Reliance Industries Ltd. reclaimed its position as India's most-valuable company briefly on Tuesday morning trade, helped by a rally driven by its mobile services arm's decision to end free services.

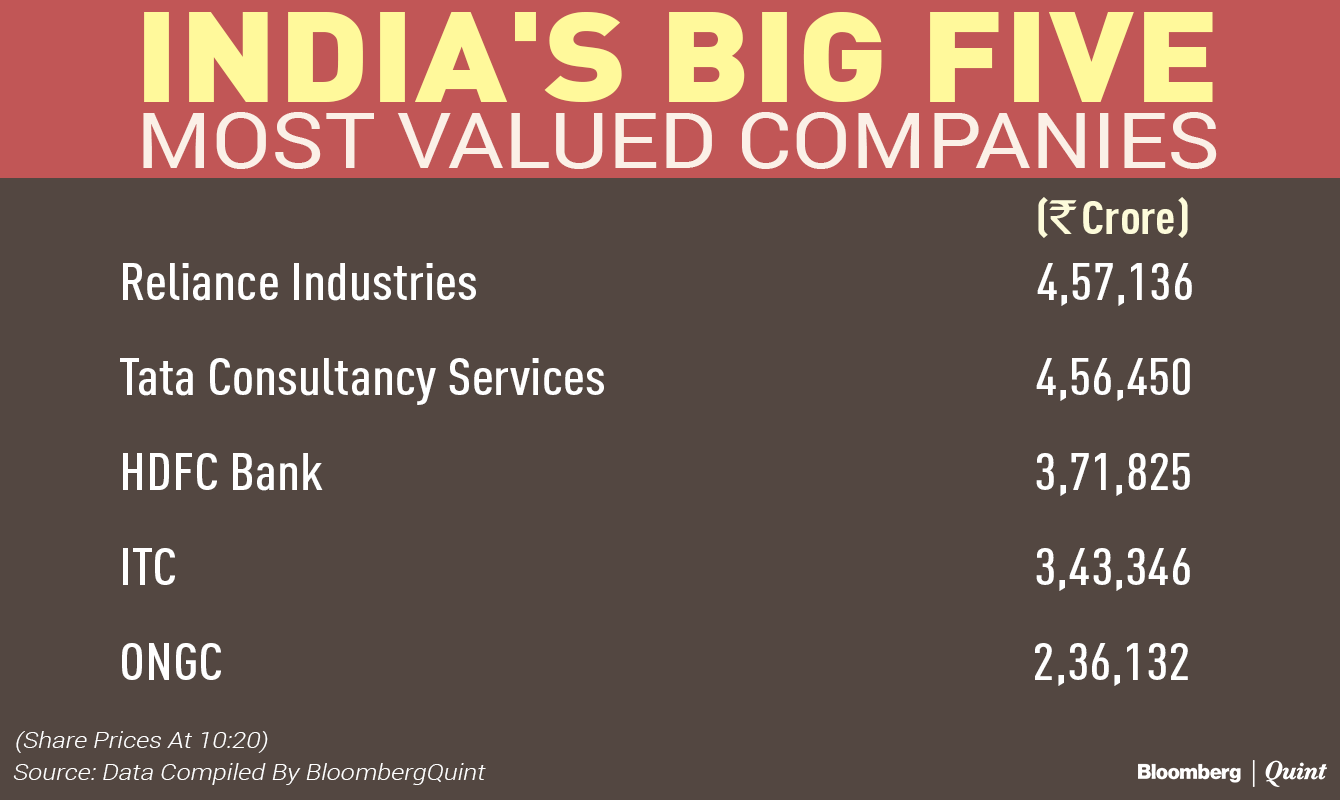

The Mukesh Ambani-owned company reached a valuation of Rs 4,57,136 crore at 10:20 a.m., ahead of Tata Consultancy Services Ltd., which led the market capitalisation rankings for nearly four years.

Reliance Industries' market value has surged nearly 30 percent year-to-date, its best gains in 11 years.

Reliance Jio Infocomm Ltd.'s decision to end free data plans for customers and a better retention ratio led to the rally. Reliance Jio, which provided free services to its customers from September 5, 2016, started charging for its services from April 1, 2017. The newest telecom operator also managed to retain 7.2 crore of its customers during its transition to paid services, becoming the fifth largest mobile services carrier in India by subscriber base.

Tata Consultancy Services, on the other hand, has given a negative return over the last one year. Its shares fell 6.3 percent compared to a 16.5 percent rise in the benchmark S&P BSE Sensex Index.

The information technology industry, including TCS, has seen muted growth with a fall in sales over the past year. More recently, U.S. President Donald Trump's review of H-1B visa norms is leading to further uncertainties. H-1B visa applications are vital for outsourcing IT companies like TCS.

Also Read: Outsourcing Firms To Get Fewer H-1B Visas After Trump's Review

The TCS stock has fallen 7.9 percent in the last 30 days, compared to a 4.5 percent average decline for its peers, according to Bloomberg data. The company is expected to post another quarter of muted growth and a fall in profit in its fourth quarter earnings due on Tuesday.

Also Read: Will TCS Surprise For The Ninth Straight Quarter?

Among the top five most valued companies, only 69 percent of the analysts tracked by Bloomberg have a ‘buy' rating on Reliance Industries as against a 93 percent and 89 percent ‘buy' ratings for ITC Ltd. and HDFC Bank Ltd.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.