Mahindra and Mahindra Financial Services Ltd.'s shares rose over 2% during trade on Thursday after the company posted its business update.

The latest quarterly performance has been described as "muted" by Morgan Stanley, with the brokerage highlighting concerns over asset quality and growth prospects. Despite this, Morgan Stanley maintained its 'equal-weight' rating on Mahindra Finance.

The Gross Stage 3 ratio increased to 3.8-3.9%, compared to 3.69% in the previous quarter and 3.56% in the same quarter last year. Similarly, the Gross Stage 2 ratio showed a slight improvement, standing at 5.8-5.9%, down from 6.1% in the first quarter of the previous fiscal.

The brokerage highlighted concerns about collection efficiency, which stood at 95% for the first quarter of fiscal 2026, down from 97% in the previous quarter.

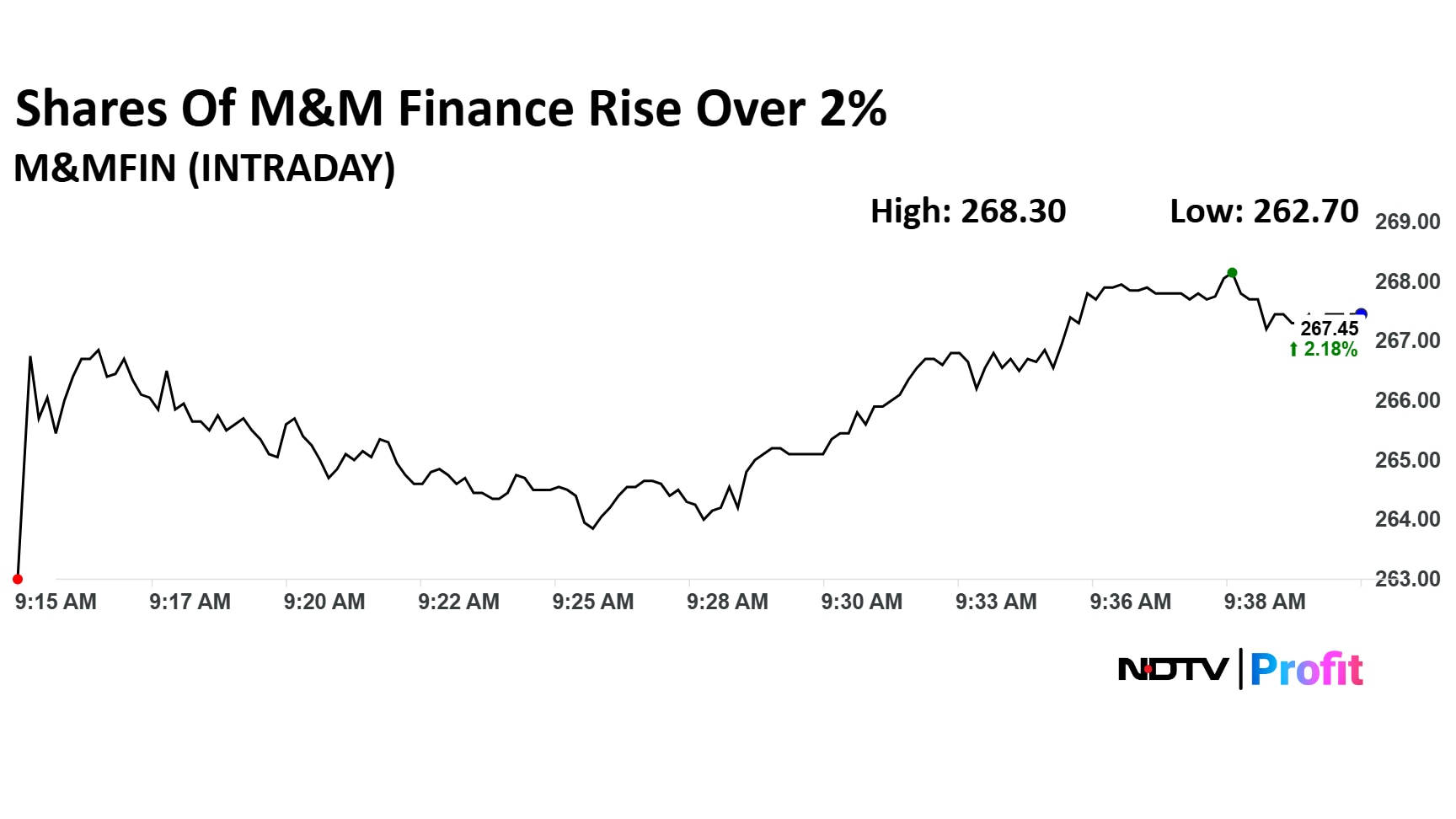

M&M Finance Share Price

M&M Finance Services stock rose as much as 2,50% during the day to Rs 268.3 apiece on the NSE. It was trading 2.27% higher at Rs 267.7 apiece, compared to a 0.17% advance in the benchmark Nifty 50 as of 9:48 a.m.

It has declined 9.39% in the last 12 months. The total traded volume so far in the day stood at 3.7 times its 30-day average. The relative strength index was at 51.2.

Fifteen out of 36 analysts tracking the company have a 'buy' rating on the stock, 15 recommend a 'hold' and six suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 287, implying a upside of 7.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.