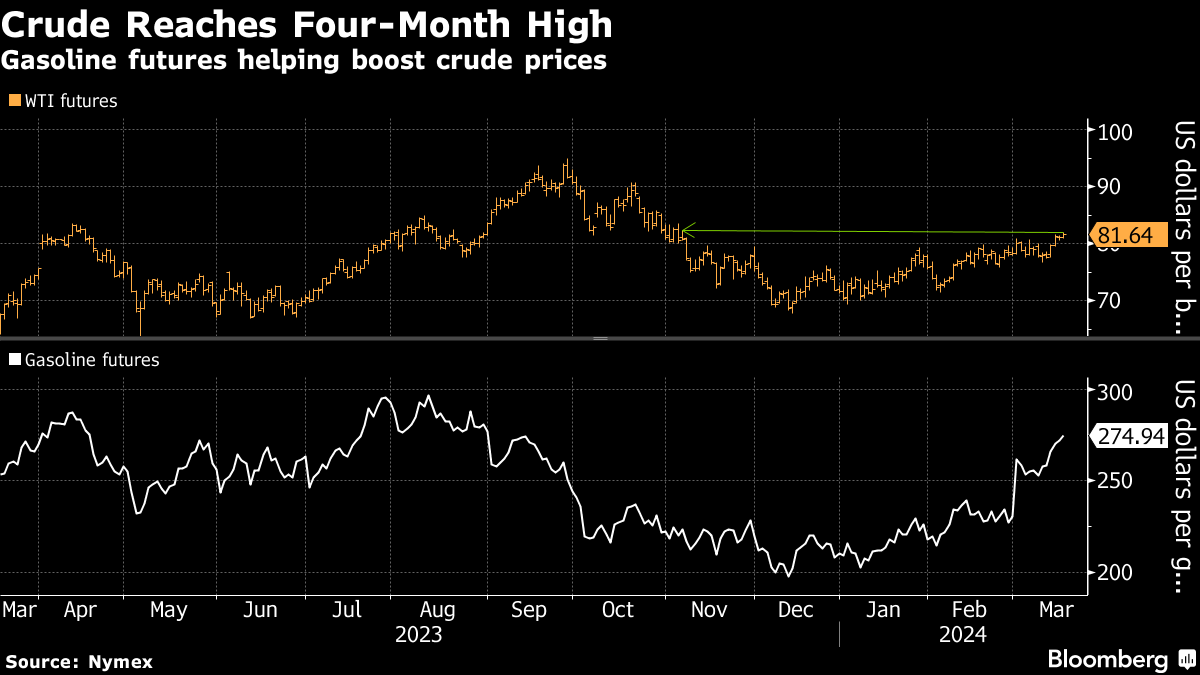

(Bloomberg) -- Oil climbed to a four-month high ask Ukrainian drone attacks on Russian refineries heightened geopolitical risks and key Chinese economic data beat estimates.

West Texas Intermediate climbed as much as 1.3% to top $82, building on last week's 3.9% advance. China's factory output and investment grew more strongly than expected at the start of the year, and the nation refined a record amount of crude, figures on Monday showed.

Drone strikes over the weekend hit multiple plants in Russia, some deep within the country's territory. Diesel futures rose for a fourth straight session while gasoline futures climbed for the sixth.

Gasoline is currently acting as a “bullish driving force behind crude” as inventories come into question, said Dennis Kissler, senior vice president at BOK Financial. Futures for the fuel have reached a six-month high and may have implications for both pump prices and crude prices if the rally continues.

“The strikes on Russian refineries added $2 to $3 a barrel of risk premium for crude last week, which remains in place as we start this week with more attacks over the weekend,” said Vandana Hari, founder of Vanda Insights in Singapore.

Crude has broken out of the tight trading range that dominated the opening months of the year, with prices hitting the highest since early November in recent days.

The advance has also been underpinned by OPEC+ cutbacks to production, with the International Energy Agency warning of a supply deficit throughout the year. That shift in outlook has seen banks including Morgan Stanley raising their oil-price forecasts.

--With assistance from Alaric Nightingale, Yongchang Chin and Julia Fanzeres.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.