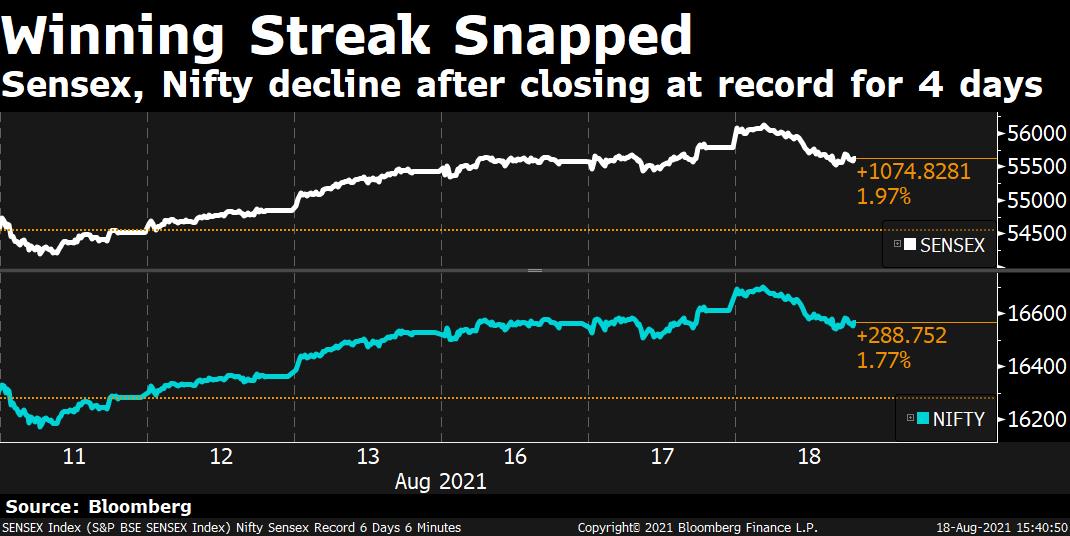

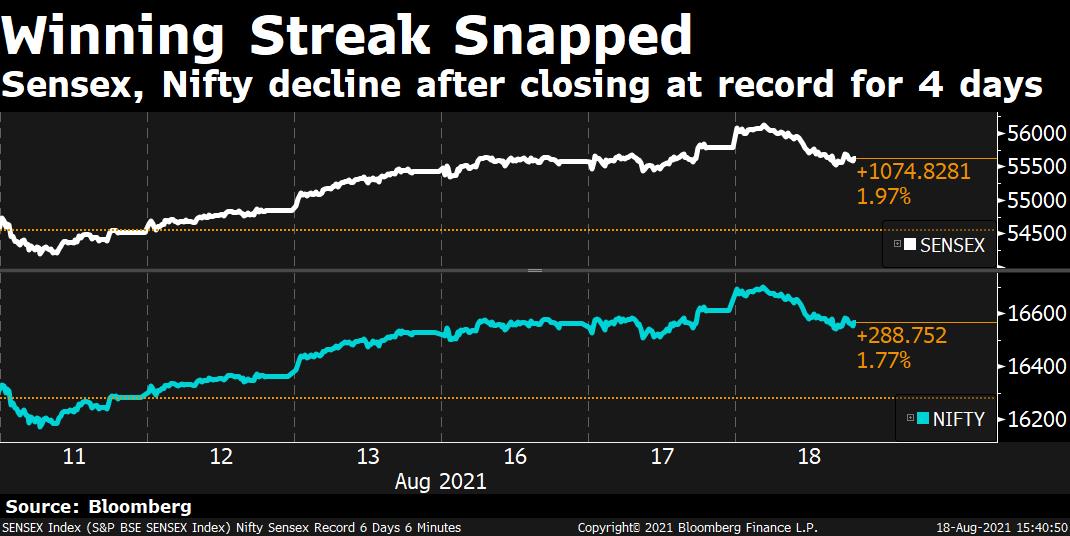

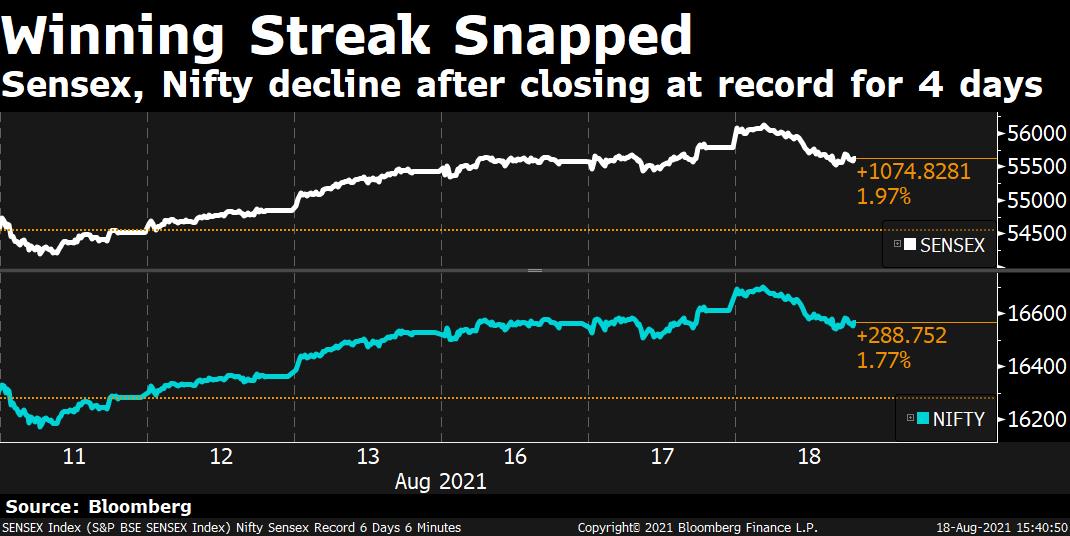

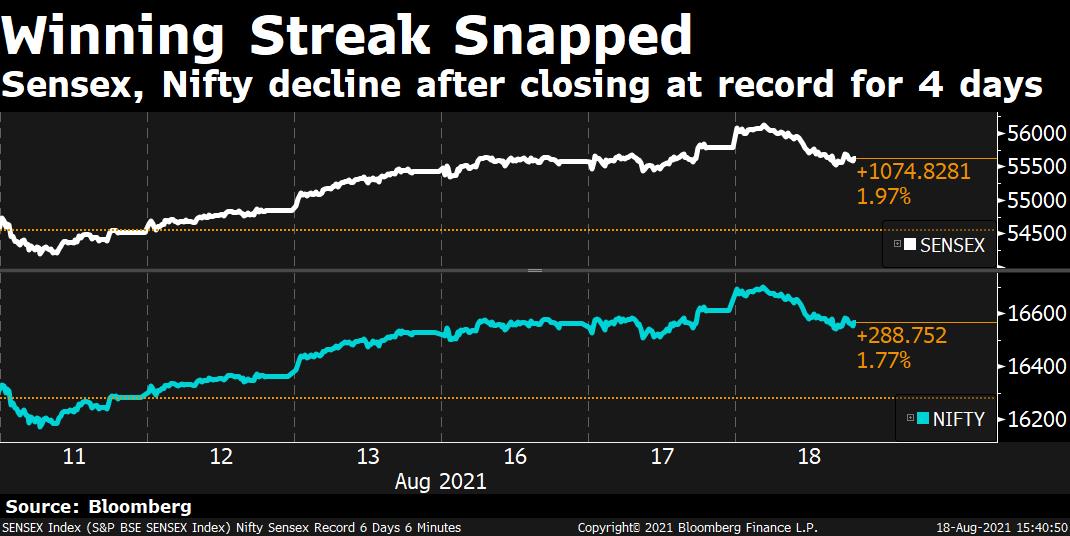

India’s stock benchmarks snapped a winning streak in which they closed at record for four consecutive sessions, weighed by the losses in banking and metal stocks.

India’s stock benchmarks snapped a winning streak in which they closed at record for four consecutive sessions, weighed by the losses in banking and metal stocks.

The S&P BSE Sensex shed 0.29% to 55,629.49. The 30-stock index hit a record 56,118.57 in intraday trade. This is the first time Sensex has crossed 56,000 mark. The NSE Nifty 50 declined by similar magnitude to 16,568.85. Nifty 50 had also logged a record 16,701.85 in intraday trade, the first ever time the 50-stock index crossed 16,700 mark.

ICICI Bank Ltd. contributed the most to the index decline, decreasing 1.8%. Hindalco Industries Ltd. had the largest drop, falling 2.2%.

India’s stock benchmarks snapped a winning streak in which they closed at record for four consecutive sessions, weighed by the losses in banking and metal stocks.

India’s stock benchmarks snapped a winning streak in which they closed at record for four consecutive sessions, weighed by the losses in banking and metal stocks.

The S&P BSE Sensex shed 0.29% to 55,629.49. The 30-stock index hit a record 56,118.57 in intraday trade. This is the first time Sensex has crossed 56,000 mark. The NSE Nifty 50 declined by similar magnitude to 16,568.85. Nifty 50 had also logged a record 16,701.85 in intraday trade, the first ever time the 50-stock index crossed 16,700 mark.

ICICI Bank Ltd. contributed the most to the index decline, decreasing 1.8%. Hindalco Industries Ltd. had the largest drop, falling 2.2%.

The S&P BSE MidCap outperformed, adding 0.26% while the S&P BSE SmallCap almost mirrored their larger peers, shedding 0.2%. Thirteen out of the 19 sectoral indices compiled by the BSE Ltd. declined, with S&P BSE Metal and S&P BSE Bankex falling 1%.

India’s stock benchmarks snapped a winning streak in which they closed at record for four consecutive sessions, weighed by the losses in banking and metal stocks.

India’s stock benchmarks snapped a winning streak in which they closed at record for four consecutive sessions, weighed by the losses in banking and metal stocks.

The S&P BSE Sensex shed 0.29% to 55,629.49. The 30-stock index hit a record 56,118.57 in intraday trade. This is the first time Sensex has crossed 56,000 mark. The NSE Nifty 50 declined by similar magnitude to 16,568.85. Nifty 50 had also logged a record 16,701.85 in intraday trade, the first ever time the 50-stock index crossed 16,700 mark.

ICICI Bank Ltd. contributed the most to the index decline, decreasing 1.8%. Hindalco Industries Ltd. had the largest drop, falling 2.2%.

India’s stock benchmarks snapped a winning streak in which they closed at record for four consecutive sessions, weighed by the losses in banking and metal stocks.

India’s stock benchmarks snapped a winning streak in which they closed at record for four consecutive sessions, weighed by the losses in banking and metal stocks.

The S&P BSE Sensex shed 0.29% to 55,629.49. The 30-stock index hit a record 56,118.57 in intraday trade. This is the first time Sensex has crossed 56,000 mark. The NSE Nifty 50 declined by similar magnitude to 16,568.85. Nifty 50 had also logged a record 16,701.85 in intraday trade, the first ever time the 50-stock index crossed 16,700 mark.

ICICI Bank Ltd. contributed the most to the index decline, decreasing 1.8%. Hindalco Industries Ltd. had the largest drop, falling 2.2%.

The S&P BSE MidCap outperformed, adding 0.26% while the S&P BSE SmallCap almost mirrored their larger peers, shedding 0.2%. Thirteen out of the 19 sectoral indices compiled by the BSE Ltd. declined, with S&P BSE Metal and S&P BSE Bankex falling 1%.

The market breadth was skewed in favour of bears. About 1,096 stocks advanced, 2,082 declined and 117 remained unchanged.

"The market have witnessed some correction from the higher levels of 16,700. It is going to be crucial for the short-term market scenario to sustain above the 16,500 level. Early signs of reversal in the market with deviation occurring in Nifty 50, Nifty MidCap, and Nifty SmallCap. Hence traders are advised the traders to refrain from building a new buying position until we see further improvement in the market breadth", Ashish Biswas, head of technical research at CapitalVia Global Research Ltd. wrote in a quote.

Shares of Aster DM Healthcare Ltd. gained over 10% to record Rs 194.70 apiece and extended its rally for the third session.

On Sunday, the company stated plans to expand the number of labs and pharmacy distribution network in the country.

Founder Chairman and Managing Director, Azad Moopen said that the company intended to invest Rs 235 crore to add 411 beds in the next 18 months in India.

All the 9 analysts tracking the company maintained ‘buy’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 12.7%.

The relative strength index of the stock is at 76, suggesting that the stock may be overbought. Shares of Aster DM Healthcare have added 13.6% in 2021 compared to 21% gains for S&P BSE Healthcare.

Shares of United Spirits Ltd. climbed 10% to hit record Rs 725.90 a piece.

United Breweries added nearly 8% while GM Breweries and Globus Spirits shares rose over 5% as well.

Radico Khaitan was the exception as the company’s shares shed 3.25% in intra-day trade.

Tata Steel has commissioned its new 0.5 million tonnes per annum steel recycling plant at Rohtak, Haryana as part of the company's sustainability commitment.

In an exchange filing, Tata Steel said that the plan has been set up in collaboration with Aarti Green Tech Ltd. as a 'Build, Own, Operate' partner.

It is the first such facility in India, equipped with equipment such as shredder, baler, material handler etc.

Tata Steel intends to provide raw material fillip to Indian steel industry by making quality processed ferrous scrap available and reduce import-dependency, the company said in a statement.

Shares of Tata Steel added 1% in intraday trade before paring the gains.

Shares of Tata Consultancy Services Ltd. rose for the 10th straight day. This is the longest winning streak since the company went public in 2004.

TCS shares gained 8.7% during the streak, including 0.21% gain on Wednesday. TCS shares also hit a record Rs 3,595 on intraday trade. Before today, the longest rally for TCS lasted nine days (September 2020).

The relative strength index of the stock is 83, indicating that it may be overbought.

NSE Nifty Bank reversed gains and shed over 0.5% to Rs. 35,649.40. The 12-stock index had risen 1% in intraday trade aided by gains in HDFC Bank.

ICICI Bank and Kotak Mahindra Bank shed 1.5% as they offset the gains in HDFC Bank with 7 of the constituents declining.

NSE Nifty Bank reversed gains and shed over 0.5% to Rs. 35,649.40. The 12-stock index had risen 1% in intraday trade aided by gains in HDFC Bank.

ICICI Bank and Kotak Mahindra Bank shed 1.5% as they offset the gains in HDFC Bank with 7 of the constituents declining.

Shares of Subex Ltd. advanced 6.22% to Rs 55.50 apiece after the company announced that it won a seven-digit, 5-year contract with Dhiraagu for integrated Revenue Assurance and Fraud Management solution.

Dhiraagu is the leading telecom operator of Maldives, with half a million subscribers. According to exchange filing by Subex, the deal would enable Dhiraagu to upgrade its systems to equip itself for the 5G era.

Subex has concluded 6 M&A deals, 7 investments and 1 deal in the past 3 months, according to Bloomberg data. Shares of Subex gained 98.4% in 2021 so far compared to 17.6% for Sensex

Metal stocks declined with S&P BSE Metal shedding over 1%. All the ten constituents of the metal index fell, with Vedanta Ltd. and Hindalco Industries Ltd. slipping over 2%.

Metal stocks declined with S&P BSE Metal shedding over 1%. All the ten constituents of the metal index fell, with Vedanta Ltd. and Hindalco Industries Ltd. slipping over 2%.

India’s stock benchmarks declined after hitting record highs for the fifth consecutive session as gains in power, utilities, FMCG and tech stocks were offset by losses in metals and realty stocks.

The S&P BSE Sensex shed 0.13% to 55,722.15. The 30-stock index hit a record 56,118.57 in intraday trade. This is the first time Sensex has crossed 56,000 mark. The NSE Nifty 50 declined by similar magnitude to 16,583.75. Nifty 50 had also logged a record 16,701.85 in intraday trade, the first ever time the 50-stock index crossed 16,700 mark.

India’s stock benchmarks declined after hitting record highs for the fifth consecutive session as gains in power, utilities, FMCG and tech stocks were offset by losses in metals and realty stocks.

The S&P BSE Sensex shed 0.13% to 55,722.15. The 30-stock index hit a record 56,118.57 in intraday trade. This is the first time Sensex has crossed 56,000 mark. The NSE Nifty 50 declined by similar magnitude to 16,583.75. Nifty 50 had also logged a record 16,701.85 in intraday trade, the first ever time the 50-stock index crossed 16,700 mark.

The S&P BSE MidCap outperformed their larger peers adding 0.1% while the S&P BSE SmallCap underperformed, shedding 0.3%. Thirteen out of the 19 sectoral indices compiled by the BSE Ltd. declined, with S&P BSE Metal falling nearly 1.3%.

The market breadth was skewed in favour of bears. About 1,058 stocks advanced, 2,013 declined and 117 remained unchanged.

"Large caps are playing a catch-up rally in the month of August, driving the benchmark indices to higher levels, while the broader market is in a consolidation zone. Mid & small caps have seen a sharp rally in the last few months and now some profit booking is visible in the space which is a healthy sign for the market. Investors are now finding comfort in the large cap space which provides more margin of safety over the broader market at current levels. We continue to see the broader market doing well, so any dips should be utilized to build positions in quality stocks where the earnings visibility and the balance sheet strength is very high. Returns from current levels will be more calibrated and focus on quality and value will yield sustainable returns", Naveen Kulkarni, Chief Investment Officer, Axis Securities wrote in a note.

India’s stock benchmarks declined after hitting record highs for the fifth consecutive session as gains in power, utilities, FMCG and tech stocks were offset by losses in metals and realty stocks.

The S&P BSE Sensex shed 0.13% to 55,722.15. The 30-stock index hit a record 56,118.57 in intraday trade. This is the first time Sensex has crossed 56,000 mark. The NSE Nifty 50 declined by similar magnitude to 16,583.75. Nifty 50 had also logged a record 16,701.85 in intraday trade, the first ever time the 50-stock index crossed 16,700 mark.

India’s stock benchmarks declined after hitting record highs for the fifth consecutive session as gains in power, utilities, FMCG and tech stocks were offset by losses in metals and realty stocks.

The S&P BSE Sensex shed 0.13% to 55,722.15. The 30-stock index hit a record 56,118.57 in intraday trade. This is the first time Sensex has crossed 56,000 mark. The NSE Nifty 50 declined by similar magnitude to 16,583.75. Nifty 50 had also logged a record 16,701.85 in intraday trade, the first ever time the 50-stock index crossed 16,700 mark.

The S&P BSE MidCap outperformed their larger peers adding 0.1% while the S&P BSE SmallCap underperformed, shedding 0.3%. Thirteen out of the 19 sectoral indices compiled by the BSE Ltd. declined, with S&P BSE Metal falling nearly 1.3%.

The market breadth was skewed in favour of bears. About 1,058 stocks advanced, 2,013 declined and 117 remained unchanged.

"Large caps are playing a catch-up rally in the month of August, driving the benchmark indices to higher levels, while the broader market is in a consolidation zone. Mid & small caps have seen a sharp rally in the last few months and now some profit booking is visible in the space which is a healthy sign for the market. Investors are now finding comfort in the large cap space which provides more margin of safety over the broader market at current levels. We continue to see the broader market doing well, so any dips should be utilized to build positions in quality stocks where the earnings visibility and the balance sheet strength is very high. Returns from current levels will be more calibrated and focus on quality and value will yield sustainable returns", Naveen Kulkarni, Chief Investment Officer, Axis Securities wrote in a note.

Shares of Ultratech Cement Ltd. rose 3.5%, the most in 16 weeks, to Rs 7,668 apiece.

Trading volume was 3,16,273 shares, double the 20-day average of 1,54,007 shares for this time of the day.

Analysts have 36 'buy', six 'hold' and two 'sell' recommendations on the stock with 31 analysts revising their price targets higher over the past month.

Shares of India’s Aavas Financiers Ltd. fell 8.67%, the most since April 12, after about 4% of equity was traded via four bunched trades on the BSE.

Trading volume was 75 times the three-month full-day average; worst performer on NSE Nifty MNC Index.

Total 2.98 million shares changed hands via four trades, according to data compiled by Bloomberg.

Buyers, sellers not immediately known.

Hinduja family pledged more of their stake in IndusInd Bank to avoid triggering a covenant breach last quarter: Bloomberg Exclusive

Source: People With Knowledge Of The Matter

Shares of Mindtree Ltd. gained 7.48%, the most in five weeks, to Rs 3,243.00 apiece in intraday trade. Trading volume was five times the average for this time of the day. Trading in the company's call options was triple the average.

Trading volume was 9,24,066 shares, five times the 20-day average of 1,82,645 shares for this time of the day.

The relative strength index on the stock was above 70, indicating that it may be overbought. Analysts have 17 'buy', 12 'hold' and 11 'sell' recommendations on the stock.

Mindtree was the top performer among its peers and led the gains in NSE Nifty IT, which hit a new high.

Shares of Mindtree Ltd. gained 7.48%, the most in five weeks, to Rs 3,243.00 apiece in intraday trade. Trading volume was five times the average for this time of the day. Trading in the company's call options was triple the average.

Trading volume was 9,24,066 shares, five times the 20-day average of 1,82,645 shares for this time of the day.

The relative strength index on the stock was above 70, indicating that it may be overbought. Analysts have 17 'buy', 12 'hold' and 11 'sell' recommendations on the stock.

Mindtree was the top performer among its peers and led the gains in NSE Nifty IT, which hit a new high.

Shares of Kaveri Seed Co Ltd. advanced 6.67% to Rs 615.00 apiece after the company informed exchanges post market hours Tuesday, that its board of directors will consider a proposal for buyback of equity shares on August 25.

Out of the 11 analysts tracking the company, 9 maintained ‘buy’ and 2 maintained ‘hold’ recommendations with 5 analysts revising the price targets lower over the past month. The overall consensus price of analysts tracked by Bloomberg implied an upside of 23.4%.

Tega Industries Ltd.’s initial public offering consists of sale of as many as 13.67 million shares by its shareholders, according to its draft prospectus.

The maker of mineral processing and material handling products isn’t selling any new share in the IPO.

Selling shareholders comprise the company’s founders Madan Mohan Mohanka, Manish Mohanka, and Wagner Ltd., which is an affiliate of private equity firm TA Associates.

Axis Capital and JM Financial are the banks managing the IPO.

Shares of Bharat Dynamics Ltd. rose 4.29% to Rs 386.85 apiece informed the exchanges that it signed a licensing agreement with MBDA to establish a facility for the final assembly, integration, and test of Advanced Short Range Air-to-Air Missile (ASRAAM) in India.

Under the agreement, MBDA will transfer the equipment and knowledge to Bharat Dynamics to establish the facility. Work on establishing this capability is due to start immediately and is expected to commence operations by 2022-23.

Shares of Cadila Healthcare Ltd advanced nearly 2% to Rs 539.40 apiece after the company informed exchanges that it received tentative approval from the USFDA to market Lenalidomide Capsules in the strengths of 2.5 mg, 5 mg, 10 mg, 15 mg, 20 mg and 25 mg.

Lenalidomide is used to treat various types of cancers. It is also used to treat anemia in patients with blood/bone marrow disorders. The drug will be manufactured at the group’s formulation manufacturing facility in Ahmedabad, according to an exchange release by the company.

Out of the 36 analysts tracking the company, 17 maintained ‘buy’, 8 maintained ‘hold’ and 11 maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 10.6%. The relative strength index on the stock is 28, suggesting that it may be oversold. Shares of Cadila Healthcare added over 12% in 2021 so far compared to 9% gains for NSE Nifty Pharma Index.

Shares of Hindustan Aeronautics Ltd. gained 4.01% to Rs 1,109.65 after the company announced that it has placed as order of Rs 5,375 crore with GE Aviation, to power the Tejas Light Combat Aircraft.

The order will account for 99 F404-GE-IN20 engines and support services with GE Aviation. “This is the largest ever deal and the purchase order placed by HAL: for Light Combat Aircraft”, said R Madhavan, chairman and managing director.

All the 5 analysts tracking the company maintained ‘buy’ recommendation. The overall consensus price of analysts tracked by Bloomberg implied an upside of 47.2%.

Shares of HDFC Bank Ltd. rose 3.35%, the most intraday gains in three months, to Rs 1,565.35 apiece after the central bank relaxed restriction on issue of new credit cards by the lender.

HDFC Bank confirmed the easing of curbs on credit cards in an exchange filing Wednesday.

Restrictions on all new launches of the Digital Business generating activities planned under Digital 2.0 will continue till further review by the central bank, the company said.

As stated earlier, all the preparations and strategies that we have put in place to ‘come back with a bang’ on credit cards will be rolled out in the coming time. We are happy that we will be able to serve our customers again with the same dedication and humility.HDFC Bank statement

Here's what brokerages have said of RBI's decision to ease curbs on the issue of new credit cards by HDFC Bank

Macquarie Research

Maintains ‘outperform’ with the target price unchanged at Rs 2,005, an implied return of 32.37%.

Believe HDFC Bank can easily capture market share in the credit card space.

Decision RBI’s confidence partially, believe it is a matter of time before the central bank lifted the full ban.

Despite worries on the technology front, the bank continues to add liability accounts at a rapid rate which implies customer acquisition has not been affected.

Motilal Oswal

Maintains ‘buy’ with the target price unchanged at Rs 1,800, an implied return of 17.55%.

RBI move address key concern as HDFC Bank is the largest credit case issuer in the country.

RBI restriction had led to the loss of 60 lakh cards for the bank.

Lifting of restrictions before the beginning of the festive season is a positive development as the bank has usually been aggressive during festive seasons.

Expect growth trends to revive in retail in coming quarters.

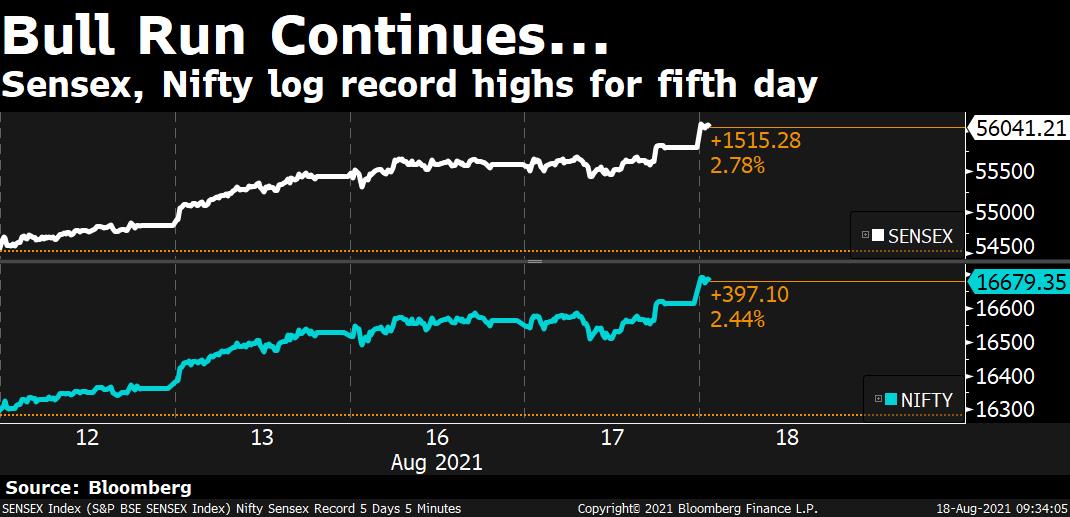

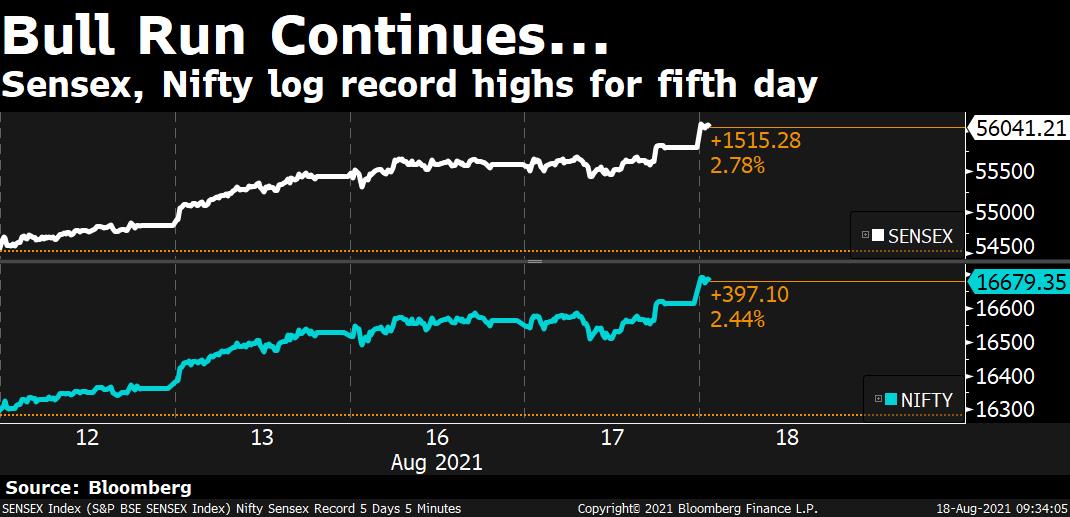

India’s stock benchmarks edged higher and hit record highs for the fifth consecutive session aided by gains in HDFC Bank amid mixed cues.

India’s stock benchmarks edged higher and hit record highs for the fifth consecutive session aided by gains in HDFC Bank amid mixed cues.

The S&P BSE Sensex rose 0.44% to 56,039.51. The 30-stock index hit a record 56,086.60 in intraday trade. The NSE Nifty 50 advanced by similar magnitude to 16,678.95. Nifty 50 had also logged a record 16,691.55 in intraday trade. HDFC Bank Ltd. contributed the most to index gain, advancing nearly 2.5%.

India’s stock benchmarks edged higher and hit record highs for the fifth consecutive session aided by gains in HDFC Bank amid mixed cues.

India’s stock benchmarks edged higher and hit record highs for the fifth consecutive session aided by gains in HDFC Bank amid mixed cues.

The S&P BSE Sensex rose 0.44% to 56,039.51. The 30-stock index hit a record 56,086.60 in intraday trade. The NSE Nifty 50 advanced by similar magnitude to 16,678.95. Nifty 50 had also logged a record 16,691.55 in intraday trade. HDFC Bank Ltd. contributed the most to index gain, advancing nearly 2.5%.

The broader indices almost mirrored their larger peers with both the S&P BSE MidCap and the S&P BSE SmallCap adding 0.3%. Fifteen out of the 19 sectoral indices compiled by the BSE Ltd. advanced, with S&P BSE Power gaining 0.8%.

The market breadth was skewed in favour of bulls. About 1,367 stocks advanced, 984 declined and 97 remained unchanged.

Shares of Indian lenders and credit card company SBI Cards and Payment Services may move after the central bank is said to have allowed HDFC Bank to issue new credit cards.

The RBI has eased curbs on HDFC Bank’s credit card business, partially removing a months-long ban on the lender, people familiar with the matter said on Tuesday.

In Focus: SBI Cards and Payment Services, ICICI Bank, RBL Bank, Axis Bank, Bajaj Finance

Future Retail paid $14 million interest on its 2025 dollar bonds within the 30-day grace period after missing the repayment due on July 22, the company said in an exchange filing post market hours Tuesday.

On Aug. 12, India’s Future Group Said to Plan Paying Missed Bond Coupon.

India’s second-largest supermarket chain had cited an adverse impact from the pandemic for missing the coupon payment last month.

The company has missed three interest-servicing dates but subsequently honored its obligations within the window allowed by the terms of the debt.

Rupee bonds could gain following commentary in the latest RBI bulletin suggesting that inflation is likely to stabilize during the rest of the year, and that the MPC is focused on supporting economic growth. Traders will await a Rs 17,000 crore sale of treasury bills, while the rupee could get a boost from a slump in crude oil prices.

10-year yields little changed at 6.24% on Tuesday; the yield on 5.63% 2026 bonds fell by 4bps to 5.70%.

India’s six-member Monetary Policy Committee is focused on reviving economic growth, while looking through what it describes as supply-side driven inflationary pressures to help Asia’s third-largest economy out of a downturn, according to the central bank’s latest bulletin .

USD/INR rises 0.1% to 74.3512 on Tuesday.

Global Funds Sell Net Rs 344 crore of India Stocks Tuesday. They bought Rs 137 crore of sovereign bonds under limits available to foreign investors, and added Rs 24 crore of corporate debt.

Asian stocks were steady on Wednesday and U.S. equity futures wavered as investors assessed risks to the economic recovery from the resurgent coronavirus. The dollar held an advance.

MSCI Inc.’s gauge of Asia-Pacific shares edged up, with Japan, China and Hong Kong posting modest gains. Overnight, U.S.-listed Chinese equities tumbled again on Beijing’s regulatory crackdown. U.S. equity contracts fluctuated in the wake of the S&P 500’s largest decline in a month.

Treasuries were little changed ahead of the release of the latest Federal Reserve minutes amid a highly uncertain outlook for yields. Traders are evaluating the spread of the delta virus variant, the prospect of reduced stimulus support and whether elevated inflation will prove transitory.

India’s SGX Nifty 50 Index futures for August delivery rose 0.2% to 16,636.00, while MSCI Asia Pacific Index gained 0.1%. The NSE Nifty 50 Index rose 0.3% on Tuesday to 16,614.60.

Investors are evaluating the outlook for global stocks after a 90% advance from last year’s pandemic lows, as the fast-spreading delta strain impedes reopening and fans worries that economic growth is peaking.

Crude oil held losses, pressured by the recent climb in the dollar and signs of an uneven U.S. recovery. Bitcoin was trading around $45,000.

Back home, UltraTech, CESC, Honeywell are among companies holding their annual shareholders’ meeting. Foreign investors sold net Rs 114 crore of stocks on Aug. 13 and Aug. 16, according to NSDL website.

Stocks To Watch

Adani Green: Says founders buy 2.02% more in company; stake rises to 58.31%.

Aurobindo Pharma: Axis Clinicals creates pledge on 400,000 Aurobindo Pharma shares; RPR Sons creates pledge on 60,000 shares of Aurobindo Pharma.

Cut to add from buy at Centrum Broking.

Bank of India: To divest all stake in Indonesian Lender: Bisnis.

Canara Bank: Begins up to $336-million share sale to institutions.

DCM Shriram: To take 30% in Turkey’s Zyrone Dynamics.

Future Retail: Pays interest on dollar bonds within grace period.

HCL Tech: Wins five-year IT deal from Wacker Chemie AG.

HDFC Bank: RBI allows HDFC Bank to issue credit cards after ban.

InterGlobe Aviation: ICRA cuts InterGlobe Aviation’s long-term rating to [ICRA] A.

Suzlon Energy: Approves allotment of 3.17 crore shares on conversion of bonds.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.