Shares of Pfizer Ltd. rose over 8% on Monday after the company signed a sales and marketing pact with Mylan Pharmaceuticals Pvt. The contract is for two brands of the company.

The company will conduct marketing and sales of Ativan and Pacitane, two brands owned by Mylan Pharmaceuticals, the pharma company said in an exchange filing on Friday. The agreement is for a period of five years within the territory of India.

Mylan has a good presence in Central Nervous System therapy area, with skilled resources for engagement with super specialists like neurologists and psychiatrists.

Pfizer Q3 Results

Pfizer's net profit fell by 2% in the third quarter of the current fiscal. The pharmaceutical company posted a bottom line of Rs 127.6 crore, as compared to Rs 130 crore for the same period last year.

The company recorded a revenue of Rs 538 crore for the October-December period, down marginally by 0.4% from Rs 540 crore in the third quarter of the previous fiscal.

Pfizer posted earnings before interest, taxes, depreciation and amortisation of Rs 146 crore, down 4% from Rs 152.6 crore in the year-ago period. The margins contracted to 27.1% from 28.3%.

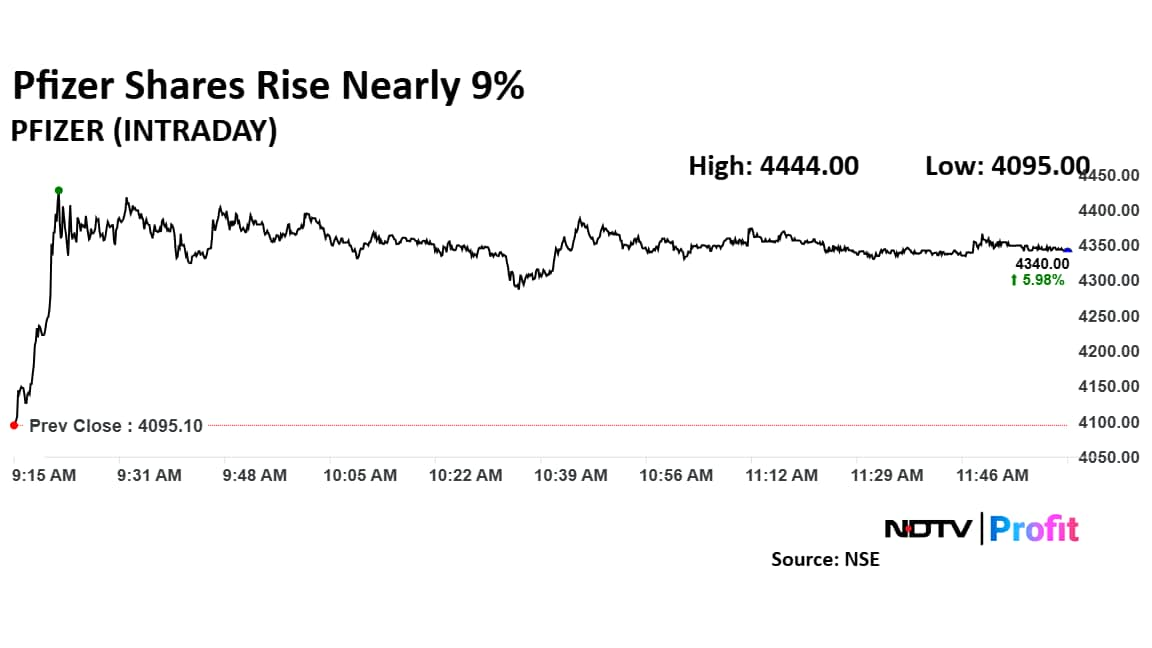

Pfizer Shares Rise

The scrip rose as much as 8.52% to Rs 4,444 apiece, the highest level since Feb. 7. It pared gains to trade 6% higher at Rs 4,340.95 apiece, as of 11:59 a.m. This compares to a 0.88% decline in the NSE Nifty 50.

It has risen 1.16% in the last 12 months. Total traded volume so far in the day stood at 46 times its 30-day average. The relative strength index was at 46.

Out of three analysts tracking the company, two maintain a 'buy' rating and one recommends a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 37.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.