.web.webp?downsize=773:435)

Ola Electric is charting an ambitious growth trajectory, backed by key advancements and strategic targets. Despite a fall in revenue and the widening of loss, the shares of the company saw a significant surge.

The company has commenced in-house production of its advanced 4,680 cells, with deliveries for vehicles utilising these cells anticipated to begin around the Navratri festival.

For the financial year 2026, Ola Electric projects strong volume guidance, expecting to deliver between 325,000 and 375,000 vehicles, alongside revenue guidance ranging from Rs 4,200 crore to Rs 4,700 crore. By the end of the financial year 2026, the company aims to achieve an automotive gross margin of 35% to 40%, benefiting from Production Linked Incentive, or PLI, schemes.

Ola Electric Mobility Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 49.6% to Rs 828 crore versus Rs 1,644 crore (Bloomberg estimate: Rs 735 crore).

Ebitda loss at Rs 237 crore versus Rs 205 crore (Bloomberg estimate: Rs 287 crore).

Net loss widens to Rs 428 crore versus Rs 347 crore (Bloomberg estimate: Rs 452 crore).

The company's inventory spiked to Rs 153 crore from Rs 12 crore. New product introductions, including the Gen 3 Scooters and Roadster bikes, have reportedly been well-received in the market. Ola Electric has also developed in-house solutions for rare earth magnets and Anti-lock Braking System, or ABS. As of June 2025, the company maintains a cash balance of Rupees 3,197 crore.

In the first quarter of financial year 2026, Ola Electric recorded a revenue of Rs 828 crore, with Electric Two-Wheeler, or E2W, deliveries reaching 68,192 units. A positive development in its financials is the gross margin improving to 25.6% and the automotive segment achieving positive Ebitda in June 2025.

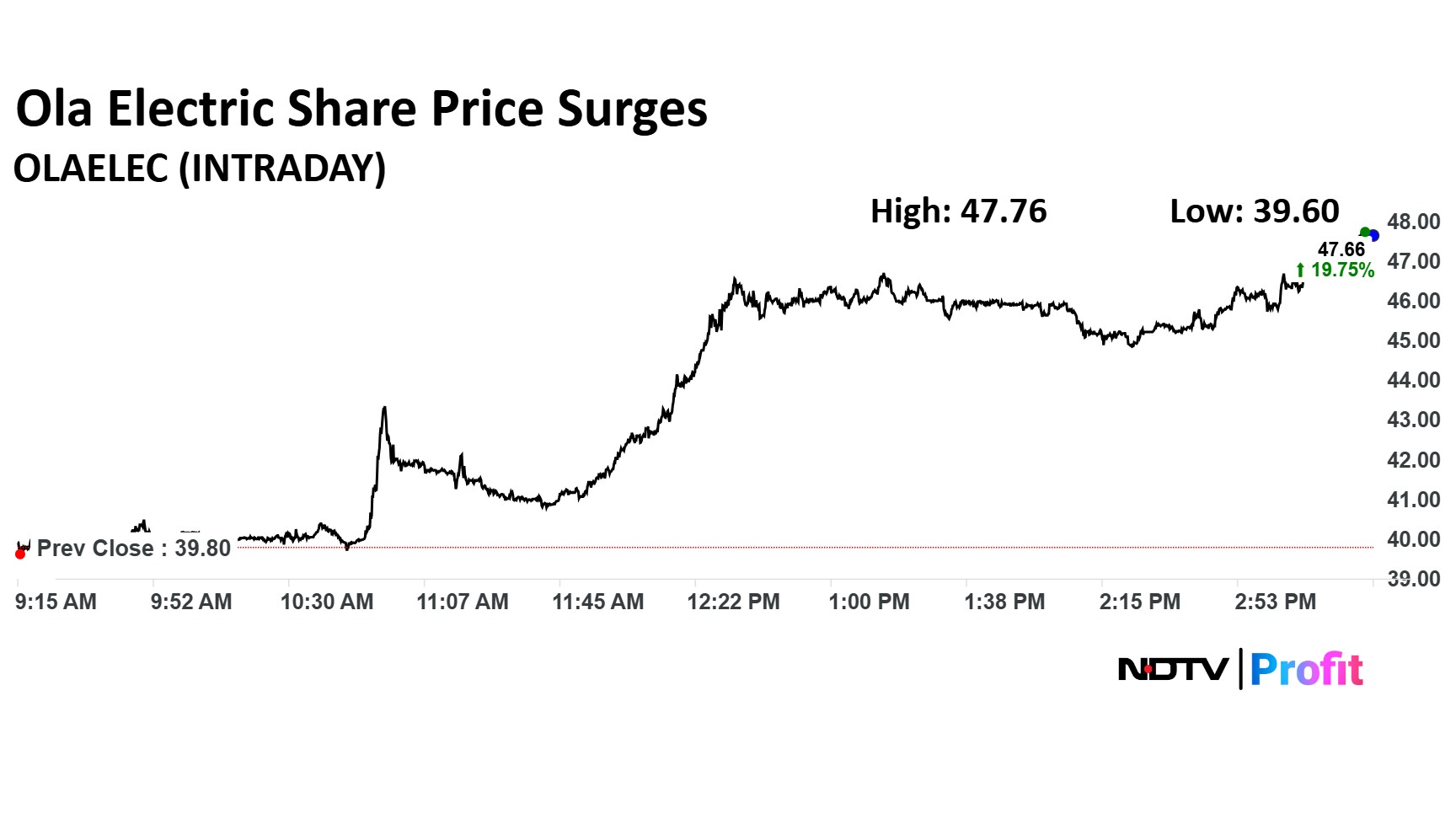

Ola Electric Share Price Spike

Shares of Ola Electric rose over 20% on improved business prospects. It pared the gains only marginally to settle 19.75% higher at Rs 47.66 apiece.

Out of eight analysts tracking the company, three maintain a 'buy' rating, two recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a potential downside of 5.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.