Hello, and welcome to NDTV Profit's coverage of India Inc.'s financial performance for the December quarter. Nearly 60 companies will declare their Q3 results on Jan. 27. Major companies that are going to announce the results for the third quarter on Jan. 27 include Asian Paints Ltd., Tata Consumer Products Ltd., Raymond Ltd., Ramkrishna Forgings Ltd., Marico Ltd. and Vodafone Idea Ltd.

As on December 31, 2025, the debt from banks was Rs 1,126 crore. Additionally, the company raised Rs 3,300 crore through NCDs during the quarter. The cash and bank balance stood at Rs 6,963 crore.

Capex for the quarter stood at Rs 2,252 crore.

Total subscriber base stood at 192.9 million. Vi closed the quarter with 128.5 million 4G/5G subscribers, up from 126.0 million in the same period last year.

Vodafone Idea's average revenue per user rose to Rs 186 from Rs 180 in the previous quarter.

Aditya Vision Q3 Highlights (Consolidated, YoY)

Net Profit up 12.8% at Rs 27.3 crore versus Rs 24.2 crore

Revenue up 27.6% at Rs 649 crore versus Rs 508 crore

EBITDA up 13.8% at Rs 53 crore versus Rs 46.6 crore

EBITDA Margin at 8.2% versus 9.2%

CG Power Q3 Highlights (Consolidated, YoY)

Net Profit up 18.5% at Rs 285 crore versus Rs 241 crore

Revenue up 26.2% at Rs 3,175 crore versus Rs 2,516 crore

EBITDA up 20.1% at Rs 398 crore versus Rs 331 crore

EBITDA Margin at 12.5% versus 13.2%

Sumitomo Chem Q3 Highlights (Consolidated, YoY)

Net Profit down 13% at Rs 75.6 crore versus Rs 87 crore

Revenue down 11.5% at Rs 568 crore versus Rs 642 crore

EBITDA down 6.2% at Rs 99.5 crore versus Rs 106 crore

EBITDA Margin at 17.5% versus 16.5%

Axis Bank's third quarter performance drew largely positive commentary from Morgan Stanley, Jefferies and Kotak Securities, with all three brokerages highlighting improving internals, better asset quality trends and a strengthening case for re-rating, even as headline earnings growth remained modest.

Read the whole story here.

Asian Paints Q3 Highlights (Consolidated, YoY)

Shares of DCB Bank touched a six-year high on Tuesday, reacting positively to the lender's strong third-quarter performance and improvement in key operating metrics.

Get all the details here.

Vodafone Idea reported a 0.6% YoY rise in consolidated total income to Rs 11,296.6 crore in Q2FY26 from Rs 11,232.2 crore in Q2FY25. It saw a loss of Rs 5,524.2 crore in Q2FY26 compared to a loss of Rs 7,175.9 crore in Q2FY25.

Tata Consumer Products Q3 Highlights (Consolidated, YoY)

Net Profit up 38% at Rs 385 crore versus Rs 279 crore

Revenue up 15% at Rs 5,112 crore versus Rs 4,444 crore

EBITDA up 27.6% at Rs 721 crore versus Rs 565 crore

EBITDA Margin at 14.1% versus 12.7%

Raymond also saw Rs 68.3 crore-worth profit from discontinued operations in the comparative quarter, contributing to the dip in bottomline for the quarter under review.

Raymond Q3 Highlights (Consolidated, YoY)

Net Profit down 90.2% at Rs 7.1 crore versus Rs 72.3 crore

Revenue up 19.5% at Rs 557 crore versus Rs 466 crore

EBITDA up 32% at Rs 59.9 crore versus Rs 45.4 crore

EBITDA Margin at 10.8% versus 9.7%

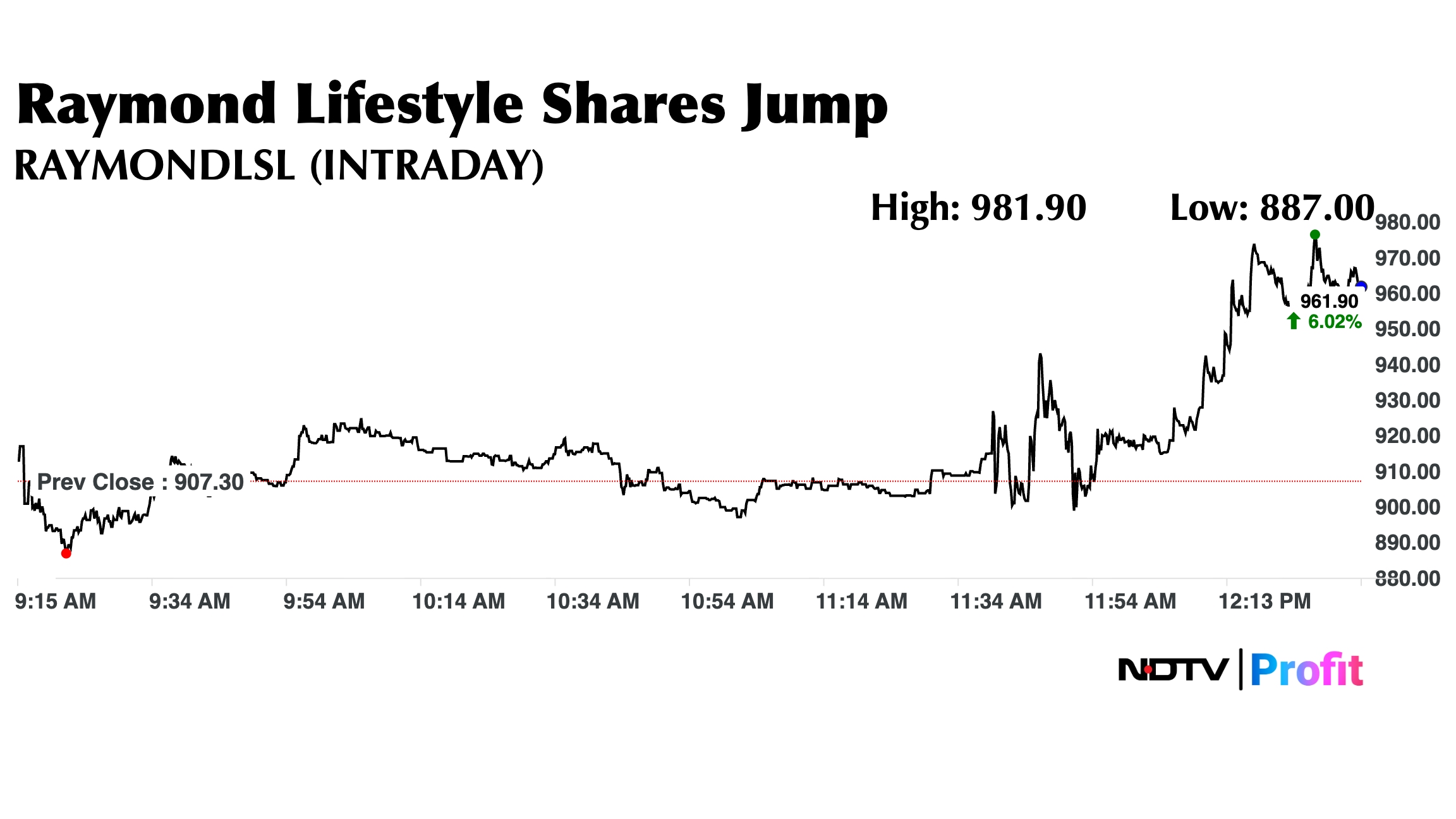

Shares of Raymond Lifestyle are up 6% at Rs 965.80 apiece after the company reported its Q3 numbers.

Tata Consumer Products reported an 18% year-on-year (YoY) rise in consolidated revenue from operations to Rs 4,966 crore in Q2FY26 from Rs 4,214 crore in Q2FY25. Profit after tax (PAT) grew 10% YoY to Rs 397 crore in Q2FY26 from Rs 359 crore in the same period in the previous financial year.

Raymond Lifestyle Q3 Highlights (Consolidated, YoY)

Net Profit down 33% at Rs 42.9 crore versus loss of Rs 64.2 crore

Revenue up 5.4% at Rs 1,849 crore versus Rs 1,754 crore

EBITDA up 32% at Rs 237 crore versus Rs 180 crore

EBITDA Margin at 12.8% versus 10.2%

WeWork India Q3 Highlights (Consolidated, YoY)

Net Profit of Rs 16.7 crore versus loss of Rs 83.3 crore

Revenue up 29% at Rs 634 crore versus Rs 492 crore

EBITDA up 31% at Rs 408 crore versus Rs 311 crore

EBITDA Margin at 64.3% versus 63.3%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.