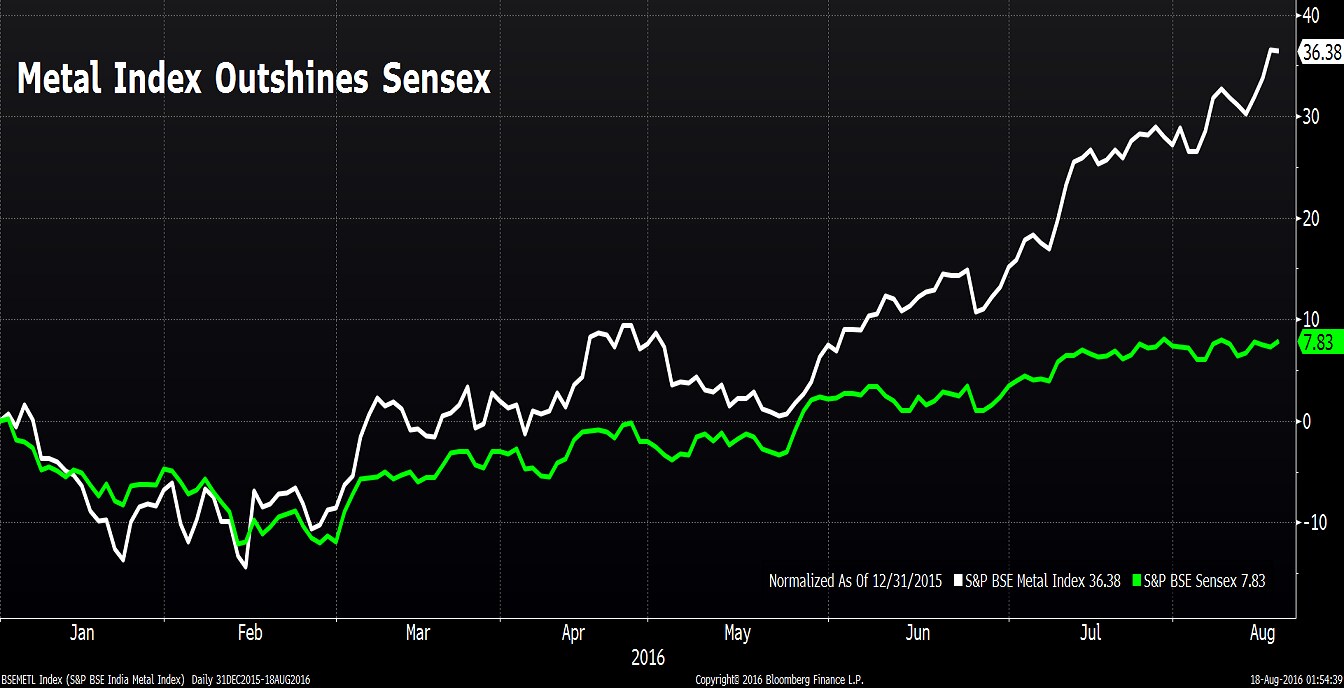

The S&P BSE Metal index has gained nearly 4 percent this week, compared to 1.4 percent increase on the broader BSE Sensex. In fact, the outperformance of the sectoral gauge is even more stark taking into account its year-to-date returns.

Steel demand in India will outpace the regional average while profitability of domestic steel companies will outperform regional peers on account of increase in domestic demand, rating agency Moody's said in a recent report.

Moody's expects the likes of Tata Steel and JSW Steel to outperform regional peers, aided by Indian government's protectionist measures in the form of minimum import prices and anti-dumping duties.

The finance ministry, in a recent notification, sought to levy provisional anti-dumping duty on cold-rolled flat products of alloy or non-alloy steel imports.

India, which accounts for 8 percent of Asian production, will increase steel production to meet rising domestic consumption, but this increase would not be enough to prevent the aggregate regional production decline.

This proves that the recent out performance of the metal sector was not a fluke, Ashu Madan, COO of Religare Securities said in a phone interview. Madan is bullish on the metal companies and expects the outperformance to continue.

However, Madan advises investors to be selective in terms of stock picking as some of these companies have run up quite a lot. “We still like Hindustan Zinc and Hindalco,” he said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.