Shares of Borosil Ltd., DLF Ltd. and Pfizer Ltd. were in focus on Tuesday, after the companies announced their fourth quarter results.

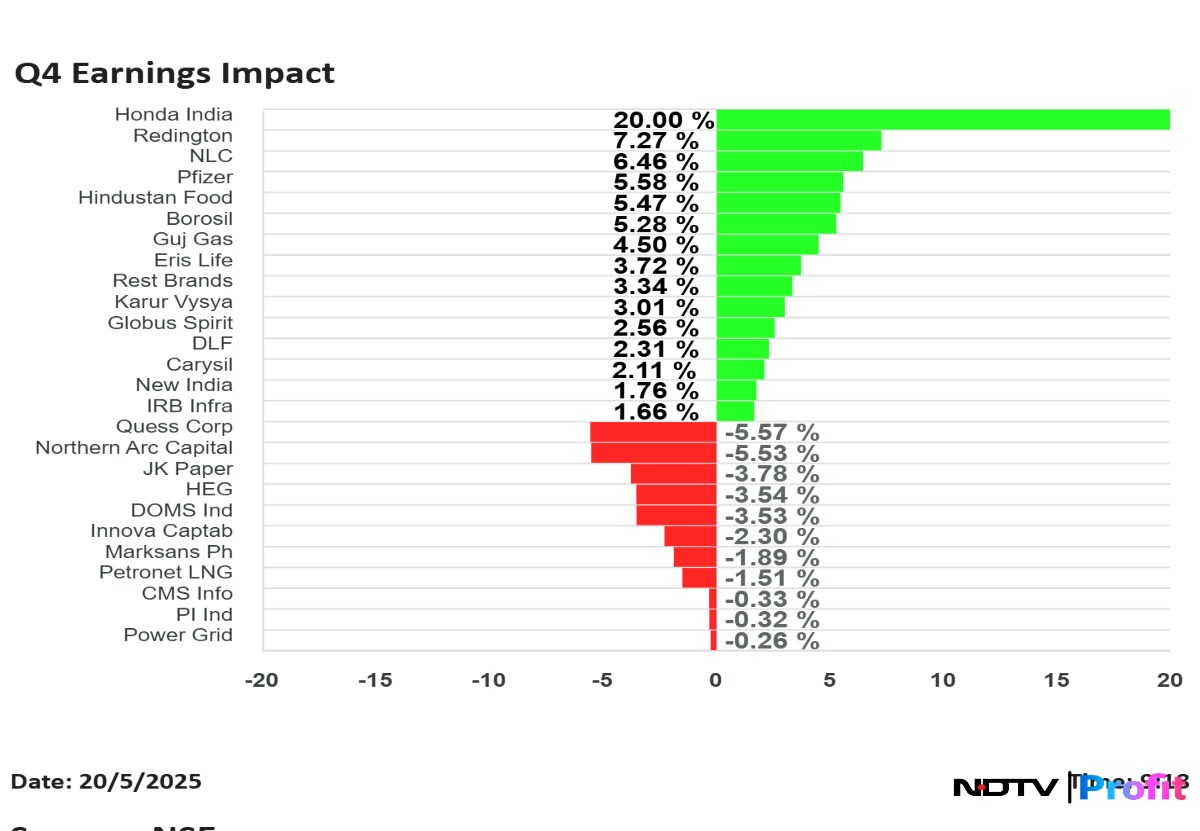

Honda India Ltd. shares rose the most, while Quess Corp. Ltd. fell the most, among the companies that announced their results for quarter ended March.

Karur Vysya Bank Q4 FY25 Results Highlights (YoY)

Share price rises 3.42% at Rs 233.18.

Net Interest Income up 9% at Rs 1,089 crore versus Rs 998 crore

Gross NPA at 0.76% versus 0.83% (QoQ)

Net NPA flat at 0.2% (QoQ)

Provisions down 45% at Rs 161 crore versus Rs 293 crore

Provisions up 9.5% at Rs 161 crore versus Rs 147 crore (QoQ)

Net Profit up 12.5% to Rs 513 crore versus Rs 456 crore

Operating Profit down 3.7% at Rs 835 crore versus Rs 867 crore

Eris Lifesciences Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 6.60% at Rs 1,539.

Revenue up 28% at Rs 705.3 crore versus Rs 551 crore (Bloomberg estimate: Rs 758 crore)

Ebitda up 70% at Rs 252 crore versus Rs 148 crore (Bloomberg estimate: Rs 265 crore)

Margin at 35.8% versus 26.9% (Bloomberg estimate: 35%)

Net Profit up 32% at Rs 93.8 crore versus Rs 71 crore (Bloomberg estimate: Rs 106.4 crore)

18 crore deferred tax credit in Q4 FY24.

NLC India Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 9% at Rs 257.70.

Revenue up 8.3% at Rs 3,836 crore versus Rs 3,541 crore

Ebitda up 43% at Rs 861 crore versus Rs 602 crore

Margin at 22.5% versus 17%

Net profit up at Rs 482 crore versus Rs 114 crore

Income of 820.64 crore in current quarter due to movement in regulatory referral account.

Deferred tax Credit of 108 crore in Q4 FY24.

The board recommended a final dividend of Rs 1.5 per share for FY25.

Bharat Electronics Q4 Highlights (Consolidated, YoY)

Share price falls 1.72% at Rs 370.

Revenue up 6.8% to Rs 9,149 crore versus Rs 8,564 crore (Bloomberg estimate: Rs 8,890 crore)

Ebitda up 23% to Rs 2,815.5 crore versus Rs 2,287.5 crore (Bloomberg estimate: Rs 2,250 crore)

Margin at 30.8% versus 26.7% (Bloomberg estimate: 25.3%)

Net Profit up 18.4% to Rs 2,127 crore versus Rs 1,797 crore (Bloomberg estimate: Rs 1,752 crore)

Other Expenses fall by 33% which aided Ebitda.

IRB Infrastructure Developers Q4 FY25 Earnings Highlights (Consolidated, YoY)

Share price rises 1.80% at Rs 51.58.

Revenue up 4.3% at Rs 2,149 crore versus Rs 2,061 crore

Ebitda up 12% at Rs 998 crore versus Rs 890 crore

Margin at 46.4% versus 43.2%

Net profit up 13.7% at Rs 215 crore versus Rs 189 crore

Power Grid Q4 Highlights (Consolidated, YoY)

Share price falls 1.87% at Rs 298.35.

Revenue up 2.5% to Rs 12,275.35 crore versus Rs 11,978.11 crore.

Ebitda up 1% to Rs 10,223.60 crore versus Rs 10,099.03 crore.

Margin at 83.3% versus 84.3%.

Net profit down 0.6% to Rs 4,142.87 crore versus Rs 4,166.33 crore.

DOMS Industries Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 6.52% at Rs 2,615.

Revenue up 26% at Rs 509 crore versus Rs 404 crore

Ebitda up 16% at Rs 88.3 crore versus Rs 76 crore

Margin at 17.4% versus 18.8%

Net profit up 7.2% at Rs 48.4 crore versus Rs 45.2 crore

Globus Spirits Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 3.22% at Rs 1,140.

Revenue up 11% at Rs 655 crore versus Rs 590 crore

EBITDA up 97% at Rs 39 crore versus Rs 20 crore

Margin at 5.9% vs 3.3%

Net Profit up at Rs 5.5 crore versus Rs 25 lakh

Current Tax expense is at 1.42 crore vs 7 lakh.

Borosil Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 7.06% at Rs 383.45.

Revenue up 15.7% at Rs 270 crore versus Rs 233 crore

Ebitda up 57% at Rs 37 crore versus Rs 23.6 crore

Margin at 13.7% versus 10.1%

Net Profit up at Rs 11 crore versus Rs 5 crore

Honda India Power Products Q4 FY25 Results Highlights (YoY)

Share price rises 20% at Rs 2,795.50.

Revenue up 16.2% at Rs 269 crore versus Rs 231 crore

Ebitda up at Rs 43.4 crore versus Rs 10.4 crore

Margin at 16.2% versus 4.5%

Net Profit up at Rs 36.2 crore versus Rs 15.8 crore

Exceptional item of Rs3.98 crore in Q4 FY24.

Gujarat Gas Q4 FY25 Results Highlights (Standalone, QoQ)

Share price rises 5.96% at Rs 495.

Revenue down 1% to Rs 4,102 crore versus Rs 4,152 crore (Bloomberg estimate: Rs 4,046 crore)

Ebitda up 18.5% to Rs 450 crore versus Rs 379.7 crore (Bloomberg estimate: Rs 410 crore)

Margin at 11% versus 9.1% (Bloomberg estimate: 10.4%)

Net Profit up 29% to Rs 287 crore versus Rs 222 crore (Bloomberg estimate: Rs 235 crore)

GMR Power Q4 Highlights (Consolidated, YoY)

Share price falls 3.32% at Rs 121.60.

Revenue up 6.3% to Rs 1,737 crore versus Rs 1,634 crore.

Ebitda down 14.4% to Rs 380 crore versus Rs 444 crore.

Margin at 21.9% versus 27.2%.

Net profit down 73% to Rs 43.7 crore versus Rs 162 crore.

Redington Ltd Q4 Highlights (Consolidated, YoY)

Share price rises 9.57% at Rs 306.99.

Revenue up 17.9% to Rs 26,439.68 crore versus Rs 22,433.41 crore.

Ebitda up 25.7% to Rs 576.91 crore versus Rs 459.32 crore.

Margin at 2.2% versus 2.0%.

Net profit up 104.3% to Rs 665.62 crore versus Rs 325.59 crore.

DLF Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 4.93% at Rs 774.

Revenue up 46.5% to Rs 3,128 crore versus Rs 2,135 crore

Ebitda up 30% to Rs 978.6 crore versus Rs 755 crore

Margin at 31.3% versus 35.4%

Net Profit up 39% to Rs 1,282 crore versus Rs 921 crore

Innova Captab Q4 Highlights (Consolidated, YoY)

Share price falls 4.50% at Rs 882.

Revenue up 19.8% to Rs 315 crore versus Rs 263 crore.

Ebitda up 25.3% to Rs 47.6 crore versus Rs 38 crore.

Margin at 15.1% versus 14.5%.

Net profit up 2.8% to Rs 29.5 crore versus Rs 28.7 crore.

PI Industries Q4 Highlights (Consolidated, YoY)

Share price rises 1.62% at Rs 3,819.80.

Revenue up 2.6% to Rs 1,787 crore versus Rs 1,741 crore.

Ebitda up 3.1% to Rs 455.6 crore versus Rs 442 crore.

Margin at 25.5% versus 25.4%.

Net profit down 10.7% to Rs 330.5 crore versus Rs 370 crore.

Petronet LNG Q4 FY25 Results Highlights (Standalone, QoQ)

Share price falls 3.20% at Rs 310.55.

Revenue up 0.7% to Rs 12,316 crore versus Rs 12,227 crore (Bloomberg estimate: Rs 12,462 crore)

Ebitda up 21.3% to Rs 1,513.65 crore versus Rs 1,247.67 crore (Bloomberg estimate: Rs 1,178 crore)

Margin at 12.3% versus 10.2% (Bloomberg estimate: 9.5%)

Net profit up 23.4% to Rs 1,070 crore versus Rs 867 crore (Bloomberg estimate: Rs 821 crore)

HEG Q4 Highlights (Consolidated, YoY)

Share price falls 4.32% at Rs 505.85.

Revenue down 0.9% to Rs 542 crore versus Rs 547 crore.

Ebitda loss of Rs 55.5 crore versus an Ebitda profit of Rs 42.8 crore.

Net loss of Rs 73.7 crore versus a net profit of Rs 32.9 crore.

Restaurant Brands Asia Q4 Highlights (Standalone, YoY)

Share price rises 8.49% at Rs 88.80.

Revenue up 11.6% to Rs 490 crore versus Rs 439 crore

Ebitda up 36.4% to Rs 75 crore versus Rs 55 crore

Margin at 15.3% versus 12.5%

Net loss of Rs 25.4 crore versus net loss of Rs 31 crore

JK Paper Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 5.09% at Rs 335.35.

Revenue down 1.7% at Rs 1,689 crore versus Rs 1,719 crore

Ebitda down 39.6% at Rs 217 crore versus Rs 359 crore

Margin at 12.8% versus 20.9%

Net profit down 72.4% at Rs 76.2 crore versus Rs 276 crore

Hindustan Foods Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 6.34% at Rs 566.

Revenue up 27.7% at Rs 933 crore versus Rs 731 crore

Ebitda up 27.7% at Rs 77.4 crore versus Rs 60.6 crore

Margin flat at 8.28%

Net profit up 34% at Rs 30.7 crore versus Rs 23 crore.

Northern Arc Q4 Highlights (Consolidated, YoY)

Share price falls 7.08% at Rs 202.

Revenue up 7.7% to Rs 603 crore versus Rs 560 crore.

Ebitda down 25.5% to Rs 236 crore versus Rs 317 crore.

Margin at 39.2% versus 56.7%.

Net profit down 57.4% to Rs 37.8 crore versus Rs 88.8 crore.

Sun Pharma Advanced Research Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 1.03% at Rs 1,748.

Revenue up 64.2% at Rs 27 crore versus Rs 16.6 crore

Ebitda loss reduced to Rs 53.2 crore from a loss of Rs 106 crore

Net loss reduced to Rs 60 crore from a loss of Rs 106 crore

Acme Solar Q4 Highlights (Consolidated, YoY)

Share price falls 4.73% at Rs 235.

Revenue up 65.1% to Rs 487 crore versus Rs 295 crore.

Ebitda up significantly to Rs 488 crore versus Rs 233 crore.

Margin at 89.5% versus 68%.

Net profit down 76.9% to Rs 123 crore versus Rs 532 crore.

CMS Info Systems Q4 Highlights (Consolidated, QoQ)

Share price falls 2.27% at Rs 471.20.

Revenue up 6.5% to Rs 619 crore versus Rs 581 crore.

Ebitda up 1.9% to Rs 162 crore versus Rs 159 crore.

Margin at 26.2% versus 27.4%.

Net profit up 4.8% to Rs 97.5 crore versus Rs 93 crore.

Carysil Q4 Highlights (Consolidated, YoY)

Share price falls 3.49% at Rs 641.15.

Revenue up 7.1% to Rs 204 crore versus Rs 190.5 crore.

Ebitda up 1.4% to Rs 35 crore versus Rs 34.5 crore.

Margin at 17.1% versus 18.1%.

Net profit up 19.6% to Rs 18.6 crore versus Rs 15.5 crore.

New India Assurance Q4 Earnings

Share price rises 1.97% at Rs 184.89.

Net Profit up 4.5% at Rs 322 crore versus Rs 308 crore

Total Income up 1.2% at Rs 11,009 crore versus Rs 10,875 crore

Marksans Pharma Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 5.31% at Rs 240.05.

Revenue up 26.5% at Rs 708 crore versus Rs 560 crore

Ebitda up 14.7% at Rs 126 crore versus Rs 110 crore

Margin at 17.7% versus 19.6%

Net Profit up 15.7% at Rs 90.5 crore versus Rs 78.2 crore

Quess Corp Q4 FY25 Results Highlights (Consolidated, QoQ)

Share price falls 11.04% at Rs 332.05.

Revenue down 9% at Rs 3,656 crore versus Rs 4,019 crore

Ebit up 8.8% at Rs 57 crore versus Rs 52.5 crore

Margin at 1.6% versus 1.3%

Net loss of Rs 95.5 crore versus profit of Rs 41.7 crore

To pay final dividend of Rs 6 per share.

Pfizer Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 11.24% at Rs 4,970.

Revenue up 8.3% to Rs 591.91 crore versus Rs 546.63 crore

Net Profit up 85% to Rs 330.94 crore versus Rs 178.86 crore

Ebitda up 20% to Rs 227.50 crore versus Rs 189.43 crore

Margin at 38.4% versus 34.7%

To pay final dividend of Rs 35 per share.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.