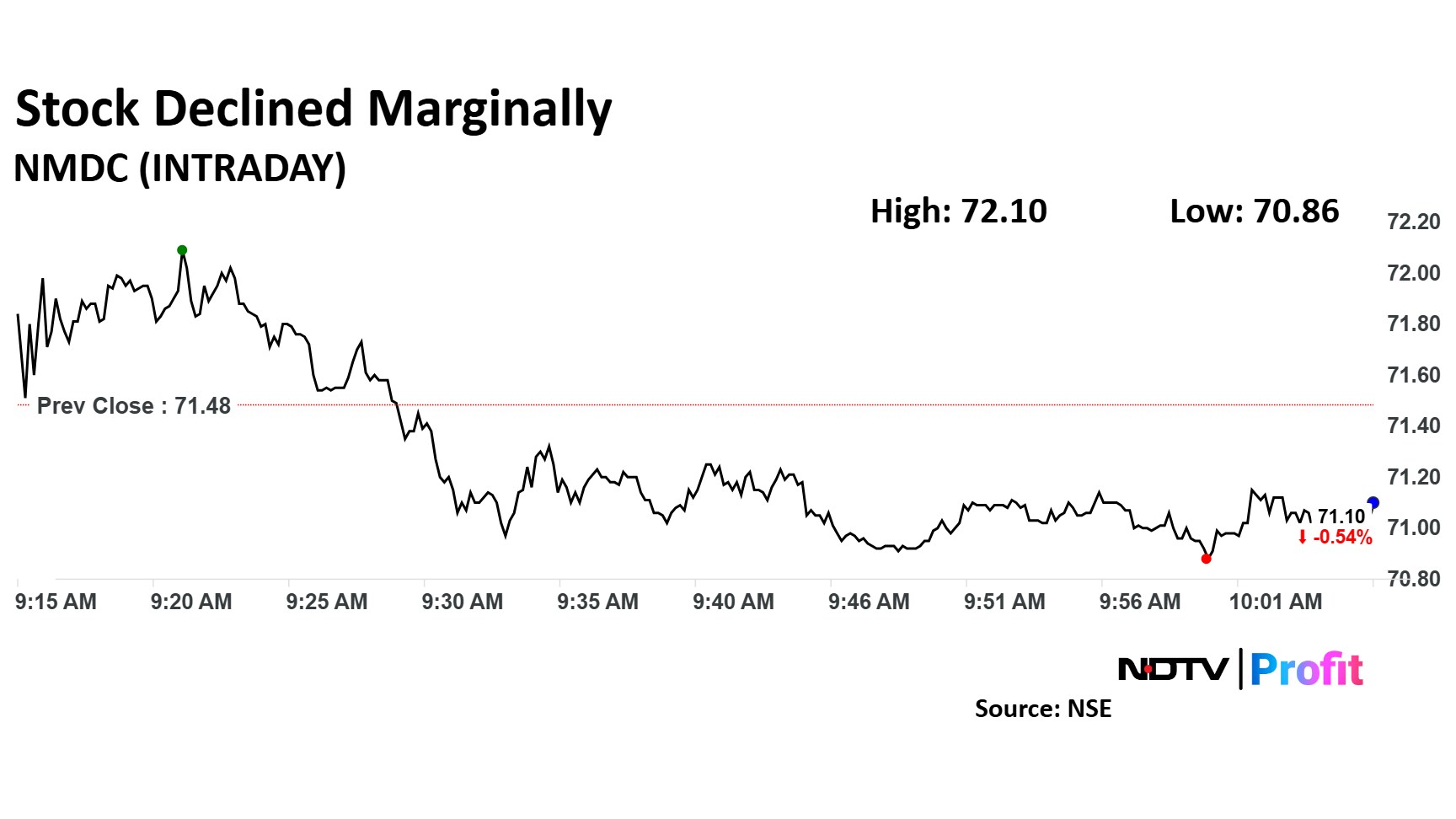

NMDC Ltd. shares gave up minor gains in the first hour of the session as they traded ex-bonus on Friday. In early trade, the counter saw a modest rise of 0.86%, trading at Rs 72.10 on the NSE after being adjusted for the bonus issue.

Earlier, NMDC had announced that Dec. 27 would be the record date for determining the eligibility of shareholders for the bonus share issuance. Shareholders who hold the stock by this date will be entitled to a bonus issue in a 2:1 ratio. This means that for every one existing share held, two new equity shares will be issued.

A total of 586 crore equity shares of Rs 1 each are expected to be allotted as part of this bonus issue. The record date, which is a cutoff set by the company to identify eligible shareholders, is crucial for investors looking to benefit from the bonus shares. To be eligible, investors were to ensure that their shares are credited to their demat accounts by Thursday, ensuring they comply with the T+1 settlement cycle.

In preparation for this bonus issue, NMDC also confirmed that it had received in-principle approval from both the BSE and the National Stock Exchange on Dec. 16. The bonus shares will be allotted to eligible shareholders on December 30, with trading set to commence on Tuesday, as per SEBI's regulations.

The scrip rose as much as 0.86%, before dropping as much to 70.86. It pared gave up gains to trade 0.69% lower at Rs 70.99 apiece, as of 10:02 a.m. This compares to a 0.73% advance in the NSE Nifty 50 Index.

NMDC stock has risen 5.72% in the last 12 months. Total traded volume so far in the day stood at 3.9 times its 30-day average. The relative strength index was at 34.

Out of 22 analysts tracking the company, 13 maintain a 'buy' rating, three recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 242.9%.

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.