- Shares of Hindustan Zinc rose 4% to Rs 532 on silver price rally

- Silver futures hit record Rs 1,91,800 per kg on strong demand

- Comex silver futures reached lifetime high of USD 62.14 per ounce

Shares of Hindustan Zinc Ltd. rose on Thursday by 4% to Rs 532 a piece. The rise is likely to be driven by a rally in silver prices.

Silver prices hit a fresh record high of Rs 1,91,800 per kg in the futures trade on Wednesday on strong investor demand and expectations of an interest rate cut by the US Federal Reserve.

Rising for the second day, the most-traded March contract of the white metal jumped by Rs 3,736, or 1.98% to touch an all-time high of Rs 1,91,800 per kg on the Multi-Commodity Exchange on Wednesday. The metal had soared by Rs 6,923, or 3.80%, to hit a record of Rs 1,88,665 per kg in the previous session on supply constraints.

Comex silver futures for March 2026 contract climbed by USD 1.3, or 2.14%, to a lifetime high of USD 62.14 per ounce. The white metal has gained USD 3.73, or 6.4%, over the last two sessions after closing at USD 58.40 per ounce on Monday.

Meanwhile, silver exchange traded fund (ETF) is also witnessing record inflows, iShares added 324 tonnes of silver in the past week, its largest weekly inflow since July.

As India's only listed pure-play silver company, Hindustan Zinc is highly sensitive to these price movements.

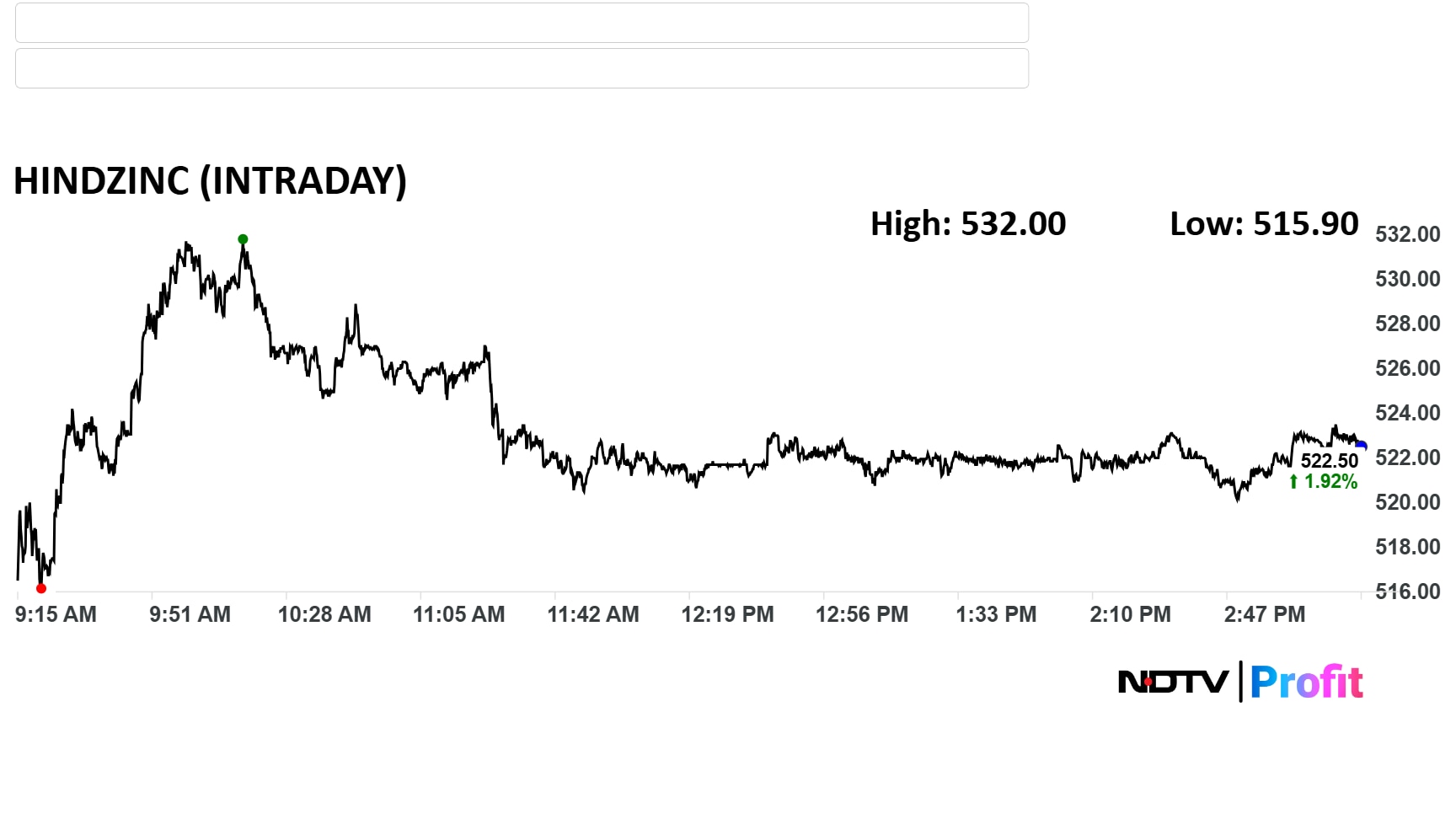

Hindustan Zinc Share Price

The scrip rose as much to Rs 532.00 apiece on Thursday. It pared gains to trade 1.92% higher at Rs 522.60 apiece, as of 3:15 p.m. This compares to a 0.55% decline in the NSE Nifty 50 Index.

It has risen 18.21% on a year-to-date basis, and 3.11% in the last 12 months. The relative strength index was at 53.56%.

Out of 17 analysts tracking the company, eight maintain a 'buy' rating, three recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target of Rs 501.56 implies an downside of 4.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.