Ola Electric Mobility Ltd.'s share price dropped over 4% on Wednesday following a warning issued by the Securities and Exchange Board of India for violating market disclosure norms.

The regulatory body cited the company's failure to adhere to the timely dissemination of material information to stock exchanges, an issue arising from a December 2024 announcement made by Ola Electric's Chairman and Managing Director, Bhavish Aggarwal, on social media platform X (formerly Twitter).

On Dec. 2, 2024, Aggarwal announced plans for a four-fold expansion of the company's store network within the month, in a post at 9:58 a.m. However, no official disclosure was made to the stock exchanges until several hours later, at 1:36 p.m. for BSE and 1:41 p.m. for NSE.

SEBI's warning highlights that the company violated several provisions under the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (LODR). Specifically, SEBI noted the failure to make the disclosure on the stock exchanges first, as mandated by Regulation 30(6)(ii), which stipulates that listed companies must report material information to stock exchanges within 12 hours of an event or information becoming known.

SEBI also pointed out that Ola Electric's decision to use social media for the announcement failed to provide equal, timely, and cost-efficient access to information for all investors, in violation of Regulation 4(1)(d) and 4(1)(f) of the LODR. These violations were deemed serious by the markets regulator, which advised the company to improve its compliance standards to avoid recurrence.

The warning letter issued by SEBI on Jan. 7, 2025, did not have any immediate financial impact on the company.

The warning follows a period of heightened attention on Ola Electric, which has rapidly expanded its electric vehicle offerings in India and is under significant public and regulatory scrutiny for its service centers.

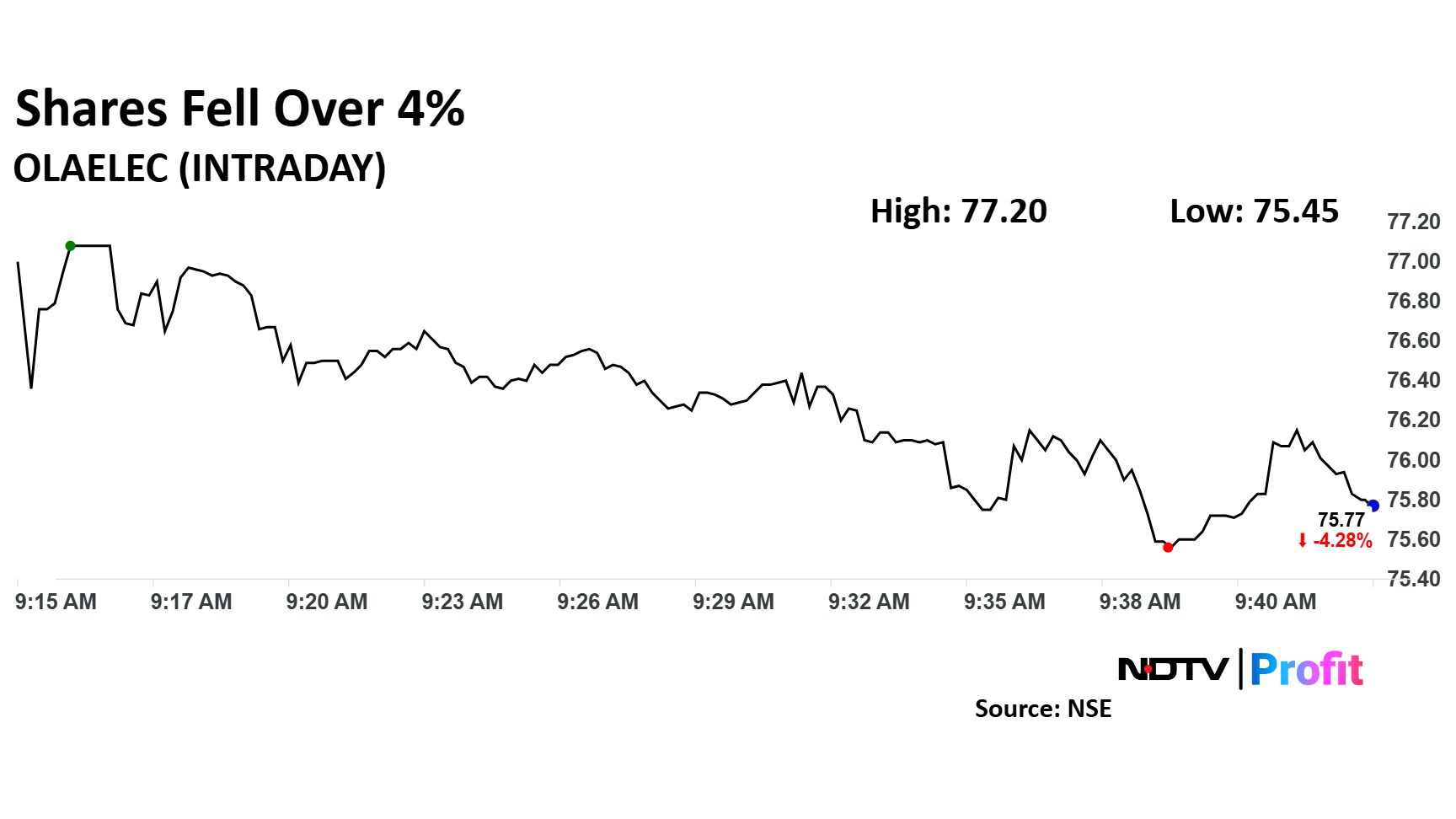

Ola Electric Mobility Share Price

The scrip fell as much as 4.42% to Rs 75.66 apiece. It pared losses to trade 3.90% lower at Rs 76.07 apiece, as of 09:38 a.m. This compares to a 0.21% decline in the NSE Nifty 50 Index.

It has fallen 16.59% since its listing date in August 2024. Total traded volume so far in the day stood at 0.7 times its 30-day average. The relative strength index was at 31.

Out of seven analysts tracking the company, five maintain a 'buy' rating, and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 26.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.