Shares of insurance companies in India advanced after the Finance Ministry proposed to raise the foreign direct investment limit to 100% from 74% earlier.

The net-owned fund's requirement for foreign re-insurers is proposed to be reduced to Rs 1,000 crore from Rs 5,000 crore earlier, according to a statement from the Ministry of Finance.

The latest proposal will empower the insurance regulator to bring down entry capital requirements for companies in un-served and underserved segments.

This is undertaken to ensure accessibility and affordability of insurance to citizens, foster expansion and development of the insurance industry, and streamline business processes, the statement said.

The proposed amendments primarily focus on promoting policyholders' interests, enhancing the financial security of the policyholders, and enabling ease of doing business among others, it said. It enhances insurance penetration to achieve the goal of 'Insurance for All by 2047', it said.

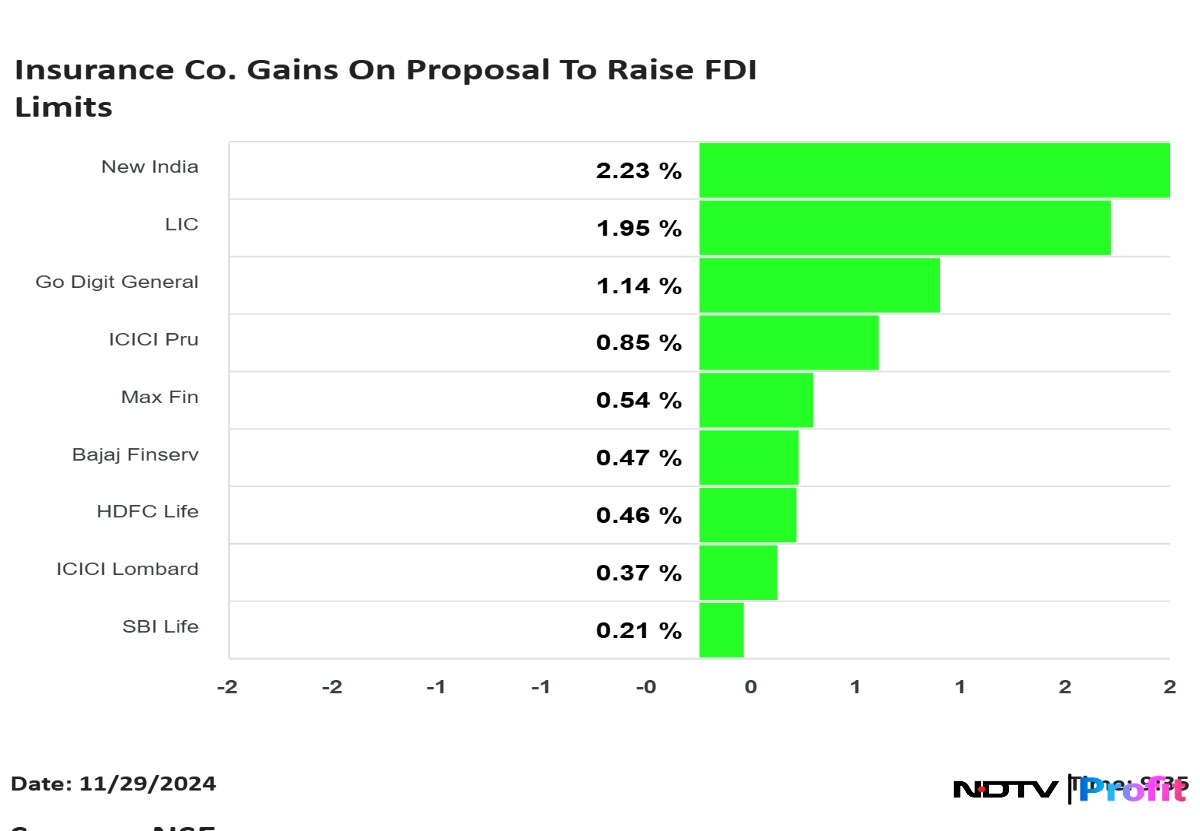

Shares of New India Assurance Co. rose the most followed by Life Insurance Corp. of India and Go Digit General Insurance Ltd. New India's shares rose as much as 3.7% and later pared gains to trade 1.72% higher. This compares to a 0.39% advance in the NSE Nifty 50.

LIC's stock rose as much as 5.2% during the day to Rs 988 apiece on the NSE. It was trading 4.3% higher at Rs 979.5 apiece.

LIC stock has risen 43% during the last 12 months and has advanced by 17% on a year-to-date basis. Total traded volume so far in the day stood at 7.4 its 30-day average. The relative strength index was at 65.

Go Digit stock rose as much as 1.5% during the day to Rs 341.7 apiece on the NSE. It was trading 0.59% higher at Rs 338.55 apiece. The relative strength index was at 26, implying that the stock is oversold.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.