The Indian benchmark indices extended their gains to day two on Thursday, led by UltraTech Cement Ltd. and information-technology stocks on positive earnings and optimism over Donald Trump's AI Policies.

The S&P BSE Sensex closed 115 points or 0.15% up at 76,520.38, while the NSE Nifty 50 was 50 points or 0.22% higher at 23,205.35. Intraday, the Nifty rose 0.5% to 23,270.80, and the S&P BSE Sensex advanced 0.44% to 76,743.54.

Shares of Coforge Ltd. and Persistent Systems Ltd. surged 11% and 12%, respectively on positive third-quarter earnings. Tech sentiments were also buoyed by Trump's push to make the US an AI superpower by having fewer guardrails.

After a muted open, the market held positive momentum throughout the day. It also formed a reversal formation on the daily charts, which supports a further uptrend from the current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

Most Asian stocks advanced during the session after China reassured investors of the government's commitment to supporting the market. The MSCI Asia Pacific index climbed for the fourth session, setting the longest winning streak in nearly a month, according to Bloomberg. The benchmark in China CSI 300 Index by as much as 1.8% before paring some gains.

As long as it is trading above 23,100 (Nifty)/76,200 (Sensex), the pullback formation is likely to continue, Chouhan said. "On the higher side, the market could bounce back to the 23,400-23,450/77,000-77,100 range."

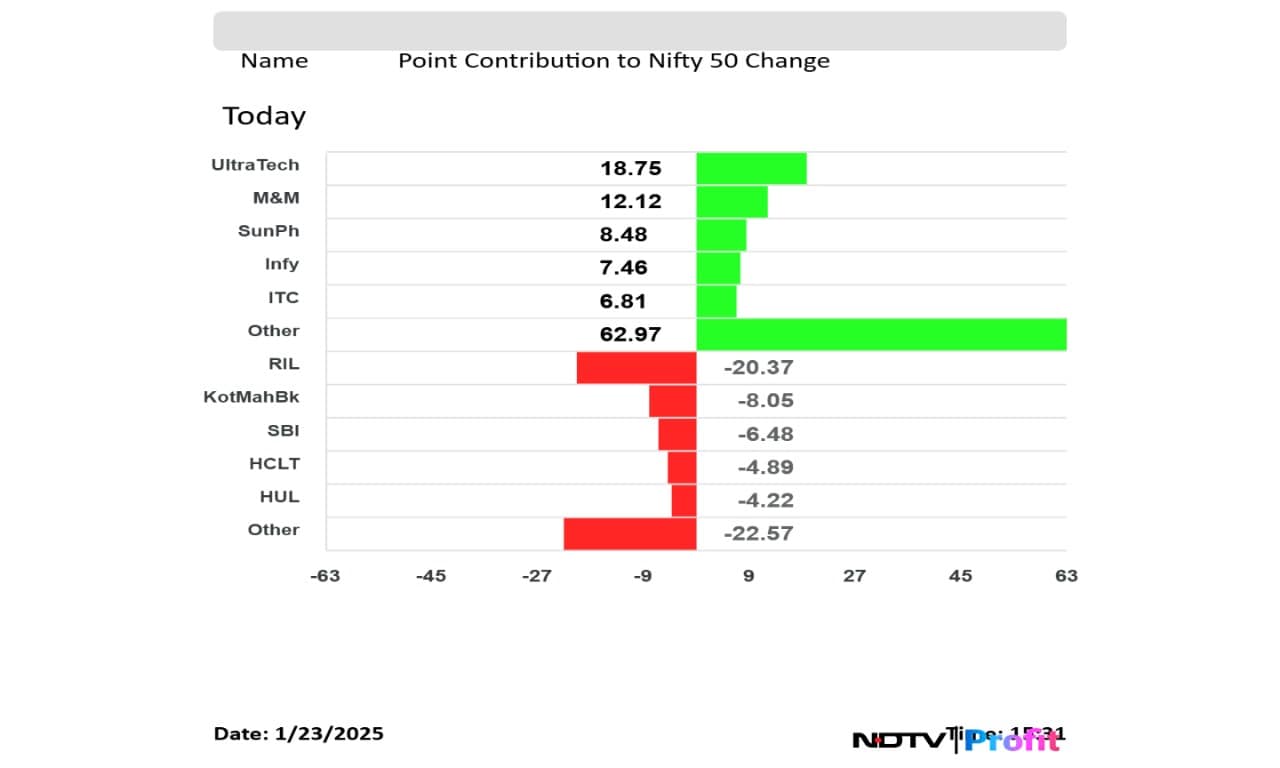

UltraTech Cement Ltd., Mahindra & Mahindra Ltd., Sun Pharmaceutical Industries Ltd., Infosys Ltd. and ITC Ltd., led the advance in the Nifty 50.

Reliance Industries Ltd., Kotak Mahindra Bank Ltd., State Bank of India, HCL Technologies Ltd. and Hindustan Unilever Ltd. weighed on the benchmark index.

The bearish trend is likely to persist as long as the index stays below 23,400, according to Rupak De, senior technical analyst at LKP Securities. "On the downside, support levels are observed at 23,150 and 23,000."

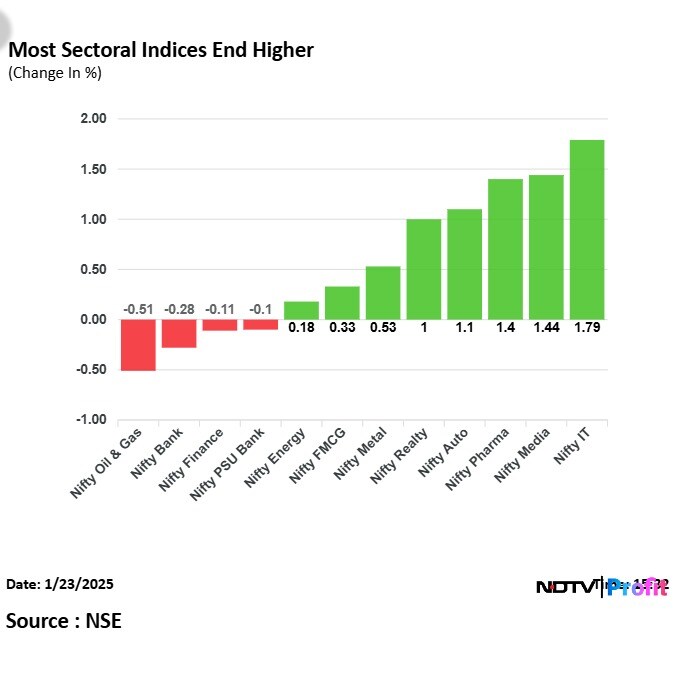

Eight out of the 12 sectors on the NSE advanced, with Nifty IT and Nifty Media rising the most on Wednesday. The Nifty Oil & Gas fell the most in trade. The Oil & Gas index fell for the third day in a row.

On the BSE, 18 sectors advanced and three declined out of 21. The BSE Consumer Durables rose the most, and the BSE Oil & Gas declined the most.

The broader markets outperformed the benchmark indices as the BSE MidCap and SmallCap indices ended 1.78% and 0.67% higher respectively.

The market breadth was skewed in favour of the buyers as 2,137 stocks advanced, 1,825 declined and 105 remained unchanged on the BSE.

Here's What To Watch Out For

Global Cues

US Jobless Claims

US Crude Inventories

US Fed Balance Sheet

Japan Interest Rate Decision

Japan Inflation Data

Japan PMI Data

Corporate Actions Ahead

DCM Shriram: Record date for interim dividend Rs 3.6 per share.

Mastek: Record date for interim dividend Rs 7 per share.

Oberoi Realty: Record date for interim dividend Rs 2 per share.

Waaree Renewable: Record date for interim dividend Re 1 per share.

Earnings Tomorrow:

Balkrishna Industries

AU Small Finance Bank

Bank of India

DLF

Godrej Consumer Products

Granules

HPCL

InterGlobe Aviation

JSW Steel

Laurus Labs

Shriram Finance

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.