Piramal Pharma Ltd.'s share price rose nearly 5% on Tuesday after JM Financial initiated coverage on the stock with a 'buy' rating, and a target price of Rs 340, implying a 36% potential upside.

The stock is currently trading at a 38% discount to its listed peers, making it an attractive opportunity for investors, according to the brokerage.

Piramal's consumer healthcare segment, which accounts for 12% of revenue, has a portfolio of over 25 brands, including names like Lacto Calamine, Polycrol, Tetmosol, and Little's. Although high advertising and promotion expenses have weighed on margins in the past, the business is on the verge of scaling up.

With additional capacity for Sevoflurane in India and 24 injectable products in the pipeline, JM Financial projects the segment to grow at 11% CAGR over the next two fiscals.

JM Financial also projected a 13% CAGR for the segment over the next three years and the margin expansion is expected with the maturing of the business. Contributing 30% to revenue, Piramal's hospital generics business specialises in complex inhalation and injectable products with high entry barriers.

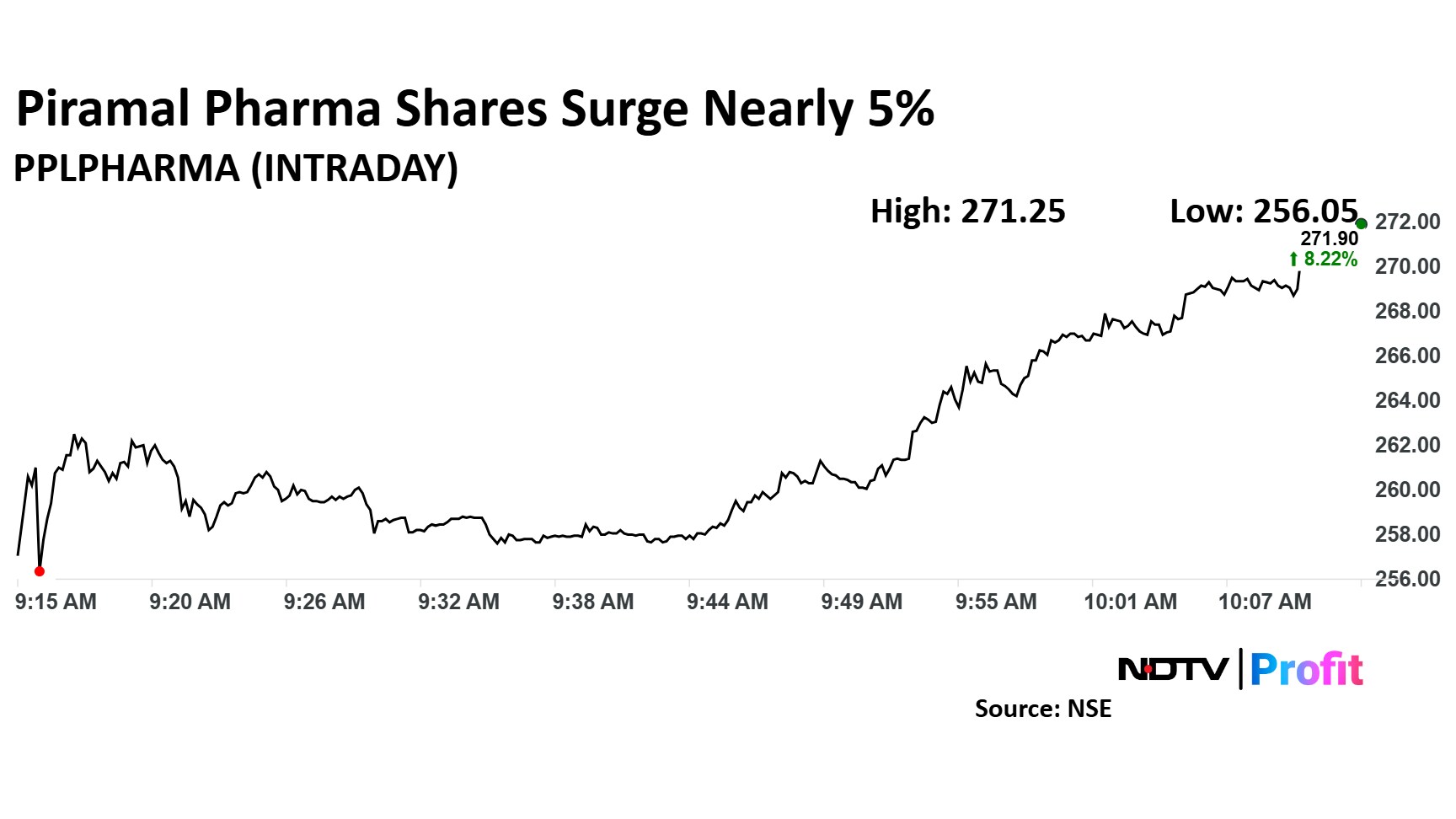

Piramal Pharma Share Price Today

Piramal Pharma Ltd. stock rose as much as 6.07% before paring gains to trade 5.51% higher at Rs 265.10 apiece as of 9:58 a.m., compared to a 0.58% decline in the benchmark Nifty 50

It has risen 110.27% in the last 12 months and 92.19% year-to-date. Total traded volume so far in the day stood at 2.5 times its 30-day average. The relative strength index was at 55.7.

All 10 analysts tracking the pharma have a 'buy' rating on the stock, according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 292.2, implying an upside of 12.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.