Indian equity benchmarks ended marginally higher today after falling the most in over two weeks during yesterday’s trade.

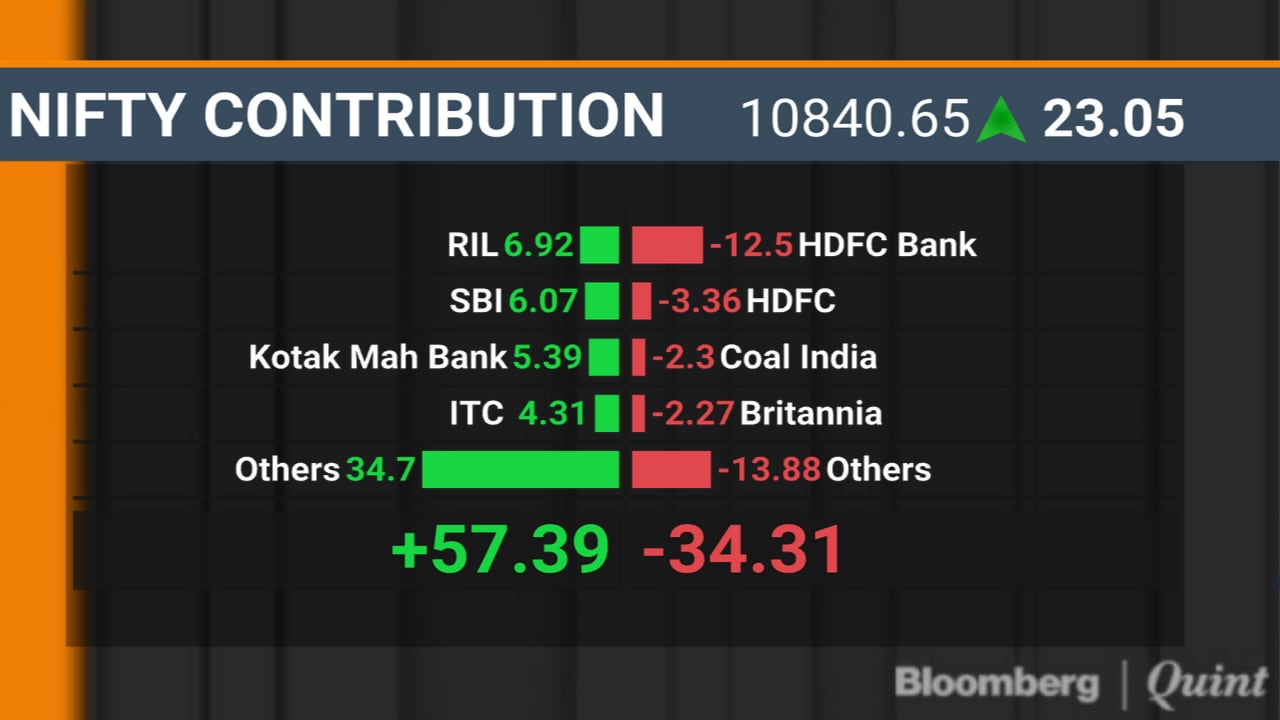

The S&P BSE Sensex ended 0.23 percent or 83 points higher at 36,563 and the NSE Nifty 50 ended 0.21 percent higher at 10,840.65. The broader markets represented by the NSE Nifty 500 Index closed 0.27 percent higher.

“The Indian markets traded with a positive bias throughout the session amidst high intraday volatility. The correction in crude oil prices has definitely provided respite to investors,” Ajit Mishra vice president–research at Religare Broking said.

“Geo-political developments would still be one of the key factors on investors’ radar as any further escalation would have an adverse impact on markets and economy. Besides, the FOMC meet outcome tonight would be a key factor as there is a wide expectation of a rate cut,” Mishra said in a mailed statement.

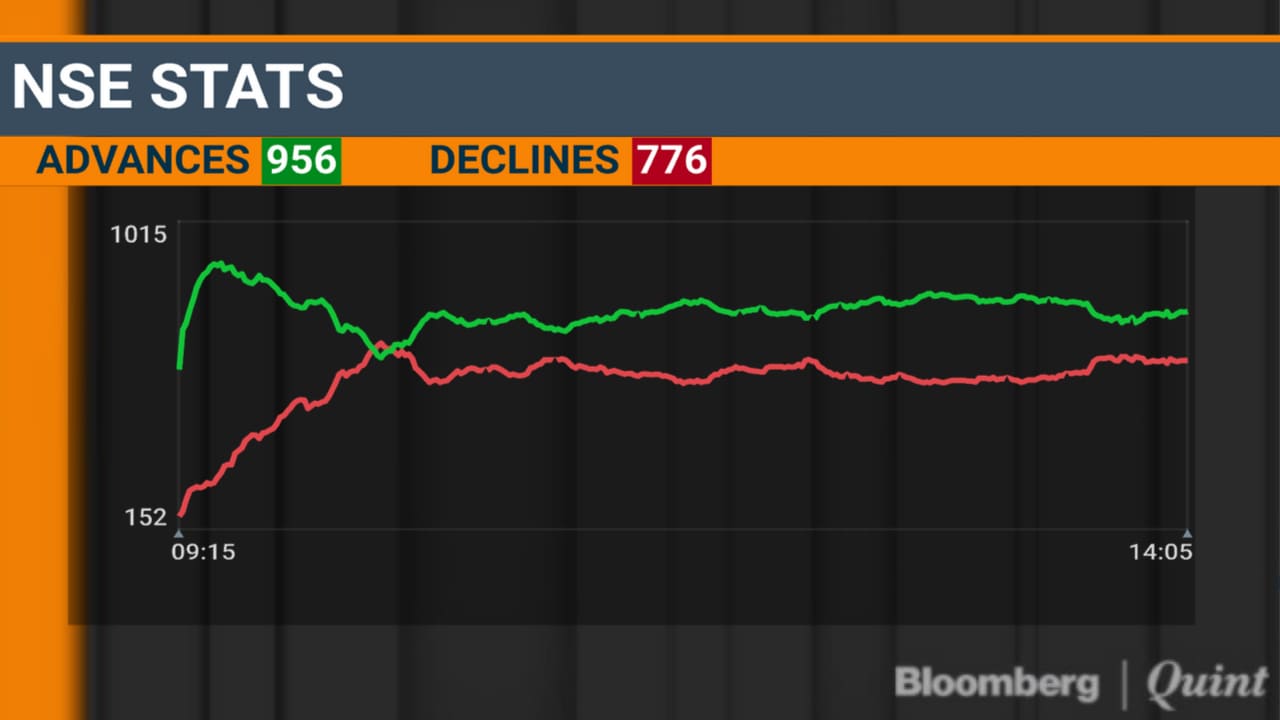

The market breadth was tilted in favour of buyers. About 920 stocks advanced and 854 shares declined on National Stock Exchange.

Eight out of 11 sectoral gauges compiled by NSE ended higher, led by the NSE Nifty Realty Index’s 1.45 percent gain. On the flipside, the NSE Nifty Media Index was the top sectoral loser, down 0.55 percent.

Indian equity benchmarks ended marginally higher today after falling the most in over two weeks during yesterday’s trade.

The S&P BSE Sensex ended 0.23 percent or 83 points higher at 36,563 and the NSE Nifty 50 ended 0.21 percent higher at 10,840.65. The broader markets represented by the NSE Nifty 500 Index closed 0.27 percent higher.

“The Indian markets traded with a positive bias throughout the session amidst high intraday volatility. The correction in crude oil prices has definitely provided respite to investors,” Ajit Mishra vice president–research at Religare Broking said.

“Geo-political developments would still be one of the key factors on investors’ radar as any further escalation would have an adverse impact on markets and economy. Besides, the FOMC meet outcome tonight would be a key factor as there is a wide expectation of a rate cut,” Mishra said in a mailed statement.

The market breadth was tilted in favour of buyers. About 920 stocks advanced and 854 shares declined on National Stock Exchange.

Eight out of 11 sectoral gauges compiled by NSE ended higher, led by the NSE Nifty Realty Index’s 1.45 percent gain. On the flipside, the NSE Nifty Media Index was the top sectoral loser, down 0.55 percent.

The Indian rupee traded near day’s high against the U.S. dollar.

The home currency appreciated 0.73 percent to 71.26 against the greenback. The local legal tender had appreciated 0.83 percent intraday.

The Indian rupee traded near day’s high against the U.S. dollar.

The home currency appreciated 0.73 percent to 71.26 against the greenback. The local legal tender had appreciated 0.83 percent intraday.

Bajaj Finance

Prestige Estates Projects

Godfrey Phillips

Hotel Leela Venture

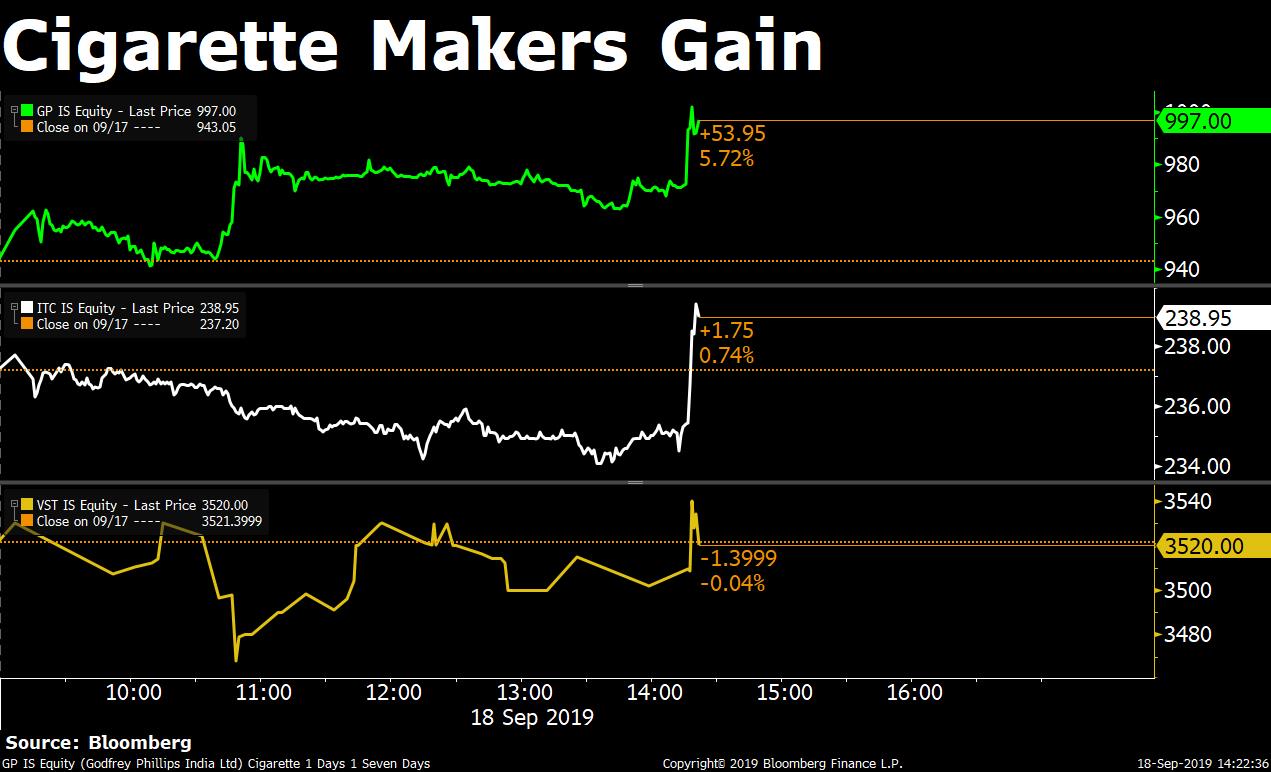

The central government today announced the ban of production and sales of e-cigarettes.

The cabinet has approved the ban of production, import/export, transport, sale, and advertisements of e-cigarettes. The decision was taken considering the impact on youths,” Finance Minister Nirmala Sitharaman said in a media conference today.

Shares of the cigarette makers gained in today’s trade, led by Godfrey Phillips.

The government today has approved banning e-cigarettes, CNBC-TV18 reported without mentioning the source of information.

Shares of the cigarette makers gained in today’s trade, led by Godfrey Phillips.

The government today has approved banning e-cigarettes, CNBC-TV18 reported without mentioning the source of information.

GE T&D India

Laurus Labs

Sanofi India

Cera Sanitaryware

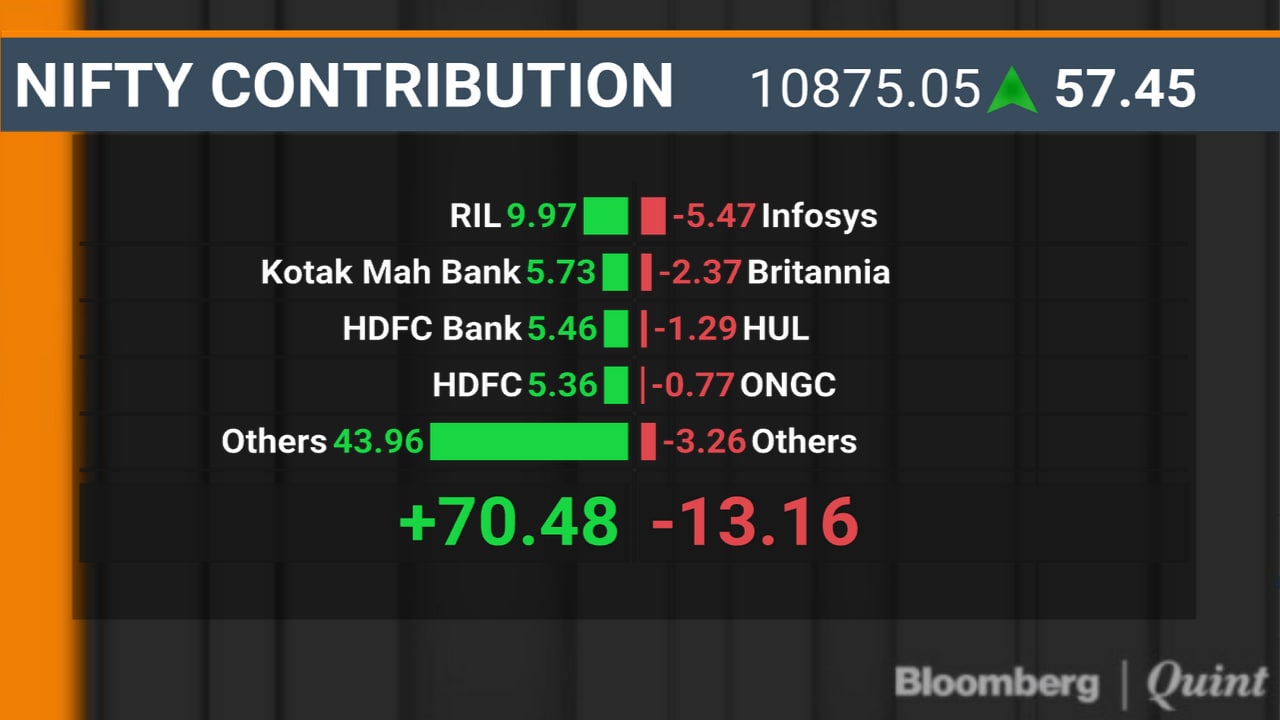

Indian equity benchmarks managed to hold on to gains, led by Kotak Mahindra Bank Ltd. and Reliance Industries Ltd.

The S&P BSE Sensex rose 0.26 percent to 36,586.91 as of 2 p.m. and the NSE Nifty 50 rose 0.26 percent to 10,845.10. The broader markets represented by the NSE Nifty 500 Index rose 0.26 percent.

The market breadth was tilted in favour of buyers. About 956 stocks advanced and 776 shares declined on National Stock Exchange.

Indian equity benchmarks managed to hold on to gains, led by Kotak Mahindra Bank Ltd. and Reliance Industries Ltd.

The S&P BSE Sensex rose 0.26 percent to 36,586.91 as of 2 p.m. and the NSE Nifty 50 rose 0.26 percent to 10,845.10. The broader markets represented by the NSE Nifty 500 Index rose 0.26 percent.

The market breadth was tilted in favour of buyers. About 956 stocks advanced and 776 shares declined on National Stock Exchange.

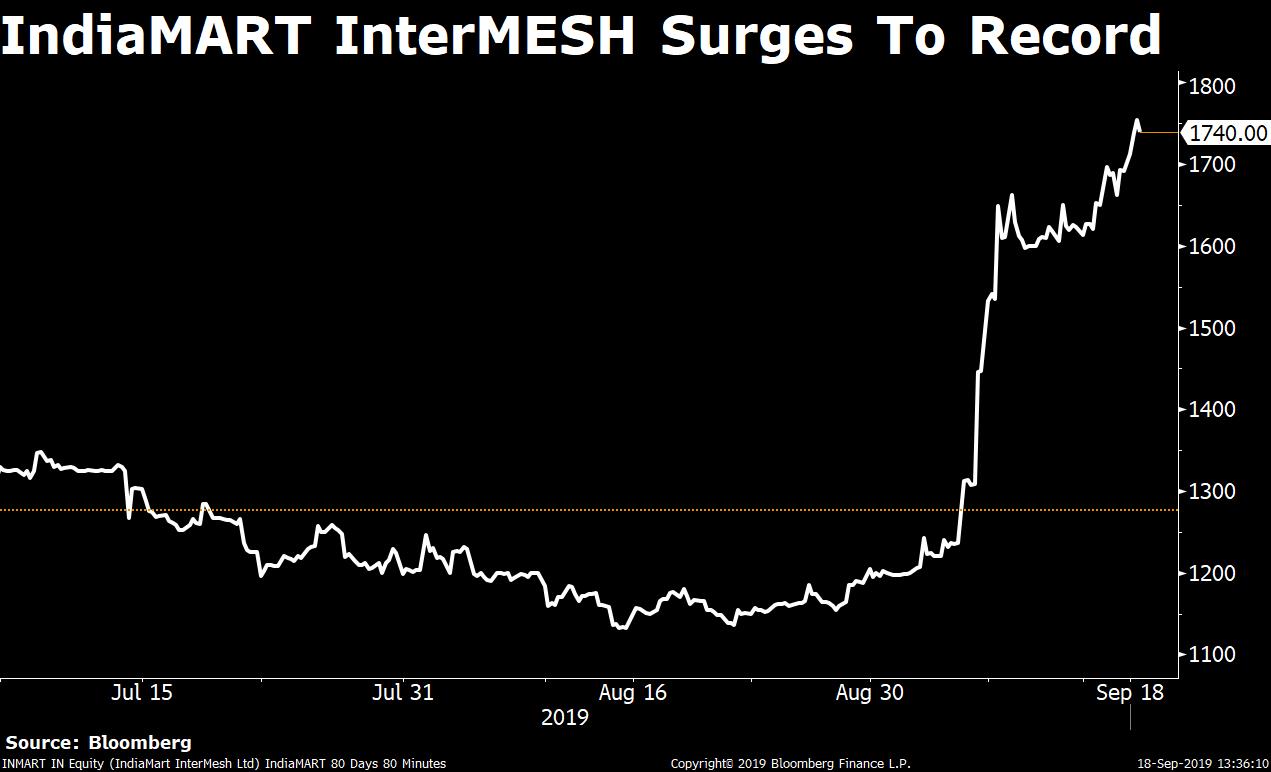

Shares of IndiaMART InterMESH extended gains for the fifth consecutive trading session. The stock rose as much as 5.4 percent to hit an all-time high at Rs 1,783.40.

The stock advanced 33.7 percent since its listing on July 4. The Relative Strength Index was above 70, indicating that the stock may be overbought, according to Bloomberg data.

Shares of IndiaMART InterMESH extended gains for the fifth consecutive trading session. The stock rose as much as 5.4 percent to hit an all-time high at Rs 1,783.40.

The stock advanced 33.7 percent since its listing on July 4. The Relative Strength Index was above 70, indicating that the stock may be overbought, according to Bloomberg data.

Lenders to the beleaguered Dewan Housing Finance Corporation Ltd. have decided to proceed with a contingency plan which involves them taking over at least a part of the company’s operations. This, after a resolution plan submitted by the company was not agreeable to lenders.

Shares of DHFL fell 2.6 percent to Rs 49.05 as of 1:25 p.m. The stock fell 5.6 percent intraday.

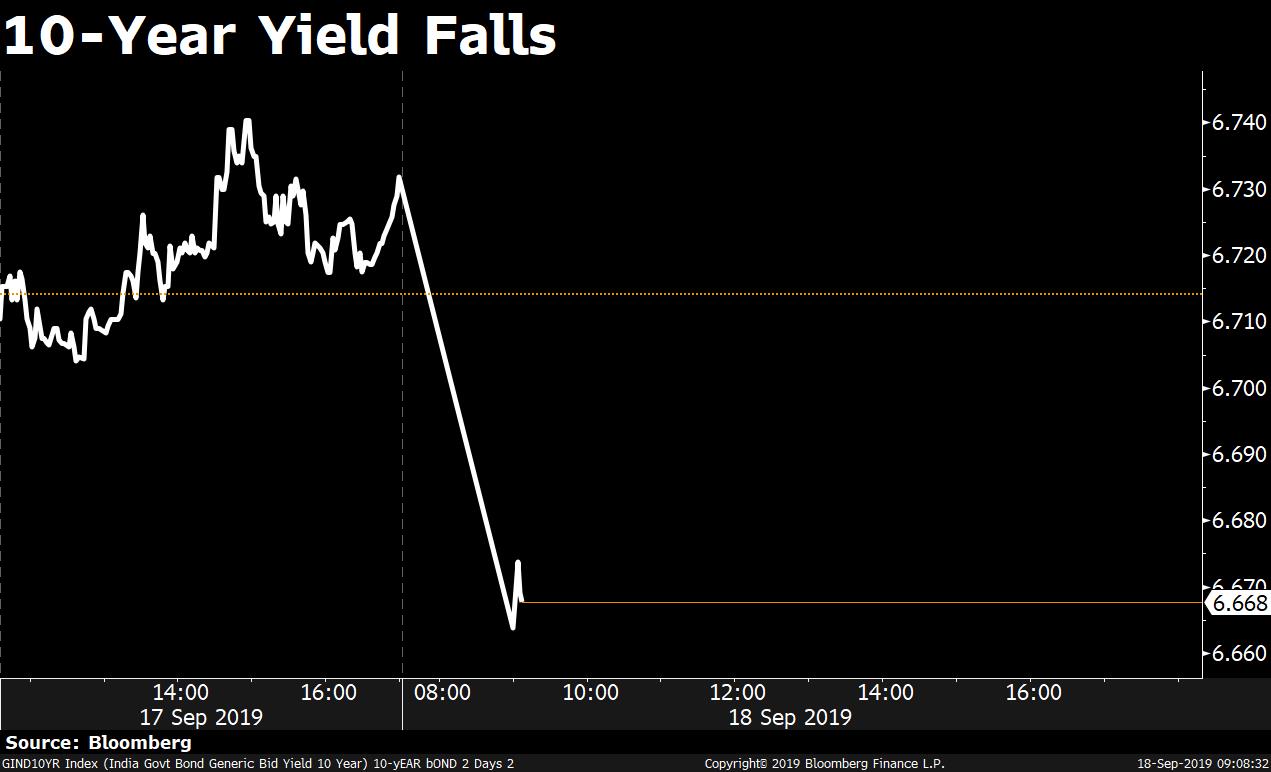

The yield on the 10-year note extended opening declines. It fell as much as 10 basis points to 6.63 percent.

The yield on the 10-year note extended opening declines. It fell as much as 10 basis points to 6.63 percent.

Indian equity benchmarks regained momentum during the afternoon trade.

The S&P BSE Sensex rose 0.37 percent to 36,614 as of 12:57 p.m. and the NSE Nifty 50 rose 0.36 percent to 10,857. The broader markets represented by the NSE Nifty 500 rose 0.39 percent.

Shares of Reliance Nippon Life Asset Management Company recovered from a fall 7.6 percent percent. The stock rose 2 percent to Rs 233.10.

Trading volume was more than four times its 20-day average, according to Bloomberg data. Of the shares traded, 42 percent were at the ask price and 46 percent were at the bid.

The stock declined 17 percent in the past five days and fell 9.7 percent in the past 30 days.

The NSE Nifty Metal Index rose 1.4 percent, led by the gains in NMDC Ltd. Tata Steel Ltd. and Jindal Steel & Power Ltd.

The NSE Nifty Metal Index rose 1.4 percent, led by the gains in NMDC Ltd. Tata Steel Ltd. and Jindal Steel & Power Ltd.

Shares of CG Power & Industrial Solutions fell 1.9 percent to Rs 15.35 as of 12:20 p.m.

Market regulator—Securities and Exchange Board of India barred the company's ex-chairman Gautam Thapar and three other former officials from capital markets for “serious” misstatement of accounts as well as diversion of funds, and ordered forensic audit of the company, according to a PTI report.

The stock declined 71 percent in the past 12 months compared to 2.1 percent fall in the Sensex.

JPMorgan expects the rupee to remain at 71 per dollar levels for the next few months as the Indian currency tracks the yuan, which has been weakening due to the ongoing U.S.-China trade war.

That’s according to Brijen Puri, head (currencies and emerging markets, Southeast Asia) at the global investment banking firm.

Here’s what Puri had to say further on India-China currency linkages

Seven out of 11 sectoral gauges compiled by NSE traded higher, led by the NSE Nifty Metal Index’s 1 percent gain. On the flipside, the NSE Nifty Pharma Index was the top sectoral loser, down 0.4 percent.

Indian equity benchmarks struggled to regain momentum as gains in Kotak Mahindra Bank Ltd. and Bajaj Finance Ltd. were offset by losses in HDFC Bank Ltd. and ITC Ltd.

The S&P BSE Sensex and the NSE Nifty 50 traded little changed at 36,506 and 10,816 as of 11 a.m. The broader markets represented by the NSE Nifty 500 Index, too, traded little changed.

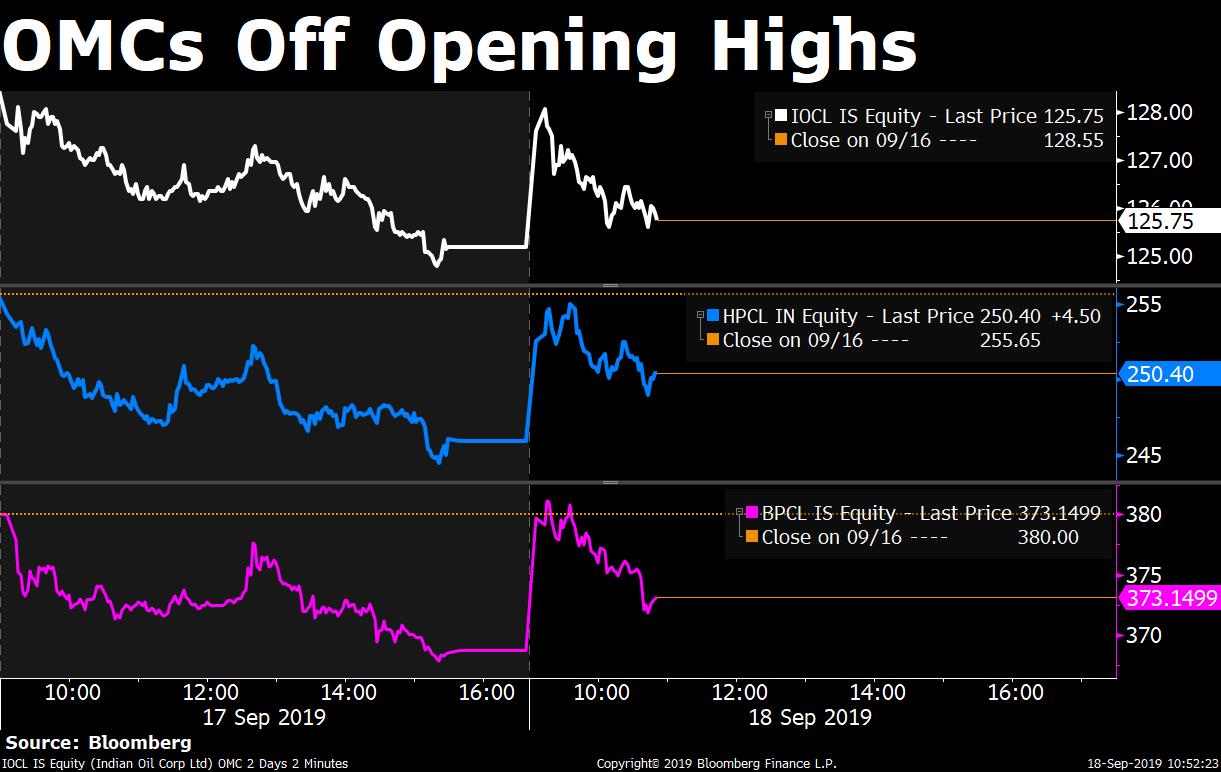

Shares of the oil marketing gained, but traded off opening highs.

The after Asia’s crude benchmark—Brent crude little changed at $64.50 a barrel after falling as much as 8 percent yesterday.

Besides, Indian refiners and Rosneft are in talks to finalise a term-contract for supply of Russian oil as part of the South Asian nation’s efforts to diversify its sources of crude, Bloomberg reported quoting oil ministry’s mail.

Shares of the oil marketing gained, but traded off opening highs.

The after Asia’s crude benchmark—Brent crude little changed at $64.50 a barrel after falling as much as 8 percent yesterday.

Besides, Indian refiners and Rosneft are in talks to finalise a term-contract for supply of Russian oil as part of the South Asian nation’s efforts to diversify its sources of crude, Bloomberg reported quoting oil ministry’s mail.

Shares of Sunteck Realty rose as much as 4.5 percent to Rs 458.

The company signed an agreement with Transcon Enterprises for development of residential, commercial and retail project in Mumbai’s Andheri area. The company said that the project has a potential saleable area of 1.1 million square feet and a revenue of over Rs 2,500 crore is expected in the next four-to-five years.

Trading volume was two times its 20-day average, Bloomberg data showed. The stock traded at 19 times its estimated earnings per share for the coming year.

Nifty’s 10,800 put option contract was among the most active Nifty option contracts on National Stock Exchange.

Premium on the weekly contract, which is set to expire tomorrow, fell 39.69 percent to Rs 27.35. Over 3.84 lakh shares were added to the open interest which stood at over 22.41 lakh shares.

Indian equity benchmarks erased opening gains as the gains in Reliance Industries Ltd. and Kotak Mahindra Bank Ltd. were offset by losses in HDFC twins.

The S&P BSE Sensex and the NSE Nifty 50 traded little changed at 36,522 and 10,824 respectively as of 10 a.m. The broader markets represented by the NSE Nifty 500 Index too traded flat.

India’s equity benchmarks NSE Nifty 50 may face a strong resistance at 10,950 levels, according to Choice Broking.

“The 50-share gauge has formed big bearish candle with high volume activity which show downside movement in the Index. It is currently trading below its 50-day moving average averages with negative crossover which show negativity in the Index,” the domestic research firm said in a note. “The downside support comes at 10,750 level,” it added.

Shares of Britannia Industries fell as much as 3.6 percent, the most in nearly a month, to Rs 2,595.

Brokerage and research firm Credit Suisse downgraded the company’s stock rating to ‘Neutral’ from ‘Outperform’; cut price target to Rs 2,750 from Rs 2,975, implying a potential upside of 2.1 percent from the last regular trade.

Here’s what Credit Suisse had to say:

Shares of Coffee Day Enterprises rose as much as 4.9 percent to Rs 76.35.

Blackstone Group and Salapuria Sattva Group have agreed to acquire the company’s Global Village Tech Park in Bengaluru. The acquisition would take place at an enterprise value of around Rs 2,700 crore in two tranches. The first tranche is expected to be transferred before Oct. 31, while the deal would be subject to conditions, including regulatory approval.

The stock declined 76 percent in the past 12 months compared to 2.9 percent decline in the Sensex. The scrip traded at 13 times its estimated earnings per share for the coming year, Bloomberg data showed.

Shares of Bajaj Finance rose as much as 2.4 percent to Rs 3,447.90.

The company plans to raise up to Rs 8,500 crore through qualified institutional placement by issuing equity shares, according to its stock exchange filing.

The stock halted its two-day losing streak. Of the shares traded, 45 percent were at the ask price and 32 percent were at the bid, according to Bloomberg data.

Indian equity benchmarks opened higher in today’s trade.

The S&P BSE Sensex rose 0.47 percent to 36,650 as of 9:16 a.m. and the NSE Nifty 50 rose 0.47 percent to 10,867.20. The broader markets represented by the NSE Nifty 500 Index rose 0.5 percent.

The market breadth was tilted in favour of buyers. About 969 stocks advanced and 378 shares declined on National Stock Exchange.

Ten out of 11 sectoral gauges compiled by NSE traded higher, led by the NSE Nifty Media Index’s 1.07 percent gain. On the flipside, the NSE Nifty IT Index was the only sectoral loser, down 0.12 percent.

Indian equity benchmarks opened higher in today’s trade.

The S&P BSE Sensex rose 0.47 percent to 36,650 as of 9:16 a.m. and the NSE Nifty 50 rose 0.47 percent to 10,867.20. The broader markets represented by the NSE Nifty 500 Index rose 0.5 percent.

The market breadth was tilted in favour of buyers. About 969 stocks advanced and 378 shares declined on National Stock Exchange.

Ten out of 11 sectoral gauges compiled by NSE traded higher, led by the NSE Nifty Media Index’s 1.07 percent gain. On the flipside, the NSE Nifty IT Index was the only sectoral loser, down 0.12 percent.

The yield on the 10-year note fell as much as seven basis points to 6.6 percent.

The yield on the 10-year note fell as much as seven basis points to 6.6 percent.

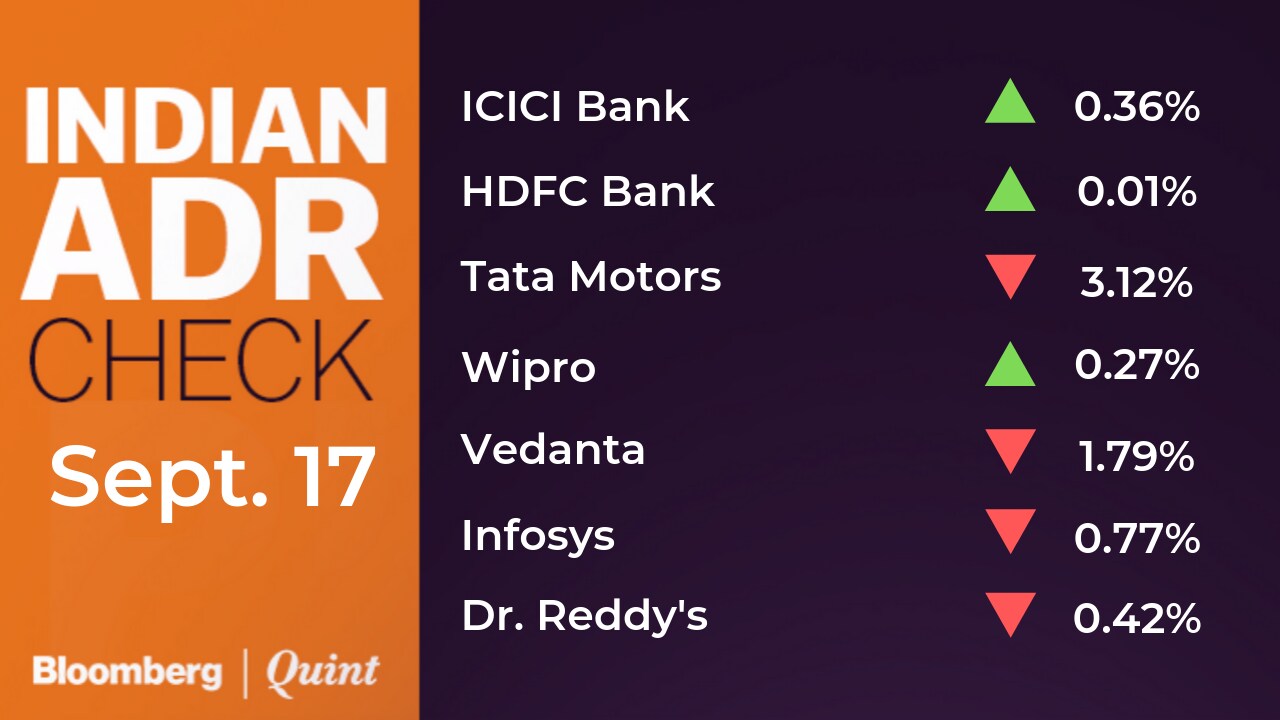

The Indian rupee opened higher against the U.S. dollar. The home currency appreciated as much as 0.49 percent to 71.43 against the greenback.

The Indian rupee opened higher against the U.S. dollar. The home currency appreciated as much as 0.49 percent to 71.43 against the greenback.

Indian equity benchmarks are set to open higher.

The S&P BSE Sensex rose 0.5 percent to 36,640 during the pre-market and the NSE Nifty 50 rose 0.45 percent to 10,865.20.

Good Morning!

The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index’s performance in India, rose 0.43 percent to 10,888.50 as of 8:05 a.m.

Stocks in Asia opened mixed as investors awaited the outcome of the Federal Reserve’s policy meeting, where it’s widely expected to cut interest rates again.

Equity indices in Japan edged down, while Hong Kong and South Korea traded flat. Futures on the S&P 500 little changed. (Get your daily fix of global markets here.)

Short on time? Well, then listen to this podcast for a quick summary of All You Need To Know before the opening bell.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.