Ola Electric Mobility Ltd.'s share price declined nearly 10% at open in Friday's session as its fourth-quarter net loss widened. Its consolidated net loss increased 109% on the year to Rs 870.00 crore versus Rs 416.00 crore.

Ola Electric net loss increased during January–March as it announced a one-off warranty cost of Rs 250 crore. The company does not expect to turn Ebitda positive from first quarter of financial year 2026.

Goldman Sachs cut revenue estimates for Ola Electric Mobility by 19%, 12%, and 11% for financial years 2026, 2027, and 2028. The brokerage also cut target price to Rs 70 from Rs 75. The current target price implied 31.5% upside from Thursday's close price. Goldman Sachs maintained a stock rating of 'buy'.

Ola Electric Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue down 61.8% to Rs 611.00 crore versus Rs 1,598.00 crore.

Ebitda loss widens by 123% to Rs 695.00 crore versus Rs 312.00 crore.

Net loss widens by 109% to Rs 870.00 crore versus Rs 416.00 crore.

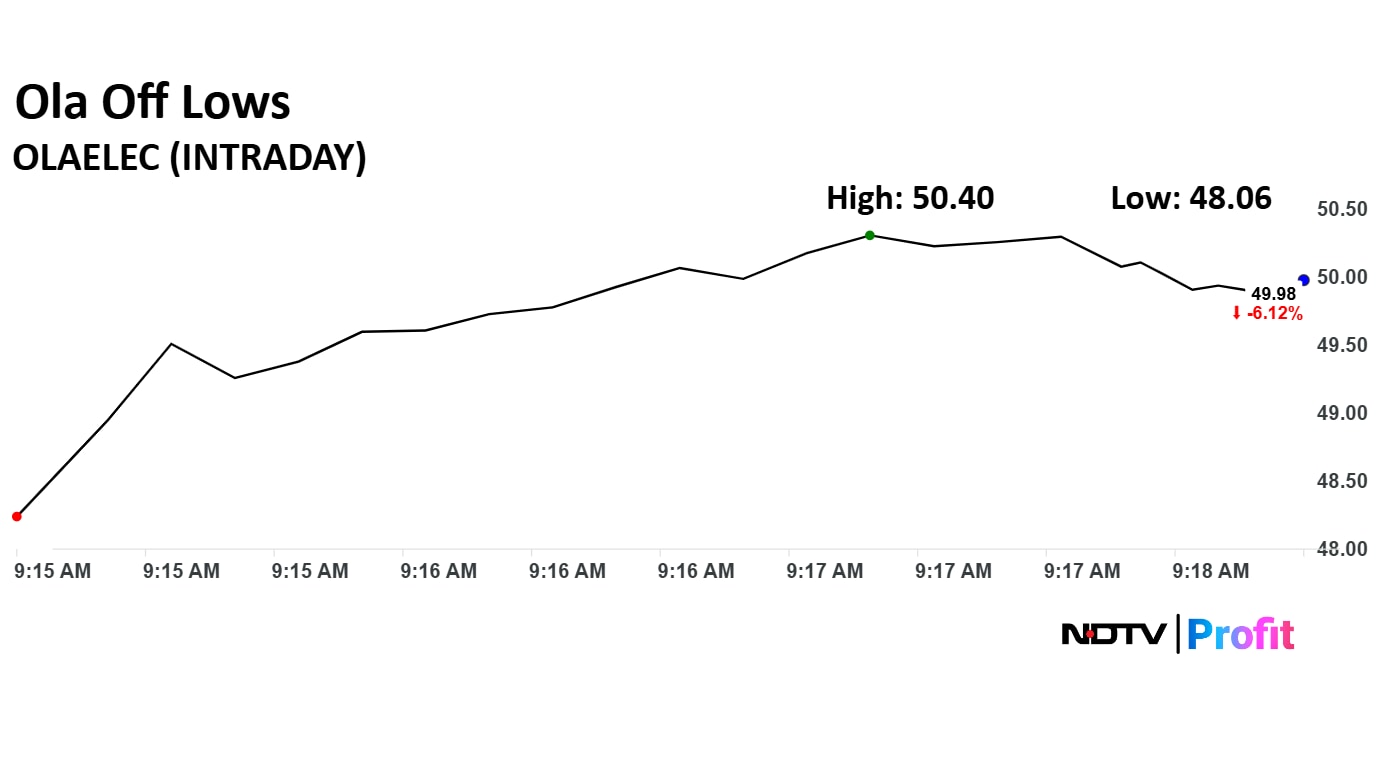

Ola Electric Share Price Today

Ola Electric Mobility share price fell 9.73% to Rs 48.06 apiece, the lowest level since May 9. The stock price pared losses to trade 5.50% down at Rs 50.31 apiece as of 9:48 a.m., as compared to 0.15% decline in the NSE Nifty 50.

The stock declined 33.97% in 12 months, and 41.5% on year to date basis. Total traded volume so far in the day stood at 4.8 times its 30-day average. The relative strength index was at 44.46.

Out of eight analysts tracking the company, four maintain a 'buy' rating, two recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 23.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.