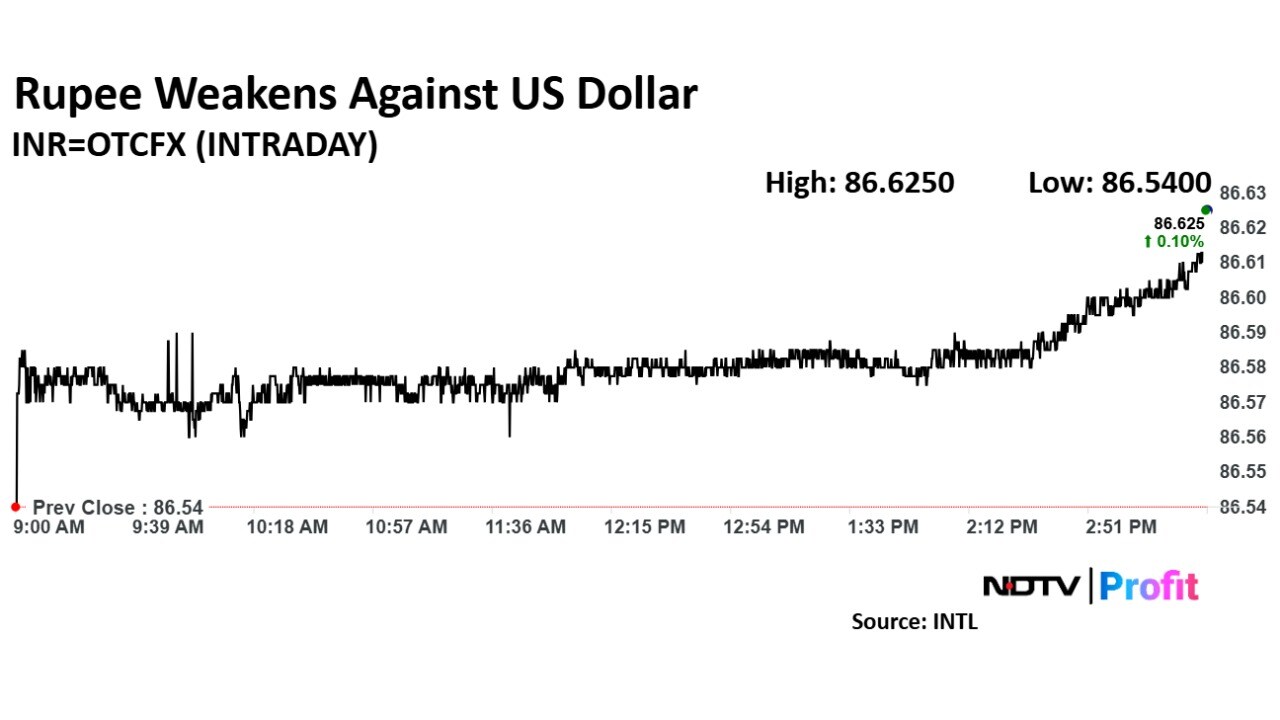

The Indian rupee continued its downward trend against the US dollar, weakening by seven paise to close at 86.63 on Thursday.

The domestic currency opened weaker against the US dollar, declining by 3 paise to start at 86.58, according to Bloomberg data. This follows a close at 86.56 on Wednesday, marking a consistent decline over the past few days.

The weakness in the domestic currency comes amid ongoing global economic concerns and market volatility. Despite efforts by the Reserve Bank of India to support liquidity through special measures, including open market operations and forex market interventions, the currency remains under pressure due to external uncertainties. These measures are expected to infuse about Rs 1.5 lakh crore into the banking system, but the rupee continues to face challenges.

Exporters should hedge small amounts near the 86.60 level, which is currently supported by the RBI, while importers should consider buying on dips, according to Anil Bhansali, executive director at Finrex Treasury Advisors LLP.

Market participants reacted to a hawkish Federal Reserve and ongoing global trade uncertainties. Traders were particularly focused on the possibility of the US imposing more tariffs, particularly on China.

The US Federal Reserve kept rates on hold, adopting a hawkish stance, signalling that rates could remain higher for longer, which contributed to a weaker outlook for US stocks. The dollar index held steady at 107.85, with the market anticipating a 90% chance of a 25-basis-point rate cut in 2025.

Looking ahead, the rupee is expected to remain in a broad range of 86.40 to 86.70, with the RBI appearing to protect the 86.61 level, Bhansali noted.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.