The NSE Nifty 50 and BSE Sensex saw their worst session on Thursday since Aug. 5 as the Securities Exchange Board unveiled curbs on futures and options trading, which dented the risk appetite of investors. Heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged the NSE Nifty 50 index.

Moreover, a rise in safe-haven assets like the US Treasury yields and the dollar index in the wake of geopolitical tension in the Middle East pressured risky assets like emerging markets' stocks.

The market cap of the Nifty 50 companies declined by Rs 4.09 lakh crore to Rs 200.94 lakh crore, according to data on the National Stock Exchange.

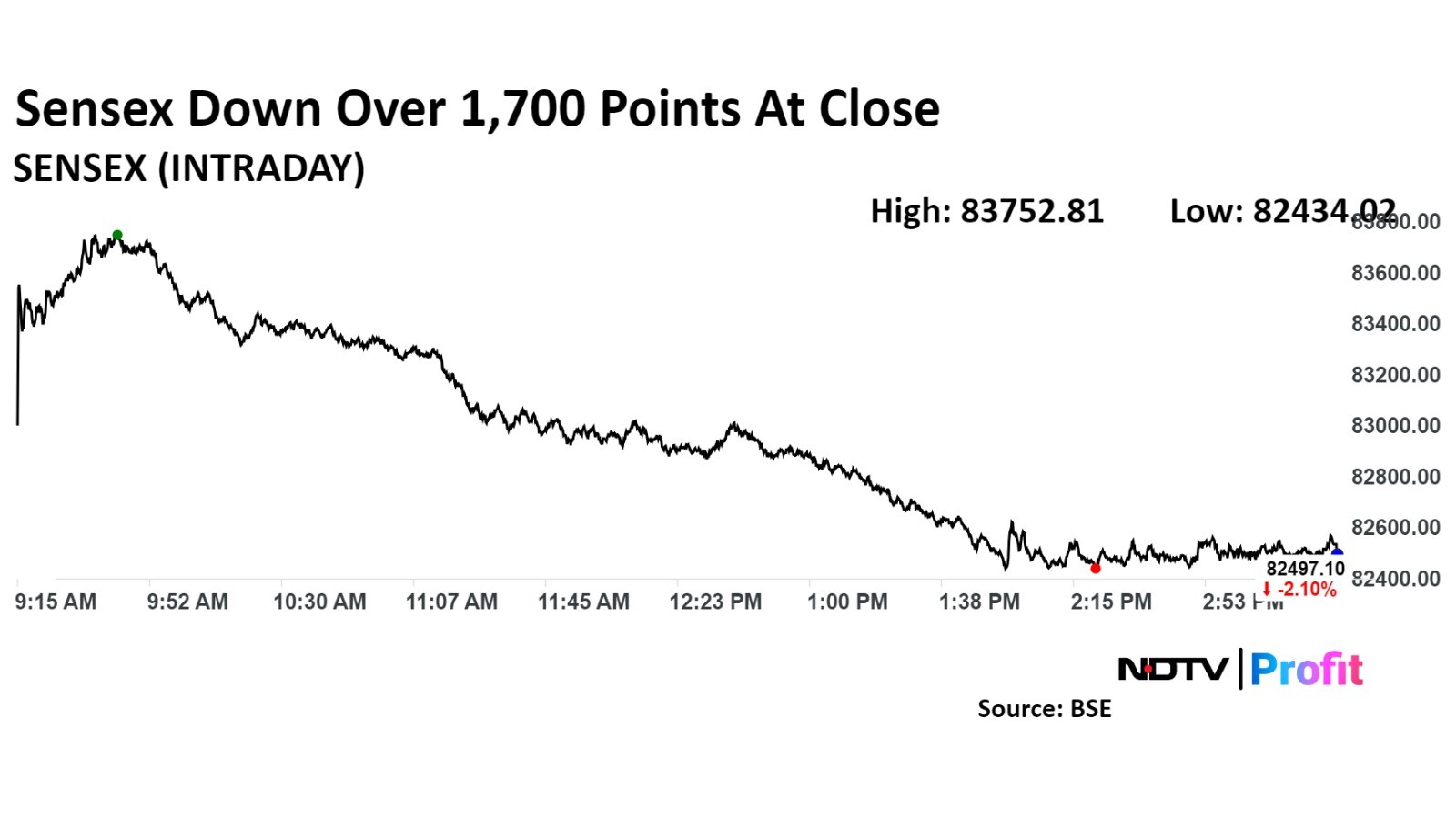

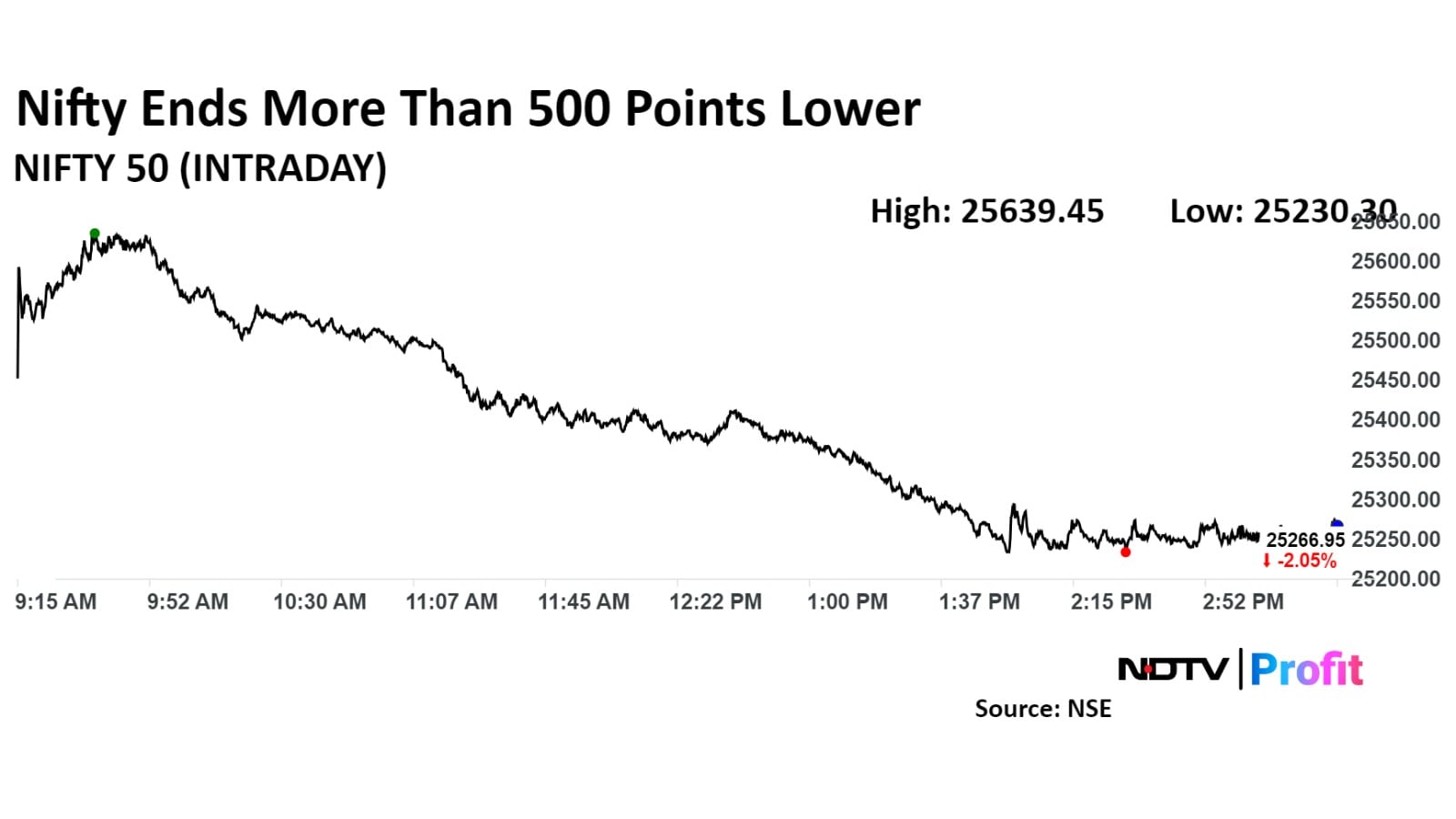

The Nifty 50 ended 546.80 points or 2.12% lower at 25,250.10, and the Sensex ended 1,769.19 points or 2.10% down at 82,497.10.

The Nifty 50 index declined 2.20% to 25,230.30, and the Sensex fell 2.17% to 82,434.02.

One reason behind today's fall is that money is shifting from India to China after it announced measures to stimulate the struggling country. This helped Chinese markets rally. Investors are catching up on the weightage gap between India and China, said Vaibhav Sanghavi, CEO, ASK Hedge Solution.

Secondly, from a fundamental perspective, earnings are likely to be weaker than expected for the second quarter. Sanghavi said.

US futures declined as tensions escalated in the Middle East as Israel attacked central Beirut. Market participants await US weekly jobless claims data, due to be published later today, and non-farm payroll data on Friday.

December futures contract of Dow Jones traded 0.4% lower at 42,363.00 as of 3:30 pm when futures contract of S&P 500 was down 0.3% at 5,742.5 and that of Nasdaq 100 was 0.4% lower at 19,928.50.

"With a strong bearish candle, the index has given a breakdown from the series of higher top higher bottom formations, which indicates trend reversal but on the lower timeframe, i.e., hourly chart, overall markets seem extremely oversold and a pullback rally is warranted. Now, the next critical support is placed at the psychological support of 25,000 coupled with 50DMA, while on the higher side, 25,550-25,600 will work as a resistance zone," said Aditya Gaggar, director, Progressive Shares.

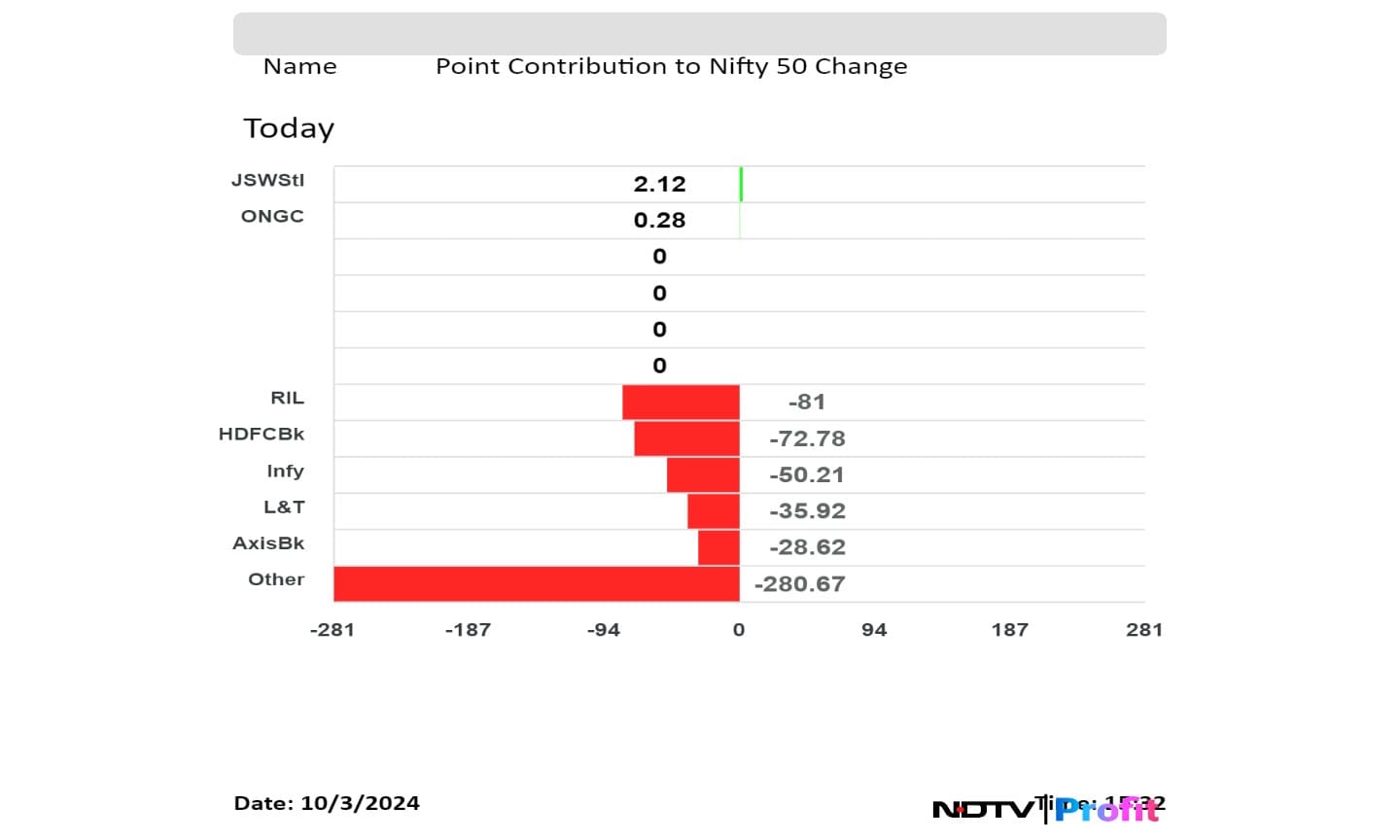

Reliance Industries Ltd., HDFC Bank Ltd., Infosys Ltd., Larsen & Toubro Ltd., and Axis Bank Ltd. weighed on the index.

JSW Steel Ltd., Oil and Natural Gas Corp. limited losses in the index.

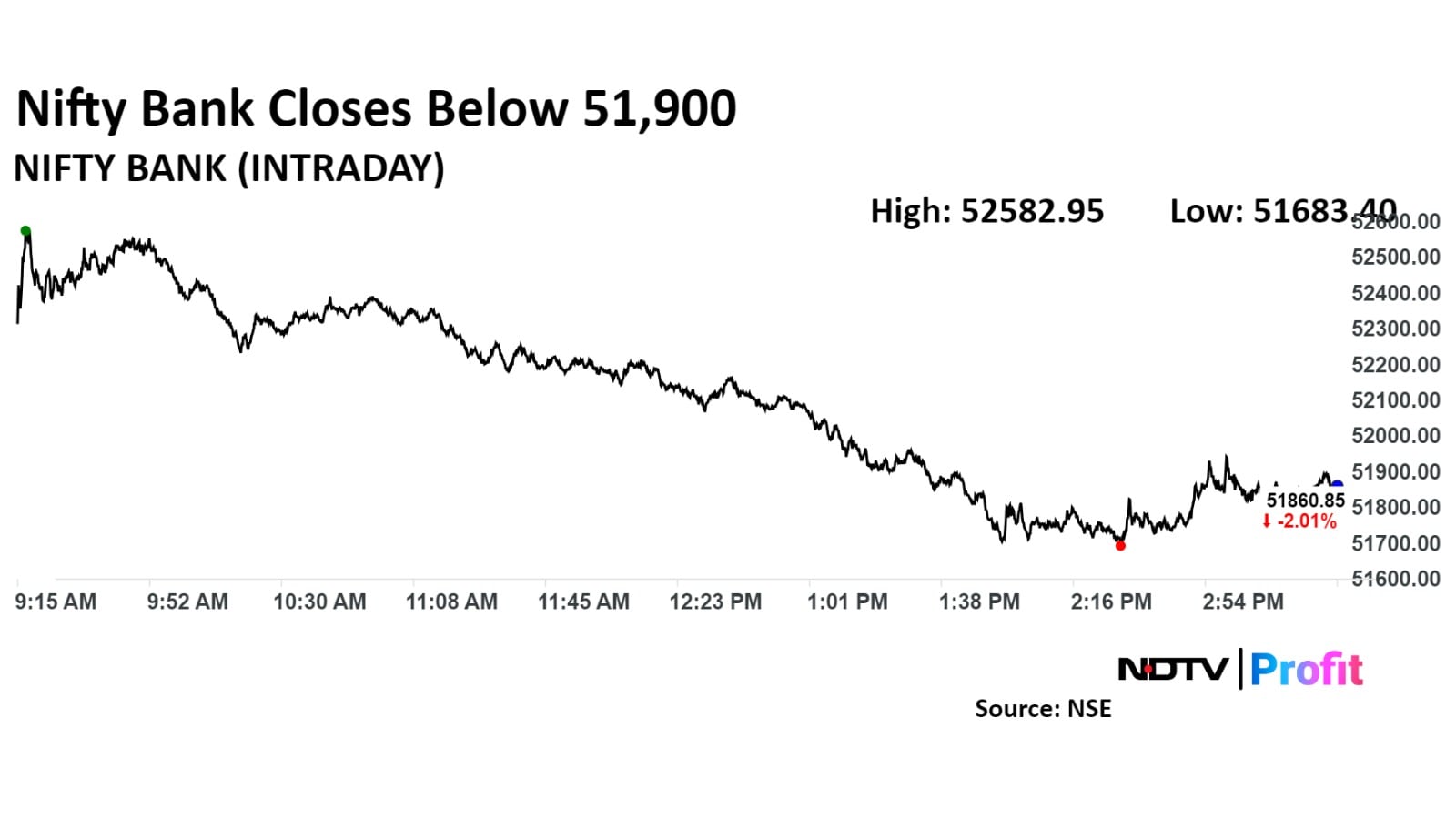

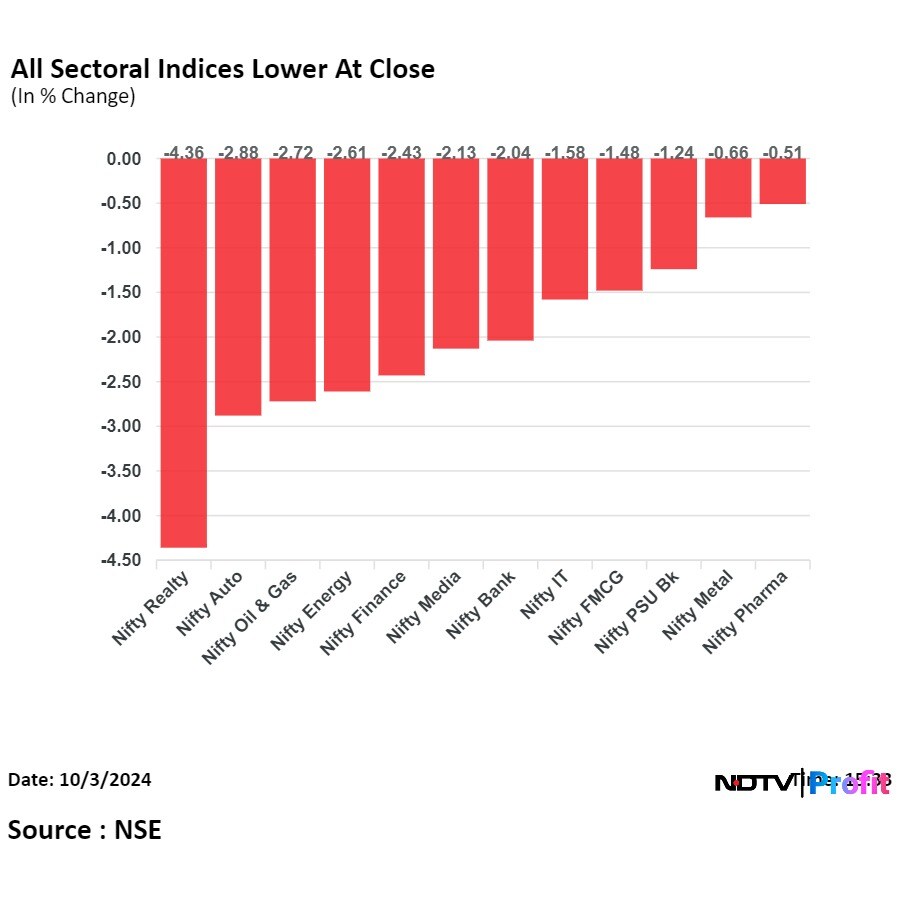

On NSE, all 12 sectors ended lower, with the NSE Nifty Realty declining the most. The NSE Nifty Pharma was the top performing sector with the least gain.

Broader indices mirrored the benchmarks. BSE Midcap closed 2.27% lower and BSE Smallcap ended 1.84% down.

All sectoral indices closed lower and BSE Realty was the top loser.

Market breadth was skewed in the favour of sellers. As many as 2,864stocks fell, 1,120 rose, and 92 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.