In expansion move, Shriram Pistons & Rings Ltd., through its wholly-owned subsidiary SPR Engenious Ltd., has entered into a share purchase agreement to acquire a 100% equity stake in TGPEL Precision Engineering Ltd. The deal, valued at an enterprise value of Rs 220 crore, aims to further diversify SPRL's business operations.

The acquisition will see SPR Engenious acquiring 100% of TGPEL Precision Engineering's shares, marking a step in the company's growth strategy. TGPEL, established in 1992 as a part of Timex Group and later rebranded in 2023, specialises in precision tooling and the manufacturing of high-precision plastic injection-moulded components, catering to the automotive and industrial sectors.

For the financial year 2023-24, TGPEL recorded a revenue of Rs 118.3 crore, with a paid-up capital of Rs 39.58 crore. The company is a recognised leader in precision engineering, offering end-to-end solutions from mold conceptualisation and design to product assembly.

The transaction is expected to close on or before December 31, 2024, contingent upon the satisfaction of customary conditions. The consideration for the acquisition will be paid in cash, with the total enterprise value of Rs 220 crore subject to adjustments based on debt, working capital, and other liabilities as of the closing date.

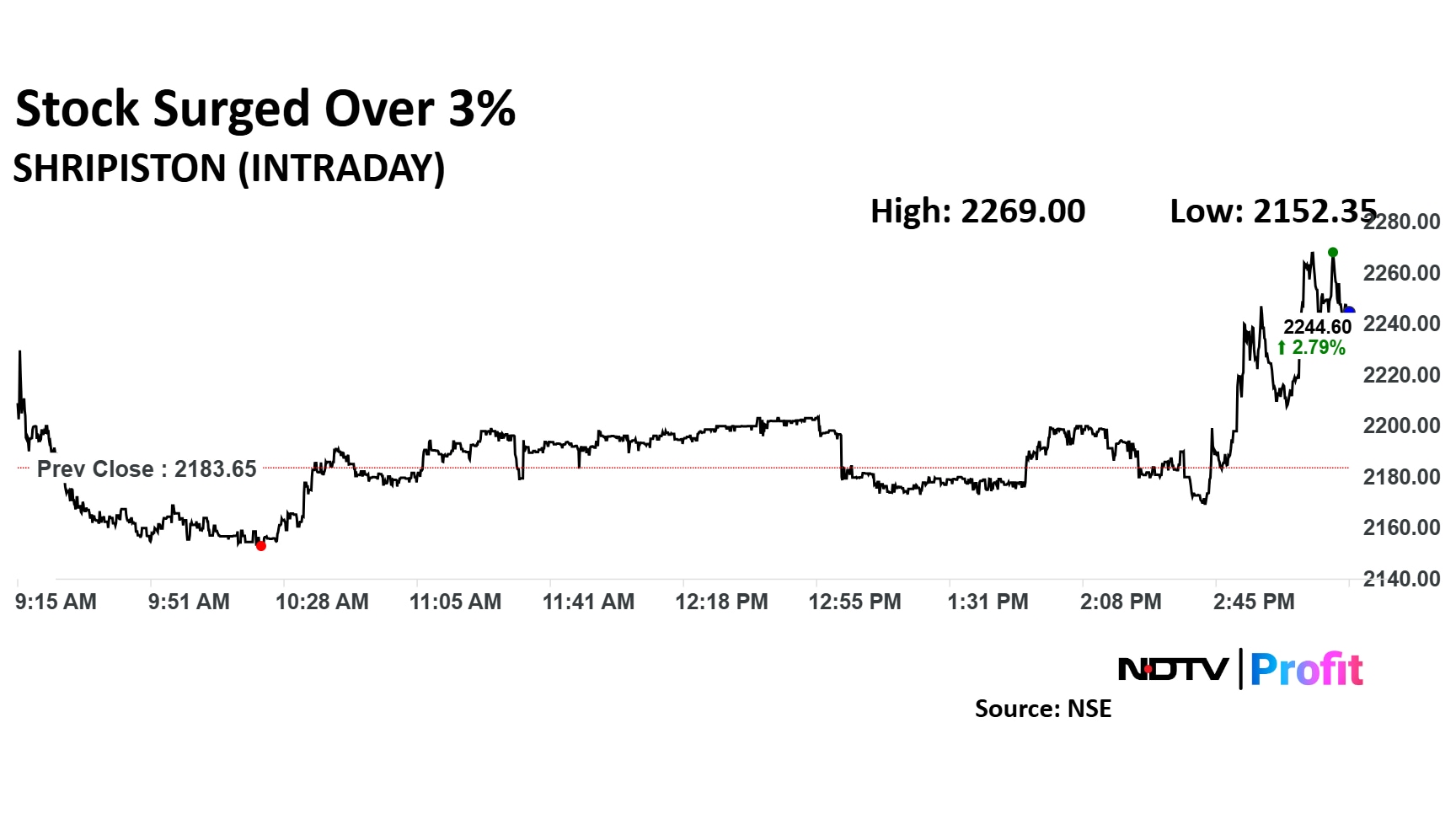

Shriram Pistons & Rings share price rose as much as 3.91% to Rs 2,269 apiece. It pared gains to trade 3.31% higher at Rs 2,256 apiece, as of 03:19 p.m. This compares to a flat NSE Nifty 50 index.

It has risen 115.91% in the last 12 months. The relative strength index was at 63.

Two analysts maintain a 'buy' rating on the stock, according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.