Shares of PG Electroplast Ltd. declined after the company's issue price for its Rs 1,500 crore qualified institutional placements was set at a discount to its floor price.

The company approved an issue price of Rs 699 apiece for around 2.14 crore equity shares that will be allotted to eligible qualified institutional buyers, according to an exchange filing.

The issue price marks a discount of Rs 6.18, or 0.88%, against the QIP floor price of Rs 705.18 per share.

The company will use the proceeds for investing in the subsidiaries PG Technoplast and Next Generation Manufacturers Pvt., as well as repayment and prepayment. Certain portion will also be used for general corporate purposes.

The QIP issue came a month after the company forayed into EV manufacturing with an agreement with Spiro Mobility, an affordable electric two-wheeler company based in Africa. As part of the agreement, the company will become an exclusive manufacturing partner of electric vehicles of Spiro Mobility in India.

In the quarter ended September 2024, PG Electroplast posted a 57.2% year-on-year jump in net profit to Rs 19.47 crore. The topline during the same period increased to Rs 671.30 crore, up 45.8% as compared to the year-ago period.

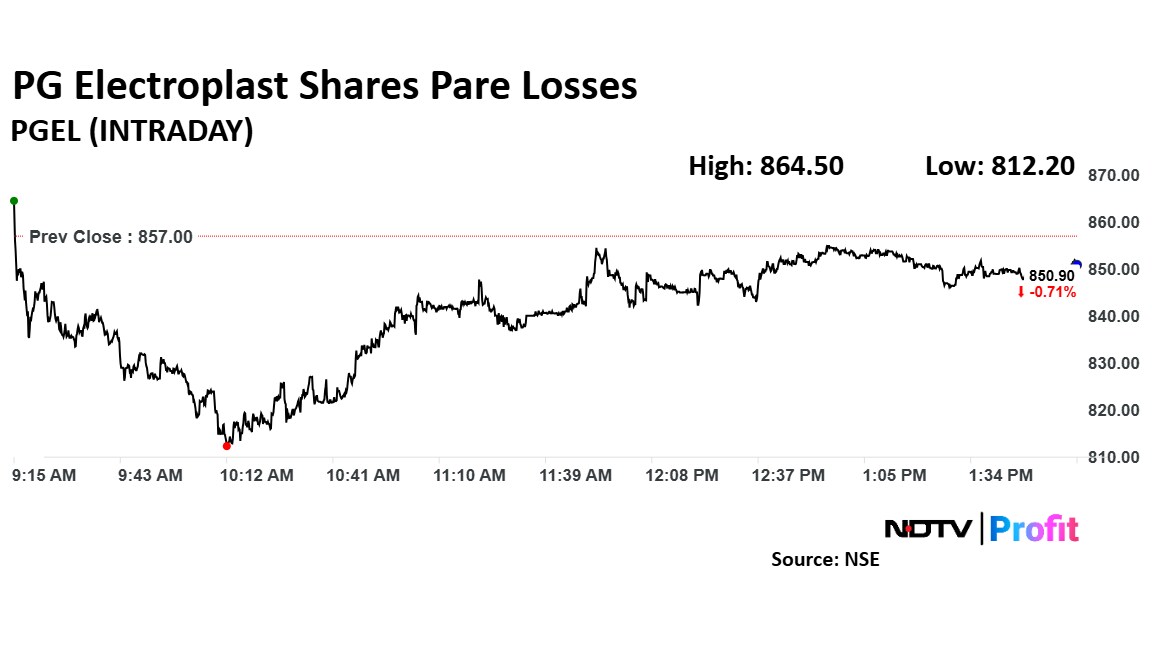

PG Electroplast's stock fell as much as 5.23% during the day to Rs 812.2 apiece on the NSE. It was trading 1.1% lower at Rs 847.6 apiece, compared to a 0.40% decline in the benchmark Nifty 50 as of 1:58 p.m.

The stock has risen by 270% over the past 12 months.

Among the eight analysts tracking the company, six have a 'buy' rating on the stock, whereas one each recommends 'hold' and 'sell,' according to Bloomberg data. The average of 12-month analysts' price target implies a potential downside of 17%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.