Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

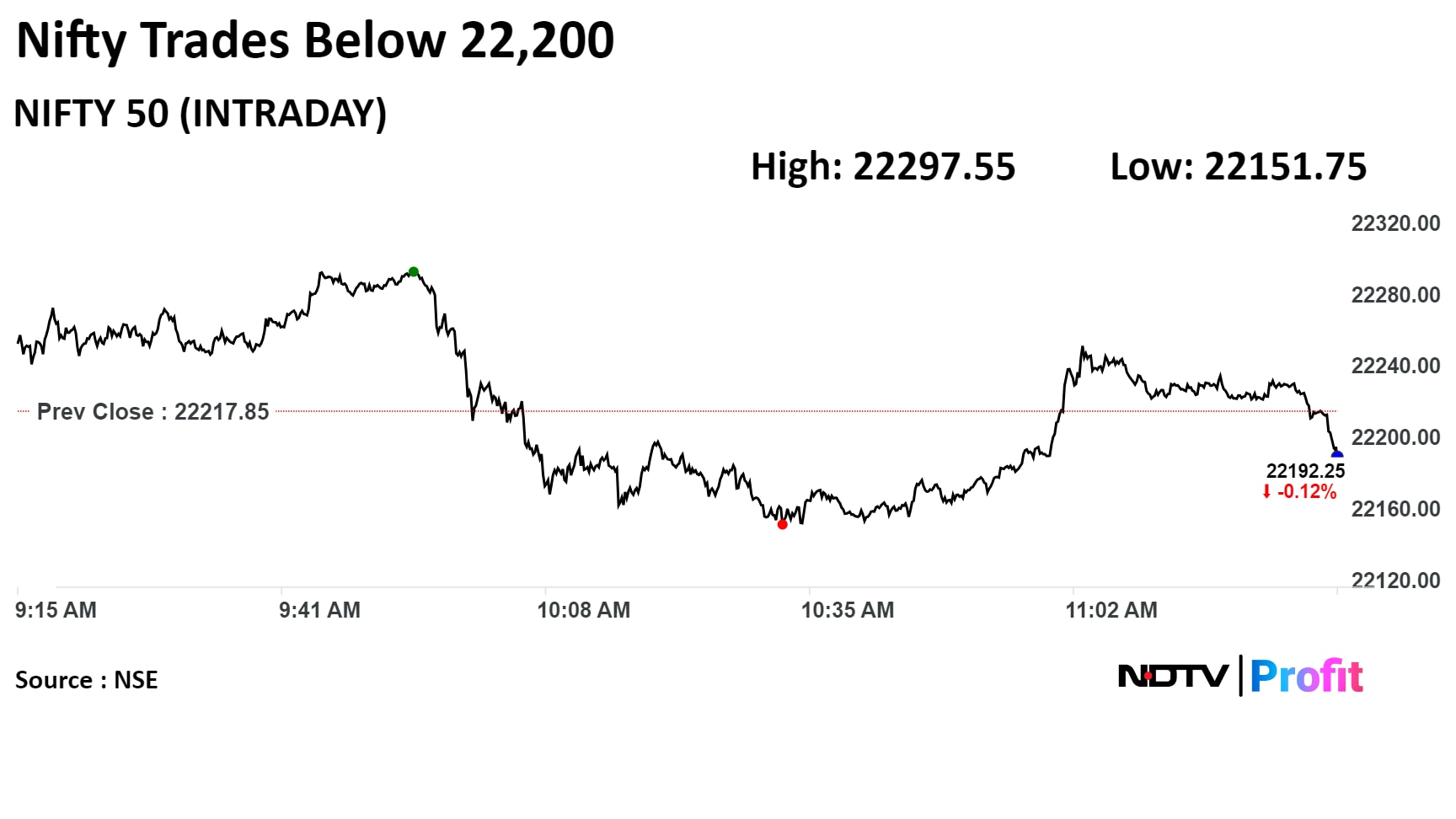

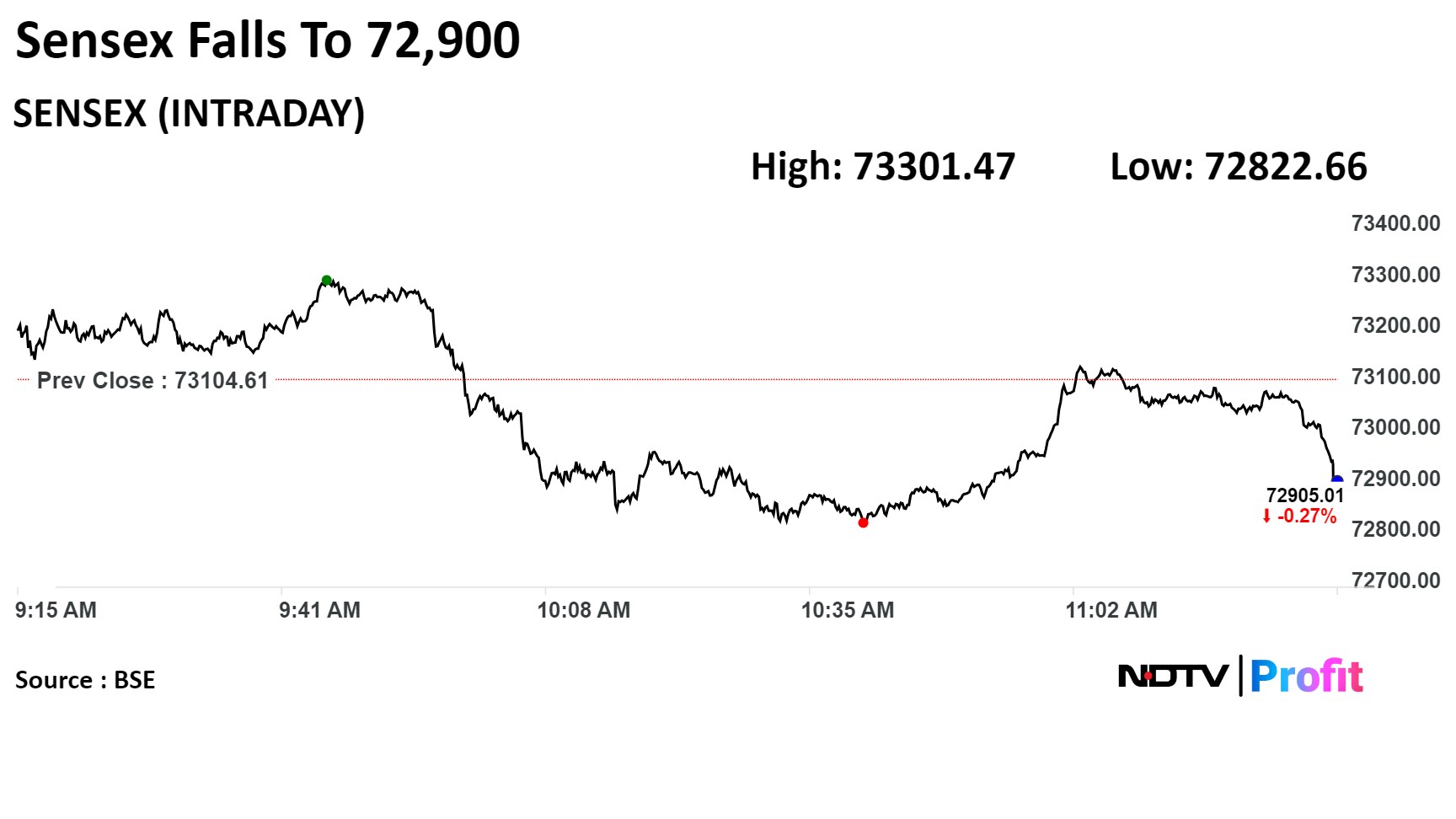

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Shares of Coal India Ltd., Cipla Ltd., Mahindra & Mahindra Ltd., Reliance Industries Ltd., and NTPC Ltd. cushioned fall in the Nifty.

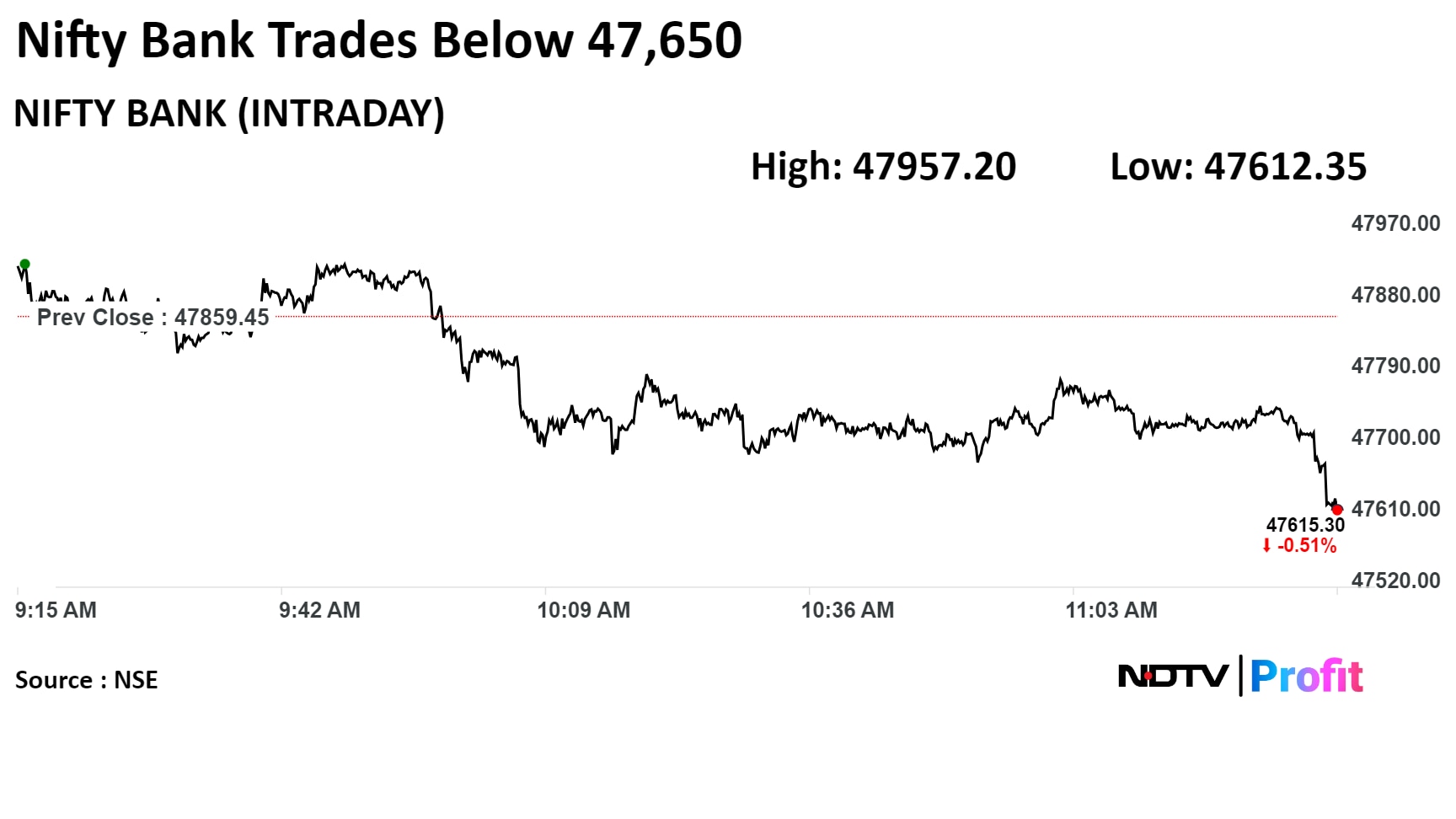

While those of HDFC Bank Ltd., ICICI Bank Ltd., Sun Pharmaceutical Industries Ltd., Tata Consultancy Services Ltd., and Hindustan Unilever Ltd. dragged the index.

.png)

Sectoral indices were mixed on the NSE, with Nifty PSU Bank and Nifty Realty gaining the most, by over 1%. Nifty FMCG and Nifty Bank were the top losers.

.png)

Broader markets outperformed. S&P BSE Midcap rose 0.66% and S&P BSE Smallcap was 0.93% higher.

Sixteen of the 20 sectoral indices rose and four declined. S&P BSE Power rose the most.

The market breadth was skewed in the favour of buyers. Around 2,269 stocks rose, 1,328 fell and 145 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.