.jpeg.jpg?downsize=773:435)

Shares of Piramal Enterprises Ltd. rose over 7% on Tuesday after the company reported profit in the third quarter of financial year 2025. It also reported higher volume during the quarter ended Dec. 31, 2024.

The non-banking financial company's net profit stood at Rs 38.6 crore for the quarter ended December, as compared to a loss of Rs 2,378 crore for the same period last year. It posted an exceptional gain of Rs 376 crore, without which, the company would have posted a loss of Rs 337.4 crore.

The company's revenue fell by 1.1% to Rs 2,449 crore for the third quarter, as against Rs 2,476 crore for the year-ago period.

The company's earnings before interest, tax, depreciation and amortisation dipped to Rs 1,075 crore, denoting a 10.8% fall for the October-December quarter from Rs 1,205 crore for the same quarter in the previous financial year.

Margins narrowed at 43.9% for the quarter under review, in contrast to 48.7% for the same period last year.

The total assets under management rose 16% year-on-year to Rs 78,362 crore, the company said in its investor presentation on Monday. The retail AUM was up 37% year-on-year to Rs 59,093 crore, while wholesale AUM was up 60% to Rs 8,916 crore.

The company maintained a strong liquidity of Rs 8,277 crore, in cash and liquid investments representing 9% of total assets.

Piramal Enterprises Share Price Today

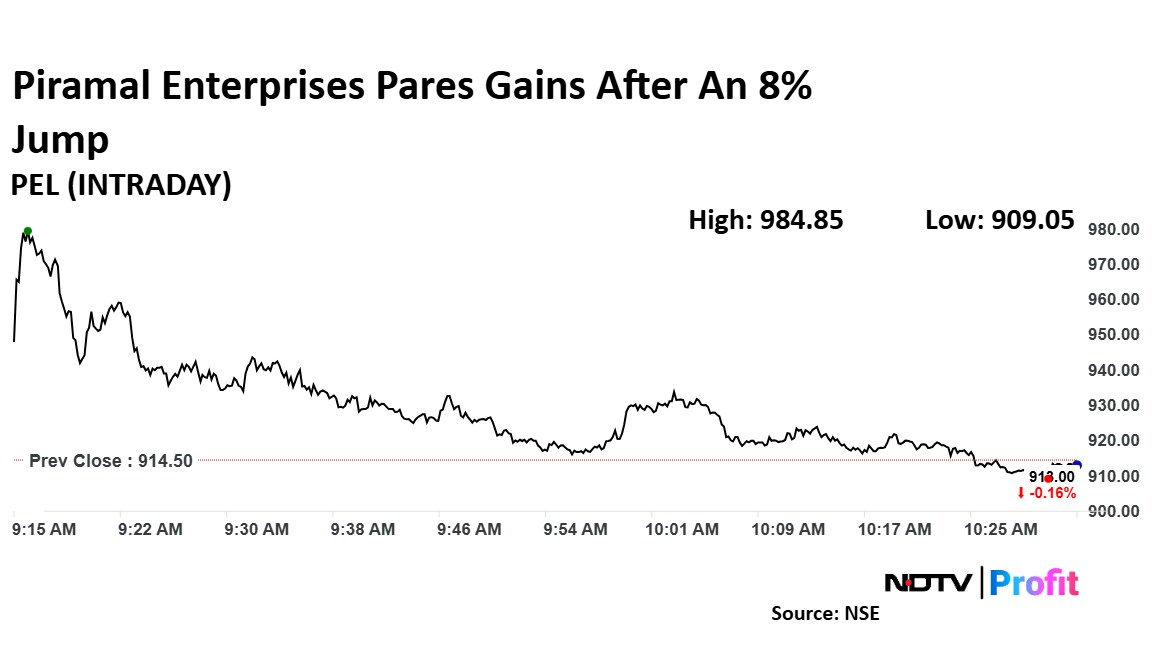

Shares of Piramal Enterprises rose as much as 7.69%, the highest level since Jan. 27, before paring gains to trade 0.27% lower at Rs 912.05 apiece, as of 10:28 a.m. This compares to a 0.27% advance in the NSE Nifty 50.

The stock has risen 3.17% in the last 12 months. Total traded volume so far in the day stood at 15 times its 30-day average. The relative strength index was at 29 indicating it was oversold.

Out of seven analysts tracking the company, one maintains a 'buy' rating, two recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 1.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.