Shares of Mahindra & Mahindra Ltd. gained after CLSA said a sharp turnaround in consolidated earnings and return on equity are likely to drive rerating on the stock.

CLSA estimated M&M's consolidated return on equity to rise from 9% in FY21 to 16% in FY23. It reiterated its ‘buy' rating and raised the target price for the company to Rs 1,220 apiece from Rs 1,090, implying a potential upside of 46%.

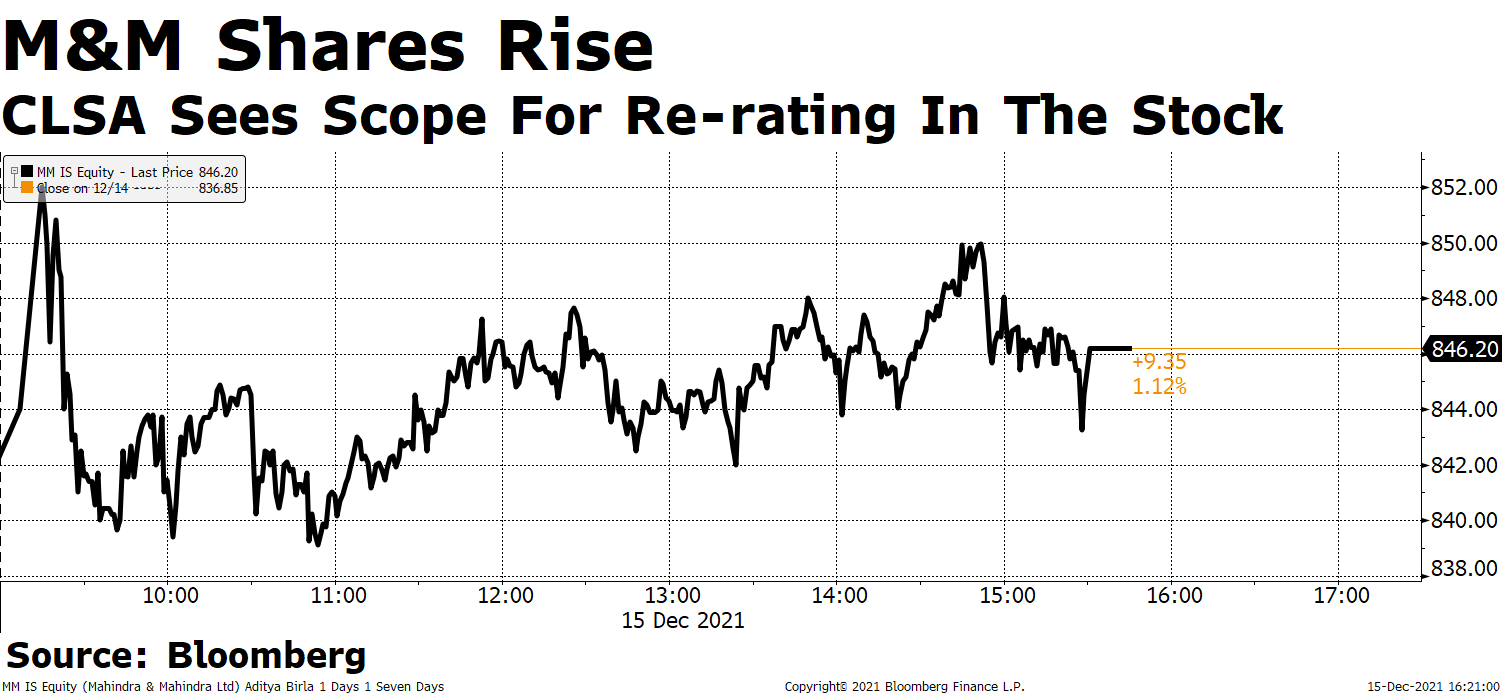

The auto stock rose more than 2% in intraday trade on Wednesday compared with a 0.28% decline in the benchmark Nifty 50. M&M shares ended the day at 1.12% higher, or Rs 846.20 apiece.

Of the 46 analysts tracking M&M, 40 maintain a 'buy' and three each recommend a 'hold' and a 'sell', according to Bloomberg data. The 12-month consensus price target implies an upside of 25.3%.

CLSA on M&M's growth prospects...

Expects strong growth in core business (auto and farm) with net profit CAGR at 20% over FY2022-24.

Expects tractor business to grow at a stable pace.

Profitability likely to improve due to a decline in commodity costs and stable pricing.

Company's plans to launch 67 new models until 2027, including 37 in tractors, 13 in sport utility vehicles and 17 in light commercial vehicles is likely to lead to market share gains.

Company's efforts to launch new products in CNG and electric vehicles space are likely to aid growth.

Forecasts M&M's subsidiary profits to increase to Rs 3,500 crore by FY24.

Values the company at Rs 1,220 per share (Rs 779 per share for M&M core business and Rs 441 per share for subsidiaries).

The stock is significantly undervalued as management has addressed capital allocation concerns related to subsidiaries.

Expects farm implement division revenues to reach 15% of the farm division business' revenue by FY2036 from the current 3%.

Decline in raw material cost and stable pricing to aid EBIT margin.

Key Risks

Delay in recovery in tractor business.

Failure of new SUV models.

Longer-than-expected economic disruption.

Increase in non-core investments.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.