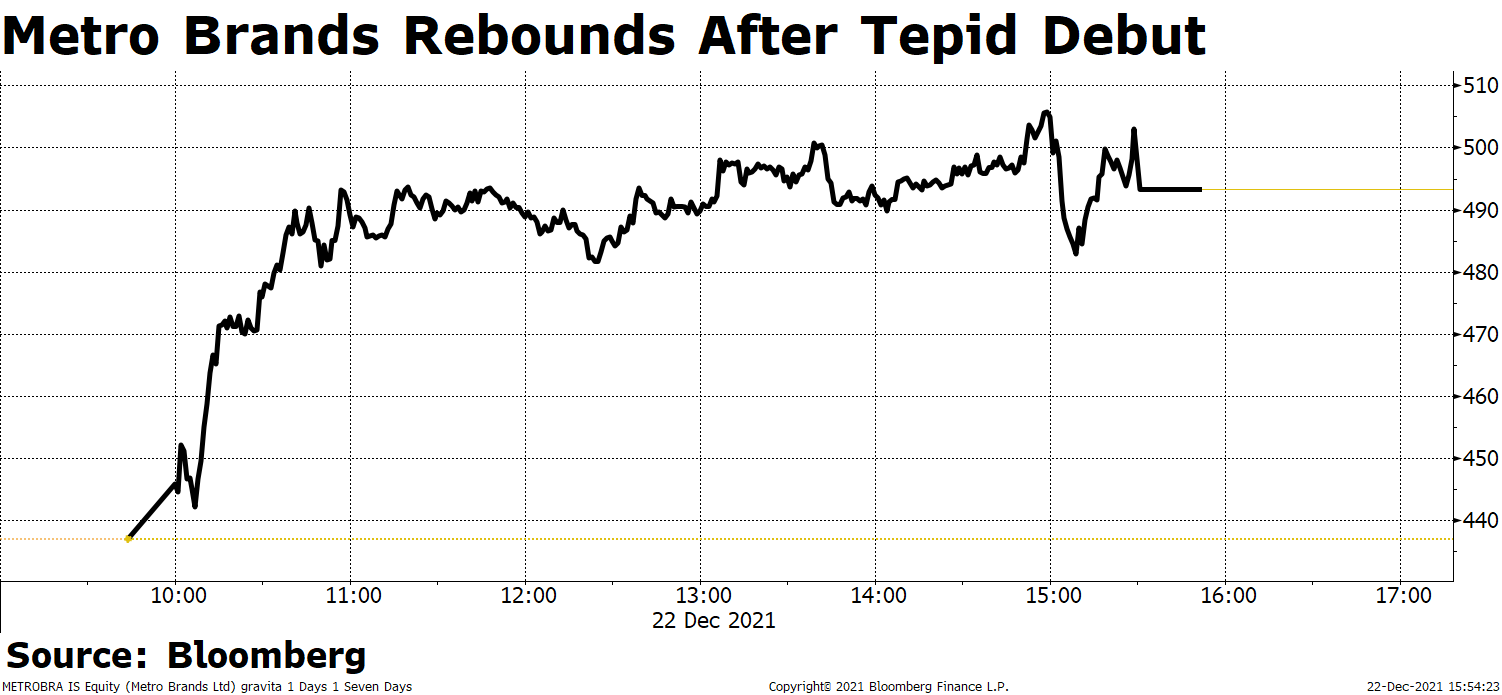

Shares of Metro Brands Ltd. declined on market debut but quickly recovered to pare all the losses.

The Rakesh Jhunjhunwala-backed footwear retailer's stock listed at Rs 437 apiece, a 12.6% discount to its IPO price of Rs 500, on the National Stock Exchange. The stock fell to Rs 426 before rebounding to an intraday high of Rs 489.85, up 11%. The stock closed at Rs 502, up 0.4% over its issue price.

The company's initial public offering—comprising a Rs 295-crore fresh issue and an offer for sale of 2.14 crore equity shares by promoters and other shareholders—was subscribed 3.64 times.

Jhunjhunwala, the third-largest shareholder owning 14.73% in the company, did not dilute any stake.

The 66-year-old Metro Brands operates on an asset-light model with third-party manufacturing through more than 250 vendors and lease arrangements. It owns brands such as Metro, Mochi, Da Vinchi, Walkway and J Fontini, and retails third-party brands such as Crocs, Skechers, Clarks, Florsheim and Fitflop.

As on Sept. 30, the company operated 598 stores across 136 cities.

Watch BloombergQuint's IPO Adda With Metro Brands' Management

Research Reports On Metro Brands IPO:

Pan India Footwear Player With Strong Brand Portfolio: ICICI Direct

Metro Brands IPO - Investment Rationale, Risks, Concerns, Financials: Nirmal Bang

Metro Brands IPO - Outlook, Valuations, Concerns, Financials: Angel One

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.