National Aluminum Co., Vedanta Ltd., and Hindalco Industries Ltd. are key players in the metal and mining sector, poised to generate significant profitability and returns, according to Emkay Global Financial Services Ltd. These companies are expected to benefit from favourable commodity prices and attractive valuations, compared to the industry.

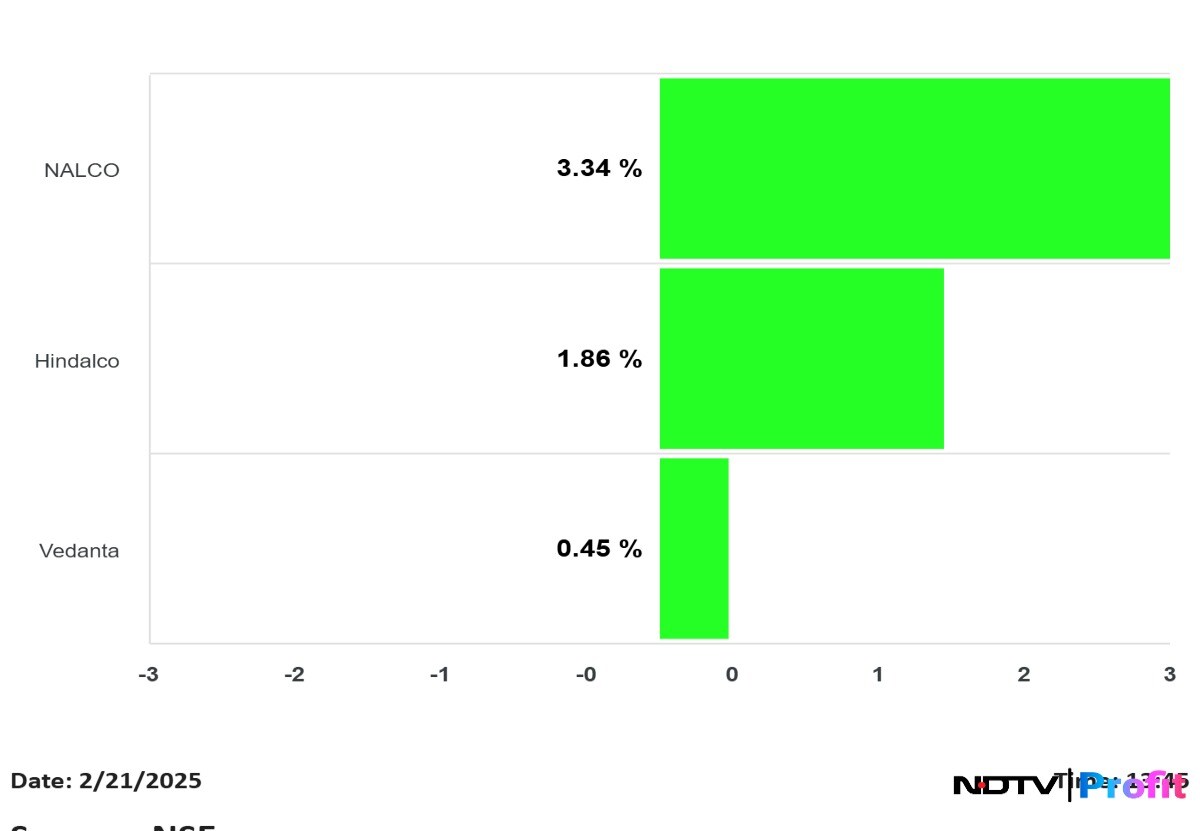

Nalco is projected to see an upside in earnings, with an Ebitda upgrade potential of 16.8% for FY26E if current spot commodity prices hold. The market is currently factoring in 16.5% lower commodity prices for Nalco, indicating potential for better-than-expected performance.

Vedanta is also expected to benefit from the current commodity price environment, with an Ebitda upgrade potential of 4.4% for FY26E. The market is factoring in 11% lower commodity prices for Vedanta, suggesting room for positive earnings surprises.

Hindalco's earnings are balanced at current spot prices versus the base case, with the market factoring in 9.8% higher commodity prices. The company's performance is closely tied to the elevated prices of alumina and aluminum, which could lead to favourable stock price performance.

The recent EU ban on Russian aluminum imports has pushed aluminum prices to Emkay's target of $2,700 per tonne. This price level is expected to support the profitability and returns of Nalco, Vedanta, and Hindalco. The ongoing tightness in the bauxite market, due to unresolved issues between Guinea and EGA, further supports the positive outlook for these companies.

At current stock prices, Nalco, Vedanta, and Hindalco are trading at attractive valuations, with Nalco and Vedanta screening better on a relative basis, due to the benefit of elevated alumina and aluminum prices. Emkay's analysis suggests that these stocks offer a cushion against downside risks, with potential for normalised earnings over time.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.