- Nomura is investigating its India fixed-income business for potential profit inflation.

- The probe focuses on valuation of trades in Strips, Indian sovereign bond segments.

- Nomura is a major player in the fast-growing $1.3 trillion Indian sovereign debt market.

Nomura Holdings Inc. is investigating its India fixed-income business, asking senior officials in its rates division to determine whether profits were inflated in recent years, according to people familiar with the matter.

The probe, launched by the bank's compliance department, centers on how the firm valued trades in Strips, an acronym for Separate Trading of Registered Interest and Principal of Securities, bonds made by separating the principal and coupon payments of Indian sovereign securities, the people said, asking not to be identified as the information isn't public.

The review matters because Nomura is one of the key players in the Strips market, a niche but a fast-growing part of India's $1.3 trillion sovereign debt market. The investigation highlights rising concern about this segment, which has become a hotspot for accounting practices that overstate reported gains, the people said.

A representative for Nomura declined to comment.

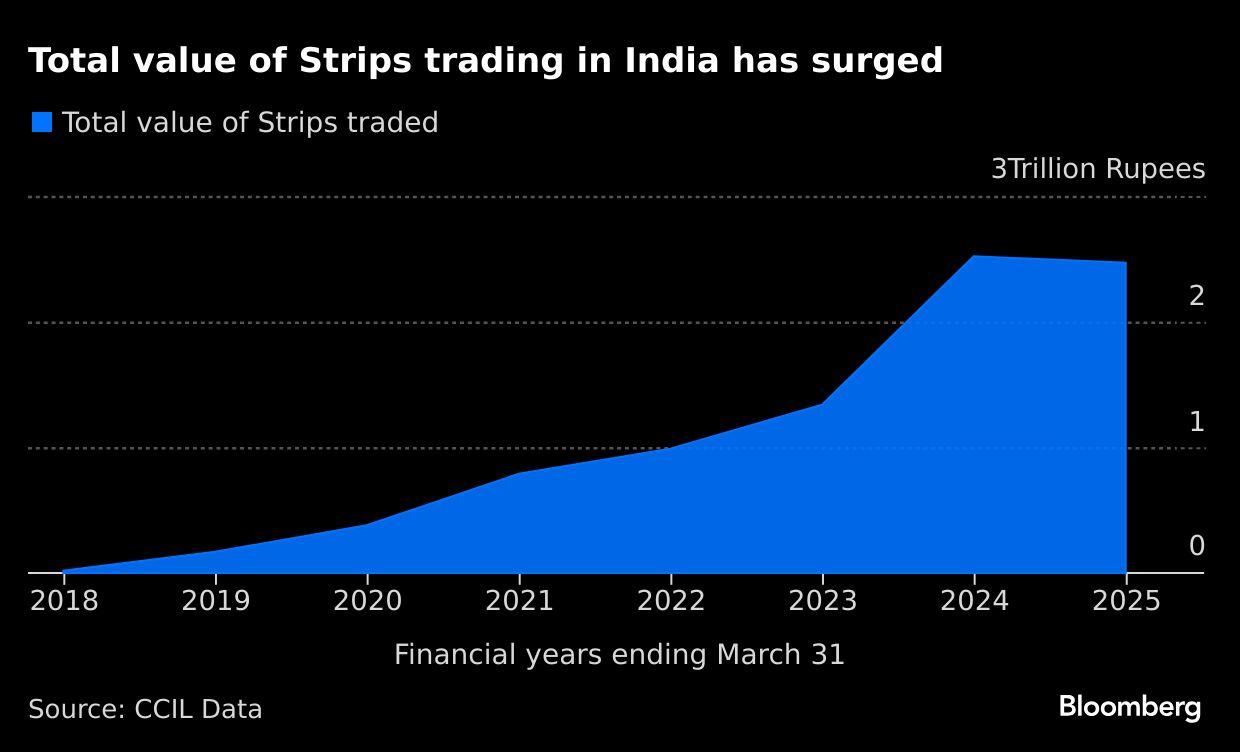

Trading volumes in Strips jumped to Rs 2.47 trillion ($28 billion) in the year ended March 31, more than six times higher than five years ago, according to clearing house data. Demand has surged as insurance companies, who prefer zero-coupon securities to shield their cash flows from interest-rate swings, have ramped up purchases.

Nomura's compliance unit began scrutinising the valuation and accounting practices of the firm's local primary dealership about a month ago, the people said. The inquiry focuses on whether the trading desk marked the positions to theoretical prices that didn't reflect actual market liquidity, potentially boosting gains, they said.

By splitting long-dated government bonds into separate principal and interest parts, institutions can record unrealised gains in illiquid securities, the people said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.