Share price of Shriram Pistons & Rings Ltd. jumped to hit its highest level in more than two months following Emkay Research's raise in target price by 13.5% to Rs 2,950 as it believes that the company's recent acquisition of TGPEL Precision Engineering is strategically important regardless of its size.

The brokerage said it believes that the acquisition, though small (~4% of SPRL sales), is important strategically. This is because it will represent another step in diversifying away from engine parts and provide another play on a high-growth area, benefiting from the light-weighting trend.

"TGPEL's healthy profitability (~20-23% EBITDA margin, and over 20% RoCE) and reasonable deal valuation (~1.9x FY24 EV/Sales; 10.6x PER) provide comfort," it added.

The company had announced the acquisition on Tuesday. "For further investment opportunities for expansion of Business, TGPEL Precision Engineering Limited (TGPEL) came across as a strategic opportunity for SPRL for the reasons that TGPEL is a reputed organization in precision tooling and is recognized for manufacturing of precision engineered plastic components in India," it said in a filing.

"It is among the few precision engineering companies providing end-to-end solutions, starting from mould conceptualization and design to produce high-precision plastic injection moulded components and product assembly."

The brokerage maintained its 'buy' with a target of Rs 2,950, implying a 31.2% upside.

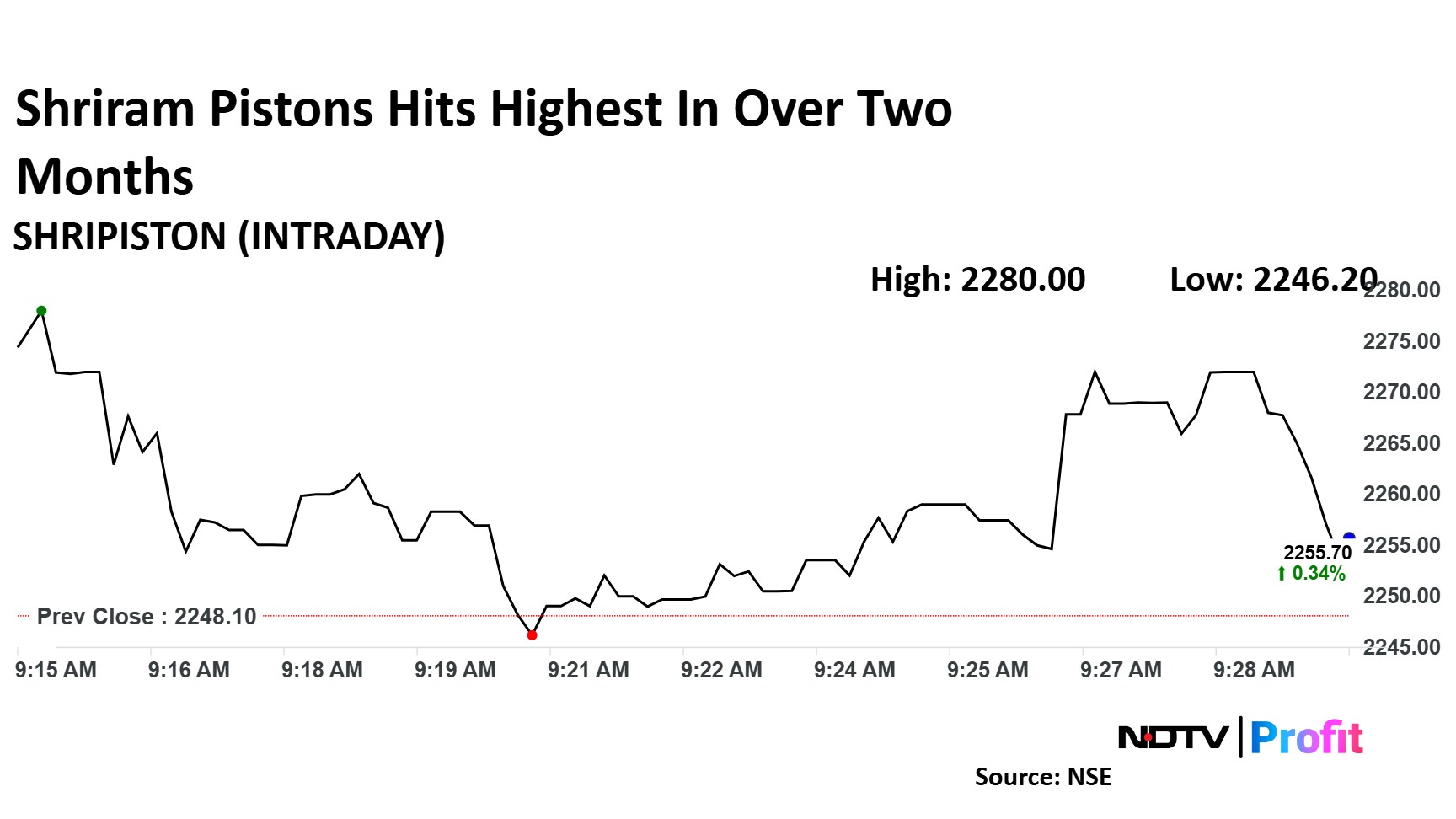

Shriram Pistons rose as much as 1.42% to Rs 2,280 apiece, the highest level since September 25. It erased gains to trade 0.44% lower at Rs 2,239.15 apiece, as of 9:39 a.m. This compares to a 0.1% advance in the NSE Nifty 50 index.

It has risen 53.5% on a year-to-date basis. The relative strength index was at 61.61.

Two analysts tracking the company have a 'buy' rating for the stock, according to Bloomberg data. The average 12-month consensus price target implies an upside of 31.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.