(Bloomberg) -- Oil rose as risk-on sentiment spurred by cooling US inflation overshadowed an unexpected increase in the country's crude stockpiles.

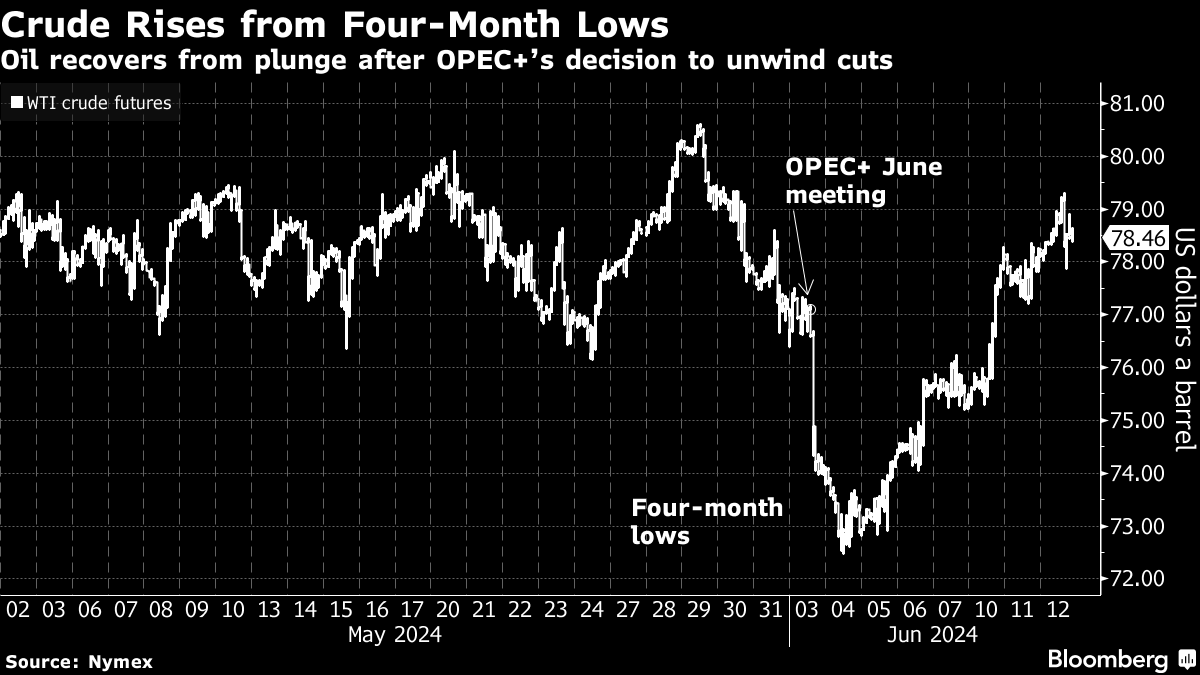

West Texas Intermediate advanced 0.8% to close above $78 a barrel after US consumer prices came in cooler than anticipated. Still, a later report showing rising US crude and gasoline inventories knocked crude off its highs for the day and even briefly sent oil into negative territory.

The consumer price data sparked a risk-on mood in broader markets, which took it as a sign of the early stages of inflation resuming a downward trend. The Federal Reserve on Wednesday decided to hold interest rates steady, and penciled in one rate cut for later in 2024 and four for 2025.

Oil has rebounded from last week's post-OPEC+ selloff, a sign that the biggest pullback in speculative bullish bets on record may be at least partially reversing. Goldman Sachs Group Inc. said earlier this week that financial demand for oil contracts still had a lot of room to recover.

Oil traders have been wrestling with bumpy price moves recently as a weak market for real-world barrels vies with hopes that consumption will improve over the summer. The US on Tuesday forecast its production in 2024 will increase more than previously estimated to a fresh record, while the International Energy Agency is warning of a lasting oil surplus for the rest of this decade.

“This week's big recovery has weakened the bears' hold on the market, although more price action is needed to confirm a bottom,” said Fawad Razaqzada, a market analyst at City Index and Forex.com. “But it is possible we could see crude oil prices come under pressure again after the recent recovery. The lower highs suggest the short-term path of least resistance is still downward, until told otherwise by the charts.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.