Share price for Mazagon Dock Shipbuilders Ltd. rose 2.35% to touch an all time high at Rs 3,750 apiece on Thursday, ahead of its fourth results. The Defence Ministry's public sector undertaking primarily involves shipbuilding, particularly naval ships and submarines.

Mazagon Dock Shipbuilders was granted the 'Navratna' status last year in June. Navratna companies represent top public sector undertakings in India, distinguished by their financial and operational prowess.

These companies enjoy greater financial and operational freedom. They can make investments of up to 30% of their net worth in one year, provided that it does not exceed Rs 1,000 crore. They also have the freedom to enter joint ventures, form alliances and float subsidiaries abroad.

In a stock exchange filing dated May 23, the company said that a meeting of its Board of Directors is scheduled on May 29 to consider and approve the audited standalone and consolidated financial statements for the quarter and financial year ended on March 31, 2025.

The board will also consider the recommendation of the final dividend, if any, for FY25.

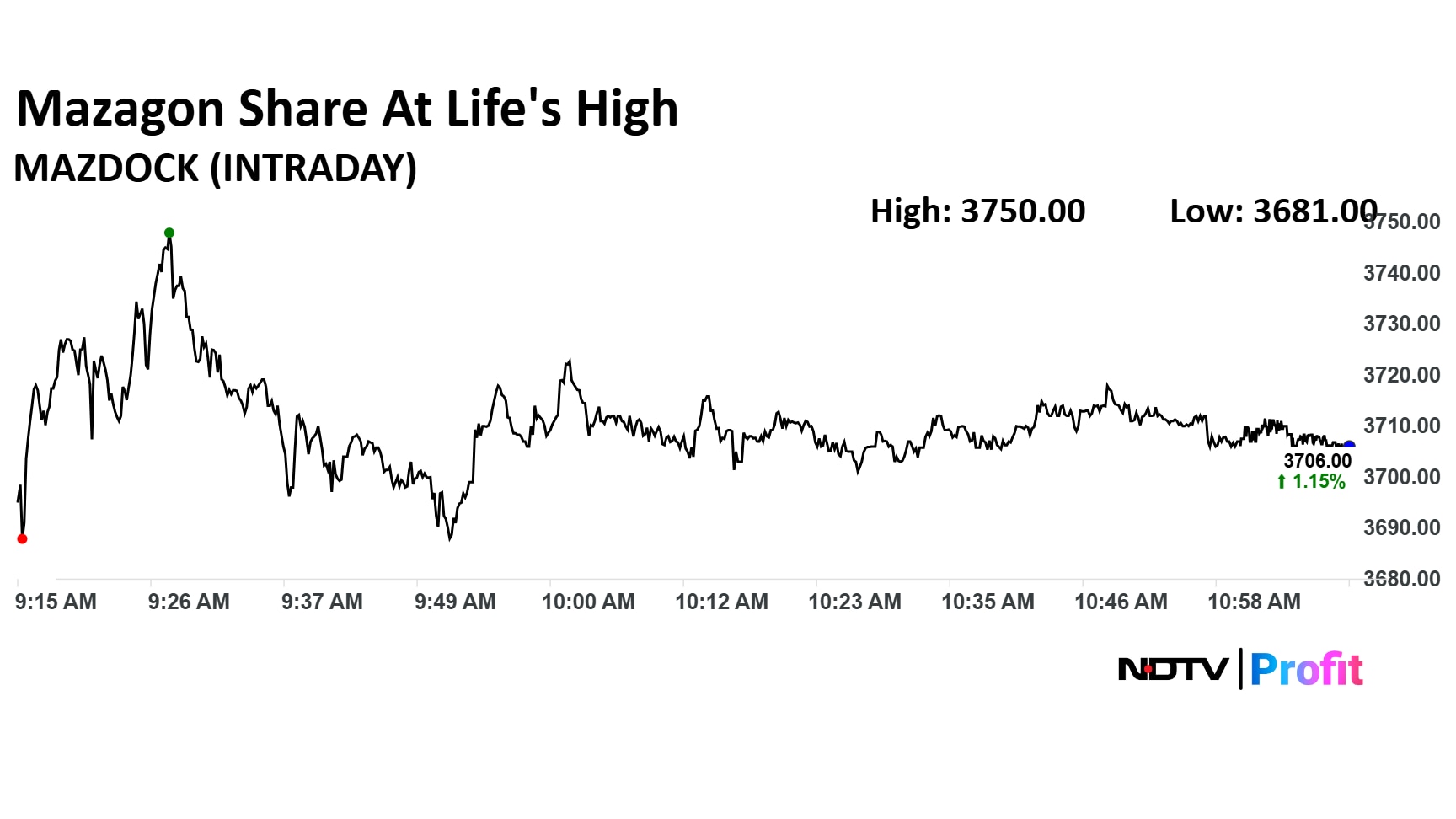

Mazagon Share Price Today

Mazagon Dock's share price rose as much as 2.35% to Rs 3,750 apiece, the highest level ever. It pared gains to trade 1.20% higher at Rs 3,707 apiece, as of 11:00 a.m. This compares to a 0.16% decline in the NSE Nifty 50.

The stock has risen 66.42% on a year-to-date basis, and 119.91% in the last 12 months. Total traded volume so far in the day stood at times its 30-day average. The relative strength index was at 57.81.

Out of six analysts tracking the company, four maintain a 'buy' rating, one recommends a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside 31.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.