- Reliance Industries shares rose 0.57% ahead of Q1 FY26 earnings release

- Revenue expected to decline 7.5% year-on-year to Rs 2.41 lakh crore

- Ebitda projected to increase 1.5% to Rs 44,497 crore with margin at 18.4%

Reliance Industries Ltd. saw its stock edge up by 0.57% on Friday, as investors positioned themselves ahead of the company's first-quarter earnings report for FY26, scheduled to be released later in the day.

Analysts anticipate a mixed set of numbers, with revenue expected to decline by 7.5% year-on-year to Rs 2.41 lakh crore, down from Rs 2.61 lakh crore. However, operating performance is likely to show resilience, with Ebitda projected to rise 1.5% to Rs 44,497 crore. This would push the Ebitda margin to 18.4%, up from 16.8% in the same quarter last year.

The Street will be closely watching management commentary on the refining and petrochemical businesses, which face headwinds from global trade uncertainties and tightening US sanctions on Iranian and Russian oil—both key suppliers in the energy market.

Despite these pressures, Reliance's telecom arm, Jio, is expected to deliver robust sequential growth, driven by subscriber additions and higher average revenue per user.

Retail, while steady on a year-on-year basis, may see a slight sequential dip. Nonetheless, the segment remains a key growth engine, with analysts optimistic about its long-term trajectory.

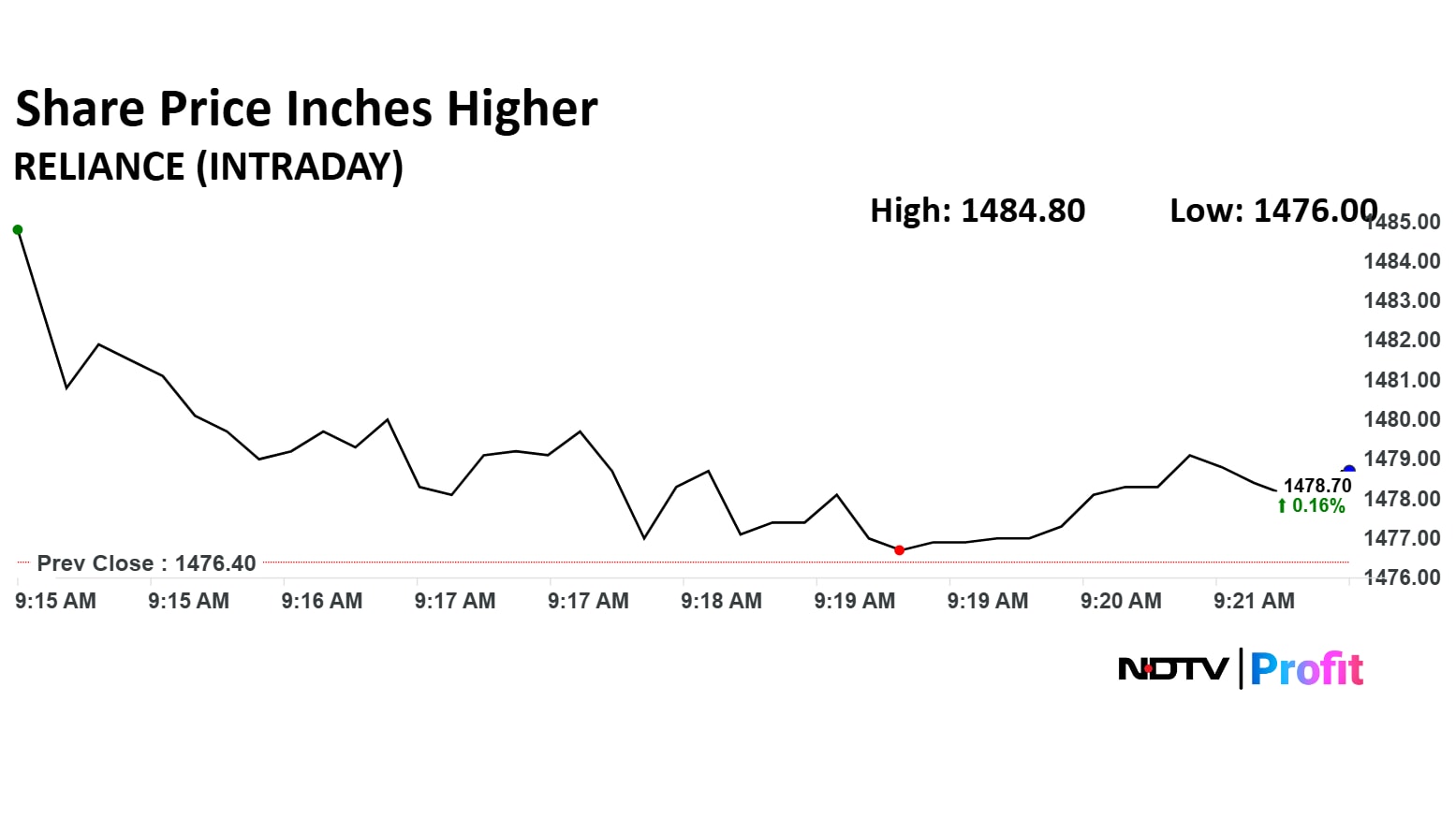

The scrip rose as much as 0.57% to Rs 1,484.80 apiece. It pared gains to trade 0.18% higher at Rs 1,479.10 apiece, as of 09:23 a.m.

It has fallen 6.78% in the last 12 months. The relative strength index was at 49.

Out of 37 analysts tracking the company, 34 maintain a 'buy' rating, one recommends a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 6.3%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.