Another big day for markets today. The spotlight shifts to a diverse set of market heavyweights— Bharti Airtel, Hindustan Copper, and Tata Motors Passenger Vehicles have already declared their results for quarter ended December 31, 2025.

Mazagon Dock Shipbuilders Ltd. declared a second interim dividend for FY26 along with a healthy quarterly performance.

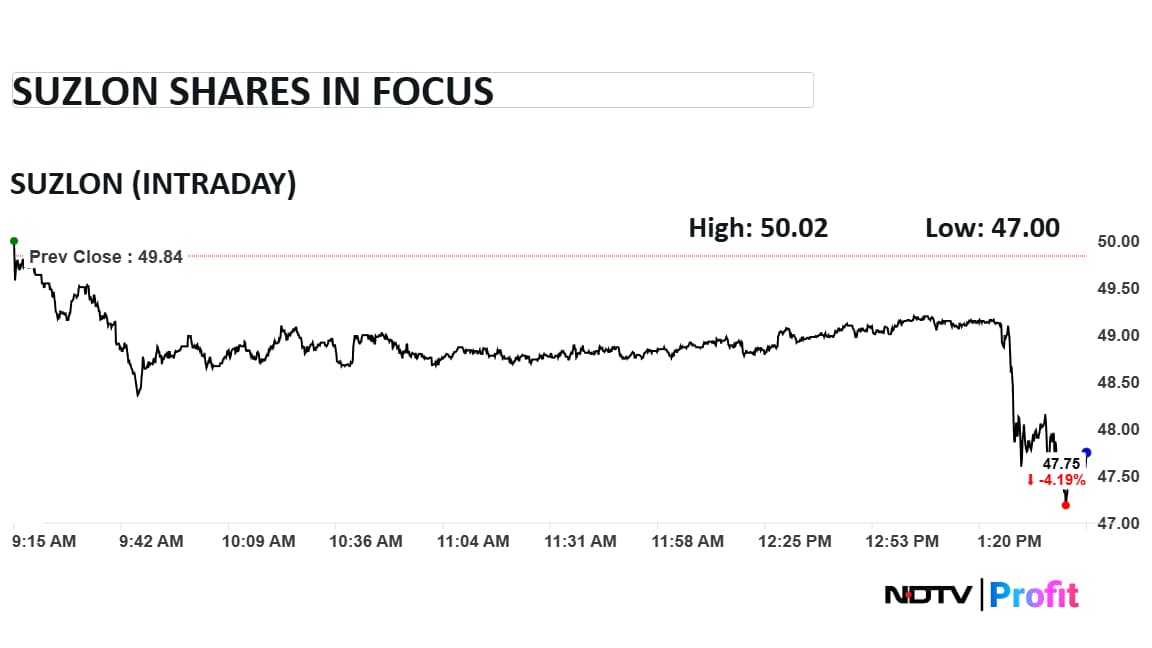

Suzlon Energy too has already reported its Q3 earnings, with profit seeing a 15% uptick while revenue zoomed 42%. Margins have also expanded for the renewable energy company in the December quarter.

IOC, too, has reported its Q3 earnings, where profit surged almost 60% while revenue saw a double-digit uptick as well.

In total, nearly 200 companies are set to report their Q3 earnings today. Most of these companies have also announced an earnings call, which will be held after the Q3FY26 announcement. During this call, the company management will discuss the performance with investors and analysts.

Stay tuned for real-time updates, key financial highlights, and expert analysis as these corporate giants reveal their performance on Dalal Street.

Healthcare Global Q3 (Cons)

PhysicsWallah Q3 (Cons)

Goodyear India Q3FY26

Shreeji Shipping Global Q3 (Cons)

Repco Home Finance Q3 (Cons)

Kaynes Tech Q3FY26 (Cons, YoY)

Shree Renuka Sugars Q3 (Cons)

Pitti Engineering Q3FY26 (Cons)

The Board has approved the merger of its wholly-owned subsidiaries, Pitti Industries and Dakshin Foundry, with Pitti Engineering.

VA Tech Wabag Q3 (Cons)

Kennametal India Q3FY26 (QoQ)

Aditya Birla Fashion Q3 (Standalone)

Mazagon Dock Shipbuilders Ltd. logged a consolidated net profit of Rs 880 crore in the quarter ended December 2025, marking a 9% uptick as compared to Rs 807 crore in the year-ago period, according to the consolidated financial results declared on Thursday.

For more details, you can read — Mazagon Dock Q3 Results: Profit Up 9%, Dividend Of Rs 7.5 Declared — Check Record Date, More Details

Shivalik Bimetal Q3 (Cons)

Eveready Industries Q3 (Cons)

Mazagon Dock has declared a second interim dividend of Rs. 7.5 per each fully paid-up equity share of Rs. 5 for FY26.

The shipbuilder has fixed Friday, Feb. 13, 2026 as Record Date for the same. The payment of the Interim Dividend shall be completed on or before March 7 2026.

Interim dividend of Rs 7.5 per share declared

Kirloskar Brothers Q3 (Cons)

NCC Q3FY26 Highlights (Cons)

Hitachi Energy Q3FY26 Highlights

Data Patterns Q3FY26 Highlights

Bharti Hexacom Q3FY26 Highlights

Astral Q3FY26 Highlights (Cons)

Tata Motors PV CFO PB Balaji said —

ARPU has risen marginally to Rs 259 during the quarter under review, as compared to Rs 256 in the July-September period.

Bharti Airtel Q3 Highlights (Cons, QoQ)

One-time cost of Rs 257 crore in Q3

One-time cost of Rs 1,597 crore in the third quarter dragged company to a net loss of Rs 3,486 crore.

Tata Motors PV Q3 Highlights (Cons, YoY)

Nilkamal Q3 (Cons)

Nykaa Q3FY26 Highlights (Cons)

Berger Paints Q3FY26 Highlights (Cons)

VRL Logistics Q3 Results

To pay interim dividend of Rs 5/share

RVNL Q3 Highlights (Cons, YoY)

To pay interim dividend of Rs 1/share

Thomas Cook Q3 Highlights (Consolidated, YoY)

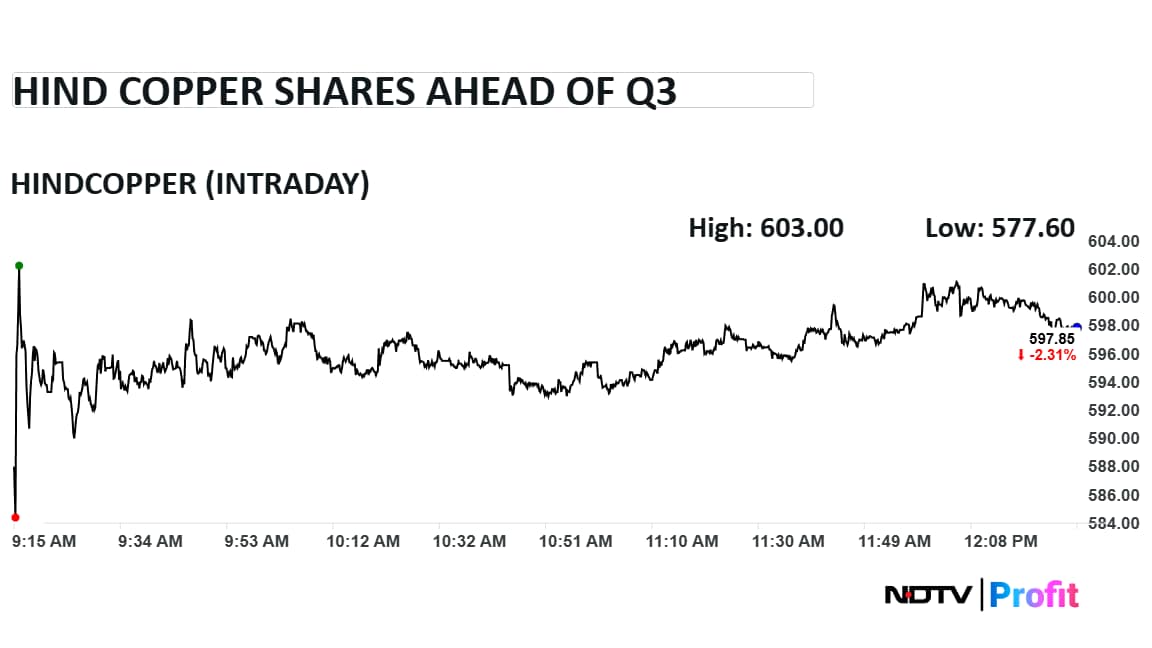

Hindustan Copper Ltd. just relaesed its earnings for the quarter ended December, and the company's quarterly performance weakened sequentially, with net profit declining 16% to Rs 156 crore from Rs 186 crore earlier.

Revenue also moderated, falling 4.3% to Rs 687 crore versus Rs 718 crore in the previous quarter. Operating performance softened as well, with EBITDA down 13.4% at Rs 245 crore compared to Rs 282 crore earlier, leading to a contraction in operating profitability, as EBITDA margin slipped to 35.6% from 39.3%.

Check more details here - Hindustan Copper Q3 Results: Margin Contracts, Profit Declines 16% On One-Time Cost

Hindustan Copper Q3 Highlights (QoQ)

Declares Interim dividend of Rs 1 per share

FDC Q3 Highlights (Consolidated, YoY)

Revenue up 0.1% at Rs 465 crore versus Rs 464 crore.

EBITDA up 12.1% at Rs 52.3 crore versus Rs 46.6 crore.

EBITDA margin at 11.2% versus 10%.

Net profit down 23.6% at Rs 28.3 crore versus Rs 37 crore.

Varroc Engineering Q3 Highlights (Consolidated, YoY)

Dredging Corporation Q3 Highlights (Consolidated, YoY)

Page Industries Q3 Highlights (Consolidated, YoY)

Minda Corp Q3 Highlights (Consolidated, YoY)

J Kumar Infraprojects Q3 Highlights (Consolidated, YoY)

Borosil Q3 Highlights (Consolidated, YoY)

Yatharth Hospital Q3 Highlights (Consolidated, YoY)

Alembic Pharma Q3 Highlights (Consolidated, YoY)

Voltamp Transformers Q3 Highlights (YoY)

PVR INOX Q3 Highlights (Consolidated, YoY)

Max Healthcare Q3 Highlights (Consolidated, YoY)

PFC Q3 Highlights (Consolidated, YoY)

Marksans Pharma Q3 Highlights (Consolidated, YoY)

Venus Pipes Q3 Highlights

IOC Q3 Highlights (Standalone, QoQ)

Suzlon Energy Q3 Highlights (Consolidated, YoY)

Revenue up 42.4% at Rs 4,236 crore versus Rs 2,975 crore.

EBITDA up 47.9% at Rs 738 crore versus Rs 499 crore.

EBITDA margin at 17.4% versus 16.8%.

Net profit up 15% at Rs 445 crore versus Rs 387 crore.

Anthem Biosciences Q3 Highlights (Consolidated, YoY)

Caplin Point Q3 Highlights (Consolidated, YoY)

Godrej Properties Q3 Highlights (Consolidated, YoY)

Uno Minda to set up 4W alloy wheel manufacturing plant worth `764 crore

Harsha Engineers Q3 Highlights (Consolidated, YoY)

UNO Minda Q3 Highlights (Consolidated, YoY)

Revenue up 20% at Rs 5,018 crore versus Rs 4,184 crore.

EBITDA up 21% at Rs 554 crore versus Rs 457 crore.

EBITDA margin at 11% versus 10.9%.

Net profit up 19% at Rs 277 crore versus Rs 233 crore.

Read More Here.

Hindustan Copper, PFC and Suzlon earnings will be worth keeping an eye on, with Hind Copper, in particular, generating a lot of buzz, having seen a massive gain in stock price over the past six months.

READ MORE: Hindustan Copper, PFC And Suzlon Shares In Focus Ahead Of Q3 Results

Hello and welcome to NDTV Profit's earnings liveblog. Today marks one of the busiest days on Dala Street with close to 200 companies expected to deliver Q3 earnings.

Keep watching this space as we deliver you the latest updates.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.