- SpiceJet shares rose over 6% after Supreme Court dismissed Rs 1,323 crore damages claim

- The claim was filed by former promoter Kalanithi Maran and KAL Airways against SpiceJet

- The dispute relates to a 2015 share transfer agreement involving Ajay Singh and Maran

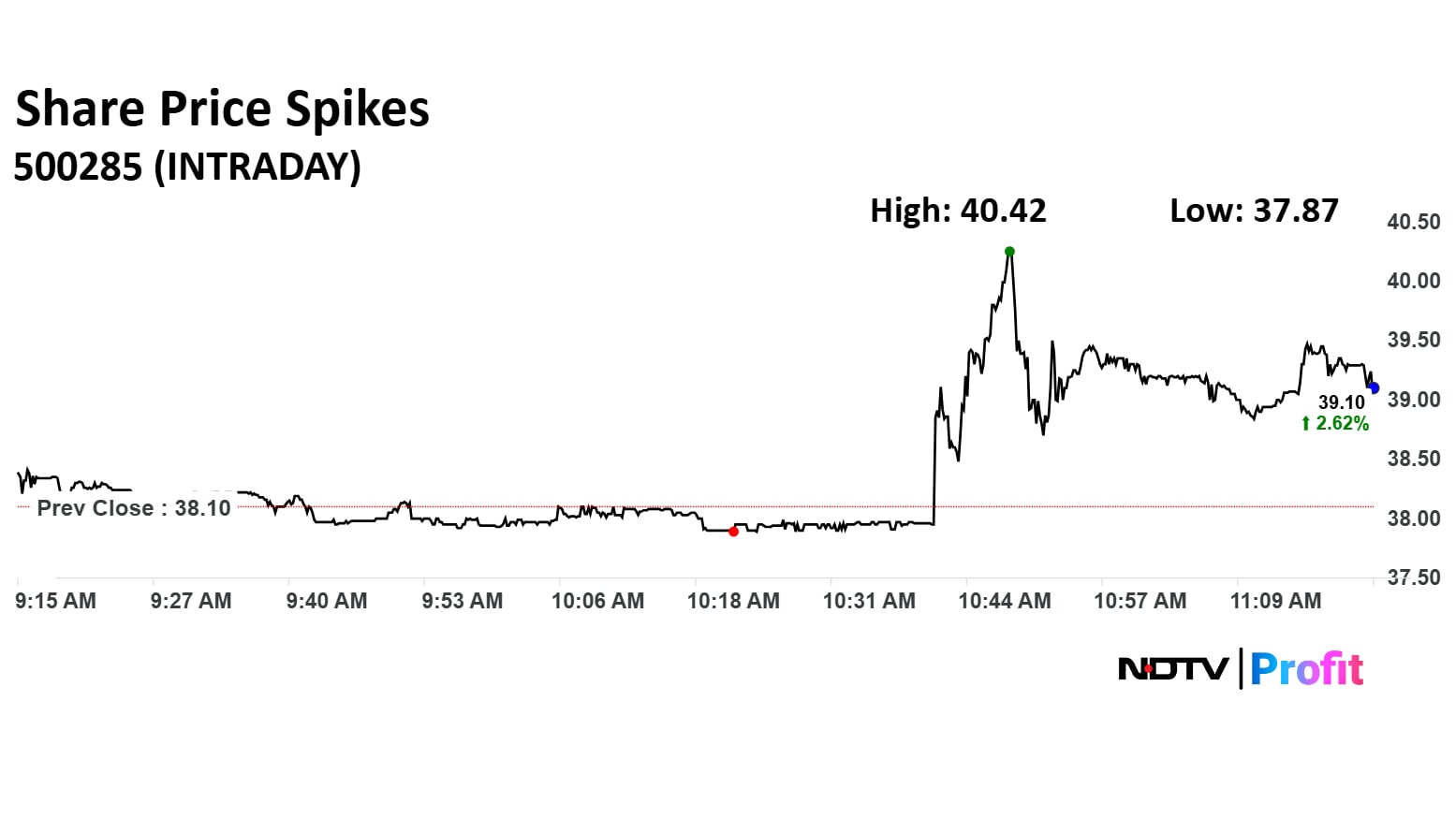

Shares of SpiceJet Ltd. rallied over 6% on Wednesday after the Supreme Court dismissed a Rs 1,323 crore damages claim filed by former promoter Kalanithi Maran and KAL Airways, bringing a major legal overhang to a close for the low-cost carrier. The stock spiked sharply following the apex court's ruling.

The dispute stems from a 2015 share transfer agreement under which Maran and KAL Airways sold their stake in SpiceJet to Ajay Singh, the airline's current chairman and managing director. As part of the deal, Maran was to receive warrants and preference shares, which were never issued. In 2018, an arbitral tribunal awarded Maran Rs 579 crore plus interest, but rejected his additional claim for Rs 1,323 crore in damages.

Wednesday's Supreme Court ruling effectively relieves SpiceJet of the larger financial liability, which had been a lingering concern for investors. The judgment is seen as a major win for the airline, which has been navigating financial and operational challenges in recent years.

The scrip rose as much as 6.09% to Rs 40.42 apiece. It pared gains to trade 3.12% higher at Rs 39.29 apiece, as of 11:19 a.m. This compares to a 0.185% advance in the NSE Nifty 50 Index.

It has fallen 30.73% in the last 12 months. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 45.

Out of four analysts tracking the company, one maintains a 'buy' rating, two recommend a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.