- Market surpassed 25,500 resistance, nearing June 30 high with strong buyer determination

- IT and banking sectors showed improved Q2 results, supporting market momentum

- Gold and silver prices rose sharply, with silver hitting a 45-year high amid supply issues

Well, finally the market seems to have got the much awaited push higher, hauling itself past the 25,500 levels that was confining it so far. I ended the last week letter stating that “market is in with a chance to push higher if it can get more positive inputs”- even if I was guarded about the possibility.

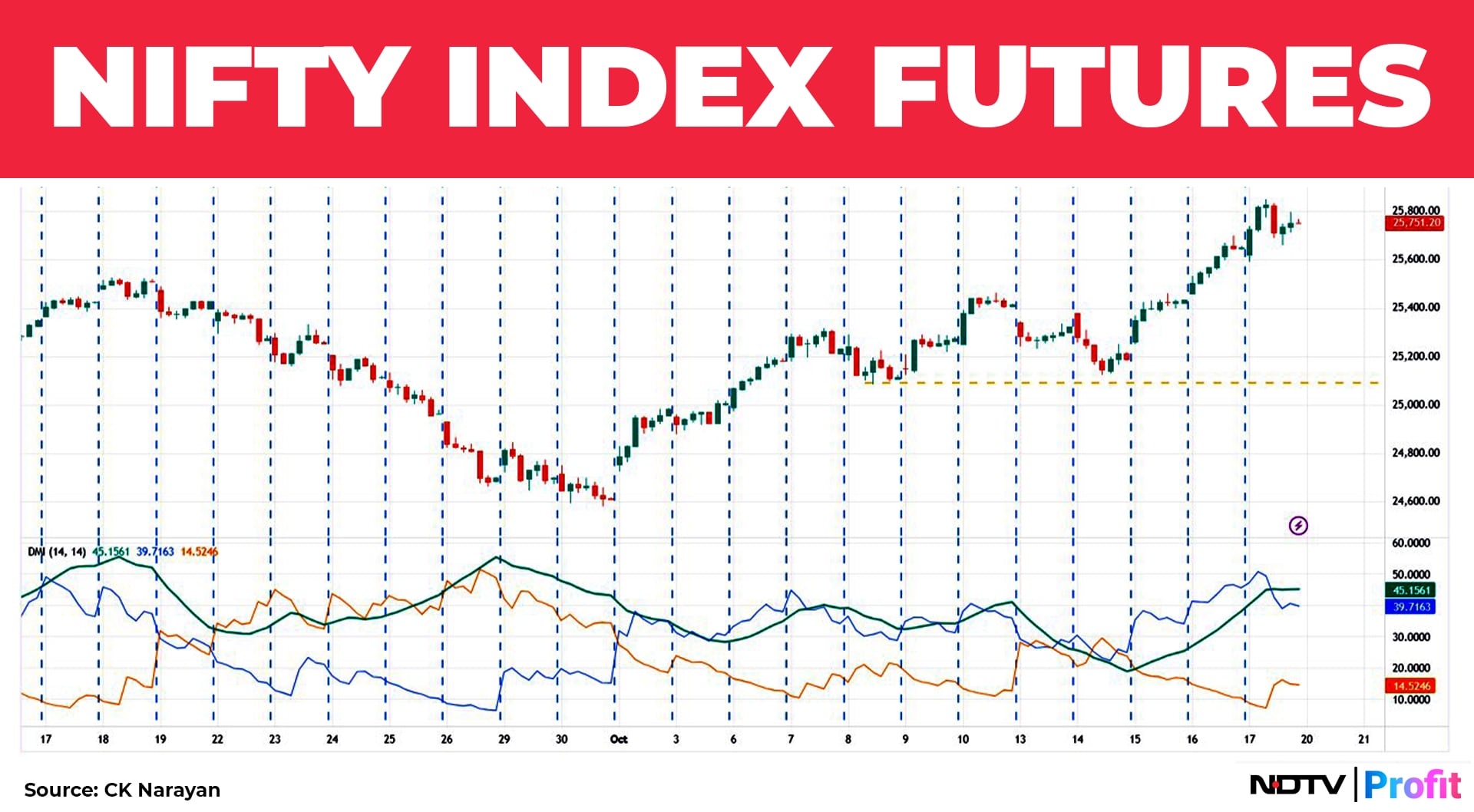

But, the market clearly found its solace somewhere. I wouldn't name a particular item that did but it seems to have picked up some collective cues and pushed higher. No matter. We all got what we wanted - a push to higher levels. At the end of week, we have almost made it to the June 30 high. Chart 1 shows the action through the week.

Starting out sedate, the market had a shakeout session on Tuesday and then took off for the hills. Finishing well, it improved the sentiments for the week ahead. Good momentum signals on 60m charts is a good signal as well. Most heartening was it pipped the highs of June 30 as well. I like it when previous highs are taken out by current rallies. It shows a buyer's determination.

Maybe it was festive cheer that is creeping into the markets or maybe it is the ‘richness feeling' engendered by the rising prices of gold and silver! After all, the extent of ownership of these two metals by Indian households is legendary. With prices making headlines every day, even the smallest of holder must be experiencing a feel-good.

It is somewhat like what an investor feels in a bull market when his portfolio value keeps increasing! Be that as it may, we are once again at another cross road. Having reached the 25,800 resistance, the bulls need to hold this fort. They can't give up now. Market moves are like wars- gained ground must be held even as the enemy tries to beat you back.

First round of results were…not bad. IT did not pulverize sentiments like it did last time. Although I consider this Street ‘expectation' to be a piece of crock, determining a reaction from the stock that lasts barely a day or so, the real deal is the actual numbers and the commentary that accompanies it. So, this time, that seems to have been better- Infy, LTIM etc.

Now, everyone will come on with a chorus of ‘sector has bottomed out'. The urge to make that call is very high in the analyst community- just like ‘breaking news' is for the TV media. Again, all that are for claiming brownie points for possible bonuses later!

But let that be as such. If the sector has indeed bottomed, we shall soon by the ability of leader stocks to hold their price levels, build higher highs and resist declines during sell offs. That is market action- and that is the only final truth.

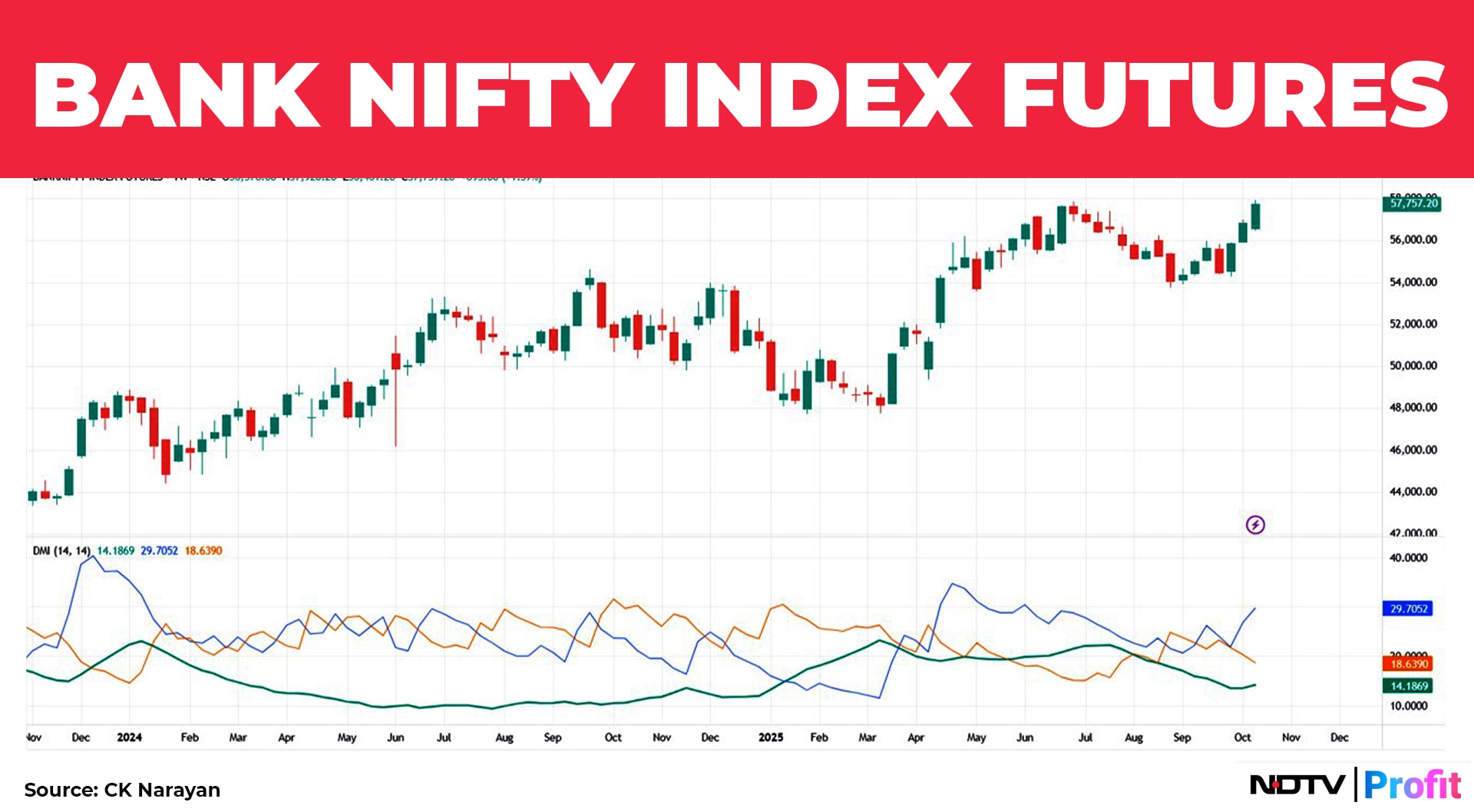

So far only a couple of names from the sector (HCLTech, Coforge, Persistent etc) have been able to do it. A couple of swallows don't make a summer, as the saying goes. Now, did Bank Nifty do the trick perhaps? After all, the index almost made it to all time new highs! That was unexpected until a week ago! When new and unexpected things happen, there is some change in the perspective underneath.

Here too, the “expectations” are running at a very low ebb. Goldman Sachs is already out with a report that the ‘worst may be behind us' stuff. So, there is going to be a good chance for everyone to say, Aha, I told you so! And jump on the bandwagon, perhaps. Sensing that, the banking index has moved higher?

A slew of results over the weekend. So some proof of all these should be available in the next week trading. Again, be that as it may. With banks contributing around 35% and IT another 12%, we have a good enough chunk of the market to push the index higher if they continue to work their wares in the coming week. So, that is only thing to watch.

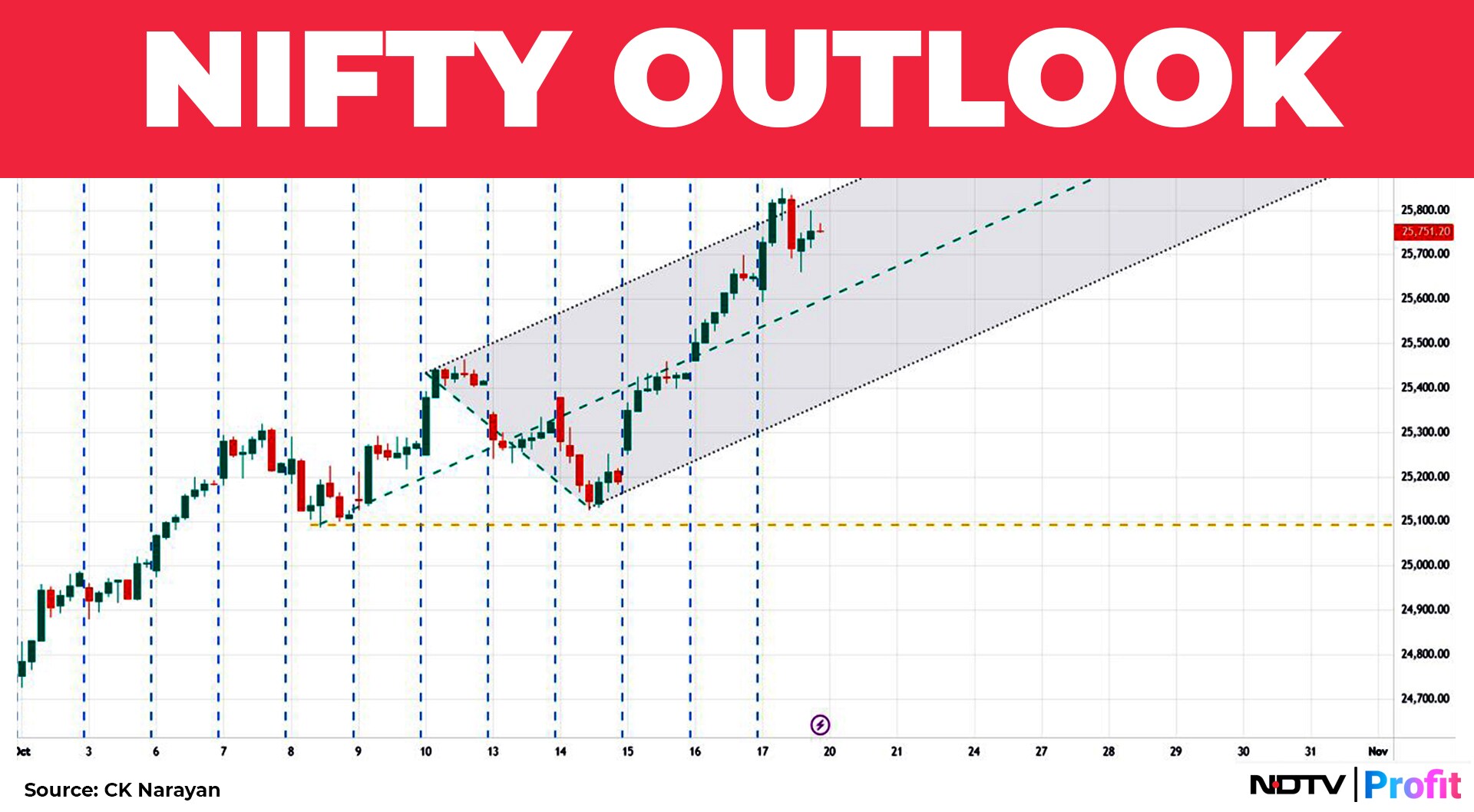

Market watching is all about fitting a model to the market and see how that is working out. For quite a while, we had the range market model (from May till now) and that, sort of, dictated what we needed to do. Now, it seems like a breakout model is getting ready for being affixed to the market. It needs to take hold.

After all, it is just a day or two hold. Cannot rush into it, can we? The market itself needs to get used to this new model first! There was much distraction from bullion and cryptos during the week. The former kept tearing away higher while the latter ran into a brick wall off sorts.

The rise in bullion is nothing short of parabolic. Exhilarating while it lasts, but then eventually it runs out. Certainly difficult to participate in, though as it is a train that you can neither board nor alight from! But silver, this time, is moving for reasons that are quite away from its fundamentals- one of strong shortage leading to some squeezes.

The very presence of a wide arbitrage trade (spot 1.8 lacs and future 1.45L) just lying there on the table and not being picked up by anyone is a clear testament towards some crisis of confidence in the system. And, this is not just in India (where it is pronounced though) but in London and other markets too.

So, the metal has got locked up somewhere and needs to come out to end this impasse. It will, eventually. But until then, no one quite knows what short term havoc can occur. That fear is keeping the buyers from appearing while egging every kind of holder to sell.

A terrible loop for prices to be caught in. Gold? Don't see anything new going on there except for parabola momentum. Maybe silver is dragging it higher right now? This does happen, you know.

But a simple point for those asking whether they should invest into silver now? Just see chart 3, the long term chart of silver. A new high has been hit on the metal after 45 long years! If that is not unnerving, I don't know what can be.

A simple research into silver will tell you that it is far more volatile than gold and hence it is certainly not a hedge. It is, at best, another trading asset. If you are able to catch some short term swings. Gold is a truer hedge, if you are looking for one.

But then, consider this. 90% of the people reading this article don't have the kind of capital where you have to bother about portfolio hedges, given that most of them would have limited capital. But this is what you read about. Oh you MUST have some gold and silver in your portfolio, say the wise ones. And you MUST have some US stocks too.

Again, accurate for some people but for the common folk, this is useless homily. A famous fund that made most of its money by being in US stocks in the last couple of years is now unable to invest further and is sitting on a truckload of cash, waiting for prices to pull back in US markets!

And it has been several months now! And, those current holdings are becoming very uncomfortable to hold on to because valuations are going out of whack. Difficult to walk that talk just now.

Warren Buffet (and his acolytes here) say, just own some good businesses. Well, easy for him to say, while sitting on a mountain of cash. But for the ordinary Joe or Joshi, what business is he going to own? What is he going to know about the business? There are so many strikes against him that such statements are homilies too.

But Joe or Joshi will listen to their commentaries and lap it all up. There is the ideal and then there is you. Recognise that reality. The only reality is that for the ordinary trader or investor, the market is a seasonal thing. When it is bullish it helps everyone make money.

When that season ends, no one makes it anymore for a while, till the season returns. So they flutter like butterflies from one source to another for help. Only thing that will help is to get some education about the market and its process. And then work like hell at it. The number of people willing to do that? A handful. That's the pity. That is also the truth. No wonder Sebi stats say 93% are losers. It is a wonder that it is not 97%.

Enough ranting I guess. Coming back to markets, the bulls have now got their grip on the animal's horns. Whether they are able to guide it ahead remains to be seen. With this shift, we are now landed squarely into buy-the-dip (BTD) territory. Chart 4 shows intra day Nifty chart again, with Pitchfork. Dips should meet support near 25,600 and below that upto 25,500-460.

Of late, PCR has shifted to being above 1 and now Put shorts have lined up around 25,500 while call shorts have moved higher to 26.000. FIIs have turned buyers of late and in Index futures too they have started cutting shorts. Now 1.62L contracts short as of last. If this trend continues, then sentiment would certainly improve further.

Pro traders have been net Index long since Oct 6. Smart guys. Follow their tracks for better short term cues. Q2 results flow ought to hold center stage. Expectations being low, there should be several occasions for market ‘surprise'. Hopefully.

Trump saga waxes and wanes and remains as unpredictable as ever and so no point in looking at it anymore. Already, the market has shown us that it has taken it in its stride. So no worries of any destabilization from that front I would think. If anything, some upwards triggers only, perhaps.

During results season, all sectors are up for grabs. So stock specific game to be played. But right now leader stocks doing well would be a bonus as they can stimulate sentiments more and move the needle for the indices.

Bank Nifty forging ahead would certainly be something that would help a great deal. Watch private banks trends next week, they may well hold the key to the promised land! And of course, GST-enabled autos now, with their commentary, if not numbers.

Stay bullish. Buy the dip.

CK Narayan is an expert in technical analysis, the founder of Growth Avenues, Chartadvise, and NeoTrader (https://neotrader.in), and the chief investment officer of Plus Delta Portfolios.

Disclaimer: The views and opinions expressed by experts and investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.