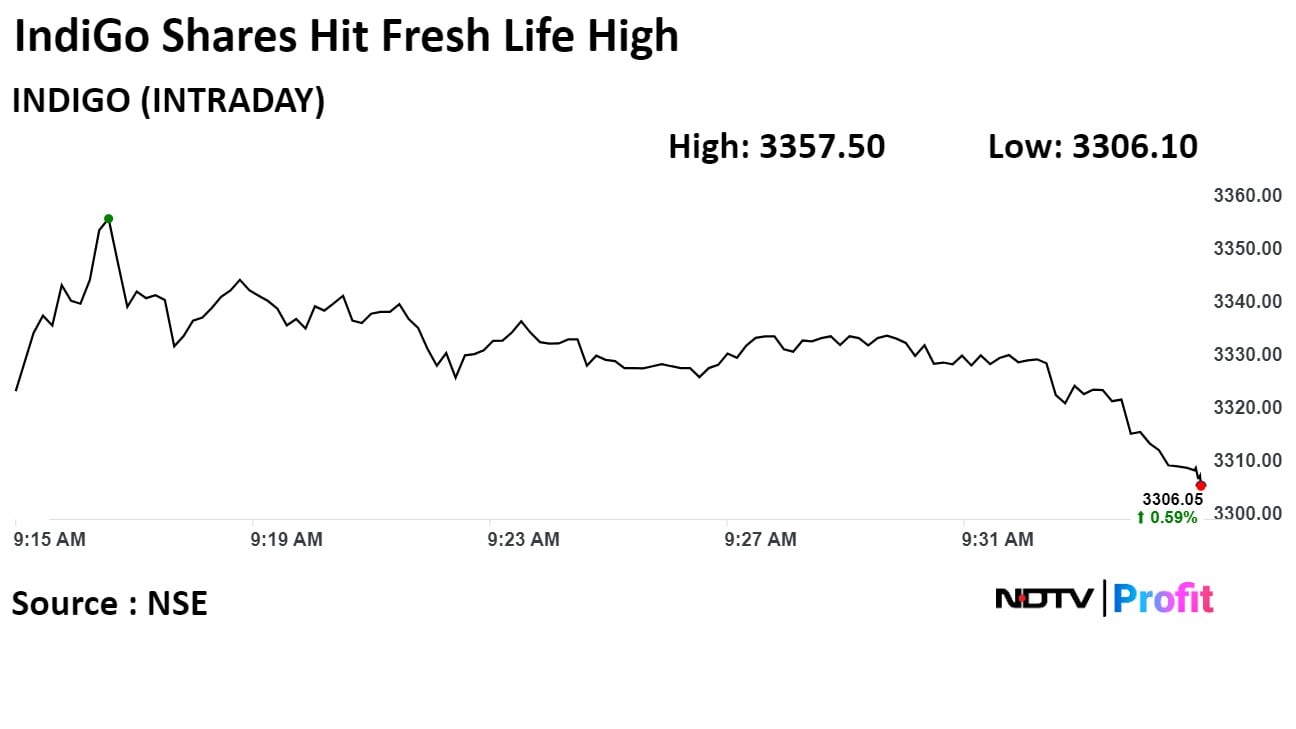

The stock jumped after various analysts said they have a positive stance on the domestic aviation leader and that they see the company sustaining strong growth with multiple drivers despite short-term hick-ups.

The stock jumped after various analysts said they have a positive stance on the domestic aviation leader and that they see the company sustaining strong growth with multiple drivers despite short-term hick-ups.

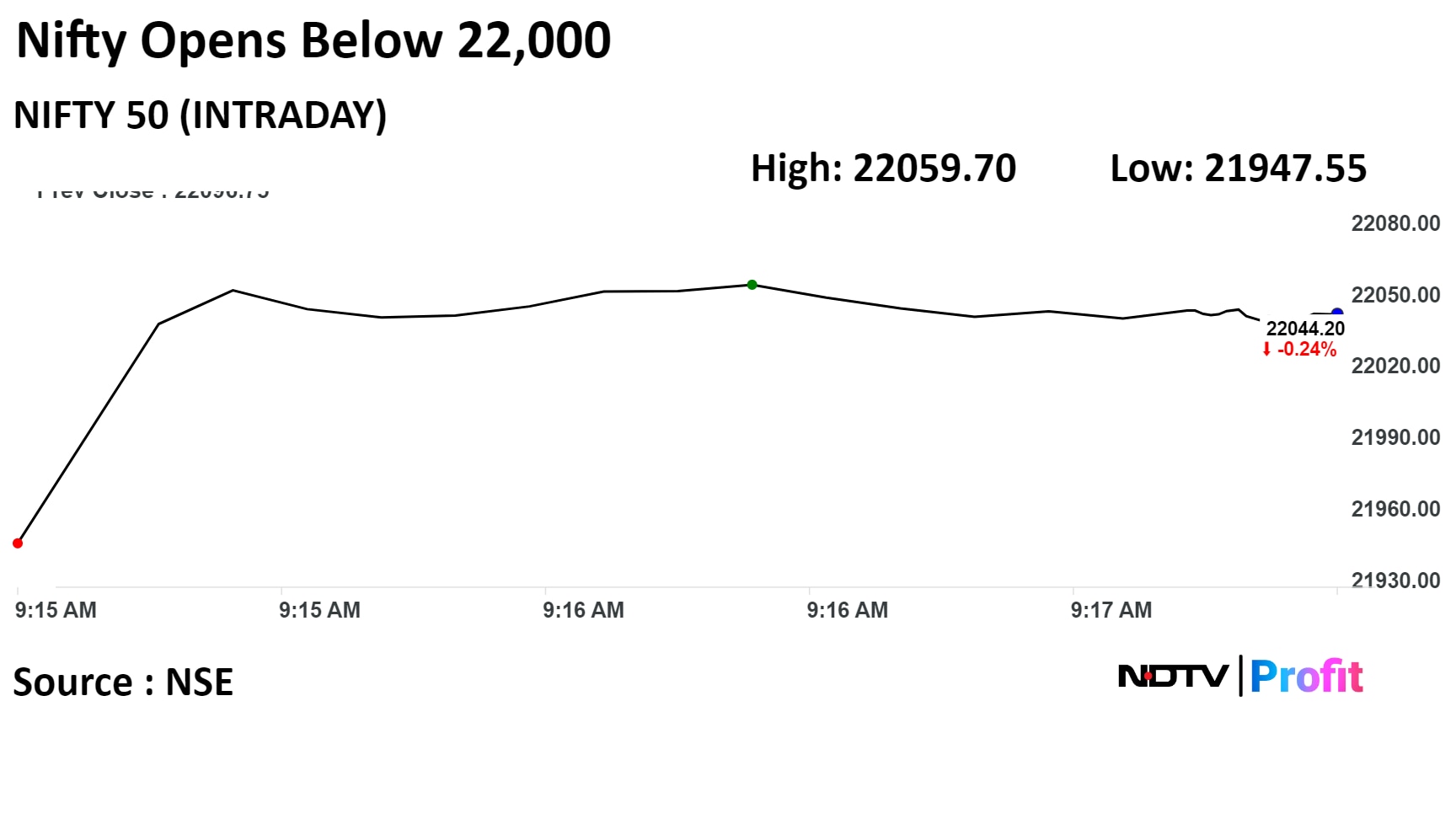

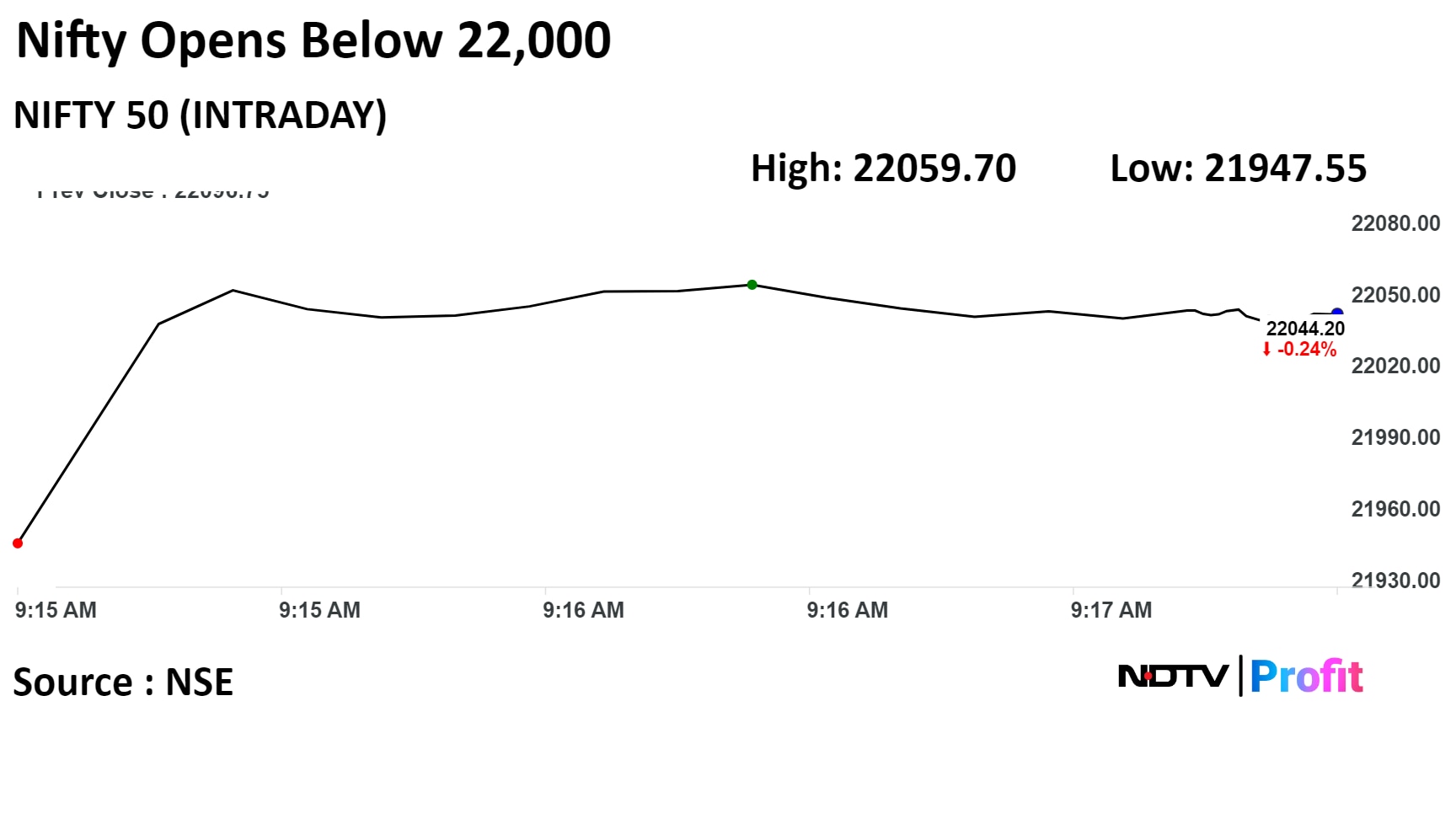

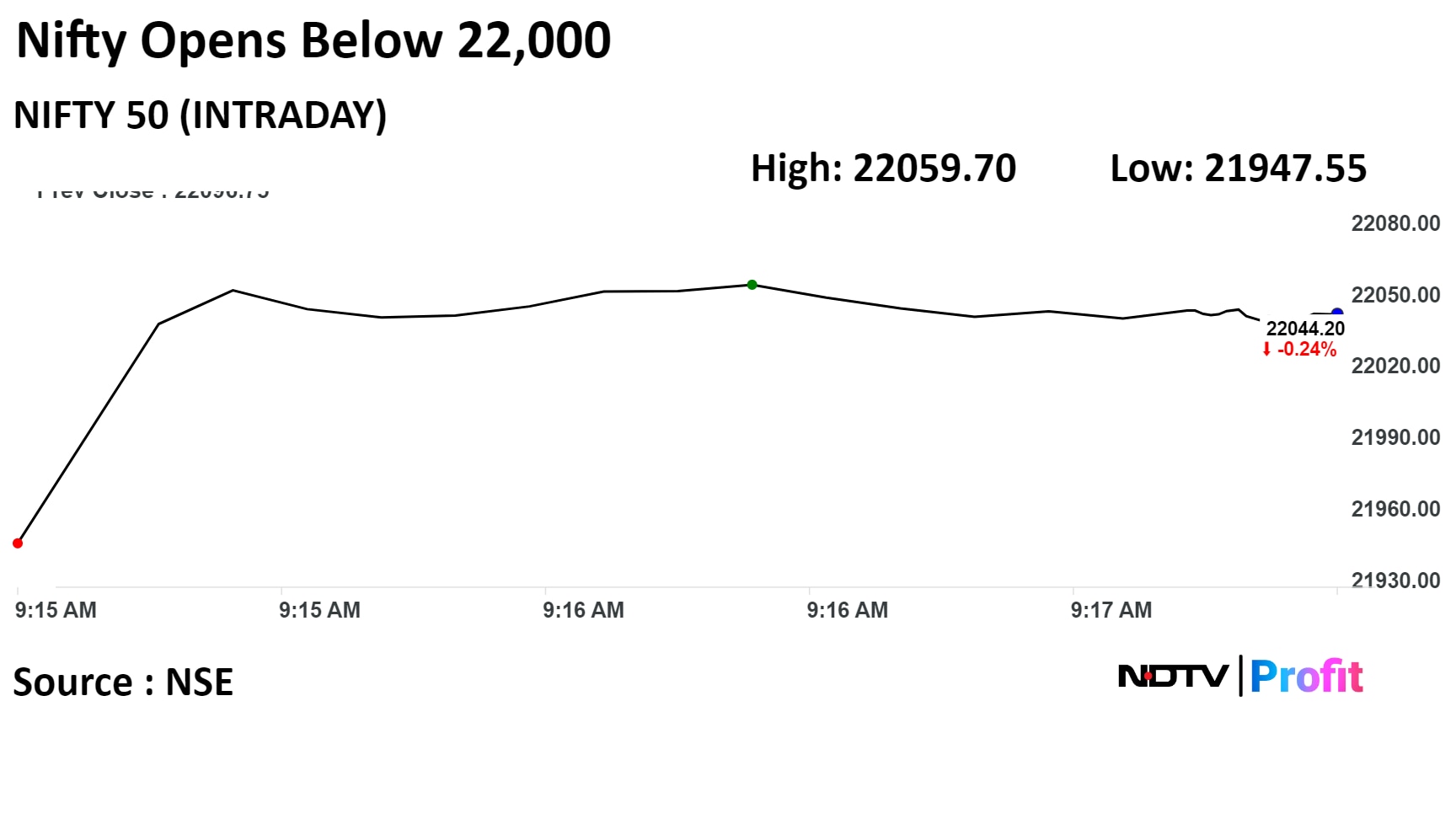

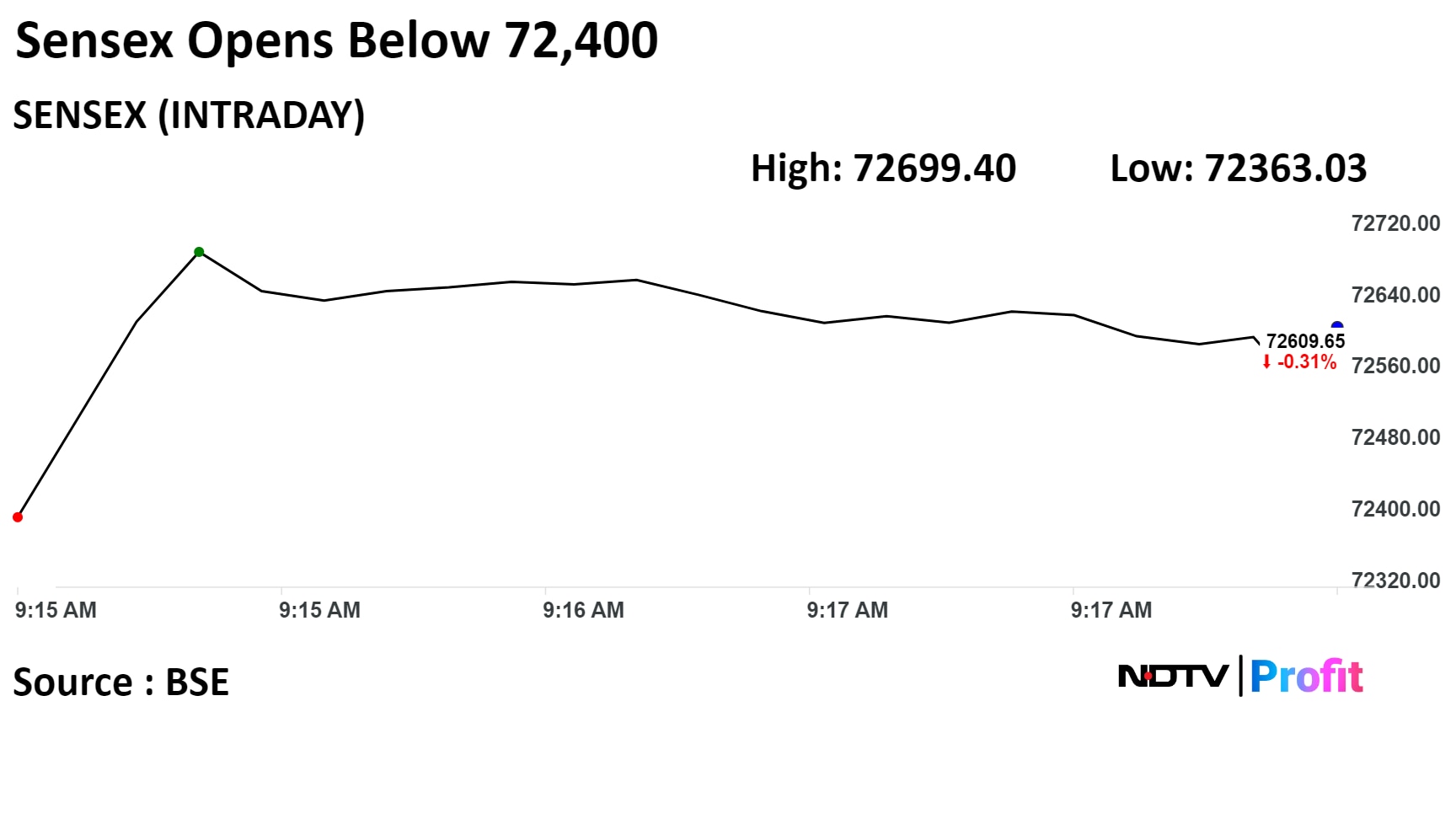

Benchmark equity indices snapped their three-day rally and opened lower as shares of banks dragged.

At pre-open, the S&P BSE Sensex Index was down 431.35 points, or 0.59%, at 72,400.59 while the NSE Nifty 50 was down 148.85 points or 0.67% higher at 21,947.90.

"NIFTY-50 has retraced 50% of the fall of 22,500-21,700 levels and crossover of 22,200 will give an upward breakout on the higher side to test the highs," said Vikas Jain, senior research analyst at Reliance Securities.

"We expect rollover volatility in individual sectors and stocks being the monthly derivatives expiry and 21,900 would act as reversal," he added.

Benchmark equity indices snapped their three-day rally and opened lower as shares of banks dragged.

At pre-open, the S&P BSE Sensex Index was down 431.35 points, or 0.59%, at 72,400.59 while the NSE Nifty 50 was down 148.85 points or 0.67% higher at 21,947.90.

"NIFTY-50 has retraced 50% of the fall of 22,500-21,700 levels and crossover of 22,200 will give an upward breakout on the higher side to test the highs," said Vikas Jain, senior research analyst at Reliance Securities.

"We expect rollover volatility in individual sectors and stocks being the monthly derivatives expiry and 21,900 would act as reversal," he added.

Benchmark equity indices snapped their three-day rally and opened lower as shares of banks dragged.

At pre-open, the S&P BSE Sensex Index was down 431.35 points, or 0.59%, at 72,400.59 while the NSE Nifty 50 was down 148.85 points or 0.67% higher at 21,947.90.

"NIFTY-50 has retraced 50% of the fall of 22,500-21,700 levels and crossover of 22,200 will give an upward breakout on the higher side to test the highs," said Vikas Jain, senior research analyst at Reliance Securities.

"We expect rollover volatility in individual sectors and stocks being the monthly derivatives expiry and 21,900 would act as reversal," he added.

Benchmark equity indices snapped their three-day rally and opened lower as shares of banks dragged.

At pre-open, the S&P BSE Sensex Index was down 431.35 points, or 0.59%, at 72,400.59 while the NSE Nifty 50 was down 148.85 points or 0.67% higher at 21,947.90.

"NIFTY-50 has retraced 50% of the fall of 22,500-21,700 levels and crossover of 22,200 will give an upward breakout on the higher side to test the highs," said Vikas Jain, senior research analyst at Reliance Securities.

"We expect rollover volatility in individual sectors and stocks being the monthly derivatives expiry and 21,900 would act as reversal," he added.

Benchmark equity indices snapped their three-day rally and opened lower as shares of banks dragged.

At pre-open, the S&P BSE Sensex Index was down 431.35 points, or 0.59%, at 72,400.59 while the NSE Nifty 50 was down 148.85 points or 0.67% higher at 21,947.90.

"NIFTY-50 has retraced 50% of the fall of 22,500-21,700 levels and crossover of 22,200 will give an upward breakout on the higher side to test the highs," said Vikas Jain, senior research analyst at Reliance Securities.

"We expect rollover volatility in individual sectors and stocks being the monthly derivatives expiry and 21,900 would act as reversal," he added.

Benchmark equity indices snapped their three-day rally and opened lower as shares of banks dragged.

At pre-open, the S&P BSE Sensex Index was down 431.35 points, or 0.59%, at 72,400.59 while the NSE Nifty 50 was down 148.85 points or 0.67% higher at 21,947.90.

"NIFTY-50 has retraced 50% of the fall of 22,500-21,700 levels and crossover of 22,200 will give an upward breakout on the higher side to test the highs," said Vikas Jain, senior research analyst at Reliance Securities.

"We expect rollover volatility in individual sectors and stocks being the monthly derivatives expiry and 21,900 would act as reversal," he added.

Benchmark equity indices snapped their three-day rally and opened lower as shares of banks dragged.

At pre-open, the S&P BSE Sensex Index was down 431.35 points, or 0.59%, at 72,400.59 while the NSE Nifty 50 was down 148.85 points or 0.67% higher at 21,947.90.

"NIFTY-50 has retraced 50% of the fall of 22,500-21,700 levels and crossover of 22,200 will give an upward breakout on the higher side to test the highs," said Vikas Jain, senior research analyst at Reliance Securities.

"We expect rollover volatility in individual sectors and stocks being the monthly derivatives expiry and 21,900 would act as reversal," he added.

Benchmark equity indices snapped their three-day rally and opened lower as shares of banks dragged.

At pre-open, the S&P BSE Sensex Index was down 431.35 points, or 0.59%, at 72,400.59 while the NSE Nifty 50 was down 148.85 points or 0.67% higher at 21,947.90.

"NIFTY-50 has retraced 50% of the fall of 22,500-21,700 levels and crossover of 22,200 will give an upward breakout on the higher side to test the highs," said Vikas Jain, senior research analyst at Reliance Securities.

"We expect rollover volatility in individual sectors and stocks being the monthly derivatives expiry and 21,900 would act as reversal," he added.

Shares of HDFC Bank Ltd., Reliance Industries Ltd., Power Grid Corp. Of India Ltd., ICICI Bank Ltd., and Bharti Airtel Ltd. dragged the Nifty 50.

Meanwhile, shares of HCLTechnologies Ltd., Bajaj Finance Ltd., Tata Motors Ltd., HDFC Life Insurance Co Ltd. cushioned the fall.

Except Nifty Auto, Nifty Media, Nifty Metal, and Nifty PSU Bank all sectoral indices fell.

Broader markets outperformed benchmark indices. The S&P BSE Midcap was flat and the S&P BSE Smallcap index was 0.14% higher.

On BSE, nine out of the 20 sectors declines. S&P BSE Metal rose the most.

Market breadth was skewed in favour of buyers. Around 1,540 stocks rose, 1,402 stocks declined, and 218 stocks remained unchanged on BSE.

At pre-open, the S&P BSE Sensex Index was down 431.35 points, or 0.59%, at 72,400.59 while the NSE Nifty 50 was down 148.85 points or 0.67% higher at 21,947.90.

Company has never been arraigned as accused in the 2G spectrum allocation case

Source: Exchange Filing

The local currency strengthened by 7 paise to open at 83.36 against the U.S. Dollar.

It recorded its lowest ever close at Rs 83.43 on Friday.

Source: Bloomberg

The yield on the 10-year bond opened flat at 7.08%.

Source: Bloomberg

Saudi Arabia-based associate co gets order worth Rs 512 crore for steel pipes

Source: Exchange Filing

Maintains 'Outperform', target price Rs 1,133

JLR retail volumes up 4.5% YoY in Feb 2024

Volume growth was muted mainly due to a 46% YoY drop in Chinese volumes

Chinese JLR volumes declined by 5% YoY in Jan-Feb 24 combined

Discounts on Jaguars increased in Feb, declined for Land Rovers

JLR’s net debt declined by GBP 675 million; set to turn net cash by FY25

Expect JLR profitability to remain strong; Tata Motors to gain market share in domestic PV

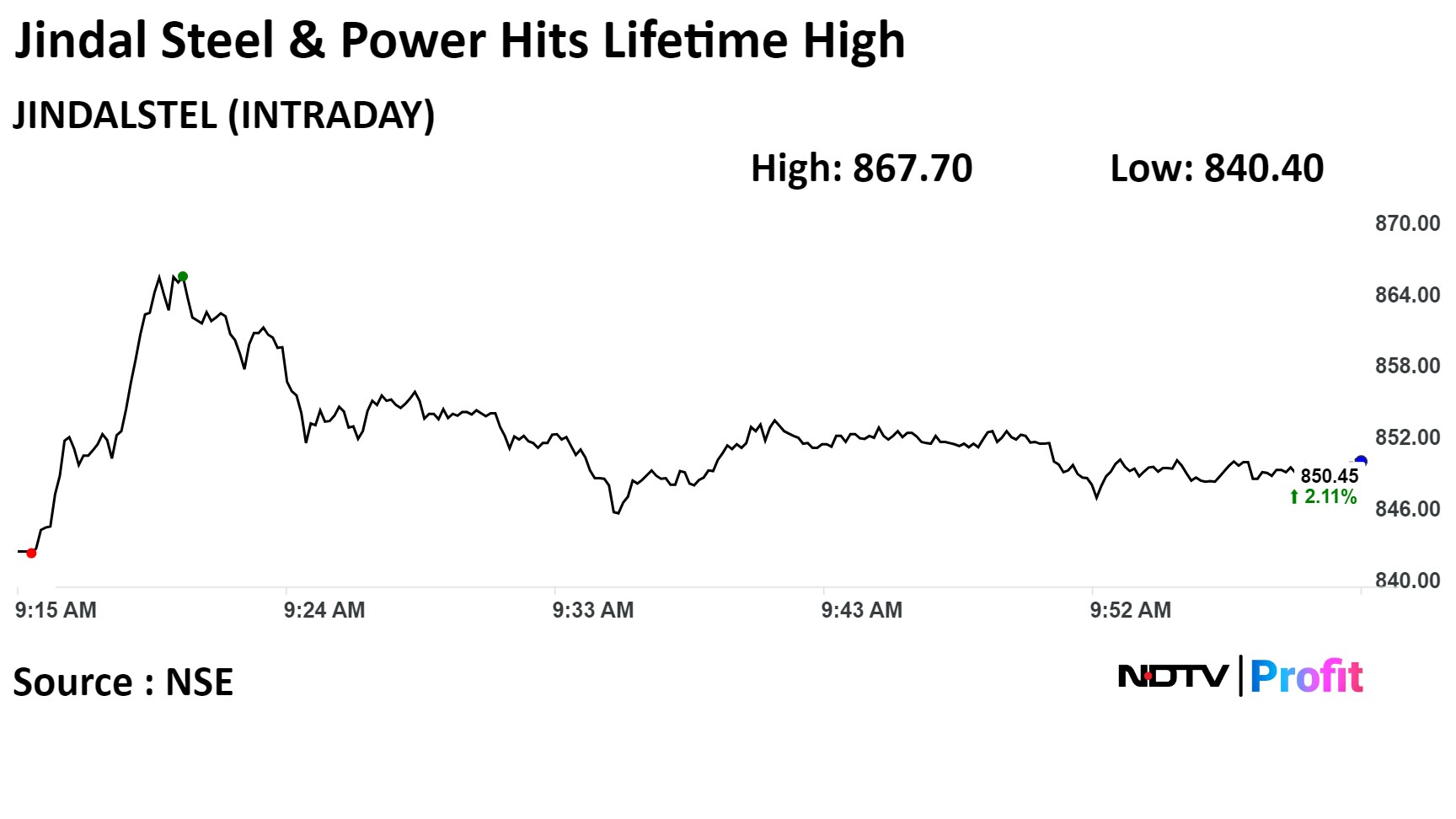

New TLA with Starcharge Energy to expand firm's capability in EV- passenger car segment

TLA to help develop local manufacturing base for home chargers

Addressable opportunity to be limited to OEM sales for now

Higher growth potential depending on EV-car industry pick over longer term

Expect healthy ramp-up as it starts EVSE production over next 1 year

Larger opportunity from ability to add more EV car components

Citi Research

Price target of Rs 3,700

FY24 guidance achieved; FY25 guidance encouraging

Supply growth, demand acceleration likely to double Indian aviation passengers over FY24-FY30E

Low cost/ASK aids profitability, healthy on time performance and low cancellation rates support market share

Addition of A321 XLRs to expand serviceable radius, aid further passenger growth

Expect some increase in salary expense from regulatory changes effective June 1

Incremental regulatory cost is likely to be passed on to flyers

Key risks — higher ATF prices from rising crude prices; higher cost pressures from depreciating INR

Morgan Stanley

Maintains 'overweight' on InterGlobe Avaiation at Rs 4145 target

Company to add 1 new aircraft per week in 2024

Aircraft order book at 960, largest amount globally

Management aims for double digit capacity growth in FY25 vs brokerage estimate of 6%

Indigo to be launch airline for new Jewar airport in Delhi

Motilal Oswal

Maintains Neutral on InterGlobe Aviation at Rs 3510

Firm working to increase international presence through strategic partnerships

Competition in international market to intensify with resurgence of Air India

Indian aviation market growth to be aided by rising airport infra, aircarft capacity additions

India could become 3rd largest aviation market in the world by CY35

Citi Research maintains 'Buy' on Torrent Pharmaceuticals; Price target of Rs 2,960

Investments in the branded markets to drive operating leverage

Generics have bottomed out and expected to pick up in coming quarters, driven by new launches/tenders wins

Expected to turn net cash positive in H2FY26, may keep scouting for inorganic opportunities

Margin trajectory is expected to remain strong over the next 2-3 years

Maintains BUY

Raise FY25/26 gross refining margin estimated to $9.5/9.5

Margin forecasts raised on refining demand/supply balances

Lower FY25E gross marketing margin on petrol & diesel to Rs1.8/ltr

Gross marketing margins lowered on price cuts

Recent price cuts to affect Q1FY25 margins

Change FY25/26 EBITDA estimates by 1%/4%

To buy stake in Gopalpur Ports at an enterprise value of Rs 3,080 crore

Signs definitive agreements to buy 56% stake from SP Group, 39% stake from Orissa Stevedores

Source: Exchange Filing

U.S. Dollar Index at 104.18

U.S. 10-year bond yield at 4.23%

Brent crude up 0.21% at $86.93 per barrel

Nymex crude up 0.26% at $82.16 per barrel

GIFT Nifty up 23 points or 0.1% at 22,116.00 as of 7:37 a.m

Bitcoin was up 0.23% at $65,619.31

Nifty March futures up by 0.24% to 22,165.45 at a premium of 68.7 points.

Nifty March futures open interest down by 12.5%.

Nifty Bank March futures up by 0.29% to 46,929 at a premium of 65.25 points.

Nifty Bank March futures open interest down by 9.5%.

Nifty Options March 28 Expiry: Maximum Call open interest at 23,000 and Maximum Put open interest at 22,000.

Bank Nifty Options March 27 Expiry: Maximum Call Open Interest at 49,000 and Maximum Put open interest at 46,500.

Securities in ban period: Biocon, SAIL, Tata Chemicals, and Zee Entertainment Enterprise.

Price band revised from 10% to 5%: Salzer Electronics, Swan Energy.

Price band revised from 20% to 10%: Manoj Vaibhav Gems N Jewellers.

Ex/record AGM: Varun Beverages.

Ex/record buyback: Garware Technical Fibers.

Moved into short-term ASM framework: Manoj Vaibhav Gems N Jewellers.

Moved out into short-term ASM framework: BCL Industries, Capri Global Capital.

Chambal Fertilizers and Chemicals: Promoter Zuari Industries created a pledge of 12 lakh shares on March 20.

Apollo Hospitals Enterprises: Promoter K Visweshwar Reddy revoked the pledge of 70,000 shares.

ADF Foods: Promoters Parul B. Thakkar and Sumer B. Thakkar created a pledge of 50,000 shares between March 20 and 22.

Ajanta Pharma: Promoter Ravi Agrawal and Trustee Ravi Agrawal Trust released a pledge of 9,770 shares on March 21.

Paisalo Digital: Promoter EQUILIBRATED VENTURE CFLOW created a pledge of 32 lakh shares on March 22.

JK Lakshmi Cement: Promoters Bengal and Assam acquired 35,263 shares on March 20.

Deepak Fertilizers and Petrochemicals: Promoter Robust Marketing Services bought 31,000 shares on March 18.

Berger Paints: Promoter U K Paints (India) bought 37,000 shares on March 21.

Usha Martin: Promoter Peterhouse Investments India sold 3 lakh shares between March 20 and 21.

NRB Bearings: Promoter Harshbeena Zaveri sold 19,139 shares between March 18 and 20.

Skipper: Promoter Ventex Trade bought 54,000 shares on March 21.

Wardwizard Innovations & Mobility: Promoter Wardwizard Solutions sold 4.11 lakh on March 19.

Star Cement: Promoter Nancy Choudhary bought 59,746 shares between March 18 and 20.

Capacite Infraprojects: Valiant Mauritius Partners bought 37.69 lakh shares (5.11%) at Rs 274.92 apiece, while Subir Malhotra sold 25.25 lakh shares (3.43%), and Paragon Partners Growth Fund sold 7.5 lakh shares (1.01%) at Rs 275 apiece.

D B Realty: Pinnacle Investments sold 30 lakh shares (0.55%) at Rs 205.37 apiece.

Deep Industries: Morning Star Private Trust sold 3.32 lakh shares (0.51%) at Rs 261.5 apiece.

Rama Steel Tubes: L7 Hitech sold 38 lakh shares (0.75%) at Rs 13.25 apiece.

Shriram Finance: Shriram Ownership Trust sold 77.78 lakh shares (2.07%), Shriram Value Services Ltd bought 77.78 lakh shares (2.07%) at Rs 2,310 apiece.

Savita Oil Technologies: Mehra Syndicate sold 20.73 lakh shares (2.99%), while SBI Mutual Fund bought 20.73 lakh shares (2.99%) at Rs 408 apiece.

Sundaram Finance: Sundaram Finance Ltd sold 55.56 lakh shares (2.51%) at Rs 191 apiece, while Trichur Sundaram Santhanam and Family bought 39.73 lakh shares (1.8%), Arjun Rangarajan bought 9 lakh shares (0.4%), and Srivats Ram bought 6.83 lakh shares (0.3%) at Rs 191 apiece.

SRM Contractors: The company will offer its shares for bidding on Tuesday. The price band is set from Rs 200 to Rs 210 per share. The Rs 130.2 crore IPO is entirely a fresh issue. The company has raised Rs 39 crore from anchor investors.

UltraTech Cement: The company commissioned 1 MTPA brownfield cement capacity at the Uttarakhand unit. The total unit capacity is now at 2.1 MTPA.

ICICI Securities: The company received a warning from SEBI after an inspection of its books and records for merchant banking activities.

JSW Energy: The company's step-down unit is in a pact with Reliance Power to acquire a 45 MW wind power project in Maharashtra for Rs 132 crore.

Lupin: The company will sell its trade generics businesses in India to arm for Rs 100–120 crore on a slump sale basis.

Hindustan Aeronautics: The company has received an order worth Rs 194 crore from the Guyana Defence Force.

Sanghi Industries: Promoter Ambuja Cements sold a 2% stake in the company for Rs 258 crore. The promoter's stake currently stands at 60.44%.

Eicher Motors: The company incorporated its wholly owned subsidiary in the Netherlands, named Royal Enfield Europe BV.

Dr Reddy’s Laboratories: The company has entered into a licence agreement with Pharmazz to commercialise the first-in-class innovative drug Centhaquine in India.

UNO Minda: The company has entered into a technical licence agreement with Starcharge Energy to manufacture and sell electric vehicle supply equipment in India.

Schaeffler India: The company has reappointed Harsha Kadam as the managing director and chief executive officer for three years, effective from Oct. 1.

Raymond: The board approved selling the entire investment in wholly owned subsidiaries Raymond Apparel and Ultrashore Realty for a consideration of Rs 1.26 crore.

Garden Reach Shipbuilders & Engineers: The company has signed a contract worth Rs 26.45 crore with the Ministry of External Affairs for a fast patrol vessel.

Exide Industries: The company made an investment of Rs 110 crore in arm Chloride Metals via rights basis.

Medplus Health Services: The company has received a temporary suspension order for two of its stores.

Maruti Suzuki India: The company recalls 11,185 units of the Baleno and 4,190 units of the Wagon R on a possible fuel pump motor defect. It also agreed to acquire a 6.44% stake in Amlgo Labs for Rs 1.99 crore.

Reliance Industries: The company acquired a 100% stake in MSKVY Nineteenth Solar SPV and MSKVY Twenty-second Solar SPV from MSEB Solar Agro Power.

Mangalore Refinery and Petrochemicals: The board has approved the acquisition of 1.35 crore shares of Mangalore SEZ for Rs 47.18 crore from IL&FS. The company's stake in Mangalore SEZ is expected to increase from 0.96% to 27.92% post-acquisition. The company appointed Mundkur Shyamprasad Kamath as chief executive officer with effect from March 22.

Hinduja Global Solutions: The company entered into an agreement to sell its optical fibre assets to its subsidiary, Indusind Media and Communications for Rs 208.04 crore.

Mankind Pharma: Beige will sell up to 2.9% stake via block deal on March 26 at a price of Rs 2,103-2,214 per share, marking a discount of 0-5% against the March 22 closing price. At lower range, the offer size stands at Rs 2,456 crore.

Adani Ports: The company will buy 95% stake in Gopalpur Ports at an enterprise value of Rs 3,080 crore. It signed definitive agreements to buy 56% stake from SP Group, 39% stake from Orissa Stevedores.

Indoco Remedies: Wholly owned arm Warren Remedies commences commercial production of Pharmaceutical Intermediates

Bharti Airtel: The company has been fined Rs 114 crore from Gurugram Tax Authority for alleged inadequate payment of tax.

HG Infra Engineering: The company got LoA in consortium with Stockwell Solar Services from Jodhpur Vidyut Vitran Nigam for solar solar project estimated at Rs 534 crore.

Puravankara: The company launched residential project 'Purva Kensho Hills' in Bengaluru.

Zydus Lifesciences: The pharmaceutical company got tentative U.S. FDA approval for Letermovir tablets.

Jindal Stainless: IIT Kharagpur signed MoU with company to execute R&D projects.

Tech Mahindra: Step-down subsidiary Born Group will merge with arm Tech Mahindra (Americas).

Paradeep Phosphates: Central Pollution Control Board issued closure of operation notice to Odisha plant due to non-compliance of conditions prescribed by Odisha State Pollution Control Board.

Electronics Mart India: The company commenced commercial operations of multi brand stores under brand name ‘Bajaj Electronics’ in Hyderabad.

Kirloskar Ferrous: U.S.-based step-down subsidiary Indian Seamless stands fully dissolved and is no longer a unit of arm ISMT.

One 97 Communications: Praveen Sharma, senior vice president-business, resigned with effect from March 31.

Most Asian-Pacific markets recovered after opening lower tracking overnight losses on Wall Street. Only Australia's S&P ASX 200 traded lower.

The rally in U.S. stocks took a breather, with the market still heading towards its best week in 2024 amid speculation the Federal Reserve will be able to cut interest rates as soon as June, according to Bloomberg.

The S&P 500 index and Nasdaq Composite fell by 0.31% and 0.27%, respectively, as of Monday. The Dow Jones Industrial Average ended 0.41% lower.

Brent crude was trading up 0.21% at $86.93 per barrel. Gold was higher by 0.88% at $2,205.58 an ounce.

India's benchmark equity indices ended higher on Friday, extending gains for a third straight day as ITC Ltd., Larsen & Toubro Ltd. and ICICI Bank Ltd. led the advance. The NSE Nifty 50 closed 84.80 points, or 0.39%, higher at 22,096.75, while the S&P BSE Sensex ended 190.75 points, or 0.26%, up at 72,831.94.

Indian equity market was closed on Monday on account of Holi.

Overseas investors remained net sellers of Indian equities for the third consecutive day on Friday. Foreign portfolio investors offloaded stocks worth Rs 3,309.8 crore and domestic institutional investors remained net buyers for the fifth day and mopped up equities worth Rs 3,764.9 crore, the NSE data showed.

The Indian rupee weakened by 28 paise to close at 83.43 against the U.S. dollar.

Most Asian-Pacific markets recovered after opening lower tracking overnight losses on Wall Street. Only Australia's S&P ASX 200 traded lower.

The rally in U.S. stocks took a breather, with the market still heading towards its best week in 2024 amid speculation the Federal Reserve will be able to cut interest rates as soon as June, according to Bloomberg.

The S&P 500 index and Nasdaq Composite fell by 0.31% and 0.27%, respectively, as of Monday. The Dow Jones Industrial Average ended 0.41% lower.

Brent crude was trading up 0.21% at $86.93 per barrel. Gold was higher by 0.88% at $2,205.58 an ounce.

India's benchmark equity indices ended higher on Friday, extending gains for a third straight day as ITC Ltd., Larsen & Toubro Ltd. and ICICI Bank Ltd. led the advance. The NSE Nifty 50 closed 84.80 points, or 0.39%, higher at 22,096.75, while the S&P BSE Sensex ended 190.75 points, or 0.26%, up at 72,831.94.

Indian equity market was closed on Monday on account of Holi.

Overseas investors remained net sellers of Indian equities for the third consecutive day on Friday. Foreign portfolio investors offloaded stocks worth Rs 3,309.8 crore and domestic institutional investors remained net buyers for the fifth day and mopped up equities worth Rs 3,764.9 crore, the NSE data showed.

The Indian rupee weakened by 28 paise to close at 83.43 against the U.S. dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.